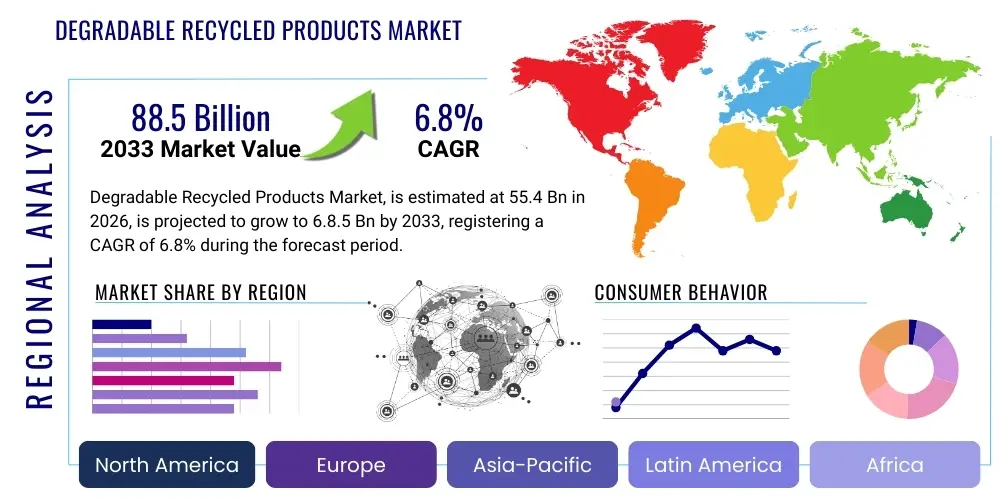

Degradable Recycled Products Market Size, By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2026 to 2033 (Financial Impact Analysis)

ID : MRU_ 442589 | Date : Feb, 2026 | Pages : 241 | Region : Global | Publisher : MRU

Degradable Recycled Products Market Size

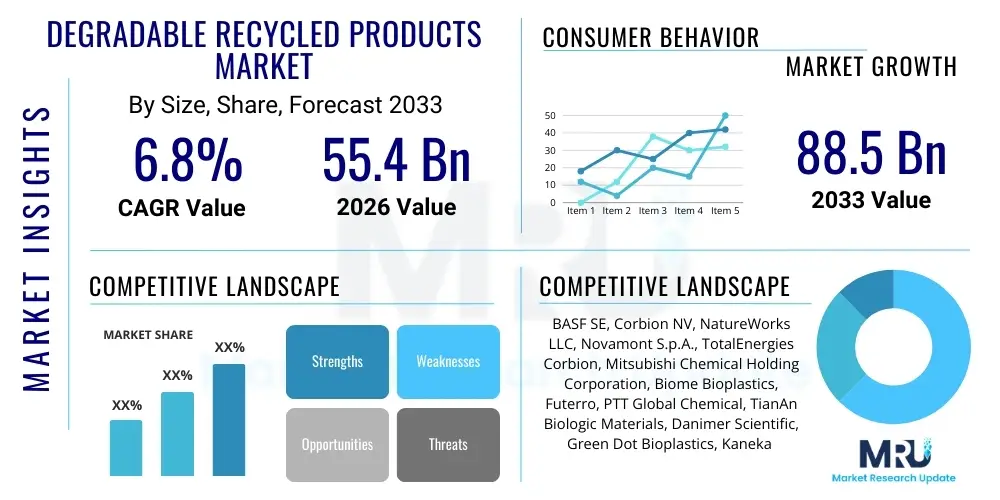

The Degradable Recycled Products Market is projected to grow at a Compound Annual Growth Rate (CAGR) of 6.8% between 2026 and 2033. The market is estimated at $55.4 Billion in 2026 and is projected to reach $88.5 Billion by the end of the forecast period in 2033.

Degradable Recycled Products Market introduction

The Degradable Recycled Products Market encompasses materials and finished goods designed to minimize environmental persistence by combining inherent biodegradability properties with feedstock derived from post-consumer or post-industrial recycled content. These products represent a pivotal convergence point between the circular economy mandate and sustainable material science, addressing the twin global crises of plastic pollution and resource depletion. The primary objective of this market segment is to drastically reduce reliance on virgin fossil fuel-based materials while ensuring that, at the end of their functional life, products can either be effectively composted under industrial conditions or safely assimilate back into the natural cycle, thereby closing material loops and reducing landfill accumulation. This duality of being recycled and degradable distinguishes this category from simple bio-based or conventional recycled products, positioning it as a premium, high-value solution for environmentally conscious industries globally.

Major applications for degradable recycled products span several high-volume industries, particularly rigid and flexible packaging, agricultural films, textiles, and consumer goods. In the packaging sector, these materials are utilized for food service disposables, beverage containers, and secondary packaging, responding directly to stringent regulatory measures imposed across regions like the European Union and specific states in North America that target single-use plastics. Benefits derived from the adoption of these products include a reduced carbon footprint, lower dependency on volatile petroleum markets, enhanced brand reputation through validated environmental responsibility (ESG metrics), and compliance with emerging global standards for extended producer responsibility (EPR) schemes. Furthermore, the incorporation of recycled content stabilizes the supply chain against virgin material price fluctuations, offering a long-term economic advantage alongside ecological gains.

The market is being significantly driven by escalating consumer demand for verifiable sustainable alternatives, coupled with proactive corporate sustainability commitments from major multinational companies seeking net-zero goals. Regulatory frameworks, such as the EU’s Packaging and Packaging Waste Regulation (PPWR) and national policies promoting minimum recycled content mandates, create a strong legal imperative for adoption. Technological advancements in chemical recycling that allow for purification of complex plastic waste into high-quality monomers suitable for polymerization, and innovations in bio-polymer blending to achieve specific degradation rates and mechanical properties, are accelerating market penetration. These technological leaps are crucial for overcoming previous barriers related to performance parity and cost-effectiveness compared to traditional non-degradable alternatives, thus fostering rapid market expansion.

Degradable Recycled Products Market Executive Summary

The Degradable Recycled Products Market is characterized by robust growth underpinned by strong governmental support for the circular economy and fundamental shifts in corporate procurement policies towards sustainable sourcing. Current business trends indicate a significant rise in strategic partnerships between chemical companies, waste management firms, and consumer packaged goods (CPG) companies, aiming to secure reliable feedstock supplies and scale up innovative recycling and composting infrastructure. Investment flows are heavily directed towards chemical recycling technologies (e.g., pyrolysis and depolymerization), which enable the recycling of traditionally hard-to-process waste streams, thus boosting the available pool of recycled content that can be subsequently formulated into degradable products. Furthermore, brand owners are increasingly prioritizing certification standards (like TUV Austria's OK Compost HOME/INDUSTRIAL) to ensure consumer trust and validate product claims, driving market transparency and professionalization.

Regionally, Europe and the Asia Pacific (APAC) stand out as primary growth engines. Europe leads due to its mature regulatory landscape, particularly the ambitious targets set by the Green Deal and related directives mandating high recycling rates and compostability standards for packaging. APAC, however, is projected to exhibit the fastest growth rate, fueled by rapidly industrializing economies such as China and India, where large-scale plastic waste issues are compelling governments to invest heavily in sustainable infrastructure and promote the adoption of bio-based and recycled materials. North America, while having significant consumer awareness, demonstrates more heterogeneous growth, driven primarily by state-level legislation (e.g., California’s mandatory recycled content laws) and strong corporate social responsibility initiatives rather than centralized federal mandates.

Segment trends highlight the dominance of bio-polyesters like Polylactic Acid (PLA) and Polyhydroxyalkanoates (PHA) in the product type category, owing to their versatility and proven degradation characteristics, particularly for applications requiring excellent barrier properties. The packaging segment remains the largest application area, constituting the majority share of the market due to the high volume and short lifespan of single-use packaging items. However, the agricultural sector, particularly applications involving mulch films and protective coverings designed for in-situ degradation, is witnessing the highest relative growth rates. Future growth is expected to pivot towards solutions that offer both high recycled content and robust degradability across various environmental conditions, including marine environments, pushing research into novel polymer blends and advanced enzymatic solutions.

AI Impact Analysis on Degradable Recycled Products Market

User inquiries regarding the role of Artificial Intelligence (AI) in the Degradable Recycled Products Market frequently center on three critical themes: material innovation speed, waste stream management efficiency, and optimization of end-of-life performance. Users are concerned with how AI can accelerate the discovery and formulation of new polymers that meet specific mechanical, thermal, and degradation criteria while maximizing recycled input content. A prevalent expectation is that AI will solve the complexity of sorting mixed plastic waste streams—a major bottleneck for high-quality recycling—and predict optimal degradation conditions based on local climate data. Key concerns revolve around the ethical deployment of AI in resource allocation and ensuring AI-driven models do not lead to material performance trade-offs, particularly regarding food safety and durability during product lifespan. The core summarized expectation is that AI will function as a catalyst, reducing R&D timelines, enhancing operational efficiency in the circular supply chain, and ensuring product compliance with rigorous environmental standards.

AI’s influence is profound, particularly in accelerating the material discovery pipeline. Traditional material science relies on slow, iterative lab testing, but AI-driven molecular modeling and predictive algorithms can simulate thousands of formulations incorporating varying levels of recycled feedstocks and bio-based additives. This capability dramatically reduces the time and cost associated with optimizing properties such as tensile strength, oxygen permeability, and the precise rate of biodegradation under specific composting or natural conditions. For instance, machine learning models analyze vast datasets concerning polymer structure, environmental factors (temperature, humidity, microbial activity), and chemical composition to identify the most promising blend ratios for specific applications, ensuring that recycled content integration does not compromise the product's functional lifespan or its environmental resolution capabilities.

Furthermore, AI is instrumental in refining the collection, sorting, and processing stages of the recycling value chain, which directly impacts the quality and availability of feedstock for degradable recycled products. Computer vision systems combined with advanced machine learning algorithms are deployed in material recovery facilities (MRFs) to identify and separate complex or contaminated plastic streams with unprecedented accuracy. This precise sorting ensures that higher purity recycled polymers are available for subsequent processing into degradable products. AI also optimizes inventory management and logistics, predicting waste generation volumes and required processing capacity, thus improving the overall economic viability and scalability of the market for high-quality recycled input materials necessary for manufacturing premium degradable goods.

- AI accelerates material R&D by simulating polymer formulations and predicting degradation performance.

- Machine Learning optimizes feedstock quality through advanced sorting in Material Recovery Facilities (MRFs).

- Predictive analytics enhance supply chain efficiency, forecasting waste flow and resource utilization.

- AI-driven simulation models ensure regulatory compliance regarding biodegradability and recycled content targets.

- Optimization algorithms minimize production waste and improve energy efficiency during compounding and manufacturing processes.

DRO & Impact Forces Of Degradable Recycled Products Market

The market dynamics for Degradable Recycled Products are intensely influenced by a matrix of regulatory pressures, technological innovation, and inherent infrastructure challenges. The primary driving force (D) is the accelerating global regulatory shift, moving away from simple recycling targets towards mandatory recycled content and verifiable end-of-life solutions like industrial composting, often mandated under Extended Producer Responsibility (EPR) schemes. Concurrently, technological advancements (O) in chemical recycling offer a critical pathway to high-quality feedstock, overcoming the quality limitations associated with mechanical recycling, thereby making high-performance degradable recycled products economically feasible. However, significant restraints (R) exist, chiefly centered on the high initial capital investment required for dedicated composting infrastructure and the higher cost of bio-polymers compared to traditional commodity plastics, which often limits their mass-market adoption in price-sensitive sectors. These forces collectively shape the market's trajectory, determining the pace of adoption and the complexity of material science required to achieve performance, degradability, and recycled content parity.

Key drivers strongly include heightened global environmental awareness and corresponding corporate ESG mandates. Multinational corporations are increasingly setting internal targets for 100% reusable, recyclable, or compostable packaging, creating guaranteed demand for these innovative materials. Consumer preference, particularly in developed economies, exhibits a willingness to pay a premium for certified sustainable products, directly incentivizing manufacturers to incorporate degradable recycled materials. Moreover, the increasing public visibility of plastic waste impacts, particularly in marine environments, has spurred governments to implement bans on specific single-use plastic items, directly creating a market vacuum that degradable recycled alternatives are designed to fill. This regulatory push, combined with corporate commitments, creates a robust and stable demand curve, mitigating some of the inherent investment risks associated with developing new material value chains.

Restraints primarily revolve around the complex technical barriers and economic viability. Achieving high performance and verifiable degradation while maintaining a high percentage of recycled content presents significant material science challenges; often, performance trade-offs must be managed. Furthermore, the lack of standardized global definitions and infrastructure for "degradable" or "compostable" materials leads to consumer confusion and contamination risks in existing recycling streams, undermining the credibility of the entire category. Opportunities lie predominantly in technological leapfrogging, focusing on developing cost-effective, high-throughput enzymatic degradation processes that can efficiently manage both pre-consumer and post-consumer materials. Additionally, exploring novel hybrid materials that leverage the best of chemical recycling (for feedstock purity) and bio-based polymerization (for degradability) represents a substantial avenue for future market growth and competitive differentiation. These advancements are essential for transforming the market from a niche sustainable solution to a mainstream material category.

Segmentation Analysis

The Degradable Recycled Products market is comprehensively segmented based on material type, application, and end-use industry, reflecting the diversity of functional requirements and environmental resolutions needed across various sectors. Material segmentation is crucial as it dictates the product’s mechanical properties, degradation mechanism (e.g., hydrolysis, microbial activity), and the feasibility of incorporating recycled content. Bio-polymers derived from renewable resources, such as PLA and PHA, are often blended with recycled polyethylene (R-PE) or recycled polypropylene (R-PP) to achieve the desired balance of cost-effectiveness, strength, and biodegradability/compostability, addressing the necessity of fulfilling both sustainability pillars simultaneously. The market's complexity demands precise material matching to end-use requirements, ranging from thin films in agriculture to robust containers in logistics.

Application segmentation illustrates the primary consumption vectors, with packaging remaining the largest segment due to the sheer volume of single-use items required globally. Within packaging, flexible packaging (pouches, wraps) and rigid packaging (bottles, trays) are major sub-segments driving innovation, particularly in areas like moisture barriers and shelf-life extension for food products. The segmentation by end-use industry, including Food & Beverage, Healthcare, Agriculture, and Automotive, reveals different purchasing priorities; for example, healthcare demands sterility and high regulatory compliance, while agriculture prioritizes soil-friendly degradation and mechanical strength for field applications. The interplay between these segments is dynamic, with cross-sector collaborations increasingly leading to specialized, high-performance degradable recycled solutions tailored for specific industrial ecosystems, such as recycled PLA/PHA blends for automotive interior components.

The continuous innovation within the market ensures that new segments constantly emerge. For instance, the use of degradable recycled materials in 3D printing filaments and specialized electronics casings represents nascent but high-growth areas. The segmentation structure provides crucial insights for investors and manufacturers, highlighting where regulatory compliance is the strongest driver (e.g., packaging in Europe) versus where performance and niche application requirements dictate material selection (e.g., agricultural films in high-humidity climates). Understanding these granular segmentation details is vital for maximizing AEO and GEO strategies, ensuring that products are correctly positioned to meet the highly specific needs of targeted industrial buyers looking for certified, sustainable materials that comply with the strictest environmental criteria.

- By Product Type:

- Polylactic Acid (PLA) based formulations (Recycled Content Blends)

- Polyhydroxyalkanoates (PHA) (Microbial Degradable Recycled Blends)

- Starch Blends (Recycled Thermoplastic Starch Derivatives)

- Cellulose-based Materials (Recycled Fiber Composites)

- Bio-Polyester Blends (e.g., PBAT with recycled content)

- By Application:

- Flexible Packaging (Films, Wraps, Pouches)

- Rigid Packaging (Bottles, Trays, Containers)

- Agricultural Products (Mulch Films, Seedling Pots)

- Textiles (Disposable Non-wovens, Apparel Components)

- Consumer Goods (Toys, Housewares, Electronics Casings)

- Automotive (Interior Trim Components)

- By End-Use Industry:

- Food & Beverage Industry

- Agriculture & Horticulture

- Healthcare & Medical

- Retail & Consumer Goods

- Building & Construction

Value Chain Analysis For Degradable Recycled Products Market

The value chain for the Degradable Recycled Products Market is intrinsically complex, starting with sustainable feedstock sourcing and culminating in the highly specialized distribution of certified end products. The upstream segment is critical and involves the collection, sorting, and pre-treatment of waste streams to generate high-quality recycled input (e.g., R-PET, R-PLA) or the sustainable sourcing of biomass for bio-based monomers. Crucially, the growth of this market segment relies heavily on robust infrastructure for both mechanical and chemical recycling, as only clean, highly purified recycled streams can be effectively blended with bio-polymers to create materials that meet stringent performance and degradation standards. Upstream innovations, such as advanced sorting technologies and depolymerization plants, are therefore paramount to ensure a consistent, scalable, and contamination-free supply of feedstock required for mass production.

The midstream segment involves the core manufacturing process: polymerization, compounding, and masterbatch creation. Chemical companies and specialized compounders process the raw feedstock (recycled pellets and bio-monomers) into intermediate polymers and blends. This stage requires significant technical expertise to control the molecular weight, achieve specific crystallinity, and incorporate additives (like pro-degradants or stabilizers) to fine-tune the material's properties—balancing durability during use with rapid degradation post-disposal. The direct distribution channel often involves large manufacturers selling customized polymer grades directly to major converters (e.g., packaging producers), allowing for tailored solutions based on specific application requirements like injection molding or film extrusion, thus ensuring high quality and minimizing supply chain steps.

The downstream analysis focuses on converters (who shape the material into final products), brand owners, and the end-of-life management system. Distribution channels are bifurcated into direct channels, typically involving large volume contracts between compounders and major industrial users (e.g., CPG giants), and indirect channels, utilizing distributors and specialized material traders to serve smaller manufacturers and niche markets. The unique aspect of this value chain is the indispensable 'reverse logistics' loop: the post-consumer collection and waste management infrastructure (composting facilities, advanced sorting) must function optimally to validate the degradability claim and complete the circularity promise. Failure in the downstream end-of-life segment can severely undermine the market’s integrity, making alignment between material producers, product manufacturers, and waste management authorities absolutely essential for sustained growth.

Degradable Recycled Products Market Potential Customers

The primary customers and end-users of degradable recycled products are diverse organizations deeply committed to meeting strict sustainability targets, either due to regulatory mandates, internal corporate responsibility goals, or intense consumer pressure. The largest cohort of buyers resides within the Food & Beverage industry, encompassing multinational CPG companies, fast-food chains, and retail grocery entities that require single-use items (e.g., food trays, cups, flexible wraps) which must comply with upcoming bans on non-compostable disposables. These buyers prioritize materials that offer verifiable certification (e.g., industrial compostability standard EN 13432) alongside performance attributes essential for food safety and shelf-life, such as adequate barrier properties and non-toxicity. Their demand dictates large-scale production requirements and drives investment into advanced compounding capabilities.

Another crucial customer segment is the Agricultural sector, particularly large-scale commercial farming operations in regions with strict plastic waste disposal regulations. These end-users utilize specialized products like degradable mulch films, netting, and seedling trays designed to degrade in the soil after use, eliminating the need for costly and environmentally damaging retrieval and disposal processes. For this segment, the material's ability to degrade without leaving toxic residues (soil eco-toxicity testing) is a key purchasing criterion, often favoring materials like starch blends and specific grades of PBAT/PLA composites. Their purchasing decisions are highly seasonal and dependent on crop cycles and regional environmental mandates.

Finally, the Healthcare and Consumer Goods industries represent high-growth, high-value potential customers. Healthcare facilities increasingly seek degradable materials for disposable clinical items, driven by the massive volume of single-use plastic waste generated in hospitals, balancing sustainability with stringent hygiene requirements. Consumer goods manufacturers, including those in fashion (textiles), cosmetics, and toys, utilize these materials for packaging and product components to visibly enhance their environmental branding and address sophisticated consumer demands for end-to-end sustainable products. For these sectors, brand image and clear communication of sustainability attributes are paramount, making third-party verified environmental claims a non-negotiable prerequisite for product adoption.

| Report Attributes | Report Details |

|---|---|

| Market Size in 2026 | $55.4 Billion |

| Market Forecast in 2033 | $88.5 Billion |

| Growth Rate | CAGR 6.8% |

| Historical Year | 2019 to 2024 |

| Base Year | 2025 |

| Forecast Year | 2026 - 2033 |

| DRO & Impact Forces |

|

| Segments Covered |

|

| Key Companies Covered | BASF SE, Corbion NV, NatureWorks LLC, Novamont S.p.A., TotalEnergies Corbion, Mitsubishi Chemical Holding Corporation, Biome Bioplastics, Futerro, PTT Global Chemical, TianAn Biologic Materials, Danimer Scientific, Green Dot Bioplastics, Kaneka Corporation, Eastman Chemical Company, LyondellBasell Industries, Avantium N.V., Bio-Fed (AKRO-PLASTIC GmbH), Plantic Technologies Ltd., Toray Industries, FKuR Kunststoff GmbH |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Enquiry Before Buy | Have specific requirements? Send us your enquiry before purchase to get customized research options. Request For Enquiry Before Buy |

Degradable Recycled Products Market Key Technology Landscape

The Degradable Recycled Products market is deeply rooted in advanced polymer science, necessitating a fusion of recycling technologies and bio-material engineering to achieve both sustainability targets. A cornerstone technology is chemical recycling (or molecular recycling), particularly depolymerization, which breaks down complex plastic waste (such as post-consumer PET or PLA) into their original monomers. This process yields recycled content with purity levels comparable to virgin material, effectively bypassing the quality degradation typically seen in traditional mechanical recycling. Utilizing these high-purity recycled monomers allows manufacturers to formulate stable, high-performance degradable polymers that can meet stringent technical specifications for applications like food contact packaging, significantly broadening the application scope of recycled content that can be classified as degradable.

Another pivotal area is the innovation in bio-polymer blending and compounding. Technologies focus on creating hybrid materials, where recycled content (R-PE, R-PP) is combined with fully biodegradable polymers like PHA or specialized biodegradable polyesters (PBAT). Advanced compounding techniques utilize twin-screw extruders and reactive extrusion processes to ensure homogenous dispersion and strong interfacial adhesion between the disparate material streams, often overcoming inherent compatibility issues between petroleum-derived recycled plastics and bio-based polymers. This technological sophistication is critical for engineering materials with controlled degradation kinetics—meaning the product remains stable during its functional life but rapidly breaks down when exposed to specific conditions, such as industrial composting facilities or specific soil environments, thereby maximizing the practical utility of the degradable recycled concept.

Furthermore, enzymatic degradation technology is emerging as a disruptive force, focusing on highly efficient, controlled end-of-life management. Researchers are engineering enzymes that can specifically and rapidly break down target polymers like PET or PLA under mild conditions. While primarily used for pre-treatment of waste or final degradation, the application of enzymatic processes in manufacturing (e.g., cleaning up mixed plastic feedstock) promises to enhance feedstock quality for recycled content even further. Coupled with digital manufacturing methods, such as process simulation and AI-driven quality control, these technologies collectively ensure that the final degradable recycled products are scalable, cost-effective, and fully compliant with evolving global standards for both recycled content thresholds and verifiable environmental end-of-life performance, solidifying the market’s technological maturity.

Regional Highlights

The global landscape for the Degradable Recycled Products Market is defined by distinct regulatory and infrastructural maturity levels across key geographical regions, resulting in varied growth rates and market structures.

- Europe: Leading the market due to the robust implementation of the European Green Deal and associated directives (ee.g., Single-Use Plastics Directive and PPWR). Strong legislative frameworks mandate high recycling rates and promote compostability, creating guaranteed demand. Germany, France, and Italy are key contributors, driven by mature industrial composting infrastructure and high consumer awareness, emphasizing certified compostable packaging solutions that utilize recycled input.

- Asia Pacific (APAC): Expected to be the fastest-growing region. Rapid industrialization, combined with urgent governmental responses to severe plastic pollution issues (especially in China, India, and Southeast Asia), is fueling massive investment. While infrastructure is developing, governmental initiatives promoting bio-based alternatives and subsidized recycling projects provide significant momentum. The focus is currently on agricultural films and flexible packaging.

- North America: Characterized by heterogeneous growth, largely driven by state-level regulations (e.g., California, Washington) and powerful corporate ESG initiatives rather than unified federal policies. The market is technologically advanced, with significant R&D spending on chemical recycling (especially in the US) to secure high-quality recycled feedstocks. Demand is strong in the food service and specialty consumer goods sectors.

- Latin America (LATAM): Growth is accelerating, primarily driven by major economies like Brazil and Mexico, where there is a growing regulatory trend towards banning specific plastics and promoting circular economy models. Infrastructure development remains a challenge, but proximity to large biomass sources favors the production of bio-based components for degradable recycled blends.

- Middle East & Africa (MEA): A nascent but high-potential market. Growth is currently localized, often driven by specific national projects (e.g., UAE, South Africa) focused on diversifying away from oil-dependent plastic production and addressing localized waste management crises. Investment in waste-to-value technologies and infrastructure is increasing, particularly in urban centers, opening up opportunities for imported and locally produced degradable recycled goods.

Top Key Players

The market research report includes a detailed profile of leading stakeholders in the Degradable Recycled Products Market.- BASF SE

- Corbion NV

- NatureWorks LLC

- Novamont S.p.A.

- TotalEnergies Corbion

- Mitsubishi Chemical Holding Corporation

- Biome Bioplastics

- Futerro

- PTT Global Chemical

- TianAn Biologic Materials

- Danimer Scientific

- Green Dot Bioplastics

- Kaneka Corporation

- Eastman Chemical Company

- LyondellBasell Industries

- Avantium N.V.

- Bio-Fed (AKRO-PLASTIC GmbH)

- Plantic Technologies Ltd.

- Toray Industries

- FKuR Kunststoff GmbH

Frequently Asked Questions

Analyze common user questions about the Degradable Recycled Products market and generate a concise list of summarized FAQs reflecting key topics and concerns.What is the primary difference between degradable recycled products and standard recycled plastics?

The key differentiator is the end-of-life performance. Standard recycled plastics maintain stability and require traditional recycling infrastructure for recovery. Degradable recycled products, however, are engineered to include a biodegradable component and recycled feedstock, allowing them to break down safely into natural elements (like water, CO2, and biomass) when exposed to specific conditions, typically in industrial composting facilities or specific natural environments.

Are degradable recycled products truly compostable, and how is this verified?

Whether a degradable recycled product is compostable depends on its certification. True compostability (industrial or home) must be verified by third-party bodies according to international standards (e.g., European EN 13432 or ASTM D6400 in the US). These tests ensure the material degrades completely within a set timeframe without leaving behind harmful residues or toxins, thereby confirming the product's compostable status and claim.

What are the main technical challenges associated with incorporating high levels of recycled content into degradable polymers?

The primary technical challenge is maintaining mechanical integrity and controlling degradation kinetics. Recycled polymers often have reduced molecular weight and inconsistent purity, which can weaken the final degradable blend. Manufacturers utilize advanced chemical recycling (depolymerization) and specialized compounding additives to ensure high-purity recycled input and achieve the necessary balance between functional durability and predictable environmental degradation without compromising quality.

Which geographical region exhibits the strongest growth potential for degradable recycled materials?

The Asia Pacific (APAC) region is projected to demonstrate the fastest Compound Annual Growth Rate (CAGR). This acceleration is driven by major governmental shifts in countries like China and India, aiming to combat severe plastic pollution through major investments in sustainable infrastructure, resulting in high demand for high-volume, cost-effective, and certified degradable recycled packaging and agricultural solutions.

How do regulatory mandates, such as Extended Producer Responsibility (EPR), influence market adoption?

EPR schemes significantly accelerate market adoption by shifting the financial and physical responsibility for product end-of-life management onto producers. These mandates often incentivize the use of easily recyclable or compostable materials, specifically driving demand for degradable recycled products by making traditional, hard-to-dispose-of plastics economically punitive and ensuring dedicated infrastructure investment.

To check our Table of Contents, please mail us at: sales@marketresearchupdate.com

Research Methodology

The Market Research Update offers technology-driven solutions and its full integration in the research process to be skilled at every step. We use diverse assets to produce the best results for our clients. The success of a research project is completely reliant on the research process adopted by the company. Market Research Update assists its clients to recognize opportunities by examining the global market and offering economic insights. We are proud of our extensive coverage that encompasses the understanding of numerous major industry domains.

Market Research Update provide consistency in our research report, also we provide on the part of the analysis of forecast across a gamut of coverage geographies and coverage. The research teams carry out primary and secondary research to implement and design the data collection procedure. The research team then analyzes data about the latest trends and major issues in reference to each industry and country. This helps to determine the anticipated market-related procedures in the future. The company offers technology-driven solutions and its full incorporation in the research method to be skilled at each step.

The Company's Research Process Has the Following Advantages:

- Information Procurement

The step comprises the procurement of market-related information or data via different methodologies & sources.

- Information Investigation

This step comprises the mapping and investigation of all the information procured from the earlier step. It also includes the analysis of data differences observed across numerous data sources.

- Highly Authentic Source

We offer highly authentic information from numerous sources. To fulfills the client’s requirement.

- Market Formulation

This step entails the placement of data points at suitable market spaces in an effort to assume possible conclusions. Analyst viewpoint and subject matter specialist based examining the form of market sizing also plays an essential role in this step.

- Validation & Publishing of Information

Validation is a significant step in the procedure. Validation via an intricately designed procedure assists us to conclude data-points to be used for final calculations.

×

Request Free Sample:

Related Reports

Select License

Why Choose Us

We're cost-effective and Offered Best services:

We are flexible and responsive startup research firm. We adapt as your research requires change, with cost-effectiveness and highly researched report that larger companies can't match.

Information Safety

Market Research Update ensure that we deliver best reports. We care about the confidential and personal information quality, safety, of reports. We use Authorize secure payment process.

We Are Committed to Quality and Deadlines

We offer quality of reports within deadlines. We've worked hard to find the best ways to offer our customers results-oriented and process driven consulting services.

Our Remarkable Track Record

We concentrate on developing lasting and strong client relationship. At present, we hold numerous preferred relationships with industry leading firms that have relied on us constantly for their research requirements.

Best Service Assured

Buy reports from our executives that best suits your need and helps you stay ahead of the competition.

Customized Research Reports

Our research services are custom-made especially to you and your firm in order to discover practical growth recommendations and strategies. We don't stick to a one size fits all strategy. We appreciate that your business has particular research necessities.

Service Assurance

At Market Research Update, we are dedicated to offer the best probable recommendations and service to all our clients. You will be able to speak to experienced analyst who will be aware of your research requirements precisely.

Contact With Our Sales Team

Customer Testimonials

The content of the report is always up to the mark. Good to see speakers from expertise authorities.

Privacy requested , Managing Director

A lot of unique and interesting topics which are described in good manner.

Privacy requested, President

Well researched, expertise analysts, well organized, concrete and current topics delivered in time.

Privacy requested, Development Manager