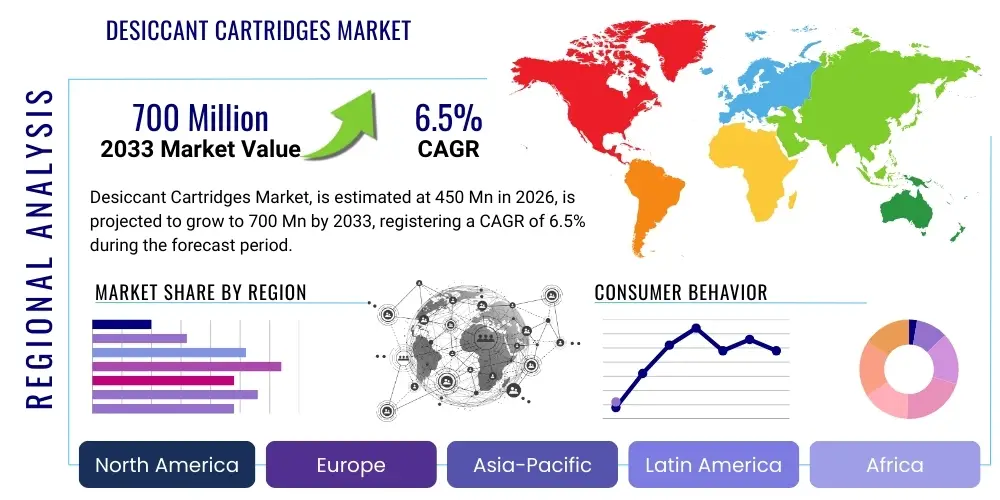

Desiccant Cartridges Market Size, By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2026 to 2033 (Financial Impact Analysis)

ID : MRU_ 442885 | Date : Feb, 2026 | Pages : 251 | Region : Global | Publisher : MRU

Desiccant Cartridges Market Size

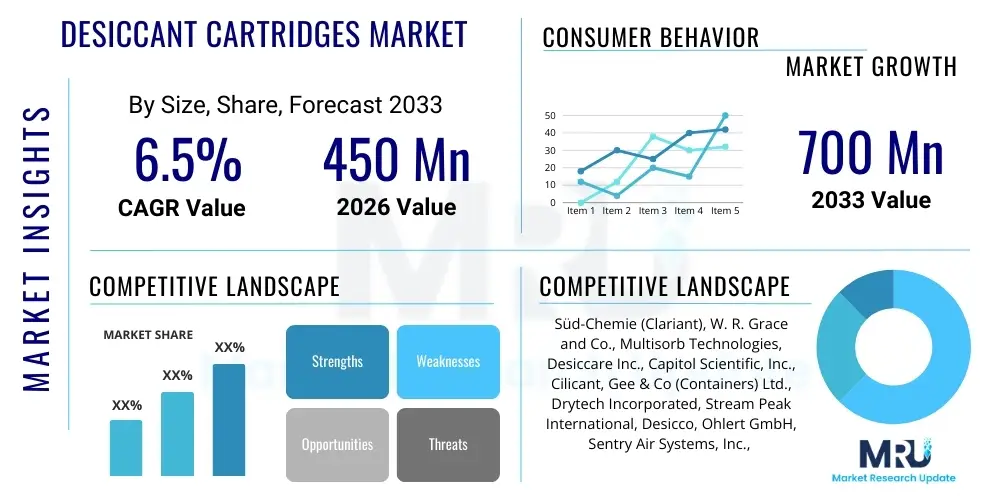

The Desiccant Cartridges Market is projected to grow at a Compound Annual Growth Rate (CAGR) of 6.5% between 2026 and 2033. The market is estimated at USD 450 Million in 2026 and is projected to reach USD 700 Million by the end of the forecast period in 2033.

Desiccant Cartridges Market introduction

The Desiccant Cartridges Market encompasses the manufacturing, distribution, and sale of specialized containers filled with adsorbent materials designed to control moisture and humidity within enclosed spaces. These cartridges are crucial for preserving the integrity and shelf life of moisture-sensitive products, particularly in industries requiring stringent environmental controls. The core product description involves sealed, robust housings—often plastic or metal—containing desiccant agents such as silica gel, molecular sieves, or activated clay, engineered to specific absorption capacities and kinetics. These materials work by physically or chemically binding water vapor from the surrounding atmosphere, thereby preventing degradation, corrosion, mold growth, and maintaining optimal performance parameters for complex machinery or chemical compounds.

Major applications of desiccant cartridges span a diverse range of high-value sectors, including pharmaceuticals, where they prevent hydrolysis of sensitive drug formulations; electronics, where they safeguard microprocessors and optical devices from condensation damage; and specialized industrial equipment, such as compressed air systems and gas purification units. The primary benefits derived from the utilization of desiccant cartridges include enhanced product stability, significant reduction in manufacturing defect rates related to moisture ingress, compliance with strict regulatory standards (especially in healthcare and aerospace), and extension of equipment operational lifespan. Their passive nature and high efficacy make them a preferred solution over active dehumidification systems in many localized applications.

Driving factors propelling the expansion of this market include the relentless growth of the global pharmaceutical industry, which increasingly requires sophisticated moisture protection for novel drug delivery systems and biologics. Furthermore, the miniaturization and complexity of modern electronics demand superior protection against atmospheric humidity during transit and storage. Increased regulatory emphasis on quality control and prevention of product spoilage across the food and beverage sectors, coupled with expanding applications in advanced automotive battery systems and specialized optics, collectively underscore the sustained demand for high-performance desiccant solutions globally. This sustained demand fuels innovation in material science aimed at improving absorption capacity and regeneration cycles.

Desiccant Cartridges Market Executive Summary

The Desiccant Cartridges Market is experiencing robust growth fueled by accelerated digitalization across various end-use industries and heightened consumer awareness regarding product quality and longevity. Business trends highlight a significant shift towards customized and application-specific desiccant formulations, moving away from generic solutions. Leading manufacturers are investing heavily in research and development to introduce advanced materials like highly porous molecular sieves and specialized clay blends that offer superior absorption at lower relative humidity levels and extended lifecycles. Furthermore, consolidation among mid-sized players and strategic collaborations aimed at securing supply chains for raw desiccant materials are defining the competitive landscape. Sustainability is emerging as a critical trend, driving demand for environmentally benign and easily disposable desiccant cartridges, particularly those utilizing renewable or regenerated materials, forcing suppliers to rethink traditional manufacturing processes and packaging designs.

Regional trends indicate that Asia Pacific (APAC) currently dominates the market, primarily due to the massive expansion of electronics manufacturing hubs in countries like China, South Korea, and Taiwan, coupled with rapidly growing pharmaceutical production capabilities in India and Southeast Asia. North America and Europe, while mature, exhibit strong demand driven by stringent regulatory frameworks in the medical device and aerospace sectors, pushing demand for ultra-high purity and certified desiccant products. Latin America and the Middle East & Africa (MEA) are poised for rapid growth, underpinned by increasing investment in healthcare infrastructure and localized food processing industries, which necessitates reliable moisture control solutions for regional supply chains. The differential regulatory landscape in these regions influences the type and quality of desiccant utilized, with highly regulated markets preferring pharmaceutical-grade silica gel.

Segmentation trends reveal that the pharmaceutical segment maintains the highest revenue share, prioritizing compliance and product efficacy above cost, leading to high uptake of pharmaceutical-grade molecular sieve cartridges. In terms of material type, silica gel remains the dominant segment due to its versatility and cost-effectiveness, although molecular sieves are gaining traction rapidly owing to their superior performance at low moisture concentrations and high temperature stability, making them ideal for specialized industrial processes and advanced battery systems. The industrial machinery and compressed air purification segment is seeing strong demand for larger, regenerative cartridges, emphasizing durability and long-term operational cost efficiency over initial purchasing price. This focus on life cycle costs underscores the maturity of the industrial segment, driving innovation in housing materials and regeneration mechanisms.

AI Impact Analysis on Desiccant Cartridges Market

Analysis of common user questions related to the intersection of Artificial Intelligence (AI) and the Desiccant Cartridges Market reveals several key themes centered around operational efficiency, predictive maintenance, and quality control. Users frequently inquire about how AI can optimize the replacement schedule for desiccant cartridges in large-scale industrial drying systems, moving beyond time-based or fixed-capacity schedules to real-time predictive models. A significant concern revolves around the potential for AI-driven sensors and diagnostics to reduce material waste by accurately determining the saturation point of the desiccant material, thereby preventing premature replacements. Expectations are high regarding AI's ability to analyze complex environmental data—temperature fluctuations, humidity readings, operational load—to automatically select the optimal desiccant type and capacity for new applications, significantly streamlining the specification process which is currently highly manual. Furthermore, users are keenly interested in how machine learning algorithms can improve the quality control processes in desiccant manufacturing, identifying micro-defects or inconsistencies in adsorption properties before the cartridges reach the end-user.

- AI-enhanced Predictive Maintenance: Utilizing machine learning algorithms to analyze sensor data (humidity, flow rate, pressure drop) to accurately predict the remaining useful life of a desiccant cartridge, optimizing replacement cycles and minimizing downtime in industrial operations.

- Optimized Manufacturing Processes: Implementing AI and computer vision systems to monitor the uniformity of desiccant material packing density and granule size distribution, significantly improving batch consistency and overall absorption performance.

- Automated Product Specification: Leveraging deep learning models to process application requirements (volume, temperature range, target relative humidity) and recommend the most effective desiccant type (silica gel, molecular sieve, activated alumina) and cartridge size, accelerating the design phase.

- Supply Chain and Inventory Management: Using AI to forecast demand based on regional industrial output and seasonality, ensuring optimal stocking levels for various cartridge specifications and reducing lead times for specialized orders.

- Smart Environmental Monitoring: Integration of desiccant cartridges with IoT sensors connected to AI platforms to provide real-time performance feedback, enabling remote adjustment of peripheral climate control systems to maximize desiccant efficacy.

DRO & Impact Forces Of Desiccant Cartridges Market

The dynamics of the Desiccant Cartridges Market are profoundly shaped by a confluence of driving factors, operational restraints, and emerging opportunities, collectively defining the impact forces influencing industry growth trajectories. Primary drivers include the global expansion of the pharmaceutical and biotechnology sectors, where the absolute requirement for moisture-free packaging and storage environments translates directly into high-volume demand for certified desiccant solutions. Simultaneously, the proliferation of sensitive electronics, particularly in high-growth areas like 5G infrastructure, electric vehicles (EVs), and specialized medical devices, necessitates robust moisture protection during manufacturing, transit, and long-term operation. These market drivers are characterized by non-negotiable quality demands, thus prioritizing high-performance desiccant types.

Conversely, significant restraints hinder optimal market acceleration. High initial and replacement costs associated with large, high-capacity industrial desiccant cartridges, especially those used in regenerative drying systems, represent a substantial capital expenditure barrier for smaller enterprises. Furthermore, environmental concerns related to the disposal of saturated or non-regenerable desiccant materials, which often require specialized waste management due to potential contamination or chemical content, impose logistical and financial constraints. Regulatory hurdles in certain jurisdictions regarding the use of specific chemical binders or additives in desiccant formulations also complicate global market entry and standardization efforts, requiring manufacturers to tailor products for specific regional compliance requirements.

Opportunities for exponential market growth lie in the rapid development and commercialization of advanced, high-efficiency desiccant materials, such as specialized porous polymers and metal-organic frameworks (MOFs), which promise significantly higher moisture absorption capacity per unit volume and weight. The increasing trend towards sustainability presents a vital opportunity for developing biodegradable cartridge materials and more energy-efficient, closed-loop regeneration technologies, appealing to environmentally conscious industries. Additionally, the integration of smart, IoT-enabled cartridges that provide real-time saturation data opens up new service models and significantly enhances overall system maintenance efficiency. The impact forces are currently skewed positively, with powerful drivers from regulated industries outweighing the restraints associated primarily with cost and environmental disposal complexities, leading to a net positive growth outlook.

Segmentation Analysis

The Desiccant Cartridges Market is extensively segmented based on material type, end-use industry, product shape, and capacity, reflecting the diverse application requirements across global industrial landscapes. Segmentation by material is critical, as the choice of desiccant directly impacts absorption kinetics, capacity, and suitability for specific temperature and humidity ranges. End-use segmentation highlights the varying regulatory and performance demands, with pharmaceuticals requiring the highest levels of purity, while industrial machinery focuses on large-scale, durable solutions. Geographic segmentation, detailed in later sections, underscores regional manufacturing dominance and regulatory variances.

The diverse nature of applications demands specific cartridge form factors, driving segmentation by shape, including cylindrical cartridges common in compressed air dryers and flat pouches often used in electronics packaging. Capacity segmentation ensures that customers can select products appropriate for the volume of the space requiring dehumidification, balancing cost with effectiveness. Understanding these segmentation nuances is crucial for manufacturers developing targeted product lines and for stakeholders forecasting localized demand patterns and competitive pressures across differing market verticals. The customization potential inherent in these segments ensures market resilience against generalized economic downturns, as specialized demand remains consistently high.

- By Material Type:

- Silica Gel

- Molecular Sieves

- Activated Alumina

- Clay (Bentonite & Montmorillonite)

- Others (e.g., Calcium Chloride, Specialized Polymers)

- By End-Use Industry:

- Pharmaceuticals & Healthcare (Drug packaging, Medical devices)

- Electronics & Semiconductors (Optics, Circuit boards, Communication devices)

- Food & Beverage (Packaging, Bulk storage)

- Automotive & Transportation (Electric vehicle batteries, Headlights)

- Industrial Machinery & Compressed Air Systems

- Aerospace & Defense

- By Shape/Form Factor:

- Cylindrical Cartridges

- Flat Cartridges/Sachets

- Custom-Molded Shapes

- By Application Type:

- Non-Regenerative (Disposable)

- Regenerative Systems

Value Chain Analysis For Desiccant Cartridges Market

The value chain for the Desiccant Cartridges Market commences with upstream analysis, focusing on the sourcing and processing of core raw materials. This segment involves mineral extraction (for clay and activated alumina), chemical synthesis (for silica gel and molecular sieves), and specialized processing to achieve required pore size distribution and surface area, which determines adsorption efficiency. Key suppliers in this stage hold considerable leverage, as the purity and quality of the desiccant material are foundational to the performance of the final product. Fluctuations in energy costs and mineral pricing directly impact the input costs for manufacturers, highlighting the importance of long-term supply agreements and material hedging strategies to ensure stable production costs and consistent quality outputs.

The midstream stage involves the design, manufacturing, and assembly of the desiccant cartridges. This process includes molding the cartridge housing (often plastic or metal), precise filling of the desiccant material, sealing, and quality control checks to ensure integrity and specified absorption capacity. Differentiation at this stage is achieved through proprietary cartridge designs that optimize air flow and mechanical durability, as well as adherence to pharmaceutical-grade manufacturing standards (e.g., ISO certifications, cGMP). Manufacturers often specialize either in high-volume, standardized products or low-volume, highly customized solutions tailored for sophisticated industrial machinery or military specifications, creating distinct competitive sub-segments within the manufacturing ecosystem.

Downstream analysis covers distribution channels and end-user engagement. Distribution is multifaceted, involving both direct sales to major OEMs (Original Equipment Manufacturers) in the automotive and aerospace sectors, and indirect sales through specialized industrial distributors, pharmaceutical packaging suppliers, and e-commerce platforms for smaller volume and specialized applications. The choice between direct and indirect channels is often dictated by the complexity of the product and the required technical support; regenerative systems typically mandate direct sales, while disposable cartridges are efficiently handled through distributors. Effective supply chain logistics, focusing on preventing moisture exposure during storage and transit of the cartridges, is paramount to maintaining product efficacy prior to use by the final customers.

Desiccant Cartridges Market Potential Customers

Potential customers for Desiccant Cartridges are highly diverse but are primarily concentrated in sectors where moisture control is not merely beneficial but essential for product functionality, safety, or regulatory compliance. The largest and most demanding customer segment is the pharmaceutical industry, including generic and branded drug manufacturers, biotechnology firms producing sensitive biologics, and contract packaging organizations (CPOs) that require high-purity, validated desiccant systems for vial and blister packaging. These customers prioritize compliance with FDA and EMA regulations, stability testing validation, and traceable material sourcing, making them less sensitive to minor price fluctuations but highly sensitive to quality and certification.

Another rapidly expanding customer base resides within the electronics and semiconductor industries, encompassing manufacturers of advanced optical devices, laser systems, microelectronic components, and specialized communication equipment. For these buyers, moisture ingress during assembly and long-term storage leads directly to catastrophic failure, making desiccant cartridges an indispensable preventative measure. The increasing complexity of electric vehicle battery packs, which require stringent humidity control during manufacturing to ensure longevity and safety, represents a significant new category of high-volume industrial customer, demanding specialized, temperature-stable desiccant solutions tailored for lithium-ion manufacturing environments.

Furthermore, major customers include large industrial operators of compressed air systems, gas purification facilities, and specialized chemical processing plants that utilize regenerative desiccant dryers to maintain low dew points. These buyers are focused on the long-term total cost of ownership (TCO), seeking cartridges with extended operational lifespans, minimal pressure drop, and easy, low-energy regeneration cycles. Food processors and packaging companies also form a substantial customer segment, relying on desiccant technology to prevent microbial growth, maintain crispness, and extend the shelf life of perishable and dry goods, particularly in tropical or high-humidity climatic zones.

| Report Attributes | Report Details |

|---|---|

| Market Size in 2026 | USD 450 Million |

| Market Forecast in 2033 | USD 700 Million |

| Growth Rate | 6.5% CAGR |

| Historical Year | 2019 to 2024 |

| Base Year | 2025 |

| Forecast Year | 2026 - 2033 |

| DRO & Impact Forces |

|

| Segments Covered |

|

| Key Companies Covered | Süd-Chemie (Clariant), W. R. Grace and Co., Multisorb Technologies, Desiccare Inc., Capitol Scientific, Inc., Cilicant, Gee & Co (Containers) Ltd., Drytech Incorporated, Stream Peak International, Desicco, Ohlert GmbH, Sentry Air Systems, Inc., Fischel, Qingdao Adsorp Technology Co., Ltd., Shenzhen Absorbking Desiccant Co., Ltd., Intertekt, Container Dry. |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Enquiry Before Buy | Have specific requirements? Send us your enquiry before purchase to get customized research options. Request For Enquiry Before Buy |

Desiccant Cartridges Market Key Technology Landscape

The technological landscape of the Desiccant Cartridges Market is primarily driven by advancements in material science aimed at maximizing adsorption capacity and minimizing regeneration energy requirements. The foundational technology relies on highly porous materials, with silica gel remaining the stalwart due to its accessibility and favorable adsorption characteristics at moderate humidity. However, modern innovation centers around enhancing the efficacy of molecular sieves (synthetic zeolites), which offer significantly higher absorption performance at very low relative humidity levels—a critical requirement for sensitive electronics and medical applications. Technological breakthroughs in synthetic zeolites focus on engineering specific pore diameters (angstrom sizes) to selectively adsorb water vapor while excluding other atmospheric gases, thereby ensuring purity and efficiency.

A burgeoning technological area involves the exploration and commercialization of next-generation sorbents, notably Metal-Organic Frameworks (MOFs) and specialized porous polymers. MOFs represent a revolutionary leap, offering extraordinary surface areas and highly tunable chemical structures, potentially allowing for adsorption capacities far exceeding traditional materials. While currently cost-prohibitive for mass market applications, the ongoing scaling up of MOF synthesis is expected to make them viable for ultra-high-performance and niche desiccant systems, particularly those demanding minimal footprint and weight, such as in aerospace or portable medical devices. These advanced materials necessitate highly specialized manufacturing environments to prevent degradation and ensure structural integrity during cartridge assembly.

Beyond the core material, cartridge technology is increasingly integrating digital and sensing capabilities. The deployment of smart desiccant systems involves incorporating specialized humidity indicators or miniature IoT sensors directly into the cartridge housing. These sensors communicate real-time data on desiccant saturation levels and internal environment conditions wirelessly to centralized monitoring systems. This shift transforms the product from a passive component into an active, data-generating node, facilitating predictive maintenance, ensuring optimal replacement timing, and dramatically improving the operational efficiency of large-scale industrial drying systems. This integration of hardware and software represents a critical competitive advantage for vendors targeting sophisticated, Industry 4.0-compliant facilities.

Regional Highlights

Regional dynamics within the Desiccant Cartridges Market are dictated by manufacturing concentration, regulatory environments, and the scale of key end-use industries like pharmaceuticals and electronics.

- Asia Pacific (APAC): APAC is the largest and fastest-growing market globally, driven by the concentration of global electronics manufacturing and the rapid expansion of generic and branded drug production, especially in China and India. The region benefits from lower manufacturing costs, but simultaneously faces the challenge of managing immense moisture levels in densely populated coastal and tropical manufacturing zones, leading to high consumption of both bulk and packaged desiccants.

- North America: Characterized by high-value, stringent regulatory environments, particularly within the medical device, aerospace, and advanced biotechnology sectors. North American demand emphasizes quality, validation, and specialized, pharmaceutical-grade molecular sieves and clay desiccants, often commanding premium prices. The emergence of the Electric Vehicle (EV) battery Gigafactory ecosystem is a significant localized driver.

- Europe: The European market is mature and highly sophisticated, focusing heavily on sustainability and compliance with environmental regulations suchating strong demand for environmentally friendly, biodegradable cartridge components and highly efficient regenerative systems. Germany, France, and the UK are key consumers due to established automotive, chemical, and pharmaceutical industries, favoring high-quality, long-life products.

- Latin America (LATAM): This region is characterized by steady growth driven by expanding local pharmaceutical packaging operations and increasing foreign investment in regional food and beverage processing facilities. Market penetration is often linked to the ability of suppliers to navigate diverse trade regulations and deliver reliable products across varied climatic zones.

- Middle East and Africa (MEA): Growth is accelerating, supported by government investments in healthcare infrastructure and localized manufacturing capabilities. The MEA region presents unique challenges due to extreme temperatures and humidity fluctuations, demanding robust and heat-stable desiccant solutions, particularly for protecting sensitive oil and gas industry equipment and power generation components.

Top Key Players

The market research report includes a detailed profile of leading stakeholders in the Desiccant Cartridges Market.- Süd-Chemie (Clariant)

- W. R. Grace and Co.

- Multisorb Technologies

- Desiccare Inc.

- Capitol Scientific, Inc.

- Cilicant

- Gee & Co (Containers) Ltd.

- Drytech Incorporated

- Stream Peak International

- Desicco

- Ohlert GmbH

- Sentry Air Systems, Inc.

- Fischel

- Qingdao Adsorp Technology Co., Ltd.

- Shenzhen Absorbking Desiccant Co., Ltd.

- Intertekt

- Container Dry

- Temptronic

- Humi-Pak Sdn Bhd

- Novipax

Frequently Asked Questions

Analyze common user questions about the Desiccant Cartridges market and generate a concise list of summarized FAQs reflecting key topics and concerns.What are the primary differences between silica gel and molecular sieve desiccant cartridges?

Silica gel is generally preferred for moderate humidity control and is highly versatile and cost-effective. Molecular sieves, conversely, offer superior moisture absorption capacity at very low relative humidity levels and high temperatures, making them essential for critical applications like specialized electronics and sensitive pharmaceutical ingredients.

How does the Desiccant Cartridges Market contribute to the Electric Vehicle (EV) supply chain?

Desiccant cartridges are critical in the EV supply chain, primarily for maintaining ultra-low humidity environments during the manufacturing process of lithium-ion battery cells and packs. Moisture control prevents detrimental side reactions, ensuring battery longevity, safety, and optimal performance.

What impact does regulatory compliance have on the pharmaceutical desiccant segment?

Regulatory compliance is paramount in the pharmaceutical segment, requiring desiccant cartridges to adhere strictly to cGMP (current Good Manufacturing Practices), USP (United States Pharmacopeia) standards, and DMF (Drug Master File) requirements. This necessitates high-purity, low-dust materials and certified, traceable manufacturing processes.

Are biodegradable and sustainable desiccant cartridges a growing trend?

Yes, sustainability is a key growth trend. Market demand is rising for desiccant solutions utilizing biodegradable or easily recyclable cartridge housings and non-toxic, regenerated sorbent materials, driven by increasing consumer and corporate environmental responsibility mandates, particularly in Europe and North America.

How can manufacturers optimize the replacement timing of large industrial desiccant cartridges?

Optimal replacement timing is achieved through the integration of smart cartridges equipped with IoT sensors that monitor real-time saturation levels, dew points, and pressure drop. This data, often analyzed by AI systems, allows for predictive maintenance, moving beyond fixed schedules to usage-based replacement, maximizing efficiency and minimizing operational waste.

To check our Table of Contents, please mail us at: sales@marketresearchupdate.com

Research Methodology

The Market Research Update offers technology-driven solutions and its full integration in the research process to be skilled at every step. We use diverse assets to produce the best results for our clients. The success of a research project is completely reliant on the research process adopted by the company. Market Research Update assists its clients to recognize opportunities by examining the global market and offering economic insights. We are proud of our extensive coverage that encompasses the understanding of numerous major industry domains.

Market Research Update provide consistency in our research report, also we provide on the part of the analysis of forecast across a gamut of coverage geographies and coverage. The research teams carry out primary and secondary research to implement and design the data collection procedure. The research team then analyzes data about the latest trends and major issues in reference to each industry and country. This helps to determine the anticipated market-related procedures in the future. The company offers technology-driven solutions and its full incorporation in the research method to be skilled at each step.

The Company's Research Process Has the Following Advantages:

- Information Procurement

The step comprises the procurement of market-related information or data via different methodologies & sources.

- Information Investigation

This step comprises the mapping and investigation of all the information procured from the earlier step. It also includes the analysis of data differences observed across numerous data sources.

- Highly Authentic Source

We offer highly authentic information from numerous sources. To fulfills the client’s requirement.

- Market Formulation

This step entails the placement of data points at suitable market spaces in an effort to assume possible conclusions. Analyst viewpoint and subject matter specialist based examining the form of market sizing also plays an essential role in this step.

- Validation & Publishing of Information

Validation is a significant step in the procedure. Validation via an intricately designed procedure assists us to conclude data-points to be used for final calculations.

×

Request Free Sample:

Related Reports

Select License

Why Choose Us

We're cost-effective and Offered Best services:

We are flexible and responsive startup research firm. We adapt as your research requires change, with cost-effectiveness and highly researched report that larger companies can't match.

Information Safety

Market Research Update ensure that we deliver best reports. We care about the confidential and personal information quality, safety, of reports. We use Authorize secure payment process.

We Are Committed to Quality and Deadlines

We offer quality of reports within deadlines. We've worked hard to find the best ways to offer our customers results-oriented and process driven consulting services.

Our Remarkable Track Record

We concentrate on developing lasting and strong client relationship. At present, we hold numerous preferred relationships with industry leading firms that have relied on us constantly for their research requirements.

Best Service Assured

Buy reports from our executives that best suits your need and helps you stay ahead of the competition.

Customized Research Reports

Our research services are custom-made especially to you and your firm in order to discover practical growth recommendations and strategies. We don't stick to a one size fits all strategy. We appreciate that your business has particular research necessities.

Service Assurance

At Market Research Update, we are dedicated to offer the best probable recommendations and service to all our clients. You will be able to speak to experienced analyst who will be aware of your research requirements precisely.

Contact With Our Sales Team

Customer Testimonials

The content of the report is always up to the mark. Good to see speakers from expertise authorities.

Privacy requested , Managing Director

A lot of unique and interesting topics which are described in good manner.

Privacy requested, President

Well researched, expertise analysts, well organized, concrete and current topics delivered in time.

Privacy requested, Development Manager