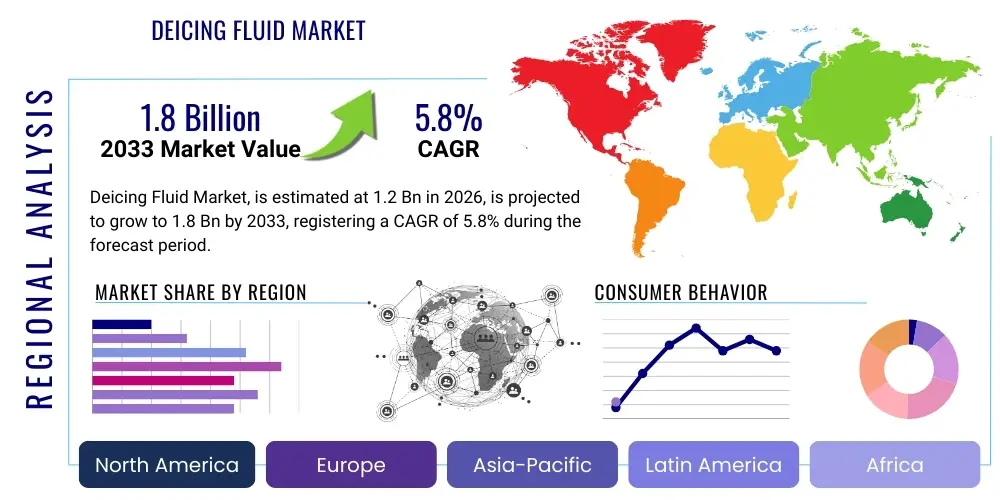

Deicing Fluid Market Size, By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2026 to 2033 (Financial Impact Analysis)

ID : MRU_ 441731 | Date : Feb, 2026 | Pages : 245 | Region : Global | Publisher : MRU

Deicing Fluid Market Size

The Deicing Fluid Market is projected to grow at a Compound Annual Growth Rate (CAGR) of 5.8% between 2026 and 2033. The market is estimated at USD 1.2 Billion in 2026 and is projected to reach USD 1.8 Billion by the end of the forecast period in 2033.

Deicing Fluid Market introduction

Deicing fluids are specialized chemical solutions designed to remove snow, frost, and ice accumulated on critical operational surfaces, predominantly utilized across the aviation, road infrastructure, and rail transport sectors. The core mandate for using these fluids is the prevention of mechanical failure, maintenance of operational safety margins, and ensuring continuity of service during adverse cold weather conditions. The chemical foundation of these formulations relies heavily on freezing point depressants, with glycols such as Ethylene Glycol (EG) and Propylene Glycol (PG) being the most common base substances due to their low freezing points, high efficacy in ice removal, and relative ease of handling. These bases are compounded with sophisticated mixtures of corrosion inhibitors, which are essential to protect the structural integrity of aluminum aircraft skins and steel infrastructure, alongside specialized wetting agents and thickening polymers that control application spread and residual film longevity.

The operational distinction between deicing and anti-icing functionalities is crucial for market segmentation. Deicing involves the active removal of existing frozen contaminants, typically using high-temperature Type I fluids applied with high pressure. In contrast, anti-icing fluids, notably Type II, Type III, and Type IV, are designed to prevent ice formation for a specified duration known as the Holdover Time (HOT), acting as a protective barrier on the cleaned surfaces. This anti-icing capability is vital for managing complex air traffic schedules, as Type IV fluids, characterized by high viscosity polymers, allow aircraft to taxi and wait for takeoff clearances without the immediate need for re-application, significantly improving winter operational efficiency and reducing delays at congested hubs. Furthermore, the selection between chemical bases is heavily influenced by environmental stewardship, prompting a measurable shift toward less toxic Propylene Glycol (PG) over Ethylene Glycol (EG) formulations, particularly in environmentally sensitive regions, despite the higher procurement cost associated with PG.

The market expansion is inexorably linked to several macro-environmental and regulatory factors. Driving factors include the continued, exponential growth of global commercial air travel, which increases the necessity for reliable all-weather airport operations. Simultaneously, recent meteorological analysis suggests an increase in the volatility and severity of winter precipitation events across diverse geographical zones, directly boosting demand for deicing preparedness. Benefits derived from optimal fluid usage include reduced flight cancellations, minimized infrastructure damage from corrosive salts, and, most importantly, enhanced public safety across road and air networks. The market dynamics necessitate continuous innovation in fluid performance, specifically focusing on fluids that maximize efficacy at extremely low temperatures, maintain stability against dilution from precipitation, and offer a demonstrably lower impact on surrounding ecosystems, thereby balancing safety requirements with escalating environmental accountability.

Deicing Fluid Market Executive Summary

The Deicing Fluid Market exhibits a robust and indispensable profile within the global transportation safety infrastructure, experiencing sustained compound annual growth predominantly anchored by the non-discretionary demand emanating from the aviation sector. Current business trends heavily emphasize sustainability, manifesting as accelerated research and commercialization of high-performance, bio-based alternatives, such as those derived from agricultural wastes or non-petrochemical sources, aiming to replace conventional glycol bases. Strategic competitive advantages are increasingly sought through vertical integration within the supply chain, ensuring stable, reliable access to feedstock glycols, and investment in advanced analytical services that help airport clients optimize fluid usage through predictive weather modeling and real-time application monitoring, thereby maximizing cost efficiencies during peak demand periods.

Analysis of regional trends confirms the enduring hegemony of the North American market, attributed to its dense network of high-volume airports and established, strict enforcement of winter flight safety regulations that drive persistent demand for high-specification Type IV anti-icing fluids. Conversely, the highest trajectory for future market penetration is clearly identified within the Asia Pacific region, especially across rapidly modernizing transportation hubs in Northeast Asia. This acceleration is driven by governmental mandates to harmonize local safety protocols with international standards and substantial public investment into expanding winter-capable airport and highway infrastructure, positioning APAC as the critical growth engine over the forecast period, albeit from a lower baseline usage rate compared to established Western markets.

Segmentation trends indicate a pronounced shift in product preference; while Ethylene Glycol remains cost-effective for general industrial use, the aviation segment’s consumption is decisively moving towards Propylene Glycol (PG) and advanced Acetate/Formate solutions, reflecting global prioritizations of ecological safety over immediate material cost savings. Within the application matrix, specialized runway deicing chemicals, including Potassium Formate solutions, are gaining ground due to their superior performance characteristics—specifically, rapid melting action and negligible corrosive effects on concrete and metal structures, offering a long-term cost benefit by reducing infrastructure replacement cycles. Strategic market positioning thus requires manufacturers to offer a comprehensive portfolio that addresses both the high-performance, low-environmental-impact niche and the large-volume, cost-sensitive ground application sectors simultaneously, ensuring sustained relevance across the diverse operational requirements of the global market.

AI Impact Analysis on Deicing Fluid Market

User inquiries concerning Artificial Intelligence in this sector overwhelmingly focus on enhancing operational precision and resource management, moving away from reactive, manual applications toward predictive, data-driven strategies. Key concerns involve the potential for AI to integrate complex meteorological data with localized surface temperature readings and aircraft scheduling, ensuring that the decision to deice, and the specific amount of fluid required, is optimized down to the individual flight level. There is a palpable expectation that AI and machine learning algorithms can drastically reduce the current rates of fluid over-application, which directly contributes to higher operational costs and increased environmental remediation expenses associated with glycol runoff management, fundamentally transforming winter efficiency protocols across major airport operations, thereby generating significant fiscal benefits.

Furthermore, stakeholders are highly interested in how AI can strengthen supply chain resiliency. Given the dramatic seasonal volatility in deicing fluid demand—which can spike unexpectedly during severe, prolonged winter weather events—AI-driven predictive analytics offer the capability to forecast localized demand patterns with unprecedented accuracy. This enables manufacturers and large distributors to strategically position inventory, hedge against feedstock price fluctuations, and ensure critical supplies reach major operational hubs promptly, mitigating the risk of operational shutdowns dueating to stock shortages. The development of integrated smart systems, combining surface sensors, application robotics, and predictive modeling, is viewed as the inevitable future, requiring significant technological investment from market leaders to maintain a competitive edge and offer value-added services beyond mere chemical supply, driving the next phase of efficiency improvement.

- AI-Powered Predictive Weather Modeling: Enhances short-term, micro-climatic forecasting specific to airport surfaces, allowing for just-in-time deicing fluid application and significantly reducing precautionary usage, leading to material cost savings and improved operational readiness.

- Optimized Fluid Application Algorithms: Machine learning models calculate the precise blend and volume of fluid (Type I, II, or IV) required based on aircraft size, surface temperature, humidity, and forecast holdover time, minimizing chemical waste and environmental burden while maximizing safety margins.

- Autonomous Deicing Systems Integration: AI guides robotic or sensor-equipped deicing vehicles for highly accurate, non-uniform spray patterns on runways and airframes, improving coverage uniformity and reducing manual errors associated with subjective human judgment during poor visibility conditions.

- Supply Chain Demand Forecasting: Advanced analytics process historical consumption data and long-range climate projections to predict peak demand seasons and regional fluid requirements with greater fidelity, optimizing inventory levels and mitigating stock-outs during critical weather windows, ensuring continuity of service.

- Environmental Impact Monitoring and Reporting: AI processes continuous sensor data regarding glycol runoff concentrations, precipitation patterns, and soil contamination levels, ensuring real-time regulatory compliance reporting and informing automated flow adjustments within the costly remediation and recycling infrastructure.

- Enhanced Holdover Time Prediction: AI models use real-time environmental factors (wind speed, temperature gradient, precipitation rate) to dynamically adjust the theoretical Holdover Time (HOT), providing pilots and ground crews with safer, more accurate operational windows than static chart references alone.

DRO & Impact Forces Of Deicing Fluid Market

The market landscape for deicing fluids is dynamically shaped by powerful intrinsic and extrinsic forces, categorized as Drivers, Restraints, and Opportunities. The most potent driver is the global aviation industry's non-negotiable requirement for operational safety, rigorously enforced by international bodies like the FAA and EASA. This regulatory framework demands the use of certified, high-performance fluids to prevent catastrophic icing accidents, creating a consistent, inelastic demand baseline that is highly resilient to transient economic fluctuations. Additionally, the observable trend towards climate change, resulting in more erratic and intense freezing rain or mixed precipitation events across diverse geographical zones, expands the geographical and seasonal necessity for preparedness, boosting volume demand even in regions previously considered marginal or temperate zones.

Significant restraints center on cost volatility and environmental concerns. The primary chemical feedstocks, particularly glycols, are derivatives of the petrochemical industry, making fluid prices highly susceptible to global crude oil market fluctuations and supply chain disruptions resulting from geopolitical instability or logistics bottlenecks. Furthermore, the massive volumes of spent deicing fluid runoff, which contain high Biological Oxygen Demand (BOD) loads, pose a substantial environmental challenge. Regulatory bodies worldwide are tightening restrictions on the permissible discharge of these chemicals, forcing airports to invest tens of millions of dollars into complex, high-cost recycling and wastewater treatment facilities, which acts as an operational and financial restraint on overall market adoption and deployment flexibility, impacting regional profitability.

Opportunities for market players are concentrated in two primary areas: sustainable chemistry and technological integration. The opportunity to develop and commercialize highly effective, cost-competitive bio-based deicing agents (such as advanced potassium acetate or novel alcohol derivatives) that offer faster biodegradability and lower aquatic toxicity is immense, allowing early movers to capture lucrative contracts from environmentally stringent airports and municipalities seeking green solutions. Concurrently, the integration of deicing fluids with smart infrastructure—including embedded runway sensors, automated spray systems, and AI-driven predictive modeling—provides manufacturers the chance to transition from simple chemical suppliers to holistic winter operational solution providers, enhancing customer value through efficiency gains and documented environmental compliance assurance, thereby achieving higher profit margins through service integration.

Segmentation Analysis

A comprehensive segmentation analysis of the Deicing Fluid Market reveals key differences in product requirements and consumption behavior across end-use industries, highlighting the strategic necessity for tailored product offerings. Segmentation by chemical composition remains paramount, dividing the market into Glycol-based (Ethylene and Propylene), Acetate-based (Potassium and Sodium), and Formate-based solutions. Glycol formulations, due to their efficacy and high volume usage, dominate the aviation sector, whereas acetates and formates are gaining favor for high-traffic runway and bridge applications where metal corrosion and concrete degradation are major long-term concerns, demanding specialized, less corrosive formulations that protect expensive civil infrastructure.

The application segmentation illustrates the clear volume hierarchy, with Aircraft Deicing representing the highest value segment due to the mandatory requirement for high-purity, certified fluids that often incorporate proprietary additive packages to achieve specific Holdover Times (HOT) under various meteorological conditions. Conversely, Ground Deicing, encompassing municipal roads and general pavement care, constitutes the highest volume segment, characterized by intense price sensitivity and a preference for cost-effective bulk chemicals like salt brines and low-grade urea, though environmental pressures are slowly introducing higher-performance, lower-corrosion liquid alternatives in urban centers. This disparity means manufacturers must maintain dual production strategies, balancing high-margin, low-volume specialty aviation fluids against low-margin, high-volume road deicers to achieve optimal market coverage and profitability.

Further granularity is achieved through the fluid classification for aviation (Type I through Type IV). Type I fluids (thin, rapid action) are essential for immediate operations, whereas Type IV fluids (thickened, anti-icing polymers) are the strategic tool for operational planning, allowing extended delays before takeoff. The complexity of managing these four fluid types, each with unique application temperatures, dilution ratios, and holdover properties, underscores the operational challenge faced by airport authorities and creates opportunities for third-party service providers offering integrated fluid management and recycling services, optimizing inventory and ensuring regulatory adherence under rapidly changing winter conditions, contributing to overall airport efficiency and reducing the environmental liability footprint.

- By Type:

- Ethylene Glycol (EG) Based: Cost-effective, high performance, but facing environmental scrutiny due to toxicity. Predominantly used in industrial and non-critical ground applications where discharge regulations are less stringent.

- Propylene Glycol (PG) Based: Higher cost, significantly lower toxicity, superior environmental profile; rapidly becoming the standard for sensitive aviation and municipal applications, particularly near environmentally regulated waterways.

- Acetate Based (Potassium Acetate, Sodium Acetate): High efficacy, excellent anti-corrosion properties, widely used for airport runway and tarmac deicing, valued for protecting expensive concrete surfaces and metallic infrastructure.

- Formate Based (Potassium Formate, Sodium Formate): Non-corrosive, rapid action, highly effective at extremely low temperatures, often preferred for critical infrastructure like high-speed rail switches and major airport runways due to superior safety profile.

- Others (Urea, Bio-Based Alcohols): Niche applications, often used for specific industrial pavements or as lower-cost alternatives where environmental regulations are less stringent or volume demands are exceptionally high, such as in bulk road treatment mixtures.

- By Application:

- Aircraft Deicing: Highest value segment, driven by strict regulatory requirements and specialized Type I/IV fluid use on airframes to maintain aerodynamic integrity.

- Runway/Tarmac Deicing: High volume segment demanding less corrosive, high-performance liquids (Acetates/Formates) to protect expensive concrete, runway lighting, and sensor systems.

- Ground Deicing (Roads, Bridges, Pavements): Largest volume segment, characterized by high price sensitivity and varied chemical usage (salt brines, EG, PG) dictated by local infrastructure and budget constraints.

- Rail Infrastructure: Specialized use for tracks, switches, and signal systems, requiring non-conductive and highly reliable low-freezing point fluids to prevent operational failures during cold snaps.

- By Fluid Classification (Aviation Specific):

- Type I (Deicing): Used immediately prior to flight; rapidly melts existing ice, providing minimal residual protection, often applied heated to enhance effectiveness.

- Type II (Anti-icing, Short Holdover): Medium viscosity, offers temporary protection against frost and light snow; often used on regional jets and is being phased out in favor of Type IV in many jurisdictions.

- Type III (Anti-icing, Moderate Holdover): Intermediate thickness, designed for smaller commuter aircraft, balancing Type I speed with Type IV protection under moderate precipitation conditions.

- Type IV (Anti-icing, Long Holdover): Highest viscosity, thickest fluid layer, provides maximum holdover time critical for high-traffic airports where taxi times are extended, ensuring safety up to the point of rotation.

- By End-User Industry:

- Aviation (Commercial & Military): Dominant segment requiring highly certified and regulated fluids under non-negotiable safety mandates.

- Municipal & Government Agencies: Large volume purchaser for public road safety and extensive infrastructure maintenance, driven by cost-effectiveness and low corrosion profiles.

- Railway Operators: Focus on specialized, non-corrosive fluids for ensuring track system functionality and minimizing system downtime during winter weather.

- Industrial & Commercial Facilities: Smaller, localized demand for maintaining access roads and critical outdoor equipment exposed to freezing temperatures.

Value Chain Analysis For Deicing Fluid Market

The Deicing Fluid market value chain initiates with the highly concentrated Upstream sector, primarily sourcing base chemicals like Monoethylene Glycol (MEG), Monopropylene Glycol (MPG), and glacial acetic acid. This segment is dominated by global petrochemical giants, making the supply chain highly susceptible to volatility in global oil and gas prices, which directly influence glycol production costs. Key challenges upstream include ensuring the consistent availability of high-purity, industrial-grade raw materials required for certified aviation fluids and navigating international trade policies affecting petrochemical imports. Manufacturers often mitigate this risk by forging long-term, fixed-price supply agreements or by engaging in backward integration to secure critical feedstock supply channels, emphasizing reliability over opportunistic pricing to ensure inventory can meet sudden winter demand surges without compromising quality or delivery times.

The Midstream phase involves complex formulation and manufacturing processes. Here, chemical producers transform raw glycols and acetates into specialized deicing fluids by adding sophisticated packages of performance enhancers. This blending requires proprietary knowledge regarding corrosion inhibitor chemistry (protecting sensitive aircraft metals like high-strength aluminum and titanium) and polymer rheology (creating the non-Newtonian, shear-thinning properties necessary for Type IV fluids). Quality control is exceptionally stringent; every batch destined for aircraft use must pass rigorous testing for freezing point, pH balance, fluid stability, and compliance with SAE AMS standards. Distribution is highly logistics-intensive, often relying on specialized, insulated tanker trucks and dedicated storage tanks located near major airports to allow for rapid, 24/7 delivery and inventory adjustment during severe weather crises, requiring substantial investment in specialized fleet management.

The Downstream market encompasses the end-users and the complex operational systems surrounding fluid application and recovery. Direct channels are typical for major customers (large international airports, large municipal transportation departments) utilizing substantial multi-year contracts and bespoke logistics solutions. Indirect channels involve regional chemical distributors or maintenance contractors serving smaller regional airports or localized industrial users. A crucial part of the downstream value proposition is the investment in sophisticated glycol recovery and recycling facilities. These systems, utilizing technologies such as ultrafiltration and reverse osmosis, are vital for sustainability and operational cost management, as they allow high-value glycol to be recovered from runoff, reducing disposal fees and reliance on virgin material purchasing, thereby closing the loop on the value chain and significantly boosting the profitability profile and environmental standing of the end-user operation.

Deicing Fluid Market Potential Customers

The customer base for deicing fluids is highly stratified, with the Aviation Sector representing the most demanding and financially significant customer segment. This group includes major commercial airline operators, regional carriers, cargo haulers, and the airport authorities themselves. These customers require fluids meeting the highest certification standards (e.g., SAE AMS 1424/1428) and prioritize product efficacy, documented Holdover Time (HOT), and, increasingly, environmental compliance (favoring PG and Acetate over EG). Procurement decisions in this sector are driven by safety mandates and operational efficiency, meaning price sensitivity takes a secondary role to performance assurance and technical specifications, leading to high-margin opportunities for specialized fluid manufacturers capable of offering integrated technical support and compliance documentation.

Municipal and Governmental Agencies constitute the largest volume purchasing segment globally. This includes state departments of transportation, provincial highway authorities, and city street maintenance departments responsible for maintaining safe passage on roads, bridges, and public pathways. Their needs span a range of products from commodity salt brines (sodium chloride) for general roads to specialized, low-corrosion liquid alternatives (calcium chloride, magnesium chloride, or potassium acetate) for sensitive infrastructure like steel bridges and overpasses. Procurement cycles often involve annual public tenders and rigorous performance evaluation, emphasizing life-cycle cost, including corrosion mitigation benefits, and demanding robust supply guarantees for rapid emergency stock replenishment during prolonged winter storms to ensure public safety and mobility.

A third, specialized tier of potential customers includes military installations, where secrecy and specific performance requirements (e.g., compatibility with unique composite materials or extremely low operational temperatures) necessitate bespoke fluid formulations; railway and mass transit operators, who require non-conductive fluids for electric rail switches and overhead lines; and large commercial/industrial entities (e.g., logistics hubs, data centers, oil and gas facilities) located in cold climates. These diverse end-users emphasize reliability, ease of storage, and specialized applicability, creating tailored niches that require targeted marketing and distribution strategies focused on providing comprehensive winter risk management solutions rather than simple bulk commodity sales, reflecting the broad and critical utility of deicing chemistry beyond standard aviation requirements.

| Report Attributes | Report Details |

|---|---|

| Market Size in 2026 | USD 1.2 Billion |

| Market Forecast in 2033 | USD 1.8 Billion |

| Growth Rate | 5.8% CAGR |

| Historical Year | 2019 to 2024 |

| Base Year | 2025 |

| Forecast Year | 2026 - 2033 |

| DRO & Impact Forces |

|

| Segments Covered |

|

| Key Companies Covered | The Dow Chemical Company, Clariant AG, Kilfrost Ltd., General Atomics, CryoVest Inc., LNT Chemicals, BASF SE, ICM, Inc., The R&M Manufacturing Company, Concentrol, Proviron, Dynalene, Inc., EnviroTech Services, Inc., FreezGard, Ashland Global Holdings Inc., New Phase Technologies, Oasis Chemical Co., Deep Run Manufacturing, Global Ground Support, Mid-Continental Chemical Company |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Enquiry Before Buy | Have specific requirements? Send us your enquiry before purchase to get customized research options. Request For Enquiry Before Buy |

Deicing Fluid Market Key Technology Landscape

The technological evolution within the deicing fluid market is fundamentally driven by the dual pressures of enhancing cold-weather performance and achieving regulatory compliance concerning environmental impact. The most pivotal technological shift involves the transition toward sustainable chemistry, specifically the commercial scalability of bio-based deicing fluids. This technology focuses on utilizing renewable feedstocks—such as derivatives from agricultural processing or fermentation byproducts—to synthesize high-purity Propylene Glycol or specialized acetate salts. This technological pathway addresses the petrochemical supply volatility and significantly lowers the Carbon Footprint of the final product, positioning manufacturers who master this conversion process at a competitive advantage in environmentally conscious European and North American markets by offering certified green alternatives.

A second critical area of innovation lies in the advanced polymer systems incorporated into Type IV anti-icing fluids. Next-generation thickeners utilize complex rheological modifiers that ensure the fluid remains adherent to the aircraft surface for maximum Holdover Time, yet simultaneously shear-thins rapidly upon takeoff. This shear-thinning feature is critical for maintaining aerodynamic integrity, as failure to shed the viscous layer at rotation speed (Vr) poses a severe safety risk. Research efforts are focused on developing polymers that resist breakdown from factors like humidity, solar radiation, and the abrasive effects of wind and rain, thereby offering reliable, predictable protection regardless of fluctuating environmental variables encountered during ground taxi and takeoff queuing, which directly improves flight scheduling reliability during winter.

Beyond chemical composition, infrastructural technology plays a massive role, particularly in glycol management. The adoption of state-of-the-art closed-loop recycling technology, often involving multi-stage filtration (ultrafiltration, reverse osmosis) and vacuum distillation units, is transforming the economics of high-volume deicing operations. This technology allows airports to recover up to 95% of high-purity glycol from the collected spent fluid runoff, significantly reducing the volume of toxic discharge and lowering the substantial costs associated with purchasing replacement virgin glycol. Furthermore, the integration of Non-Destructive Testing (NDT) technology, such as specialized sensors and spectrometers for real-time fluid concentration monitoring and quality assurance, is becoming standard, ensuring that applied fluid meets safety specifications instantly before aircraft departure, adding a layer of crucial operational safety verification.

Regional Highlights

The operational and strategic emphasis of the Deicing Fluid Market varies significantly across global regions, reflecting localized climate, regulatory stringency, and infrastructural maturity. North America, characterized by its high density of large commercial airports (e.g., O'Hare, JFK, Toronto Pearson) and prolonged, intense winter seasons, accounts for the largest market share. The regional preference strongly favors Propylene Glycol (PG) based Type I and Type IV fluids, driven by strict FAA regulations and state-level environmental protections related to ground water. Investment in North America is focused on optimizing application logistics, utilizing sophisticated deicing rigs, and establishing high-capacity glycol recycling centers, cementing its role as the dominant consumer and a leader in fluid handling technology and procedural efficiency.

Europe presents a highly mature market segment that is the global vanguard for environmental mandates and sustainable chemistry adoption. Regulatory pressure from the European Union has severely curtailed the use of Ethylene Glycol and pushed airports toward highly biodegradable, non-glycol alternatives, such as Potassium Acetate and Potassium Formate, for runway treatment to prevent damage to sensitive concrete and lighting infrastructure. Key European airports are setting the standard for closed-loop resource management, often employing advanced recovery technologies that maximize the reuse of spent fluids. This focus on compliance and sustainability means product innovation in Europe is heavily concentrated on developing certified, low-toxicity formulations that meet both high performance and strict ecological disposal criteria, often exceeding global benchmarks.

The Asia Pacific (APAC) region is projected to experience the fastest market expansion. This growth is primarily attributable to massive state-led investments in expanding airport and highway networks in countries like China, India, and Russia's Far East, many of which experience severe winter climates. As these emerging economies align their operational safety standards with international ICAO guidelines, the demand for certified, high-quality deicing fluids (particularly PG-based aviation fluids) is accelerating dramatically. While price sensitivity remains higher in municipal ground applications compared to Western markets, the necessity for high-performance aviation fluids in burgeoning international hubs ensures robust growth, signaling a significant future shift in global consumption geography and requiring manufacturers to establish robust local supply chains quickly.

- North America: Market leader driven by high commercial air traffic and predictable severe winter weather; strong adoption of Propylene Glycol due to environmental mandates; primary focus on optimized application efficiency and advanced fluid recovery systems to manage high consumption volumes.

- Europe: High focus on environmental sustainability and closed-loop recycling; rapid adoption of non-glycol alternatives like Potassium Acetate and Formate for runway maintenance; mature market with an advanced regulatory framework dictating product composition and discharge limits.

- Asia Pacific (APAC): Fastest growing region fueled by infrastructure expansion in Northern China, Japan, and India; increasing compliance with international aviation safety standards; represents the largest untapped potential for both aviation and municipal segment growth, driven by rapid industrialization.

- Latin America and Middle East & Africa (MEA): Generally smaller markets due with localized, sporadic demand centered around specific high-altitude airports (e.g., Mexico City, Johannesburg) or mountain passes experiencing frost; high reliance on imported, certified fluid technology, with limited local manufacturing capacity, making supply chain reliability crucial.

Top Key Players

The market research report includes a detailed profile of leading stakeholders in the Deicing Fluid Market.- The Dow Chemical Company

- Clariant AG

- Kilfrost Ltd.

- General Atomics

- CryoVest Inc.

- LNT Chemicals

- BASF SE

- ICM, Inc.

- The R&M Manufacturing Company

- Concentrol

- Proviron

- Dynalene, Inc.

- EnviroTech Services, Inc.

- FreezGard

- Ashland Global Holdings Inc.

- New Phase Technologies

- Oasis Chemical Co.

- Deep Run Manufacturing

- Global Ground Support

- Mid-Continental Chemical Company

Frequently Asked Questions

Analyze common user questions about the Deicing Fluid market and generate a concise list of summarized FAQs reflecting key topics and concerns.What is the primary driver of growth in the Deicing Fluid Market?

The primary driver is the stringent and mandatory safety regulations imposed by global aviation bodies (FAA, EASA, ICAO) requiring certified deicing and anti-icing procedures to ensure flight safety, regardless of operational costs, thereby creating inelastic demand and necessitating product innovation.

What is the difference between Type I and Type IV deicing fluids?

Type I fluids are low-viscosity, heated glycol-based solutions used for immediate deicing (ice removal) with minimal residual effect. Type IV fluids are highly viscous polymer-thickened anti-icing fluids designed to provide extended protection (Holdover Time) against ice reformation before takeoff, crucial for complex taxiing operations.

Which chemical composition is preferred for environmental reasons?

Propylene Glycol (PG) based fluids and Acetate/Formate solutions are overwhelmingly preferred over traditional Ethylene Glycol (EG) due to their significantly lower aquatic toxicity and superior environmental profiles, aligning with strict global regulatory mandates regarding water discharge.

How does AI technology affect deicing operations?

AI impacts operations by enabling highly precise micro-weather forecasting, optimizing the exact volume and concentration of fluid needed per application, and guiding autonomous systems, leading to substantial reductions in fluid consumption, waste, and overall operational labor time and cost.

What is the significance of the Asia Pacific region in this market?

The Asia Pacific region is expected to demonstrate the highest growth rate due to the rapid expansion of new airport construction, increased flight traffic, and the adoption of modern, international-standard winter operational protocols in rapidly developing, cold-climate economies like China and South Korea, driving future demand volume.

To check our Table of Contents, please mail us at: sales@marketresearchupdate.com

Research Methodology

The Market Research Update offers technology-driven solutions and its full integration in the research process to be skilled at every step. We use diverse assets to produce the best results for our clients. The success of a research project is completely reliant on the research process adopted by the company. Market Research Update assists its clients to recognize opportunities by examining the global market and offering economic insights. We are proud of our extensive coverage that encompasses the understanding of numerous major industry domains.

Market Research Update provide consistency in our research report, also we provide on the part of the analysis of forecast across a gamut of coverage geographies and coverage. The research teams carry out primary and secondary research to implement and design the data collection procedure. The research team then analyzes data about the latest trends and major issues in reference to each industry and country. This helps to determine the anticipated market-related procedures in the future. The company offers technology-driven solutions and its full incorporation in the research method to be skilled at each step.

The Company's Research Process Has the Following Advantages:

- Information Procurement

The step comprises the procurement of market-related information or data via different methodologies & sources.

- Information Investigation

This step comprises the mapping and investigation of all the information procured from the earlier step. It also includes the analysis of data differences observed across numerous data sources.

- Highly Authentic Source

We offer highly authentic information from numerous sources. To fulfills the client’s requirement.

- Market Formulation

This step entails the placement of data points at suitable market spaces in an effort to assume possible conclusions. Analyst viewpoint and subject matter specialist based examining the form of market sizing also plays an essential role in this step.

- Validation & Publishing of Information

Validation is a significant step in the procedure. Validation via an intricately designed procedure assists us to conclude data-points to be used for final calculations.

×

Request Free Sample:

Related Reports

Select License

Why Choose Us

We're cost-effective and Offered Best services:

We are flexible and responsive startup research firm. We adapt as your research requires change, with cost-effectiveness and highly researched report that larger companies can't match.

Information Safety

Market Research Update ensure that we deliver best reports. We care about the confidential and personal information quality, safety, of reports. We use Authorize secure payment process.

We Are Committed to Quality and Deadlines

We offer quality of reports within deadlines. We've worked hard to find the best ways to offer our customers results-oriented and process driven consulting services.

Our Remarkable Track Record

We concentrate on developing lasting and strong client relationship. At present, we hold numerous preferred relationships with industry leading firms that have relied on us constantly for their research requirements.

Best Service Assured

Buy reports from our executives that best suits your need and helps you stay ahead of the competition.

Customized Research Reports

Our research services are custom-made especially to you and your firm in order to discover practical growth recommendations and strategies. We don't stick to a one size fits all strategy. We appreciate that your business has particular research necessities.

Service Assurance

At Market Research Update, we are dedicated to offer the best probable recommendations and service to all our clients. You will be able to speak to experienced analyst who will be aware of your research requirements precisely.

Contact With Our Sales Team

Customer Testimonials

The content of the report is always up to the mark. Good to see speakers from expertise authorities.

Privacy requested , Managing Director

A lot of unique and interesting topics which are described in good manner.

Privacy requested, President

Well researched, expertise analysts, well organized, concrete and current topics delivered in time.

Privacy requested, Development Manager