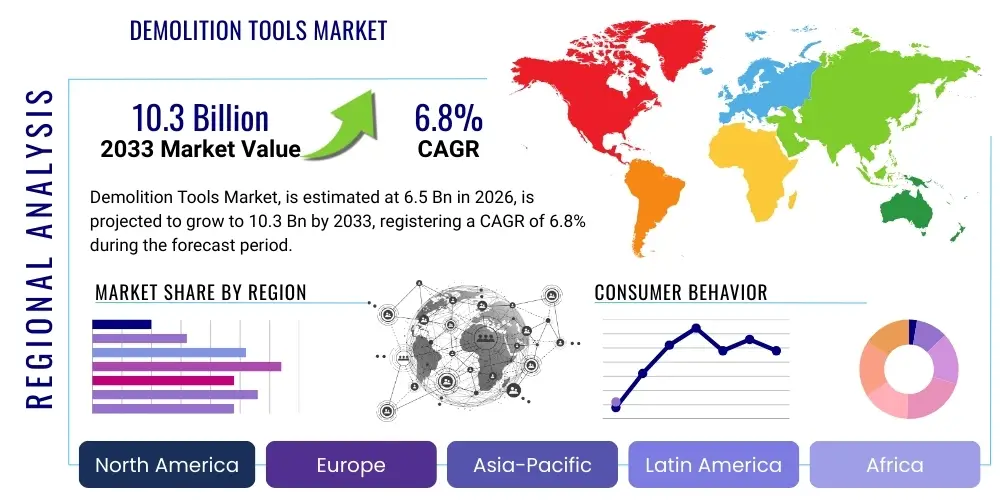

Demolition Tools Market Size, By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2026 to 2033 (Financial Impact Analysis)

ID : MRU_ 441461 | Date : Feb, 2026 | Pages : 249 | Region : Global | Publisher : MRU

Demolition Tools Market Size

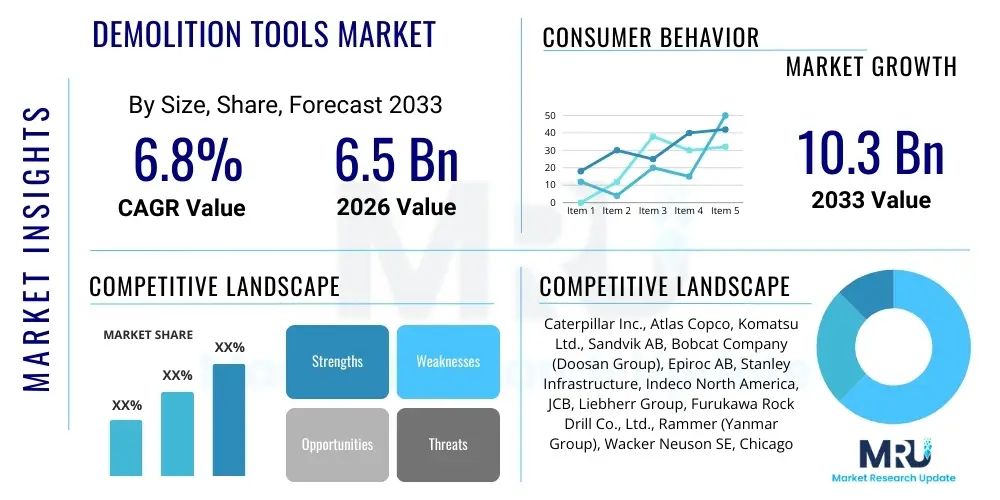

The Demolition Tools Market is projected to grow at a Compound Annual Growth Rate (CAGR) of 6.8% between 2026 and 2033. The market is estimated at USD 6.5 Billion in 2026 and is projected to reach USD 10.3 Billion by the end of the forecast period in 2033.

Demolition Tools Market introduction

The Demolition Tools Market encompasses a diverse range of specialized equipment designed for dismantling structures, breaking concrete, and removing materials in construction, renovation, and infrastructure projects. These tools range from heavy-duty equipment like hydraulic breakers, concrete crushers, and demolition robots, often mounted on excavators, to handheld power tools such as jackhammers, demolition hammers, and specialized saws. The primary objective of these products is to enhance efficiency, improve safety, and minimize noise and dust pollution during destructive operations. Key applications include building renovation, infrastructure modernization (bridges, roads), disaster recovery, and the decommissioning of industrial facilities and power plants. Product reliability, power-to-weight ratio, and compliance with stringent environmental regulations are critical competitive factors in this highly specialized sector. Adoption is heavily influenced by global construction spending and the increasing necessity for urban renewal projects.

The market growth trajectory is significantly fueled by rapid urbanization, particularly across the Asia Pacific region, leading to continuous large-scale residential and commercial demolition and reconstruction activities. Furthermore, the global shift towards sustainable construction practices mandates the use of specialized tools that facilitate selective demolition and material recycling, driving demand for advanced, precision-focused demolition equipment. Technological advancements, such as the integration of advanced hydraulics, anti-vibration technology, and remote-controlled operations, are transforming how demolition projects are executed, making them safer and more precise. The increasing focus on worker safety standards globally also propels the adoption of semi-autonomous and robotic demolition tools that reduce manual labor exposure to hazardous environments.

Major applications of demolition tools span three core areas: residential and commercial building demolition, infrastructure maintenance and expansion, and specialized industrial breakdown. Benefits derived from utilizing high-quality demolition tools include reduced project timelines due to enhanced operational speed, cost efficiencies realized through minimizing labor requirements, and improved adherence to strict regulatory guidelines regarding environmental protection and noise control. Driving factors for the market include massive government investments in infrastructure development, particularly in emerging economies, and the continuous need to replace aging infrastructure in mature markets like North America and Europe. The product category is essential for the circular economy, enabling the efficient recovery and sorting of construction and demolition waste (CDW).

Demolition Tools Market Executive Summary

The Demolition Tools Market is poised for substantial expansion, driven primarily by favorable macroeconomic business trends such as escalating global infrastructure spending and the heightened emphasis on urban redevelopment and recycling mandates. Business trends indicate a strong move toward automation, with manufacturers focusing R&D on electric and battery-powered demolition equipment to address sustainability concerns and reduce operational emissions on construction sites. Mergers, acquisitions, and strategic partnerships aimed at broadening geographic reach and integrating complementary technologies (e.g., advanced sensor technology for precise cutting) are common strategies among key market players to consolidate market share. The shift from heavy, diesel-powered machinery to lighter, more versatile, and energy-efficient hydraulic and electric systems represents a core thematic trend influencing equipment design and procurement decisions across the industry.

Regionally, Asia Pacific (APAC) stands out as the primary growth engine, fueled by unprecedented rates of infrastructure development, urbanization, and ambitious government projects in countries like China, India, and Southeast Asian nations. North America and Europe, while mature markets, demonstrate robust demand, predominantly driven by maintenance, repair, and overhaul (MRO) activities related to aging public infrastructure and strict compliance requirements for environmentally sound demolition processes. Regulatory trends in these regions favor equipment that minimizes noise pollution and vibration, thereby accelerating the uptake of specialized low-impact demolition robots and silenced hydraulic breakers. These regional trends highlight a bifurcated market: rapid volume growth in APAC versus high-value, technology-driven innovation in Western economies.

Segmentation trends reveal significant traction in the Hydraulic Breakers segment due to their indispensable role in heavy-duty concrete and rock breaking, especially in quarrying and large civil engineering projects. Concurrently, the Demolition Robots segment is experiencing the highest growth CAGR, attributed to their capacity for high-risk, precision tasks in confined or hazardous environments, significantly improving worker safety profiles. By application, the Infrastructure segment (roads, bridges, utilities) maintains the largest market share, closely followed by the Residential and Commercial Building segment, which sees cyclical demand tied to new construction and refurbishment cycles. The continuous innovation in tool attachments and specialized cutting technologies ensures that even traditional segments maintain relevance by offering enhanced versatility and performance.

AI Impact Analysis on Demolition Tools Market

User inquiries regarding the impact of Artificial Intelligence (AI) on the Demolition Tools Market predominantly revolve around how AI can enhance operational efficiency, increase safety, and enable predictive maintenance for high-cost machinery. Key user concerns include the integration complexity of AI systems into existing fleets, the necessity for specialized operator training, and the potential for AI-driven robotics to displace traditional labor. Users are keenly interested in predictive demolition planning—using AI to analyze structural blueprints, material composition, and surrounding environmental factors (noise sensitivity, dust control) to optimize the sequence and method of dismantling before work even begins. The overarching expectation is that AI will move demolition from a reactive, brute-force operation to a highly calculated, precise, and resource-efficient undertaking.

The direct impact of AI is becoming evident through intelligent equipment control systems. AI algorithms are utilized to optimize the performance parameters of hydraulic systems, automatically adjusting pressure and flow rates based on the density and resistance of the material being demolished. This not only maximizes the efficiency of the tool (e.g., hydraulic breaker) but also significantly extends the lifespan of the equipment by mitigating unnecessary wear and tear. Furthermore, AI-powered computer vision and sensor fusion are being integrated into remote-controlled demolition robots, allowing for real-time hazard identification, precise target acquisition, and autonomous navigation within unstable or poorly lit demolition sites, far surpassing the capabilities of conventional manual control.

AI also plays a critical role in the maintenance and logistical facets of the demolition tools industry. Predictive maintenance models analyze vibration, temperature, and usage data collected from IoT sensors embedded within the tools to forecast potential equipment failures, thereby minimizing unexpected downtime which is highly costly in large projects. From a strategic market perspective, AI assists manufacturers in simulating and designing optimized tool geometry and material science, leading to the development of lighter, more durable, and more powerful equipment. This pervasive application of AI, from pre-planning and operational execution to post-deployment maintenance, is redefining industry standards for productivity and safety compliance, establishing a new benchmark for high-performance demolition equipment.

- AI-driven predictive demolition modeling and sequence optimization.

- Integration of computer vision and machine learning for autonomous navigation and structural assessment in demolition robots.

- Real-time material sensing and automated power adjustment for hydraulic tools, maximizing energy efficiency.

- Predictive maintenance schedules based on AI analysis of tool usage data, minimizing costly unplanned downtime.

- Enhanced worker safety through AI-monitored exclusion zones and autonomous operation in hazardous environments.

- Optimization of supply chain and logistics for tool parts and replacements based on predictive regional demand.

DRO & Impact Forces Of Demolition Tools Market

The Demolition Tools Market dynamics are governed by a complex interplay of Drivers, Restraints, and Opportunities (DRO), which collectively shape the competitive landscape and technological evolution. Key drivers include massive global expenditures on infrastructure modernization, particularly the rebuilding of aging utility networks and transportation systems in developed nations, coupled with accelerated urbanization demanding vertical and horizontal construction, requiring the systematic demolition of older structures. Opportunities primarily revolve around technological innovation, specifically the proliferation of advanced hydraulic systems, electric and battery-powered tools, and sophisticated demolition robotics which cater to niches requiring high precision, low noise, and zero emissions. The major market restraint remains the high initial investment cost associated with specialized, heavy-duty demolition equipment and the shortage of highly skilled operators capable of utilizing increasingly complex remote and automated systems effectively.

Impact forces within the market are predominantly defined by five key elements: competitive rivalry, buyer power, supplier power, threat of new entrants, and threat of substitutes. Competitive rivalry is intense, characterized by a few global dominant players vying for market share through continuous product innovation, robust distribution networks, and attractive after-sales service packages. Buyer power is substantial, driven by large construction firms and equipment rental houses that demand high performance, durability, and competitive pricing, often negotiating customized supply agreements. Supplier power, concerning specialized components like advanced hydraulic pumps and specialized high-strength steel, is moderate but increasing, as technological superiority in these components becomes a differentiating factor for tool manufacturers.

The threat of new entrants is low due to the high capital requirements, stringent safety certifications, and the necessity for established brand trust and extensive service networks. However, niche manufacturers specializing in modular attachments or robotics could disrupt specific segments. The threat of substitutes, while traditionally low (as mechanical tools are essential for certain tasks), is evolving; non-destructive testing (NDT) methods and chemical demolition agents offer limited substitution possibilities for highly specialized applications but are unlikely to replace mechanical tools entirely for large-scale projects. The overall impact forces suggest a market characterized by high fixed costs, intense internal competition, and significant technological barriers to entry, pushing established players towards continuous innovation to maintain competitive edge and profitability.

Segmentation Analysis

The Demolition Tools Market is systematically segmented based on product type, power source, application, and end-user, enabling granular analysis of specific market dynamics and growth potential within targeted niches. Segmentation by product type highlights the dominant role of Hydraulic Breakers and the rapid growth trajectory of Demolition Robots, reflecting the industry's dual need for raw power in general applications and precision/safety in complex environments. By power source, the market is shifting perceptibly toward Electric/Battery-Powered tools, driven by regulatory mandates and site-level preferences for reduced carbon footprint and lower operational noise compared to traditional Diesel/Gasoline-Powered equipment, which still dominate in heavy, remote applications where mobility and sustained power are paramount.

Analysis across application segments underscores the reliance on demolition tools across the entire built environment lifecycle. The Infrastructure segment commands the largest share, reflecting massive global governmental investment in public works, including maintenance and expansion of transport networks. Simultaneously, the Residential and Commercial segment remains vital, closely tied to cyclical economic activity and urban renewal projects, driving demand for medium-duty and handheld tools. End-user segmentation emphasizes the importance of the Equipment Rental sector, which provides accessibility to high-cost specialized machinery for smaller contractors, significantly influencing equipment procurement volumes and maintenance strategies for manufacturers.

This detailed segmentation provides critical insights for manufacturers regarding product development strategy, distribution channel effectiveness, and regional market penetration tactics. For instance, manufacturers targeting the European market may prioritize the development of advanced electric, low-noise tools (power source segment), focusing on the Demolition Robots product type, and marketing directly to large Tier 1 Construction Companies (end-user segment). Conversely, focusing on the APAC market might emphasize robust, diesel-powered hydraulic breakers for rapid infrastructure deployment, utilizing equipment dealers as the primary channel. The intersection of these segments defines where the highest returns on investment can be achieved.

- By Product Type:

- Hydraulic Breakers

- Concrete Crushers/Pulverizers

- Demolition Robots

- Demolition Hammers/Jackhammers (Handheld)

- Demolition Shears/Grapples

- Specialized Saws and Cutters

- By Power Source:

- Hydraulic

- Electric/Battery-Powered

- Diesel/Gasoline Powered

- Pneumatic

- By Application:

- Residential Demolition

- Commercial Demolition

- Industrial Decommissioning

- Infrastructure (Roads, Bridges, Utilities)

- By End-User:

- Construction Companies

- Mining & Quarrying

- Equipment Rental Companies

- Utility Contractors

Value Chain Analysis For Demolition Tools Market

The value chain for the Demolition Tools Market initiates with upstream activities involving the sourcing of specialized raw materials, primarily high-grade, wear-resistant steel alloys and complex hydraulic components. Suppliers of these critical materials, which often require proprietary manufacturing processes to meet strict durability standards, hold moderate power, necessitating long-term strategic relationships with key tool manufacturers. Research and Development (R&D) and design form a crucial upstream component, focusing on integrating advanced anti-vibration technologies, optimizing power-to-weight ratios, and developing modular interfaces for compatibility with various carrier machines (e.g., excavators). Manufacturing processes, including precision casting, forging, and assembly, are highly capital-intensive and subject to stringent quality control, defining the efficiency and reliability of the final product.

The midstream of the value chain is dominated by distribution channels, which are bifurcated into direct sales and indirect sales mechanisms. Direct sales often cater to large, institutional clients, such as major international construction conglomerates or government bodies, allowing manufacturers to control pricing and offer customized service agreements. Indirect sales, predominantly through authorized dealers, regional distributors, and, crucially, specialized equipment rental houses, account for the majority of volume transactions. Equipment rental companies act as significant intermediaries, providing the necessary logistical support, maintenance, and flexible accessibility to specialized tools, making them vital partners in market penetration, especially for high-cost robotic equipment or infrequently used attachments.

Downstream activities center on end-user utilization and essential after-sales services. The efficacy of demolition tools relies heavily on routine maintenance, spare parts supply, and rapid repair services. Manufacturers and authorized dealers invest heavily in comprehensive service networks to minimize customer downtime, recognizing that operational reliability is a paramount concern for contractors. Furthermore, the integration of digital services, such as remote diagnostics and usage monitoring, represents a growing downstream segment. The ultimate value delivery is realized at the demolition site, where the efficiency, safety, and precision of the tools directly translate into project profitability and regulatory compliance for the end-user, thereby completing the cycle and driving future procurement decisions.

Demolition Tools Market Potential Customers

Potential customers for the Demolition Tools Market are highly diversified but can be broadly categorized into sectors whose core operations involve the removal, dismantling, or processing of hardened materials. The primary end-users are large civil engineering and general construction firms that manage projects requiring mass concrete breaking, structural steel cutting, or general site clearance. These customers prioritize equipment reliability, operational capacity, and low total cost of ownership (TCO), making purchasing decisions based on detailed performance specifications and established brand reputation. Their demands often center on heavy-duty equipment like large hydraulic breakers mounted on 30-ton excavators and specialized concrete crushers utilized for recycling on-site materials.

A rapidly expanding customer base resides within the specialized utility and environmental contracting sectors. Utility contractors require specialized, low-vibration tools for working around sensitive underground infrastructure (gas lines, power cables), often preferring handheld electric or pneumatic demolition hammers for precision and control. Environmental contractors, particularly those involved in industrial decommissioning and asbestos removal, are major buyers of demolition robots due to the need for remote operation in hazardous, contaminated environments. These users place an exceptionally high value on safety certifications, precision control interfaces, and minimal environmental disturbance, often leading them to adopt the latest technologically advanced, low-emission equipment.

Furthermore, Equipment Rental Companies represent a critical and influential segment of potential customers. These businesses serve as the gateway for smaller contractors and project-based users to access expensive, high-performance demolition tools without the burden of capital expenditure. Rental companies prioritize tool durability, ease of maintenance, and maximum utilization rates (minimal downtime). They are bulk purchasers and significantly influence market demand trends by deciding which brands and specific tool models are made widely available to the broader construction industry. Their purchasing power and focus on robust, versatile equipment make them essential strategic partners for demolition tool manufacturers seeking broad market penetration.

| Report Attributes | Report Details |

|---|---|

| Market Size in 2026 | USD 6.5 Billion |

| Market Forecast in 2033 | USD 10.3 Billion |

| Growth Rate | 6.8% CAGR |

| Historical Year | 2019 to 2024 |

| Base Year | 2025 |

| Forecast Year | 2026 - 2033 |

| DRO & Impact Forces |

|

| Segments Covered |

|

| Key Companies Covered | Caterpillar Inc., Atlas Copco, Komatsu Ltd., Sandvik AB, Bobcat Company (Doosan Group), Epiroc AB, Stanley Infrastructure, Indeco North America, JCB, Liebherr Group, Furukawa Rock Drill Co., Ltd., Rammer (Yanmar Group), Wacker Neuson SE, Chicago Pneumatic (CP), Volvo Construction Equipment, Okada Aiyon Corporation, NPK Construction Equipment, Toku America, Inc., Rokla GmbH, Brokk AB. |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Enquiry Before Buy | Have specific requirements? Send us your enquiry before purchase to get customized research options. Request For Enquiry Before Buy |

Demolition Tools Market Key Technology Landscape

The technological landscape of the Demolition Tools Market is rapidly advancing, focusing primarily on hydraulic efficiency, automation, and noise mitigation to meet evolving regulatory and operational demands. A core technological area is the development of advanced hydraulic systems incorporating energy recovery mechanisms, ensuring that energy typically lost during the retraction stroke of a breaker is recaptured, thus improving fuel efficiency and overall power output. Furthermore, manufacturers are integrating sophisticated anti-vibration and sound dampening technologies into both handheld and machine-mounted tools. These features are critical for enhancing operator comfort, reducing the risk of hand-arm vibration syndrome (HAVS), and enabling operations in noise-sensitive urban environments, directly addressing major occupational health and safety concerns within the industry.

Robotics and remote-control technology represent the most disruptive technological shift. Specialized demolition robots, such as those manufactured by Brokk or Husqvarna, utilize advanced sensor technology, sometimes including LiDAR or high-definition cameras, to perform tasks autonomously or semi-autonomously from a safe distance. This technology allows precise, controlled dismantling in structurally compromised buildings, minimizing risk to human operators. The transition to electric and battery-powered hydraulic tools is another significant trend. Driven by increasing demand for zero-emission construction sites (particularly in Europe and certain North American cities), battery technology is rapidly improving to offer competitive power and sustained operation times, challenging the long-held dominance of diesel-hydraulic systems in medium-duty applications.

Material science innovation also plays a vital, albeit less visible, role. The use of proprietary high-strength steel and composite materials in tool bodies and working components (chisels, points) significantly extends the service life and durability of the equipment, especially under extreme stress conditions like rock breaking or concrete crushing. Digitalization, encompassing IoT sensors and telematics systems, is becoming standard, providing real-time data on tool utilization, geographic location, and operational health. This enables crucial features like geo-fencing, utilization optimization, and, most importantly, predictive failure analysis, transitioning the service model from reactive repair to proactive maintenance, thus enhancing customer profitability and equipment uptime across the construction and demolition sector.

Regional Highlights

- Asia Pacific (APAC): This region is the undisputed leader in terms of market volume and growth rate, primarily driven by rapid urbanization and massive infrastructure projects across China, India, and Southeast Asia. The demand is characterized by high volumes of heavy-duty hydraulic breakers and large excavators needed for foundational work and major civil engineering projects. Government policies supporting smart city development and high rates of construction waste recycling further bolster the need for high-capacity demolition and crushing equipment.

- North America: A mature market focused on replacing and upgrading aging public infrastructure, including bridges, roadways, and utilities, particularly in the US and Canada. Demand here is characterized by a strong emphasis on precision, safety, and adherence to environmental regulations (low noise, low dust). There is high adoption of advanced robotics, sophisticated handheld tools, and digital integration (telematics). The dominance of equipment rental companies significantly influences purchasing patterns.

- Europe: This region exhibits high demand for sustainable and low-emission demolition solutions. Stringent environmental regulations, especially related to noise pollution in densely populated areas, are major market drivers, leading to the rapid adoption of electric-powered tools and specialized, quiet hydraulic attachments. The focus is often on selective demolition for renovation and retrofit projects, favoring smaller, more versatile equipment and specialized cutting tools that enable efficient material sorting and recycling.

- Latin America (LATAM): Growth is moderate but steady, driven by urbanization in major economies like Brazil and Mexico, coupled with extractive industries (mining and quarrying) requiring heavy rock-breaking equipment. Market growth is sensitive to political stability and capital investment flows, often favoring cost-effective and robust, standard hydraulic equipment over highly specialized robotics due to budget constraints and less stringent environmental enforcement compared to Europe.

- Middle East and Africa (MEA): Characterized by large-scale, high-value mega-projects (e.g., NEOM in Saudi Arabia, rapid urban development in the UAE). Demand is highly cyclical and project-dependent, necessitating high-capacity, high-performance tools capable of operating in extreme temperatures and abrasive conditions. The market relies heavily on imports and large-scale, multi-year construction contracts, driving short-term spikes in demand for heavy demolition machinery and attachments.

Top Key Players

The market research report includes a detailed profile of leading stakeholders in the Demolition Tools Market.- Caterpillar Inc.

- Atlas Copco

- Komatsu Ltd.

- Sandvik AB

- Epiroc AB

- Bobcat Company (Doosan Group)

- Stanley Infrastructure

- Indeco North America

- JCB

- Liebherr Group

- Furukawa Rock Drill Co., Ltd.

- Rammer (Yanmar Group)

- Wacker Neuson SE

- Chicago Pneumatic (CP)

- Volvo Construction Equipment

- Okada Aiyon Corporation

- NPK Construction Equipment

- Toku America, Inc.

- Rokla GmbH

- Brokk AB

Frequently Asked Questions

Analyze common user questions about the Demolition Tools market and generate a concise list of summarized FAQs reflecting key topics and concerns.What is driving the growth of the demolition tools market?

The market growth is primarily driven by escalating global infrastructure spending, rapid urbanization leading to continuous reconstruction activities, and increasing environmental mandates requiring selective demolition and efficient construction and demolition waste (CDW) recycling practices.

Which product segment holds the largest market share in the Demolition Tools Market?

Hydraulic Breakers currently command the largest share due to their indispensable role in heavy-duty applications like road construction, tunneling, and large-scale concrete crushing. However, Demolition Robots are projected to exhibit the fastest growth CAGR due to safety and precision demands.

How is technology impacting safety within the demolition industry?

Technology is significantly improving safety through the widespread adoption of remote-controlled demolition robots for high-risk environments, advanced anti-vibration systems in handheld tools, and real-time monitoring via IoT sensors to prevent equipment failure and ensure structural stability checks.

Which geographical region offers the highest growth potential for demolition tool manufacturers?

The Asia Pacific (APAC) region offers the highest growth potential, characterized by extensive government-backed infrastructure development and high rates of urbanization, fueling demand for both heavy machinery and associated demolition attachments.

What are the primary restraints affecting the Demolition Tools Market?

Key restraints include the substantial initial capital investment required for purchasing high-tech, heavy-duty equipment and the chronic global shortage of skilled operators necessary to proficiently utilize advanced robotic and automated demolition systems.

To check our Table of Contents, please mail us at: sales@marketresearchupdate.com

Research Methodology

The Market Research Update offers technology-driven solutions and its full integration in the research process to be skilled at every step. We use diverse assets to produce the best results for our clients. The success of a research project is completely reliant on the research process adopted by the company. Market Research Update assists its clients to recognize opportunities by examining the global market and offering economic insights. We are proud of our extensive coverage that encompasses the understanding of numerous major industry domains.

Market Research Update provide consistency in our research report, also we provide on the part of the analysis of forecast across a gamut of coverage geographies and coverage. The research teams carry out primary and secondary research to implement and design the data collection procedure. The research team then analyzes data about the latest trends and major issues in reference to each industry and country. This helps to determine the anticipated market-related procedures in the future. The company offers technology-driven solutions and its full incorporation in the research method to be skilled at each step.

The Company's Research Process Has the Following Advantages:

- Information Procurement

The step comprises the procurement of market-related information or data via different methodologies & sources.

- Information Investigation

This step comprises the mapping and investigation of all the information procured from the earlier step. It also includes the analysis of data differences observed across numerous data sources.

- Highly Authentic Source

We offer highly authentic information from numerous sources. To fulfills the client’s requirement.

- Market Formulation

This step entails the placement of data points at suitable market spaces in an effort to assume possible conclusions. Analyst viewpoint and subject matter specialist based examining the form of market sizing also plays an essential role in this step.

- Validation & Publishing of Information

Validation is a significant step in the procedure. Validation via an intricately designed procedure assists us to conclude data-points to be used for final calculations.

×

Request Free Sample:

Related Reports

Select License

Why Choose Us

We're cost-effective and Offered Best services:

We are flexible and responsive startup research firm. We adapt as your research requires change, with cost-effectiveness and highly researched report that larger companies can't match.

Information Safety

Market Research Update ensure that we deliver best reports. We care about the confidential and personal information quality, safety, of reports. We use Authorize secure payment process.

We Are Committed to Quality and Deadlines

We offer quality of reports within deadlines. We've worked hard to find the best ways to offer our customers results-oriented and process driven consulting services.

Our Remarkable Track Record

We concentrate on developing lasting and strong client relationship. At present, we hold numerous preferred relationships with industry leading firms that have relied on us constantly for their research requirements.

Best Service Assured

Buy reports from our executives that best suits your need and helps you stay ahead of the competition.

Customized Research Reports

Our research services are custom-made especially to you and your firm in order to discover practical growth recommendations and strategies. We don't stick to a one size fits all strategy. We appreciate that your business has particular research necessities.

Service Assurance

At Market Research Update, we are dedicated to offer the best probable recommendations and service to all our clients. You will be able to speak to experienced analyst who will be aware of your research requirements precisely.

Contact With Our Sales Team

Customer Testimonials

The content of the report is always up to the mark. Good to see speakers from expertise authorities.

Privacy requested , Managing Director

A lot of unique and interesting topics which are described in good manner.

Privacy requested, President

Well researched, expertise analysts, well organized, concrete and current topics delivered in time.

Privacy requested, Development Manager