Desulfurization and Denitrification Market Size, By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2026 to 2033 (Financial Impact Analysis)

ID : MRU_ 441531 | Date : Feb, 2026 | Pages : 249 | Region : Global | Publisher : MRU

Desulfurization and Denitrification Market Size

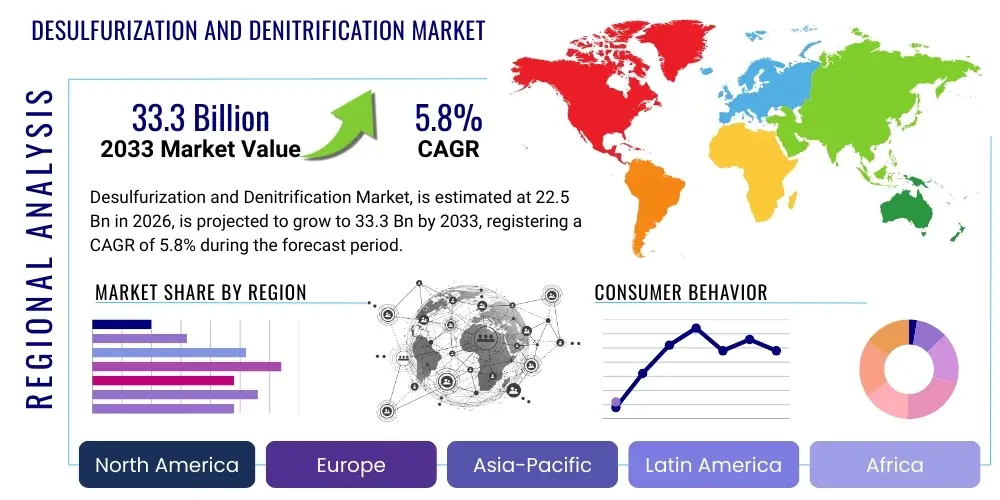

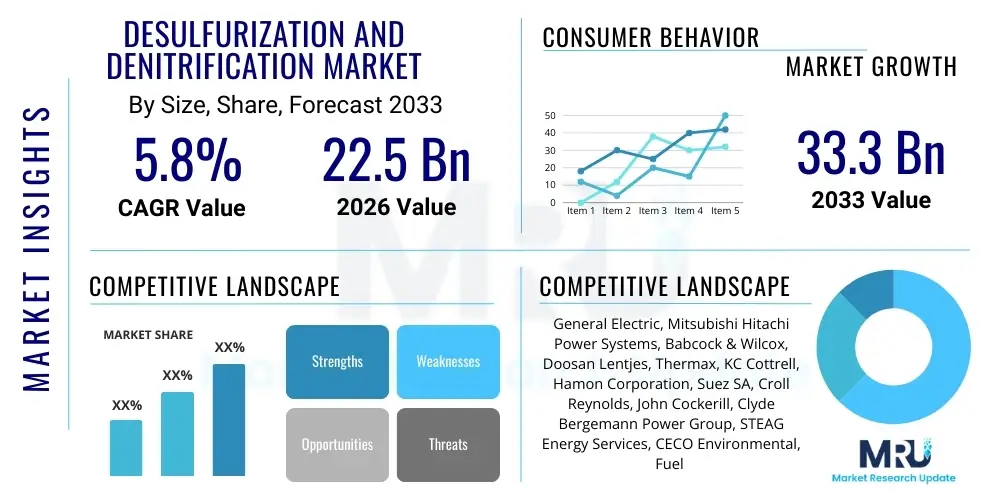

The Desulfurization and Denitrification Market is projected to grow at a Compound Annual Growth Rate (CAGR) of 5.8% between 2026 and 2033. The market is estimated at $22.5 Billion in 2026 and is projected to reach $33.3 Billion by the end of the forecast period in 2033.

Desulfurization and Denitrification Market introduction

The Desulfurization (Flue Gas Desulfurization or FGD) and Denitrification (Selective Catalytic Reduction or SCR/SNCR) market encompasses technologies designed to remove sulfur dioxide (SO2) and nitrogen oxides (NOx) from the exhaust flue gases generated by industrial combustion sources, primarily power plants, cement factories, and refineries. These environmental control technologies are critical for meeting stringent global air quality standards aimed at mitigating acid rain, smog formation, and particulate matter pollution, which pose significant risks to public health and ecological systems. The necessity of adopting these highly specialized systems is directly driven by international protocols, such as the Gothenburg Protocol, and powerful national regulatory bodies like the U.S. Environmental Protection Agency (EPA) and China’s Ministry of Ecology and Environment, effectively transforming mandatory compliance requirements into persistent market demand for specialized abatement solutions and associated services.

Market solutions are diverse, categorized mainly by the removal chemical process and the physical state of the absorbent used. For SO2 capture, solutions range from wet scrubbing using cost-effective reagents like limestone or seawater, which yield saleable gypsum as a byproduct, to dry or semi-dry systems that offer less complex waste handling and are often preferred for mid-sized boilers or applications with lower water availability. NOx reduction predominantly utilizes catalytic methods (SCR) or non-catalytic injection methods (SNCR). The product spectrum includes not just the major capital equipment—scrubbers, reactors, complex piping, and heat exchangers—but also critical consumables, notably high-performance catalysts and large volumes of reagents (ammonia, urea, limestone slurry). Major applications span across the entire energy and heavy industry complex, including thermal power generation (coal and gas), waste incineration facilities, and large-scale industrial boilers, all of which are defined by high operational throughputs and significant volumes of gaseous pollutant generation.

The principal benefits derived from the deployment of these robust technologies extend beyond mere regulatory compliance, including enhanced environmental performance that protects public health, reduced material degradation within the plant due to acid gas corrosion, and improved corporate reputation aligned with Environmental, Social, and Governance (ESG) criteria. Driving factors for the sustained market expansion are multi-faceted: the ongoing tightening of emission standards globally (e.g., China’s Ultra-Low Emission standards pushing for near-zero discharge), the relentless increase in global energy consumption necessitating more efficient and cleaner utilization of fossil fuels, and continuous technological advancements focused on integrated multi-pollutant removal capabilities and substantial reductions in overall operational costs. Although the long-term energy transition toward renewables is underway, the current mandate for extending the operational viability and environmental footprint of existing fossil fuel assets ensures substantial, sustained investment in high-efficiency desulfurization and denitrification solutions.

Desulfurization and Denitrification Market Executive Summary

The global Desulfurization and Denitrification market is exhibiting a period of moderate but robust growth, characterized by significant investments driven by globally converging, rigorous environmental mandates and localized industrial expansion patterns. Current business trends indicate a fundamental shift among major technology providers toward holistic, digitally integrated solutions. This involves leveraging advanced analytics and sensor technology to optimize existing abatement systems, moving beyond simple compliance toward maximizing energy efficiency and minimizing consumable waste. Capital expenditures in major markets are increasingly directed towards brownfield retrofitting and lifetime extension projects for legacy assets, particularly in heavy industry and power sectors across the Asia Pacific region, where coal remains a dominant energy source. Strategic emphasis is placed on developing highly durable catalysts and offering specialized lifecycle service contracts, including catalyst regeneration and long-term maintenance agreements, to create stable, recurring revenue streams amidst the cyclical nature of new plant construction.

Regional trends distinctly define market activity. Asia Pacific (APAC) stands as the undisputed engine of growth, propelled by the unparalleled scale of industrial expansion and the aggressive adoption of ultra-low emission standards, particularly in China, necessitating immediate and comprehensive upgrades to their vast fleet of power plants. In contrast, Europe represents a technologically advanced, replacement-driven market, focusing on optimizing existing high-efficiency systems and adhering to circular economy principles, often utilizing desulfurization byproducts effectively. North America maintains stable, high-value demand, with a noticeable regulatory shift concentrating on NOx control from natural gas power generation and compliance solutions for non-utility industrial sources. These pronounced regional variations mandate that market participants develop localized supply chains, tailored technological solutions, and deep regulatory knowledge specific to each operating geography to ensure successful market penetration and compliance adherence.

Structural analysis of segment trends confirms that the Flue Gas Desulfurization (FGD) segment retains the largest market valuation, a reflection of the significant capital intensity required for constructing and installing massive wet scrubber systems, especially in coal-heavy economies. Within the complementary Denitrification segment, Selective Catalytic Reduction (SCR) technology commands the dominant market share due to its proven, high-performance capabilities in achieving the lowest NOx emission limits, essential for modern compliance. Application-wise, the thermal power generation sector remains the bedrock of demand; however, accelerated adoption rates are observed in the cement, refining, and metallurgical industries, where global regulations are increasingly targeting previously under-regulated non-utility sources. A critical emerging trend is the commercialization and deployment of hybrid technologies that efficiently achieve combined SOx and NOx removal, offering operators a simplified, integrated approach to complex multi-pollutant challenges and setting the stage for the next generation of emission control infrastructure.

AI Impact Analysis on Desulfurization and Denitrification Market

User inquiries concerning the integration of Artificial Intelligence (AI) frequently center on its potential to revolutionize operational expenditure (OPEX) and regulatory compliance consistency within complex abatement systems. Common questions explore how Machine Learning (ML) can predict and preempt catalyst poisoning or degradation in SCR units, whether dynamic AI models can surpass traditional PID controls in optimizing reagent dosing efficiency, and the expected Return on Investment (ROI) derived from implementing sophisticated predictive maintenance strategies across major capital assets like absorbers and reaction towers. The overarching themes reflect high user expectations for AI to deliver substantial efficiency gains, transition plant operations from reactive troubleshooting to highly predictive management, and simultaneously manage the trade-offs between maximizing efficiency and minimizing regulatory risk in real-time. Underlying concerns often relate to the data infrastructure requirements, the proprietary nature of vendor-specific AI models, and the shortage of trained personnel capable of managing and optimizing these intelligent systems.

AI's fundamental impact is concentrated on elevating the performance envelope of existing physical abatement infrastructure, shifting management paradigms from static, design-point operations to dynamic, real-time optimized control. By analyzing vast, multivariate streams of operational data—including instantaneous flue gas temperature, volume, contaminant concentrations, and upstream combustion conditions—ML algorithms can precisely predict the necessary reagent dose (e.g., limestone slurry or ammonia/urea injection) down to minute-by-minute requirements. This optimization dramatically reduces chemical overuse, which constitutes a significant component of OPEX, especially in high-volume applications like Wet FGD and SCR. Furthermore, AI-driven diagnostics are transforming asset reliability by identifying subtle anomalies indicative of impending mechanical failure or catalyst deactivation well in advance, thus enabling scheduled, just-in-time maintenance interventions rather than costly, emergency shutdowns, which are often non-compliant.

The most advanced application involves the creation of AI-enabled digital twins, virtual representations of the physical FGD and DeNOx plants. These twins allow plant managers to simulate the performance impact of varying fuel types, fluctuating power demand (load following), and reagent quality changes virtually, minimizing risk before changes are deployed in the field. This high-fidelity simulation and control ensure that the abatement system maintains peak efficiency and consistent compliance—even under challenging transient load conditions which typically stress traditional control systems. While AI does not displace the need for physical scrubbers or reactors, it profoundly enhances the operational intelligence, reducing utility costs (power consumption for pumps and fans) and extending the operational lifecycle of crucial components, effectively acting as a critical technological layer for achieving sustainable ultra-low emission targets.

- AI-driven Predictive Maintenance: Forecasting mechanical failures in pumps, fans, and mixers within FGD/SCR systems using vibration analysis and sensor data to prevent catastrophic unplanned outages.

- Reagent Optimization: Utilizing machine learning to precisely tailor absorbent or catalyst injection rates based on real-time flue gas composition, significantly reducing chemical consumption and minimizing associated waste disposal costs.

- Digital Twin Modeling and Simulation: Implementing virtual models of abatement systems to test control strategies, optimize start-up/shut-down procedures, and train operators in a risk-free environment, ensuring system stability.

- Enhanced Compliance Assurance: Continuous, AI-powered analysis of Continuous Emission Monitoring System (CEMS) data to predict potential excursions outside regulatory limits minutes or hours in advance, allowing for proactive system adjustments and minimizing violation risks.

- Energy Consumption Reduction: Optimizing power-consuming components like fan speeds, pump usage, and heating requirements within the abatement process based on real-time flue gas volumes and required removal efficiency targets.

DRO & Impact Forces Of Desulfurization and Denitrification Market

The operational dynamics of the Desulfurization and Denitrification market are intrinsically linked to mandatory regulatory frameworks and the capital structure of energy and heavy industrial sectors. The key drivers are primarily centered around environmental accountability, specifically the relentless, global tightening of permissible atmospheric emission levels for SOx and NOx. This legislative pressure is amplified by public awareness regarding air quality, particularly in densely populated industrial regions, creating an undeniable, non-negotiable requirement for high-efficiency abatement investments. Opportunities emerge from technological convergence, specifically the development of cost-effective, multi-pollutant control systems that can address SOx, NOx, and mercury simultaneously, offering clients integrated, space-saving compliance solutions. Furthermore, the massive retrofit market in high-growth economies presents substantial growth prospects for established technology vendors capable of customizing solutions for aging infrastructure.

Conversely, significant restraints hinder unfettered market expansion. Foremost among these are the exorbitant initial capital expenditure (CapEx) required for installing large-scale, state-of-the-art FGD and SCR systems, coupled with persistently high operational expenditures (OpEx) tied to reagent consumption (e.g., ammonia/urea for SCR, limestone for FGD) and energy use for running large circulation pumps and fans. This high cost profile makes investment decisions difficult for companies facing uncertain long-term operational forecasts. Furthermore, the structural, long-term challenge is the accelerating global transition towards renewable energy sources and natural gas, which naturally displace coal and heavy oil, reducing the future addressable market for high-volume SOx abatement technologies in utility sectors over the coming decades.

The overarching impact forces shaping market trajectories include continuous innovation in catalyst technology, aiming for improved durability and lower operating temperatures, which could substantially lower SCR system costs and broaden applicability. Economic volatility, particularly the fluctuation of global commodity prices (metals for catalysts, reagents, construction materials), directly influences project viability and profitability margins for EPC firms. Moreover, geopolitical shifts impacting energy policy—such as major countries committing to accelerated net-zero goals—can abruptly reduce the investment horizon for new fossil fuel plants, shifting market focus entirely toward maintenance, service, and optimization contracts for existing operational assets. The necessity of maintaining high grid stability globally, even during the transition, ensures that the market for highly reliable, compliant fossil fuel operation equipment remains critical in the short to medium term.

Segmentation Analysis

The Desulfurization and Denitrification market is analytically segmented across several dimensions—technology employed, specific pollutant targeted, the industrial application source, and geographical deployment—reflecting the complexity and specialization required to address diverse emission control challenges. Technology segmentation separates processes based on chemical mechanisms: Desulfurization includes Wet FGD (high efficiency, byproduct recovery), Dry and Semi-Dry methods (lower CapEx, less water intensive), and unique processes like Seawater FGD. Denitrification is categorized into the high-efficiency, catalyst-dependent SCR, the lower-cost, high-temperature SNCR, and primary combustion modification methods like Low NOx burners. The selection criteria within these segments are defined by required removal rates, permissible space constraints, and access to necessary utility resources like water and power.

Pollutant segmentation clearly delineates the market into Flue Gas Desulfurization (FGD), primarily targeting SO2, and Denitrification (DeNOx), targeting NOx. The FGD segment currently represents the historical bedrock of the market, driven by decades of regulatory focus on acid rain caused by sulfur emissions from coal. Conversely, the DeNOx segment is experiencing faster proportional growth, fueled by increasing concern over ground-level ozone and regional smog, leading to stricter control requirements on NOx from both utility and non-utility boilers and gas turbines. This dual focus necessitates technology providers to offer integrated or modular systems capable of addressing both contaminants efficiently and economically.

Application source segmentation is fundamental for market sizing and customer strategy. The Power Generation sector (particularly coal-fired plants) remains the largest consumer, requiring the most robust and largest-scale systems. However, rapid growth is now being observed in the Industrial segment, comprising cement production (where kiln emissions are complex), petroleum refining (emissions from FCC units), and metal processing. These industrial applications require solutions that are resilient to sudden process variability, high dust loads, and often necessitate multi-pollutant removal packages, driving demand for specialized, smaller-scale, and often modular abatement units tailored to specific industrial processes rather than standardized utility operations.

- By Technology Type (Desulfurization):

- Wet Flue Gas Desulfurization (Wet FGD)

- Dry and Semi-Dry Flue Gas Desulfurization (SDA, DSI)

- Circulating Fluidized Bed Scrubber (CFBS)

- Seawater FGD

- By Technology Type (Denitrification):

- Selective Catalytic Reduction (SCR)

- Selective Non-Catalytic Reduction (SNCR)

- Hybrid SCR-SNCR Systems

- Low NOx Burners and Over-Fire Air (OFA)

- By Application Source:

- Power Generation (Coal-fired, Gas-fired, Oil-fired Turbines)

- Cement Industry (Kilns and Coolers)

- Refineries and Petrochemicals (FCC Units, Process Heaters)

- Metallurgical Industry (Sinter Plants, Blast Furnaces)

- Chemical and Fertilizer Manufacturing

- Municipal and Industrial Waste Incineration

- By Component:

- Major Equipment (Absorbers, Reactors, Heat Exchangers, Fans, Pumps)

- Consumables (Catalysts, Reagents—Limestone, Urea, Ammonia, Caustic Soda)

- Ancillary Systems (Monitoring Equipment, Dust Collectors)

- Services (Installation, Commissioning, Operation & Maintenance, Catalyst Management)

Value Chain Analysis For Desulfurization and Denitrification Market

The upstream segment of the Desulfurization and Denitrification market value chain is focused intensely on the sourcing and processing of core raw materials essential for both mechanical components and chemical processes. This includes the mining and high-purity processing of limestone and gypsum, the manufacturing of chemical precursors like ammonia and urea for DeNOx reagents, and the meticulous preparation of specialized metals—such as Vanadium, Tungsten, and Titanium dioxide—which form the active matrix of SCR catalysts. Maintaining security of supply for these often globally sourced commodities is a strategic priority, as price volatility and quality consistency directly impact the profitability and performance guarantees provided by downstream system integrators. Specialized metallurgical firms and chemical processors constitute the primary actors in this initial, material-intensive phase.

The mid-stream segment encompasses the complex engineering and manufacturing of the core abatement technologies. This involves specialized fabrication of corrosion-resistant, large-scale industrial equipment, including flue gas ducts, scrubbing towers, reactor vessels, internal spray systems, and regenerative heat exchangers. Engineering Procurement and Construction (EPC) firms and Original Equipment Manufacturers (OEMs) dominate this phase, requiring sophisticated design capabilities to tailor generic technology platforms to the unique operating parameters (gas volume, temperature, dust load) of each client’s facility. Project execution demands precise coordination between mechanical, chemical, and electrical engineering disciplines, often involving globally dispersed supply chains for specialized parts, making project management expertise a critical value differentiator.

Downstream activities are dominated by the deployment, operation, and ongoing maintenance phases. Distribution channels are predominantly direct, characterized by high-value, long-term contracts negotiated directly between major technology vendors (e.g., General Electric, MHPS, Babcock & Wilcox) and asset owners (utility companies, national oil companies). The sales cycle is protracted and heavily dependent on demonstrating regulatory compliance success and proven operational longevity. The crucial revenue stream in the downstream segment is the provision of lifecycle services, including highly profitable maintenance agreements, supply of replacement catalysts (which have a finite lifespan of 3–5 years), and continuous supply of chemical reagents. This service-centric model ensures high client retention and provides resilient revenue streams insulated from cyclical CapEx spending on new facilities, making the service segment increasingly vital for market stability.

Desulfurization and Denitrification Market Potential Customers

The potential customer base for Desulfurization and Denitrification systems is expansive but heavily skewed toward industries defined by high-temperature combustion and fossil fuel utilization, where regulatory oversight is maximal. The largest demographic remains the power generation sector, specifically the global operators of coal-fired and heavy oil power plants. These customers are mandated to invest in multi-billion dollar abatement technologies—chiefly Wet FGD and high-efficiency SCR—to ensure continued operation under increasingly strict national environmental laws. Their purchasing decisions are capital-intensive, strategically critical, and dictated by governmental long-term energy planning, making them the anchor clients for major EPC and OEM firms globally.

A rapidly growing segment of potential customers includes heavy process industries such as cement manufacturers, integrated steel mills, and non-ferrous smelters. These industrial sources face evolving and often complex regulations addressing not just SOx and NOx but also volatile organic compounds (VOCs) and heavy metals. For instance, the cement industry, characterized by high-dust, high-variability flue gas streams, often opts for Dry or Semi-Dry FGD systems and SNCR or hybrid DeNOx solutions that offer flexibility and lower capital investment compared to utility-scale systems. Customer demand in this segment prioritizes robust, modular systems that minimize operational complexity and integrate seamlessly with existing process controls without disrupting production uptime.

Furthermore, refineries and petrochemical plants constitute significant customers, requiring solutions to control emissions from fluid catalytic cracking (FCC) units and process heaters. Municipal solid waste (MSW) incinerators also represent a growing niche, mandated to control not only SOx and NOx but also dioxins and heavy metals, often utilizing integrated flue gas treatment systems that combine desulfurization capabilities with other pollutant controls. For these customers, the emphasis is placed not only on compliance but also on public relations and demonstrating the highest possible level of environmental stewardship, driving adoption of best available technologies (BAT) even where minimum compliance standards might be lower. These diverse industrial segments ensure consistent demand for specialized and adaptable abatement solutions.

| Report Attributes | Report Details |

|---|---|

| Market Size in 2026 | $22.5 Billion |

| Market Forecast in 2033 | $33.3 Billion |

| Growth Rate | 5.8% CAGR |

| Historical Year | 2019 to 2024 |

| Base Year | 2025 |

| Forecast Year | 2026 - 2033 |

| DRO & Impact Forces |

|

| Segments Covered |

|

| Key Companies Covered | General Electric, Mitsubishi Hitachi Power Systems, Babcock & Wilcox, Doosan Lentjes, Thermax, KC Cottrell, Hamon Corporation, Suez SA, Croll Reynolds, John Cockerill, Clyde Bergemann Power Group, STEAG Energy Services, CECO Environmental, Fuel Tech Inc., China Energy Conservation and Environmental Protection Group (CECEP), Fives, FLSmidth, Longking, Hitachi Zosen Inova, Mitsubishi Heavy Industries |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Enquiry Before Buy | Have specific requirements? Send us your enquiry before purchase to get customized research options. Request For Enquiry Before Buy |

Desulfurization and Denitrification Market Key Technology Landscape

The technological landscape of the Desulfurization and Denitrification market is anchored by well-established, chemical-intensive processes that are continually being refined for higher efficiency, lower operating costs, and greater resilience to varied fuel input. In Flue Gas Desulfurization (FGD), the choice of technology hinges critically on the required removal efficiency and site constraints. Wet FGD, typically utilizing limestone slurry, remains the most prevalent technology globally for large utility boilers, offering removal rates exceeding 98% and generating marketable gypsum. However, the technological push is toward optimizing water usage and managing wastewater discharge, leading to advanced modifications like closed-loop wet scrubbing, which minimizes environmental impact and regulatory burden related to water effluents.

Denitrification technologies are dominated by Selective Catalytic Reduction (SCR), which represents the pinnacle of NOx removal capability (90-95%+). The evolution in SCR primarily focuses on catalyst innovation—developing low-temperature catalysts that operate effectively at lower flue gas temperatures (critical for gas turbine exhaust and some industrial processes), and formulating catalysts that are highly resistant to poisoning by sulfur, arsenic, and heavy metals prevalent in flue gas. Key research areas include honeycomb, plate, and corrugated catalyst geometries optimized for minimal pressure drop and maximum active surface area. Selective Non-Catalytic Reduction (SNCR), while less efficient, continues to be technologically refined through optimization of reagent injection strategies (using advanced lances and nozzles) and integration with AI controls, enhancing mixing and reaction completion, thus reducing ammonia slip and maintaining compliance at a lower total system cost.

The cutting edge of the technology landscape is characterized by integration and digitalization. Hybrid multi-pollutant control systems, such as combining Dry FGD with a fabric filter that captures oxidized mercury and particulates, or integrating SNCR with downstream polishing SCR stages (Reburn/SCR concepts), are gaining traction by offering a comprehensive solution package. Crucially, the deployment of industrial IoT (IIoT) sensors and Advanced Process Control (APC) leveraging AI/ML models is no longer ancillary but foundational. These digital overlays optimize the chemical balance and mechanical operation of the physical systems, extending catalyst life, minimizing energy consumption, and ensuring ultra-consistent compliance under dynamic load conditions, transforming legacy heavy engineering into smart, efficient environmental assets capable of achieving near-zero emission standards.

Regional Highlights

The Asia Pacific (APAC) region continues its role as the undisputed global driver and largest market for Desulfurization and Denitrification systems. This dominance is underpinned by a confluence of massive population growth, rapid industrial expansion, and an enduring reliance on coal for base-load power generation across economies like China, India, and Southeast Asian nations. Regulatory pressures in this region are exceptionally high; for example, China's aggressive mandate for ultra-low emission retrofitting across its vast coal fleet has created unparalleled demand for both Wet FGD and high-performance SCR units. This regional market is characterized by large, complex EPC projects, strong government oversight, and increasing localization of technology manufacturing and service provision by global players seeking competitive advantage.

The European market offers a contrasting profile, defined by high maturity and deep integration of abatement technologies driven by the European Union's strict Industrial Emissions Directive (IED). While the phase-out of coal reduces the total addressable market over the long term, significant stable demand persists in the industrial and waste-to-energy sectors, which require complex, high-efficiency systems often tailored to handle highly variable flue gas streams and strict local air quality mandates. European regional activity is increasingly centered on lifecycle management, optimization services, and the specialized supply of reagents and high-durability catalysts for existing high-value assets, rather than massive new installations. Furthermore, the emphasis on recycling FGD byproducts, such as turning gypsum into building materials, reinforces the market’s alignment with circular economy principles.

North America, encompassing the United States and Canada, presents a dynamic market environment where demand is highly dependent on localized state regulations and the structural shift in the energy mix. The retirement of older, less-compliant coal facilities has stabilized SOx abatement demand, but intensified the focus on NOx control for the burgeoning fleet of natural gas-fired power turbines, making SCR a central investment area. Furthermore, regulatory spotlight is increasingly shifting towards non-utility industrial sources like refineries and petrochemical plants, ensuring sustained, albeit targeted, demand. The Latin American and the Middle East & Africa (MEA) regions represent emerging opportunity hubs, where market growth is project-specific, driven by major, state-sponsored investments in new industrial complexes, such as large refineries in the Gulf States or mining facilities in South America, which require best-in-class environmental controls to attract international investment and meet export requirements.

- Asia Pacific (APAC): Largest market share, driven by mandatory Ultra-Low Emission (ULE) retrofits in China and significant power plant expansion in India and Indonesia; high demand across both FGD and SCR segments due to rapid industrial and energy sector growth.

- Europe: Mature market focused on optimization, compliance with the Industrial Emissions Directive (IED), and long-term service contracts; structural challenge from coal phase-out offset by strong niche demand from waste incineration and complex industrial chemical processes.

- North America: Stable, high-value demand, shifting focus from coal-based FGD toward high-efficiency SCR installations for natural gas turbines and critical industrial source compliance (Refining, Petrochemicals, Metals).

- Middle East & Africa (MEA): Emerging market potential tied to significant investment in large-scale petrochemical refining and new power generation infrastructure, requiring globally competitive abatement standards to meet sustainability goals.

- Latin America (LATAM): Growth driven by necessary environmental compliance upgrades for existing utility fleets and new investment in key industrial sectors like mining, cement, and metal processing, often utilizing imported specialized technologies.

Top Key Players

The market research report includes a detailed profile of leading stakeholders in the Desulfurization and Denitrification Market.- General Electric

- Mitsubishi Hitachi Power Systems

- Babcock & Wilcox

- Doosan Lentjes

- Thermax

- KC Cottrell

- Hamon Corporation

- Suez SA

- Croll Reynolds

- John Cockerill

- Clyde Bergemann Power Group

- STEAG Energy Services

- CECO Environmental

- Fuel Tech Inc.

- China Energy Conservation and Environmental Protection Group (CECEP)

- Fives

- FLSmidth

- Longking

- Hitachi Zosen Inova

- Mitsubishi Heavy Industries

Frequently Asked Questions

Analyze common user questions about the Desulfurization and Denitrification market and generate a concise list of summarized FAQs reflecting key topics and concerns.What is the primary factor driving demand in the Desulfurization and Denitrification market?

The primary factor is the increasing global implementation of stringent governmental environmental regulations, particularly those mandating ultra-low emissions for sulfur dioxide (SO2) and nitrogen oxides (NOx) from industrial combustion sources, forcing utility and industrial operators to upgrade or install new abatement systems to maintain operational compliance.

Which technology segment dominates the denitrification market share?

Selective Catalytic Reduction (SCR) technology dominates the denitrification market due to its superior removal efficiency, typically exceeding 90-95%, making it the necessary and preferred solution for large power plants and high-volume industrial applications required to meet the most demanding emission limits globally.

How is the transition to renewable energy affecting the market?

While the long-term shift toward renewables acts as a structural restraint in developed nations by slowly retiring older fossil fuel plants, it concurrently increases the demand for highly efficient, often AI-optimized, abatement solutions for remaining fossil assets that must operate cleanly and reliably to balance grid fluctuations during the complex energy transition period.

Which geographical region exhibits the highest growth potential?

Asia Pacific (APAC), particularly driven by massive government-mandated retrofitting and new capacity installation programs in countries such as China and India, holds the highest current market share and is projected to exhibit the fastest Compound Annual Growth Rate (CAGR) due to ongoing industrial expansion and regulatory enforcement.

What role does Artificial Intelligence play in Desulfurization systems?

AI is increasingly utilized to optimize the operational efficiency of existing systems through predictive maintenance, real-time precise reagent dosing based on dynamic input conditions, and overall system control, ensuring consistent regulatory compliance while minimizing operational costs and maximizing the longevity of catalysts and major equipment.

To check our Table of Contents, please mail us at: sales@marketresearchupdate.com

Research Methodology

The Market Research Update offers technology-driven solutions and its full integration in the research process to be skilled at every step. We use diverse assets to produce the best results for our clients. The success of a research project is completely reliant on the research process adopted by the company. Market Research Update assists its clients to recognize opportunities by examining the global market and offering economic insights. We are proud of our extensive coverage that encompasses the understanding of numerous major industry domains.

Market Research Update provide consistency in our research report, also we provide on the part of the analysis of forecast across a gamut of coverage geographies and coverage. The research teams carry out primary and secondary research to implement and design the data collection procedure. The research team then analyzes data about the latest trends and major issues in reference to each industry and country. This helps to determine the anticipated market-related procedures in the future. The company offers technology-driven solutions and its full incorporation in the research method to be skilled at each step.

The Company's Research Process Has the Following Advantages:

- Information Procurement

The step comprises the procurement of market-related information or data via different methodologies & sources.

- Information Investigation

This step comprises the mapping and investigation of all the information procured from the earlier step. It also includes the analysis of data differences observed across numerous data sources.

- Highly Authentic Source

We offer highly authentic information from numerous sources. To fulfills the client’s requirement.

- Market Formulation

This step entails the placement of data points at suitable market spaces in an effort to assume possible conclusions. Analyst viewpoint and subject matter specialist based examining the form of market sizing also plays an essential role in this step.

- Validation & Publishing of Information

Validation is a significant step in the procedure. Validation via an intricately designed procedure assists us to conclude data-points to be used for final calculations.

×

Request Free Sample:

Related Reports

Select License

Why Choose Us

We're cost-effective and Offered Best services:

We are flexible and responsive startup research firm. We adapt as your research requires change, with cost-effectiveness and highly researched report that larger companies can't match.

Information Safety

Market Research Update ensure that we deliver best reports. We care about the confidential and personal information quality, safety, of reports. We use Authorize secure payment process.

We Are Committed to Quality and Deadlines

We offer quality of reports within deadlines. We've worked hard to find the best ways to offer our customers results-oriented and process driven consulting services.

Our Remarkable Track Record

We concentrate on developing lasting and strong client relationship. At present, we hold numerous preferred relationships with industry leading firms that have relied on us constantly for their research requirements.

Best Service Assured

Buy reports from our executives that best suits your need and helps you stay ahead of the competition.

Customized Research Reports

Our research services are custom-made especially to you and your firm in order to discover practical growth recommendations and strategies. We don't stick to a one size fits all strategy. We appreciate that your business has particular research necessities.

Service Assurance

At Market Research Update, we are dedicated to offer the best probable recommendations and service to all our clients. You will be able to speak to experienced analyst who will be aware of your research requirements precisely.

Contact With Our Sales Team

Customer Testimonials

The content of the report is always up to the mark. Good to see speakers from expertise authorities.

Privacy requested , Managing Director

A lot of unique and interesting topics which are described in good manner.

Privacy requested, President

Well researched, expertise analysts, well organized, concrete and current topics delivered in time.

Privacy requested, Development Manager