Diabetes Management Devices Market Size, By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2026 to 2033 (Financial Impact Analysis)

ID : MRU_ 442917 | Date : Feb, 2026 | Pages : 257 | Region : Global | Publisher : MRU

Diabetes Management Devices Market Size

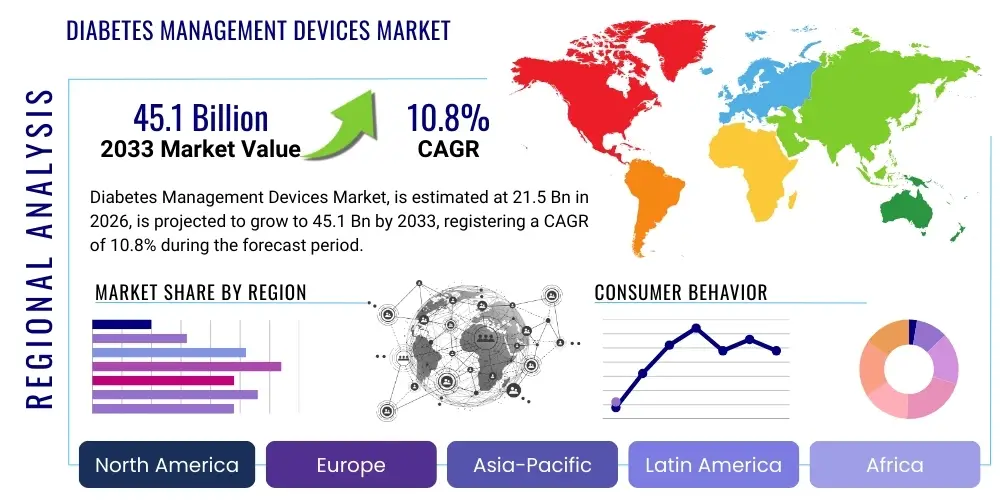

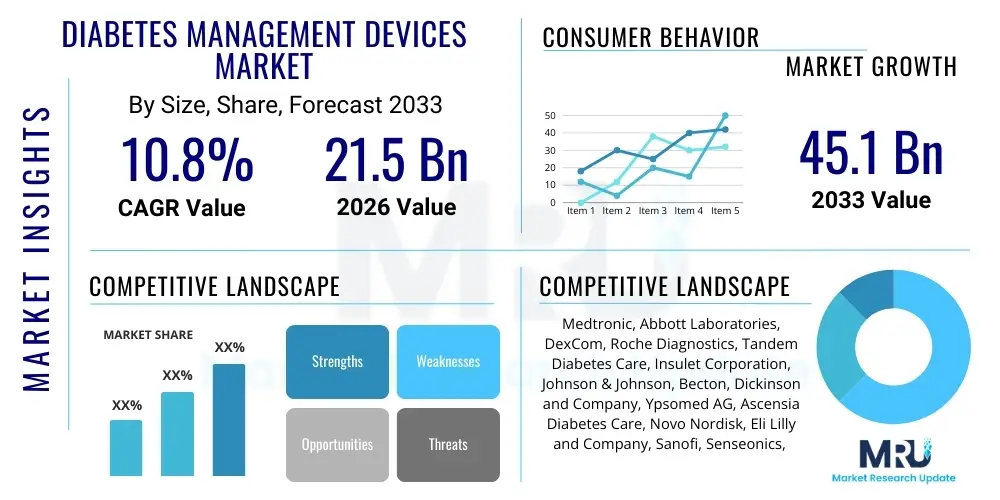

The Diabetes Management Devices Market is projected to grow at a Compound Annual Growth Rate (CAGR) of 10.8% between 2026 and 2033. The market is estimated at $21.5 Billion in 2026 and is projected to reach $45.1 Billion by the end of the forecast period in 2033.

Diabetes Management Devices Market introduction

The Diabetes Management Devices Market encompasses a broad spectrum of medical technologies designed to monitor blood glucose levels and administer insulin or other glucose-regulating substances, primarily targeting individuals diagnosed with Type 1 and Type 2 diabetes. Key product categories include continuous glucose monitoring (CGM) systems, self-monitoring blood glucose (SMBG) meters, and advanced insulin delivery systems such as automated insulin pumps and smart insulin pens. These devices are integral to modern endocrinological practice, enabling patients and healthcare providers to maintain tight glycemic control, which is essential for mitigating severe long-term complications associated with chronic hyperglycemia, including neuropathy, nephropathy, and cardiovascular disease.

The principal application of these devices lies in the daily, proactive management of blood sugar homeostasis, moving beyond reactive testing to provide predictive insights and therapeutic guidance. Benefits derived from the adoption of modern diabetes management tools include enhanced quality of life for patients, significant reduction in the frequency and severity of hypoglycemic and hyperglycemic events, and improved adherence to prescribed treatment regimens. Furthermore, the integration of these devices with digital health platforms allows for remote patient monitoring, facilitating timely clinical interventions and optimizing personalized care plans, thereby making treatment far more dynamic and responsive to individual physiological needs.

A central driving factor propelling market expansion is the alarming global increase in diabetes prevalence, spurred by demographic changes, lifestyle factors, and improved diagnostic capabilities across emerging economies. Concurrently, continuous technological innovation, particularly the miniaturization of sensors, the development of sophisticated algorithms for closed-loop systems (artificial pancreas), and increased connectivity through smartphone applications, is making these devices more accurate, user-friendly, and accessible. Favorable regulatory policies that support faster approval of cutting-edge technologies and increasing governmental and private healthcare expenditure focused on chronic disease management also contribute significantly to the positive market trajectory, ensuring sustained demand for advanced diabetes care solutions.

Diabetes Management Devices Market Executive Summary

The Diabetes Management Devices Market is currently experiencing transformative business trends characterized by intense competitive innovation focused on user experience and data integration. The primary commercial shift involves the acceleration of the market penetration of Continuous Glucose Monitoring (CGM) systems, which are increasingly replacing traditional Self-Monitoring Blood Glucose (SMBG) devices due to their superior data density and ability to provide real-time, predictive glucose readings. Companies are heavily investing in integrating AI and machine learning capabilities into both CGM and insulin pump technologies, moving towards fully automated, closed-loop delivery systems that significantly reduce the burden of diabetes self-management. Business models are evolving to emphasize subscription services and data analytics platforms, creating recurring revenue streams and strengthening the linkage between technology providers and clinical outcomes.

Regionally, North America maintains its dominance due to high disposable income, well-established reimbursement frameworks, and rapid adoption of cutting-edge medical technologies. However, the Asia Pacific (APAC) region is poised to become the fastest-growing market segment, driven by the massive underlying patient population in countries like China and India, increasing healthcare infrastructure development, and growing awareness regarding advanced diabetes care. European markets exhibit robust growth, supported by national healthcare systems that prioritize chronic disease prevention and management, ensuring broad access to high-cost devices like insulin pumps and professional-grade CGM. The Middle East and Latin America are also showing increased market activity as healthcare reforms improve access to specialized care, particularly targeting urban populations with high diabetes prevalence.

Segment trends overwhelmingly favor smart and connected devices. Within device segmentation, CGM holds a burgeoning market share, fueled by expanding indications for Type 2 non-insulin-dependent patients and improved affordability. Insulin delivery systems are transitioning rapidly from traditional syringes and pens to sophisticated smart pens and patch pumps, which offer precision dosing and integration with monitoring data. The end-user segment demonstrates a noticeable trend towards home care settings, reflecting the shift towards decentralized healthcare models where patients actively manage their condition outside of conventional clinical environments. This decentralization necessitates robust, consumer-grade technology that is intuitive and provides actionable insights directly to the user.

AI Impact Analysis on Diabetes Management Devices Market

User queries regarding the impact of Artificial Intelligence (AI) on the Diabetes Management Devices Market predominantly revolve around three critical themes: the future of closed-loop systems, the accuracy and reliability of predictive algorithms, and the implications for data privacy and security. Users are keenly interested in how AI can transition current hybrid closed-loop systems into true artificial pancreases, offering completely autonomous insulin delivery. They frequently question the predictive power of AI models in anticipating glycemic variability and minimizing both hypo- and hyperglycemia. Furthermore, given the highly sensitive nature of continuous health data collected by these devices, significant concerns are raised about the security of cloud-based data storage and the ethical governance of AI-driven personalized treatment recommendations, ensuring that technology enhances, rather than dictates, clinical autonomy.

AI’s influence is profound, fundamentally transforming device functionality from simple data collection tools into sophisticated decision support systems. Machine learning algorithms analyze vast datasets—including glucose readings, insulin doses, physical activity, and dietary input—to generate personalized models of insulin sensitivity and carbohydrate ratios. This enables predictive alerts, offering patients a critical window to intervene before a crisis occurs. For instance, AI-driven predictive algorithms are now capable of forecasting hypoglycemia up to 30–60 minutes in advance with high specificity, dramatically improving safety and reducing patient anxiety associated with blood sugar excursions. This level of personalization is crucial for optimizing time-in-range (TIR) metrics, which is becoming the standard measure of successful diabetes management.

The most immediate commercial impact of AI is seen in the advancement of Automated Insulin Delivery (AID) systems. AI algorithms serve as the 'brains' of these closed-loop systems, constantly adjusting insulin basal rates and correction doses in response to real-time glucose fluctuations, aiming for near-normoglycemia. Beyond automated dosing, AI is optimizing the manufacturing and calibration of sensors, reducing drift, and improving sensor longevity. Furthermore, AI applications extend to clinical decision support for healthcare professionals, streamlining the interpretation of complex patient data gathered over weeks or months, thereby facilitating more efficient and accurate adjustments to long-term treatment protocols during clinical visits.

- Enhanced Predictive Analytics: AI algorithms forecast glucose trends to prevent hypo/hyperglycemia.

- Automated Insulin Delivery (AID): Core driver of closed-loop systems and artificial pancreas technology.

- Personalized Treatment Protocols: Machine learning tailors insulin delivery rates based on individual physiological responses and lifestyle data.

- Sensor Accuracy Improvement: AI optimizes sensor calibration and compensates for biological variances.

- Streamlined Clinical Interpretation: AI synthesizes large datasets (e.g., Ambulatory Glucose Profile) for efficient clinical review.

- Telehealth Optimization: AI facilitates remote patient monitoring and alerts for proactive clinical intervention.

DRO & Impact Forces Of Diabetes Management Devices Market

The Diabetes Management Devices Market is shaped by dynamic interactions among powerful drivers, persistent restraints, and compelling opportunities, all contributing to significant market impact forces. The dominant driver is the escalating global prevalence of both Type 1 and Type 2 diabetes, fueled by aging populations, sedentary lifestyles, and dietary shifts in rapidly developing nations. This epidemiological trend ensures a continually expanding patient base requiring proactive management tools. Simultaneously, the accelerating pace of technological innovation, particularly in the development of minimally invasive or non-invasive glucose monitoring techniques and highly sophisticated, interoperable automated insulin delivery (AID) systems, serves as a crucial market impetus, offering safer and more effective therapeutic options that enhance patient compliance and clinical outcomes.

However, the market expansion faces significant restraints, primarily centered around the high cost associated with advanced devices, such as CGM systems and insulin pumps, and the subsequent challenges related to inconsistent or insufficient reimbursement policies across various global jurisdictions. Even where these devices are approved, coverage limitations often restrict access to broad patient groups, particularly in lower- and middle-income countries. Furthermore, despite improvements, complexity in device operation, technological literacy barriers among certain patient demographics (especially the elderly), and issues pertaining to cybersecurity and data integrity for connected devices pose ongoing challenges that regulatory bodies and manufacturers must continually address to ensure mass market acceptance and trust. The need for specialized training for healthcare providers to effectively utilize and interpret data from these advanced systems also represents a bottleneck in widespread clinical adoption.

The key opportunities lie in the expansion into untapped emerging markets, particularly within the APAC region, where urbanization and economic growth are creating a massive, addressable patient population ready for modern care solutions, provided affordability challenges can be overcome through localized manufacturing or subsidized programs. The integration of diabetes management devices with the broader digital health ecosystem, including telemedicine and electronic health records (EHRs), offers a robust avenue for growth, enabling seamless data flow between patients, providers, and payers, which promises to revolutionize disease management efficiency. Furthermore, the burgeoning focus on preventive care and the potential for these devices to be utilized in pre-diabetes identification and lifestyle intervention programs present a significant commercial opportunity beyond traditional chronic disease management.

Segmentation Analysis

The segmentation of the Diabetes Management Devices Market provides a nuanced understanding of product adoption rates, end-user preferences, and geographic concentration of demand. The market is primarily segmented based on the type of device, encompassing the dichotomy between monitoring and delivery systems, the end-user setting where these devices are utilized (e.g., hospitals vs. home care), and the distribution channels facilitating their acquisition. Continuous Glucose Monitoring (CGM) systems constitute the most dynamic segment under device type, registering rapid growth driven by superior accuracy, patient preference for less finger-pricking, and expanding insurance coverage for Type 2 patients not dependent on insulin. This contrasts with the slower, yet stable, growth observed in the traditional Self-Monitoring Blood Glucose (SMBG) segment, which still holds dominance in developing economies due to lower initial investment costs.

Within the insulin delivery segment, the transition from conventional injection devices to highly advanced, smart insulin pumps and patch pumps is highly evident. These automated delivery systems are favored in developed markets, offering precise basal and bolus delivery profiles and seamless integration with CGM data, forming the backbone of closed-loop systems. Conversely, standard insulin pens and syringes remain critical components of treatment in regions where cost sensitivity is high, or where infrastructure for pump training and maintenance is lacking. The segmentation by end-user strongly indicates a migration of care from traditional clinical settings to the home care environment, necessitating robust, consumer-friendly, and highly durable devices designed for daily self-management and remote connectivity.

The market's structural evolution is heavily influenced by the interplay between technological maturity and accessibility. Manufacturers are focusing on developing products that cater to distinct sub-segments, such as disposable patch pumps for convenience or professional CGM devices for diagnostic purposes in clinics. The emphasis on connectivity has also created a crucial sub-segment around software and data management platforms, which are essential for maximizing the utility of the hardware. This granular segmentation allows stakeholders, including healthcare providers and policymakers, to tailor technology adoption and reimbursement strategies to specific patient needs, thereby optimizing resource allocation and improving overall diabetes care efficiency.

- By Device Type:

- Monitoring Devices:

- Continuous Glucose Monitoring (CGM) Systems

- Self-Monitoring Blood Glucose (SMBG) Meters

- Lancets and Test Strips

- Insulin Delivery Devices:

- Insulin Pumps (Tethered and Patch Pumps)

- Insulin Pens (Reusable and Disposable, Smart Pens)

- Syringes

- Monitoring Devices:

- By End-User:

- Hospitals & Clinics

- Home Care Settings

- Diagnostic Centers & Research Labs

- By Distribution Channel:

- Retail Pharmacies

- Hospital Pharmacies

- Online Pharmacies & E-commerce

Value Chain Analysis For Diabetes Management Devices Market

The value chain for the Diabetes Management Devices Market begins with the upstream segment, which involves the sourcing and processing of highly specialized raw materials and electronic components. This includes biosensors, polymer materials for device casing, microprocessors, and battery technology required for miniature, portable, and implantable devices like CGM sensors and insulin pump mechanisms. Key activities in this stage involve rigorous quality control, ensuring biocompatibility of materials, and establishing reliable supply chains for critical, often proprietary, sensor chemistries. Reliability and consistent supply are paramount, as disruptions in components like microchips or specialized polymers can directly halt the sophisticated manufacturing processes downstream.

The midstream segment is dominated by device manufacturing, assembly, and rigorous testing. This stage includes the complex integration of mechanical, electronic, and software components, ensuring regulatory compliance (e.g., FDA, CE Mark). Manufacturing processes are characterized by high capital investment in precision engineering and cleanroom environments, particularly for sterile insulin delivery components and highly sensitive glucose sensor production. Following production, products move through validation, packaging, and labeling. The development of accompanying software platforms, often involving cloud infrastructure for data storage and analysis, is also a critical midstream function that determines the device's market competitiveness and user experience.

The downstream activities involve distribution and final delivery to the end-users. Distribution channels are varied, including direct sales to large hospital networks and diabetes clinics, distribution through established medical device wholesalers and retail pharmacy chains, and increasingly, direct-to-consumer models facilitated by online pharmacies and e-commerce platforms, especially for consumable components like test strips and sensor replacements. Direct channels often serve high-volume customers and facilitate necessary technical support and training for complex devices like pumps. Indirect channels (retail and online pharmacies) offer broad accessibility, particularly for routine replacements, simplifying the procurement process for patients managing their condition primarily from home. Effective downstream management requires robust logistics and sophisticated inventory tracking to ensure product availability and cold chain maintenance where necessary.

Diabetes Management Devices Market Potential Customers

The primary customer base for the Diabetes Management Devices Market consists of the vast global population diagnosed with chronic diabetes, spanning both Type 1 Diabetes Mellitus (T1DM) and Type 2 Diabetes Mellitus (T2DM). T1DM patients, who are insulin-dependent, represent a core, high-priority segment for advanced technologies like insulin pumps and Continuous Glucose Monitoring (CGM) systems, as these devices are essential for survival and achieving tight glycemic control. The need for precise, continuous monitoring and automated delivery drives their adoption of premium, sophisticated devices. The T2DM population, which represents the overwhelming majority of diabetes cases globally, constitutes a rapidly expanding customer base for diabetes management devices, especially as T2DM progression increasingly requires insulin therapy and intensive monitoring to prevent severe complications, thereby fueling demand for SMBG and, increasingly, professional and personal CGM systems.

Beyond individual patients, key organizational customers include hospitals, specialized diabetes clinics, and general primary care centers. Hospitals and specialized clinics are crucial end-users, adopting professional-grade CGM devices for diagnostic purposes, optimizing inpatient glycemic management, and training patients on new self-management technologies before discharge. These institutional customers often purchase devices and consumables in bulk, influenced heavily by clinical efficacy data, total cost of ownership, and integration capabilities with existing hospital information systems (HIS) and Electronic Health Records (EHR). The adoption of automated insulin delivery systems in hospital settings is also increasing to minimize medication errors and improve patient safety during critical care.

A burgeoning potential customer segment involves healthcare payers and providers focusing on population health management and preventative care. Insurance companies and government health schemes, while often acting as economic gatekeepers through reimbursement policies, are increasingly recognizing the long-term cost savings associated with improved glycemic control achieved through advanced devices. By investing in widespread access to monitoring and delivery tools, they aim to reduce costly emergency room visits and hospitalizations resulting from diabetes-related complications. Furthermore, organizations involved in clinical trials and medical research also serve as high-value, albeit smaller, customers, utilizing these devices for collecting precise, real-time physiological data to advance pharmacological and technological treatments for diabetes.

| Report Attributes | Report Details |

|---|---|

| Market Size in 2026 | $21.5 Billion |

| Market Forecast in 2033 | $45.1 Billion |

| Growth Rate | CAGR 10.8% |

| Historical Year | 2019 to 2024 |

| Base Year | 2025 |

| Forecast Year | 2026 - 2033 |

| DRO & Impact Forces |

|

| Segments Covered |

|

| Key Companies Covered | Medtronic, Abbott Laboratories, DexCom, Roche Diagnostics, Tandem Diabetes Care, Insulet Corporation, Johnson & Johnson, Becton, Dickinson and Company, Ypsomed AG, Ascensia Diabetes Care, Novo Nordisk, Eli Lilly and Company, Sanofi, Senseonics, ACON Laboratories, Terumo Corporation, Arkray Inc., Lifescan, Omnipod, Beta Bionics. |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Enquiry Before Buy | Have specific requirements? Send us your enquiry before purchase to get customized research options. Request For Enquiry Before Buy |

Diabetes Management Devices Market Key Technology Landscape

The technological landscape of the Diabetes Management Devices Market is defined by three major thrusts: advanced sensor development, sophisticated automated delivery systems, and enhanced digital connectivity. Sensor technology has progressed significantly from electrochemical methods to minimally invasive continuous glucose monitoring (CGM) sensors that offer accuracy comparable to blood-draw lab tests (MARD < 9%). Current research focuses on improving sensor longevity, reducing calibration requirements, and exploring true non-invasive glucose monitoring techniques, such as optical or spectroscopic methods, which promise to eliminate physical penetration entirely. Furthermore, integration of new materials and algorithms aims to minimize sensor drift and interference from common medications like acetaminophen, ensuring reliable, continuous data streams crucial for effective management.

Insulin delivery technology is rapidly converging toward Closed-Loop Systems (CLS), often referred to as the Artificial Pancreas. These systems integrate a CGM, an insulin pump, and a control algorithm (often AI-driven) that mimics the function of a healthy pancreas by automatically adjusting insulin delivery in real-time based on predicted glucose levels. Key technological developments include hybrid closed-loop systems, which require manual input for meals, evolving into fully automated, tubeless patch pump designs that enhance portability and discretion. Research is also accelerating in dual-hormone pumps that deliver both insulin and glucagon, offering enhanced protection against hypoglycemia and potentially tighter glycemic control than insulin-only systems.

Digitalization and connectivity represent the pervasive technological overlay across the market. Modern diabetes devices are intrinsically linked to the Internet of Medical Things (IoMT) via Bluetooth and Wi-Fi capabilities, facilitating seamless data transfer to cloud platforms and patient/provider applications. This connectivity supports robust remote patient monitoring (RPM) and telehealth services, enabling healthcare providers to review glucose data, adherence patterns, and time-in-range metrics without requiring in-person visits. Furthermore, sophisticated software interfaces utilize big data analytics to generate actionable insights, improving personalized therapy adjustments and fostering greater patient engagement through gamification and motivational feedback loops, thus making self-care regimens more manageable and effective.

Regional Highlights

The North American region, particularly the United States and Canada, currently dominates the global Diabetes Management Devices Market share, characterized by high penetration rates of premium devices like CGM and insulin pumps. This dominance is underpinned by robust healthcare infrastructure, substantial public and private expenditure on chronic disease management, and favorable, albeit complex, reimbursement landscapes that increasingly cover advanced technological solutions. Early and aggressive adoption of cutting-edge innovations, coupled with the presence of major industry players and significant R&D investment, ensures this region remains the epicenter for market launch and technology commercialization. The high prevalence of both Type 1 and Type 2 diabetes and the strong cultural acceptance of self-management technology further solidify its leading position.

Europe represents a mature market with high technological uptake, driven by strong public healthcare systems that emphasize standardized care protocols and effective management of chronic conditions. Countries such as Germany, the UK, and France show significant adoption of both monitoring and delivery devices, supported by comprehensive national reimbursement schemes. The European market is distinct due to its stringent regulatory environment (MDR) and a preference for proven, evidence-based technologies. Growth in this region is steady, fueled by increasing awareness campaigns and a push towards integrated care models that utilize remote monitoring capabilities to manage aging populations afflicted by diabetes and co-morbidities.

The Asia Pacific (APAC) region is projected to exhibit the highest Compound Annual Growth Rate (CAGR) throughout the forecast period. This rapid growth is propelled by the sheer size of the diabetic population in key countries like China and India, rapidly improving healthcare access, and rising disposable incomes that are making advanced devices increasingly affordable. While traditional SMBG devices still form the bulk of the market, there is a significant, accelerated shift towards CGM systems, particularly in urban centers. Market penetration is often characterized by strategies focused on affordability and localized manufacturing to overcome importation costs. The regulatory environment is maturing across several APAC nations, simplifying market entry for international players and fostering domestic innovation, creating a highly competitive and dynamic growth frontier for diabetes technologies.

- North America: Market leader due to high adoption of advanced technologies, strong reimbursement policies, and significant healthcare spending. Key focus on closed-loop systems and telemedicine integration.

- Europe: Mature market with high penetration, supported by comprehensive public healthcare and strong regulatory frameworks prioritizing standardized chronic care management.

- Asia Pacific (APAC): Fastest-growing region, driven by massive patient volume (especially China and India), improving economic conditions, and increasing awareness leading to rapid adoption of CGM technology.

- Latin America (LATAM): Emerging market demonstrating incremental growth, focused mainly on basic monitoring devices, with pockets of high-tech adoption in urban centers like Brazil and Mexico.

- Middle East and Africa (MEA): Growth driven by rising diabetes prevalence in affluent Gulf nations (GCC countries) and improving healthcare access; often relies on imported premium devices.

Top Key Players

The market research report includes a detailed profile of leading stakeholders in the Diabetes Management Devices Market.- Medtronic plc

- Abbott Laboratories

- DexCom Inc.

- Roche Diagnostics (A Division of F. Hoffmann-La Roche Ltd)

- Tandem Diabetes Care Inc.

- Insulet Corporation

- Johnson & Johnson (LifeScan, now independent/Ascensia Diabetes Care)

- Becton, Dickinson and Company (BD)

- Ypsomed AG

- Ascensia Diabetes Care Holdings AG

- Novo Nordisk A/S

- Eli Lilly and Company

- Sanofi S.A.

- Senseonics Holdings Inc.

- ACON Laboratories Inc.

- Terumo Corporation

- Arkray Inc.

- Microlife Corporation

- Beta Bionics Inc.

- Glooko Inc. (Software/Data Management)

Frequently Asked Questions

Analyze common user questions about the Diabetes Management Devices market and generate a concise list of summarized FAQs reflecting key topics and concerns.What is the primary factor driving the growth of the Diabetes Management Devices Market?

The central driver is the rapidly increasing global prevalence of diabetes (both Type 1 and Type 2), coupled with continuous technological advancements, particularly in Continuous Glucose Monitoring (CGM) and Automated Insulin Delivery (AID) systems, which offer superior glycemic control and quality of life improvements.

Which segment of the Diabetes Management Devices Market is growing the fastest?

The Continuous Glucose Monitoring (CGM) segment is exhibiting the fastest growth. This is due to its clinical advantages over traditional blood glucose meters, expanding insurance coverage, and its integral role in enabling automated, closed-loop insulin delivery systems.

How is Artificial Intelligence (AI) being utilized in diabetes management devices?

AI is primarily used in control algorithms for Automated Insulin Delivery (AID) systems to predict glucose fluctuations and adjust insulin dosing automatically. It also enhances predictive analytics, improves sensor accuracy, and aids in personalized treatment recommendations for patients and clinicians.

What is the largest regional market for diabetes management devices?

North America currently holds the largest market share, driven by high disposable income, established and favorable reimbursement policies for advanced technologies, and a strong concentration of key market players focused on innovation and aggressive commercialization.

What are the main restraints impacting the widespread adoption of advanced diabetes devices?

Key restraints include the high initial cost of advanced devices such as insulin pumps and CGM systems, inconsistent or restrictive public and private reimbursement policies across different geographies, and challenges related to patient training and technological literacy, particularly in emerging markets.

To check our Table of Contents, please mail us at: sales@marketresearchupdate.com

Research Methodology

The Market Research Update offers technology-driven solutions and its full integration in the research process to be skilled at every step. We use diverse assets to produce the best results for our clients. The success of a research project is completely reliant on the research process adopted by the company. Market Research Update assists its clients to recognize opportunities by examining the global market and offering economic insights. We are proud of our extensive coverage that encompasses the understanding of numerous major industry domains.

Market Research Update provide consistency in our research report, also we provide on the part of the analysis of forecast across a gamut of coverage geographies and coverage. The research teams carry out primary and secondary research to implement and design the data collection procedure. The research team then analyzes data about the latest trends and major issues in reference to each industry and country. This helps to determine the anticipated market-related procedures in the future. The company offers technology-driven solutions and its full incorporation in the research method to be skilled at each step.

The Company's Research Process Has the Following Advantages:

- Information Procurement

The step comprises the procurement of market-related information or data via different methodologies & sources.

- Information Investigation

This step comprises the mapping and investigation of all the information procured from the earlier step. It also includes the analysis of data differences observed across numerous data sources.

- Highly Authentic Source

We offer highly authentic information from numerous sources. To fulfills the client’s requirement.

- Market Formulation

This step entails the placement of data points at suitable market spaces in an effort to assume possible conclusions. Analyst viewpoint and subject matter specialist based examining the form of market sizing also plays an essential role in this step.

- Validation & Publishing of Information

Validation is a significant step in the procedure. Validation via an intricately designed procedure assists us to conclude data-points to be used for final calculations.

×

Request Free Sample:

Related Reports

Select License

Why Choose Us

We're cost-effective and Offered Best services:

We are flexible and responsive startup research firm. We adapt as your research requires change, with cost-effectiveness and highly researched report that larger companies can't match.

Information Safety

Market Research Update ensure that we deliver best reports. We care about the confidential and personal information quality, safety, of reports. We use Authorize secure payment process.

We Are Committed to Quality and Deadlines

We offer quality of reports within deadlines. We've worked hard to find the best ways to offer our customers results-oriented and process driven consulting services.

Our Remarkable Track Record

We concentrate on developing lasting and strong client relationship. At present, we hold numerous preferred relationships with industry leading firms that have relied on us constantly for their research requirements.

Best Service Assured

Buy reports from our executives that best suits your need and helps you stay ahead of the competition.

Customized Research Reports

Our research services are custom-made especially to you and your firm in order to discover practical growth recommendations and strategies. We don't stick to a one size fits all strategy. We appreciate that your business has particular research necessities.

Service Assurance

At Market Research Update, we are dedicated to offer the best probable recommendations and service to all our clients. You will be able to speak to experienced analyst who will be aware of your research requirements precisely.

Contact With Our Sales Team

Customer Testimonials

The content of the report is always up to the mark. Good to see speakers from expertise authorities.

Privacy requested , Managing Director

A lot of unique and interesting topics which are described in good manner.

Privacy requested, President

Well researched, expertise analysts, well organized, concrete and current topics delivered in time.

Privacy requested, Development Manager