Diamond Tile Cutter Market Size, By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2026 to 2033 (Financial Impact Analysis)

ID : MRU_ 441596 | Date : Feb, 2026 | Pages : 243 | Region : Global | Publisher : MRU

Diamond Tile Cutter Market Size

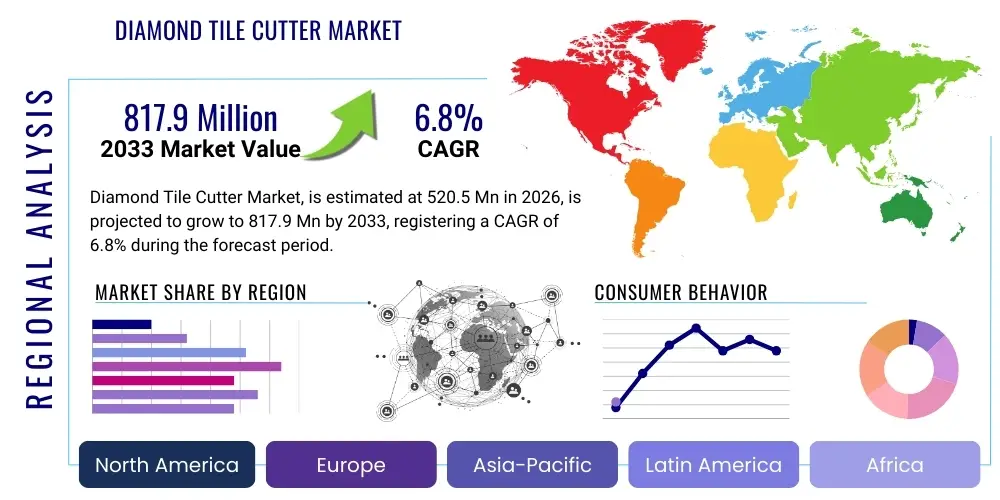

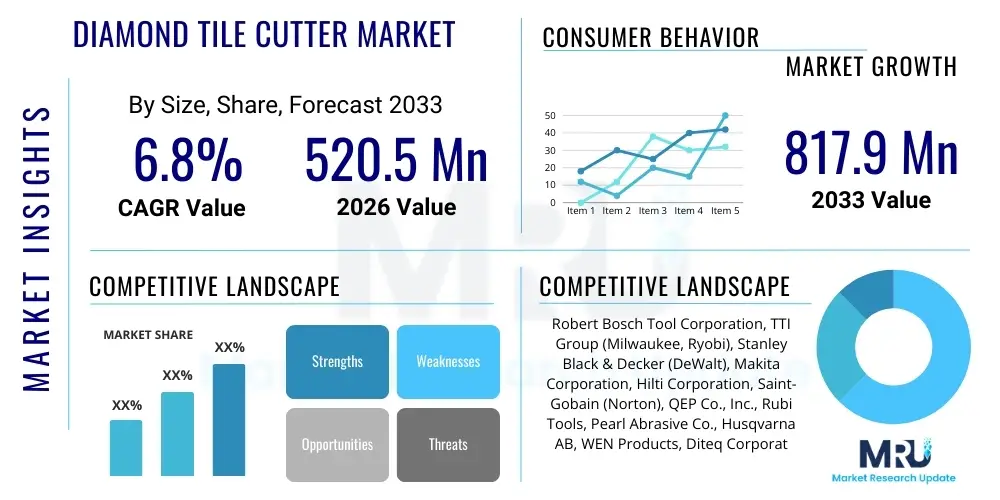

The Diamond Tile Cutter Market is projected to grow at a Compound Annual Growth Rate (CAGR) of 6.8% between 2026 and 2033. The market is estimated at USD 520.5 Million in 2026 and is projected to reach USD 817.9 Million by the end of the forecast period in 2033.

Diamond Tile Cutter Market introduction

The Diamond Tile Cutter Market encompasses specialized power tools designed for accurately and efficiently cutting hard, brittle materials such as ceramic, porcelain, natural stone, and glass tiles. These devices utilize cutting wheels embedded with industrial-grade synthetic diamonds, enabling superior abrasive performance, precision, and longevity compared to traditional abrasive blades. The product range includes manual snap cutters for thin tiles, robust benchtop wet saws for high-volume commercial applications, and ergonomic handheld electric cutters suitable for intricate work and renovation projects. The primary function is to facilitate construction and renovation activities requiring precise tile fitting, thereby driving indispensable demand across residential, commercial, and industrial infrastructure sectors globally.

Major applications of diamond tile cutters span professional construction, architectural design implementation, high-end home improvement, and large-scale infrastructure projects like airports, hospitals, and educational institutions where durable, high-quality tiling is mandatory. The inherent benefits of diamond cutting technology include significantly reduced chipping and cracking of expensive materials, vastly superior cutting speeds, and the ability to cleanly process extremely dense modern materials, such as rectified porcelain and massive large-format slabs (LFS). The crucial utilization of wet cutting systems, often integrated into these tools, minimizes the generation of hazardous crystalline silica dust, enhancing operator safety and ensuring compliance with stringent environmental health regulations on construction sites worldwide.

Driving factors for sustained market growth include the global surge in residential construction fueled by continuous urbanization, coupled with increasing disposable incomes leading to higher consumer investment in high-quality home renovations and luxury finishes. Furthermore, significant technological advancements, such as the introduction of lightweight, high-power cordless, high-voltage battery-powered cutters and enhanced diamond blade geometries, dramatically improve tool portability and cutting performance. These innovations make sophisticated, high-precision tools accessible to a broader user base, including professional contractors and advanced DIY enthusiasts, while the necessary transition towards installing large-format tiles necessitates the reliable, precision cutting capability offered exclusively by diamond technology, continuously bolstering market demand across both developed and emerging economies.

Diamond Tile Cutter Market Executive Summary

The Diamond Tile Cutter Market is experiencing robust expansion driven primarily by escalating global construction output, especially concentrated in the Asia Pacific region, which is currently undergoing rapid urbanization and massive infrastructure development. Key business trends involve a decisive industry shift towards highly efficient cordless and battery-operated tools, maximizing portability, setup speed, and convenience on diverse and often challenging job sites, aligning seamlessly with the broader global industrial trend of tool electrification. Leading manufacturers are strategically focusing on integrating sophisticated smart features, such as highly accurate laser guides, integrated vacuum ports, and advanced water delivery systems, to optimize cutting efficiency and minimize costly material waste, catering directly to professional contractors demanding consistently higher productivity and unparalleled precision in complex, high-end projects.

Regionally, the market dynamics exhibit significant variation based on maturity, regulation, and construction scale. North America and Europe represent mature, high-value markets characterized predominantly by replacement demand, adherence to strict safety standards, and a high adoption rate of premium, technologically advanced cutters featuring ergonomic designs. Conversely, the high-growth Asia Pacific market is dominated by volumetric expansion and the accelerating penetration of professional-grade power tools replacing older, rudimentary methods, particularly notable in rapidly modernizing economies such as China, India, and Indonesia. Latin America and the Middle East and Africa (MEA) show promising potential fueled by emerging large-scale tourism infrastructure and sustained public housing projects. Intense pricing pressure persists in the high-volume, mid-range segments, compelling manufacturers to pursue differentiation through superior motor technology, robust durability, and the provision of comprehensive, effective after-sales service networks.

Segmentation trends highlight the increasing financial dominance of the professional application segment, which consistently prioritizes long-term durability, sustained high performance, and minimal downtime, typically preferring advanced wet tile saws capable of handling continuous, heavy-duty applications. The growing popularity and efficiency of online retail channels, coupled with the adoption of direct-to-consumer models by tool manufacturers, are actively disrupting established traditional distribution networks, offering brands broader geographical reach, lower overheads, and competitive pricing advantages directly to end-users. Furthermore, the specialized segment dedicated to cutters for large-format tile (LFS) installation is witnessing a rapid pace of innovation, introducing precision rail-guided scoring and cutting systems designed to manage massive, oversized ceramic and porcelain slabs with unparalleled accuracy, directly addressing a crucial and high-value need in modern luxury architecture and commercial tiling projects.

AI Impact Analysis on Diamond Tile Cutter Market

User queries regarding the impact of Artificial Intelligence (AI) on the Diamond Tile Cutter Market frequently revolve around how sophisticated AI systems can enhance inherent manufacturing processes, potentially improve tool lifespan through predictive maintenance, and possibly automate aspects of high-precision, repetitive cutting tasks. Common concerns and expectations include the application of predictive analytics for generating highly accurate tool maintenance schedules, the optimization of complex supply chain logistics for critical raw materials like synthetic diamond powder, and the theoretical integration of machine learning algorithms into advanced CNC tile cutting systems used in specialized stone and ceramic fabrication workshops. Users are specifically seeking concrete evidence of AI-driven improvements in blade wear prediction, automated quality control mechanisms during blade manufacturing, and the future development of 'smart' tools that could potentially adjust internal cutting parameters dynamically based on real-time sensor feedback concerning tile density or material hardness.

While the fundamental material removal process involving the diamond blade remains mechanical, AI significantly influences and optimizes the entire supporting technological ecosystem, particularly in production and asset management. In manufacturing, sophisticated machine learning models analyze vast amounts of production data in real-time to identify micro-defects in diamond matrix bonding, rigorously optimizing complex sintering temperatures and pressure profiles. This rigorous optimization leads directly to the creation of more consistently durable and efficient blades and substantially reduces production waste rates for manufacturers. Supply chain management operations extensively utilize AI to accurately forecast short-term and long-term demand fluctuations based on complex construction industry indices and regional project pipelines, ensuring the timely and precise delivery of specialized components and significantly reducing expensive inventory carrying costs for major global tool manufacturers.

Looking ahead into the forecast period, the influence of AI and its supporting technologies will likely manifest most visibly in higher-end, fully automated cutting systems and professional fleet management. For specialized large-scale contractors dealing with intricate custom patterns or massive tiling volumes, AI-driven visual recognition systems will become standard for optimizing the complex nesting and layout of cuts on expensive tiles, effectively minimizing material wastage and maximizing yield utilization. Furthermore, advanced diagnostic tools utilizing embedded sensors and AI algorithms could continuously monitor internal tool parameters such as vibration patterns, motor current load, and thermal stability in real-time, providing highly accurate estimations of blade lifespan and intelligently recommending optimal replacement or servicing times, thereby maximizing jobsite uptime and significantly reducing operational unpredictability for professional users working under critical construction deadlines.

- AI rigorously optimizes diamond matrix manufacturing processes, significantly enhancing blade durability and consistency through automated predictive quality control checks.

- Machine learning algorithms substantially improve supply chain efficiency by accurately forecasting global construction demand and intelligently managing critical raw material logistics for diamond powder and steel.

- Predictive maintenance analytics leverage comprehensive sensor data (vibration, temperature, current draw) in high-end wet cutters to forecast potential tool failure or blade wear, thereby maximizing operational uptime.

- AI-driven visual recognition systems are increasingly utilized in automated CNC tile cutting to perform complex material optimization and highly accurate pattern alignment, drastically reducing expensive tile wastage.

- Integrated diagnostic tools powered by AI enhance professional after-sales service, quickly identifying and troubleshooting complex tool issues via embedded telematics and providing actionable maintenance recommendations.

DRO & Impact Forces Of Diamond Tile Cutter Market

The Diamond Tile Cutter Market is powerfully propelled by overwhelming global urbanization trends and substantial governmental and private sector investments in both residential and commercial infrastructure, particularly concentrated in rapidly developing economies, which inherently necessitates high volumes of precise and high-quality tile installation. Key drivers include the growing consumer and architectural preference for extremely durable, aesthetically appealing materials such as large-format porcelain, engineered stone, and natural stone tiles, which mandate the exclusive use of high-precision diamond cutting technology for consistently clean and perfect results. However, the market faces significant constraining restraints, primarily stemming from the relatively high initial capital expenditure associated with purchasing premium diamond tools and specialized industrial wet cutting systems, which slows market penetration in highly price-sensitive segments. Additionally, the increasing global stringency of regulations regarding construction dust and mandatory worker safety necessitates the utilization of expensive dust-suppressing wet saws, which, while beneficial, adds inherent complexity, maintenance requirements, and weight to the tools, slightly restraining the immediate widespread adoption of simpler, cheaper dry-cutting alternatives.

Opportunities for decisive market expansion are abundant, particularly centered around continuous technological innovation focused intensely on optimizing portability, power output, and overall cutting efficiency. The rapid and profound maturation of lithium-ion battery technology currently offers a major opportunity for manufacturers to develop professional-grade, high-voltage cordless wet tile cutters that effectively match and potentially surpass the continuous performance and duty cycle of legacy corded counterparts. This directly addresses the critical demand for superior flexibility and mobility on diverse job sites without compromising essential cutting power or necessary operational duration. Furthermore, the burgeoning and high-value market for specialized large-format tile (LFS) installation tools presents a significant niche growth opportunity, as these massive, high-value, and delicate tiles require dedicated, high-precision, rail-guided cutting and handling systems that standard benchtop cutters cannot safely or effectively accommodate. Manufacturers are also strategically exploring opportunities within the retrofitting and blade replacement market, consistently offering highly efficient, specialized diamond blades compatible with the massive existing install base of standard angle grinders and manual cutters.

The impact forces within this specialized market are substantial and multifaceted, fundamentally dictated by the volatile price fluctuations of critical raw materials (primarily synthetic diamonds and high-grade steel alloys), the inherent cyclical nature of the global construction industry, and continuous technological disruption. The primary internal impact force is the delicate balance between maximum tool performance (encompassing cutting speed, finished precision, and blade longevity) and competitive cost, heavily influencing the complex purchasing decisions made by professional contractors who critically rely on tool efficiency for maintaining profitability. The competitive landscape is intensely focused on aggressive patenting of advancements in specialized diamond bonding techniques and optimizing motor efficiency (e.g., advanced brushless DC technology). Regulatory pressures, particularly those related to minimizing harmful crystalline silica dust exposure (such as strict OHSA standards in North America), serve as a powerful external force, compelling the entire industry unequivocally toward safer, enclosed wet-cutting solutions and sophisticated dust extraction attachments, fundamentally shaping future product design and core market offerings.

Segmentation Analysis

The Diamond Tile Cutter market is comprehensively segmented based on product type, fundamental operation mode, application environment, and primary distribution channel, providing highly granular insights into specific user needs, operational requirements, and global purchasing behavior patterns. Product Type segmentation differentiates clearly between high-volume manual (score-and-snap) cutters, industrial wet saws (including stationary benchtop or large bridge saws), and highly versatile handheld electric cutters, accurately reflecting the diverse scale, material complexity, and precision required across various tiling projects. Operation mode analysis distinctly categorizes tools into traditional corded models and increasingly popular cordless battery-powered models, a distinction that is rapidly growing in strategic importance as advanced battery technology improves and job site electrification accelerates globally. Application segmentation distinctly divides market demand based on the end-user environment, meticulously separating typical residential renovation needs from the rigorous, continuous demands of commercial, infrastructural, and industrial construction requirements, each demanding unique tool specifications regarding power output, duty cycle, and durability.

- By Product Type:

- Wet Tile Saws (Professional Bridge Saws, Benchtop Models)

- Handheld Electric Cutters (Wet and Dry Capable)

- Manual Tile Cutters (Score and Snap Systems)

- Large Format Tile Cutting Systems (Rail-guided and Suction-assisted Systems)

- By Operation Mode:

- Corded Electric Tools

- Cordless Battery-Powered Tools (High-Voltage Platforms)

- By Application:

- Residential Construction and Remodeling (DIY and Contractor)

- Commercial Building Projects (Hospitals, Malls, Offices, Schools)

- Industrial and Infrastructure Development (Manufacturing Plants, Airports, Public Works)

- By Distribution Channel:

- Online Retail and E-commerce Platforms (Amazon, Specialty Tool Websites)

- Offline Channels (Specialty Hardware Stores, Large DIY Home Improvement Centers, Professional Direct Distributors)

Value Chain Analysis For Diamond Tile Cutter Market

The critical value chain for the Diamond Tile Cutter Market commences with highly specialized upstream activities, which focus intensely on the rigorous procurement and precise processing of critical raw materials. These materials primarily include industrial-grade synthetic diamonds (used for cutting segments), specialized high-tensile steel alloys for the blade cores, and advanced composite plastics and high-efficiency electric motors for the tool bodies. The established quality and production efficiency of the synthetic diamond manufacturing process—typically utilizing high-pressure, high-temperature (HPHT) or chemical vapor deposition (CVD) methods—are foundational, as superior diamond quality directly and significantly dictates the final blade longevity, overall cutting performance, and consistency. Key upstream strategic challenges involve maintaining a stable and consistent supply of high-purity carbon precursors and effectively managing the intensive energy requirements necessary for diamond synthesis, which contributes significantly to the final product cost and potential market price volatility.

The midstream segment encompasses manufacturing, intricate assembly, and stringent quality control. Major global tool manufacturers often strategically outsource high-volume components like advanced brushless motors and robust lithium-ion batteries but invariably maintain proprietary, strict control over the critical diamond blade production process. This includes proprietary focus on highly advanced bonding technologies (such as sintering, specialized brazing, and laser welding) to securely affix the diamond segments to the steel core. Operational efficiency in midstream processes is heavily reliant on advanced robotics, highly optimized automation lines, and rigorous, continuous testing procedures, collectively ensuring that the final assembled cutters consistently meet the demanding professional standards for motor power, effective water management, and mandatory safety compliance. This entire stage is inherently highly capital-intensive due to the need for precision engineering necessary to produce robust, professional-grade tools designed specifically for continuous, demanding use in unforgiving, harsh construction environments.

Downstream activities are strategically centered on logistics, distribution, and direct end-user engagement. Distribution channels are currently bifurcated between established traditional brick-and-mortar stores (including specialty tool retailers and large DIY chains) and the rapidly accelerating penetration of e-commerce platforms. Direct distribution strategies, particularly tailored for large industrial and governmental accounts, allow manufacturers significantly greater control over brand positioning, pricing fidelity, and detailed product servicing. For mass retail distribution, the emphasis shifts to providing highly effective product demonstration areas, comprehensive, well-structured after-sales support, and robust warranty programs, which are essential for reassuring professional users of the tool’s critical long-term reliability. Potential customers, spanning individual self-employed tilers and small contracting firms to vast multinational construction corporations, rigorously prioritize factors such as optimal power-to-weight ratio, integrated effective dust control features, and overall documented tool lifespan when making major purchase decisions, making the efficiency and responsiveness of the downstream service network a critical competitive differentiator.

| Report Attributes | Report Details |

|---|---|

| Market Size in 2026 | USD 520.5 Million |

| Market Forecast in 2033 | USD 817.9 Million |

| Growth Rate | 6.8% CAGR |

| Historical Year | 2019 to 2024 |

| Base Year | 2025 |

| Forecast Year | 2026 - 2033 |

| DRO & Impact Forces |

|

| Segments Covered |

|

| Key Companies Covered | Robert Bosch Tool Corporation, TTI Group (Milwaukee, Ryobi), Stanley Black & Decker (DeWalt), Makita Corporation, Hilti Corporation, Saint-Gobain (Norton), QEP Co., Inc., Rubi Tools, Pearl Abrasive Co., Husqvarna AB, WEN Products, Diteq Corporation, Felker Tile Saws, Loxgand Tools, Chicago Pneumatic, Norton Clipper, Montolit, Lackmond Products, Crain Cutter Co., Metabo HPT. |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Enquiry Before Buy | Have specific requirements? Send us your enquiry before purchase to get customized research options. Request For Enquiry Before Buy |

Diamond Tile Cutter Market Key Technology Landscape

The key technology landscape of the Diamond Tile Cutter Market is characterized by rapid and focused evolution, fundamentally driven by the non-negotiable industry requirements for enhanced cutting precision, stringent dust mitigation compliance, and superior tool portability. A major and ongoing technological focus is the extensive development and pervasive integration of high-efficiency brushless DC (BLDC) motors across both corded and especially cordless product lines. Brushless motors offer significantly higher power-to-weight ratios, drastically extended operational life due to reduced frictional heat generation and component wear, and superior efficiency in battery consumption. This efficiency is absolutely critical for professional-grade cordless wet tile saws that must reliably maintain peak torque under continuous, heavy load when cutting exceptionally dense and large materials like rectified porcelain and natural stone.

Blade technology represents another fundamentally pivotal area of sustained innovation. Manufacturers are increasingly employing highly advanced laser welding and specialized sintering techniques to exponentially improve the mechanical bond between the highly stressed diamond cutting segments and the underlying steel core. This advancement allows for the safe production of substantially thinner blades (reduced kerf) which significantly reduces friction, improves overall cutting speed, and minimizes material waste, all without compromising essential segment retention strength or long-term durability. The strategic introduction of turbo rim, continuous rim, and specialized segmented rim blades, often featuring specialized coolant channels and refined, highly controlled diamond grit sizing, is specifically targeted at optimizing performance for particular materials, providing superior results for ultra-hard natural stones, delicate glass tiles, or highly abrasive ceramic types. This specialization in blade technology directly caters to the nuanced needs of professional tilers who require highly optimized tools for their specific job specifications, moving far beyond the operational limitations of traditional one-size-fits-all blade approaches.

In terms of optimizing the overall user experience and mandatory jobsite safety, technological innovation is heavily concentrated on advanced dust and water management systems. High-performance wet saws now frequently feature sophisticated, closed-loop water recirculation systems that aggressively minimize water waste and maximize coolant delivery efficiency, significantly extending diamond blade life and effectively suppressing hazardous crystalline silica dust exposure, ensuring full compliance with stringent global health and safety standards. Furthermore, highly precise laser guidance systems are rapidly becoming standard features, projecting an accurate, clearly visible cut line onto the tile surface, dramatically improving user accuracy and reducing costly measurement errors, which is particularly vital when handling expensive, oversized, large-format materials. Finally, the incorporation of advanced Battery Management Systems (BMS) in all cordless cutters further enhances operational safety and product longevity by vigilantly protecting battery packs from detrimental overcharging, damaging deep discharge cycles, and excessive thermal stress, thereby guaranteeing reliable, predictable performance throughout the tool's intended lifecycle.

Regional Highlights

- Asia Pacific (APAC): APAC represents the largest current market and is projected to be the fastest-growing region, driven by monumental governmental investments in residential, commercial, and transport infrastructure, particularly concentrated in massive urbanization centers in China, India, and Southeast Asian nations. The region is structurally characterized by high volumetric consumption and an accelerating transition from purely manual cutting methods to mechanized electric and sophisticated wet saw technology, fueled by rising labor costs and the mandatory adoption of higher quality international construction standards. Demand here is exceptionally strong for robust, durable benchtop and bridge wet saws specifically suitable for intensive, continuous use on vast, large-scale construction sites.

- North America: North America is defined as a mature, high-value market characterized by a strong, consistent emphasis on professional-grade, high-performance, and predominantly cordless tools. The region exhibits high adoption rates of premium, established brands and cutting-edge technology, fundamentally driven by extremely strict safety regulations (especially those concerning airborne silica dust) and a strong professional preference for maximum efficiency and tool mobility. The large residential renovation sector, favoring high-end luxury materials like massive porcelain slabs, is a major, consistent demand driver, focusing sales decisively towards specialized rail-guided LFS cutting systems and the latest high-voltage battery platforms.

- Europe: The diverse European market, particularly in established economies like Germany, the UK, and France, is highly competitive, technologically sophisticated, and strictly regulated. Key underlying drivers include rigorous quality standards, pervasive environmental regulations, and a very strong, highly skilled professional tiling trade that consistently demands unparalleled precision and advanced ergonomic design. There is significant and rapid innovation adoption here, particularly concerning effective integrated dust extraction accessories and highly efficient, advanced manual cutters optimized for quick, precise scoring of standard-sized ceramic tiles in sensitive urban renovation projects.

- Latin America: This region is an emerging market currently experiencing steady, if sometimes fluctuating, growth, intrinsically linked to generally positive trends in construction and sustained tourism infrastructure development. The market structure is inherently more price-sensitive than North America and Europe, leading to a substantial demand profile for versatile, reliable mid-range electric cutters. As regional construction quality standards steadily rise, there is increasing, measurable interest in adopting wet cutting technology to improve overall jobsite safety and guarantee superior final material finish quality.

- Middle East and Africa (MEA): Growth in MEA is highly concentrated within the economically powerful Gulf Cooperation Council (GCC) nations (e.g., Saudi Arabia, UAE), driven by multiple major ongoing and vast planned megaprojects (such as NEOM). These ambitious projects require vast quantities of high-durability natural stone and dense porcelain, critically fueling demand for heavy-duty, industrial-grade bridge saws and high-capacity wet cutting stations capable of efficiently handling continuous, high-volume work cycles under the region's specific, extreme operating conditions.

Top Key Players

The market research report includes a detailed profile of leading stakeholders in the Diamond Tile Cutter Market.- Robert Bosch Tool Corporation

- TTI Group (Milwaukee, Ryobi)

- Stanley Black & Decker (DeWalt)

- Makita Corporation

- Hilti Corporation

- Saint-Gobain (Norton)

- QEP Co., Inc.

- Rubi Tools

- Pearl Abrasive Co.

- Husqvarna AB

- WEN Products

- Diteq Corporation

- Felker Tile Saws

- Loxgand Tools

- Chicago Pneumatic

- Norton Clipper

- Montolit

- Lackmond Products

- Crain Cutter Co.

- Metabo HPT

Frequently Asked Questions

Analyze common user questions about the Diamond Tile Cutter market and generate a concise list of summarized FAQs reflecting key topics and concerns.What is the primary factor driving the demand for professional wet tile saws?

The primary driver is the global increase in the use of dense, large-format porcelain and ceramic tiles, which absolutely require water-cooled diamond blades for precise, chip-free cutting and effective suppression of hazardous crystalline silica dust, ensuring full compliance with construction safety standards.

How are cordless tile cutters overcoming the power limitations of corded tools?

Cordless cutters are leveraging major advancements in high-voltage lithium-ion battery platforms (e.g., 54V or 60V systems) and highly efficient brushless motor technology (BLDC) to deliver sustained torque and extended runtime comparable to professional corded units, drastically improving jobsite portability and operational flexibility.

Which geographical region is expected to demonstrate the highest market growth rate?

The Asia Pacific (APAC) region is projected to exhibit the highest Compound Annual Growth Rate (CAGR) due to massive ongoing urbanization, robust infrastructure development, and a rapid, widespread shift toward mechanization and professional-grade tool adoption in key emerging economies like India and China.

What are the key technological differentiators among competing diamond tile cutter brands?

Key technological differentiators include proprietary advanced diamond bonding techniques for extended blade life, superior integrated water recirculation and dust management systems, the precise integration of laser guidance, and patented brushless motor control systems that dynamically optimize cutting speed and battery efficiency.

What is the significance of rail-guided systems in the tile cutter market?

Rail-guided systems are essential for accurately cutting expensive, large-format slabs (LFS) and ensuring perfect linear scores over long distances, effectively minimizing the high risk of breakage and material waste associated with handling oversized and extremely dense modern architectural tiles.

The extensive analysis of the Diamond Tile Cutter Market reveals a technologically sophisticated sector where continuous advancements are intrinsically linked to the ongoing evolution of construction materials and increasingly rigorous global safety standards. The sustained market growth trajectory is fundamentally underpinned by global construction cycles and the growing necessity for precision tools capable of effectively working with increasingly hard, geometrically large, and costly tiling materials. The decisive industry shift towards cordless mobility, facilitated by superior battery chemistry and advanced brushless motor technologies, fundamentally enhances contractor productivity and operational flexibility. Furthermore, the imperative for highly effective dust mitigation is strongly steering future product development toward advanced wet cutting solutions and integrated vacuum accessories, ensuring alignment with critical global regulatory trends like those mandated by OSHA regarding airborne silica dust exposure. The segmentation detailed above highlights the robust and resilient demand within the professional end-user category, who consistently prioritize maximum durability, unwavering precision, and long-term tool longevity over initial acquisition cost, subsequently driving innovation towards premium, high-duty-cycle equipment, particularly advanced bridge saws and specialized large-format cutting systems.

Geographically, current market momentum is heavily concentrated in the Asia Pacific region, fueled by unprecedented urbanization rates and expansive public and private infrastructure projects, providing the largest volumetric opportunity globally. Conversely, mature and highly regulated markets in North America and Europe focus intensely on incremental innovation, meticulously optimizing existing tool platforms for enhanced safety features, superior ergonomic design, and digital connectivity, primarily catering to replacement cycles and highly complex, high-end residential remodeling projects. The intensely competitive landscape remains dominated by large, multinational tool manufacturers who leverage established global distribution networks and technological scale to strategically integrate sophisticated features like AI-supported diagnostics, advanced telematics, and precise electronic controls into their premier product offerings. Future market growth hinges critically upon manufacturers' ongoing ability to continuously reduce the cost-performance ratio of high-quality synthetic diamond blades while simultaneously successfully developing highly portable, high-power battery-powered systems that fully substitute the necessary cutting power capabilities historically unique to robust corded equipment, thereby maximizing jobsite efficiency and increasing professional acceptance across all relevant geographical regions.

The intricate and complex value chain, stretching from highly specialized diamond synthesis (via HPHT/CVD processes) upstream to multifaceted distribution channels (encompassing online retail and specialty retailers) downstream, mandates a highly coordinated and agile operational strategy across all market participants. Successful and sustained market penetration requires not only the delivery of superior product design and performance but also the effective and strategic management of supply chain volatility, particularly concerning critical raw materials like industrial diamonds and copper components. Manufacturers must also strategically invest heavily in educating end-users about the verifiable long-term cost benefits and superior return on investment provided by professional-grade diamond cutting tools versus cheaper, less precise abrasive alternatives, consistently emphasizing crucial factors such as drastically reduced material waste, superior finished quality, and minimal unexpected jobsite downtime. Overall, the Diamond Tile Cutter Market is unequivocally poised for steady, continuous, and technologically driven expansion throughout the forecast period, inherently tied to underlying global demographic trends, continuous technological advancement, and the unwavering demand for aesthetically pleasing, highly durable surfaces in modern architectural design and critical infrastructural development.

The core of technological innovation remains firmly rooted in enhancing the efficacy, durability, and operational longevity of the diamond blade itself, which serves as the primary consumable component. Advances in cutting segment height, bonding tensile strength, and optimized diamond concentration directly influence the tool's perceived value and overall cost-effectiveness for the professional user. For instance, the ongoing transition from simple, low-cost sintered blades to sophisticated vacuum-brazed and laser-welded cutting segments has dramatically increased both the measurable durability and high-speed cutting capability, thereby easily justifying the necessary premium price point of professional series blades. Furthermore, the strategic integration of tool connectivity—often utilizing standard Bluetooth or other emerging IoT communication standards—allows high-end tools to securely communicate usage data back to centralized fleet managers or predictive maintenance platforms, facilitating highly optimized service scheduling and maximizing efficient asset utilization across large-scale construction companies, marking a decisive step toward pervasive digital integration within the global professional power tool sector.

Market segmentation by fundamental operation mode (Corded vs. Cordless) is proving to be particularly strategically crucial. The verified robust power and sustained performance capabilities of contemporary high-voltage 18V, 20V, and multi-volt cordless systems have begun significantly eroding the substantial market share traditionally held exclusively by corded tile saws in all but the heaviest, most continuous industrial bridge-saw applications. Professional contractors highly value the crucial elimination of dangerous trip hazards, the significant speed of jobsite setup, and the inherent ability to work flexibly in remote areas without immediate access to stable power outlets. This profound trend is compelling major manufacturers to prioritize massive investment in battery chemistry research and development, aggressively seeking crucial breakthroughs that sustainably increase energy density without adding prohibitive weight or significantly increasing the final consumer cost. Consequently, the next generation of professional diamond tile cutters will almost certainly feature universally interchangeable, highly compatible battery platforms, further streamlining and simplifying tool management logistics for professional users operating multi-brand tool inventories.

In terms of competitive strategy, the major global players are intensely focused on achieving ecosystem lock-in, a strategy where a professional tiler makes a strategic long-term investment in a specific battery platform (e.g., Milwaukee M18, DeWalt FlexVolt) and subsequently purchases compatible specialized tools like diamond tile cutters exclusively from that same system, increasing platform reliance. This strategy effectively creates high switching costs for the end-user and generally guarantees continuous replacement sales of both tools and essential accessories. Conversely, smaller, highly specialized companies often compete effectively by focusing intensely on high-value niche segments, such as creating superior ergonomic manual snap cutters for ultra-thin ceramics or providing highly specialized, custom components for large format slabs (LFS), differentiating themselves through unparalleled cutting precision and innovative ergonomic or safety features rather than sheer product breadth. The overall intense competition drives continuous downward price reduction pressure in the high-volume, mid-range segment while simultaneously fostering a state of premium pricing stability for genuinely innovative, patent-protected technologies targeting the demanding top tier of professional tradespeople.

The regulatory environment continues to exert a powerful, non-optional influence on market trends. Specifically, increasing public awareness and stricter governmental mandates regarding the severe long-term health hazards associated with airborne crystalline silica dust (which is generated extensively during the dry cutting of concrete, tile, and natural stone) are compelling professional users to rapidly adopt wet cutting methods or utilize integrated, high-efficiency HEPA dust extraction shrouds. This pervasive regulatory force directly and significantly benefits the manufacturers of advanced wet tile saws and associated water management technologies, acting as a non-optional market driver for mandated equipment upgrades across all major regulated construction markets globally. Compliance with these mandatory standards is increasingly becoming a significant market entry barrier for low-cost, dry-cut focused manufacturers who lack the technological capabilities to meet these critical health and safety requirements without substantial product redesign.

Final comprehensive analysis of the core market dynamics reveals that sustained, robust profitability for manufacturers depends heavily on continuous innovation in consumable components—specifically the high-demand diamond blades. While the power tool body is typically a long-term capital purchase, specialized blades represent recurring revenue generators. Companies that successfully engineer blades offering demonstrably superior lifespan, faster overall cutting speed, and enhanced debris clearance mechanisms will inevitably capture greater and more sustainable market share. Furthermore, end-customer loyalty is strongly and consistently linked to the verified reliability and proven effectiveness of the integrated water management system and the overall ergonomic quality of the saw, especially in professional scenarios where tools are expected to be used continuously for eight or more hours daily. Strategic mergers and acquisitions are anticipated throughout the forecast period as large corporations seek to rapidly assimilate smaller, agile firms specializing in advanced battery technology or unique, proprietary diamond segment bonding processes, solidifying their dominant competitive advantage in this essential and highly profitable power tool category.

To check our Table of Contents, please mail us at: sales@marketresearchupdate.com

Research Methodology

The Market Research Update offers technology-driven solutions and its full integration in the research process to be skilled at every step. We use diverse assets to produce the best results for our clients. The success of a research project is completely reliant on the research process adopted by the company. Market Research Update assists its clients to recognize opportunities by examining the global market and offering economic insights. We are proud of our extensive coverage that encompasses the understanding of numerous major industry domains.

Market Research Update provide consistency in our research report, also we provide on the part of the analysis of forecast across a gamut of coverage geographies and coverage. The research teams carry out primary and secondary research to implement and design the data collection procedure. The research team then analyzes data about the latest trends and major issues in reference to each industry and country. This helps to determine the anticipated market-related procedures in the future. The company offers technology-driven solutions and its full incorporation in the research method to be skilled at each step.

The Company's Research Process Has the Following Advantages:

- Information Procurement

The step comprises the procurement of market-related information or data via different methodologies & sources.

- Information Investigation

This step comprises the mapping and investigation of all the information procured from the earlier step. It also includes the analysis of data differences observed across numerous data sources.

- Highly Authentic Source

We offer highly authentic information from numerous sources. To fulfills the client’s requirement.

- Market Formulation

This step entails the placement of data points at suitable market spaces in an effort to assume possible conclusions. Analyst viewpoint and subject matter specialist based examining the form of market sizing also plays an essential role in this step.

- Validation & Publishing of Information

Validation is a significant step in the procedure. Validation via an intricately designed procedure assists us to conclude data-points to be used for final calculations.

×

Request Free Sample:

Related Reports

Select License

Why Choose Us

We're cost-effective and Offered Best services:

We are flexible and responsive startup research firm. We adapt as your research requires change, with cost-effectiveness and highly researched report that larger companies can't match.

Information Safety

Market Research Update ensure that we deliver best reports. We care about the confidential and personal information quality, safety, of reports. We use Authorize secure payment process.

We Are Committed to Quality and Deadlines

We offer quality of reports within deadlines. We've worked hard to find the best ways to offer our customers results-oriented and process driven consulting services.

Our Remarkable Track Record

We concentrate on developing lasting and strong client relationship. At present, we hold numerous preferred relationships with industry leading firms that have relied on us constantly for their research requirements.

Best Service Assured

Buy reports from our executives that best suits your need and helps you stay ahead of the competition.

Customized Research Reports

Our research services are custom-made especially to you and your firm in order to discover practical growth recommendations and strategies. We don't stick to a one size fits all strategy. We appreciate that your business has particular research necessities.

Service Assurance

At Market Research Update, we are dedicated to offer the best probable recommendations and service to all our clients. You will be able to speak to experienced analyst who will be aware of your research requirements precisely.

Contact With Our Sales Team

Customer Testimonials

The content of the report is always up to the mark. Good to see speakers from expertise authorities.

Privacy requested , Managing Director

A lot of unique and interesting topics which are described in good manner.

Privacy requested, President

Well researched, expertise analysts, well organized, concrete and current topics delivered in time.

Privacy requested, Development Manager