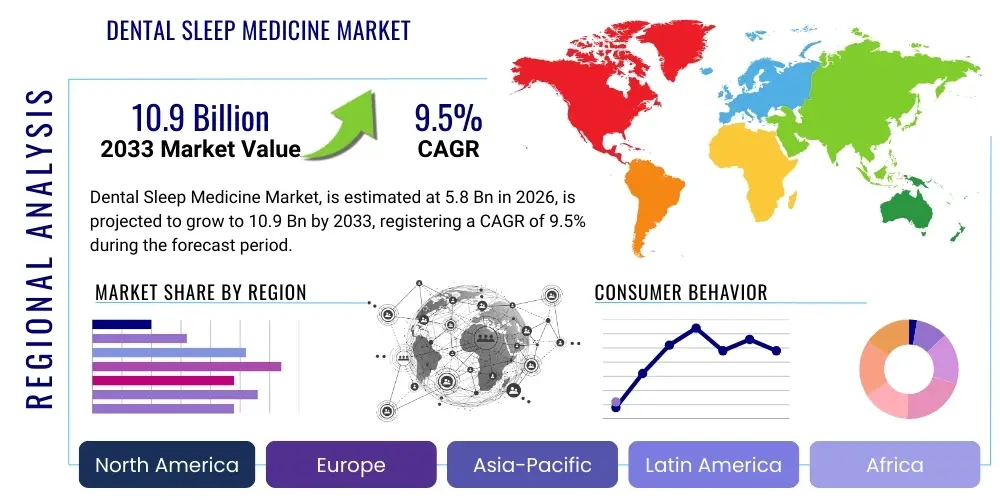

Dental Sleep Medicine Market Size, By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2026 to 2033 (Financial Impact Analysis)

ID : MRU_ 441343 | Date : Feb, 2026 | Pages : 241 | Region : Global | Publisher : MRU

Dental Sleep Medicine Market Size

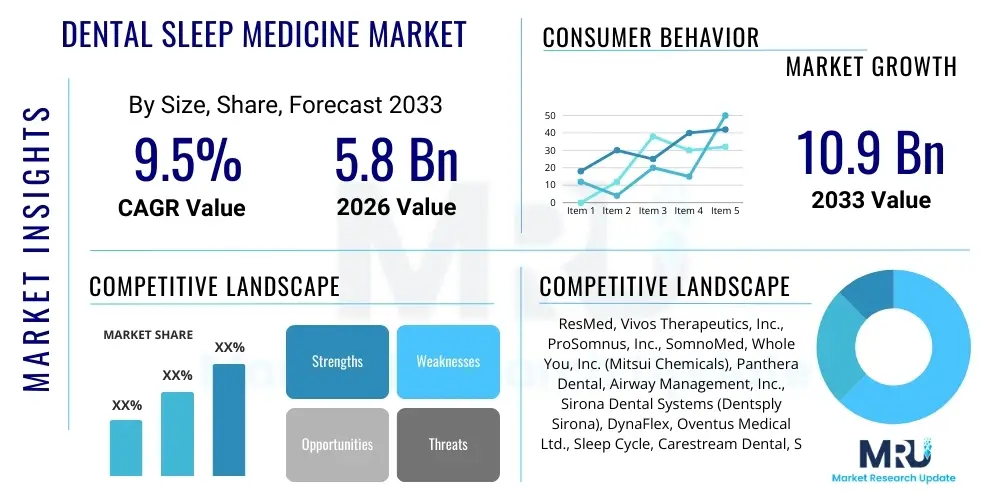

The Dental Sleep Medicine Market is projected to grow at a Compound Annual Growth Rate (CAGR) of 9.5% between 2026 and 2033. The market is estimated at USD 5.8 Billion in 2026 and is projected to reach USD 10.9 Billion by the end of the forecast period in 2033. This substantial expansion is primarily driven by the increasing global prevalence of sleep disorders, particularly Obstructive Sleep Apnea (OSA), and the growing preference for minimally invasive, patient-friendly treatment alternatives like Oral Appliance Therapy (OAT) over traditional Continuous Positive Airway Pressure (CPAP) machines.

Dental Sleep Medicine Market introduction

The Dental Sleep Medicine Market encompasses diagnostic and therapeutic solutions provided by dental professionals focused on managing sleep-related breathing disorders, most notably Obstructive Sleep Apnea (OSA) and primary snoring. Key products include customized oral appliances, such as Mandibular Advancement Devices (MADs) and Tongue Retaining Devices (TRDs), utilized primarily for patients with mild to moderate OSA or those who cannot tolerate CPAP therapy. These devices function by repositioning the jaw or tongue forward during sleep, thereby preventing the collapse of the airway and facilitating unobstructed breathing. The major application of these treatments is the reduction of the Apnea-Hypopnea Index (AHI), mitigating severe health risks associated with untreated sleep apnea.

The market’s benefits are significant, offering patients a portable, quiet, and less intrusive treatment option compared to traditional mechanical ventilation devices. The increasing collaboration between sleep physicians and dentists is accelerating the market penetration of OAT. Driving factors include the escalating awareness campaigns regarding the cardiovascular and metabolic risks associated with undiagnosed sleep disorders, technological advancements in 3D scanning and manufacturing leading to highly customized and comfortable appliances, and the rising global prevalence of risk factors such as obesity and aging populations, which disproportionately contribute to sleep apnea incidence.

Furthermore, the market is characterized by a shift towards digital workflows, utilizing intraoral scanners and computer-aided design and manufacturing (CAD/CAM) processes. This integration minimizes fitting errors, speeds up the production cycle of custom devices, and enhances patient compliance rates. The efficacy and growing acceptance of OAT as a viable first-line treatment option, especially for non-severe cases, cement its position as a critical component in the comprehensive management of sleep-disordered breathing, ensuring sustained market growth throughout the forecast period.

Dental Sleep Medicine Market Executive Summary

The Dental Sleep Medicine Market is currently witnessing robust business trends characterized by significant investment in digital dentistry infrastructure, aiming to optimize the creation of personalized therapeutic appliances. Key market participants are focused on developing smart oral appliances embedded with sensors to track usage and efficacy, enhancing patient compliance data for physicians. Regional trends show North America maintaining market dominance due to high OSA prevalence, established reimbursement systems, and a high concentration of specialized sleep clinics and dentists. However, the Asia Pacific region is demonstrating the fastest growth trajectory, fueled by rapidly improving healthcare access, increasing disposable income, and growing awareness regarding chronic health conditions linked to sleep deprivation. The competitive landscape is moderately fragmented, with large medical device companies increasingly acquiring specialized dental sleep solution providers to expand their product portfolios and distribution networks.

Segment trends reveal that the Oral Appliances segment, particularly Mandibular Advancement Devices (MADs), continues to hold the largest market share due to their widespread acceptance and proven clinical efficacy for treating mild-to-moderate OSA. Conversely, the diagnostic devices segment, including portable home sleep testing (HST) kits, is experiencing accelerated growth driven by the shift from expensive, time-consuming in-lab polysomnography (PSG) to simpler, cost-effective diagnostic methods. End-user analysis highlights dental clinics and specialized sleep centers as the primary points of care, though the integration of dental sleep services within general medical facilities is a notable emerging trend. Technological adoption, especially 3D printing, is streamlining manufacturing processes, reducing material waste, and allowing for greater geometric complexity in appliance design, directly impacting patient comfort and device longevity.

The overall market trajectory indicates a strong positive outlook, underpinned by the confluence of technological innovation and increasing clinical evidence supporting OAT. Strategic emphasis is being placed on standardization of treatment protocols and improved patient education materials to overcome existing barriers related to initial discomfort and long-term compliance. The convergence of medical and dental practices, supported by regulatory bodies acknowledging the vital role of dentists in sleep disorder management, provides a fertile environment for market stakeholders to expand both geographical reach and product utilization, ensuring the market remains dynamic and responsive to evolving patient needs.

AI Impact Analysis on Dental Sleep Medicine Market

Users frequently inquire about AI’s potential to revolutionize the accuracy and efficiency of diagnosing sleep apnea, specifically asking if AI algorithms can analyze complex polysomnography (PSG) or home sleep apnea test (HSAT) data faster than human technicians, and if machine learning can predict the optimal oral appliance design for individual patient anatomy. Key concerns revolve around data privacy, the validation of AI-driven diagnostic scores against traditional methods, and the integration costs of new AI software into existing dental practice management systems. There is also significant curiosity about AI's role in long-term therapy monitoring, specifically through analyzing sensor data from smart oral appliances to track compliance and treatment effectiveness autonomously. The underlying themes center on enhancing diagnostic precision, personalizing therapy, and reducing the operational burdens on both sleep physicians and dental sleep specialists.

The application of Artificial Intelligence within Dental Sleep Medicine is rapidly moving beyond simple data analysis into complex predictive modeling and enhanced computer-aided design (CAD). AI systems are being trained on vast datasets of craniofacial morphology, derived from CBCT scans and intraoral scans, linked with corresponding sleep study outcomes. This allows AI to accurately predict the patient’s response to Mandibular Advancement Devices (MADs) before the device is even fabricated, significantly improving treatment success rates and minimizing the need for multiple adjustments. Furthermore, AI-powered tools are streamlining the diagnostic pathway by automatically scoring sleep event data (apneas, hypopneas, and arousal indices), thereby reducing the workload of sleep technicians and ensuring more objective and standardized diagnostic reporting across different clinical settings, which is crucial for managing the growing volume of patients referred for sleep disorder evaluation.

In the realm of customized appliance manufacturing, Generative Design powered by AI optimizes the geometry of oral appliances based on patient-specific biomechanical parameters, such as bite registration, airway volume, and mandibular movement range. This results in devices that are not only more comfortable but also clinically more effective at maintaining airway patency throughout the sleep cycle. The integration of AI extends into patient adherence management, where machine learning algorithms analyze real-time usage data collected from embedded sensors in smart devices. If usage patterns deviate, the AI can alert the patient or clinician, recommending targeted intervention strategies, thereby mitigating one of the primary restraints of Oral Appliance Therapy—non-compliance. This fusion of precision diagnostics, personalized manufacturing, and proactive adherence management marks a paradigm shift in how dental sleep disorders are treated.

- AI enhances diagnostic accuracy by rapid analysis and scoring of polysomnography (PSG) and home sleep test (HST) data.

- Predictive modeling using machine learning optimizes oral appliance design (MAD/TRD) based on craniofacial geometry (CBCT/Intraoral scans).

- AI-driven optimization reduces fabrication time and minimizes necessary post-fitting adjustments.

- Machine learning algorithms monitor patient compliance data from smart appliances, enabling proactive adherence interventions.

- Generative design techniques facilitate the creation of ultra-customized and highly comfortable therapeutic devices.

- AI supports clinical decision-making by correlating anatomical features with treatment success probability.

DRO & Impact Forces Of Dental Sleep Medicine Market

The market dynamics are shaped by a complex interplay of Drivers (D), Restraints (R), Opportunities (O), and internal/external Impact Forces. The primary drivers fueling growth include the soaring global prevalence of Obstructive Sleep Apnea (OSA), often correlating with rising obesity rates and an aging population, coupled with growing dissatisfaction and low adherence rates associated with Continuous Positive Airway Pressure (CPAP) therapy, pushing patients toward less intrusive oral appliances. Restraints primarily involve the lack of standardized clinical training and accreditation for dentists practicing sleep medicine, leading to variability in treatment outcomes, as well as significant challenges in securing consistent and comprehensive reimbursement coverage across all geographical regions, making custom devices a high out-of-pocket expense for many patients. Furthermore, patient compliance with long-term use of oral appliances remains a critical barrier, requiring continuous monitoring and adjustment.

Opportunities for expansion are vast, centering on the integration of smart technology—such as biosensors and monitoring platforms—into oral appliances to track efficacy and compliance, thereby providing objective data to physicians and potentially improving insurance coverage rates. The untapped potential in pediatric dental sleep medicine, focusing on early intervention for airway development issues, represents a critical emerging opportunity. The impact forces are multifaceted; technological forces, specifically 3D printing and CAD/CAM, are positively disrupting manufacturing speed and accuracy, reducing costs. Economic forces, however, impose a restraint due to the high initial investment required for specialized dental equipment and training. Social forces, driven by increasing public awareness of the detrimental effects of sleep deprivation on overall health, are accelerating patient self-referral and consultation rates.

The market exhibits strong inherent stability, largely insulated from typical economic volatility because sleep disorders represent a significant, non-discretionary health concern. Regulatory forces, particularly in North America and Europe, are increasingly recognizing oral appliances as a medically necessary intervention, which positively influences reimbursement policies, acting as a powerful driver. Competitive forces are intensifying innovation, particularly in materials science to create lighter, more durable, and hypoallergenic appliances. Strategic partnerships between established dental manufacturers, specialist sleep laboratories, and technology firms are enhancing the distribution efficiency and clinical integration of dental sleep solutions, ensuring the market structure remains geared toward specialized, high-value customized care delivery.

Segmentation Analysis

The Dental Sleep Medicine market is systematically segmented primarily based on Product Type, Application, and End-User, reflecting the diverse approaches available for diagnosis and treatment of sleep-related breathing disorders. The Product Type segment is dominated by therapeutic devices, specifically custom-fit oral appliances designed to prevent airway collapse during sleep. Diagnostic tools, including portable monitoring systems for Home Sleep Testing (HST), form the second major product category, experiencing rapid adoption due to their convenience and lower cost compared to traditional in-lab Polysomnography (PSG). Application segmentation centers overwhelmingly on Obstructive Sleep Apnea (OSA), given its high prevalence and documented effectiveness of oral appliance therapy (OAT) in mild-to-moderate cases, with snoring management serving as an important secondary application area.

Segmentation by End-User reveals that Specialized Dental Clinics and independent dental practices that have integrated sleep medicine services are the primary distribution and treatment centers, accounting for the largest share of utilization. However, the market is seeing increased adoption within Hospitals and Sleep Centers, where dental specialists are often integrated into multidisciplinary sleep teams to offer OAT as an alternative or complementary treatment to CPAP. The geographical segmentation (covered in the Regional Highlights) underscores North America's leadership due to high disease awareness and advanced healthcare infrastructure, while APAC represents the critical future growth engine propelled by expanding urban populations and infrastructural investment.

- By Product Type:

- Oral Appliances

- Mandibular Advancement Devices (MADs)

- Tongue Retaining Devices (TRDs)

- Diagnostic Devices

- Polysomnography (PSG) Devices (In-Lab)

- Home Sleep Testing (HST) Devices (Portable Monitors)

- Oximeters and Sensors

- Oral Appliances

- By Application:

- Obstructive Sleep Apnea (OSA) Treatment

- Snoring Management

- By End-User:

- Dental Clinics and Practices

- Hospitals and Sleep Centers

- Home Care Settings

Value Chain Analysis For Dental Sleep Medicine Market

The value chain for the Dental Sleep Medicine Market begins with upstream activities involving raw material suppliers, predominantly providers of medical-grade biocompatible polymers, specialized acrylics, and metal components used in the fabrication of oral appliances. This segment also includes specialized technology providers supplying advanced 3D printing resins, CAD/CAM software licenses, and sophisticated intraoral scanners. Upstream efficiency and quality control are paramount, as the final performance of the device hinges on the materials used. Key players in this stage focus on innovation in lightweight, durable, and hypoallergenic materials, ensuring compliance with strict medical device standards and regulatory approvals necessary for clinical use.

The midstream stage is dominated by the manufacturing and fabrication of the custom devices. This segment includes both large-scale medical device manufacturers that own proprietary appliance designs and a vast network of specialized dental laboratories that utilize digital workflows (CAD/CAM, 3D printing) to create patient-specific MADs or TRDs based on prescriptions. The distribution channel is bifurcated into direct and indirect routes. Direct distribution involves large manufacturers supplying proprietary systems directly to high-volume sleep centers or integrated dental organizations. Indirect distribution is more common, involving manufacturers or labs distributing through established medical distributors, dental suppliers, and relying heavily on the prescribing dental professional for patient fitting and adjustments.

The downstream segment revolves around the point of care and the end-user. This phase is critical as it involves the specialized training and certification of dentists to diagnose, prescribe, fit, and manage Oral Appliance Therapy (OAT). Dental clinics and sleep centers are the ultimate service delivery points. Successful patient outcomes depend heavily on the specialized skills of the clinician in taking accurate impressions (increasingly digital impressions), managing the titration process (adjusting the device incrementally to maximize efficacy), and ensuring long-term patient adherence. The value chain is characterized by a high degree of collaboration between sleep physicians (for initial diagnosis) and dental sleep specialists (for treatment implementation), underscoring the integrated nature of this therapeutic field.

Dental Sleep Medicine Market Potential Customers

The primary target demographic and end-users of Dental Sleep Medicine products are patients diagnosed with mild to moderate Obstructive Sleep Apnea (OSA) who seek an alternative to the cumbersome Continuous Positive Airway Pressure (CPAP) machine. This segment includes individuals who have been diagnosed with an Apnea-Hypopnea Index (AHI) score within the mild (5–15 events/hour) or moderate (15–30 events/hour) range, for whom Oral Appliance Therapy (OAT) is clinically recommended as a first-line treatment. Additionally, a significant pool of potential customers consists of patients with severe OSA who exhibit CPAP intolerance or non-compliance, representing a sizable secondary market for OAT as a viable, albeit sometimes less efficacious, alternative treatment pathway when primary therapy fails. These individuals prioritize comfort, portability, and ease of use, making customized oral appliances highly appealing.

Beyond clinical OSA patients, a substantial portion of the market comprises individuals seeking treatment specifically for primary snoring—a condition that does not necessarily involve significant apneas but severely impacts quality of life for the patient and their bed partner. While often considered a non-medical application, snoring appliances are fabricated using similar technologies and materials, contributing significantly to the market volume. Furthermore, healthcare institutions, including specialized Sleep Centers, major Hospital systems, and General Dentistry practices increasingly incorporating screening and treatment protocols for sleep disorders, act as institutional buyers, investing in diagnostic devices and forming partnerships with oral appliance manufacturers and dedicated dental laboratories. These professional buyers require durable, reliable, and clinically validated products that integrate seamlessly into their multidisciplinary patient care frameworks.

The ideal potential customer profile is often an older, overweight male, though prevalence is rising rapidly in women and younger demographics. Importantly, dental sleep medicine customers are often highly motivated to seek treatment due to the pronounced impact of sleep deprivation on daily functioning, co-morbidities like hypertension, and relationship strain caused by snoring. Therefore, effective customer engagement relies on robust education emphasizing the health benefits of improved sleep quality and the non-invasive nature of the treatment, driving strong consumer demand for customized and technologically advanced oral appliances.

| Report Attributes | Report Details |

|---|---|

| Market Size in 2026 | USD 5.8 Billion |

| Market Forecast in 2033 | USD 10.9 Billion |

| Growth Rate | 9.5% CAGR |

| Historical Year | 2019 to 2024 |

| Base Year | 2025 |

| Forecast Year | 2026 - 2033 |

| DRO & Impact Forces |

|

| Segments Covered |

|

| Key Companies Covered | ResMed, Vivos Therapeutics, Inc., ProSomnus, Inc., SomnoMed, Whole You, Inc. (Mitsui Chemicals), Panthera Dental, Airway Management, Inc., Sirona Dental Systems (Dentsply Sirona), DynaFlex, Oventus Medical Ltd., Sleep Cycle, Carestream Dental, Sleep Better Appliances, Strong Dental International, Myerson LLC, 3D Systems, Stratasys, Inc., Align Technology, Inc., ClearChoice Dental Implant Centers, Voco GmbH. |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Enquiry Before Buy | Have specific requirements? Send us your enquiry before purchase to get customized research options. Request For Enquiry Before Buy |

Dental Sleep Medicine Market Key Technology Landscape

The technological evolution within the Dental Sleep Medicine Market is centered on enhancing precision, accelerating the fabrication process, and improving patient experience through digitalization. Key to this transition is the widespread adoption of Computer-Aided Design and Computer-Aided Manufacturing (CAD/CAM) workflows, which replace traditional, time-consuming plaster casts with high-resolution digital impressions taken using intraoral scanners. This digital shift ensures superior accuracy in capturing the patient's oral anatomy, which is critical for creating effective Mandibular Advancement Devices (MADs). CAD software allows technicians to design the appliance virtually, ensuring optimal biomechanical fit and predictable jaw positioning, minimizing chair time for the dental professional and drastically reducing the number of fitting adjustments required post-fabrication. This technological integration not only increases clinical efficiency but also enhances patient comfort, addressing a core restraint in OAT adoption.

Complementary to CAD/CAM is the surge in 3D Printing (Additive Manufacturing) technology used for the rapid fabrication of oral appliances. Advanced 3D printing allows for the use of medical-grade, biocompatible resins to manufacture custom shells and components directly from the digital design file, bypassing traditional milling or vacuum-forming processes that were less precise and often resulted in bulkier devices. This enables mass customization, allowing manufacturers to quickly produce lighter, stronger, and highly individualized appliances at a competitive cost. Furthermore, 3D printing facilitates the creation of complex geometries necessary for advanced appliance features, such as integrated airway space monitoring mechanisms or multi-part adjustment systems, which were previously difficult or impossible to manufacture economically, driving a new wave of innovative product design.

Another transformative technology involves the integration of Smart Sensor Technology and Telehealth platforms. Smart oral appliances now feature embedded micro-sensors that objectively measure device usage duration, jaw position, and sometimes even airway patency, providing critical compliance data that can be remotely analyzed by clinicians. This objective data is vital for demonstrating medical necessity to insurance providers and ensuring the device is being used effectively. Tele-dentistry platforms are increasingly used for remote consultations, follow-ups, and monitoring of OAT titration adjustments, especially valuable for patients in rural or underserved areas, thereby expanding market accessibility and simplifying the management of long-term therapy, solidifying the market's focus on evidence-based, data-driven treatment protocols.

Regional Highlights

- North America: Market Leader Due to High Healthcare Spending and Awareness

North America, particularly the United States, commands the largest market share in the Dental Sleep Medicine sector. This dominance is attributable to several factors: the extremely high prevalence of diagnosed and undiagnosed OSA stemming from prevalent obesity rates, well-established clinical guidelines recognizing Oral Appliance Therapy (OAT) as an effective treatment modality, and sophisticated healthcare infrastructure that includes numerous specialized sleep centers. Furthermore, the presence of major key players, coupled with favorable, albeit complex, reimbursement landscapes through Medicare and private insurance for medically necessary devices, accelerates the adoption rate. The region also boasts high penetration of advanced dental technologies like intraoral scanning and 3D printing, supporting customized device fabrication. High consumer awareness and proactive patient seeking behavior further cement its leading position, making it a critical region for technological launch and clinical trial dissemination.

- Europe: Steady Growth Fueled by Regulatory Support and Integrated Healthcare

Europe represents a mature market experiencing steady, consistent growth. Key drivers include supportive regulatory environments, particularly within the EU, which facilitate the clearance and distribution of certified medical devices. Countries such as Germany, France, and the UK have strong public health systems increasingly integrating dental sleep medicine into comprehensive care pathways. The region is seeing rapid professional specialization, with dental academies focusing heavily on sleep disorder management training. The emphasis on non-invasive, preventive healthcare aligns well with OAT solutions, promoting its use over potentially more intrusive surgical or mechanical alternatives. However, market adoption varies significantly across individual member states, often contingent on local reimbursement policies and the maturity of integrated medical-dental referral systems.

- Asia Pacific (APAC): Fastest Growing Region Driven by Infrastructure Investment

The Asia Pacific region is projected to register the highest Compound Annual Growth Rate (CAGR) during the forecast period. This rapid expansion is primarily fueled by massive infrastructure investment in healthcare across populous nations like China, India, and South Korea, leading to improved access to diagnostic services. The region is characterized by increasing urbanization and the westernization of lifestyles, contributing to rising obesity rates—a major risk factor for OSA. While awareness was traditionally lower, government initiatives and educational campaigns targeting chronic diseases are boosting diagnosis rates. Although reimbursement structures are still developing in many countries, the large addressable patient population and the growing middle class willing to pay for premium healthcare solutions present substantial opportunities for international manufacturers and local innovators specializing in cost-effective OAT solutions. This region will be crucial for the market's long-term volumetric growth.

Top Key Players

The market research report includes a detailed profile of leading stakeholders in the Dental Sleep Medicine Market.- ResMed

- Vivos Therapeutics, Inc.

- ProSomnus, Inc.

- SomnoMed

- Whole You, Inc. (Mitsui Chemicals)

- Panthera Dental

- Airway Management, Inc.

- DynaFlex

- Oventus Medical Ltd.

- Sleep Cycle

- Carestream Dental

- Sleep Better Appliances

- Strong Dental International

- Myerson LLC

- 3D Systems

- Stratasys, Inc.

- Align Technology, Inc.

- ClearChoice Dental Implant Centers

- Voco GmbH

- Sirona Dental Systems (Dentsply Sirona)

Frequently Asked Questions

Analyze common user questions about the Dental Sleep Medicine market and generate a concise list of summarized FAQs reflecting key topics and concerns.What is Dental Sleep Medicine and how does it treat Obstructive Sleep Apnea (OSA)?

Dental Sleep Medicine is a branch of dentistry focused on managing sleep-related breathing disorders, primarily OSA and snoring, using custom-made Oral Appliances (OAs). These devices, most commonly Mandibular Advancement Devices (MADs), work by holding the lower jaw and tongue forward during sleep, preventing the collapse of the upper airway and ensuring continuous airflow.

How effective is Oral Appliance Therapy (OAT) compared to CPAP for sleep apnea?

OAT is highly effective and recommended as a first-line treatment for patients with mild to moderate OSA, or for patients with severe OSA who cannot tolerate CPAP. While CPAP generally has higher efficacy in severe cases, OAT often boasts significantly higher patient adherence rates due to its comfort and portability, making the overall real-world effectiveness comparable in many instances.

Are oral appliances covered by medical insurance or dental insurance?

Custom-fabricated oral appliances for OSA treatment are generally considered a medical treatment, not a dental treatment, and are typically covered by major medical insurance plans (including Medicare in the U.S.) if they are prescribed by a sleep physician following a formal sleep study diagnosis. Coverage is contingent upon medical necessity criteria and plan specifics.

What are the key benefits of using 3D printing technology in fabricating dental sleep devices?

3D printing drastically improves the manufacturing process by allowing for precise, customized fabrication directly from digital scans. Key benefits include faster turnaround times, superior fit and patient comfort due to higher geometric accuracy, reduced material waste, and the ability to produce lightweight yet durable appliances tailored exactly to the patient’s unique anatomical contours.

What qualifications should a dental professional have to provide Oral Appliance Therapy?

Dentists providing OAT should possess specific advanced training beyond general dental school, often including specialized certifications or diplomate status from recognized bodies like the American Academy of Dental Sleep Medicine (AADSM). They must understand the diagnosis, management, titration, and potential side effects of sleep appliances, requiring collaboration with a prescribing sleep physician.

To check our Table of Contents, please mail us at: sales@marketresearchupdate.com

Research Methodology

The Market Research Update offers technology-driven solutions and its full integration in the research process to be skilled at every step. We use diverse assets to produce the best results for our clients. The success of a research project is completely reliant on the research process adopted by the company. Market Research Update assists its clients to recognize opportunities by examining the global market and offering economic insights. We are proud of our extensive coverage that encompasses the understanding of numerous major industry domains.

Market Research Update provide consistency in our research report, also we provide on the part of the analysis of forecast across a gamut of coverage geographies and coverage. The research teams carry out primary and secondary research to implement and design the data collection procedure. The research team then analyzes data about the latest trends and major issues in reference to each industry and country. This helps to determine the anticipated market-related procedures in the future. The company offers technology-driven solutions and its full incorporation in the research method to be skilled at each step.

The Company's Research Process Has the Following Advantages:

- Information Procurement

The step comprises the procurement of market-related information or data via different methodologies & sources.

- Information Investigation

This step comprises the mapping and investigation of all the information procured from the earlier step. It also includes the analysis of data differences observed across numerous data sources.

- Highly Authentic Source

We offer highly authentic information from numerous sources. To fulfills the client’s requirement.

- Market Formulation

This step entails the placement of data points at suitable market spaces in an effort to assume possible conclusions. Analyst viewpoint and subject matter specialist based examining the form of market sizing also plays an essential role in this step.

- Validation & Publishing of Information

Validation is a significant step in the procedure. Validation via an intricately designed procedure assists us to conclude data-points to be used for final calculations.

×

Request Free Sample:

Related Reports

Select License

Why Choose Us

We're cost-effective and Offered Best services:

We are flexible and responsive startup research firm. We adapt as your research requires change, with cost-effectiveness and highly researched report that larger companies can't match.

Information Safety

Market Research Update ensure that we deliver best reports. We care about the confidential and personal information quality, safety, of reports. We use Authorize secure payment process.

We Are Committed to Quality and Deadlines

We offer quality of reports within deadlines. We've worked hard to find the best ways to offer our customers results-oriented and process driven consulting services.

Our Remarkable Track Record

We concentrate on developing lasting and strong client relationship. At present, we hold numerous preferred relationships with industry leading firms that have relied on us constantly for their research requirements.

Best Service Assured

Buy reports from our executives that best suits your need and helps you stay ahead of the competition.

Customized Research Reports

Our research services are custom-made especially to you and your firm in order to discover practical growth recommendations and strategies. We don't stick to a one size fits all strategy. We appreciate that your business has particular research necessities.

Service Assurance

At Market Research Update, we are dedicated to offer the best probable recommendations and service to all our clients. You will be able to speak to experienced analyst who will be aware of your research requirements precisely.

Contact With Our Sales Team

Customer Testimonials

The content of the report is always up to the mark. Good to see speakers from expertise authorities.

Privacy requested , Managing Director

A lot of unique and interesting topics which are described in good manner.

Privacy requested, President

Well researched, expertise analysts, well organized, concrete and current topics delivered in time.

Privacy requested, Development Manager