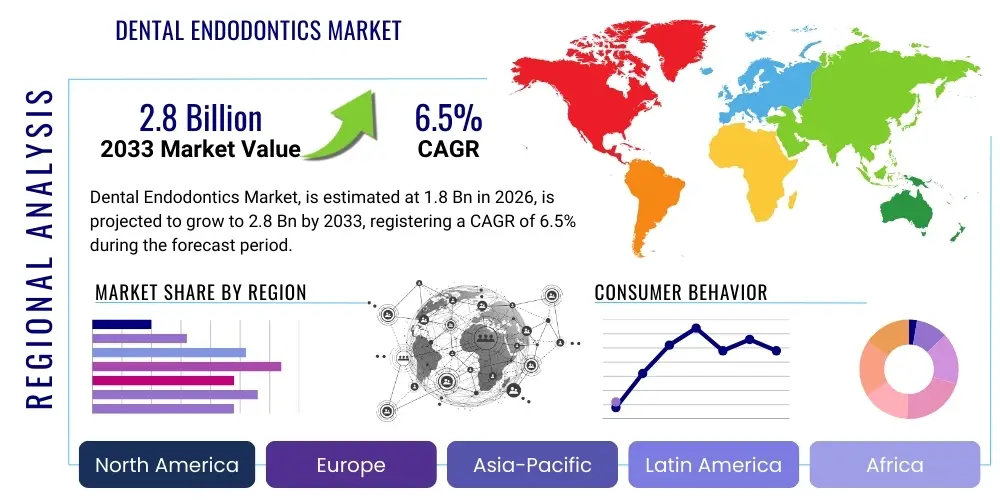

Dental Endodontics Market Size, By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2026 to 2033 (Financial Impact Analysis)

ID : MRU_ 442526 | Date : Feb, 2026 | Pages : 258 | Region : Global | Publisher : MRU

Dental Endodontics Market Size

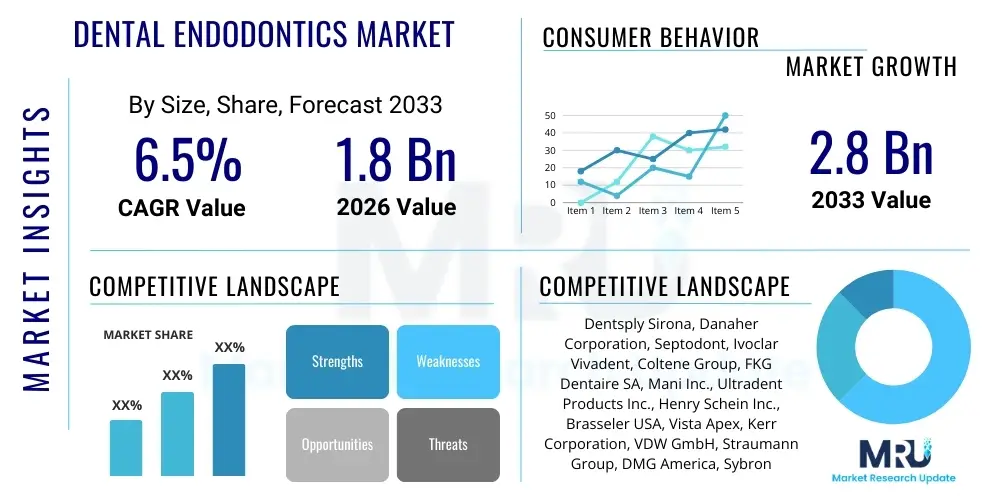

The Dental Endodontics Market is projected to grow at a Compound Annual Growth Rate (CAGR) of 6.5% between 2026 and 2033. The market is estimated at USD 1.8 Billion in 2026 and is projected to reach USD 2.8 Billion by the end of the forecast period in 2033. This consistent expansion is primarily fueled by the increasing prevalence of dental caries and periodontal diseases globally, coupled with a growing elderly population that requires complex restorative and maintenance dental procedures.

Dental Endodontics Market introduction

The Dental Endodontics Market encompasses a specialized segment within dentistry focused on the diagnosis and treatment of diseases of the dental pulp and the periapical tissues. Endodontic procedures, predominantly root canal treatments (RCTs), are critical for saving teeth that have been affected by deep decay, cracks, or trauma. Key products driving this market include high-precision instruments such as rotary and reciprocating nickel-titanium (NiTi) files, specialized dental operating microscopes, apex locators for accurate measurement, and sophisticated obturation systems utilizing materials like bioceramic sealers and gutta-percha. The continuous evolution of these products emphasizes enhanced efficiency, reduced procedure time, and improved patient outcomes, positioning endodontics as a cornerstone of advanced restorative dental care.

Major applications for endodontic devices and consumables involve addressing severe pulpitis, irreversible pulp inflammation, apical periodontitis, and managing dental traumatic injuries. The primary benefits of advanced endodontic treatment include tooth preservation, elimination of pain, and prevention of systemic infection, which significantly enhances the patient’s quality of life compared to extraction. The market's robust growth is underpinned by several powerful factors, most notably the rising incidence of chronic dental issues worldwide, heightened patient awareness regarding oral health preservation, and substantial technological leaps in material science and digital imaging capabilities, which facilitate complex procedures with higher success rates.

Dental Endodontics Market Executive Summary

The global Dental Endodontics Market is undergoing significant transformation, driven by strong business trends centered around miniaturization, material innovation, and the integration of digital technologies. Business trends indicate a marked shift towards nickel-titanium (NiTi) alloy instruments, particularly those utilizing heat treatment for superior flexibility and fracture resistance, thereby increasing procedural safety and success rates. Regional trends show that North America and Europe currently dominate the market due to established healthcare infrastructure, high reimbursement rates, and significant adoption of advanced rotary systems and imaging technologies. However, the Asia Pacific (APAC) region is poised for the fastest growth, primarily fueled by expanding dental tourism, increasing dental expenditure in developing economies, and government initiatives promoting preventative oral healthcare.

Segment trends highlight the Instruments segment, specifically endodontic files and reamers, as the largest revenue contributor, reflecting the necessity of these tools in every root canal procedure. The growing preference for rotary and reciprocating motion systems over manual techniques is driving the demand within this segment. Concurrently, the consumables segment, which includes highly advanced bioceramic sealers and irrigants, is witnessing accelerated adoption due to their superior sealing properties and biocompatibility. Overall, the market's trajectory points towards greater specialization and efficiency, rewarding manufacturers who prioritize research and development in smart instrumentation and non-invasive diagnostic tools.

AI Impact Analysis on Dental Endodontics Market

Common user questions regarding AI's influence in the Dental Endodontics Market center around themes of diagnostic accuracy, automated treatment planning, and prediction of clinical outcomes. Users frequently inquire: "How accurately can AI systems identify periapical lesions compared to human endodontists?", "Can AI automate the selection of the most appropriate file system and treatment length?", and "What role will machine learning play in predicting the long-term success or failure of root canal therapy?" This indicates a primary user expectation that AI should enhance diagnostic precision, minimize human error in procedural planning, and ultimately improve the predictability of complex endodontic procedures. The concerns often revolve around data privacy, the potential over-reliance on technology, and the integration costs for small dental practices.

The summary of key themes reveals that AI is fundamentally expected to act as a powerful clinical decision support system, moving beyond basic image analysis to sophisticated interpretation of cone-beam computed tomography (CBCT) data and complex case categorization. This enhanced analytical capability allows practitioners to better visualize intricate root canal morphologies, leading to more targeted and less invasive treatment protocols. The integration of AI algorithms into apex locators and endodontic motors is also a significant anticipated theme, promising real-time feedback and adaptive control during filing and cleaning, thereby substantially mitigating the risk of instrument fracture and perforation. Manufacturers are increasingly focusing R&D on proprietary algorithms that can analyze vast databases of clinical outcomes to offer personalized prognosis to patients.

- Enhanced diagnostic accuracy through automated identification of periapical lesions and complex canal anatomy on radiographs and CBCT scans.

- Optimized treatment planning by suggesting ideal file sequences, working lengths, and irrigation protocols based on case complexity.

- Integration into endodontic equipment (motors and apex locators) for adaptive, real-time control to prevent procedural errors.

- Predictive analytics for determining long-term success rates of root canal treatments, aiding patient consultation and informed consent.

- Automated charting and documentation, reducing administrative burden and increasing clinical throughput.

DRO & Impact Forces Of Dental Endodontics Market

The Dental Endodontics Market is significantly shaped by a confluence of driving factors, restrictive elements, and burgeoning opportunities. Drivers are primarily anchored in the increasing global burden of dental diseases, particularly deep dental caries that necessitate root canal therapy, alongside the demographic trend of an aging population retaining more of their natural teeth longer. The opportunity landscape is vast, dominated by continuous material science innovations, specifically in the development of flexible and resilient heat-treated NiTi files and advanced bioactive restorative materials, which offer superior clinical outcomes. These positive forces collectively outweigh existing constraints, propelling sustained market expansion across key geographies.

Restraints, however, pose moderate challenges, predominantly relating to the high initial investment cost associated with sophisticated endodontic equipment, such as operating microscopes and CBCT scanners, which can deter adoption in smaller dental practices and developing nations. Furthermore, the limited availability of skilled endodontists, particularly in rural and underserved areas, creates a bottleneck in service delivery. Despite these constraints, the market exhibits strong positive momentum, driven by crucial impact forces including governmental prioritization of oral health initiatives and patient demand for minimally invasive treatments that maximize natural tooth retention.

The opportunity for market participants lies squarely in geographical expansion into emerging economies, where disposable incomes are rising and access to private dental care is increasing. Furthermore, the potential for expanding educational and training programs focused on advanced rotary endodontics is critical for widening the utilization base. The major impact forces thus include the accelerating technological obsolescence of older equipment, necessitating upgrades (a powerful driver), and regulatory hurdles related to medical device approvals (a moderate restraint), collectively pushing the industry toward greater quality and safety standards.

Segmentation Analysis

The Dental Endodontics Market is systematically segmented based on Product, Application, and End-User, providing a comprehensive view of market dynamics and revenue streams. The Product segmentation distinguishes between specialized Instruments, essential Consumables, and advanced Equipment, reflecting the complex array of tools needed for modern endodontic practice. The segmentation by Application categorizes the market based on the specific clinical conditions treated, such as Pulpitis, Apical Periodontitis, and Traumatic Injuries, which helps in understanding disease prevalence and corresponding treatment demand. Finally, the End-User segmentation, focusing on Dental Clinics, Hospitals, and Academic Institutions, highlights the primary points of consumption and the varying purchasing power across these entities.

Understanding these segments is crucial for strategic market positioning. For instance, the demand for sophisticated Equipment is highest in large hospital settings and specialized dental clinics, which have the financial capacity and case complexity to justify the investment in high-end CBCT and operating microscopes. Conversely, consumables and instrument sales are universally distributed, though volumes are driven heavily by high-volume dental chains and independent practitioners. Analyzing these cross-sections allows manufacturers to tailor their marketing and distribution strategies effectively, focusing on product durability, cost-effectiveness, and clinical efficacy pertinent to the target end-user.

- Product: Instruments, Consumables, Equipment

- Application: Pulpitis, Apical Periodontitis, Traumatic Injuries, Other Indications

- End-User: Dental Clinics, Hospitals, Dental Academic & Research Institutes

Value Chain Analysis For Dental Endodontics Market

The value chain for the Dental Endodontics Market commences with upstream activities involving the sourcing and processing of specialized raw materials, primarily high-grade nickel-titanium alloys, medical-grade plastics, and bioceramic components. Key upstream activities focus on material innovation to enhance instrument properties such as flexibility, cutting efficiency, and fracture resistance. Manufacturers invest heavily in R&D here to develop proprietary heat treatment protocols for NiTi files (e.g., controlled memory, wire technology) which serve as a critical differentiator in the competitive landscape. Efficiency and intellectual property protection at this stage directly influence the final product quality and pricing.

The manufacturing stage involves the precision engineering and sterilization of instruments and equipment, adhering to stringent global medical device standards (e.g., FDA, CE Mark). Downstream activities primarily involve intricate distribution channels, where products move from manufacturers to specialized distributors, dental supply houses, and direct sales teams targeting key end-users. The distribution network is complex, balancing the need for broad reach (indirect channels via large distributors) with the requirement for technical support and product education (direct channels to specialized endodontists). Digital commerce platforms are also gaining traction, particularly for consumables and frequently replaced instruments.

The direct sales channel is often preferred for high-value equipment like CBCT systems and operating microscopes, where installation, training, and ongoing technical service are mandatory components of the sale. Indirect channels are more efficient for high-volume, low-cost consumables and files. The final stage involves the utilization of these products by dental professionals in clinics and hospitals, where the perceived value is determined by clinical success rates, ease of use, and patient comfort. Effective supply chain management that ensures timely delivery and proper inventory control is essential for maintaining market share and optimizing operational expenditure across the chain.

Dental Endodontics Market Potential Customers

The primary consumers and end-users of dental endodontic products are highly specialized dental practitioners, including general dentists who perform basic root canal procedures, and, more critically, certified endodontists who handle complex, specialist cases. Dental Clinics represent the largest segment of consumption due to the sheer volume of routine and specialized endodontic treatments performed globally. These clinics range from small, independent practices to large, multi-chair corporate dental chains, with the latter increasingly driving bulk purchasing decisions and standardization of equipment and consumable brands.

Hospitals, particularly those with comprehensive dental departments or trauma centers, also constitute a significant customer base. In hospital settings, the demand is typically for high-end equipment, including advanced imaging modalities and surgical endodontic tools, often linked to managing severe trauma cases or treatments under general anesthesia. Furthermore, Dental Academic and Research Institutes serve as crucial early adopters and customers, utilizing endodontic products for training future dentists and conducting critical research on new materials and techniques. These institutions often prioritize systems that offer broad educational utility and are leaders in validating emerging technologies before widespread commercial adoption.

The purchasing behavior across these customer segments varies considerably. Specialized endodontists prioritize instruments offering maximum safety and superior clinical outcomes, often opting for premium, highly flexible NiTi systems and advanced bioceramics, regardless of marginal cost differences. General practitioners, who perform fewer complex cases, often seek systems that balance efficiency, ease of use, and cost-effectiveness. Therefore, manufacturers must segment their product portfolio to address the distinct needs and budgetary constraints of these diverse groups of buyers, emphasizing training and educational support tailored to the specific skill level of the potential customer.

| Report Attributes | Report Details |

|---|---|

| Market Size in 2026 | USD 1.8 Billion |

| Market Forecast in 2033 | USD 2.8 Billion |

| Growth Rate | 6.5% CAGR |

| Historical Year | 2019 to 2024 |

| Base Year | 2025 |

| Forecast Year | 2026 - 2033 |

| DRO & Impact Forces |

|

| Segments Covered |

|

| Key Companies Covered | Dentsply Sirona, Danaher Corporation, Septodont, Ivoclar Vivadent, Coltene Group, FKG Dentaire SA, Mani Inc., Ultradent Products Inc., Henry Schein Inc., Brasseler USA, Vista Apex, Kerr Corporation, VDW GmbH, Straumann Group, DMG America, SybronEndo (Kerr), VOCO GmbH, Essential Dental Systems, Micro-Mega SA, Parkell Inc. |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Enquiry Before Buy | Have specific requirements? Send us your enquiry before purchase to get customized research options. Request For Enquiry Before Buy |

Dental Endodontics Market Key Technology Landscape

The technological landscape of the Dental Endodontics Market is characterized by continuous innovation aimed at enhancing precision, reducing treatment time, and improving biocompatibility. The most pivotal technology remains the evolution of Nickel-Titanium (NiTi) rotary and reciprocating file systems. Modern NiTi alloys incorporate specialized heat treatments (e.g., M-wire, controlled memory, proprietary thermal processes) that dramatically increase the files' flexibility and resistance to cyclic fatigue and torsional stress. This allows practitioners to safely navigate complex and severely curved root canal anatomies, a critical factor in procedural success, driving the rapid obsolescence of traditional stainless-steel instruments.

Alongside file technology, the widespread adoption of high-magnification and visualization tools, primarily Dental Operating Microscopes (DOMs) and Cone-Beam Computed Tomography (CBCT) systems, has redefined endodontic standards. DOMs provide illuminated, magnified views essential for finding calcified canals and performing complex microsurgeries. CBCT offers three-dimensional imaging capabilities, allowing for non-invasive pre-operative planning, accurate assessment of root morphology, and precise localization of periapical pathologies, which were previously impossible with conventional 2D radiographs. The convergence of these imaging tools with advanced treatment devices establishes a foundation for true minimally invasive endodontic procedures.

Furthermore, the development of advanced bioactive materials, particularly bioceramic sealers and repair materials, represents a significant technological leap in the consumables segment. Bioceramics offer superior sealing properties, are highly biocompatible, and promote the formation of hydroxyapatite, which is conducive to healing and tissue regeneration. These materials are replacing older generations of zinc-oxide eugenol and epoxy resin-based sealers. Finally, the integration of digital technology is manifesting in highly accurate electronic apex locators and cordless endodontic motors with integrated features such as torque control and auto-reverse functions, ensuring standardized and safe preparation of the root canal system, further cementing technology as the primary market driver.

Regional Highlights

- North America (U.S. and Canada): This region dominates the global market, characterized by sophisticated healthcare infrastructure, high patient awareness regarding oral health, substantial healthcare expenditure, and the early adoption of premium, high-tech endodontic equipment like CBCT and operating microscopes. Favorable reimbursement policies and the presence of major industry players further solidify its leading position. The demand here is driven by specialized endodontists prioritizing clinical excellence and minimal invasive techniques.

- Europe (Germany, UK, France): Europe holds the second-largest market share, supported by universal healthcare coverage and stringent regulatory standards promoting high-quality dental care. Countries like Germany and the Scandinavian nations are significant consumers of advanced instruments and bioceramic sealers. Market growth is sustained by ongoing dental postgraduate education and a cultural focus on maintaining natural dentition.

- Asia Pacific (APAC) (China, India, Japan): APAC is projected to exhibit the highest CAGR during the forecast period. This rapid growth is a result of increasing disposable incomes, significant expansion of private dental clinic networks, improving dental hygiene awareness, and the booming dental tourism sector. While Japan is a mature market, the massive populations of China and India represent immense untapped potential, with increasing adoption of rotary systems replacing manual techniques.

- Latin America (LATAM) and Middle East & Africa (MEA): These regions represent emerging opportunities. Growth in LATAM is driven by increasing access to private dental insurance and urbanization. In MEA, market penetration is rising due to government investments in healthcare infrastructure and the establishment of international hospital chains. However, affordability and limited access to specialized training remain moderate constraints in certain sub-regions.

Top Key Players

The market research report includes a detailed profile of leading stakeholders in the Dental Endodontics Market.- Dentsply Sirona

- Danaher Corporation

- Septodont

- Ivoclar Vivadent

- Coltene Group

- FKG Dentaire SA

- Mani Inc.

- Ultradent Products Inc.

- Henry Schein Inc.

- Brasseler USA

- Vista Apex

- Kerr Corporation

- VDW GmbH

- Straumann Group

- DMG America

- SybronEndo (Kerr)

- VOCO GmbH

- Essential Dental Systems

- Micro-Mega SA

- Parkell Inc.

Frequently Asked Questions

Analyze common user questions about the Dental Endodontics market and generate a concise list of summarized FAQs reflecting key topics and concerns.What is driving the shift from manual endodontic filing to rotary systems?

The shift is driven primarily by the superior efficiency, consistency, and reduced risk of procedural errors offered by rotary and reciprocating NiTi file systems. These systems decrease treatment time, improve the quality of canal preparation, and, due to advanced metallurgy, possess greater flexibility and resistance to fracture compared to traditional stainless steel instruments.

How are bioceramic sealers influencing the endodontics consumables segment?

Bioceramic sealers are highly influential as they offer exceptional biocompatibility, superior dimensional stability, and hydrophilicity, allowing them to set even in the presence of moisture. This leads to improved apical sealing and encourages a favorable environment for periapical tissue healing, setting a new standard for root canal obturation materials.

Which geographical region is expected to demonstrate the fastest growth in the Dental Endodontics Market?

The Asia Pacific (APAC) region is projected to register the highest Compound Annual Growth Rate (CAGR). This acceleration is attributable to rapidly expanding dental healthcare access, increasing dental expenditure due to rising disposable incomes, and the widespread adoption of modern Western endodontic techniques in densely populated countries like China and India.

What role does Cone-Beam Computed Tomography (CBCT) play in modern endodontic procedures?

CBCT plays a critical role by providing high-resolution, three-dimensional (3D) visualization of root canal anatomy, allowing endodontists to accurately diagnose complex pathologies, locate missed canals, and plan surgical procedures with extreme precision, thereby significantly improving clinical outcomes that traditional 2D X-rays cannot achieve.

What is the greatest constraint impacting the widespread adoption of high-end endodontic technology?

The most significant constraint is the high capital cost associated with purchasing and installing sophisticated endodontic equipment, such as dental operating microscopes and CBCT units. This financial barrier often restricts their adoption by small or independent dental practices, especially in price-sensitive developing markets.

To check our Table of Contents, please mail us at: sales@marketresearchupdate.com

Research Methodology

The Market Research Update offers technology-driven solutions and its full integration in the research process to be skilled at every step. We use diverse assets to produce the best results for our clients. The success of a research project is completely reliant on the research process adopted by the company. Market Research Update assists its clients to recognize opportunities by examining the global market and offering economic insights. We are proud of our extensive coverage that encompasses the understanding of numerous major industry domains.

Market Research Update provide consistency in our research report, also we provide on the part of the analysis of forecast across a gamut of coverage geographies and coverage. The research teams carry out primary and secondary research to implement and design the data collection procedure. The research team then analyzes data about the latest trends and major issues in reference to each industry and country. This helps to determine the anticipated market-related procedures in the future. The company offers technology-driven solutions and its full incorporation in the research method to be skilled at each step.

The Company's Research Process Has the Following Advantages:

- Information Procurement

The step comprises the procurement of market-related information or data via different methodologies & sources.

- Information Investigation

This step comprises the mapping and investigation of all the information procured from the earlier step. It also includes the analysis of data differences observed across numerous data sources.

- Highly Authentic Source

We offer highly authentic information from numerous sources. To fulfills the client’s requirement.

- Market Formulation

This step entails the placement of data points at suitable market spaces in an effort to assume possible conclusions. Analyst viewpoint and subject matter specialist based examining the form of market sizing also plays an essential role in this step.

- Validation & Publishing of Information

Validation is a significant step in the procedure. Validation via an intricately designed procedure assists us to conclude data-points to be used for final calculations.

×

Request Free Sample:

Related Reports

Select License

Why Choose Us

We're cost-effective and Offered Best services:

We are flexible and responsive startup research firm. We adapt as your research requires change, with cost-effectiveness and highly researched report that larger companies can't match.

Information Safety

Market Research Update ensure that we deliver best reports. We care about the confidential and personal information quality, safety, of reports. We use Authorize secure payment process.

We Are Committed to Quality and Deadlines

We offer quality of reports within deadlines. We've worked hard to find the best ways to offer our customers results-oriented and process driven consulting services.

Our Remarkable Track Record

We concentrate on developing lasting and strong client relationship. At present, we hold numerous preferred relationships with industry leading firms that have relied on us constantly for their research requirements.

Best Service Assured

Buy reports from our executives that best suits your need and helps you stay ahead of the competition.

Customized Research Reports

Our research services are custom-made especially to you and your firm in order to discover practical growth recommendations and strategies. We don't stick to a one size fits all strategy. We appreciate that your business has particular research necessities.

Service Assurance

At Market Research Update, we are dedicated to offer the best probable recommendations and service to all our clients. You will be able to speak to experienced analyst who will be aware of your research requirements precisely.

Contact With Our Sales Team

Customer Testimonials

The content of the report is always up to the mark. Good to see speakers from expertise authorities.

Privacy requested , Managing Director

A lot of unique and interesting topics which are described in good manner.

Privacy requested, President

Well researched, expertise analysts, well organized, concrete and current topics delivered in time.

Privacy requested, Development Manager