Diamond Optical Windows Market Size, By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2026 to 2033 (Financial Impact Analysis)

ID : MRU_ 440850 | Date : Feb, 2026 | Pages : 246 | Region : Global | Publisher : MRU

Diamond Optical Windows Market Size

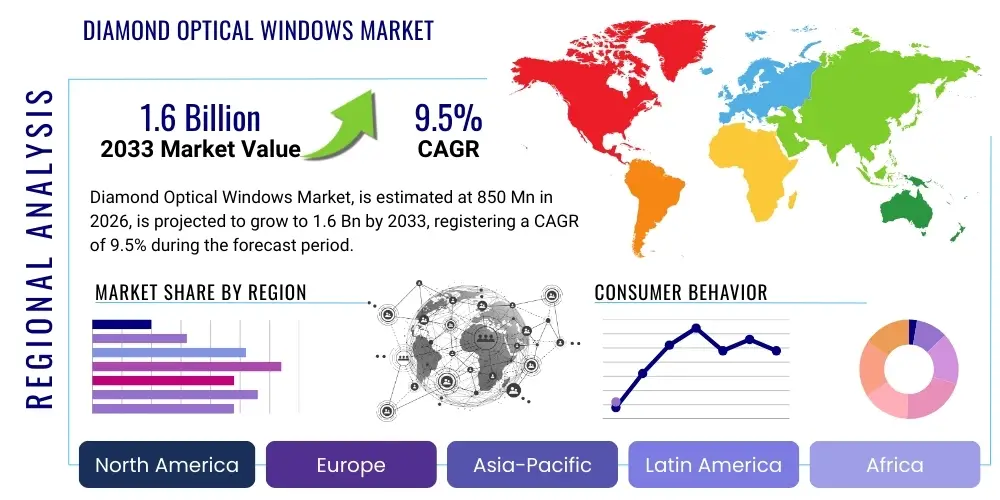

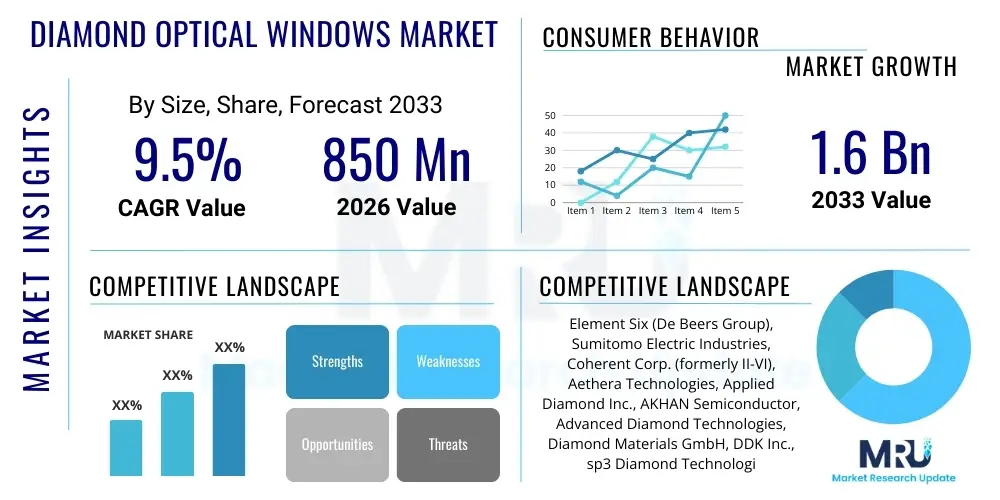

The Diamond Optical Windows Market is projected to grow at a Compound Annual Growth Rate (CAGR) of 9.5% between 2026 and 2033. The market is estimated at USD 850 million in 2026 and is projected to reach USD 1.6 billion by the end of the forecast period in 2033.

Diamond Optical Windows Market introduction

The Diamond Optical Windows Market is a highly specialized and technologically advanced segment within the broader photonics and optics industry, focusing on the production and application of windows made from synthetic diamond materials. These windows are critical components in a myriad of high-performance optical systems where extreme properties are required, surpassing the capabilities of conventional optical materials like fused silica, sapphire, or silicon. Diamond optical windows are essentially transparent or semi-transparent plates, typically with precisely polished surfaces, designed to transmit specific wavelengths of electromagnetic radiation while offering unparalleled resistance to heat, abrasion, chemical corrosion, and radiation damage. Their unique combination of highest thermal conductivity, exceptional hardness, broad spectral transparency (from UV to far-IR), and chemical inertness makes them indispensable in environments that would degrade or destroy other optical materials. The product primarily includes various forms of synthetic diamond, such as Chemical Vapor Deposition (CVD) diamond, High-Pressure/High-Temperature (HPHT) diamond, and polycrystalline diamond, each tailored for specific performance characteristics and cost considerations. The manufacturing processes for these windows are complex and highly specialized, involving sophisticated growth techniques, precision cutting, and advanced polishing methods to achieve the stringent optical and mechanical tolerances required for their intended applications.

Major applications for diamond optical windows span a diverse range of high-tech sectors, reflecting the material's superior performance attributes. In the realm of high-power lasers, these windows serve as output couplers or protective covers, enduring extreme thermal loads and high optical fluence without degradation, which is crucial for industrial cutting, welding, and scientific research lasers. The defense and aerospace industries utilize them in missile domes, infrared countermeasures, and sensor windows, where resistance to harsh environmental conditions, high-speed impacts, and thermal shock is paramount. The burgeoning semiconductor manufacturing sector employs diamond windows in lithography systems and plasma etching equipment, leveraging their durability and transparency for precise material processing. Furthermore, scientific research benefits immensely from diamond windows in spectroscopy, particle accelerators, and high-pressure experimental cells, enabling studies under extreme conditions. Medical devices, particularly those involving laser surgery or diagnostic imaging, are also incorporating diamond windows for enhanced precision and sterilization capabilities. The benefits derived from using diamond optical windows are substantial and directly impact system performance, longevity, and reliability. These include superior thermal management due to diamond's unmatched thermal conductivity, allowing for operation at higher power densities without thermal lensing or catastrophic failure. Their extreme hardness and chemical inertness provide exceptional scratch resistance and corrosion protection, extending the lifespan of optical systems in abrasive or corrosive environments. Broad spectral transparency enables their use across a wide range of wavelengths, simplifying system design and reducing component count. The low coefficient of thermal expansion ensures optical stability even under rapid temperature fluctuations. Ultimately, these benefits translate into improved system efficiency, reduced maintenance costs, and expanded operational envelopes for critical technologies.

The market is predominantly driven by the escalating demand for high-power laser systems across industrial, scientific, and defense applications. As lasers become more powerful and precise, the need for robust optical components that can withstand extreme conditions intensifies, positioning diamond as the material of choice. The rapid advancements in semiconductor manufacturing, particularly the shift towards smaller nodes and more complex fabrication processes, necessitate optical windows that can endure plasma environments and high temperatures while maintaining optical integrity. Furthermore, increased investment in defense and aerospace technologies, driven by global security concerns and the development of next-generation missile and surveillance systems, fuels the demand for high-performance, durable optical components. Growth in scientific research, especially in fields like high-energy physics, materials science, and quantum computing, where experimental conditions often push the limits of conventional materials, also contributes significantly to market expansion. Technological advancements in diamond synthesis, particularly in CVD techniques, have made it possible to produce larger, higher-quality, and more cost-effective diamond material, expanding its applicability. Lastly, the inherent advantages of diamond – its unparalleled combination of thermal, mechanical, and optical properties – continue to solidify its position as a preferred material in demanding optical applications, driving consistent market growth and innovation. These factors collectively underpin the positive trajectory of the Diamond Optical Windows Market, as industries increasingly recognize the value proposition of this advanced material.

Diamond Optical Windows Market Executive Summary

The Diamond Optical Windows Market is experiencing robust growth, driven by an accelerating demand for high-performance optical components across several critical industries. Business trends indicate a strong focus on enhancing manufacturing scalability and reducing production costs through advancements in Chemical Vapor Deposition (CVD) techniques, making diamond windows more accessible for a wider range of applications. There is also a growing trend towards customization, with manufacturers offering bespoke solutions to meet the specific wavelength, power handling, and environmental requirements of niche applications. Strategic partnerships between diamond material suppliers, optical component fabricators, and end-system integrators are becoming more prevalent, aimed at accelerating product development and market penetration. Furthermore, increased R&D investment is evident, particularly in developing larger aperture windows and integrating anti-reflective coatings directly onto diamond surfaces to minimize losses and enhance performance. Sustainability considerations are also beginning to influence business strategies, with an emphasis on energy-efficient manufacturing processes and the lifecycle management of diamond products.

Regional trends highlight North America and Europe as established leaders in the Diamond Optical Windows Market, largely due to strong defense spending, advanced aerospace industries, and significant investments in scientific research and high-power laser technologies. These regions benefit from a robust ecosystem of research institutions, technology developers, and end-users that foster innovation and demand for cutting-edge optical solutions. The Asia Pacific region, particularly China, Japan, and South Korea, is emerging as a significant growth engine, fueled by its rapidly expanding semiconductor manufacturing sector, burgeoning industrial laser market, and increasing governmental investment in advanced materials research. This region is witnessing a surge in both production capabilities and end-user adoption, driven by industrialization and technological advancements. Latin America, the Middle East, and Africa are showing nascent but promising growth, primarily influenced by investments in defense modernizations and diversification efforts in industrial sectors, although their market share remains comparatively smaller. The competitive landscape is characterized by a mix of large, established material science companies and specialized photonics firms, all vying for market leadership through technological differentiation and strategic market positioning.

Segmentation trends reveal that the CVD diamond segment dominates the market, primarily due to its ability to produce large-area, high-purity diamond material suitable for a wide array of optical applications, offering a balance of performance and cost-effectiveness. The HPHT diamond segment, while smaller, continues to serve niche applications requiring specific crystalline properties or smaller form factors. Application-wise, high-power lasers and defense & aerospace sectors remain the largest consumers, driven by the critical need for extreme durability and thermal management. However, the semiconductor manufacturing segment is exhibiting the fastest growth, propelled by the relentless demand for precision etching and lithography processes. Scientific research and medical device applications are also showing steady growth, expanding the market's reach into new domains. The end-user segmentation mirrors these trends, with industrial and defense end-users constituting the largest shares, while R&D and medical sectors represent significant growth opportunities. Overall, the market's trajectory is upward, propelled by its indispensable role in enabling advanced technologies across multiple high-stakes industries, demonstrating its strategic importance in the global technology landscape.

AI Impact Analysis on Diamond Optical Windows Market

User questions regarding the impact of AI on the Diamond Optical Windows Market predominantly revolve around how artificial intelligence can optimize manufacturing processes, enhance product quality and performance, and unlock new application areas. Common queries include the potential for AI-driven automation in diamond synthesis and fabrication, the role of machine learning in defect detection and quality control, and the possibilities of AI in designing novel diamond structures or integrated optical systems. Users are also keen to understand how AI can improve the predictive maintenance and lifetime assessment of diamond windows in harsh environments, and if AI will lead to more cost-effective production methods. There's also an interest in how AI could accelerate research and development, potentially discovering new material properties or optimizing existing ones for specific optical requirements. The overarching themes are efficiency, precision, innovation, and cost reduction, reflecting a strong expectation that AI will be a transformative force in both the production and application of diamond optical windows, leading to higher performance products and smarter manufacturing paradigms.

- AI-powered process optimization in CVD and HPHT diamond growth, leading to enhanced material purity, uniformity, and reduced growth times, thereby increasing manufacturing efficiency and yield.

- Advanced defect detection and classification using machine learning algorithms during the inspection phase, identifying microscopic flaws that are challenging for human operators to spot, ensuring superior optical quality.

- Predictive analytics for equipment maintenance in diamond processing facilities, minimizing downtime and optimizing operational costs by forecasting potential failures before they occur.

- AI-driven design and simulation of diamond window geometries and coatings, accelerating the development of application-specific windows with optimized optical performance, thermal management, and stress distribution.

- Robotics and automation integration, guided by AI, for precision cutting, polishing, and surface finishing of diamond materials, achieving tighter tolerances and greater repeatability.

- Enhanced quality control systems utilizing computer vision and AI for real-time monitoring of surface roughness, flatness, and parallelism, ensuring adherence to stringent specifications.

- Optimization of material handling and inventory management within the supply chain, leveraging AI to predict demand and streamline logistics for diamond precursors and finished products.

- Development of smart diamond windows with embedded AI capabilities for real-time environmental sensing or self-monitoring of optical performance degradation in critical applications.

- Accelerated discovery of new diamond-like materials or hybrid composites with tailored optical properties through AI-assisted materials science research and high-throughput experimentation.

- Improved data analysis from experimental setups in scientific research using diamond windows, extracting deeper insights and accelerating discoveries in fields like high-energy physics or quantum optics.

DRO & Impact Forces Of Diamond Optical Windows Market

The Diamond Optical Windows Market is significantly shaped by a dynamic interplay of drivers, restraints, and opportunities, all influenced by various impact forces that determine its growth trajectory and evolutionary path. A primary driver is the burgeoning demand for high-power laser systems across industrial, defense, and scientific applications. As laser technology advances, requiring greater power output and precision, the indispensable thermal and mechanical properties of diamond make it the material of choice for optical components that can withstand extreme energy densities without degradation. The relentless miniaturization and increasing complexity in semiconductor manufacturing also fuel demand, as diamond windows are crucial for lithography and plasma etching equipment that operate in harsh environments. Furthermore, robust investments in defense and aerospace sectors globally, aimed at developing advanced missile guidance systems, surveillance technologies, and directed energy weapons, necessitate diamond's superior durability and transparency. Growing R&D activities in emerging fields such as quantum computing, THz technology, and advanced medical diagnostics, where diamond's unique attributes offer unparalleled performance, also act as significant drivers. The inherent benefits of diamond, including its exceptional thermal conductivity, hardness, broad spectral transparency, and chemical inertness, collectively solidify its irreplaceable position in these demanding applications. These factors converge to create a strong pull for diamond optical windows, as industries strive for higher performance, greater reliability, and extended component lifespans in their cutting-edge systems.

Despite these powerful drivers, the market faces notable restraints that can impede its growth. The high manufacturing cost associated with producing high-quality synthetic diamond materials, especially large-area, single-crystal diamond, remains a significant barrier. The complexity of diamond synthesis techniques, particularly Chemical Vapor Deposition (CVD), requires specialized equipment and expertise, contributing to elevated production expenses. Furthermore, the limited availability of large-size, high-purity diamond substrates, free from crystalline defects, poses a challenge for certain advanced applications requiring larger aperture windows. Fabrication processes, including precision cutting, grinding, and polishing of ultra-hard diamond, are inherently difficult, time-consuming, and expensive, demanding specialized tools and skilled technicians. Competition from alternative optical materials, such as sapphire, silicon carbide, zinc sulfide, and fused silica, which are often more cost-effective for less extreme applications, also presents a restraint, especially where the unique properties of diamond are not strictly mandatory. The long lead times for custom diamond window orders and the specialized supply chain infrastructure further add to the complexities, making quick scaling challenging. These restraints necessitate ongoing research into cost reduction strategies, improved synthesis yields, and more efficient fabrication methods to broaden market accessibility.

Opportunities for growth in the Diamond Optical Windows Market are abundant and diverse, driven by technological advancements and the exploration of new application frontiers. The emergence of quantum computing and quantum communication technologies presents a fertile ground for diamond optics, particularly for components operating at cryogenic temperatures or requiring specific quantum properties. Advancements in THz (terahertz) technology, for applications in imaging, sensing, and communication, are increasingly leveraging diamond for its low absorption and dispersion in the THz range. The expanding field of medical imaging and laser surgery, where diamond windows offer enhanced precision, durability, and sterilization capabilities, represents another significant growth avenue. Furthermore, the increasing complexity of space exploration missions and satellite technologies demands optical components that can withstand extreme radiation and thermal cycling, positioning diamond as a preferred material. The ongoing development of advanced anti-reflective coatings and integrated optical functionalities directly onto diamond surfaces offers opportunities for higher performance and more compact system designs. Miniaturization trends across various industries, coupled with the need for robust optical solutions in compact devices, also present opportunities for smaller, high-performance diamond windows. The underlying impact forces shaping this market include continuous technological advancements in diamond synthesis and fabrication, which are crucial for overcoming current cost and size limitations. Regulatory policies, especially in defense and aerospace, influencing material specifications and procurement, also play a role. Global economic conditions affect R&D spending and industrial investment, while geopolitical stability can impact supply chains and defense budgets. The interplay of these forces and the continuous innovation within the diamond materials science community will dictate the market's future expansion and its ability to penetrate new, high-value applications. The strategic importance of diamond as an enabling technology for next-generation systems ensures its continued relevance and growth potential.

Segmentation Analysis

The Diamond Optical Windows Market is comprehensively segmented to provide a detailed understanding of its various facets, allowing for precise market analysis and strategic planning. This segmentation typically categorizes the market based on the type of diamond material used, the specific application areas where these windows are deployed, and the end-user industries that procure them. Understanding these segments helps in identifying key growth drivers, niche opportunities, competitive landscapes, and the evolving needs of different customer bases. The technical characteristics of different diamond types, the specific requirements of high-tech applications, and the operational demands of various end-user sectors fundamentally shape the market's structure and dynamics, reflecting a highly specialized and technically driven industry.

- By Type

- Chemical Vapor Deposition (CVD) Diamond: Dominate due to scalability, ability to produce large areas, and tunable properties.

- High-Pressure/High-Temperature (HPHT) Diamond: Used for smaller, high-purity applications, sometimes offering superior crystal quality for specific needs.

- Polycrystalline Diamond: Lower cost, used in less stringent applications where high optical quality is secondary to mechanical robustness.

- By Application

- High-Power Lasers & Optics: Output couplers, beam dumps, protective covers, high-fluence environments.

- Defense & Aerospace: Missile domes, infrared countermeasures (IRCM), sensor windows, targeting systems in harsh environments.

- Semiconductor Manufacturing: Lithography systems, plasma etching equipment, material processing tools.

- Spectroscopy: Raman spectroscopy, FTIR, UV-Vis, IR spectroscopy for demanding sample environments.

- Scientific Research: Particle accelerators, high-pressure cells, vacuum windows, cryogenic optics.

- Medical Devices: Laser surgery, diagnostic imaging, medical probes.

- THz Applications: THz imaging, sensing, and communication systems.

- Other Applications: Synchrotron radiation facilities, environmental monitoring.

- By End-User Industry

- Industrial: Manufacturing (cutting, welding), material processing.

- Defense: Military and security applications.

- Aerospace: Satellite, spacecraft, and aircraft systems.

- Research & Development (R&D): Universities, government labs, corporate R&D centers.

- Medical: Hospitals, clinics, medical device manufacturers.

- Semiconductor: Chip manufacturers, equipment suppliers.

- Telecommunications: Fiber optics, high-speed data transmission.

- By Region

- North America

- Europe

- Asia Pacific (APAC)

- Latin America

- Middle East & Africa (MEA)

Value Chain Analysis For Diamond Optical Windows Market

The value chain for the Diamond Optical Windows Market is intricate, involving multiple specialized stages from raw material sourcing to end-user application, highlighting the highly technical and specialized nature of this industry. At the upstream end, the chain begins with the sourcing and purification of precursor materials required for synthetic diamond growth, primarily high-purity carbon sources (like methane for CVD) and specialized gases. This stage also includes the development and manufacturing of sophisticated diamond growth equipment, such as CVD reactors or HPHT presses, which are capital-intensive and require significant R&D. Key players at this stage include chemical suppliers and advanced equipment manufacturers. The next critical stage is the diamond synthesis itself, where raw diamond material is grown. This involves highly specialized processes like Chemical Vapor Deposition (CVD), which produces large-area polycrystalline or single-crystal diamond, or High-Pressure/High-Temperature (HPHT) synthesis, typically for smaller, high-purity crystals. This manufacturing phase is dominated by companies with deep material science expertise and significant investment in proprietary growth technologies. Stringent quality control measures are integrated throughout this stage to ensure material purity, crystalline quality, and optical properties meet the demanding specifications of end applications. The downstream analysis of the value chain focuses on the transformation of raw diamond material into finished optical windows and their subsequent integration into end systems. This involves precision fabrication processes, including laser cutting, grinding, and ultra-precision polishing to achieve the required optical flatness, parallelism, and surface finish. Following fabrication, optical coatings (e.g., anti-reflective coatings) may be applied to enhance performance for specific wavelengths. These processes require highly specialized machinery and skilled technicians. Subsequently, these finished diamond optical windows are either sold directly to Original Equipment Manufacturers (OEMs) who integrate them into their high-power lasers, defense systems, semiconductor tools, or scientific instruments, or they pass through various distribution channels.

The distribution channels for diamond optical windows are typically highly specialized, reflecting the niche nature of the product and the technical expertise required by customers. Direct sales channels are prevalent for large volume orders or highly customized solutions, where manufacturers work directly with major OEMs in defense, aerospace, or industrial laser sectors. This direct approach allows for close collaboration, ensuring that the optical windows are precisely tailored to the specific performance requirements of the end system. Manufacturers often employ dedicated sales teams with deep technical knowledge to engage with R&D departments and engineering teams of their clients, providing consulting and support throughout the design and integration phases. For smaller orders, specific regional markets, or specialized research institutions, indirect distribution channels are also utilized. This involves specialized distributors or sales agents who possess expertise in high-performance optical components and cater to a broader range of customers. These distributors often maintain inventories of standard diamond window sizes and specifications, offering quicker turnaround times for less custom requirements. They also play a crucial role in market penetration into new regions or smaller market segments where direct sales might not be cost-effective for the manufacturer. Both direct and indirect channels emphasize the importance of technical support, product knowledge, and reliability, given the critical nature of diamond optical windows in high-stakes applications. The value chain culminates with the end-users—ranging from industrial manufacturers leveraging high-power lasers for material processing, to defense contractors integrating advanced sensor windows, semiconductor companies utilizing diamond in lithography, and scientific researchers pushing the boundaries of experimental physics. Each stage of the value chain adds significant value through specialized knowledge, advanced technology, and rigorous quality control, ensuring the delivery of high-performance diamond optical windows that enable cutting-edge technologies across diverse industries.

Diamond Optical Windows Market Potential Customers

The potential customers for Diamond Optical Windows are primarily high-tech industries and research institutions that require optical components with extreme performance characteristics, often operating in harsh or demanding environments where conventional materials would fail. These end-users are driven by the need for unparalleled thermal management, exceptional durability, broad spectral transparency, and chemical inertness, which are intrinsic properties of diamond. The customer base is highly technical, often comprising engineers, scientists, and procurement specialists who understand the critical role these windows play in their sophisticated systems. They prioritize reliability, longevity, and precision, and are willing to invest in premium materials to achieve superior system performance and extended operational lifespans. This group of customers spans various sectors, each with distinct needs and application requirements, yet all united by their demand for the highest-performing optical solutions available on the market. Understanding their specific needs and pain points is crucial for market penetration and product development, enabling manufacturers to tailor solutions that directly address the most challenging optical and environmental requirements across diverse high-tech domains.

A significant segment of potential customers resides within the Industrial Manufacturing sector, particularly those involved in high-power laser applications for cutting, welding, drilling, and additive manufacturing. These industrial users require diamond windows for laser output couplers, protective covers, and beam delivery systems to maintain beam quality and prevent thermal distortion at very high power densities. The Defense and Aerospace industries represent another critical customer group, utilizing diamond windows in missile domes, infrared countermeasures (IRCM) systems, targeting pods, and space-based optical sensors. Their primary drivers are extreme environmental resilience, resistance to thermal shock, high-speed impact durability, and reliable performance in battlefield or extraterrestrial conditions. The Semiconductor Manufacturing sector is rapidly growing in its demand, with chip manufacturers and equipment suppliers requiring diamond windows for advanced lithography systems, plasma etching chambers, and chemical vapor deposition (CVD) tools. These applications necessitate extreme resistance to aggressive chemical environments, high temperatures, and energetic plasmas, along with precise optical transmission for micron-level patterning. The Scientific Research and Development (R&D) community, encompassing universities, government laboratories, and corporate R&D centers, is a consistent customer for diamond windows. Researchers utilize these windows in high-pressure physics experiments, particle accelerators, synchrotron light sources, extreme UV (EUV) and X-ray systems, and various spectroscopy applications (e.g., Raman, FTIR) to study materials under unique and extreme conditions, leveraging diamond's transparency across a broad spectrum and its robustness. Additionally, the Medical Devices industry is an emerging customer base, particularly for advanced laser surgery equipment and certain diagnostic imaging systems where precision, durability, and biocompatibility are paramount. For instance, in ophthalmic or dermatological laser systems, diamond windows offer superior performance and a longer operational life compared to conventional optics. Lastly, companies involved in the development of cutting-edge technologies such as Quantum Computing and THz Communications are increasingly exploring diamond optical windows for their unique properties at cryogenic temperatures or in specific frequency ranges. These customers represent the forefront of technological innovation, where diamond optical windows are enabling next-generation capabilities.

| Report Attributes | Report Details |

|---|---|

| Market Size in 2026 | USD 850 Million |

| Market Forecast in 2033 | USD 1.6 Billion |

| Growth Rate | 9.5% CAGR |

| Historical Year | 2019 to 2024 |

| Base Year | 2025 |

| Forecast Year | 2026 - 2033 |

| DRO & Impact Forces |

|

| Segments Covered |

|

| Key Companies Covered | Element Six (De Beers Group), Sumitomo Electric Industries, Coherent Corp. (formerly II-VI), Aethera Technologies, Applied Diamond Inc., AKHAN Semiconductor, Advanced Diamond Technologies, Diamond Materials GmbH, DDK Inc., sp3 Diamond Technologies, Cornes Technologies Ltd., Renishaw, IDEX Optics & Photonics (Semrock, CVI Laser Optics), Almax easyLab, Goodfellow, Fraunhofer IAF, Optosigma Inc., Diamond-MMT, Sichuan Yalong Diamond Tools, Engis Corporation |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Enquiry Before Buy | Have specific requirements? Send us your enquiry before purchase to get customized research options. Request For Enquiry Before Buy |

Diamond Optical Windows Market Key Technology Landscape

The Diamond Optical Windows Market is underpinned by a sophisticated array of advanced technologies, primarily centered around the synthesis, fabrication, and characterization of synthetic diamond materials to meet extremely demanding optical and mechanical specifications. At the core of this landscape are the diamond growth technologies, predominantly Chemical Vapor Deposition (CVD) and High-Pressure/High-Temperature (HPHT) methods. CVD is the leading technology for producing large-area, high-purity polycrystalline and single-crystal diamond films, allowing for precise control over material properties, including nitrogen concentration, isotopic purity, and crystallographic orientation. Innovations in CVD techniques focus on increasing growth rates, reducing defect densities, and expanding the achievable dimensions of optical grade diamond. HPHT technology, while typically yielding smaller crystals, is crucial for producing specific types of diamond with particular defect structures or color centers, often used in niche quantum technology applications. Continuous advancements in both these synthesis methods are vital for improving material quality, scalability, and cost-effectiveness, thereby broadening the market's reach. Beyond growth, the fabrication of optical windows from these ultra-hard materials demands specialized cutting, grinding, and polishing technologies. Traditional abrasive methods are being augmented by advanced laser cutting and chemical-mechanical polishing (CMP) techniques, which enable ultra-smooth surfaces, precise geometries, and minimal subsurface damage. These technologies are critical for achieving the optical flatness, parallelism, and surface roughness required for high-performance applications, often involving sub-nanometer tolerances. The challenge of processing diamond requires continuous innovation in tooling and process optimization, pushing the boundaries of precision manufacturing.

Further enhancing the performance of diamond optical windows are advanced surface engineering technologies, particularly anti-reflective (AR) coatings. While diamond itself has a high refractive index, requiring coatings to minimize reflection losses, applying durable AR coatings to diamond surfaces presents a unique challenge due to diamond's extreme hardness and chemical inertness. Technologies like plasma-enhanced CVD (PECVD), ion-assisted deposition, and atomic layer deposition (ALD) are being explored and refined to deposit robust, low-stress, and highly transmissive AR layers that adhere strongly to the diamond substrate and withstand the same harsh environments as the diamond itself. These coatings are essential for maximizing light transmission and minimizing optical losses, especially in high-power laser systems. Moreover, sophisticated metrology and characterization techniques are indispensable across the entire technology landscape. Advanced spectroscopic methods (e.g., Raman, FTIR, UV-Vis), X-ray diffraction, electron microscopy, and interferometry are used to meticulously assess diamond purity, crystal structure, defect density, stress, and optical transmission properties. These characterization tools are critical for quality control, process feedback, and ensuring that the manufactured windows meet the stringent performance criteria of end-user applications. Thermal management solutions, while not directly part of the window fabrication, are also a key technological consideration, as diamond's excellent thermal conductivity must be effectively utilized within the broader optical system. This involves innovative mounting and cooling strategies that efficiently dissipate heat from the diamond window, preserving its optical performance under high thermal loads. The convergence of these advanced material science, manufacturing, and characterization technologies collectively defines the cutting-edge landscape of the Diamond Optical Windows Market, continuously pushing the boundaries of what is possible in high-performance optics.

Regional Highlights

- North America: This region is a dominant force in the Diamond Optical Windows Market, primarily driven by significant investments in defense and aerospace, a robust R&D infrastructure, and a thriving high-power laser industry. The United States, in particular, leads in military spending, driving demand for advanced optical components in missile systems, surveillance, and directed energy applications. Additionally, a strong presence of semiconductor manufacturers, research institutions, and industrial laser integrators contributes to sustained growth. Innovation in diamond synthesis and fabrication technologies is actively pursued in this region, with numerous specialized companies and academic collaborations pushing the boundaries of material science.

- Europe: Europe represents another key market, characterized by strong governmental support for scientific research, advanced industrial manufacturing, and a well-established photonics industry. Countries like Germany, the UK, and France are at the forefront of laser technology development and applications in defense, scientific instrumentation, and high-precision industrial processes. The region benefits from a mature ecosystem of specialized optics manufacturers and research institutes, fostering both demand and supply of high-quality diamond optical windows. Regulatory frameworks and collaborative projects further enhance R&D efforts and market growth across various end-user sectors.

- Asia Pacific (APAC): The APAC region is poised for the fastest growth, primarily fueled by the rapid expansion of its semiconductor manufacturing industry, particularly in countries like China, South Korea, Japan, and Taiwan. The region's significant investments in industrial automation, high-power laser applications, and increasing defense expenditures are also major drivers. China, in particular, is emerging as a critical player, both as a producer and consumer of diamond materials, driven by its vast industrial base and ambitious technological goals. The growing demand for advanced materials in electronics and precision manufacturing sectors underscores the region's increasing importance.

- Latin America: While a smaller market compared to other regions, Latin America exhibits potential for growth, mainly influenced by modernization efforts in its defense sectors and nascent industrial development. Investments in infrastructure and manufacturing capabilities could gradually increase the demand for high-performance optical components, including diamond windows, particularly in applications requiring robust and durable solutions. However, market penetration is currently limited by economic factors and less developed high-tech manufacturing ecosystems.

- Middle East & Africa (MEA): The MEA region is characterized by emerging demand, driven by increasing defense spending and diversification efforts in industrial sectors, particularly in Gulf Cooperation Council (GCC) countries. As these nations invest in advanced technologies and diversify their economies away from oil, there is a growing need for sophisticated industrial tools and defense systems that incorporate high-performance optics. However, the market remains relatively niche, with growth highly dependent on government strategic initiatives and foreign investment in technology infrastructure.

Top Key Players

The market research report includes a detailed profile of leading stakeholders in the Diamond Optical Windows Market.- Element Six (De Beers Group)

- Sumitomo Electric Industries

- Coherent Corp. (formerly II-VI)

- Aethera Technologies

- Applied Diamond Inc.

- AKHAN Semiconductor

- Advanced Diamond Technologies

- Diamond Materials GmbH

- DDK Inc.

- sp3 Diamond Technologies

- Cornes Technologies Ltd.

- Renishaw

- IDEX Optics & Photonics (Semrock, CVI Laser Optics)

- Almax easyLab

- Goodfellow

- Fraunhofer IAF

- Optosigma Inc.

- Diamond-MMT

- Sichuan Yalong Diamond Tools

- Engis Corporation

Frequently Asked Questions

Analyze common user questions about the Diamond Optical Windows market and generate a concise list of summarized FAQs reflecting key topics and concerns.What are Diamond Optical Windows and their primary benefits?

Diamond optical windows are transparent components made from synthetic diamond, valued for their exceptional properties like highest thermal conductivity, extreme hardness, broad spectral transparency from UV to far-IR, and chemical inertness. Their primary benefits include superior durability, ability to withstand high-power lasers and harsh environments, excellent thermal management, and long operational lifespan compared to conventional optical materials.

Which industries are the major consumers of Diamond Optical Windows?

The major consumers include the high-power laser industry (for industrial, scientific, and defense applications), defense and aerospace (for missile domes and sensor windows), semiconductor manufacturing (for lithography and etching equipment), and scientific research (for high-pressure cells and spectroscopy). Medical device and THz technology sectors are also emerging as significant users.

What factors are driving the growth of the Diamond Optical Windows Market?

Growth is primarily driven by increasing demand for high-power laser systems, expanding applications in the defense and aerospace sectors, the rapid advancement and material requirements of the semiconductor industry, significant investments in scientific research, and the unique, superior properties of diamond material itself.

What are the main challenges faced by the Diamond Optical Windows Market?

Key challenges include the high manufacturing cost of producing high-quality synthetic diamond, the limited availability of large-size, defect-free diamond substrates, the technical complexity and high cost of precision fabrication processes (cutting, grinding, polishing), and competition from more cost-effective alternative optical materials for less demanding applications.

How is Artificial Intelligence (AI) impacting the Diamond Optical Windows Market?

AI is impacting the market by optimizing diamond synthesis processes for better purity and yield, enhancing defect detection and quality control through machine learning, enabling AI-driven design of customized windows and coatings, and improving predictive maintenance of manufacturing equipment. It aims to boost efficiency, precision, and potentially reduce costs across the value chain.

To check our Table of Contents, please mail us at: sales@marketresearchupdate.com

Research Methodology

The Market Research Update offers technology-driven solutions and its full integration in the research process to be skilled at every step. We use diverse assets to produce the best results for our clients. The success of a research project is completely reliant on the research process adopted by the company. Market Research Update assists its clients to recognize opportunities by examining the global market and offering economic insights. We are proud of our extensive coverage that encompasses the understanding of numerous major industry domains.

Market Research Update provide consistency in our research report, also we provide on the part of the analysis of forecast across a gamut of coverage geographies and coverage. The research teams carry out primary and secondary research to implement and design the data collection procedure. The research team then analyzes data about the latest trends and major issues in reference to each industry and country. This helps to determine the anticipated market-related procedures in the future. The company offers technology-driven solutions and its full incorporation in the research method to be skilled at each step.

The Company's Research Process Has the Following Advantages:

- Information Procurement

The step comprises the procurement of market-related information or data via different methodologies & sources.

- Information Investigation

This step comprises the mapping and investigation of all the information procured from the earlier step. It also includes the analysis of data differences observed across numerous data sources.

- Highly Authentic Source

We offer highly authentic information from numerous sources. To fulfills the client’s requirement.

- Market Formulation

This step entails the placement of data points at suitable market spaces in an effort to assume possible conclusions. Analyst viewpoint and subject matter specialist based examining the form of market sizing also plays an essential role in this step.

- Validation & Publishing of Information

Validation is a significant step in the procedure. Validation via an intricately designed procedure assists us to conclude data-points to be used for final calculations.

×

Request Free Sample:

Related Reports

Select License

Why Choose Us

We're cost-effective and Offered Best services:

We are flexible and responsive startup research firm. We adapt as your research requires change, with cost-effectiveness and highly researched report that larger companies can't match.

Information Safety

Market Research Update ensure that we deliver best reports. We care about the confidential and personal information quality, safety, of reports. We use Authorize secure payment process.

We Are Committed to Quality and Deadlines

We offer quality of reports within deadlines. We've worked hard to find the best ways to offer our customers results-oriented and process driven consulting services.

Our Remarkable Track Record

We concentrate on developing lasting and strong client relationship. At present, we hold numerous preferred relationships with industry leading firms that have relied on us constantly for their research requirements.

Best Service Assured

Buy reports from our executives that best suits your need and helps you stay ahead of the competition.

Customized Research Reports

Our research services are custom-made especially to you and your firm in order to discover practical growth recommendations and strategies. We don't stick to a one size fits all strategy. We appreciate that your business has particular research necessities.

Service Assurance

At Market Research Update, we are dedicated to offer the best probable recommendations and service to all our clients. You will be able to speak to experienced analyst who will be aware of your research requirements precisely.

Contact With Our Sales Team

Customer Testimonials

The content of the report is always up to the mark. Good to see speakers from expertise authorities.

Privacy requested , Managing Director

A lot of unique and interesting topics which are described in good manner.

Privacy requested, President

Well researched, expertise analysts, well organized, concrete and current topics delivered in time.

Privacy requested, Development Manager