Diamond Slurry Market Size, By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2026 to 2033 (Financial Impact Analysis)

ID : MRU_ 443332 | Date : Feb, 2026 | Pages : 248 | Region : Global | Publisher : MRU

Diamond Slurry Market Size

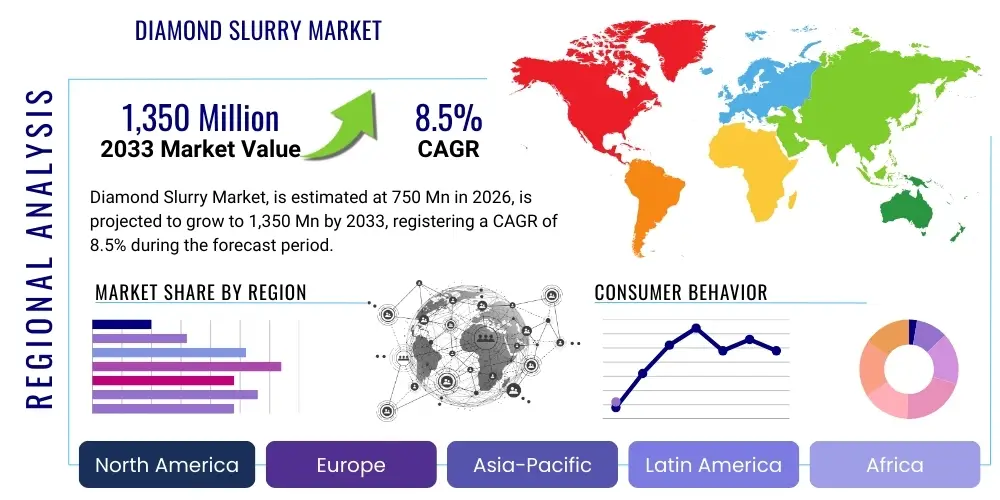

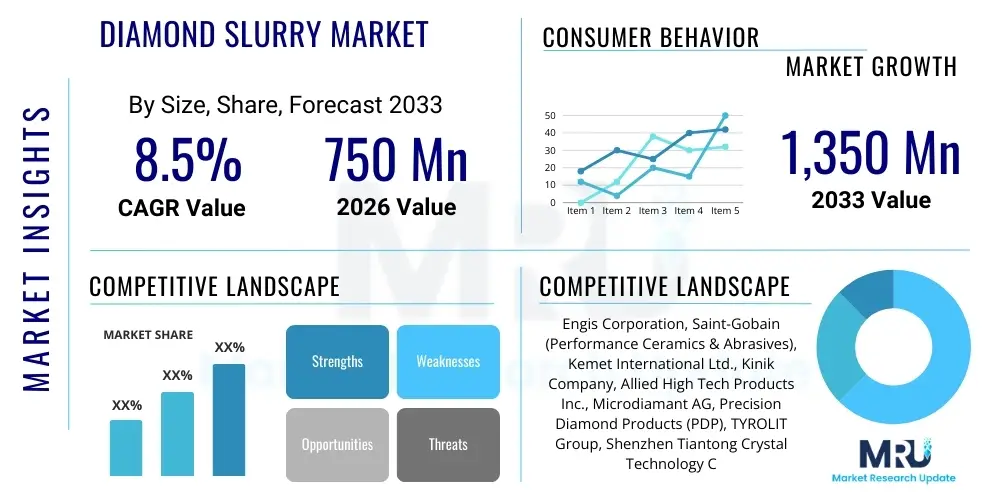

The Diamond Slurry Market is projected to grow at a Compound Annual Growth Rate (CAGR) of 8.5% between 2026 and 2033. The market is estimated at $750 Million in 2026 and is projected to reach $1,350 Million by the end of the forecast period in 2033. This substantial growth is fundamentally driven by the escalating demand for high-precision finishing processes across crucial industrial sectors, particularly semiconductor manufacturing, where ultra-flat surfaces are indispensable for advanced chip architectures. The constant miniaturization of electronic components and the necessity for superior material removal rates without causing subsurface damage are key accelerators for market valuation.

Diamond Slurry Market introduction

The Diamond Slurry Market encompasses high-precision abrasive compounds utilized primarily for lapping, polishing, and Chemical Mechanical Planarization (CMP) applications. Diamond slurry, formulated by suspending microscopic diamond particles (natural or synthetic) in a carrier fluid (water, oil, or alcohol-based solution), serves as the quintessential abrasive medium required for achieving nano-scale surface finishes. These specialized slurries are critical in processing hard materials such as silicon carbide, sapphire, ceramics, composite materials, and various metals integral to modern electronics and optics.

Product description highlights the distinct material characteristics that define the slurry's performance, including diamond crystal structure (monocrystalline, polycrystalline, or nanodiamond), particle size distribution, concentration uniformity, and the chemical stability of the suspension. Major applications span the manufacturing of high-brightness LEDs, precision optical lenses, hard disk drive components, and, most significantly, advanced semiconductor wafers, where surface roughness standards are measured in angstroms. The ability of diamond slurries to provide high stock removal rates while maintaining exceptional surface quality distinguishes them from conventional abrasive media.

Key driving factors include the rapid expansion of the compound semiconductor industry, driven by the rollout of 5G technology, the increasing adoption of electric vehicles (which rely heavily on SiC components), and stringent quality mandates within the medical and aerospace sectors. The benefits derived from using diamond slurries—such as enhanced product longevity, improved functional performance of polished components, and reduction in material defects—further cement their indispensability in high-tech manufacturing processes worldwide. Furthermore, continuous innovation in carrier fluid chemistry and particle morphology customization is expanding the addressable market.

Diamond Slurry Market Executive Summary

The Diamond Slurry Market is characterized by robust business trends centered on technological advancements in abrasive formulations and process integration, primarily within Asia Pacific's manufacturing hubs. Regional trends show APAC maintaining market dominance due to its overwhelming concentration of semiconductor fabrication plants (fabs) and large-scale optics production facilities in regions like Taiwan, South Korea, and mainland China. North America and Europe, while smaller in volume, lead in R&D and the production of highly specialized, ultra-high-purity slurries required for cutting-edge aerospace and medical applications. The market structure remains moderately competitive, with key players focusing on offering customized slurry solutions tailored to specific material substrates.

Segment trends indicate a strong shift toward polycrystalline diamond slurries and, increasingly, nanodiamond slurries, driven by their superior performance in achieving highly uniform and defect-free surfaces crucial for next-generation microprocessors and power electronics. While monocrystalline diamond remains a staple due to its cost-effectiveness and broad utility, the demand for more structurally complex and robust abrasive particles is accelerating. Furthermore, water-based slurries are gaining traction over oil-based variants, prompted by growing environmental regulations and the desire for easier post-polishing cleanup processes within high-volume production environments.

Overall, the market trajectory is firmly upward, underpinned by irreversible trends in digital transformation and energy efficiency, both of which require higher performance materials and tighter manufacturing tolerances. Strategic consolidation and partnerships aimed at integrating slurry chemistry with CMP equipment are becoming essential for maintaining competitive advantages. The future growth hinges on the industry's ability to develop greener, more stable, and increasingly efficient slurry formulations that can handle novel materials such as gallium nitride (GaN) and sophisticated composite substrates without compromising precision or throughput.

AI Impact Analysis on Diamond Slurry Market

Common user questions regarding AI's impact on the Diamond Slurry Market revolve around how artificial intelligence and machine learning (ML) can optimize slurry formulation, enhance process consistency in Chemical Mechanical Planarization (CMP), and improve overall supply chain predictability. Users frequently inquire about the potential for AI-driven sensors to detect subtle variations in polishing conditions and automatically adjust slurry flow rates, concentration, and composition in real-time, thereby reducing material waste and achieving tighter control over surface finish parameters. Key concerns center on the data infrastructure required to support these complex AI models and the initial capital investment necessary for integrating smart manufacturing capabilities within existing fabrication plants.

The integration of AI/ML technologies is transforming the operational dynamics of diamond slurry utilization, moving the market toward predictive processing rather than reactive adjustments. AI algorithms are increasingly employed to analyze high-dimensional data generated during the CMP process—including pressure, temperature, rotation speed, and friction force—correlating these inputs with the resulting surface topology and material removal rate (MRR). This sophisticated analysis allows manufacturers to fine-tune slurry chemistry and physical attributes (such as particle aggregation stability and zeta potential) for peak efficiency specific to different wafer materials, significantly minimizing trial-and-error phases in R&D and maximizing throughput in production environments.

Furthermore, AI significantly impacts quality assurance and inventory management within the slurry supply chain. Predictive models are utilized to forecast demand based on semiconductor fab utilization rates and to manage the shelf life and stability of complex slurry mixtures, which are often prone to settling or degradation over time. By optimizing logistics and minimizing the risk of using sub-optimal or expired formulations, AI integration ensures consistent product quality and reduces operational downtime, providing substantial cost savings and driving the demand for smart, high-consistency diamond slurry products.

- AI optimizes slurry formulation based on desired MRR and surface roughness targets.

- Machine learning models predict and manage slurry stability and shelf life, minimizing waste.

- Real-time sensor data processed by AI allows for dynamic adjustment of CMP parameters (flow, concentration).

- AI-driven automated quality control systems enhance detection of subsurface damage and defects.

- Predictive maintenance schedules for CMP equipment are improved by analyzing slurry performance degradation.

- Supply chain efficiency and raw material sourcing are optimized using predictive analytics.

DRO & Impact Forces Of Diamond Slurry Market

The dynamics of the Diamond Slurry Market are shaped by powerful impact forces encompassing both accelerating drivers and constraining factors. The primary drivers include the relentless global push toward miniaturization in electronics, necessitating exceptionally smooth and precise surfaces achievable only through diamond-based polishing processes, alongside the boom in advanced materials manufacturing, particularly Silicon Carbide (SiC) and Gallium Nitride (GaN) for power electronics and RF applications. Restraints primarily involve the high cost associated with synthesizing high-purity diamond particles and the significant environmental and disposal challenges related to managing spent slurries, which often contain complex chemical additives and fine abrasive waste. The impact forces indicate a trend toward sustainable innovation, where market opportunities are unlocked by developing eco-friendly formulations and advanced recycling technologies.

Opportunities in this highly specialized market are focused on developing customized nanodiamond slurries optimized for emerging technologies like Micro-LED displays and quantum computing components, which require ultra-precision finishing at the atomic scale. Furthermore, advancements in CMP equipment design that allow for lower slurry consumption rates and improved containment systems present a strong avenue for market penetration. The continuous evolution of additive manufacturing and 3D printing techniques for demanding industrial parts also requires sophisticated post-processing, opening new vertical applications for specialized diamond formulations. Addressing the current restraints through robust R&D in green chemistry remains a critical factor for sustained, long-term market growth.

The inherent impact forces dictate that market success is increasingly linked to quality consistency and technological integration. Since the performance of a semiconductor wafer or an optical lens is directly correlated with the slurry used, end-users prioritize suppliers capable of delivering highly stable and reproducible products. This high-stakes environment drives innovation towards higher purity grades and tighter specifications for particle size and morphology, solidifying the market position of suppliers who invest heavily in material science and stringent quality control protocols. Geopolitical factors affecting the semiconductor supply chain also exert an indirect, yet powerful, impact on regional slurry demand and sourcing strategies.

Segmentation Analysis

The Diamond Slurry Market is extensively segmented based on the type of diamond utilized, the composition of the carrier fluid, the particle size range, and the critical end-use application. Understanding these segmentation nuances is vital for market participants to tailor product offerings precisely to the performance requirements of different industries, such as achieving atomic flatness in wafer processing versus maximizing stock removal rates for ceramic machining. The choice of diamond type—monocrystalline for versatility and cost, polycrystalline for enhanced mechanical toughness and removal, or nanodiamond for ultimate surface quality—fundamentally dictates the final product's utility and premium pricing structure, reflecting the depth of specialization within the market.

Segmentation by carrier fluid reflects a crucial industrial choice between achieving high-efficiency processing and adhering to environmental mandates. Water-based slurries are preferred in large-scale semiconductor fabrication due to easier cleanup and lower toxicity, provided the slurry stabilizers can maintain particle suspension stability over long periods. Conversely, oil-based or alcohol-based carriers are often selected for specific hard materials or processes where water could induce corrosion or where superior dispersion and lubrication properties are required to prevent surface scratching. Particle size segmentation directly correlates with the finishing requirement, ranging from coarse grades (micrometers) for initial lapping to ultra-fine grades (nanometers) for final polishing and CMP, showcasing the market's linear relationship between particle scale and required precision.

Application-based segmentation is the most direct measure of market demand, highlighting the dominance of the electronics and semiconductor sectors, followed by optics, precision machining, and materials science research. Each application demands a unique balance of cost, removal efficiency, and surface finish, driving manufacturers to offer a wide portfolio of products. This detailed categorization allows analysts and stakeholders to accurately assess the highest growth verticals and concentrate strategic investments in regions experiencing rapid expansion in these specific manufacturing capabilities, ensuring resource allocation aligns with emerging industrial needs and technological shifts.

- By Diamond Type:

- Monocrystalline Diamond Slurry

- Polycrystalline Diamond Slurry

- Nanodiamond Slurry

- By Carrier Fluid:

- Water-Based Slurry

- Oil-Based Slurry

- Alcohol-Based Slurry

- By Application:

- Semiconductor & Electronics (CMP)

- Optics & Photonics (Lenses, Mirrors)

- Metallurgy & Material Science

- Aerospace & Defense Components

- Medical & Dental Devices

- Precision Machining

- By Particle Size (Abrasive Grade):

- Sub-Micron (Nanometer Scale)

- Micron (1 µm to 10 µm)

- Coarse (> 10 µm)

Value Chain Analysis For Diamond Slurry Market

The value chain for the Diamond Slurry Market begins with the highly specialized upstream processes involving the synthesis and sourcing of diamond material, which dictates the quality and cost structure of the final product. Upstream analysis focuses on high-pressure/high-temperature (HPHT) synthesis or chemical vapor deposition (CVD) methods for producing synthetic diamonds, followed by rigorous sorting, crushing, and purification to achieve the precise particle shape and size required. Key suppliers in this stage are typically specialized diamond producers who focus heavily on particle morphology control and chemical purity, as even minor contaminants can severely impact downstream polishing performance, particularly in sensitive semiconductor applications. The procurement of high-grade carrier fluids, stabilizers, and proprietary chemical additives also constitutes a significant part of the initial value creation, requiring strong intellectual property protection.

Midstream activities involve the highly technical process of slurry formulation, where the prepared diamond particles are precisely dispersed and stabilized within the carrier fluid to create a uniform, non-settling suspension. This manufacturing phase requires advanced mixing equipment and strict quality control protocols to ensure consistency in concentration and zeta potential—a critical parameter for slurry performance. Distribution channel dynamics are typically a mix of direct sales to large, high-volume end-users (like major semiconductor fabs) and indirect sales through specialized technical distributors or agents who provide local inventory management, technical support, and rapid delivery services. Due to the technical complexity, distributors often require specific training on handling, storage, and application of the different slurry types.

Downstream analysis centers on the integration and consumption of the diamond slurry within end-user manufacturing environments, particularly within CMP operations. Direct customers benefit from tailored formulations and direct technical consultation regarding process optimization, which is vital in achieving high yields in advanced nodes. Indirect channels primarily serve smaller job shops, R&D facilities, and specialty material processors who benefit from the distributor's localized inventory and multi-brand portfolio. The ultimate value capture occurs when the slurry enables the end-user to produce high-specification components (e.g., highly flat semiconductor wafers or scratch-free optical lenses), thereby justifying the premium cost associated with precision abrasive technology and closing the feedback loop for continuous product improvement.

Diamond Slurry Market Potential Customers

The primary potential customers and end-users of diamond slurry are concentrated within industries demanding ultra-high precision, stringent material removal control, and superior surface integrity. Foremost among these are semiconductor manufacturers, particularly those involved in advanced wafer processing, including silicon, SiC, and GaN substrates used for microprocessors, memory chips, power devices, and RF components. These fabrication plants (fabs) utilize diamond slurry extensively in the Chemical Mechanical Planarization (CMP) stage to achieve near-perfect planarity, which is non-negotiable for multi-layered circuit integration and defect reduction, driving continuous, high-volume procurement.

Beyond electronics, key buyers include manufacturers in the precision optics sector, encompassing companies that produce high-definition lenses, prisms, mirrors for laser systems, and optical filters utilized in aerospace, defense, and advanced medical imaging equipment. These customers require slurries capable of achieving scratch-free surfaces and specific curvature tolerances with minimal sub-surface damage. Additionally, the metallurgy and precision engineering sectors, especially those manufacturing hard-material components like ceramic seals, turbine blades, hard disk read/write heads, and medical implants (e.g., orthopedic joints), represent substantial end-user segments, valuing the slurry's capability to efficiently process extremely tough materials.

The demand profile of these potential customers is characterized by a high need for product customization and technical support. Buyers typically seek suppliers who can demonstrate consistent quality control (lot-to-lot consistency), provide robust technical data detailing material removal rates and surface finish results, and offer solutions that minimize waste and maximize operational uptime. Emerging customer groups include research institutions and specialized material labs working on next-generation composite materials, advanced ceramics, and novel energy storage components, all requiring precise surface modification tools.

| Report Attributes | Report Details |

|---|---|

| Market Size in 2026 | $750 Million |

| Market Forecast in 2033 | $1,350 Million |

| Growth Rate | 8.5% CAGR |

| Historical Year | 2019 to 2024 |

| Base Year | 2025 |

| Forecast Year | 2026 - 2033 |

| DRO & Impact Forces |

|

| Segments Covered |

|

| Key Companies Covered | Engis Corporation, Saint-Gobain (Performance Ceramics & Abrasives), Kemet International Ltd., Kinik Company, Allied High Tech Products Inc., Microdiamant AG, Precision Diamond Products (PDP), TYROLIT Group, Shenzhen Tiantong Crystal Technology Co., Ltd., Henan Huajing Diamond Co., Ltd., Beijing Grish Hitech Co., Ltd., Ultra Tec Manufacturing Inc., Essentra PLC (via specialized divisions), DuPont (through material science offerings), Fujimi Corporation, RDC Co., Ltd., 3M Company (through abrasive systems), Cumi EMD (Carborundum Universal Ltd.). |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Enquiry Before Buy | Have specific requirements? Send us your enquiry before purchase to get customized research options. Request For Enquiry Before Buy |

Diamond Slurry Market Key Technology Landscape

The technology landscape of the Diamond Slurry Market is critically interwoven with advancements in material synthesis and fluid mechanics, focusing intensely on achieving unparalleled precision and consistency. A core technological focus involves optimizing the synthesis of diamond powders, moving beyond traditional High-Pressure/High-Temperature (HPHT) methods toward refined Chemical Vapor Deposition (CVD) techniques, especially for nanodiamonds. CVD offers superior control over crystal structure and defect density, which translates directly into better performance in the high-stakes environment of Chemical Mechanical Planarization (CMP). Furthermore, proprietary surface treatment technologies are being employed to modify diamond particle surfaces, enhancing their compatibility with specific carrier fluids and ensuring long-term colloidal stability, thereby preventing agglomeration which leads to surface defects.

Another crucial technological pillar involves slurry formulation chemistry, centered around the development of advanced stabilizing and dispersing agents. Achieving a highly stable, uniform suspension of diamond particles, particularly in the sub-micron and nanometer range, is technologically challenging yet essential. Innovations in zeta potential control and pH buffering systems are critical to prevent settling and maintain consistent abrasive action throughout the polishing process. This chemical complexity is proprietary and forms a major barrier to entry, as the interaction between the abrasive, the liquid medium, and the chemical additives directly influences the removal kinetics and the ultimate quality of the surface finish. The shift towards water-based, environmentally friendlier formulations necessitates the invention of new, highly effective, yet non-toxic dispersants.

The technological landscape is also increasingly shaped by integration with CMP equipment and monitoring systems. Slurry manufacturers are collaborating with equipment vendors to develop "smart slurries" compatible with advanced process control technologies, including in-situ monitoring sensors. These sensors track changes in slurry properties (such as concentration, temperature, and particle size distribution) during the polishing cycle, allowing for real-time feedback loops. This confluence of specialized abrasive technology and sophisticated manufacturing control systems represents the current frontier, aiming to deliver zero-defect polishing solutions for next-generation materials like ultra-hard ceramics, sapphire wafers, and complex semiconductor stacks, ensuring yield rates remain high even as feature sizes continue to shrink below the 7nm node.

Regional Highlights

The global Diamond Slurry Market demonstrates a pronounced geographical imbalance, driven primarily by concentrations of high-tech manufacturing capabilities and regional technological leadership. Asia Pacific (APAC) holds the undeniable majority share of the market, fueled by its status as the global epicenter for electronics manufacturing, specifically semiconductor fabrication, data storage production, and high-volume optics manufacturing. Countries like Taiwan (TSMC, UMC), South Korea (Samsung, SK Hynix), and mainland China (rapidly expanding domestic chip production) generate enormous demand for precision CMP slurries. This region’s growth is further supported by governmental initiatives focused on establishing local, high-grade material supply chains, making APAC the primary growth driver for both volume and specialized nanodiamond formulations.

North America is characterized by robust demand concentrated in high-value, niche applications, focusing heavily on R&D, aerospace, defense, and advanced medical devices. While the sheer volume of slurry consumption is lower than in APAC, the US leads in the development and adoption of cutting-edge slurry technologies and high-purity, low-defect formulations. The presence of major innovation centers, specialized material science companies, and leading aerospace manufacturers drives demand for highly customized and premium-priced diamond slurries. The ongoing national push to re-shore semiconductor manufacturing capacity also projects a significant future increase in slurry demand within the North American region over the forecast period, particularly for sophisticated SiC and GaN polishing.

Europe represents a stable, mature market driven by established sectors like precision engineering, automotive manufacturing (especially in Germany), and the production of specialized optical components. European demand is highly influenced by stringent quality control standards and a growing focus on sustainability, promoting the adoption of environmentally compliant, water-based formulations. Countries such as Germany, Switzerland, and the UK leverage diamond slurry for high-precision finishing of tooling, medical implants, and industrial ceramics. Latin America and the Middle East & Africa (MEA) currently hold smaller market shares, but demand is steadily increasing, largely driven by investments in localized precision machining and material processing centers, supported by growing regional infrastructure and industrial diversification efforts.

- Asia Pacific (APAC): Dominant market share due to semiconductor (CMP) and optics manufacturing concentration; fastest growth rate fueled by China’s domestic chip strategy and the high demand from Taiwan and South Korea.

- North America: Leading market for R&D and high-purity, specialized slurries for aerospace, defense, and advanced SiC/GaN power electronics applications. Expected resurgence in demand driven by semiconductor supply chain localization.

- Europe: Stable market driven by precision engineering, medical device manufacturing, and high-quality optics production; strong emphasis on water-based and environmentally compliant formulations.

- Latin America (LATAM): Emerging market with slow but steady growth, primarily focused on localized industrial maintenance and precision machinery parts.

- Middle East and Africa (MEA): Minimal current market share, potential for future growth linked to diversification into high-tech manufacturing and regional infrastructure projects requiring hard material finishing.

Top Key Players

The market research report includes a detailed profile of leading stakeholders in the Diamond Slurry Market.- Engis Corporation

- Saint-Gobain (Performance Ceramics & Abrasives)

- Kemet International Ltd.

- Kinik Company

- Allied High Tech Products Inc.

- Microdiamant AG

- Precision Diamond Products (PDP)

- TYROLIT Group

- Shenzhen Tiantong Crystal Technology Co., Ltd.

- Henan Huajing Diamond Co., Ltd.

- Beijing Grish Hitech Co., Ltd.

- Ultra Tec Manufacturing Inc.

- Essentra PLC (via specialized divisions)

- DuPont (through material science offerings)

- Fujimi Corporation

- RDC Co., Ltd.

- 3M Company (through abrasive systems)

- Cumi EMD (Carborundum Universal Ltd.)

- Nano-Abrasives Inc.

Frequently Asked Questions

Analyze common user questions about the Diamond Slurry market and generate a concise list of summarized FAQs reflecting key topics and concerns.What is the primary function of diamond slurry in semiconductor manufacturing?

The primary function of diamond slurry in semiconductor manufacturing is Chemical Mechanical Planarization (CMP). CMP is a critical process used to polish and flatten the surface of silicon and compound semiconductor wafers to achieve ultra-uniform thickness and planarity, essential for depositing subsequent micro-circuit layers without defects. Diamond slurries provide the high abrasive power necessary to efficiently remove material while achieving atomic-scale surface quality.

How do monocrystalline and polycrystalline diamond slurries differ in application?

Monocrystalline diamond slurry consists of single, highly defined crystal structures, offering efficiency and consistent abrasion, making it suitable for general lapping and polishing of various hard materials. Polycrystalline diamond slurry consists of crystals with multiple cutting edges (micro-cleavage points), which fracture during use to expose fresh abrasive surfaces, providing superior material removal rates and a finer finish, often preferred for extremely hard materials like specialized ceramics and high-performance alloys.

What is Nanodiamond slurry and why is it gaining importance in the market?

Nanodiamond slurry utilizes diamond particles with sizes typically below 100 nanometers. It is gaining importance because it enables ultra-precision finishing and super-smooth surfaces essential for emerging technologies such as Micro-LED displays, advanced optics, and high-density memory devices. Nanodiamonds offer minimal subsurface damage and superior polishing consistency required for next-generation material processing where feature sizes are shrinking rapidly.

Are water-based or oil-based diamond slurries more environmentally sustainable?

Water-based diamond slurries are generally considered more environmentally sustainable than traditional oil-based or alcohol-based formulations. They facilitate easier cleanup processes, reduce volatile organic compound (VOC) emissions, and simplify disposal procedures, aligning with stringent environmental regulations, particularly in large-scale manufacturing facilities that are prioritizing green chemistry solutions and reduced environmental footprints in their material inputs.

What factors determine the optimal particle size selection for a diamond slurry application?

Optimal particle size selection is determined by the required material removal rate (MRR) and the final desired surface finish (roughness). Larger particle sizes (micron scale) are used for initial lapping stages where high material removal is prioritized. Conversely, smaller particle sizes (sub-micron or nanometer scale) are required for final polishing and CMP stages where achieving the lowest possible surface roughness (measured in angstroms) and minimizing defects is the critical objective.

How does the stability of diamond slurry impact manufacturing yield?

Slurry stability, primarily influenced by the carrier fluid and dispersants, is paramount because unstable slurries lead to particle agglomeration and sedimentation. Agglomerated particles cause random surface scratches and defects on polished substrates, such as silicon wafers, drastically reducing the manufacturing yield (the percentage of usable products). High-stability slurries ensure uniform particle distribution and consistent material removal, maximizing yield in precision industries.

What role does the Chemical Mechanical Planarization (CMP) process play in diamond slurry demand?

CMP is the single largest driver of demand for high-grade diamond slurry. As semiconductor circuitry becomes denser and features shrink, the need for perfectly planarized surfaces across the entire wafer increases exponentially. Diamond slurry is indispensable for CMP because it offers the necessary balance of mechanical abrasion and chemical activity to remove material uniformly and achieve the required extreme flatness specifications for advanced node fabrication.

What are the main constraints limiting the growth of the Diamond Slurry Market?

The main constraints include the high initial cost of synthesizing high-quality, high-purity diamond powders, which is energy-intensive. Additionally, the complex environmental challenges associated with the safe handling and disposal of spent slurries—which are classified as industrial waste containing fine abrasive particles and proprietary chemical residues—pose significant regulatory and logistical burdens for manufacturers worldwide, necessitating investment in specialized waste treatment.

How is AI being utilized to improve diamond slurry performance?

AI is increasingly utilized to optimize diamond slurry performance through predictive modeling and process control. Machine learning algorithms analyze real-time CMP process data (pressure, temperature, friction) to predict the optimal formulation adjustments (concentration, flow rate) needed to maintain peak material removal rates and defect-free finishes. This automation reduces human error, minimizes material consumption, and accelerates R&D cycles for new slurry formulations.

Which regional market holds the technological lead in specialized diamond slurry innovation?

While Asia Pacific leads in overall volume consumption and manufacturing application, North America, particularly the United States, tends to hold the technological lead in specialized diamond slurry innovation. This leadership is rooted in extensive R&D focusing on ultra-high-purity, custom formulations for advanced defense, aerospace, and next-generation power electronics (SiC/GaN) applications, driven by collaborative efforts between academic research and specialized material science corporations.

Why is particle morphology control critical in diamond slurry manufacturing?

Particle morphology (shape and surface texture) control is critical because it directly dictates the interaction between the abrasive material and the workpiece surface. Uniform, precisely controlled particle shapes prevent scratching and subsurface damage. Different morphologies, such as blocky or needle-like shapes, are engineered for specific functions—from aggressive stock removal to ultra-smooth final polishing—ensuring the slurry meets the tight specifications required by high-precision industries.

What are the emerging opportunities for diamond slurry outside of the semiconductor industry?

Emerging opportunities for diamond slurry lie in the medical device sector (polishing orthopedic implants and surgical instruments), the production of complex ceramic components for high-temperature and wear-resistant applications (e.g., aerospace engines), and the finishing of specialized components required for quantum computing hardware. These industries require the same level of precision and material compatibility that diamond slurries reliably provide.

How does the quality of the carrier fluid affect the overall performance of the slurry?

The carrier fluid is not merely a medium; its quality significantly affects slurry performance by ensuring particle dispersion, lubrication, heat dissipation, and chemical stability. A high-quality carrier fluid prevents particle settling (sedimentation) and agglomeration, maintains the chemical integrity of the solution (zeta potential), and minimizes friction during polishing, thereby enabling consistent material removal rates and achieving superior, defect-free surface finishes over the operational lifespan of the slurry.

What are the differences between natural and synthetic diamond slurries?

Synthetic diamond slurries, produced via HPHT or CVD, dominate the market due to their controlled purity, highly uniform crystal structure, and scalable production, allowing for precise customization of particle size and morphology tailored to specific polishing needs. Natural diamond slurries, while still used in some niche, traditional applications, often exhibit more structural variation and impurities, making them less suitable for the ultra-stringent requirements of modern high-tech manufacturing, such as advanced CMP.

What impact do raw material price fluctuations have on the diamond slurry market?

Fluctuations in the price of synthetic diamond powder, the primary raw material, have a direct and significant impact on the final pricing and profitability of diamond slurries. Since the synthesis process (especially HPHT and CVD) is energy-intensive and requires high-purity inputs, price volatility can compress profit margins for manufacturers and lead to cost pass-through to end-users, affecting procurement decisions, particularly for high-volume consumers in the Asia Pacific region.

To check our Table of Contents, please mail us at: sales@marketresearchupdate.com

Research Methodology

The Market Research Update offers technology-driven solutions and its full integration in the research process to be skilled at every step. We use diverse assets to produce the best results for our clients. The success of a research project is completely reliant on the research process adopted by the company. Market Research Update assists its clients to recognize opportunities by examining the global market and offering economic insights. We are proud of our extensive coverage that encompasses the understanding of numerous major industry domains.

Market Research Update provide consistency in our research report, also we provide on the part of the analysis of forecast across a gamut of coverage geographies and coverage. The research teams carry out primary and secondary research to implement and design the data collection procedure. The research team then analyzes data about the latest trends and major issues in reference to each industry and country. This helps to determine the anticipated market-related procedures in the future. The company offers technology-driven solutions and its full incorporation in the research method to be skilled at each step.

The Company's Research Process Has the Following Advantages:

- Information Procurement

The step comprises the procurement of market-related information or data via different methodologies & sources.

- Information Investigation

This step comprises the mapping and investigation of all the information procured from the earlier step. It also includes the analysis of data differences observed across numerous data sources.

- Highly Authentic Source

We offer highly authentic information from numerous sources. To fulfills the client’s requirement.

- Market Formulation

This step entails the placement of data points at suitable market spaces in an effort to assume possible conclusions. Analyst viewpoint and subject matter specialist based examining the form of market sizing also plays an essential role in this step.

- Validation & Publishing of Information

Validation is a significant step in the procedure. Validation via an intricately designed procedure assists us to conclude data-points to be used for final calculations.

×

Request Free Sample:

Related Reports

Select License

Why Choose Us

We're cost-effective and Offered Best services:

We are flexible and responsive startup research firm. We adapt as your research requires change, with cost-effectiveness and highly researched report that larger companies can't match.

Information Safety

Market Research Update ensure that we deliver best reports. We care about the confidential and personal information quality, safety, of reports. We use Authorize secure payment process.

We Are Committed to Quality and Deadlines

We offer quality of reports within deadlines. We've worked hard to find the best ways to offer our customers results-oriented and process driven consulting services.

Our Remarkable Track Record

We concentrate on developing lasting and strong client relationship. At present, we hold numerous preferred relationships with industry leading firms that have relied on us constantly for their research requirements.

Best Service Assured

Buy reports from our executives that best suits your need and helps you stay ahead of the competition.

Customized Research Reports

Our research services are custom-made especially to you and your firm in order to discover practical growth recommendations and strategies. We don't stick to a one size fits all strategy. We appreciate that your business has particular research necessities.

Service Assurance

At Market Research Update, we are dedicated to offer the best probable recommendations and service to all our clients. You will be able to speak to experienced analyst who will be aware of your research requirements precisely.

Contact With Our Sales Team

Customer Testimonials

The content of the report is always up to the mark. Good to see speakers from expertise authorities.

Privacy requested , Managing Director

A lot of unique and interesting topics which are described in good manner.

Privacy requested, President

Well researched, expertise analysts, well organized, concrete and current topics delivered in time.

Privacy requested, Development Manager