Dental Operatory Lights Market Size, By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2026 to 2033 (Financial Impact Analysis)

ID : MRU_ 442293 | Date : Feb, 2026 | Pages : 249 | Region : Global | Publisher : MRU

Dental Operatory Lights Market Size

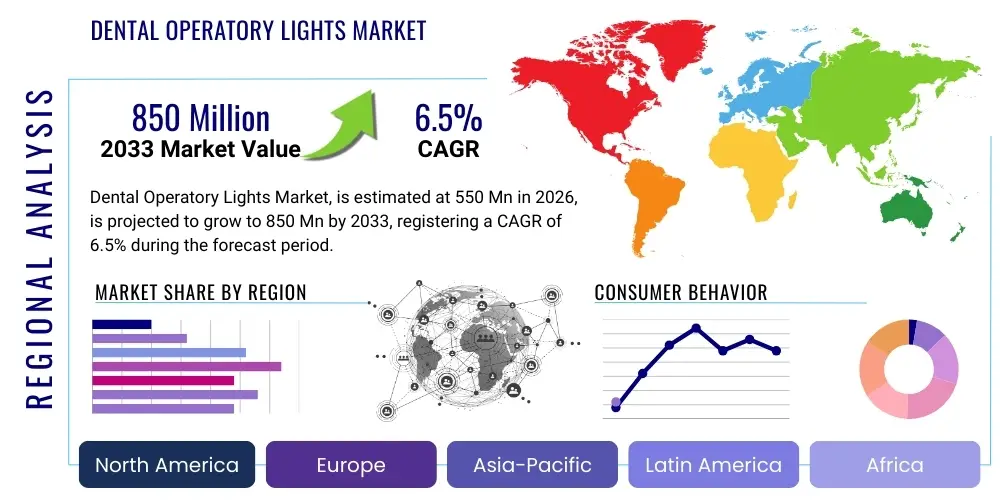

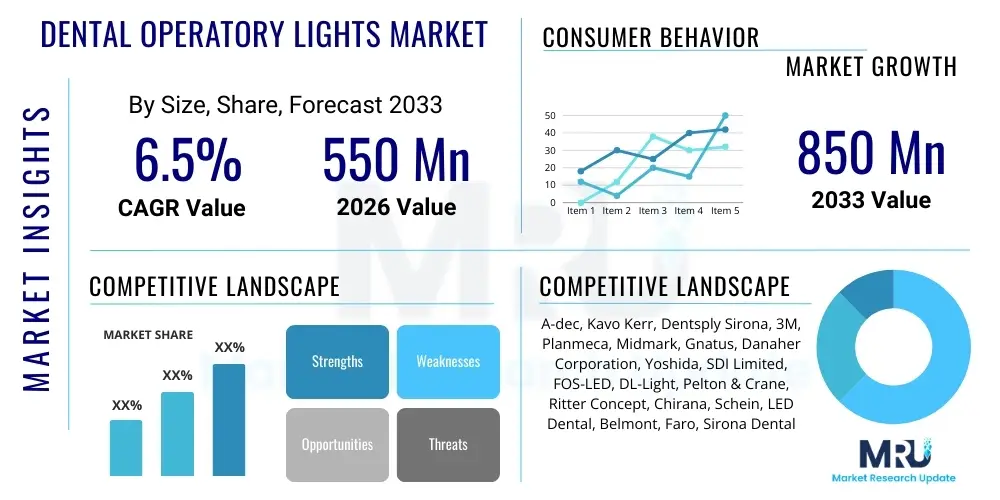

The Dental Operatory Lights Market is projected to grow at a Compound Annual Growth Rate (CAGR) of 6.5% between 2026 and 2033. The market is estimated at $550 Million in 2026 and is projected to reach $850 Million by the end of the forecast period in 2033.

Dental Operatory Lights Market introduction

The Dental Operatory Lights Market encompasses specialized illumination systems crucial for enhancing visibility during dental procedures, ranging from routine examinations to complex surgical interventions. These lighting systems, primarily driven by advanced LED (Light Emitting Diode) technology, are designed to minimize shadows, provide accurate color rendering (CRI), and reduce eye strain for both the clinician and the patient. Modern operatory lights often incorporate features such as adjustable intensity, color temperature variation, and specialized curing modes, addressing the stringent requirements of contemporary dentistry, particularly concerning composite restoration and shade matching.

The core product category includes ceiling-mounted, chair-mounted, and mobile standalone units, each tailored for different clinical settings and ergonomic needs. Major applications span general dentistry, orthodontics, oral surgery, and cosmetic dentistry. The inherent benefits of these modern lighting solutions—such as lower heat emission compared to traditional halogen bulbs, significantly longer operational lifespan, and reduced energy consumption—are powerful driving factors. Furthermore, the increasing prevalence of dental tourism, rising awareness regarding oral hygiene, and the growing global elderly population requiring extensive dental care substantially contribute to the expanding demand for sophisticated operatory lighting equipment.

Key market drivers include the ongoing technological transition towards high-performance LEDs offering superior lux levels and precise light field geometry. Regulatory compliance, focusing on patient and practitioner safety, mandates the adoption of ergonomically designed and certified equipment, further accelerating the replacement cycle of older, less efficient halogen units. Investment in advanced infrastructure by Dental Service Organizations (DSOs) and the trend towards establishing specialized dental clinics equipped with state-of-the-art diagnostic and therapeutic tools are reinforcing the market's positive trajectory, making precise, shadow-free illumination an indispensable component of quality dental practice.

Dental Operatory Lights Market Executive Summary

The Dental Operatory Lights Market is experiencing robust growth driven by significant technological shifts and evolving healthcare infrastructure globally. Business trends are characterized by fierce competition in the LED segment, with key players focusing heavily on integrating smart features such as sensor activation, touchless controls, and connectivity for seamless digital workflow integration. Consolidation among smaller manufacturers and strategic partnerships between equipment providers and dental technology firms are prominent strategies aimed at capturing market share and enhancing product development capabilities. The shift towards energy-efficient and highly customizable lighting solutions is a central theme defining modern product cycles, influencing purchasing decisions across private practices and large hospital systems alike.

Regionally, North America and Europe maintain dominance, attributed to high healthcare expenditure, established regulatory frameworks, and rapid adoption of advanced dental technologies by DSOs. However, the Asia Pacific (APAC) region is forecasted to exhibit the highest growth rate, propelled by expanding dental patient bases, increasing disposable incomes supporting elective procedures, and government initiatives aimed at modernizing healthcare facilities in populous nations like China and India. Latin America and the Middle East & Africa (MEA) are emerging as high-potential markets, though growth here is often tempered by fluctuating economic conditions and less centralized dental procurement processes.

Segment trends highlight the overwhelming market preference for LED technology over traditional halogen lights due to superior performance metrics. Application-wise, general dentistry continues to be the largest consumer base, but the demand for specialized lights suitable for surgical procedures and magnification techniques is growing rapidly. End-user segmentation shows that large hospital dental departments and corporate DSOs are major revenue generators, driven by large-volume purchasing agreements and a need for standardized, high-quality equipment across multiple locations. The trend favors modular systems that allow for future upgrades and easy maintenance, optimizing the total cost of ownership (TCO) for dental practices.

AI Impact Analysis on Dental Operatory Lights Market

User queries regarding the intersection of Artificial Intelligence (AI) and Dental Operatory Lights frequently center on how AI can enhance diagnostic accuracy, optimize workflow efficiency, and potentially automate environmental control in the operatory room. Common questions involve the integration of AI-driven color analysis for shade matching, the use of computer vision for monitoring light field consistency and shadow reduction in real-time, and whether predictive maintenance systems utilizing AI will reduce equipment downtime. Users are keen to understand if AI can personalize lighting profiles based on the specific procedure (e.g., restorative vs. surgical) or the individual visual acuity of the clinician, moving beyond static settings towards dynamic, responsive illumination systems that minimize procedural errors and improve patient outcomes.

AI's influence in the dental lighting domain is currently manifesting through sophisticated sensor integration and predictive analytics, though direct AI control of light output is still nascent. AI algorithms can analyze ambient room conditions and the patient's oral cavity structure, automatically adjusting light intensity, focus, and temperature to provide optimal viewing conditions, thereby reducing visual fatigue and enhancing precision during intricate procedures. This level of environmental control is critical for complex tasks like implant placement and endodontics, where nuanced differences in tissue color and structure must be clearly differentiated. Furthermore, AI-powered systems can track usage patterns and identify potential component failures (such as driver instability or LED degradation) before they occur, scheduling preventative maintenance and significantly improving the operational longevity and reliability of the equipment.

The future trajectory suggests AI-integrated operatory lights will become essential components of the digital dental ecosystem. Integration with intraoral scanners and CAD/CAM systems will allow AI to reference pre-procedural imaging data and automatically set optimal lighting parameters for specific tasks, such as ensuring the correct color temperature for verifying the fit of ceramic restorations. This convergence of lighting, imaging, and predictive software will transform the operatory light from a simple illumination device into a smart, proactive diagnostic aid, thereby increasing both the procedural speed and accuracy of dental professionals globally.

- Real-time shadow reduction through computer vision algorithms.

- AI-driven optimization of light color temperature for accurate shade matching in cosmetic dentistry.

- Predictive maintenance schedules based on sensor data analysis, minimizing equipment failure.

- Automated adjustment of light intensity relative to procedural type and magnification levels (e.g., microscope integration).

- Integration with patient records to customize ergonomic and lighting settings specific to the clinician's preference.

- Enhanced energy management and longevity through smart power utilization supervised by AI models.

DRO & Impact Forces Of Dental Operatory Lights Market

The market for Dental Operatory Lights is shaped by a confluence of powerful drivers (D) such as the mandatory shift to LED technology for energy efficiency and clinical superiority, stringent regulatory standards demanding shadow-free illumination and infection control features, and the global expansion of corporate dentistry (DSOs). Restraints (R) primarily include the high initial capital investment required for purchasing advanced LED units compared to older halogen systems, budget constraints in small private practices and emerging markets, and the persistent challenge of counterfeiting and substandard lighting products impacting quality perception. Opportunities (O) abound in developing highly integrated, ergonomic light systems with advanced features like touchless controls and integrated cameras, tapping into specialized procedural needs (e.g., surgical lights with laminar flow compatibility), and expanding market penetration in underserved regions like rural APAC and Africa. These factors create significant impact forces on market dynamics, compelling manufacturers to focus on innovation, cost-effectiveness, and adherence to international quality standards.

The primary driving force remains technological superiority; LED lights offer unparalleled longevity, minimal heat emission, and high Color Rendering Index (CRI), essential for accurate diagnosis and precise restorative work. Increased awareness about ergonomics and operator comfort further fuels demand for articulated, easily positioned lights that minimize musculoskeletal strain. Conversely, the restraint imposed by high cost is significant, forcing many independent practitioners to delay upgrades or opt for refurbished equipment, thereby slowing market penetration of the newest technologies. Manufacturers must continuously justify the Total Cost of Ownership (TCO) benefit, emphasizing energy savings and reduced maintenance compared to upfront capital expenditure.

The impact forces generated by global regulatory bodies, such as ISO and IEC standards pertaining to medical electrical equipment, necessitate rigorous testing and certification, raising the barrier to entry but ensuring high product quality. Opportunities in integration—specifically incorporating intra-oral cameras, monitors, and light curing capabilities directly into the operatory light unit—are redefining the product category from simple illumination to a multi-functional hub. The strategic leveraging of these forces—mitigating costs while aggressively pursuing integrated, standard-compliant technologies—will determine market leadership and adoption rates over the forecast period, emphasizing the need for robust supply chain management and customer education on clinical benefits.

Segmentation Analysis

The Dental Operatory Lights Market is comprehensively segmented based on technology, product type, application, and end-user, allowing for precise market analysis and targeted strategic planning. The segmentation by technology clearly distinguishes the highly dominant LED segment from the rapidly diminishing Halogen segment, reflecting the industry's commitment to energy efficiency and superior light quality. Product type differentiation separates chair-mounted, ceiling-mounted, and mobile units, catering to varying space constraints and mobility requirements in different clinical environments. Application segmentation identifies demand across general dentistry, orthodontics, and oral surgery, while the end-user perspective divides the market based on purchasing power and scale, analyzing Dental Service Organizations (DSOs), independent clinics, and hospital dental departments.

Analyzing these segments reveals critical trends. The LED segment's growth is inherently linked to its ability to offer customizable color temperatures (e.g., cool light for surgical procedures, warmer light for shade matching) and the availability of curing-safe modes (where light spectrum is filtered to prevent premature setting of composite resins). Within product types, chair-mounted lights remain the most common installation due to their convenience and integration with standard dental chairs, but ceiling-mounted systems are preferred in high-end surgical suites where complex configurations and maximum space clearance are necessary. The rapid expansion of DSOs, characterized by standardized equipment procurement, drives the demand for reliable, large-volume solutions.

Further granularity in segmentation helps identify niche opportunities. For example, lights designed specifically for microscopes and magnification aids represent a growing sub-segment driven by specialization in endodontics and microsurgery. Similarly, innovations in infection control—such as fully sealed housings, autoclavable handles, and touchless control sensors—are becoming crucial differentiators within the functional segmentation. This detailed analysis allows stakeholders to align their product development and marketing efforts with the specific needs and procurement cycles of key customer groups, ensuring maximum market relevance and penetration across specialized dentistry fields.

- Technology: LED Lights, Halogen Lights

- Product Type: Chair-Mounted Lights, Ceiling-Mounted Lights, Mobile Standalone Lights

- Application: General Dentistry, Cosmetic Dentistry, Orthodontics, Oral Surgery and Implantology, Endodontics

- End-User: Dental Service Organizations (DSOs), Independent Dental Clinics, Hospital Dental Departments, Academic and Research Institutions

Value Chain Analysis For Dental Operatory Lights Market

The value chain for Dental Operatory Lights begins with upstream activities involving the sourcing and manufacturing of highly specialized components, primarily focusing on advanced optical lenses, high-performance LED chips, microcontrollers, and sophisticated articulation mechanisms (arms and joints). Key challenges upstream involve securing a stable supply of high-CRI LEDs and ensuring quality control for proprietary optics necessary to achieve precise light field geometry and uniformity. Collaboration with electronics manufacturers capable of producing durable, low-heat drivers and seamless sensor integration is crucial. The high dependence on specialized suppliers for optics and electronics dictates production quality and overall cost structure, making supply chain resilience a significant competitive factor in the initial stages of the value chain.

Midstream processes involve the assembly, rigorous quality testing, and certification of the final product according to international standards (e.g., IEC 60601). Manufacturers integrate the components, focusing on ergonomic design, thermal management, and reliable mechanical articulation. The distribution channel, representing the downstream activity, is diverse. Direct sales are often utilized for large DSOs and governmental tenders, allowing manufacturers to maintain tight control over pricing and installation services. Indirect channels, involving authorized distributors, dealers, and regional stocking partners, are essential for reaching independent dental clinics, particularly in geographically diverse or highly regulated markets. These distributors often provide critical installation, maintenance, and technical support services, adding significant value.

The structure of the value chain necessitates a strong focus on aftermarket services. Because operatory lights are long-term capital investments, the availability of specialized replacement parts (e.g., driver boards, articulated joint mechanisms) and scheduled maintenance services is vital for customer satisfaction and long-term revenue generation. The prevalence of indirect distribution channels highlights the importance of training dealer networks extensively on product specifications and maintenance protocols. Moreover, digital platforms are increasingly being utilized both directly and indirectly to offer virtual training, manage inventory, and handle warranty claims efficiently, streamlining the complex interplay between manufacturing, distribution, and end-user support.

Dental Operatory Lights Market Potential Customers

The primary customers for Dental Operatory Lights are highly diversified professional entities ranging from large-scale corporate purchasers to individual practitioners. Dental Service Organizations (DSOs) represent the most significant potential customer segment globally. DSOs, which manage multiple affiliated dental practices, demand bulk orders of standardized, high-quality lighting systems that integrate easily across various clinic layouts and IT infrastructures. Their purchasing decisions prioritize longevity, energy efficiency, consistency in performance, and favorable volume pricing, often leading to long-term supply agreements with major manufacturers. This segment requires advanced features such as centralized diagnostics and remote monitoring capabilities.

Independent Dental Clinics and private practices form the largest segment by sheer numbers, though their purchasing volumes are smaller. These end-users prioritize ergonomic design, ease of use, and compatibility with existing chair and unit infrastructure. Their buying decisions are frequently influenced by clinical requirements (e.g., the need for specialized lights for magnification or specific restorative materials) and the recommendations of local distributors. Budget constraints play a more critical role here, often leading to a focus on the mid-range LED products that offer a strong balance between performance and cost. The replacement cycle in this segment is often triggered by equipment failure or major clinic renovations.

Hospital Dental Departments and Academic Institutions constitute specialized customer segments. Hospitals require operatory lights that meet stringent infection control standards (e.g., sealed units, autoclavable components) and often need surgical-grade illumination with features like emergency battery backup and integration into laminar flow environments. Academic institutions, conversely, require robust, highly reliable lights suitable for student training environments and high-volume usage, often purchasing equipment in large cohorts for simulation labs and teaching clinics. For these institutional buyers, adherence to procurement specifications, durability, and comprehensive warranty coverage are paramount factors influencing procurement decisions.

| Report Attributes | Report Details |

|---|---|

| Market Size in 2026 | $550 Million |

| Market Forecast in 2033 | $850 Million |

| Growth Rate | 6.5% CAGR |

| Historical Year | 2019 to 2024 |

| Base Year | 2025 |

| Forecast Year | 2026 - 2033 |

| DRO & Impact Forces |

|

| Segments Covered |

|

| Key Companies Covered | A-dec, Kavo Kerr, Dentsply Sirona, 3M, Planmeca, Midmark, Gnatus, Danaher Corporation, Yoshida, SDI Limited, FOS-LED, DL-Light, Pelton & Crane, Ritter Concept, Chirana, Schein, LED Dental, Belmont, Faro, Sirona Dental |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Enquiry Before Buy | Have specific requirements? Send us your enquiry before purchase to get customized research options. Request For Enquiry Before Buy |

Dental Operatory Lights Market Key Technology Landscape

The technological landscape of the Dental Operatory Lights market is predominantly defined by the maturation and continuous refinement of Light Emitting Diode (LED) technology, which has fundamentally replaced outdated halogen systems. Modern LED operatory lights utilize sophisticated optical systems, often employing multiple diode clusters and custom reflectors or lenses to create a homogenous light field with sharp cut-offs, effectively eliminating shadows caused by the dentist's head, hands, or instruments. A key technological advancement involves incorporating high Color Rendering Index (CRI) LEDs, typically exceeding 90, to ensure colors (especially soft tissues and restorative materials) are viewed accurately, which is critical for shade matching and diagnosing subtle pathologies. Furthermore, advanced thermal management systems are vital for dissipating heat efficiently, ensuring LED longevity and maintaining consistent light output over extended periods of operation without discomfort to the patient.

Another pivotal technological trend is the integration of "smart" features and connectivity. This includes the implementation of proximity sensors and infrared controls enabling touchless operation, significantly improving infection control protocols by minimizing surface contact. Additionally, some high-end units incorporate built-in video cameras (HD or 4K) positioned centrally within the light head. These cameras facilitate documentation, live education, and communication with patients, seamlessly integrating the operatory light into the broader digital workflow. The use of microprocessors allows for programmable settings, enabling clinicians to store customized light profiles based on procedure type, magnification level, or personal preference, accessible via digital control panels or even mobile device synchronization, reflecting a move towards personalized clinical environments.

Specialized lighting modes are becoming standard features, significantly expanding the utility of operatory lights beyond simple illumination. These include composite curing-safe modes, which utilize yellow filters or spectral modifications to block wavelengths that prematurely polymerize light-cured resins, and enhanced diagnostic modes that might emphasize certain wavelengths to highlight specific tissue characteristics or plaque. Emerging technologies also focus on ergonomic improvements, such as advanced fluid articulation systems that allow for smooth, effortless repositioning of the light head, and materials science innovations resulting in lighter, more durable construction. The future technological direction centers on maximizing energy efficiency, minimizing ambient light interference, and achieving regulatory compliance for light intensity limits to prevent retinal damage while ensuring sufficient illumination for highly magnified procedures.

Regional Highlights

- North America (USA and Canada)

North America holds a dominant position in the global Dental Operatory Lights Market, primarily driven by high per capita healthcare spending, the rapid adoption of cutting-edge dental technologies, and a highly developed infrastructure characterized by an increasing number of large Dental Service Organizations (DSOs). The region benefits from stringent regulatory environments that enforce high standards for medical device quality and safety, favoring manufacturers who incorporate the latest LED and infection control technologies. The strong presence of major market players and a culture of continuous technological upgrade, especially concerning integration with digital impression systems and electronic health records, solidify North America's status as a mature yet highly dynamic market. Emphasis is placed on ergonomic features and systems that offer documented clinical advantages in color rendering accuracy.

The market growth is also sustained by the aging population requiring complex restorative and aesthetic procedures, which demand superior illumination quality. Demand drivers in the US include tax incentives for capital expenditure on medical equipment and competition among DSOs to offer state-of-the-art facilities. Canada follows a similar trajectory, albeit with a stronger focus on centralized procurement within provincial healthcare systems. Replacement cycles are relatively short due to technological obsolescence and the desire for enhanced infection control capabilities, making it a lucrative market for advanced, sensor-controlled LED systems.

- Europe (Germany, UK, France, Italy, Spain, Rest of Europe)

The European market is robust, characterized by high quality standards and a strong manufacturing base, particularly in Germany and Italy. Western European nations exhibit high penetration rates for advanced LED operatory lights, supported by national healthcare systems and specialized private clinics that prioritize long-term investment in durable, energy-efficient equipment. Germany, being a hub for dental equipment innovation and manufacturing, dictates many regional trends, focusing on precision engineering, superior optics, and compliance with EU Medical Device Regulations (MDR). The shift towards minimal invasive dentistry and endodontic microsurgery necessitates lights optimized for use with microscopes, boosting the demand for high-intensity, small-field illumination.

While economic volatility affects some Southern European markets, the overall trend is positive, driven by refurbishment projects and clinic expansion across the continent. Eastern Europe represents an emerging opportunity, with increasing private investment modernizing previously state-controlled dental facilities. A significant regional highlight is the preference for modular systems that allow for easy repair and upgrades, appealing to environmentally conscious consumers and regulations promoting product longevity. The UK market shows consistent demand tied to the expansion of corporate dental groups and private specialist centers focusing on aesthetics and implantology.

- Asia Pacific (APAC) (China, Japan, India, South Korea, Australia, Rest of APAC)

APAC is the fastest-growing region globally, fueled by massive untapped potential, rapidly increasing healthcare expenditure, and the expansion of medical tourism. China and India are the primary growth engines, driven by substantial investment in new hospital infrastructure and a significant increase in the number of trained dental professionals entering the workforce. While Japan and Australia represent mature markets with high adoption of premium brands and advanced technology, similar to North America, the emerging economies are price-sensitive but offer vast volume potential.

The challenges in APAC include variable regulatory environments and competition from low-cost, local manufacturers. However, as standards of care rise, there is a distinct move towards internationally certified LED lights, particularly in urban centers and high-end private practices. South Korea is a leader in adopting digital dentistry, ensuring that operatory lights with integrated smart features and connectivity capabilities find ready adoption. The market dynamism is characterized by international manufacturers establishing local production or distribution partnerships to navigate regional logistics and competitive pricing pressures, targeting large-scale government procurement projects for public health systems.

- Latin America (Brazil, Mexico, Rest of Latin America)

Latin America is an emerging market with moderate growth, heavily influenced by the economic stability of key markets like Brazil and Mexico. The presence of strong local manufacturers, particularly in Brazil, provides cost-competitive alternatives, though high-end clinics still predominantly rely on imported systems from North America and Europe. Market growth is closely tied to the expansion of private dental insurance schemes and the establishment of sophisticated dental chains in major metropolitan areas. Price sensitivity remains a major factor, leading to a strong demand for reliable, mid-range LED products.

The trend towards improving infection control and adopting energy-efficient solutions is gradually replacing legacy halogen units. Mexico, benefiting from cross-border dental tourism, sees strong investment in modern operatory equipment to maintain competitive standards. Challenges include bureaucratic import processes and currency fluctuations, which necessitate flexible distribution and inventory management strategies by international suppliers.

- Middle East and Africa (MEA) (GCC Countries, South Africa, Rest of MEA)

The MEA market exhibits heterogeneous growth. The Gulf Cooperation Council (GCC) countries (UAE, Saudi Arabia, Qatar) are high-value markets, characterized by state-of-the-art dental facilities, high disposable income, and a strong preference for premium, fully-featured European and North American brands. Investment is often focused on establishing world-class specialty centers and medical tourism hubs, demanding the highest quality surgical and diagnostic lighting. These markets are less price-sensitive and rapidly adopt the latest innovations like integrated cameras and touchless controls.

Conversely, the African continent, excluding South Africa, represents a largely nascent market where procurement is often driven by international aid organizations or concentrated in urban private clinics. Growth is tied to infrastructure development and improving access to basic dental care. South Africa is the regional leader, showing steady demand for reliable LED technology driven by a well-established private healthcare sector. The major challenge across many parts of Africa is the need for durable, low-maintenance equipment capable of operating reliably despite potential power fluctuations and logistical difficulties.

Top Key Players

The market research report includes a detailed profile of leading stakeholders in the Dental Operatory Lights Market.- A-dec

- Kavo Kerr

- Dentsply Sirona

- 3M

- Planmeca

- Midmark

- Gnatus

- Danaher Corporation

- Yoshida

- SDI Limited

- FOS-LED

- DL-Light

- Pelton & Crane

- Ritter Concept

- Chirana

- Schein

- LED Dental

- Belmont

- Faro

- Sirona Dental

Frequently Asked Questions

Analyze common user questions about the Dental Operatory Lights market and generate a concise list of summarized FAQs reflecting key topics and concerns.What is the primary advantage of LED operatory lights over traditional halogen systems?

The primary advantage of LED operatory lights is their superior energy efficiency, significantly longer lifespan, minimal heat emission, and high Color Rendering Index (CRI), which ensures accurate color representation essential for shade matching and diagnosis, unlike the yellowed, hot light produced by halogen systems.

How do Dental Service Organizations (DSOs) influence the operatory lights market?

DSOs drive market trends by standardizing equipment procurement across multiple locations, leading to bulk purchases of advanced, reliable LED systems. Their demand focuses on integrated features, centralized management compatibility, and favorable volume pricing, accelerating the adoption rate of new technologies.

What key technological features are currently defining high-end dental operatory lights?

High-end dental operatory lights are defined by key technological features such as touchless control sensors for infection mitigation, adjustable color temperature and intensity, built-in HD cameras for documentation, and advanced optical systems designed for optimal shadow reduction and uniform light distribution.

Which geographical region is projected to have the highest growth rate for dental operatory lights?

The Asia Pacific (APAC) region is projected to experience the highest Compound Annual Growth Rate (CAGR), driven by rapid infrastructure development in populous nations like China and India, increasing healthcare investment, and rising patient awareness leading to higher demand for modern dental procedures.

Are there specific lighting requirements for composite resin procedures?

Yes, dental operatory lights used for composite resin procedures should ideally feature a 'curing-safe' mode, often utilizing a yellow filter or spectral modification, which prevents the blue light spectrum from prematurely initiating the polymerization (curing) process of light-sensitive restorative materials, allowing the clinician more working time.

To check our Table of Contents, please mail us at: sales@marketresearchupdate.com

Research Methodology

The Market Research Update offers technology-driven solutions and its full integration in the research process to be skilled at every step. We use diverse assets to produce the best results for our clients. The success of a research project is completely reliant on the research process adopted by the company. Market Research Update assists its clients to recognize opportunities by examining the global market and offering economic insights. We are proud of our extensive coverage that encompasses the understanding of numerous major industry domains.

Market Research Update provide consistency in our research report, also we provide on the part of the analysis of forecast across a gamut of coverage geographies and coverage. The research teams carry out primary and secondary research to implement and design the data collection procedure. The research team then analyzes data about the latest trends and major issues in reference to each industry and country. This helps to determine the anticipated market-related procedures in the future. The company offers technology-driven solutions and its full incorporation in the research method to be skilled at each step.

The Company's Research Process Has the Following Advantages:

- Information Procurement

The step comprises the procurement of market-related information or data via different methodologies & sources.

- Information Investigation

This step comprises the mapping and investigation of all the information procured from the earlier step. It also includes the analysis of data differences observed across numerous data sources.

- Highly Authentic Source

We offer highly authentic information from numerous sources. To fulfills the client’s requirement.

- Market Formulation

This step entails the placement of data points at suitable market spaces in an effort to assume possible conclusions. Analyst viewpoint and subject matter specialist based examining the form of market sizing also plays an essential role in this step.

- Validation & Publishing of Information

Validation is a significant step in the procedure. Validation via an intricately designed procedure assists us to conclude data-points to be used for final calculations.

×

Request Free Sample:

Related Reports

Select License

Why Choose Us

We're cost-effective and Offered Best services:

We are flexible and responsive startup research firm. We adapt as your research requires change, with cost-effectiveness and highly researched report that larger companies can't match.

Information Safety

Market Research Update ensure that we deliver best reports. We care about the confidential and personal information quality, safety, of reports. We use Authorize secure payment process.

We Are Committed to Quality and Deadlines

We offer quality of reports within deadlines. We've worked hard to find the best ways to offer our customers results-oriented and process driven consulting services.

Our Remarkable Track Record

We concentrate on developing lasting and strong client relationship. At present, we hold numerous preferred relationships with industry leading firms that have relied on us constantly for their research requirements.

Best Service Assured

Buy reports from our executives that best suits your need and helps you stay ahead of the competition.

Customized Research Reports

Our research services are custom-made especially to you and your firm in order to discover practical growth recommendations and strategies. We don't stick to a one size fits all strategy. We appreciate that your business has particular research necessities.

Service Assurance

At Market Research Update, we are dedicated to offer the best probable recommendations and service to all our clients. You will be able to speak to experienced analyst who will be aware of your research requirements precisely.

Contact With Our Sales Team

Customer Testimonials

The content of the report is always up to the mark. Good to see speakers from expertise authorities.

Privacy requested , Managing Director

A lot of unique and interesting topics which are described in good manner.

Privacy requested, President

Well researched, expertise analysts, well organized, concrete and current topics delivered in time.

Privacy requested, Development Manager