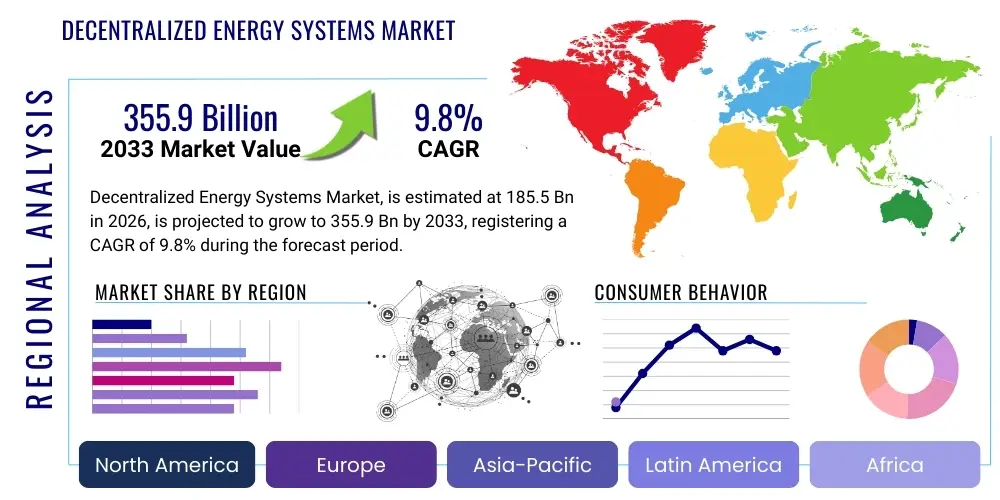

Decentralized Energy Systems Market Size, By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2026 to 2033 (Financial Impact Analysis)

ID : MRU_ 443283 | Date : Feb, 2026 | Pages : 246 | Region : Global | Publisher : MRU

Decentralized Energy Systems Market Size

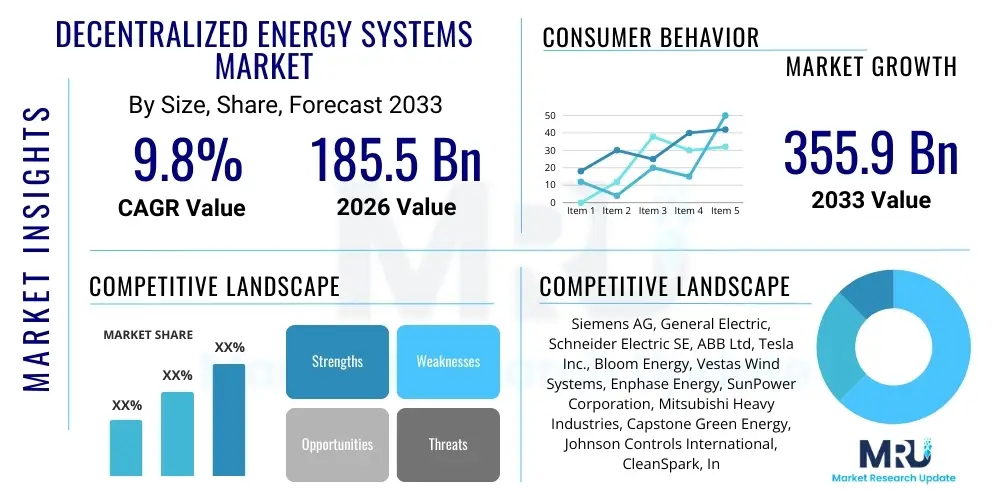

The Decentralized Energy Systems Market is projected to grow at a Compound Annual Growth Rate (CAGR) of 9.8% between 2026 and 2033. The market is estimated at $185.5 Billion in 2026 and is projected to reach $355.9 Billion by the end of the forecast period in 2033.

Decentralized Energy Systems Market introduction

The Decentralized Energy Systems (DES) Market encompasses technologies and infrastructure that generate, store, and manage energy closer to the point of consumption, operating independently or interconnected with the central grid. These systems typically utilize renewable sources such as solar photovoltaics (PV), wind turbines, combined heat and power (CHP) units, and advanced battery energy storage systems (BESS). The core premise of DES is to enhance energy resilience, reduce transmission losses inherent in centralized networks, and provide access to sustainable power, particularly in remote or underserved areas. Key market participants include technology providers for microgrids, smart grid components, distributed generation equipment, and system integrators specializing in localized energy management solutions.

Major applications of DES span residential, commercial, industrial, and utility sectors. Residential deployments often focus on rooftop solar PV coupled with home battery storage to achieve self-consumption and grid independence. Commercial and industrial (C&I) sectors utilize DES for critical load management, peak shaving, and ensuring operational continuity through microgrids, driven primarily by rising electricity costs and the need for reliable, high-quality power. Furthermore, utilities are increasingly adopting DES to manage grid congestion, defer costly infrastructure upgrades, and integrate variable renewable energy resources effectively into the distribution network. The flexibility and scalability offered by decentralized solutions make them vital components of the transition to a modern, low-carbon energy infrastructure.

The market growth is substantially driven by the global imperative for decarbonization and energy security. Governments worldwide are implementing supportive regulatory frameworks, including feed-in tariffs, net metering policies, and incentives for renewable energy deployment, which significantly improve the economic viability of DES projects. Technological advancements, particularly in energy storage efficiency and smart grid control systems, are lowering installation costs and improving system performance. These benefits—reduced carbon footprint, enhanced reliability, and lower long-term operational costs—solidify the role of Decentralized Energy Systems as a foundational element of the future energy landscape.

Decentralized Energy Systems Market Executive Summary

The Decentralized Energy Systems market is currently experiencing robust expansion, fundamentally shifting the traditional energy paradigm from large, centrally controlled power plants toward a more distributed, resilient, and consumer-centric model. Business trends indicate a massive convergence of digitalization and electrification, where sophisticated software platforms and AI-driven control systems are becoming indispensable for optimizing the complex interactions within microgrids and virtual power plants (VPPs). Key industry participants are increasingly focused on vertical integration, acquiring or partnering with battery manufacturers and software firms to offer comprehensive, turnkey solutions that simplify deployment for end-users, driving significant merger and acquisition activity across the technological stack.

Regionally, Asia Pacific is anticipated to demonstrate the fastest growth rate due to rapid industrialization, burgeoning energy demand, and ongoing efforts in countries like India and China to electrify rural populations using off-grid and mini-grid solutions. North America and Europe remain mature markets, characterized by significant investment in grid modernization, regulatory mandates supporting renewable integration, and high adoption rates in the commercial and industrial segments seeking resilience against extreme weather events and grid instability. The Middle East and Africa (MEA) are emerging hotspots, leveraging decentralized solar power to address energy poverty and manage peak cooling loads effectively.

In terms of segmentation, the technology segment dominated by Solar PV continues its rapid deployment due to cost competitiveness, while the Energy Storage Systems segment is projected to exhibit the highest CAGR, crucial for maximizing the value of intermittent renewable sources. Application-wise, the Industrial sector represents the largest opportunity, seeking microgrid solutions for mission-critical operations. The growing prevalence of hybrid systems, combining solar, wind, and storage, underscores the trend toward multi-source decentralized solutions optimized for regional resource availability and specific load profiles, ensuring a reliable and sustainable energy supply irrespective of the primary generation technology.

AI Impact Analysis on Decentralized Energy Systems Market

User inquiries regarding AI's influence on Decentralized Energy Systems frequently center on optimization, prediction capabilities, and enhanced grid management. Common questions focus on how AI algorithms can predict renewable energy output (e.g., solar irradiance, wind speed) with greater accuracy, how machine learning can optimize battery charge/discharge cycles for maximum economic benefit (e.g., arbitrage), and how AI facilitates the coordination of thousands of distributed energy resources (DERs) within virtual power plants (VPPs) to maintain grid stability. Users are highly interested in AI’s role in automating fault detection, predictive maintenance of DES components, and improving cybersecurity measures across interconnected decentralized networks, recognizing that intelligent control is the prerequisite for scaling complexity and ensuring the reliability of these highly distributed systems.

- AI-driven Predictive Analytics: Enhances the forecasting accuracy of variable renewable generation (solar and wind), optimizing scheduling and minimizing reliance on fossil fuel backups.

- Optimized Energy Management: Machine learning algorithms precisely manage energy storage systems (BESS), enabling real-time arbitrage and reducing peak demand charges for C&I users.

- Virtual Power Plant (VPP) Coordination: AI aggregates distributed energy resources (DERs) into VPPs, allowing them to provide ancillary services to the main grid, such as frequency regulation and voltage support.

- Automated Fault Detection and Diagnostics: Utilizes pattern recognition to identify equipment anomalies and predict failures within decentralized infrastructure, significantly lowering maintenance costs and reducing downtime.

- Enhanced Grid Resilience: AI systems dynamically reconfigure microgrids during islanding events, ensuring stable power supply to critical loads without human intervention.

- Load Forecasting and Demand Response: Improves the accuracy of localized load prediction, enabling proactive implementation of demand response programs tailored to specific consumer segments.

DRO & Impact Forces Of Decentralized Energy Systems Market

The growth trajectory of the Decentralized Energy Systems market is primarily fueled by compelling drivers, including the relentless reduction in the levelized cost of electricity (LCOE) for renewable technologies, particularly solar PV and battery storage, which makes DES economically competitive with traditional grid power. Furthermore, growing concerns over grid reliability, especially in regions prone to extreme weather or vulnerable to physical and cyber threats, drive commercial and industrial entities to invest heavily in resilient microgrid solutions. However, this expansion is constrained by several factors, including the complexity of permitting and interconnection processes, often hampered by outdated regulatory frameworks that favor centralized utilities. Additionally, the high upfront capital expenditure required for large-scale DES deployments and the technical challenges associated with integrating highly variable DERs into existing distribution networks present significant barriers.

Despite these restraints, substantial opportunities are emerging that promise accelerated market development. The global rise of the electric vehicle (EV) sector creates a massive potential for using EV batteries as distributed storage assets (Vehicle-to-Grid or V2G), thereby augmenting the capacity and flexibility of DES infrastructure. Furthermore, increasing investment in smart city projects and digitalization efforts worldwide mandates the deployment of localized, smart microgrids for reliable public service operations. The push toward energy independence among remote communities and developing nations, often bypassed by centralized grid infrastructure, provides a ready market for standardized, scalable off-grid DES solutions.

The overall impact forces are overwhelmingly positive, driven by supportive governmental policies emphasizing sustainability and energy independence, coupled with rapid technological innovation in power electronics and energy storage chemistry. The interaction between technology advancements (lowering costs) and regulatory tailwinds (creating incentives) establishes a self-reinforcing growth loop. The crucial force accelerating adoption is the demonstrable improvement in energy resilience achieved by DES, transforming it from a niche solution into a fundamental necessity for modern critical infrastructure, ultimately resulting in lower overall system costs and greater consumer empowerment.

Segmentation Analysis

The Decentralized Energy Systems market is comprehensively segmented based on technology type, application, end-user, and connectivity model, reflecting the diverse spectrum of solutions available to meet varied energy needs globally. Understanding these segments is critical for stakeholders to identify specific market niches and tailor deployment strategies, ranging from small-scale residential setups using singular technologies to complex industrial microgrids integrating multiple power sources and sophisticated control systems. The rapid evolution of battery technology, alongside the maturity of renewable generation methods, ensures that the flexibility within these segments is continually increasing, driving greater efficiency and adaptability across the energy landscape.

- By Technology:

- Solar Photovoltaic (PV)

- Combined Heat and Power (CHP)/Cogeneration

- Wind Turbines

- Fuel Cells

- Energy Storage Systems (BESS, Flywheels, Thermal)

- Microturbines

- By Application:

- On-Grid (Grid-Connected)

- Off-Grid (Stand-Alone)

- By End-User:

- Residential

- Commercial

- Industrial

- Utility & Infrastructure

- By Connectivity:

- Microgrids

- Virtual Power Plants (VPPs)

- Individual Distributed Generation Units

- By Region:

- North America

- Europe

- Asia Pacific (APAC)

- Latin America

- Middle East & Africa (MEA)

Value Chain Analysis For Decentralized Energy Systems Market

The value chain for Decentralized Energy Systems starts with the upstream segment, which is dominated by component manufacturing. This stage involves the production of critical hardware, including solar panels (PV modules), wind turbine blades and nacelles, specialized inverters (both string and microinverters), power electronics, and advanced battery cells and packs (Lithium-ion being dominant). Key activities here include raw material procurement, highly specialized manufacturing processes, and quality assurance testing. Intense global competition and rapid technological turnover characterize the upstream market, driving continuous price erosion and efficiency gains, particularly in the photovoltaic sector.

The midstream involves system integration, project development, and engineering, procurement, and construction (EPC) services. This segment acts as the crucial link between component suppliers and end-users, requiring deep technical expertise in system sizing, site assessment, grid interconnection standards, and regulatory compliance. EPC contractors handle the installation and commissioning of the decentralized systems, customizing solutions—such as microgrid controllers or CHP units—to meet specific load requirements and operational mandates. Distribution channels in this segment vary widely, utilizing direct sales models for large utility-scale or industrial projects, and indirect channels (distributors, specialized installers, and channel partners) for residential and smaller commercial installations.

The downstream activities focus predominantly on operations, maintenance (O&M), and energy management services, which represent a significant and growing revenue stream due to the long operational life of DES assets. O&M includes predictive maintenance (often leveraging AI and IoT sensors), performance monitoring, and fault repair. Furthermore, the downstream sector encompasses energy service companies (ESCOs) and software providers who manage the real-time interaction of DERs with the utility grid, optimize energy trading through VPPs, and provide financial services like power purchase agreements (PPAs), which lower the upfront investment burden for end-users, thereby accelerating market penetration.

Decentralized Energy Systems Market Potential Customers

Potential customers and end-users of Decentralized Energy Systems are diverse, ranging from individual homeowners seeking energy independence to multinational corporations and public utilities requiring robust, localized power generation capabilities. In the residential sector, early adopters are driven by financial motivations (reducing electricity bills) and environmental consciousness, often purchasing rooftop PV and battery storage systems. For this segment, ease of installation, aesthetic integration, and supportive financing mechanisms are key purchasing drivers, emphasizing packaged consumer-friendly solutions and net metering benefits offered by utilities.

The Commercial and Industrial (C&I) sectors represent the most lucrative customer base, driven primarily by the need for energy resiliency and cost stability. Customers in this category include data centers, hospitals, manufacturing facilities, and large retail chains. These entities prioritize microgrids and CHP systems to ensure continuous operation, particularly where power interruptions result in massive financial losses or pose risks to public safety. Their purchasing decisions are based on return on investment (ROI), system reliability, and compliance with stringent operational standards, often involving direct partnerships with large EPC firms for custom-engineered solutions.

The Utility and Public Infrastructure sector forms the third major customer group. Utilities purchase DES to enhance grid reliability, defer transmission and distribution (T&D) infrastructure upgrades, and manage peak demand through distributed generation. Public infrastructure buyers, such as government agencies, military bases, and educational campuses, prioritize community resilience and secure, islandable microgrids that can operate autonomously during regional outages. These customers require robust, scalable, and highly interoperable systems, typically procured through competitive bidding processes that emphasize long-term service contracts and adherence to strict regulatory mandates.

| Report Attributes | Report Details |

|---|---|

| Market Size in 2026 | $185.5 Billion |

| Market Forecast in 2033 | $355.9 Billion |

| Growth Rate | 9.8% CAGR |

| Historical Year | 2019 to 2024 |

| Base Year | 2025 |

| Forecast Year | 2026 - 2033 |

| DRO & Impact Forces |

|

| Segments Covered |

|

| Key Companies Covered | Siemens AG, General Electric, Schneider Electric SE, ABB Ltd, Tesla Inc., Bloom Energy, Vestas Wind Systems, Enphase Energy, SunPower Corporation, Mitsubishi Heavy Industries, Capstone Green Energy, Johnson Controls International, CleanSpark, Inc., EDF Group, Engie SA, SMA Solar Technology, Fluence Energy, Eaton Corporation, Cummins Inc., Honeywell International Inc. |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Enquiry Before Buy | Have specific requirements? Send us your enquiry before purchase to get customized research options. Request For Enquiry Before Buy |

Decentralized Energy Systems Market Key Technology Landscape

The technological landscape of the Decentralized Energy Systems market is characterized by rapid innovation focused on improving efficiency, reducing hardware costs, and enhancing system intelligence and interoperability. Central to this evolution is the ongoing refinement of photovoltaic technology, including the adoption of higher-efficiency PERC and TopCon cells, bifacial modules, and flexible solar films, enabling greater energy harvest from limited surface areas. Complementing generation technologies, the sophistication of power electronics—particularly advanced inverters and microinverters—is crucial for maximizing power quality and seamlessly managing the bidirectional flow of electricity between DERs and the main grid, complying with stringent grid codes and safety standards globally.

Battery Energy Storage Systems (BESS) are arguably the most transformative technology in the DES space, serving as the essential enabler for microgrid functionality and renewable integration. Lithium-ion batteries (Li-ion) currently dominate the market due to their high energy density and cycle life, but significant research and development are ongoing in alternative chemistries like flow batteries, sodium-ion batteries, and solid-state technology, aiming to improve safety, longevity, and overall cost per kilowatt-hour stored. The integration of robust battery management systems (BMS) and thermal management systems is vital for safe and effective operation across diverse environmental conditions, especially in off-grid deployments.

Beyond core hardware, software and control technologies underpin the functionality of advanced DES. Smart grid platforms, often built upon IoT infrastructure and cloud computing, provide the necessary infrastructure for monitoring, control, and data analysis across geographically dispersed assets. Microgrid controllers, utilizing artificial intelligence and machine learning algorithms, are responsible for maintaining system stability, managing load balancing, optimizing energy generation mix in real-time, and facilitating seamless transition between grid-connected and islanded modes. The deployment of cybersecurity solutions tailored for operational technology (OT) networks is also paramount, given the increasing interconnectedness and potential vulnerability of decentralized energy assets to sophisticated cyber threats.

Regional Highlights

Regional variations in regulatory frameworks, energy demand profiles, and resource availability significantly shape the Decentralized Energy Systems market adoption rates worldwide. North America is a pioneer, driven by stringent energy efficiency regulations, high electricity costs, and the critical need for resilience against natural disasters, particularly in states like California and Texas. The substantial deployment of corporate microgrids and the rapid proliferation of residential solar coupled with BESS exemplify the region's focus on grid stability and self-sufficiency, bolstered by federal incentives like the Investment Tax Credit (ITC).

Europe stands out due to its aggressive decarbonization targets, reflected in policies promoting high penetrations of renewable energy and the phasing out of fossil fuels. Countries like Germany, the UK, and Scandinavian nations have robust decentralized markets, primarily utilizing rooftop solar, biomass CHP, and sophisticated VPPs to manage intermittent generation. Regulatory instruments such as feed-in tariffs and supportive market designs for distributed flexibility providers have made DES a foundational element of the region's energy transition strategy.

Asia Pacific (APAC) represents the largest potential market by volume and is poised for the highest growth. This acceleration is driven by massive energy access gaps in rural areas (particularly Southeast Asia and India), rapid urbanization, and soaring electricity demand from industrial expansion in China. The focus here is two-fold: large-scale industrial microgrids to ensure manufacturing reliability, and essential off-grid/mini-grid deployments to provide foundational electricity access to millions, utilizing decentralized solar PV as the primary technology due to its scalability and low maintenance requirements.

- North America: Focus on resilience, high penetration of corporate microgrids, mature residential solar-plus-storage segment, and strong federal and state-level incentives supporting DER deployment.

- Europe: Driven by strict climate targets, high adoption of Combined Heat and Power (CHP), advanced Virtual Power Plants (VPPs), and regulatory frameworks supporting grid flexibility and renewable integration.

- Asia Pacific (APAC): Rapid growth attributed to energy access initiatives, heavy industrial demand, governmental subsidies for renewable mini-grids, especially in developing economies like India, Indonesia, and the Philippines.

- Latin America: Emerging market characterized by high solar potential, fluctuating grid reliability, and increasing private investment in commercial and industrial self-consumption projects across Brazil, Mexico, and Chile.

- Middle East & Africa (MEA): Focus on utility-scale solar projects and decentralized solar solutions to address energy poverty and manage high cooling loads; significant investment in off-grid solutions for remote mining and agricultural operations.

Top Key Players

The market research report includes a detailed profile of leading stakeholders in the Decentralized Energy Systems Market.- Siemens AG

- General Electric

- Schneider Electric SE

- ABB Ltd

- Tesla Inc.

- Bloom Energy

- Vestas Wind Systems

- Enphase Energy

- SunPower Corporation

- Mitsubishi Heavy Industries

- Capstone Green Energy

- Johnson Controls International

- CleanSpark, Inc.

- EDF Group

- Engie SA

- SMA Solar Technology

- Fluence Energy

- Eaton Corporation

- Cummins Inc.

- Honeywell International Inc.

- NEC Corporation

- Wärtsilä Corporation

- Doosan Fuel Cell America

- Hitachi Ltd.

- First Solar, Inc.

Frequently Asked Questions

Analyze common user questions about the Decentralized Energy Systems market and generate a concise list of summarized FAQs reflecting key topics and concerns.What is the primary factor driving the adoption of Decentralized Energy Systems?

The primary driver is the necessity for enhanced energy resilience and security, particularly among commercial and industrial users seeking protection from grid failures, coupled with the continuously declining cost of renewable energy generation and storage technologies.

How do Decentralized Energy Systems enhance grid stability?

DES enhance grid stability by reducing peak load demands, providing localized voltage and frequency support, and enabling utilities to utilize distributed resources as virtual power plants (VPPs) for ancillary services and efficient load management.

Which technology segment is expected to show the highest growth rate?

The Energy Storage Systems (ESS) segment, especially Battery Energy Storage Systems (BESS), is projected to exhibit the highest CAGR as storage is essential for integrating intermittent renewable sources and optimizing the economic performance of decentralized assets.

What is the role of microgrids in the Decentralized Energy Systems market?

Microgrids are foundational, enabling critical facilities (e.g., hospitals, military bases, industrial complexes) to "island" or operate autonomously from the main grid during outages, ensuring continuous, high-quality power supply and local energy management.

What are the main regulatory challenges facing DES deployment?

Key regulatory challenges include complex and lengthy grid interconnection procedures, outdated utility tariff structures that do not fully incentivize distributed generation, and variability in permitting requirements across different jurisdictions.

How does AI contribute to the efficiency of DES?

AI significantly contributes by optimizing asset performance through predictive maintenance, improving renewable energy forecasting accuracy, and enabling real-time automated control of DERs within VPPs to maximize profitability and operational efficiency.

Which geographical region leads the market in terms of deployed capacity?

North America and Europe traditionally hold significant deployed capacity due to early adoption and mature regulatory support, but the Asia Pacific region is rapidly dominating new installations, driven by large-scale energy demand and rural electrification efforts.

Are decentralized systems only suitable for off-grid applications?

No. While critical for off-grid communities, the vast majority of new DES installations are grid-connected (on-grid), focusing on energy independence, cost management, peak shaving, and providing essential services back to the main utility grid.

What are the primary components of a typical Decentralized Energy System?

A typical DES includes a generation source (e.g., Solar PV, CHP), a storage component (BESS), power electronics (inverters, converters), and a sophisticated control system or energy management software to coordinate operations.

What impact does the rise of Electric Vehicles (EVs) have on DES?

The rise of EVs introduces the concept of Vehicle-to-Grid (V2G) technology, turning large fleets of parked EVs into potentially massive, flexible distributed energy storage assets that can bolster grid stability and energy trading opportunities within DES frameworks.

Why is the industrial sector a major consumer of DES?

The industrial sector is a major consumer because power reliability is crucial for manufacturing continuity and avoiding costly downtime; microgrids offer a localized, guaranteed power supply superior to traditional utility infrastructure for mission-critical operations.

What are the long-term cost benefits of adopting DES?

Long-term cost benefits include reduced exposure to volatile utility electricity prices, lower transmission and distribution charges, potential revenue generation from participating in VPPs, and minimal operational costs associated with renewable generation.

How do governments incentivize DES deployment?

Governments incentivize deployment through mechanisms such as capital expenditure grants, production tax credits (PTC), investment tax credits (ITC), favorable net metering policies, feed-in tariffs (FITs), and specific mandates for renewable portfolio standards (RPS).

What distinguishes a Virtual Power Plant (VPP) from a microgrid?

A microgrid is a physical, localized power system that can operate independently (islanded), while a VPP is a cloud-based aggregation of geographically dispersed DERs managed centrally by software to act as a single, flexible power plant for grid services.

What are the risks associated with the increasing digitalization of DES?

The primary risk is heightened cybersecurity vulnerability. As more devices and control systems become interconnected via IoT platforms, they present larger attack surfaces susceptible to disruption or unauthorized access, necessitating robust OT cybersecurity measures.

How is the Value Chain for DES structured?

The value chain begins with upstream component manufacturing (PV, batteries), moves through midstream system integration and EPC services (installation, customized engineering), and concludes with downstream operations, maintenance, and energy optimization services (O&M, VPP management).

Is Combined Heat and Power (CHP) still relevant in the DES market?

Yes, CHP remains highly relevant, particularly in the industrial and large commercial sectors and cold climates, as it offers exceptional overall system efficiency by utilizing waste heat for thermal loads, complementing intermittent renewables and providing high baseload reliability.

What is the projected CAGR for the DES market through 2033?

The Decentralized Energy Systems market is projected to grow at a Compound Annual Growth Rate (CAGR) of 9.8% between 2026 and 2033, reflecting substantial anticipated global investment and adoption.

What role do microturbines play in the technology mix?

Microturbines serve as reliable, small-scale baseload generation and peaking units, often utilizing natural gas or biogas. They are integral in hybrid DES where they provide predictable power and system black start capability, complementing variable solar and wind generation.

What are the main financial instruments used to finance DES projects?

Financing instruments commonly include Power Purchase Agreements (PPAs), where a third party owns and operates the system; leasing models; green bonds; and favorable government-backed loan programs designed specifically for renewable and energy efficiency projects.

How does DES support the development of smart cities?

DES provides smart cities with localized, clean, and highly reliable power infrastructure, enabling the continuous operation of sensors, IoT devices, smart street lighting, and public transportation, which are essential components of urban digitalization efforts.

What impact do supply chain constraints have on the DES market?

Supply chain constraints, particularly concerning semiconductor components for inverters and raw materials for Li-ion batteries, can temporarily inflate component prices and lengthen deployment timelines, requiring strategic sourcing and diversified manufacturing footprints.

How is system interoperability achieved in a complex DES?

Interoperability is achieved through standardized communication protocols (like Modbus, DNP3, and increasingly IEEE 2030.5), open-source software architectures, and sophisticated energy management systems (EMS) that ensure seamless communication among diverse DERs and control hardware.

What is the significance of the shift from centralized to decentralized energy systems?

This shift democratizes energy production, enhances overall grid resilience against large-scale failure, reduces long-distance transmission losses, and accelerates the integration of sustainable, clean energy sources closer to the point of consumption.

Which End-User segment shows the most immediate growth potential?

While industrial adoption is strong, the Utility & Infrastructure segment shows massive potential as utilities worldwide are beginning to recognize the economic benefits of using distributed resources as viable non-wires alternatives (NWAs) to defer costly conventional infrastructure upgrades.

How do decentralized systems contribute to climate change mitigation?

DES utilize predominately renewable sources (solar, wind), directly displacing high-emission fossil fuel generation, thereby lowering the overall carbon intensity of the energy supply and playing a crucial role in achieving global net-zero targets.

What are the primary differences between on-grid and off-grid applications?

On-grid applications connect to the utility network, prioritizing energy cost optimization and providing grid support, whereas off-grid systems are entirely self-sufficient, focusing exclusively on maximizing system reliability and providing basic energy access in remote locations.

How is the concept of 'Energy as a Service' (EaaS) influencing the DES market?

EaaS allows customers to procure energy solutions without substantial upfront capital investment. Providers retain ownership of the decentralized assets and charge the customer based on energy consumption or service provided, greatly lowering the entry barrier for adoption.

What advancements are being made in fuel cell technology for DES?

Advancements focus on solid oxide fuel cells (SOFC) and proton exchange membrane (PEM) fuel cells, improving their durability, achieving higher conversion efficiencies, and expanding their capability to utilize diverse fuels like natural gas, hydrogen, or biogas for continuous, low-emission power generation.

What are the key drivers for DES adoption in Latin America?

Key drivers include abundant solar resources, highly volatile wholesale electricity prices, and localized grid weaknesses, which push commercial entities and rural areas toward independent generation solutions to stabilize power costs and ensure operational continuity.

How important is energy efficiency in the context of DES?

Energy efficiency is paramount; optimizing consumption before deploying DES reduces the required size and cost of the generation and storage assets, thereby maximizing the overall economic and environmental return on investment for the entire decentralized system.

What kind of skills are highly sought after in the DES workforce?

High-demand skills include expertise in power electronics, renewable energy system integration, cybersecurity specific to operational technology (OT), data science for VPP optimization, and advanced electrical engineering related to microgrid control systems.

What defines the current competitive landscape in the DES market?

The landscape is intensely competitive, featuring large industrial conglomerates providing turnkey solutions, specialized energy storage and software firms, and utility companies increasingly deploying their own DER portfolios, often leading to vertical and horizontal integration strategies.

How do utilities view the proliferation of customer-owned DES?

Utilities initially viewed DERs as a threat to traditional revenue models, but are increasingly viewing them as assets. Many are now partnering with DER owners or developing their own VPPs to utilize distributed capacity for grid modernization and peak demand management.

What is the primary challenge in integrating DERs into existing distribution grids?

The primary technical challenge is managing the variability and ensuring the stability of two-way power flow. High penetrations of intermittent DERs can cause voltage fluctuations and power quality issues, requiring sophisticated grid monitoring and adaptive control systems.

Why is the Industrial segment often focused on Combined Heat and Power (CHP)?

Industrial facilities often have substantial, simultaneous demands for both electrical power and thermal energy (steam/heat) for processes. CHP systems efficiently meet both needs from a single fuel source, offering superior energy utilization compared to separate heat and power generation.

What is the market size of Decentralized Energy Systems estimated for 2033?

The market size for Decentralized Energy Systems is projected to reach $355.9 Billion by the end of the forecast period in 2033, driven by sustained global investment in renewable energy infrastructure and resilience.

How does DES adoption differ between developing and developed nations?

In developed nations, DES is primarily driven by decarbonization, cost optimization, and resilience; in developing nations, it is often driven by the fundamental need for energy access, using off-grid solutions to bypass non-existent or inadequate central grid infrastructure.

What role does the Internet of Things (IoT) play in DES?

IoT enables real-time data collection from decentralized assets, allowing for granular monitoring of performance, remote control capabilities, predictive maintenance alerts, and seamless communication necessary for VPP orchestration and smart grid management.

What distinguishes Microturbines from traditional gas turbines in DES?

Microturbines are smaller (typically 30kW to 500kW), operate on cleaner combustion cycles, require less maintenance, and are designed for distributed generation at commercial or small industrial sites, focusing on high reliability and lower overall emissions compared to larger centralized turbines.

How are environmental benefits quantified in DES?

Environmental benefits are quantified primarily by the reduction in greenhouse gas emissions (CO2 equivalent) due to the displacement of fossil fuel generation, lower air pollution (NOx, SOx, particulate matter), and reduced land impact compared to large centralized power plants.

Which key technology is essential for managing the variability of renewable energy?

Battery Energy Storage Systems (BESS) are essential, providing crucial short-term energy storage capacity that buffers the intermittent nature of solar and wind power, ensuring a steady, reliable supply that matches demand and maintains system frequency.

What are the latest trends in the downstream segment of the value chain?

Latest trends include the rise of digital platforms for O&M, the widespread implementation of blockchain for secure energy trading within localized networks, and the expansion of ‘as-a-service’ business models for financing and managing DER assets.

Why is standardization critical for scaling the DES market?

Standardization of hardware interfaces, communication protocols, and regulatory approval processes reduces complexity, lowers integration costs, shortens deployment times, and ensures interoperability, all of which are necessary for mass market adoption and scalability.

How does DES contribute to load balancing in a smart city context?

DES, through smart metering and VPPs, can dynamically adjust generation or consumption (demand response) at localized points in the city, preventing strain on specific distribution feeders and effectively managing load fluctuations in real-time, especially during peak hours.

What role do public sector entities play as customers in this market?

Public sector entities, including military installations and universities, act as major customers by investing in mission-critical microgrids to ensure continuous operations during widespread outages, often setting mandates for 100% renewable energy use on their campuses.

What are the investment priorities for leading DES technology companies?

Investment priorities center on enhancing battery technology lifespan and safety, developing more sophisticated AI-driven control software, improving cybersecurity defenses for OT systems, and increasing the manufacturing efficiency of solar and inverter components.

How do tariffs and net metering policies affect residential DES adoption?

Favorable net metering policies, which credit solar owners for excess electricity fed back to the grid, dramatically improve the financial viability of residential installations, making the payback period attractive and significantly driving consumer adoption rates.

What is the expected long-term impact of decentralized systems on traditional utilities?

The long-term impact compels traditional utilities to transform their business models from solely being power suppliers to becoming sophisticated distribution system operators (DSOs) that manage complex bidirectional flows and integrate vast numbers of customer-owned DERs efficiently.

In the context of DES, what does 'islanded mode' refer to?

'Islanded mode' refers to the operation of a microgrid or decentralized system that disconnects itself from the main utility grid and operates independently, supplying power only to its local loads, typically activated automatically during a grid outage to ensure continuity.

What is the primary constraint related to high capital expenditure in DES?

The primary constraint is the high upfront cost, particularly for the Energy Storage Systems (BESS) and advanced microgrid controllers, which often necessitates third-party financing solutions or long-term contracts (like PPAs) to make the projects financially viable for end-users.

To check our Table of Contents, please mail us at: sales@marketresearchupdate.com

Research Methodology

The Market Research Update offers technology-driven solutions and its full integration in the research process to be skilled at every step. We use diverse assets to produce the best results for our clients. The success of a research project is completely reliant on the research process adopted by the company. Market Research Update assists its clients to recognize opportunities by examining the global market and offering economic insights. We are proud of our extensive coverage that encompasses the understanding of numerous major industry domains.

Market Research Update provide consistency in our research report, also we provide on the part of the analysis of forecast across a gamut of coverage geographies and coverage. The research teams carry out primary and secondary research to implement and design the data collection procedure. The research team then analyzes data about the latest trends and major issues in reference to each industry and country. This helps to determine the anticipated market-related procedures in the future. The company offers technology-driven solutions and its full incorporation in the research method to be skilled at each step.

The Company's Research Process Has the Following Advantages:

- Information Procurement

The step comprises the procurement of market-related information or data via different methodologies & sources.

- Information Investigation

This step comprises the mapping and investigation of all the information procured from the earlier step. It also includes the analysis of data differences observed across numerous data sources.

- Highly Authentic Source

We offer highly authentic information from numerous sources. To fulfills the client’s requirement.

- Market Formulation

This step entails the placement of data points at suitable market spaces in an effort to assume possible conclusions. Analyst viewpoint and subject matter specialist based examining the form of market sizing also plays an essential role in this step.

- Validation & Publishing of Information

Validation is a significant step in the procedure. Validation via an intricately designed procedure assists us to conclude data-points to be used for final calculations.

×

Request Free Sample:

Related Reports

Select License

Why Choose Us

We're cost-effective and Offered Best services:

We are flexible and responsive startup research firm. We adapt as your research requires change, with cost-effectiveness and highly researched report that larger companies can't match.

Information Safety

Market Research Update ensure that we deliver best reports. We care about the confidential and personal information quality, safety, of reports. We use Authorize secure payment process.

We Are Committed to Quality and Deadlines

We offer quality of reports within deadlines. We've worked hard to find the best ways to offer our customers results-oriented and process driven consulting services.

Our Remarkable Track Record

We concentrate on developing lasting and strong client relationship. At present, we hold numerous preferred relationships with industry leading firms that have relied on us constantly for their research requirements.

Best Service Assured

Buy reports from our executives that best suits your need and helps you stay ahead of the competition.

Customized Research Reports

Our research services are custom-made especially to you and your firm in order to discover practical growth recommendations and strategies. We don't stick to a one size fits all strategy. We appreciate that your business has particular research necessities.

Service Assurance

At Market Research Update, we are dedicated to offer the best probable recommendations and service to all our clients. You will be able to speak to experienced analyst who will be aware of your research requirements precisely.

Contact With Our Sales Team

Customer Testimonials

The content of the report is always up to the mark. Good to see speakers from expertise authorities.

Privacy requested , Managing Director

A lot of unique and interesting topics which are described in good manner.

Privacy requested, President

Well researched, expertise analysts, well organized, concrete and current topics delivered in time.

Privacy requested, Development Manager