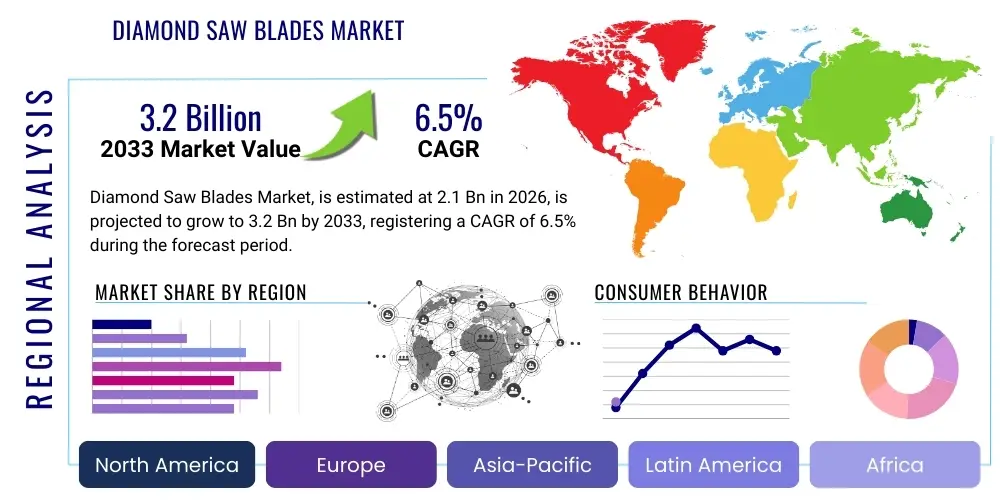

Diamond Saw Blades Market Size, By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2026 to 2033 (Financial Impact Analysis)

ID : MRU_ 441838 | Date : Feb, 2026 | Pages : 248 | Region : Global | Publisher : MRU

Diamond Saw Blades Market Size

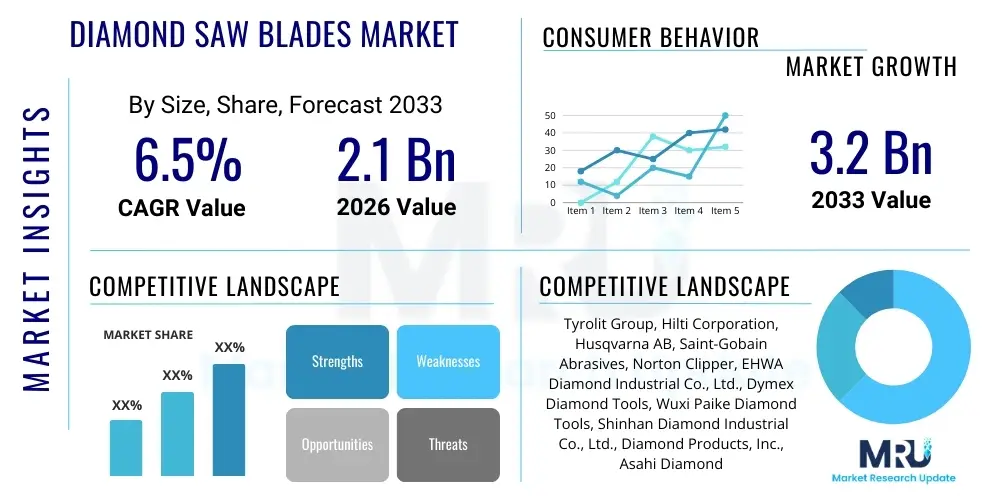

The Diamond Saw Blades Market is projected to grow at a Compound Annual Growth Rate (CAGR) of 6.5% between 2026 and 2033. The market is estimated at USD 2.1 Billion in 2026 and is projected to reach USD 3.2 Billion by the end of the forecast period in 2033.

Diamond Saw Blades Market introduction

The Diamond Saw Blades Market comprises tools essential for cutting extremely hard, abrasive materials such as concrete, granite, ceramics, asphalt, and reinforced stone. These blades utilize industrial-grade synthetic diamond segments embedded in a metal matrix (typically cobalt, iron, or copper alloys) which are bonded to the steel core of the blade. The exceptional hardness of diamond enables efficient and precise material removal in demanding applications across various industries. Modern diamond saw blades are categorized primarily by their bonding methods, including sintering, laser welding, and brazing, each optimized for specific cutting conditions, material types, and operational speeds. The performance metrics such as cutting speed, blade life, and segment depth are crucial considerations for end-users, driving continuous innovation in metallurgy and diamond placement techniques to enhance productivity and reduce operational costs.

The primary applications for diamond saw blades span major heavy industries, predominantly construction, infrastructure development, stone processing, and mining. In construction, these tools are indispensable for cutting expansion joints, modifying reinforced concrete structures, and sizing prefabricated concrete elements. The stone industry relies heavily on these blades for squaring blocks, slabbing natural stone (marble, granite, quartzite), and precision shaping intricate designs. The inherent advantages of diamond blades, including superior durability, minimal dust generation (when wet cutting), and high precision, make them the preferred choice over conventional abrasive blades, particularly for large-scale, high-volume processing operations. The shift toward sustainable building materials and advanced composite cutting requirements is continually expanding the functional scope of these tools.

Key driving factors fueling market expansion include rapid global urbanization and significant public and private investments in infrastructure projects, particularly in emerging economies of Asia Pacific and Latin America. The increasing demand for aesthetically pleasing and durable natural stone in residential and commercial architecture further stimulates the market for high-quality, specialized diamond cutting tools. Furthermore, technological advancements focused on improving blade safety, increasing cutting efficiency (measured in square meters per hour), and extending tool life through enhanced bonding materials and segment designs are critical catalysts. The push for automation in manufacturing and construction processes also favors the adoption of consistently reliable and high-performance diamond blades suitable for automated cutting systems and robotic applications.

Diamond Saw Blades Market Executive Summary

The Diamond Saw Blades Market demonstrates robust growth driven primarily by a resurgence in global construction spending, especially in critical infrastructure sectors such as roads, bridges, and public utilities. Business trends indicate a strong move toward advanced manufacturing techniques, specifically laser-welded and vacuum-brazed blades, which offer superior safety and performance compared to traditional sintered counterparts, commanding premium pricing and higher market penetration in professional applications. Manufacturers are focusing heavily on developing application-specific blades, such as those optimized for high-performance concrete (HPC) or extremely hard engineered quartz, thereby diversifying product portfolios and mitigating risks associated with material standardization. Consolidation activities, including strategic acquisitions and mergers, are also defining the competitive landscape as companies seek to gain access to proprietary bonding technologies, specialized regional distribution networks, and established customer bases in high-growth segments like large-diameter blades for primary block cutting in quarries.

Regionally, the Asia Pacific (APAC) market, spearheaded by China and India, represents the largest and fastest-growing segment, propelled by unprecedented levels of urban development, mass transit project implementation, and large-scale residential construction. North America and Europe, characterized by established infrastructure and stringent quality standards, show high demand for premium, long-life, and environmentally compliant blades, particularly those designed for refurbishment and demolition (R&D) activities where precision and dust control are paramount. Latin America and the Middle East & Africa (MEA) are emerging as significant growth centers, fueled by substantial government investments in resource extraction facilities and ongoing large-scale construction booms, requiring durable blades capable of handling region-specific, tough materials like basalt and dense limestone. The global supply chain remains crucial, with raw material sourcing (industrial diamonds, metal powders) significantly impacting production costs and market pricing strategies across all geographical areas.

Segmentation trends highlight the increasing dominance of large-diameter blades (over 500 mm) in the stone processing and quarrying sectors, reflecting efficiency demands in bulk material breakdown. Conversely, the construction sector is driving high-volume sales of small and medium-diameter blades (under 350 mm) for handheld and pavement saws used in finishing and utility work. In terms of technology, laser-welded blades are rapidly gaining market share due to their superior bonding strength, crucial for safety and operational reliability under high stress. Furthermore, a rising emphasis on environmental, social, and governance (ESG) factors is leading to increased demand for blades utilizing recycled or sustainably sourced core materials and processes that minimize energy consumption during manufacturing. This trend is pushing R&D towards hybrid segment formulations that offer optimal wear characteristics while adhering to reduced heavy metal content regulations.

AI Impact Analysis on Diamond Saw Blades Market

User inquiries regarding AI's influence on the Diamond Saw Blades market primarily revolve around three central themes: enhancing manufacturing precision, optimizing product design for specific materials, and revolutionizing predictive maintenance for heavy cutting machinery. Users are keen to understand how AI-driven simulations can replace traditional trial-and-error methods in segment material composition (e.g., determining the optimal mix of metallic powders and diamond grit size/concentration) to improve blade life and cutting speed. Concerns often include the accessibility and implementation cost of AI solutions, especially for small to medium-sized manufacturers. Expectations center on AI's ability to analyze real-time operational data (vibration, heat, power draw) from connected cutting machines to offer prescriptive advice on blade replacement schedules, thereby minimizing catastrophic failures and maximizing machinery uptime in demanding industrial environments.

The application of Artificial Intelligence within the manufacturing lifecycle of diamond saw blades promises significant advancements, particularly in quality control and customization. Machine learning algorithms are being deployed to analyze vast datasets pertaining to segment failure mechanisms, correlating variables such as sintering temperature, pressure profiles, and subsequent cutting performance in diverse materials. This data-driven approach allows manufacturers to rapidly adjust production parameters to achieve tighter tolerances and more consistent blade quality across batches. Furthermore, AI is crucial in automating visual inspection systems, identifying microscopic defects or irregularities in segment alignment or bonding layers that are imperceptible to the human eye, ensuring only flawless products reach the market, thereby enhancing safety and reliability.

Beyond the factory floor, AI integration is extending into the maintenance and operational phases. Telematics and IoT sensors installed on cutting machines, especially large bridge saws and concrete floor saws, generate continuous data streams. AI systems process this data to create accurate predictive models for segment wear based on material being cut, ambient temperature, and operator usage patterns. This capability shifts maintenance from reactive or time-based scheduling to condition-based monitoring, offering substantial savings in downtime and replacement part costs for high-capital equipment users in construction and stone processing. The adoption of smart, AI-guided cutting programs also helps optimize cutting paths and feed rates, minimizing stress on the blade core and maximizing the overall operational efficiency of the entire cutting system.

- AI-driven optimization of diamond segment formulation (grit size, concentration, bond metallurgy).

- Machine Learning models for predictive maintenance of cutting machinery, reducing blade failure risk.

- Automated, high-precision visual inspection and quality control of laser welding and sintering processes.

- Real-time operational feedback systems for optimizing cutting parameters (speed, pressure, water flow).

- Simulation of blade performance across various material densities and hardness levels before physical prototyping.

DRO & Impact Forces Of Diamond Saw Blades Market

The dynamics of the Diamond Saw Blades Market are governed by a complex interplay of Drivers, Restraints, and Opportunities (DRO), collectively constituting the market's Impact Forces. Key drivers include the robust expansion of global construction activities, particularly government-led infrastructure modernization initiatives in developing nations, demanding high volumes of durable cutting tools for concrete and asphalt. The increasing global preference for natural stone in both commercial and high-end residential construction significantly boosts demand for precision cutting blades in the stone processing industry. Technological advancements, such as the introduction of more wear-resistant matrices and superior diamond materials (e.g., PCD and synthetic monocrystalline diamond), continually enhance product performance, accelerating replacement cycles and driving market value growth. These positive forces establish a baseline requirement for high-efficiency cutting solutions across the industrial landscape.

However, the market faces notable restraints that temper growth potential. The primary challenge is the volatility and high cost of raw materials, particularly industrial diamonds and specialized metal powders (cobalt, nickel), which are sensitive to geopolitical supply chain disruptions. Furthermore, the market's strong correlation with the cyclical nature of the global construction and mining industries means that economic downturns or prolonged regulatory hurdles in key regions can immediately slow down procurement. Regulatory scrutiny regarding manufacturing processes, specifically concerning dust emissions (silica exposure) and heavy metal usage in bond formulations, imposes additional compliance costs on manufacturers, especially in stringent markets like Europe and North America. The market must navigate these cost pressures while simultaneously meeting increasingly demanding performance specifications required by modern composite materials.

Significant opportunities exist, primarily through geographical expansion into untapped emerging markets where infrastructure backlogs are massive, requiring new tools for rapid development. Product innovation presents a continuous opportunity, focusing on developing environmentally friendly, long-lasting blades that facilitate dry cutting or utilize non-hazardous bonding agents. The growing trend toward specialized, application-specific tools—such as silent core blades for urban construction or blades optimized for composite materials like carbon fiber reinforced polymer (CFRP) used in aerospace and automotive modifications—opens up high-margin niche segments. The impact forces indicate a market characterized by high technical barrier to entry and strong dependency on global macroeconomic stability, with the balance shifting towards technological superiority and operational efficiency as key competitive differentiators.

Segmentation Analysis

The Diamond Saw Blades market is extensively segmented based on key criteria including the bonding technology utilized, the size (diameter) of the blade, the primary material intended for cutting, and the end-use application. This comprehensive segmentation allows market participants to tailor their offerings precisely to the varied requirements of end-users, ranging from large-scale quarry operations demanding massive, robust blades to precision artisans requiring small, highly accurate tools for ceramics or glass. Understanding these segments is crucial for strategic market positioning, as performance requirements, pricing sensitivity, and distribution channels vary significantly between, for instance, the stone processing segment and the civil engineering segment.

The segmentation by blade diameter is particularly important as it dictates the type of machinery the blade is compatible with, affecting the scale of operation and potential sales volume. Small diameter blades (typically up to 350 mm) cater to handheld power tools and bench saws, dominating the residential and light commercial repair/renovation sectors. Medium and large diameter blades (up to 1200 mm and beyond) are reserved for heavy industrial machinery, such as block cutters and pavement saws used in infrastructure projects and quarrying, representing high-value transactions. Moreover, the segmentation based on material cut (e.g., granite, marble, concrete, masonry) drives specialized segment design, where the hardness, abrasive nature, and internal composition of the material dictate the necessary diamond concentration, bond hardness, and segment geometry.

- By Product Type:

- Sintered Diamond Saw Blades

- Laser Welded Diamond Saw Blades

- Vacuum Brazed Diamond Saw Blades

- Electroplated Diamond Saw Blades

- By Blade Diameter:

- Small Diameter (Less than 350 mm)

- Medium Diameter (350 mm to 1000 mm)

- Large Diameter (More than 1000 mm)

- By Material Cut:

- Concrete and Asphalt

- Natural Stone (Granite, Marble, Quartzite)

- Tiles and Ceramics

- Masonry and Bricks

- Other Materials (Glass, Refractory Materials)

- By End-Use Application:

- Construction and Infrastructure

- Stone Processing and Quarrying

- Utility and Demolition

- Automotive and Aerospace (Specialty Applications)

Value Chain Analysis For Diamond Saw Blades Market

The value chain for the Diamond Saw Blades market begins with the Upstream analysis, focusing heavily on the sourcing and preparation of critical raw materials. This stage involves highly specialized industries responsible for the synthesis of industrial-grade synthetic diamonds, which are manufactured under extreme pressure and temperature conditions to achieve the desired crystal structure, size, and purity. Simultaneously, strategic sourcing of high-pquality metal powders, including cobalt, tungsten carbide, iron, and copper alloys, is essential for creating the metallic bond matrix. Price fluctuations and supply consistency in these specialized raw materials, particularly cobalt, represent significant risk factors in the upstream segment. Furthermore, the quality of the steel core, typically high-tensile spring steel, is crucial for blade stability and safety, sourced from specialized steel mills capable of meeting stringent flatness and tolerance requirements.

The Midstream component encompasses the complex manufacturing processes—sintering, laser welding, and brazing—where the diamond segments are attached to the steel core. This phase requires significant capital investment in highly automated machinery, precise thermal control systems, and specialized labor skills to manage the metallurgical bonding processes. Manufacturers differentiate themselves through proprietary bond formulations and sophisticated techniques for uniform diamond distribution within the segment. Efficiency in this stage, including minimizing waste and maximizing energy utilization (especially in high-heat processes like sintering and laser welding), directly determines the final unit cost and product performance. Quality assurance is paramount here, involving advanced testing for bond strength and segment wear resistance before blades move into distribution.

The Downstream phase focuses on distribution channels and reaching the diverse end-user base. Given the heavy-duty nature and professional application of these products, sales are predominantly executed through specialized industrial distributors, construction equipment rental companies, and wholesale stone processing equipment suppliers. Direct sales models are often employed for large quarry customers or major infrastructure contractors, offering bespoke products and technical support. The indirect channel relies on networks of local hardware stores and retail outlets for smaller, consumer-grade blades. Effective logistics, technical training for distributor staff, and maintaining sufficient inventory levels close to major construction hubs are critical success factors in the downstream segment, ensuring rapid supply and tailored technical service for complex cutting requirements.

Diamond Saw Blades Market Potential Customers

Potential customers for Diamond Saw Blades are highly diverse, spanning multiple industrial sectors characterized by the routine need to modify, shape, or demolish hard mineral-based materials. The largest customer segment encompasses the Civil Engineering and General Construction industries, which utilize these blades extensively for road building, bridge repair, airport runway maintenance, and general commercial and residential building. These buyers, ranging from large multinational construction conglomerates to local contractors, primarily purchase medium to large diameter blades for cutting concrete (including reinforced concrete) and asphalt. Their buying decisions are driven by blade durability, cutting speed (productivity), and compliance with safety standards, favoring high-performance laser-welded blades that offer maximum reliability under continuous use.

Another major group consists of Stone Processors and Quarry Operators. These customers utilize the largest, most specialized diamond saw blades, often exceeding 1 meter in diameter, for primary cutting of massive natural stone blocks (e.g., granite, marble, slate) into slabs and tiles. This segment demands blades optimized for precision, low material waste, and prolonged life against specific stone types. Buying decisions are highly technical, often involving long-term supply contracts based on detailed performance guarantees and technical support. Furthermore, the specialized trades, including tile setters, plumbers, and electricians, represent a significant customer base for smaller, precision-oriented blades (e.g., electroplated or brazed blades) used for cutting high-end ceramic tiles, porcelain, and glass-like materials during finishing work in residential and commercial projects, valuing clean cuts and low chip rates.

In addition to traditional construction and stone industries, emerging customers include specialized demolition and renovation firms, who require blades capable of rapid, accurate dry cutting in challenging environments, often involving historic preservation or structural modification projects. Furthermore, customers in advanced manufacturing sectors, such as the automotive, aerospace, and semiconductor industries, occasionally require highly specialized, precision diamond blades for cutting advanced composite materials, carbon fibers, or specialized refractory ceramics. These niche applications require bespoke blade geometries and exotic bonding technologies, leading to lower volume but high-margin sales. For all customer types, the shift towards greater operational efficiency and reduced labor costs strongly dictates the adoption of higher quality, longer-lasting diamond tools over cheaper, lower-performance alternatives.

| Report Attributes | Report Details |

|---|---|

| Market Size in 2026 | USD 2.1 Billion |

| Market Forecast in 2033 | USD 3.2 Billion |

| Growth Rate | 6.5% CAGR |

| Historical Year | 2019 to 2024 |

| Base Year | 2025 |

| Forecast Year | 2026 - 2033 |

| DRO & Impact Forces |

|

| Segments Covered |

|

| Key Companies Covered | Tyrolit Group, Hilti Corporation, Husqvarna AB, Saint-Gobain Abrasives, Norton Clipper, EHWA Diamond Industrial Co., Ltd., Dymex Diamond Tools, Wuxi Paike Diamond Tools, Shinhan Diamond Industrial Co., Ltd., Diamond Products, Inc., Asahi Diamond Industrial Co., Ltd., KGS Diamond Group, Lenox Tools, Makita Corporation, DeWalt (Stanley Black & Decker), Robert Bosch GmbH, Montolit Spa, Taga Diamond Tools, Beijing Grinding Wheel Factory, Continental Diamond Tool Corporation |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Enquiry Before Buy | Have specific requirements? Send us your enquiry before purchase to get customized research options. Request For Enquiry Before Buy |

Diamond Saw Blades Market Key Technology Landscape

The core technology landscape of the Diamond Saw Blades market centers around optimizing the bond between the industrial diamond grit and the metallic matrix, and securing this segment to the steel core. The most prevalent technology is Sintering, which involves compressing metal powders and diamond particles in a mold and heating them below the melting point of the metal matrix. This process, typically carried out using hot-press or cold-press methods followed by high-temperature furnaces, creates a robust, uniform segment structure. Continuous advancements in sintering focus on developing complex bond metallurgy—incorporating elements like titanium or chromium—to enhance diamond retention (the ability of the matrix to hold the diamond during the cutting process) and increase the bond hardness, thereby extending blade life when cutting highly abrasive materials like high-silica concrete or hard granite. Sintering remains cost-effective for mass production but can be surpassed in strength by newer technologies.

A significant technological shift has been the widespread adoption of Laser Welding, particularly for high-safety, high-performance blades used in demanding construction environments. Laser welding fuses the diamond segment directly onto the steel core using a high-powered laser beam, creating an unbreakable metallurgical bond superior to traditional brazing or mechanical fixing. This technology is critical for dry cutting applications where frictional heat is extreme and the risk of segment loss is high. Manufacturers utilize sophisticated multi-axis robotic laser welding systems to ensure precise segment positioning and consistent bond integrity, which is essential for maintaining rotational balance and operational safety at high peripheral speeds. The efficiency and consistency of laser welding have positioned these blades as the standard for professional contractors in North America and Europe.

Further innovation is driven by Vacuum Brazing and Electroplating technologies, which address highly specialized cutting needs. Vacuum brazed blades use a layer of braze alloy (often containing silver) to bond the diamond crystals onto the blade surface in a high-vacuum furnace. This process exposes the diamond peaks more effectively, leading to extremely aggressive cutting action, making them ideal for materials like glass, fiber composites, and ceramics where a smooth, chip-free finish is prioritized over sheer longevity. Electroplated blades utilize an electrochemical process to deposit a single layer of diamonds onto the steel core using a nickel alloy bond. While offering rapid, smooth cutting for specialized applications, electroplated blades typically have the shortest lifespan among the major categories. The future technological trajectory involves leveraging nanomaterials and advanced composite bonding agents to create segments with tailored wear rates that maximize efficiency while minimizing energy expenditure during the cutting operation.

Regional Highlights

The regional market dynamics for diamond saw blades are highly differentiated, reflecting varying levels of infrastructure maturity, economic development, and material usage preferences across the globe. Asia Pacific (APAC) stands out as the engine of growth, capturing the largest market share and exhibiting the highest growth rate. This dominance is directly attributable to massive government-led spending on urbanization, the construction of high-speed rail networks, new energy infrastructure, and rapidly expanding residential sectors, particularly in China, India, and Southeast Asian nations. The high volume of natural stone extraction and processing in countries like India also significantly contributes to the regional demand for large-diameter quarrying blades.

North America and Europe represent mature markets characterized by stringent quality standards and a high demand for advanced, premium products. In these regions, growth is primarily driven by renovation, maintenance, and demolition projects (R&M), requiring specialized blades for cutting aging infrastructure materials and high-performance concrete. The focus here is on blades offering superior safety features (e.g., silent cores), compliance with environmental regulations, and longevity, often leading to a preference for laser-welded and specialized vacuum-brazed tools. Furthermore, the high labor costs incentivize the use of high-efficiency blades that minimize downtime and maximize productivity.

Latin America and the Middle East & Africa (MEA) are emerging regions experiencing dynamic growth, albeit with higher economic volatility. In the MEA, substantial investments in oil and gas infrastructure, megaprojects (like NEOM), and high-end residential and commercial developments fuel demand for heavy-duty construction blades. Brazil and Mexico in Latin America drive demand through mining operations and infrastructural upgrades. These regions are often price-sensitive but increasingly recognize the long-term value of higher-quality blades in terms of operational efficiency and reduced replacement frequency, creating attractive opportunities for mid-to-high-range product penetration.

- Asia Pacific (APAC): Highest volume market driven by infrastructure projects, massive urbanization, and dominance in the global natural stone processing industry (especially China, India).

- North America: Mature market focused on renovation, demolition, and infrastructure repair; high demand for premium, laser-welded, and safety-compliant blades.

- Europe: Characterized by strict environmental and safety regulations; emphasis on silent-core blades and highly specialized tools for cutting historical materials and advanced composites.

- Latin America: Growing market fueled by mining operations and regional infrastructure development; increasing adoption of durable tools over lower-cost alternatives.

- Middle East and Africa (MEA): Driven by ongoing large-scale construction megaprojects and resource extraction activities, requiring robust, heavy-duty blades suitable for harsh environments.

Top Key Players

The market research report includes a detailed profile of leading stakeholders in the Diamond Saw Blades Market.- Tyrolit Group

- Hilti Corporation

- Husqvarna AB

- Saint-Gobain Abrasives

- Norton Clipper

- EHWA Diamond Industrial Co., Ltd.

- Dymex Diamond Tools

- Wuxi Paike Diamond Tools

- Shinhan Diamond Industrial Co., Ltd.

- Diamond Products, Inc.

- Asahi Diamond Industrial Co., Ltd.

- KGS Diamond Group

- Lenox Tools

- Makita Corporation

- DeWalt (Stanley Black & Decker)

- Robert Bosch GmbH

- Montolit Spa

- Taga Diamond Tools

- Beijing Grinding Wheel Factory

- Continental Diamond Tool Corporation

Frequently Asked Questions

Analyze common user questions about the Diamond Saw Blades market and generate a concise list of summarized FAQs reflecting key topics and concerns.What is the primary factor driving demand in the Diamond Saw Blades Market?

The central driver is significant global investment in infrastructure modernization and urban development, particularly the continuous construction and maintenance of roads, bridges, and commercial buildings, requiring high-volume, efficient cutting of concrete and asphalt.

How do laser-welded blades differ fundamentally from sintered blades?

Laser-welded blades utilize high-powered lasers to forge a direct, unbreakable metallurgical bond between the diamond segment and the steel core, providing superior safety and durability, especially in dry cutting. Sintered blades rely on heat and pressure to bond the segment to the core via a separate layer of brazing material.

Which geographical region holds the largest market share for Diamond Saw Blades?

The Asia Pacific (APAC) region currently holds the largest market share, driven by rapid industrialization, large-scale urbanization, and extensive construction projects in major economies such as China and India.

What are the key technical challenges facing Diamond Saw Blade manufacturers?

Key challenges include managing the high volatility and cost of raw materials (especially industrial diamonds and cobalt), and continually innovating segment bond metallurgy to maintain optimal diamond retention and achieve longer operational life across varied, hard cutting materials.

What are the most crucial performance indicators for professional buyers of diamond blades?

Professional buyers prioritize three main indicators: blade life (measured in total linear meters cut), cutting speed (productivity), and operational safety, with minimal segment loss under heavy-duty usage being a non-negotiable requirement for critical applications.

To check our Table of Contents, please mail us at: sales@marketresearchupdate.com

Research Methodology

The Market Research Update offers technology-driven solutions and its full integration in the research process to be skilled at every step. We use diverse assets to produce the best results for our clients. The success of a research project is completely reliant on the research process adopted by the company. Market Research Update assists its clients to recognize opportunities by examining the global market and offering economic insights. We are proud of our extensive coverage that encompasses the understanding of numerous major industry domains.

Market Research Update provide consistency in our research report, also we provide on the part of the analysis of forecast across a gamut of coverage geographies and coverage. The research teams carry out primary and secondary research to implement and design the data collection procedure. The research team then analyzes data about the latest trends and major issues in reference to each industry and country. This helps to determine the anticipated market-related procedures in the future. The company offers technology-driven solutions and its full incorporation in the research method to be skilled at each step.

The Company's Research Process Has the Following Advantages:

- Information Procurement

The step comprises the procurement of market-related information or data via different methodologies & sources.

- Information Investigation

This step comprises the mapping and investigation of all the information procured from the earlier step. It also includes the analysis of data differences observed across numerous data sources.

- Highly Authentic Source

We offer highly authentic information from numerous sources. To fulfills the client’s requirement.

- Market Formulation

This step entails the placement of data points at suitable market spaces in an effort to assume possible conclusions. Analyst viewpoint and subject matter specialist based examining the form of market sizing also plays an essential role in this step.

- Validation & Publishing of Information

Validation is a significant step in the procedure. Validation via an intricately designed procedure assists us to conclude data-points to be used for final calculations.

×

Request Free Sample:

Related Reports

- Diamond Saw Blades Market Size Report By Type (Sintering, High-frequency Welding, Laser Welding), By Application (Stone Industry, Building Construction Industry, Ceramic Industry, Others), By Region (North America, Latin America, Europe, Asia Pacific, Middle East, and Africa) - Share, Trends, Outlook and Forecast 2025-2032

- Segmented Diamond Saw Blades Market Statistics 2025 Analysis By Application (Stone Industry, Building Construction Industry, Ceramic Industry, Others), By Type (Sintered, welded, Electroplated), and By Region (North America, Latin America, Europe, Asia Pacific, Middle East, and Africa) - Size, Share, Outlook, and Forecast 2025 to 2032

- Sintered Diamond Saw Blades Market Statistics 2025 Analysis By Application (Stone Industry, Building Construction Industry, Ceramic Industry, Others), By Type (Hot Pressed Sintered, Cold Press Sintered), and By Region (North America, Latin America, Europe, Asia Pacific, Middle East, and Africa) - Size, Share, Outlook, and Forecast 2025 to 2032

- Welded Diamond Saw Blades Market Statistics 2025 Analysis By Application (Stone Industry, Building Construction Industry, Ceramic Industry, Others), By Type (High-frequency Welding, Laser Welding), and By Region (North America, Latin America, Europe, Asia Pacific, Middle East, and Africa) - Size, Share, Outlook, and Forecast 2025 to 2032

- Electroplated Diamond Saw Blades Market Statistics 2025 Analysis By Application (.), By Type (Size), and By Region (North America, Latin America, Europe, Asia Pacific, Middle East, and Africa) - Size, Share, Outlook, and Forecast 2025 to 2032

Select License

Why Choose Us

We're cost-effective and Offered Best services:

We are flexible and responsive startup research firm. We adapt as your research requires change, with cost-effectiveness and highly researched report that larger companies can't match.

Information Safety

Market Research Update ensure that we deliver best reports. We care about the confidential and personal information quality, safety, of reports. We use Authorize secure payment process.

We Are Committed to Quality and Deadlines

We offer quality of reports within deadlines. We've worked hard to find the best ways to offer our customers results-oriented and process driven consulting services.

Our Remarkable Track Record

We concentrate on developing lasting and strong client relationship. At present, we hold numerous preferred relationships with industry leading firms that have relied on us constantly for their research requirements.

Best Service Assured

Buy reports from our executives that best suits your need and helps you stay ahead of the competition.

Customized Research Reports

Our research services are custom-made especially to you and your firm in order to discover practical growth recommendations and strategies. We don't stick to a one size fits all strategy. We appreciate that your business has particular research necessities.

Service Assurance

At Market Research Update, we are dedicated to offer the best probable recommendations and service to all our clients. You will be able to speak to experienced analyst who will be aware of your research requirements precisely.

Contact With Our Sales Team

Customer Testimonials

The content of the report is always up to the mark. Good to see speakers from expertise authorities.

Privacy requested , Managing Director

A lot of unique and interesting topics which are described in good manner.

Privacy requested, President

Well researched, expertise analysts, well organized, concrete and current topics delivered in time.

Privacy requested, Development Manager