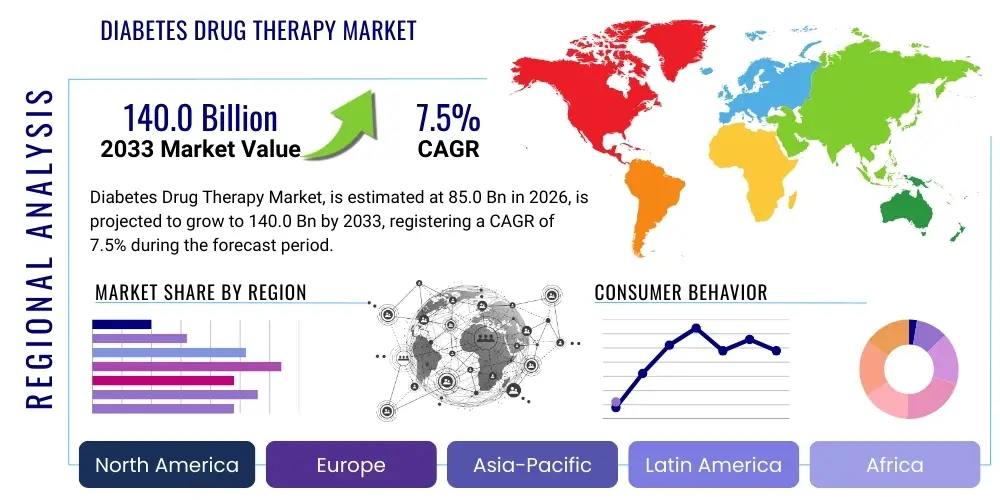

Diabetes Drug Therapy Market Size, By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2026 to 2033 (Financial Impact Analysis)

ID : MRU_ 443271 | Date : Feb, 2026 | Pages : 258 | Region : Global | Publisher : MRU

Diabetes Drug Therapy Market Size

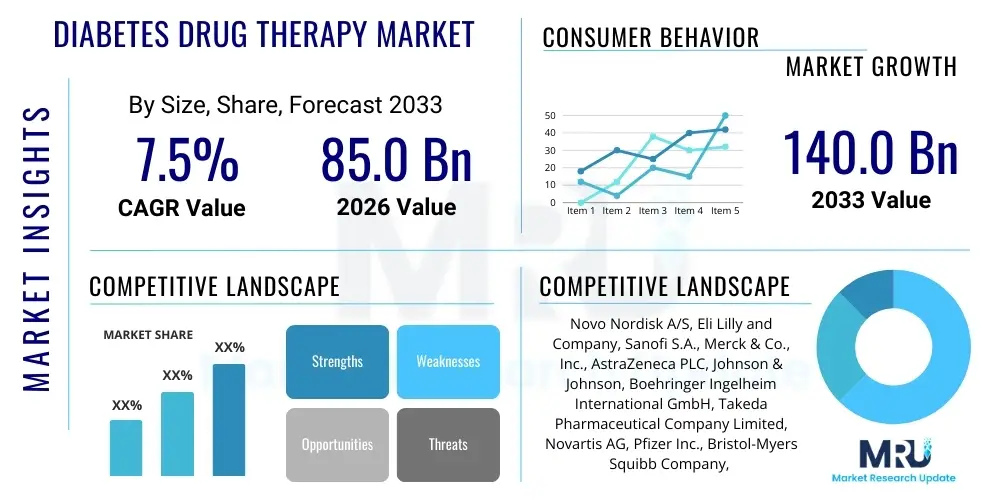

The Diabetes Drug Therapy Market is projected to grow at a Compound Annual Growth Rate (CAGR) of 7.5% between 2026 and 2033. The market is estimated at USD 85.0 Billion in 2026 and is projected to reach USD 140.0 Billion by the end of the forecast period in 2033. This substantial expansion is fundamentally driven by the escalating global incidence of both Type 1 and Type 2 diabetes, coupled with significant advancements in pharmacological research leading to the development of novel, highly effective drug classes, such as GLP-1 receptor agonists and SGLT2 inhibitors. Furthermore, increasing awareness campaigns and improved diagnostic infrastructure in emerging economies are expanding the patient pool accessing therapy, contributing significantly to market valuation growth.

Diabetes Drug Therapy Market introduction

The Diabetes Drug Therapy Market encompasses the sale and distribution of pharmaceutical agents used to manage blood glucose levels in patients diagnosed with diabetes mellitus. This comprehensive market includes various drug classes, such as insulin and insulin analogs, oral hypoglycemic agents (like Metformin, Sulfonylureas, and DPP-4 inhibitors), and modern injectable non-insulin therapies (such as GLP-1 receptor agonists and SGLT2 inhibitors). The primary objective of these therapies is to prevent chronic complications associated with hyperglycemia, including cardiovascular disease, neuropathy, and nephropathy, thereby improving the patient's quality of life and longevity. Given the chronic nature of diabetes, continuous drug consumption is a prerequisite, establishing a stable and perpetually growing demand base globally.

Product descriptions within this market range widely. Insulin, still the cornerstone for Type 1 diabetes and often necessary for advanced Type 2 diabetes, is seeing evolution through long-acting, ultra-long-acting, and rapid-acting analogs designed for enhanced pharmacokinetic profiles and patient convenience. Concurrently, oral therapies are gaining prominence, especially the fixed-dose combinations that improve patient compliance by simplifying complex regimens. Major applications span prophylactic interventions in pre-diabetic stages to intensive glycemic control in established chronic cases, focusing heavily on patient stratification based on comorbidities and specific therapeutic needs, such as weight management or cardiovascular risk reduction.

Key driving factors include the demographic shift toward aging populations worldwide, higher rates of obesity and sedentary lifestyles contributing to Type 2 diabetes prevalence, and favorable regulatory pathways accelerating the introduction of breakthrough combination therapies. The benefits of effective diabetes drug therapy are profound, extending beyond glycemic control to include documented reductions in major adverse cardiovascular events (MACE), protection against kidney function decline, and significant healthcare cost savings derived from preventing severe complications. However, market growth is often mediated by challenges related to pricing, patient adherence, and the need for personalized medicine approaches to maximize therapeutic efficacy across diverse patient populations.

Diabetes Drug Therapy Market Executive Summary

The Diabetes Drug Therapy Market is characterized by robust commercial activity driven by intense R&D focusing on superior efficacy and convenience. Business trends indicate a strong pivot toward non-insulin injectable therapies, particularly the GLP-1 receptor agonists and dual agonists, which offer dual benefits of glycemic control and significant weight reduction, positioning them as first-line alternatives to traditional oral medications in many clinical guidelines. Mergers, acquisitions, and strategic partnerships centered on pipeline assets and advanced drug delivery systems (e.g., smart insulin pens and patch pumps) are shaping competitive dynamics, with major pharmaceutical companies aggressively investing to secure market leadership in next-generation therapeutic classes. Furthermore, the expiration of patents for blockbuster drugs is fueling the growth of biosimilars and generic versions, enhancing market accessibility but concurrently pressurizing pricing structures in developed economies.

Regional trends highlight North America, particularly the United States, as the dominant revenue generator, attributed to high diabetes prevalence, sophisticated healthcare infrastructure, and high per capita drug expenditure. However, the Asia Pacific (APAC) region is projected to register the highest Compound Annual Growth Rate (CAGR), driven by massive undiagnosed populations, rapid urbanization leading to lifestyle changes, and improving reimbursement scenarios in key markets like China and India. Europe maintains a strong position, characterized by stringent regulatory oversight but high adoption rates for premium, innovative therapies. The ongoing challenge across all regions remains the balancing act between providing access to expensive, novel treatments and managing overall national healthcare budgets, leading to varied adoption rates for expensive biologics.

Segmentation trends reveal that the GLP-1 receptor agonists segment, including tirzepatide (a dual GIP/GLP-1 agonist), is experiencing explosive growth, significantly outpacing traditional oral antidiabetics. Similarly, SGLT2 inhibitors are gaining immense traction due to compelling data demonstrating cardiorenal protective effects, moving them beyond strictly glycemic management into broader cardiovascular and renal risk mitigation strategies. The insulin segment, while mature, is sustained by the increasing prevalence of advanced Type 2 diabetes requiring insulinization and ongoing innovation in ultra-long-acting insulin formulations. Dosage form segmentation reflects a consumer preference shift toward convenient administration, with pre-filled pens and automated injection devices dominating the parenteral drug delivery sub-segment, enhancing patient self-management capabilities and adherence to complex drug regimens.

AI Impact Analysis on Diabetes Drug Therapy Market

User queries regarding AI's influence in the diabetes drug therapy domain primarily revolve around personalized treatment efficacy, acceleration of drug discovery, and the utilization of predictive analytics for patient management. Key themes identified include how AI can optimize dosing schedules in real-time using continuous glucose monitoring (CGM) data, whether machine learning (ML) models can predict patient responsiveness to specific drug classes (e.g., predicting who will benefit most from SGLT2 inhibitors versus GLP-1 agonists), and the role of generative AI in identifying novel therapeutic targets or accelerating the hit-to-lead phase of drug development. Users also express interest in AI-powered tools for adherence monitoring and behavioral modification integrated into smart drug delivery devices, aiming for holistic patient care.

AI is fundamentally transforming drug discovery by streamlining target identification and validation, significantly reducing the time and cost associated with preclinical research. Machine learning algorithms analyze vast datasets of genomics, proteomics, and real-world clinical data to uncover subtle biological pathways implicated in diabetes pathophysiology that were previously inaccessible through traditional methods. This capability accelerates the identification of novel small molecules and biological entities tailored to address underlying disease mechanisms rather than just symptom management. Furthermore, AI is crucial in optimizing clinical trial design, helping identify the most suitable patient cohorts for trials, predicting dropout rates, and improving data integrity and analysis, thereby speeding up regulatory approval processes for new diabetes medications.

In the post-marketing phase, AI algorithms are integral to precision medicine within diabetes care. By integrating longitudinal patient data—including electronic health records (EHRs), wearable data (activity, sleep), and CGM readings—AI systems can generate highly individualized therapeutic recommendations. This moves treatment from standardized guidelines toward dynamic, adaptive dosing and drug combinations tailored to an individual’s metabolic profile, lifestyle, and unique risk factors. This analytical capability is expected to maximize therapeutic efficacy, minimize adverse effects, and dramatically improve long-term outcomes, fundamentally shifting the paradigm of chronic disease management in the diabetes drug therapy market.

- Accelerated identification of novel drug targets using genomic and proteomic data.

- Optimization of drug compound synthesis and screening through generative AI models.

- Real-time, personalized drug dosing recommendations based on continuous glucose monitoring (CGM) and wearable data.

- Enhanced clinical trial efficiency through predictive patient selection and outcome modeling.

- AI-driven platforms for predicting patient non-adherence and implementing tailored intervention strategies.

- Development of smart insulin pumps and delivery systems integrated with ML algorithms for autonomous blood sugar regulation (closed-loop systems).

- Improved pharmacovigilance by rapidly analyzing global adverse event reporting data for drug safety profiling.

DRO & Impact Forces Of Diabetes Drug Therapy Market

The Diabetes Drug Therapy Market is strongly influenced by a confluence of driving factors, critical restraints, and substantial opportunities, collectively summarized as DRO & Impact Forces. The primary drivers include the relentlessly increasing global prevalence of diabetes, fueled by demographic shifts and poor lifestyle choices; the continuous introduction of superior drug classes offering better safety profiles (especially cardiovascular benefits, e.g., SGLT2 inhibitors); and rising healthcare expenditure coupled with improved patient access in developing regions. Restraints center around the high cost of patented novel therapies (GLP-1 agonists and advanced insulins), leading to affordability barriers and payer pushback, particularly in markets without robust reimbursement mechanisms. Further constraints include the lack of patient adherence to complex, long-term therapeutic regimens, and safety concerns related to older drug classes.

Opportunities abound, stemming primarily from the large pool of undiagnosed diabetes and pre-diabetes patients globally, representing a vast untapped market for early intervention and preventative pharmacotherapy. Significant growth opportunities also lie in developing fixed-dose combination products that enhance compliance, and the utilization of advanced drug delivery systems (e.g., weekly or monthly injectables, oral insulin formulations) to improve patient convenience. Furthermore, capitalizing on pharmacogenomics and AI to personalize treatment regimens offers a competitive advantage, promising superior outcomes and justifying premium pricing. The expansion into therapies focused on obesity management, often linked intrinsically to Type 2 diabetes, through dual and triple-agonist drugs, represents a massive synergistic market opportunity that transcends traditional diabetes care.

Impact forces are heavily weighted toward regulatory approvals and clinical trial outcomes, particularly those demonstrating significant non-glycemic benefits (cardiorenal protection). Shifts in clinical practice guidelines, such as those published by the American Diabetes Association (ADA) or European Association for the Study of Diabetes (EASD), rapidly influence prescription patterns, favoring drugs with established cardiovascular risk reduction data. Payer influence is another major force, determining formulary placement and patient out-of-pocket costs, which significantly impacts market penetration for expensive branded drugs. Lastly, the dynamic nature of patent cliffs and the subsequent entry of biosimilars and generics exert downward pressure on overall market value growth while simultaneously expanding patient accessibility, creating a complex balance between innovation revenue and volume market expansion.

Segmentation Analysis

The Diabetes Drug Therapy Market is systematically segmented based on various criteria, including drug class, route of administration, indication (Type 1 or Type 2 Diabetes), and distribution channel. The segmentation by drug class remains the most dynamic, reflecting the rapid innovation and competitive shift between insulin products, oral anti-diabetics, and the increasingly dominant non-insulin injectables. This granular classification allows market players to precisely target their R&D and commercial strategies, focusing resources on high-growth segments like GLP-1 receptor agonists and SGLT2 inhibitors, which are reshaping standard treatment algorithms globally due to their proven ancillary benefits beyond simple glycemic control. The dominance of Type 2 diabetes as the primary indication drives the volume market, while Type 1 diabetes dictates the constant need for advanced, user-friendly insulin analogs.

Route of administration divides the market into Oral and Parenteral (Injectable) segments. While oral medications maintain the largest patient base due to convenience and historical usage, the Parenteral segment, propelled by insulins, GLP-1s, and their combination counterparts, is growing faster in value. The continuous development of pre-filled, disposable pens and auto-injectors has mitigated some of the historical resistance associated with injectable therapies. Geographic segmentation further dissects the market, highlighting the disparity in treatment standards and market maturity between developed regions (North America, Western Europe) where adoption of premium, patented drugs is high, and emerging markets (APAC, LATAM) where generic and older oral therapies constitute the majority of prescriptions, though this is rapidly changing.

- By Drug Class:

- Insulin and Insulin Analogs (Rapid-Acting, Short-Acting, Intermediate-Acting, Long-Acting, Ultra-Long Acting, Premixed Insulins)

- Non-Insulin Injectable Antidiabetics (Glucagon-Like Peptide-1 (GLP-1) Receptor Agonists, Dual Agonists)

- Oral Antidiabetics (Biguanides (Metformin), Sulfonylureas, Thiazolidinediones (TZDs), Dipeptidyl Peptidase-4 (DPP-4) Inhibitors, Sodium-Glucose Co-Transporter-2 (SGLT2) Inhibitors, Alpha-Glucosidase Inhibitors, Meglitinides)

- By Indication:

- Type 1 Diabetes Mellitus (T1DM)

- Type 2 Diabetes Mellitus (T2DM)

- By Route of Administration:

- Parenteral (Injectable)

- Oral

- By Distribution Channel:

- Hospital Pharmacies

- Retail Pharmacies

- Online Pharmacies

Value Chain Analysis For Diabetes Drug Therapy Market

The value chain for the Diabetes Drug Therapy Market begins with rigorous upstream activities, including drug discovery and preclinical research, often involving intensive biochemical synthesis and biological testing conducted by pharmaceutical companies and specialized biotech firms. This phase is characterized by high capital expenditure, long timelines, and high risk, particularly in identifying novel therapeutic targets. Key inputs include Active Pharmaceutical Ingredients (APIs), specialized excipients, and proprietary drug delivery technology components. Efficiency in the upstream phase is increasingly reliant on outsourcing contract research organizations (CROs) for clinical trial management and specialized manufacturing organizations (CMOs) for scaled production, optimizing resource allocation and speed to market.

Midstream activities encompass the manufacturing, formulation, and packaging of the final drug product, ranging from tablet compression for oral medications to sterile filling and assembly for complex injectable pens and vials. Quality control and regulatory compliance, adhering to strict Good Manufacturing Practices (GMP), are paramount in this stage, given the life-critical nature of diabetes medications. The integration of advanced manufacturing technologies, such as continuous manufacturing, is emerging to enhance production scalability and reduce batch-to-batch variability. Following manufacturing, the distribution channel orchestration takes over, connecting the product to end-users globally through highly regulated supply networks.

Downstream activities involve distribution, marketing, and sales, utilizing both direct and indirect channels. Direct channels involve manufacturers selling directly to large institutional buyers, such as national governments or major hospital networks, especially for high-volume insulin contracts. Indirect channels rely heavily on wholesalers and specialized pharmaceutical distributors who manage inventory and logistics to supply retail pharmacies, clinic dispensaries, and online pharmacy platforms. The effectiveness of the downstream segment is highly dependent on securing favorable formulary coverage from third-party payers and insurers, and implementing sophisticated sales and marketing strategies that target endocrinologists, primary care physicians, and increasingly, specialized diabetes educators to influence prescribing behavior. Patient support programs further solidify the downstream value, enhancing adherence and brand loyalty.

Diabetes Drug Therapy Market Potential Customers

The primary consumers and end-users of diabetes drug therapy products are individuals diagnosed with diabetes mellitus, categorized into Type 1 and Type 2 patients, spanning all age groups and demographics globally. Given that Type 2 diabetes accounts for over 90% of the patient population, this segment represents the largest volume market. Specifically, potential customers include newly diagnosed Type 2 adults requiring initial oral therapy (often Metformin or SGLT2/GLP-1 combinations), and established chronic Type 2 patients who have progressed to requiring insulin or advanced injectable combinations due to deteriorating pancreatic function. Type 1 diabetes patients form a crucial, albeit smaller, segment characterized by a lifelong, non-negotiable dependence on insulin and its analogs, demanding highly sophisticated delivery systems.

Secondary but crucial potential customer groups include healthcare providers, such as specialized endocrinology clinics, large tertiary care hospitals, and general practitioners who initiate and manage chronic diabetes care. These professionals are the ultimate purchasers (via institutional formularies) and prescribers of these therapies. Furthermore, national and regional health insurance payers, government health agencies, and private managed care organizations are critical customers, as they determine access and reimbursement policies, thereby controlling the overall market penetration and utilization rates of branded versus generic drugs. Their purchasing decisions are driven by cost-effectiveness ratios, clinical efficacy data, and budget impact analyses for various drug classes, making them key influencers in the market dynamics.

| Report Attributes | Report Details |

|---|---|

| Market Size in 2026 | USD 85.0 Billion |

| Market Forecast in 2033 | USD 140.0 Billion |

| Growth Rate | 7.5% CAGR |

| Historical Year | 2019 to 2024 |

| Base Year | 2025 |

| Forecast Year | 2026 - 2033 |

| DRO & Impact Forces |

|

| Segments Covered |

|

| Key Companies Covered | Novo Nordisk A/S, Eli Lilly and Company, Sanofi S.A., Merck & Co., Inc., AstraZeneca PLC, Johnson & Johnson, Boehringer Ingelheim International GmbH, Takeda Pharmaceutical Company Limited, Novartis AG, Pfizer Inc., Bristol-Myers Squibb Company, Glenmark Pharmaceuticals Ltd., Sun Pharmaceutical Industries Ltd., Biocon Ltd., MannKind Corporation, Amgen Inc., Medtronic PLC (Diabetes Group), Dexcom, Inc., Abbott Laboratories, Insulet Corporation |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Enquiry Before Buy | Have specific requirements? Send us your enquiry before purchase to get customized research options. Request For Enquiry Before Buy |

Diabetes Drug Therapy Market Key Technology Landscape

The technological landscape of the Diabetes Drug Therapy Market is rapidly evolving, driven by the dual goals of maximizing therapeutic efficacy and enhancing patient compliance. A significant technology trend is the advancement in drug formulation and delivery systems. This includes the development of ultra-long-acting insulin analogs, which reduce the frequency of injections, and the creation of fixed-dose combination therapies that merge multiple drug classes (e.g., GLP-1/insulin or SGLT2/DPP-4) into a single pill or injectable, simplifying complex treatment regimens for patients. Furthermore, there is intense research into non-invasive drug delivery methods, such as oral insulin formulations and inhaled insulin products, aiming to eliminate the injection burden entirely, although these technologies still face significant bioavailability challenges.

A second crucial technological shift involves smart drug delivery devices and integrated digital platforms. This includes the widespread adoption of smart insulin pens, which track dosing time and amount, and connect wirelessly to smartphone applications for data logging and analysis. Closed-loop systems, commonly known as artificial pancreas technology (which integrate Continuous Glucose Monitors (CGM) with automated insulin pumps managed by sophisticated algorithms), represent the apex of current therapeutic technology, moving care towards automated, highly personalized glycemic control, particularly for Type 1 diabetes. These systems utilize advanced machine learning algorithms to predict glucose fluctuations and adjust insulin delivery preemptively, requiring seamless integration of hardware, software, and highly reliable drug components.

The biotechnology landscape is also heavily influenced by innovation in the biologics sector, specifically the continuous refinement of incretin-based therapies. Beyond traditional GLP-1 receptor agonists, the development of dual agonists (GLP-1 and GIP) and triple agonists (GLP-1, GIP, and Glucagon) represents the latest frontier. These novel peptides leverage multiple hormonal pathways simultaneously, offering superior weight loss and glycemic control outcomes, fundamentally altering the competitive dynamics of the injectable market. These technological breakthroughs are often patented heavily, defining the economic moat for the leading pharmaceutical firms and directing future R&D investment towards multi-target therapeutic strategies that address the complex metabolic syndrome associated with Type 2 diabetes.

Regional Highlights

The global market for diabetes drug therapy exhibits pronounced regional variation in terms of size, growth rate, and therapeutic preferences, influenced by differences in diabetes prevalence, healthcare infrastructure, and reimbursement policies. North America, driven predominantly by the United States, holds the largest market share globally. This dominance is attributed to a high prevalence of obesity and diabetes, high disposable income facilitating the uptake of expensive, patented drugs (like branded GLP-1s and SGLT2s), and a robust, innovation-supportive regulatory environment. The US market is characterized by complex payer dynamics, where securing favorable formulary placement is critical for commercial success, leading to significant investment in managed care contracting and aggressive marketing of premium therapies.

Europe represents a mature market with high penetration of both generics and advanced biologics. Western European countries benefit from sophisticated healthcare systems and established clinical guidelines, favoring drugs with proven cardiovascular and renal benefits. However, pricing pressure from centralized national health systems (e.g., NHS in the UK, G-BA in Germany) often restricts the initial uptake of high-cost novel therapies compared to the US. The market dynamics are highly sensitive to HTA (Health Technology Assessment) decisions, which rigorously evaluate the cost-effectiveness of new diabetes drugs before granting widespread reimbursement, leading to slower but more sustainable market growth.

The Asia Pacific (APAC) region is projected to be the fastest-growing market globally throughout the forecast period. This rapid growth is fueled by an enormous and rapidly increasing diabetic population, particularly in high-density countries like China and India, where urbanization and lifestyle changes are accelerating T2DM incidence. While historical preference leaned towards low-cost generics (Metformin, Sulfonylureas), rising economic power and improving government healthcare investment are driving demand for advanced therapies. Market players are strategically expanding local manufacturing and distribution networks to navigate varied regulatory landscapes and address the need for affordable access to medication across diverse socioeconomic strata in the region.

- North America: Dominant market share due to high prevalence, high per capita healthcare spending, and rapid adoption of premium, innovative drug classes (especially GLP-1 and SGLT2 inhibitors).

- Europe: Characterized by mature market status, high generic usage, and strong regulatory focus on cost-effectiveness (HTA), favoring evidence-based therapies with documented cardiorenal protection.

- Asia Pacific (APAC): Highest CAGR forecast; growth driven by huge patient base in China and India, increasing healthcare expenditure, and greater access to advanced therapies in metropolitan areas.

- Latin America (LATAM): Growing market influenced by lifestyle diseases; constrained by economic instability and variable public health coverage, leading to reliance on older, more affordable drug classes.

- Middle East and Africa (MEA): High regional diabetes prevalence, particularly in Gulf Cooperation Council (GCC) countries; market growth tied to government investment in healthcare infrastructure and high adoption rates of Western therapeutic standards.

Top Key Players

The market research report includes a detailed profile of leading stakeholders in the Diabetes Drug Therapy Market.- Novo Nordisk A/S

- Eli Lilly and Company

- Sanofi S.A.

- Merck & Co., Inc.

- AstraZeneca PLC

- Johnson & Johnson

- Boehringer Ingelheim International GmbH

- Takeda Pharmaceutical Company Limited

- Novartis AG

- Pfizer Inc.

- Bristol-Myers Squibb Company

- Glenmark Pharmaceuticals Ltd.

- Sun Pharmaceutical Industries Ltd.

- Biocon Ltd.

- MannKind Corporation

- Amgen Inc.

- Medtronic PLC (Diabetes Group)

- Dexcom, Inc.

- Abbott Laboratories

- Insulet Corporation

Frequently Asked Questions

Analyze common user questions about the Diabetes Drug Therapy market and generate a concise list of summarized FAQs reflecting key topics and concerns.What are the fastest-growing drug classes in the Diabetes Drug Therapy Market?

The fastest-growing drug classes are GLP-1 receptor agonists and SGLT2 inhibitors. This growth is driven by their superior efficacy in glycemic control, coupled with demonstrated secondary benefits in cardiovascular risk reduction, kidney protection, and substantial weight loss, making them preferred first-line and combination therapies.

How is the rise of biosimilars impacting the insulin segment?

The entry of insulin biosimilars following the patent expiration of blockbuster insulin analogs (like Lantus) is intensifying competition and exerting significant downward pressure on pricing, particularly in developed markets. This improves affordability and patient access while challenging the revenue base of originator companies, prompting innovation in ultra-long-acting analogs.

What role does Artificial Intelligence play in future diabetes treatment?

AI is crucial in two main areas: accelerating the discovery of novel therapeutic targets and enabling precision medicine. AI algorithms analyze patient data (e.g., CGM readings, EHRs) to optimize individual dosing schedules in real-time and predict patient response to specific drug combinations, enhancing personalized care and outcomes.

Which region offers the highest growth potential for diabetes drugs?

The Asia Pacific (APAC) region offers the highest Compound Annual Growth Rate (CAGR) potential. This is primarily due to the massive, growing diabetic population in countries like China and India, alongside improving healthcare expenditure and increasing adoption of modern, advanced therapeutic options.

What are the primary restraints affecting market expansion?

Key restraints include the prohibitively high cost of patented novel therapies (e.g., branded GLP-1s), which limits accessibility and prompts strong payer resistance. Additionally, challenges related to long-term patient adherence to complex therapeutic regimens and the competition from generic drugs pose ongoing constraints on overall market value growth.

To check our Table of Contents, please mail us at: sales@marketresearchupdate.com

Research Methodology

The Market Research Update offers technology-driven solutions and its full integration in the research process to be skilled at every step. We use diverse assets to produce the best results for our clients. The success of a research project is completely reliant on the research process adopted by the company. Market Research Update assists its clients to recognize opportunities by examining the global market and offering economic insights. We are proud of our extensive coverage that encompasses the understanding of numerous major industry domains.

Market Research Update provide consistency in our research report, also we provide on the part of the analysis of forecast across a gamut of coverage geographies and coverage. The research teams carry out primary and secondary research to implement and design the data collection procedure. The research team then analyzes data about the latest trends and major issues in reference to each industry and country. This helps to determine the anticipated market-related procedures in the future. The company offers technology-driven solutions and its full incorporation in the research method to be skilled at each step.

The Company's Research Process Has the Following Advantages:

- Information Procurement

The step comprises the procurement of market-related information or data via different methodologies & sources.

- Information Investigation

This step comprises the mapping and investigation of all the information procured from the earlier step. It also includes the analysis of data differences observed across numerous data sources.

- Highly Authentic Source

We offer highly authentic information from numerous sources. To fulfills the client’s requirement.

- Market Formulation

This step entails the placement of data points at suitable market spaces in an effort to assume possible conclusions. Analyst viewpoint and subject matter specialist based examining the form of market sizing also plays an essential role in this step.

- Validation & Publishing of Information

Validation is a significant step in the procedure. Validation via an intricately designed procedure assists us to conclude data-points to be used for final calculations.

×

Request Free Sample:

Related Reports

Select License

Why Choose Us

We're cost-effective and Offered Best services:

We are flexible and responsive startup research firm. We adapt as your research requires change, with cost-effectiveness and highly researched report that larger companies can't match.

Information Safety

Market Research Update ensure that we deliver best reports. We care about the confidential and personal information quality, safety, of reports. We use Authorize secure payment process.

We Are Committed to Quality and Deadlines

We offer quality of reports within deadlines. We've worked hard to find the best ways to offer our customers results-oriented and process driven consulting services.

Our Remarkable Track Record

We concentrate on developing lasting and strong client relationship. At present, we hold numerous preferred relationships with industry leading firms that have relied on us constantly for their research requirements.

Best Service Assured

Buy reports from our executives that best suits your need and helps you stay ahead of the competition.

Customized Research Reports

Our research services are custom-made especially to you and your firm in order to discover practical growth recommendations and strategies. We don't stick to a one size fits all strategy. We appreciate that your business has particular research necessities.

Service Assurance

At Market Research Update, we are dedicated to offer the best probable recommendations and service to all our clients. You will be able to speak to experienced analyst who will be aware of your research requirements precisely.

Contact With Our Sales Team

Customer Testimonials

The content of the report is always up to the mark. Good to see speakers from expertise authorities.

Privacy requested , Managing Director

A lot of unique and interesting topics which are described in good manner.

Privacy requested, President

Well researched, expertise analysts, well organized, concrete and current topics delivered in time.

Privacy requested, Development Manager