Defatted Wheat Germ Powder Market Size, By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2026 to 2033 (Financial Impact Analysis)

ID : MRU_ 441005 | Date : Feb, 2026 | Pages : 258 | Region : Global | Publisher : MRU

Defatted Wheat Germ Powder Market Size

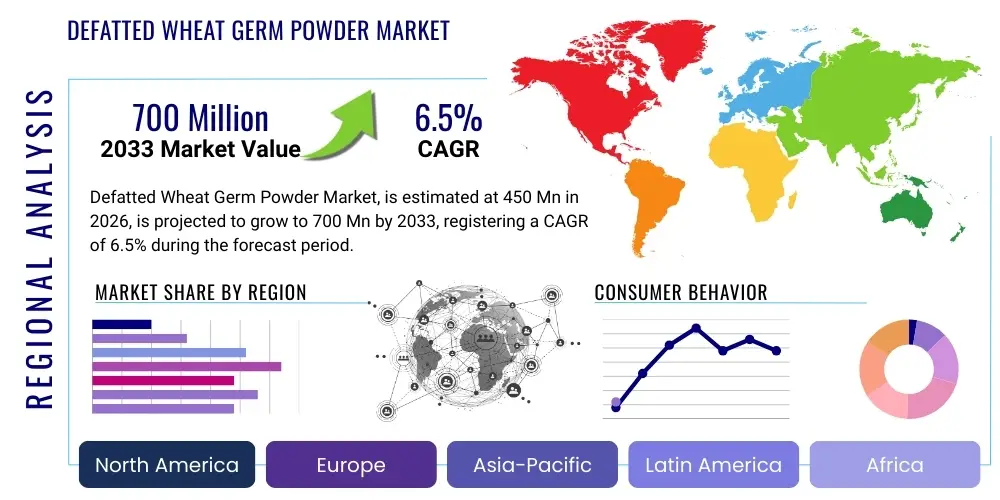

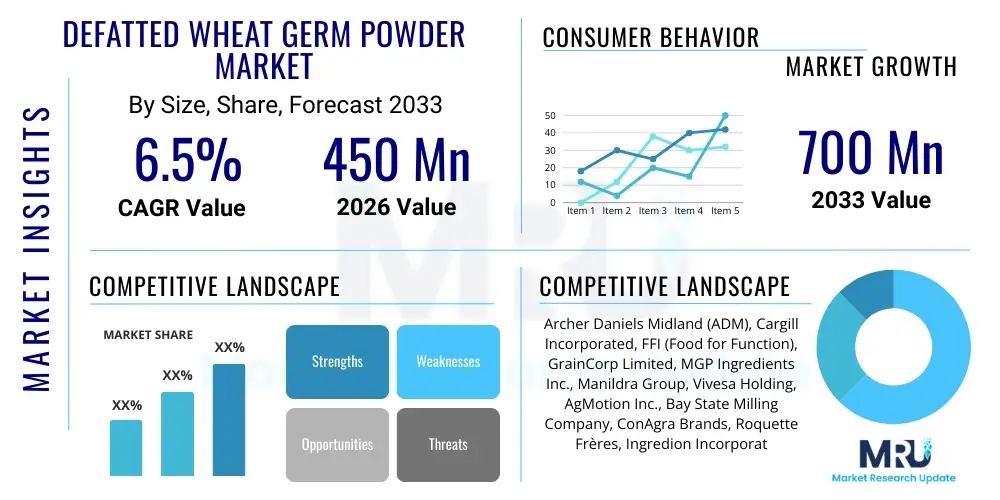

The Defatted Wheat Germ Powder Market is projected to grow at a Compound Annual Growth Rate (CAGR) of 6.5% between 2026 and 2033. The market is estimated at USD 450 Million in 2026 and is projected to reach USD 700 Million by the end of the forecast period in 2033.

Defatted Wheat Germ Powder Market introduction

Defatted wheat germ powder represents a highly concentrated nutritional derivative obtained through the mechanical or solvent extraction of crude wheat germ oil, leaving behind a protein and fiber-rich meal that is subsequently milled into a fine powder. Wheat germ itself is the embryonic part of the wheat kernel, accounting for only a small percentage of the kernel's total weight but containing the majority of its critical nutrients, particularly B vitamins, Vitamin E, essential minerals, and high-quality protein. The process of defatting is crucial for enhancing the product's shelf stability and increasing the concentration of non-lipid components. Raw wheat germ is highly susceptible to rancidity due to its significant oil content (typically 8% to 12%), which limits its integration into commercial food applications. By reducing the fat content significantly, often below 1%, the resulting powder achieves superior oxidative stability, making it ideal for large-scale industrial use in functional foods, beverages, and nutritional supplements that require a longer shelf life.

The product's primary appeal lies in its exceptional nutritional profile and functional attributes. Defatted wheat germ powder is an outstanding source of dietary fiber, high-quality plant-based protein (often exceeding 30% protein content), and beneficial micronutrients such as folate, magnesium, phosphorus, and zinc. Its application spectrum is broad and expanding, driven by global trends toward preventive healthcare and clean-label ingredients. In the food industry, it is widely utilized as a dough conditioner in baking, enhancing the texture, volume, and nutritional value of bread, pastries, and cereals. Furthermore, its functional properties, such as excellent water-binding capacity and emulsifying characteristics, make it a valuable ingredient in meat analogs and processed meat products, where it aids in moisture retention and improving overall product mouthfeel. The nutraceutical segment utilizes it extensively in protein powders, meal replacement mixes, and specific dietary supplements targeting athletes and the elderly population seeking concentrated sources of essential amino acids and antioxidant properties.

Major market drivers propelling the demand for defatted wheat germ powder include the surging consumer interest in plant-based nutrition and the documented health benefits associated with high-fiber, high-protein diets. The global rise in chronic diseases, coupled with heightened health consciousness among middle-income populations, has fueled the demand for functional ingredients that naturally fortify everyday foods. Additionally, the advancement in processing technologies, particularly cold-pressing and supercritical fluid extraction (SFE) methods which avoid harsh chemicals, has improved the quality and perception of defatted wheat germ powder, ensuring that maximum nutritional integrity is retained. Regulatory support for including whole grains and their derivatives in recommended daily diets further reinforces its market position. The ingredient’s versatility allows for seamless incorporation across various food matrices, positioning it as a key component in the innovation pipelines of major food and beverage manufacturers focusing on health and wellness categories.

Defatted Wheat Germ Powder Market Executive Summary

The Defatted Wheat Germ Powder market is characterized by robust growth stemming from macro-level consumer shifts toward preventive health and the increased incorporation of functional ingredients in staple foods. Key business trends include aggressive capacity expansion by major millers and specialized ingredient processors, focusing on securing non-GMO and organic certifications to meet premium market demand. There is a notable trend toward product innovation, specifically micronization and encapsulation techniques, aimed at improving solubility, reducing particle size for beverage applications, and masking the slightly bitter taste sometimes associated with wheat germ derivatives. Strategic collaborations between wheat germ processors and major food manufacturers, particularly in the dairy-alternative and bakery sectors, are accelerating market penetration. Furthermore, sustainability practices, including utilizing wheat milling by-products (germ) efficiently, are becoming a significant competitive differentiator, aligning with corporate environmental, social, and governance (ESG) goals.

Regionally, North America and Europe currently dominate the market, largely due to high consumer awareness regarding dietary supplements, established regulatory frameworks supporting novel food ingredients, and the pervasive presence of major functional food companies. The Asia Pacific (APAC) region, however, is projected to exhibit the fastest growth over the forecast period. This acceleration is attributed to rapidly growing populations, increasing disposable incomes, and the Westernization of dietary patterns, leading to greater acceptance of fortified and processed health foods, particularly in emerging economies like China and India. Government initiatives promoting better nutrition and investments in sophisticated food processing infrastructure across Southeast Asia are further unlocking significant opportunities. Latin America and the Middle East & Africa (MEA) represent nascent but promising markets, driven primarily by localized nutritional programs and the initial adoption of packaged nutritional snacks.

Segmentation analysis reveals that the food & beverage application segment holds the largest market share, driven primarily by the high volume usage in the baking and breakfast cereal industries. Within the product type segmentation, the solvent-extracted powder segment, while offering lower cost efficiency and higher yields, is gradually losing ground to mechanically defatted (cold-pressed) varieties. Consumers are increasingly favoring the mechanically processed powder due to the perception of cleaner processing and minimal chemical residues, which aligns with clean-label trends, despite the higher production cost. End-user demand is heavily skewed towards the nutraceutical and sports nutrition sectors, where the high protein and fiber concentration provides immediate formulation advantages for performance-enhancing and recovery products. The distribution channel analysis shows a continuing reliance on business-to-business (B2B) direct supply contracts, though e-commerce channels are gaining traction for smaller, specialized nutraceutical firms and direct-to-consumer sales.

AI Impact Analysis on Defatted Wheat Germ Powder Market

User inquiries concerning the integration of Artificial Intelligence (AI) and Machine Learning (ML) within the defatted wheat germ powder sector primarily revolve around optimizing operational efficiency, enhancing quality control consistency, and accelerating new product development cycles. Key themes include how AI can predict variations in raw material quality (wheat germ) based on meteorological and sourcing data, thus ensuring stable nutritional input profiles necessary for consistent final products. Concerns are often raised regarding the deployment cost of sophisticated sensor technology and AI platforms, particularly for small and medium-sized processors. Expectations center on AI's ability to minimize waste during the defatting and stabilization processes, optimize energy consumption in drying, and provide granular traceability across the supply chain, addressing growing consumer demand for transparency and mitigating potential contamination risks efficiently.

The implementation of AI systems is fundamentally changing how manufacturers manage the complex biochemical aspects of wheat germ processing. For instance, ML algorithms can analyze real-time data from near-infrared spectroscopy (NIR) sensors to instantaneously adjust parameters during the defatting process, such as temperature, pressure, or solvent flow rates (if used), ensuring optimal oil extraction while preserving the integrity of heat-sensitive nutrients like Vitamin E and B vitamins. This level of precision minimizes nutrient degradation and maximizes yield consistency, which is particularly challenging given the natural variability of agricultural inputs. Furthermore, predictive maintenance powered by AI is drastically reducing unplanned downtime for specialized equipment like continuous centrifuges and vacuum dryers, leading to higher operational reliability and lower overall manufacturing costs per unit of powder.

In the realm of market strategy and consumer interaction, AI tools are proving invaluable for rapid insight generation. Generative AI models analyze vast datasets of consumer preferences, ingredient interactions, and market trends to identify gaps for new product innovation, such as novel applications of defatted wheat germ powder in plant-based dairy or high-protein savory snacks. AI-driven sentiment analysis of social media and review platforms allows ingredient suppliers and food formulators to quickly assess public reaction to new products and adjust marketing messages or reformulate ingredients accordingly. This rapid feedback loop shortens the product lifecycle and ensures that investments in R&D are targeted towards formulations with the highest probability of market acceptance, ensuring the defatted wheat germ powder remains a contemporary and sought-after functional food ingredient.

- AI optimizes extraction and drying parameters for maximum nutrient retention and energy efficiency.

- Machine Learning algorithms predict raw material quality variance, ensuring input consistency.

- Predictive analytics enhance supply chain resilience and demand forecasting, reducing stock-outs and spoilage.

- Computer vision and AI sensors provide continuous, non-invasive quality checks for color, particle size, and purity.

- Generative AI accelerates new food formulation design by modeling ingredient interactions and consumer acceptability.

- AI-powered traceability systems offer granular, immutable records of processing steps, enhancing compliance and trust.

DRO & Impact Forces Of Defatted Wheat Germ Powder Market

The market for Defatted Wheat Germ Powder is shaped by a powerful confluence of drivers, constraints, and emerging opportunities, collectively defining the impact forces within the industry. Key drivers include the global mandate for nutrient fortification of everyday foods, necessitated by widespread micronutrient deficiencies and increased public health focus on whole grains and plant proteins. Restraints center predominantly on the inherent challenges associated with processing wheat derivatives, including complex regulatory requirements related to allergen labeling (wheat is a major allergen) and maintaining stringent quality standards to prevent microbial contamination. Opportunities are significantly concentrated around the expansion into specialized nutritional sectors, such as infant formula and clinical nutrition, where the powder’s concentrated nutrient profile is highly valued. The overall market dynamic is one of positive momentum, although sustained growth requires proactive management of processing efficiencies and regulatory compliance across diverse international jurisdictions.

Drivers: The dominant driver is the compelling shift in consumer behavior toward functional and preventative nutrition. Consumers are actively seeking ingredients that offer benefits beyond basic sustenance, viewing defatted wheat germ powder as a natural source of high-biological-value protein, essential fibers (including beneficial prebiotics), and potent antioxidants (tocopherols). Furthermore, the global proliferation of the sports and active nutrition market provides a consistent high-demand outlet, as the ingredient supports muscle synthesis and energy metabolism with a clean-label appeal. The economic driver stems from its status as a by-product of the mainstream milling industry, offering an attractive valorization pathway for what would otherwise be a low-value stream, thus improving the overall profitability of wheat processing operations and ensuring a relatively stable raw material supply base.

Restraints: Significant market constraints include the aforementioned allergen status of wheat, which mandates careful segregation and stringent labeling, potentially restricting its use in certain allergen-sensitive facilities or product lines. Cost volatility in the specialized processing required for defatting, especially high-cost methods like cold-pressing or SFE, impacts the final ingredient price, making it less competitive against commodity protein sources like soy or conventional whey. Shelf life, though significantly improved through defatting, still requires careful packaging (often inert gas flushing or vacuum packing) and controlled storage environments, adding logistical complexity and cost compared to highly stable, synthetic ingredients. Consumer skepticism regarding processed ingredients, even when derived from natural sources, also presents a marketing hurdle that requires continuous educational outreach and transparent sourcing practices.

Opportunities: Key opportunities lie in technological advancements that reduce the residual lipid content even further, potentially opening up highly sensitive applications requiring extremely long shelf stability. The development of specialized hydrolyzed or fermented defatted wheat germ derivatives is a strong growth avenue, as these modified forms offer enhanced solubility, improved digestibility, and reduced allergenicity, making them suitable for clinical and infant nutrition. Geographically, untapped potential exists in developing markets where nutritional deficiencies are prevalent and government-led fortification programs are intensifying. The burgeoning demand for sustainable, circular economy inputs also favors defatted wheat germ powder, positioning it attractively against less sustainable, imported protein sources, fostering local production and reducing the overall carbon footprint of finished products.

Segmentation Analysis

The Defatted Wheat Germ Powder market is intricately segmented across several key dimensions, providing a comprehensive view of consumption patterns and market potential. Primary segmentation focuses on the method of processing (determining purity and cost), the specific application area (reflecting end-user industries), and the geographical region (highlighting regional growth dynamics and regulatory variations). The segmentation by processing method is critical as it dictates the ingredient’s functional performance and suitability for clean-label formulation; mechanically defatted powder is premium but preferred for transparency, while solvent-extracted remains the high-volume, cost-effective choice. Application segmentation confirms the market's reliance on the functional food and nutraceutical sectors, although the ingredient is increasingly penetrating specialized areas like pet nutrition and cosmetics due to its potent antioxidant properties and high protein content.

- By Processing Method:

- Mechanically Defatted (Cold Pressed)

- Solvent Extracted

- By Application:

- Food & Beverages (Baking, Cereals, Confectionery)

- Nutraceuticals & Dietary Supplements (Protein Powders, Functional Bars)

- Animal Nutrition (Feed Additives)

- Cosmeceuticals and Personal Care

- By Distribution Channel:

- Direct Sales (B2B)

- Indirect Sales (Distributors, Online Retail)

- By Region:

- North America (U.S., Canada, Mexico)

- Europe (Germany, U.K., France, Italy, Spain)

- Asia Pacific (China, India, Japan, Australia)

- Latin America (Brazil, Argentina)

- Middle East & Africa (South Africa, GCC Countries)

Value Chain Analysis For Defatted Wheat Germ Powder Market

The value chain for defatted wheat germ powder is initiated upstream with the procurement of high-quality wheat kernels, typically sourced from specialized milling operations that separate the germ efficiently during the flour production process. This initial segregation is crucial as the viability and integrity of the raw wheat germ directly impact the quality and yield of the final defatted powder. Key upstream activities involve quality checks for mycotoxins and pesticide residues, followed by careful handling to prevent oxidative damage before the defatting stage. Suppliers must maintain rigorous cold storage protocols for the germ prior to processing. The core manufacturing stage involves specialized lipid extraction technology—either chemical solvent extraction (e.g., hexane) for industrial scale and high efficiency, or mechanical cold pressing for higher nutritional integrity and cleaner label claims. This stage adds significant value through stabilization and detoxification, ensuring the powder is palatable and safe for consumption.

The midstream of the value chain is dominated by specialized ingredient processors who transform the crude defatted germ meal into a marketable powder, involving processes such as milling, sieving for particle size uniformity, and advanced packaging (often using modified atmosphere packaging to prevent residual fat oxidation). Product differentiation occurs here through specialization, such as producing organic, non-GMO, or highly micronized grades suitable for specific high-end applications like smooth protein drinks. Downstream activities involve distribution and final formulation. The distribution channel is heavily weighted towards direct B2B sales, where ingredient manufacturers establish long-term contracts with major food and nutraceutical companies. These large-volume transactions benefit from direct technical support and customized supply specifications, minimizing reliance on intermediary distributors for bulk quantities.

Indirect distribution plays a supporting role, primarily serving smaller formulators, specialty bakeries, and the direct-to-consumer (D2C) market through online ingredient suppliers and authorized local distributors. These channels require less bulk but often demand higher margins due to handling and packaging complexity. The final customers—food, beverage, and supplement companies—incorporate the powder into their proprietary blends. Their purchasing decisions are heavily influenced by technical specifications (protein content, moisture level, particle size), price competitiveness, and certifications (e.g., Kosher, Halal, Organic). Efficiency across this entire chain is highly dependent on managing the volatility associated with agricultural raw material pricing and mitigating risks related to rapid nutrient degradation inherent in wheat germ derivatives, making sophisticated inventory and quality management systems critical for market success and maintaining robust profit margins.

Defatted Wheat Germ Powder Market Potential Customers

The primary customer base for defatted wheat germ powder spans several distinct industries, unified by the need for high-quality, plant-based functional ingredients rich in protein and fiber. The largest segment of potential customers resides within the nutraceutical and dietary supplement industries, specifically manufacturers of sports nutrition products, functional protein blends, and meal replacement powders. These customers value the high protein content (often exceeding 30%) and the presence of essential amino acids and complex B vitamins, positioning it as a superior, natural alternative to some conventional protein isolates. The robust growth in preventative health spending globally ensures that this sector remains the most stable and highest-value customer segment, often requiring premium, technically superior grades of the powder, such as those that are highly soluble or non-allergenic (e.g., hydrolyzed forms).

The second major group consists of large-scale industrial food manufacturers, particularly those specializing in baked goods, breakfast cereals, and extruded snacks. In baking, defatted wheat germ powder is utilized not only for nutritional fortification but also for its functional properties as a natural emulsifier and texture enhancer, improving the crumb structure and extending the freshness of products. Cereal manufacturers incorporate it to meet increasing consumer demand for high-fiber, whole-grain claims. As consumer preference shifts toward plant-forward diets, a rapidly growing customer segment includes manufacturers developing meat analogs, plant-based burgers, and dairy-free alternatives, where the powder acts as an excellent binding agent, protein source, and flavor enhancer, providing a desirable ‘earthy’ undertone and improving moisture retention characteristics.

Finally, niche but high-growth customer bases include the animal nutrition sector (specifically high-performance pet food and specialized livestock feed) and the personal care/cosmeceuticals industry. In animal nutrition, it serves as a concentrated source of highly digestible protein and vitamins for specialized dietary requirements. In cosmeceuticals, its extract is valued for its antioxidant tocopherols and moisturizing capabilities, leading to demand from manufacturers of anti-aging creams, serums, and hair care products. These varied applications necessitate suppliers to maintain flexibility in production, offering both bulk ingredient supply for the industrial sector and specialized, highly pure fractions for the clinical and cosmetic industries, ensuring a broad and diversified customer portfolio across the market.

| Report Attributes | Report Details |

|---|---|

| Market Size in 2026 | USD 450 Million |

| Market Forecast in 2033 | USD 700 Million |

| Growth Rate | 6.5% CAGR |

| Historical Year | 2019 to 2024 |

| Base Year | 2025 |

| Forecast Year | 2026 - 2033 |

| DRO & Impact Forces |

|

| Segments Covered |

|

| Key Companies Covered | Archer Daniels Midland (ADM), Cargill Incorporated, FFI (Food for Function), GrainCorp Limited, MGP Ingredients Inc., Manildra Group, Vivesa Holding, AgMotion Inc., Bay State Milling Company, ConAgra Brands, Roquette Frères, Ingredion Incorporated, Sunopta Inc., Bunge Limited, Wilmar International, ADM Milling, Ardent Mills, Siemer Milling Company, Bob's Red Mill Natural Foods, King Arthur Baking Company. |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Enquiry Before Buy | Have specific requirements? Send us your enquiry before purchase to get customized research options. Request For Enquiry Before Buy |

Defatted Wheat Germ Powder Market Key Technology Landscape

The technological landscape surrounding the production of defatted wheat germ powder is pivotal to achieving high-quality, functionally superior ingredients, heavily emphasizing lipid extraction and stability enhancement. Traditional methods relied primarily on chemical solvent extraction, typically using hexane, which is highly efficient for oil removal (achieving <1% residual fat) and cost-effective for high-volume production. However, rising consumer aversion to chemical residues has necessitated a rapid shift toward cleaner technologies. Consequently, advanced mechanical extraction methods, such as cold-pressing using high-pressure expellers, are gaining prominence. While these methods often leave a slightly higher fat content (around 3-5%), they preserve the natural integrity of the proteins and vitamins, appealing directly to the clean-label and organic segments. Crucially, the stabilization process post-defatting involves advanced drying techniques, particularly vacuum or fluid-bed drying, meticulously controlled to minimize thermal degradation of heat-sensitive B vitamins and tocopherols, ensuring maximum nutritional bioavailability in the final powder.

Another area of intense technological focus is particle engineering. To improve the usability of defatted wheat germ powder in modern food matrices, manufacturers are investing in micronization and nano-milling technologies. These techniques reduce the average particle size significantly, which enhances solubility and reduces grittiness, making the powder ideal for incorporation into beverages, smooth yogurts, and clear protein shakes without affecting texture. Furthermore, enzyme treatment technologies are being applied to the defatted powder to produce hydrolyzed wheat germ protein. Hydrolysis breaks down complex proteins into smaller peptides, improving their digestibility and potentially reducing allergenicity, thereby expanding the powder's market entry into sensitive applications like clinical and infant nutrition formulas, which require highly absorbable protein sources. This biochemical modification requires precise reactor control and enzyme selection to ensure consistent peptide profiles.

Finally, packaging and preservation technology plays a fundamental role in maintaining the extended shelf life conferred by defatting. Even minimal residual lipids can oxidize over time, leading to rancidity and flavor deterioration. Therefore, manufacturers are increasingly adopting sophisticated barrier packaging materials combined with modified atmosphere packaging (MAP), typically involving nitrogen flushing or vacuum sealing. This minimizes oxygen exposure, dramatically slowing the rate of oxidative degradation. Integrated sensor technologies, often utilizing colorimetric or spectroscopic analysis, are being implemented directly within the production line to ensure real-time monitoring of key quality indicators—such as moisture content, residual oil percentage, and microbial load—before packaging. This continuous inline monitoring capability, often linked to AI predictive systems, ensures that only products meeting the most rigorous safety and quality specifications enter the distribution stream, thus mitigating large-scale recalls and protecting brand integrity in a highly competitive functional ingredient market.

Regional Highlights

- North America: This region holds a dominant market share, primarily driven by the mature and robust dietary supplement industry, high consumer expenditure on health and wellness products, and the prevalence of major international food corporations focused on fortification. The U.S. market is characterized by strong demand for non-GMO and organic certified defatted wheat germ powder, particularly within the sports nutrition and functional baking segments. Regulatory frameworks are well-established, necessitating transparency and strict labeling compliance, which favors established international suppliers. Canada also exhibits strong growth, mirroring the U.S. trends but often with a greater emphasis on locally sourced and sustainable ingredients.

- Europe: Europe represents another significant market, powered by stringent EU regulations promoting the use of fiber and protein-rich ingredients and a culturally ingrained focus on natural and whole foods. Countries like Germany, the UK, and France are major consumers, especially in the bakery and meat substitute sectors. The European market sees strong growth in mechanically defatted powder, aligning with the EU's clean-label and minimal processing mandates. Innovation is concentrated around novel applications in functional dairy and specialty dietary foods targeted at the aging population, leveraging the high nutrient density of the powder.

- Asia Pacific (APAC): APAC is anticipated to be the fastest-growing region during the forecast period. This growth is fueled by massive demographic shifts, rising disposable income, and a rapid increase in awareness regarding preventive nutrition and Western dietary habits in China, India, and Southeast Asia. While cost sensitivity remains a factor, the increasing middle-class populations are driving demand for fortified food products, particularly infant foods and accessible nutritional supplements. Local production capacities are expanding rapidly, often employing more cost-effective solvent extraction methods initially, though clean-label demand is slowly pushing towards mechanical extraction in industrialized pockets like Japan and South Korea.

- Latin America: This region is characterized by emerging market demand, driven by government nutritional programs and the industrialization of the packaged food sector, particularly in Brazil and Mexico. Defatted wheat germ powder is primarily utilized for basic food fortification and inclusion in affordable, high-volume products like bread and corn-based snacks to address prevalent protein and fiber gaps in local diets. Market growth is stable but sensitive to currency fluctuations and relies heavily on imported processing technology and ingredients.

- Middle East and Africa (MEA): MEA currently holds the smallest market share but presents long-term growth potential, particularly in GCC countries due to high consumer purchasing power and the resulting increase in demand for premium, imported health foods and nutritional supplements. In parts of Africa, the ingredient's use is driven by humanitarian and large-scale government initiatives aimed at combating malnutrition, where its high protein content is a significant advantage. Challenges include logistical complexities and high reliance on imports for high-quality powder.

Top Key Players

The market research report includes a detailed profile of leading stakeholders in the Defatted Wheat Germ Powder Market.- Archer Daniels Midland (ADM)

- Cargill Incorporated

- FFI (Food for Function)

- GrainCorp Limited

- MGP Ingredients Inc.

- Manildra Group

- Vivesa Holding

- AgMotion Inc.

- Bay State Milling Company

- ConAgra Brands

- Roquette Frères

- Ingredion Incorporated

- Sunopta Inc.

- Bunge Limited

- Wilmar International

- ADM Milling

- Ardent Mills

- Siemer Milling Company

- Bob's Red Mill Natural Foods

- King Arthur Baking Company

Frequently Asked Questions

Analyze common user questions about the Defatted Wheat Germ Powder market and generate a concise list of summarized FAQs reflecting key topics and concerns.What are the primary nutritional advantages of using defatted wheat germ powder?

Defatted wheat germ powder is highly valued for its concentrated nutritional profile, primarily offering high levels of plant-based protein (typically 30% or more), significant dietary fiber, essential B vitamins (like folate and thiamine), and key minerals such as magnesium, phosphorus, and zinc. The defatting process removes unstable oils, enhancing its utility as a stable nutritional fortifier.

How does the defatting process impact the shelf life and flavor of wheat germ?

The defatting process drastically improves the product’s shelf life by removing the polyunsaturated fatty acids that are highly susceptible to oxidative rancidity. By reducing the fat content below 1-5%, the resulting powder achieves superior stability, allowing for longer storage and wider application without developing the bitter, stale flavor associated with non-defatted wheat germ.

What is the key difference between mechanically defatted and solvent-extracted wheat germ powder?

Mechanically defatted powder (typically cold-pressed) is generally preferred for clean-label applications as it uses physical pressure without chemical solvents, retaining maximum nutrient integrity but often at a slightly higher residual fat level. Solvent-extracted powder uses chemical agents (e.g., hexane) for high efficiency, achieving near-zero fat content at a lower cost, suitable for large-scale industrial use where cost-effectiveness is paramount.

Which application segment drives the highest demand for this ingredient?

The nutraceuticals and dietary supplements segment drives the highest-value demand, utilizing the powder extensively in protein bars, functional drinks, and nutritional supplements due to its clean-label protein and high-fiber content. The food and beverage sector, particularly baking and cereals, drives the highest volume demand due to its functional properties in texture enhancement and nutritional fortification.

Are there technological innovations addressing the allergen concerns related to wheat germ?

Yes, significant research is focused on enzymatic hydrolysis technologies. By treating the defatted powder with specific enzymes, manufacturers can break down complex proteins into smaller, potentially less allergenic peptides. This modified form, known as hydrolyzed wheat germ protein, is designed to be more digestible and suitable for sensitive applications like clinical and specialized nutritional formulas.

Defatted wheat germ powder represents a vital component in the contemporary functional food and nutraceutical market, occupying a unique space as a sustainable, nutrient-dense by-product of the wheat milling industry. The rigorous process of defatting, which involves specialized extraction techniques, is the defining factor that transforms highly perishable raw wheat germ into a commercially viable, long shelf-life ingredient. The removal of unstable lipids is critical, as it concentrates the valuable macro and micronutrients—including highly bioavailable protein, complex dietary fibers, and essential vitamins—while significantly retarding oxidative degradation. This process ensures that the powder maintains its functional integrity and neutral flavor profile, making it a versatile additive across numerous food and supplement formulations without compromising the sensory qualities of the final product. Market growth is fundamentally tied to global demographic and health trends. An aging population globally, particularly in developed regions, drives demand for convenient, high-protein sources to combat sarcopenia and improve general well-being. Simultaneously, the younger consumer base, increasingly adopting plant-based and flexitarian diets, finds defatted wheat germ powder an attractive, sustainable, and non-soy protein alternative. Manufacturers are investing heavily in technological differentiation. This includes adopting greener extraction methods like supercritical CO2 extraction, though still cost-prohibitive for mass production, and advanced grinding techniques to achieve ultra-fine particle sizes. These innovations directly address industry needs for highly soluble ingredients that can be seamlessly incorporated into liquid applications, such as clear protein water and smooth nutritional shakes, which represent a high-growth category within the functional beverage market. The necessity for these high-specification ingredients underlines the premiumization trend observed across North American and European markets. The supply chain for defatted wheat germ powder is complex, relying heavily on the efficiency and scale of the upstream wheat flour milling sector. The quality of the raw germ is susceptible to seasonal variations and storage conditions of the initial wheat grain, necessitating stringent quality control protocols from the raw material stage onward. Large-scale processors often integrate AI and ML systems to monitor and predict raw material quality, ensuring minimal disruption to the continuous manufacturing process. Logistics, particularly the maintenance of a low-temperature supply chain for the raw germ prior to defatting, adds considerable cost and complexity. The final powdered product, despite its enhanced stability, still requires specialized, moisture-proof and oxygen-barrier packaging to guarantee the extended shelf life demanded by global distributors and end-users. The market is also heavily influenced by regulatory oversight regarding food allergens (wheat) and claims substantiation. Marketing efforts are increasingly focused on transparency and traceability, leveraging blockchain technology in some premium segments to provide consumers with verifiable information about the sourcing, processing methods, and nutritional analysis of the final product. This drive for transparency is crucial in distinguishing high-quality, sustainably sourced powders from generic commodity ingredients, thereby commanding premium pricing and strengthening brand loyalty among health-conscious consumers. The integration of defatted wheat germ powder into specialty applications, such as clinical diets for hospitalized patients and specialized sports recovery products, continues to validate its status as a high-value functional ingredient with a robust long-term growth trajectory. The convergence of nutritional science and advanced processing technology will define the competitive landscape over the next decade. The Defatted Wheat Germ Powder market’s resilience during economic fluctuations is noteworthy, largely attributed to its essential role in addressing basic nutritional needs and supporting health-focused formulations, areas that typically experience inelastic demand. The ongoing expansion into emerging markets, particularly within APAC, is contingent upon local regulatory harmonization and consumer education initiatives regarding the benefits of wheat germ derivatives. Key industry players are strategically forming joint ventures with local food manufacturers in Asia to mitigate market entry barriers and adapt product specifications to local culinary preferences. For instance, developing defatted wheat germ powder suitable for traditional Asian staple foods, such as noodles or rice derivatives, opens up substantial untapped market potential beyond Western-style baking and nutraceuticals. This geographical diversification is critical for stabilizing revenue streams and mitigating dependency on the mature, but saturated, markets of the West. Sustainability metrics are becoming integral to investment decisions. The fact that defatted wheat germ powder utilizes a previously low-value milling by-product aligns perfectly with circular economy principles. Companies that can demonstrate low energy consumption in their defatting and stabilization processes, along with ethical sourcing, gain a competitive edge in B2B negotiations with multinational food companies committed to ambitious ESG targets. The future competitive landscape will likely favor vertically integrated companies that control the entire chain from grain procurement to final ingredient processing, offering unparalleled consistency, traceability, and cost efficiency. Innovation in customized functional ingredients, such as defatted wheat germ flakes or agglomerated granules designed for specific texture requirements in meal bars, represents a clear path to high-margin revenue growth. Furthermore, continuous investment in clinical trials to substantiate the specific health benefits of wheat germ bioactive components—like phytosterols and specific peptides—will further elevate the ingredient from a bulk fortifier to a highly specialized, evidence-based functional food component.

The technological evolution in the Defatted Wheat Germ Powder market is moving rapidly beyond mere efficient extraction toward maximizing the bioavailability and functional utility of the residual components. One significant area of development involves enzymatic modification of the defatted proteins. Treating the powder with specific proteases allows manufacturers to control the degree of hydrolysis, yielding customized peptide fractions. These fractions are not only easier for the human body to absorb—making them superior for clinical and infant nutrition applications—but also possess enhanced functional properties, such as improved solubility in acidic environments and potentially stronger antioxidant activity. This high-level protein engineering transforms the powder from a commodity protein source into a high-value bioactive ingredient. Manufacturers pursuing this path require substantial investment in bioreactor technology, precise temperature and pH control systems, and analytical instrumentation to consistently characterize the resulting peptide profile, ensuring batch-to-batch uniformity critical for pharmaceutical-grade applications.

Furthermore, research into microencapsulation techniques is addressing the challenges of integrating defatted wheat germ powder into complex food matrices. Although the powder is defatted, some sensitive components, like residual vitamins and specific minor bioactive compounds, can still degrade when exposed to heat, moisture, or light during the processing of the final food product. Microencapsulation involves coating the powder particles with a protective layer, often composed of food-grade polymers or lipids, using techniques such as spray drying or fluidized bed coating. This protection shields the core ingredient during high-shear mixing, extrusion, or baking processes, ensuring that the nutritional benefits are delivered intact to the consumer. This technology is particularly valuable for the baking industry, where high-temperature exposure is inevitable, and for the beverage sector, where maintaining suspension stability and preventing sedimentation are critical for consumer acceptance.

The convergence of advanced sensor technology and data analytics is also revolutionizing quality assurance in this industry. Sophisticated inline spectroscopic methods, such as Near-Infrared (NIR) and Fourier-Transform Infrared (FTIR) spectroscopy, are integrated directly into the production lines. These sensors provide instantaneous, non-destructive analysis of crucial quality parameters, including moisture content, protein percentage, residual oil levels, and even early detection of potential microbial contamination markers. By feeding this real-time data into Machine Learning models, processors can implement predictive quality control, adjusting processing speeds or drying temperatures milliseconds before a batch drifts out of specification. This minimizes waste, reduces energy consumption associated with reprocessing, and significantly lowers the risk of large-scale product recalls. The ability to guarantee a consistently high-quality ingredient profile across millions of kilograms of product is a substantial competitive differentiator, particularly when supplying major global food corporations that demand near-perfect ingredient consistency for their formulated products.

To check our Table of Contents, please mail us at: sales@marketresearchupdate.com

Research Methodology

The Market Research Update offers technology-driven solutions and its full integration in the research process to be skilled at every step. We use diverse assets to produce the best results for our clients. The success of a research project is completely reliant on the research process adopted by the company. Market Research Update assists its clients to recognize opportunities by examining the global market and offering economic insights. We are proud of our extensive coverage that encompasses the understanding of numerous major industry domains.

Market Research Update provide consistency in our research report, also we provide on the part of the analysis of forecast across a gamut of coverage geographies and coverage. The research teams carry out primary and secondary research to implement and design the data collection procedure. The research team then analyzes data about the latest trends and major issues in reference to each industry and country. This helps to determine the anticipated market-related procedures in the future. The company offers technology-driven solutions and its full incorporation in the research method to be skilled at each step.

The Company's Research Process Has the Following Advantages:

- Information Procurement

The step comprises the procurement of market-related information or data via different methodologies & sources.

- Information Investigation

This step comprises the mapping and investigation of all the information procured from the earlier step. It also includes the analysis of data differences observed across numerous data sources.

- Highly Authentic Source

We offer highly authentic information from numerous sources. To fulfills the client’s requirement.

- Market Formulation

This step entails the placement of data points at suitable market spaces in an effort to assume possible conclusions. Analyst viewpoint and subject matter specialist based examining the form of market sizing also plays an essential role in this step.

- Validation & Publishing of Information

Validation is a significant step in the procedure. Validation via an intricately designed procedure assists us to conclude data-points to be used for final calculations.

×

Request Free Sample:

Related Reports

Select License

Why Choose Us

We're cost-effective and Offered Best services:

We are flexible and responsive startup research firm. We adapt as your research requires change, with cost-effectiveness and highly researched report that larger companies can't match.

Information Safety

Market Research Update ensure that we deliver best reports. We care about the confidential and personal information quality, safety, of reports. We use Authorize secure payment process.

We Are Committed to Quality and Deadlines

We offer quality of reports within deadlines. We've worked hard to find the best ways to offer our customers results-oriented and process driven consulting services.

Our Remarkable Track Record

We concentrate on developing lasting and strong client relationship. At present, we hold numerous preferred relationships with industry leading firms that have relied on us constantly for their research requirements.

Best Service Assured

Buy reports from our executives that best suits your need and helps you stay ahead of the competition.

Customized Research Reports

Our research services are custom-made especially to you and your firm in order to discover practical growth recommendations and strategies. We don't stick to a one size fits all strategy. We appreciate that your business has particular research necessities.

Service Assurance

At Market Research Update, we are dedicated to offer the best probable recommendations and service to all our clients. You will be able to speak to experienced analyst who will be aware of your research requirements precisely.

Contact With Our Sales Team

Customer Testimonials

The content of the report is always up to the mark. Good to see speakers from expertise authorities.

Privacy requested , Managing Director

A lot of unique and interesting topics which are described in good manner.

Privacy requested, President

Well researched, expertise analysts, well organized, concrete and current topics delivered in time.

Privacy requested, Development Manager