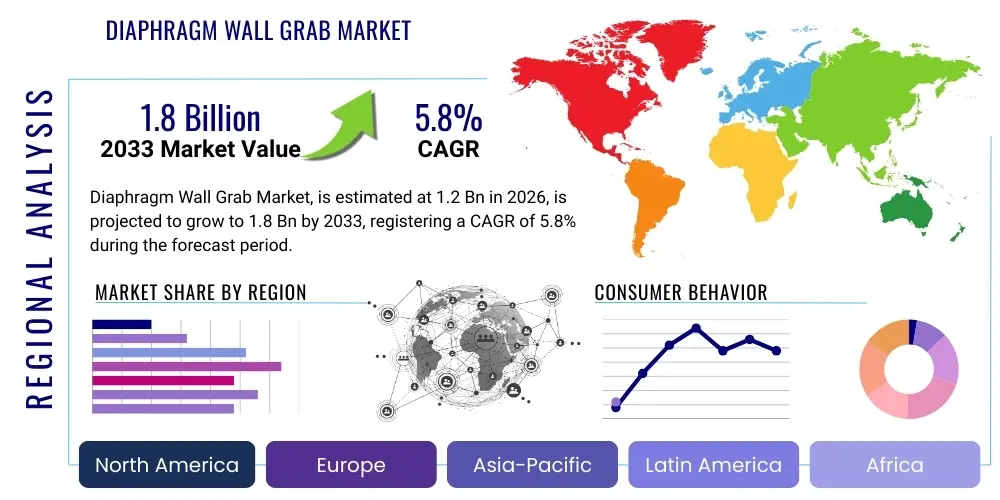

Diaphragm Wall Grab Market Size, By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2026 to 2033 (Financial Impact Analysis)

ID : MRU_ 442031 | Date : Feb, 2026 | Pages : 242 | Region : Global | Publisher : MRU

Diaphragm Wall Grab Market Size

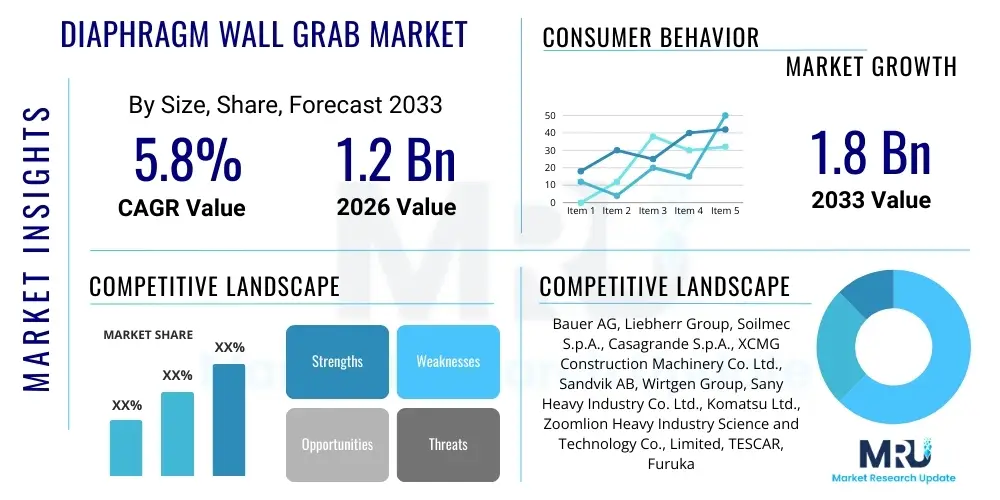

The Diaphragm Wall Grab Market is projected to grow at a Compound Annual Growth Rate (CAGR) of 5.8% between 2026 and 2033. The market is estimated at USD 1.2 Billion in 2026 and is projected to reach USD 1.8 Billion by the end of the forecast period in 2033. This consistent growth trajectory is primarily underpinned by massive global investments in complex urban infrastructure projects, deep foundation engineering requirements for high-rise commercial and residential structures, and expanding metro rail networks, particularly across burgeoning economies in Asia Pacific and the Middle East.

Diaphragm Wall Grab Market introduction

The Diaphragm Wall Grab Market encompasses specialized heavy machinery crucial for deep foundation construction, specifically employed in the excavation and trenching required for constructing subterranean barrier walls known as diaphragm walls or slurry walls. These walls are integral components in major civil engineering projects, serving critical functions such as deep basements, subterranean parking structures, cut-and-cover tunnels, and effective groundwater cutoff barriers for large-scale construction sites. The grabs themselves are robust, hydraulically or mechanically operated tools, designed to work within a bentonite or polymer slurry trench, which stabilizes the excavation sides until the concrete is poured, ensuring geotechnical stability throughout the process.

Key products within this specialized market segment include mechanical grabs, which are traditionally cable-suspended and operated using the lifting capability of a crane; hydraulic grabs, which are mounted on specialized base carriers, offering enhanced precision, greater digging force, and superior control in variable geological conditions; and specific variants designed for hard rock excavation or extremely deep trenches. The complexity of modern urban construction, often involving deep excavations adjacent to existing sensitive structures, mandates the use of high-precision grabs capable of maintaining strict verticality and tight dimensional tolerances, thereby driving demand for technologically advanced hydraulic systems.

Major applications driving the consumption of diaphragm wall grabs include extensive urbanization programs leading to the proliferation of high-density metropolitan areas requiring deep foundations, coupled with massive government funding directed towards public transportation infrastructure development, notably high-speed rail and subway system expansions globally. The inherent benefits of utilizing diaphragm walls—such as superior structural rigidity, effective water tightness, and minimal settlement risk to surrounding soil—make the grabs indispensable tools in projects prioritizing longevity and site safety. Furthermore, stringent safety regulations and the need for operational efficiency are key factors propelling the shift toward advanced, automation-ready hydraulic grabs.

Diaphragm Wall Grab Market Executive Summary

The global Diaphragm Wall Grab Market is currently characterized by significant technological differentiation, with a clear trend toward high-efficiency hydraulic systems that integrate advanced sensing and control features to enhance precision and productivity on complex job sites. Business trends highlight a strong focus on equipment rental models in mature markets like North America and Europe, allowing contractors to access high-capital equipment without substantial upfront investment, while emerging markets, particularly China and India, show substantial outright purchasing activity driven by sustained, large-scale national infrastructure initiatives. Manufacturers are increasingly prioritizing modular designs and telematics integration to facilitate predictive maintenance and optimized fleet management, addressing the growing contractor demand for reliability and reduced downtime.

Regionally, Asia Pacific maintains its dominance as the largest and fastest-growing market, primarily fueled by rapid urbanization, substantial investments in critical infrastructure like metro rail, hydropower projects, and coastal protection barriers, and the sheer volume of high-rise commercial and residential projects undertaken, particularly in East and Southeast Asian nations. North America and Europe, while representing mature markets, exhibit stable demand, characterized by high requirements for specialized equipment suited for rehabilitation, complex urban renewal projects, and environmental barrier construction. The Middle East continues to present strong growth potential, driven by megaprojects associated with national economic diversification plans, often requiring ultra-deep excavations and specialized foundation solutions.

Segment-wise, the Hydraulic Grab segment leads the market based on equipment type, attributable to its inherent advantages in terms of control accuracy, higher penetration force, and ability to handle varying soil conditions compared to traditional mechanical grabs. Application trends indicate that the Transportation Infrastructure segment, encompassing subway, road tunnels, and underpasses, generates the highest revenue share, followed closely by the Commercial and Residential Construction segment, which requires deep basements and retaining structures for modern, high-density complexes. The trend toward digitalization in construction is further influencing the market, with operators seeking grabs equipped with real-time monitoring capabilities and GPS integration for verifiable construction quality.

AI Impact Analysis on Diaphragm Wall Grab Market

Common user inquiries regarding AI's influence in the Diaphragm Wall Grab Market center primarily on how these sophisticated digital technologies can enhance operational precision, improve safety, and predict equipment failure, thereby reducing the high operational costs associated with deep foundation work. Users frequently ask about the implementation of machine learning for real-time soil condition analysis, optimizing the digging sequence, and automating tedious or hazardous aspects of trenching. Concerns also revolve around the required digital infrastructure investment, the retraining of specialized operators, and the integration of third-party AI platforms with existing heavy machinery telematics systems. The overriding expectation is that AI will transition the operation from purely manual skill-based tasks to data-driven, highly optimized processes, ensuring greater verticality, minimal slurry loss, and enhanced overall project efficiency.

The core application of Artificial Intelligence (AI) and Machine Learning (ML) in this domain is focused on augmenting the highly specialized process control required for diaphragm wall construction. AI algorithms are being developed to process inputs from gyroscope sensors, inclinometers, and pressure gauges mounted on the grab, providing real-time feedback that allows the system to autonomously correct for deviations in verticality or digging path. This level of automated adjustment significantly minimizes human error, a critical factor in achieving the strict tolerances required for subsequent concrete pouring and structural integrity. Furthermore, ML models are utilized to analyze historical data sets related to ground conditions and equipment performance, creating predictive maintenance schedules that anticipate component fatigue and schedule servicing proactively, thus dramatically minimizing costly unplanned downtime.

In terms of strategic decision-making, AI is transforming how contractors approach site preparation and equipment deployment. By simulating various digging scenarios based on available geotechnical reports and leveraging reinforcement learning, construction managers can select the optimal grab type, operating parameters (like speed and pressure), and slurry mixture for specific site conditions. This analytical approach reduces reliance on generalized construction heuristics, leading to faster excavation cycles and superior quality control. As integration capabilities improve, AI-driven supervisory systems will become standard, overseeing multiple grabs simultaneously on large infrastructure sites, ensuring coordinated operation and optimized material handling processes.

- AI-driven real-time verticality correction enhances trench accuracy and minimizes deviation.

- Machine Learning optimizes grab operational parameters (speed, pressure) based on complex soil composition inputs.

- Predictive maintenance algorithms reduce unplanned equipment failure and operational downtime.

- Automated slurry management systems maintain optimal fluid levels and consistency based on real-time data feedback.

- Advanced telematics utilizing AI provide deep insights into equipment utilization and energy consumption optimization.

- Reinforcement learning simulates complex digging patterns for efficient rock or obstacle removal.

- Improved safety monitoring through vision systems and AI alerting operators to instability near the trench edge.

DRO & Impact Forces Of Diaphragm Wall Grab Market

The Diaphragm Wall Grab Market is powerfully driven by the global imperative for modern infrastructure development, particularly concentrated urbanization trends requiring robust deep foundations for high-rise buildings and extensive subterranean transportation networks. A primary driver is the accelerating pace of metro system construction and expansion in major global cities, where diaphragm walls are essential for creating durable, watertight station boxes and tunnels beneath densely populated areas. Furthermore, the inherent geotechnical advantages of using diaphragm walls in challenging environments, such as soft soils or near water bodies, where traditional piling methods are insufficient or pose high risks, solidify the continuous demand for high-performance grabs. Regulatory pressure for enhanced construction safety and structural longevity also pushes contractors toward high-quality, specialized foundation solutions.

However, the market faces significant restraints, notably the high initial capital expenditure associated with purchasing and deploying advanced hydraulic diaphragm wall grabs and their specialized base carriers. This cost often prohibits smaller construction firms from entering the market or compels them to rely solely on expensive rental options. Operational complexity is another restraint; these specialized machines require highly skilled and well-trained operators and maintenance crews, which represents a scarcity in many rapidly developing regions. Moreover, economic instability and cyclical fluctuations in government funding for large public works projects can introduce unpredictability, potentially delaying or halting major foundation contracts, thereby impacting equipment sales and utilization rates across the industry.

Opportunities for market expansion are substantial, driven by the emergence of new applications and geographical territories. The increasing focus on environmental infrastructure, such as coastal erosion barriers, flood defense systems, and secure landfill containment walls, presents a niche but growing application area for specialized diaphragm wall construction. Geographically, untapped regions in Southeast Asia, Africa, and Latin America are poised for significant infrastructure catch-up spending, providing new frontiers for market penetration. Furthermore, technological innovation centered on hybridization, utilizing electric or hybrid power sources for grabs to reduce emissions and noise pollution, offers a distinct competitive advantage, aligning with global green construction mandates and opening up access to urban job sites with strict environmental regulations. The development of lighter, modular equipment adaptable to tighter urban spaces is also a key market opportunity.

Segmentation Analysis

The Diaphragm Wall Grab Market is comprehensively segmented based on three primary factors: the type of equipment or mechanism employed (mechanical vs. hydraulic), the specific application area for the resulting foundation structure (infrastructure, commercial, residential), and the maximum depth capability of the equipment. Segmentation by type reflects the technological maturity and operational precision offered, with hydraulic grabs gaining market share due to their superior efficiency and control, making them indispensable for high-precision civil engineering work. Conversely, mechanical grabs, while offering lower initial cost, are typically reserved for less constrained, large-scale projects where extreme depth or precision is not the paramount concern.

Application-based segmentation is critical for understanding revenue streams, with the Transportation Infrastructure category consistently dominating the market due to the colossal scale and public funding associated with mass transit projects like metro systems, high-speed rail tunnels, and major roadway underpasses. Commercial and residential construction, encompassing deep basements for skyscrapers and subterranean parking, forms the second major segment, reflecting urbanization intensity. Other crucial applications include water resource management (dams, reservoirs), environmental projects (seepage cutoff walls), and specialized industrial facilities.

Geographically, the market is dissected into major regions—North America, Europe, Asia Pacific, Latin America, and the Middle East & Africa—reflecting highly disparate growth rates and market dynamics. Asia Pacific's massive population density and ongoing infrastructure deficits ensure its leadership in market volume, while Europe and North America prioritize technological replacement cycles and compliance with stringent environmental standards. Analyzing these segments provides strategic insights for manufacturers regarding product development, channel management, and targeted marketing efforts tailored to regional operational requirements and regulatory environments.

- By Type:

- Mechanical Grabs (Cable-Suspended)

- Hydraulic Grabs (Mounted on Base Carrier)

- Specialized Rock Grabs

- By Application:

- Transportation Infrastructure (Metro Rail, Tunnels, Highways)

- Commercial and Residential Construction (Deep Basements, Retaining Walls)

- Water Management and Environmental Projects (Dams, Flood Barriers, Cutoff Walls)

- Industrial Facilities and Power Plants

- By Operating Depth:

- Shallow Depth (Up to 30 meters)

- Medium Depth (30 to 60 meters)

- Deep Excavation (Over 60 meters)

Value Chain Analysis For Diaphragm Wall Grab Market

The value chain for the Diaphragm Wall Grab Market begins with the upstream suppliers responsible for high-grade raw materials, primarily specialized alloys and hydraulic components such as high-pressure pumps, cylinders, and advanced sensors necessary for the manufacturing of reliable, heavy-duty equipment. Manufacturers operate as the core link, transforming these materials into highly complex, specialized machinery, focusing intensely on engineering precision, structural integrity, and integration of cutting-edge hydraulic and electronic control systems. Key strategic activities at this stage include R&D efforts aimed at enhancing digging efficiency, reducing noise emissions, and improving telematics capabilities. The quality and reliability of upstream component supply directly correlate with the performance and longevity of the final product, influencing competitive positioning.

The midstream and distribution channels involve the logistical movement and commercialization of the manufactured grabs. Distribution is bifurcated into direct sales channels, often used for major infrastructure contractors and large construction conglomerates, and indirect channels relying on authorized dealers, regional distributors, and specialized equipment rental companies. Rental fleets play a particularly vital role, especially in economically mature markets, enabling access to high-cost equipment on a project-by-project basis, thereby lowering the barrier to entry for smaller or specialized foundation contractors. Effective distribution requires a robust network capable of providing immediate technical support, spare parts availability, and localized training for specialized operators.

Downstream activities involve the end-users—civil engineering firms, foundation specialists, and large infrastructure project developers—who deploy the grabs on site. This phase is characterized by intensive specialized application and maintenance. The value chain concludes with critical after-sales services, including routine maintenance, component replacement, advanced repair work, and technological upgrades, often provided directly by the original equipment manufacturers (OEMs) or their certified service partners. The longevity of a grab, which can span decades, makes the provision of high-quality, readily available aftermarket support a crucial competitive differentiator and a significant revenue stream for established market players, closing the loop within the total value ecosystem.

Diaphragm Wall Grab Market Potential Customers

The primary consumers, or potential customers, in the Diaphragm Wall Grab Market are specialized deep foundation contractors and large-scale civil engineering firms (CEFs) that undertake complex, multi-million or multi-billion dollar infrastructure projects. These entities require proprietary equipment capable of executing highly precise trenching operations for diaphragm walls, particularly in densely populated urban environments where space is restricted and surrounding structures must be protected from settlement. Specific customer segments include those focused on subway tunnel construction, high-rise building basement foundations (exceeding four levels deep), and port or harbor development where waterfront retaining structures are mandatory. Their purchasing criteria heavily emphasize reliability, maximum depth capability, operational precision (verticality control), and robust global aftermarket support.

Another significant customer category consists of governmental or public sector bodies, including municipal public works departments and national transportation authorities, which often lease or indirectly procure these services through prime contractors. While they may not purchase the grab equipment directly, their procurement policies, funding allocations for public works, and stringent technical specifications for projects like flood defense systems or highway expansions dictate the demand and technological standards that contractors must meet, subsequently driving the required fleet investment by the specialized foundation firms. Furthermore, environmental and resource management agencies are increasing their reliance on diaphragm walls for environmental remediation projects, such as contaminant containment barriers around industrial sites, thus expanding the customer base beyond traditional infrastructure.

Finally, global equipment rental houses, especially those specializing in heavy construction machinery, represent an increasingly critical segment of potential customers. These companies purchase grabs in large quantities to maintain a modern, diversified rental fleet, servicing smaller or regional contractors who cannot justify the substantial capital investment for purchase. The rental market demands equipment flexibility, ease of transport, and comprehensive monitoring capabilities, often preferring models equipped with advanced telematics systems to optimize utilization and track performance across diverse project sites, making rental organizations powerful influencers on manufacturer product specifications and inventory decisions.

| Report Attributes | Report Details |

|---|---|

| Market Size in 2026 | USD 1.2 Billion |

| Market Forecast in 2033 | USD 1.8 Billion |

| Growth Rate | 5.8% CAGR |

| Historical Year | 2019 to 2024 |

| Base Year | 2025 |

| Forecast Year | 2026 - 2033 |

| DRO & Impact Forces |

|

| Segments Covered |

|

| Key Companies Covered | Bauer AG, Liebherr Group, Soilmec S.p.A., Casagrande S.p.A., XCMG Construction Machinery Co. Ltd., Sandvik AB, Wirtgen Group, Sany Heavy Industry Co. Ltd., Komatsu Ltd., Zoomlion Heavy Industry Science and Technology Co., Limited, TESCAR, Furukawa Co. Ltd., Hitachi Construction Machinery Co., Ltd., Jining Sany Baoma, Shanghai Jintai Equipment Co. Ltd., DELMAG GmbH & Co. KG, Mait S.p.A., Trelleborg AB, Caterpillar Inc. (Select Models), Kowan Company. |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Enquiry Before Buy | Have specific requirements? Send us your enquiry before purchase to get customized research options. Request For Enquiry Before Buy |

Diaphragm Wall Grab Market Key Technology Landscape

The technological landscape of the Diaphragm Wall Grab Market is defined by continuous innovation in hydraulic power systems and advanced geotechnical sensing capabilities, aiming to optimize trenching quality and speed. Modern grabs utilize highly responsive, load-sensing hydraulic circuits which provide proportional control over the grab's opening, closing, and vertical movement, significantly reducing energy consumption while maximizing digging force in heterogeneous soil strata. Key technological advancements include the integration of high-precision inclinometers and proprietary electronic measuring systems (EMS) that provide the operator with real-time feedback on the grab’s position and deviation from the design vertical axis, enabling immediate corrective adjustments crucial for maintaining wall integrity.

Furthermore, telematics and IoT integration represent a pivotal shift in managing diaphragm wall equipment fleets. Modern grabs are often equipped with embedded hardware and connectivity solutions that transmit operational data—including hydraulic pressures, engine load, fuel consumption, and precise excavation depth—to cloud-based platforms. This remote monitoring capability allows construction firms and manufacturers to perform data analytics for performance benchmarking, schedule preventive maintenance based on actual usage patterns rather than fixed intervals, and remotely diagnose issues, thereby substantially enhancing uptime and operational efficiency across globally dispersed project sites.

Another increasingly important technological area is the development of specialized tooling and rock penetration capabilities. For projects involving hard rock formations or highly cemented layers, standard grabs are insufficient. Manufacturers are innovating with heavy-duty rock grabs featuring enhanced structural robustness and tungsten carbide teeth, coupled with specialized base carriers capable of providing greater vertical crowd force. This focus on specialized tooling ensures that diaphragm wall technology remains viable and cost-effective even in the most challenging geological conditions encountered in urban or mountainous infrastructure projects, expanding the application potential of the market segment significantly.

Regional Highlights

- Asia Pacific (APAC): APAC is the global epicenter for the Diaphragm Wall Grab Market, primarily driven by massive, ongoing national infrastructure modernization programs, particularly in China, India, and Southeast Asian nations like Indonesia and Vietnam. The necessity for deep foundations in sprawling urban centers for metro rail systems and high-rise commercial complexes underpins this growth. The region exhibits high demand for both volume and depth capability, with fierce competition among local and international manufacturers leading to rapid adoption of hydraulic grab technology.

- Europe: Europe represents a mature but technologically demanding market. Growth is slower but highly stable, focusing primarily on replacement cycles, specialized urban renewal projects, and environmental remediation (e.g., cutoff walls for contaminated sites). European contractors prioritize grabs with stringent environmental compliance features, such as low-emission engines and reduced noise levels, alongside superior verticality accuracy due to the proximity of historic and sensitive existing structures.

- North America: The market here is characterized by high operational costs and a strong reliance on equipment rental models. Demand is stimulated by large-scale public works projects (e.g., water tunnels, deep highway infrastructure) and substantial private sector investments in complex deep basements. North American customers require robust telematics integration for fleet management and often demand high-capacity, specialized grabs suitable for unique North American geological conditions.

- Middle East & Africa (MEA): This region is a significant high-growth area, fueled by massive, government-backed "Vision" projects, notably in Saudi Arabia and the UAE, requiring specialized deep foundation work for new cities and massive coastal and marine infrastructure. The extreme heat and challenging soil mechanics necessitate robust, highly durable equipment and comprehensive, on-site service support from manufacturers. Africa is emerging slowly, driven by mining infrastructure and port expansions.

- Latin America (LATAM): The LATAM market is highly sensitive to economic volatility and political stability, often resulting in cyclical demand patterns. Key drivers include metro expansion projects in major cities like São Paulo and Mexico City, and necessary infrastructure upgrades for commodity extraction industries. Contractors in this region often seek a balance between cost-effectiveness and reliable performance, influencing a moderate uptake of high-end hydraulic models mixed with well-maintained mechanical fleets.

Top Key Players

The market research report includes a detailed profile of leading stakeholders in the Diaphragm Wall Grab Market.- Bauer AG (Germany - Deep Foundation Equipment Specialist)

- Liebherr Group (Switzerland/Germany - Heavy Machinery Manufacturer)

- Soilmec S.p.A. (Italy - Foundation Equipment Leader)

- Casagrande S.p.A. (Italy - Advanced Drilling and Foundation Technology)

- XCMG Construction Machinery Co. Ltd. (China - Global Heavy Equipment Supplier)

- Sany Heavy Industry Co. Ltd. (China - Major Global Manufacturer)

- Zoomlion Heavy Industry Science and Technology Co., Limited (China - Construction Machinery)

- TESCAR (Italy - Specialized Hydraulic Drilling and Foundation Equipment)

- Wirtgen Group (Germany - Specialized Road and Construction Machinery)

- Jining Sany Baoma (China - Foundation Equipment Division)

- Shanghai Jintai Equipment Co. Ltd. (China - Diaphragm Wall Equipment Expert)

- DELMAG GmbH & Co. KG (Germany - Foundation Engineering Technology)

- Mait S.p.A. (Italy - Piling and Foundation Equipment)

- Trelleborg AB (Sweden - Specialized Slurry Handling and Sealing Solutions)

- Caterpillar Inc. (USA - Construction Machinery and Related Base Carriers)

- Kowan Company (Japan - Hydraulic Foundation Equipment and Tools)

- Furukawa Co. Ltd. (Japan - Rock Drilling and Construction Machinery)

- Hitachi Construction Machinery Co., Ltd. (Japan - Hydraulic Equipment Base Units)

- Wuhan Kingwell Construction Machinery Co., Ltd. (China - Foundation Equipment Focus)

- Sunward Intelligent Equipment Co., Ltd. (China - Construction and Excavation Tools)

Frequently Asked Questions

Analyze common user questions about the Diaphragm Wall Grab market and generate a concise list of summarized FAQs reflecting key topics and concerns.What is the primary technical difference between mechanical and hydraulic diaphragm wall grabs?

The key difference lies in the operating mechanism and precision. Mechanical grabs are cable-suspended, relying on gravity and the crane's hoisting power, offering less control. Hydraulic grabs are mounted on a specialized base carrier, using high-pressure hydraulics for superior digging force, precise control, and highly accurate verticality monitoring essential for deep, complex urban excavations.

Which geographical region exhibits the highest growth potential for Diaphragm Wall Grab utilization?

Asia Pacific (APAC), specifically the rapidly developing nations within Southeast Asia and the established economies of China and India, shows the highest sustained growth potential, driven by unparalleled levels of urbanization and critical investment in underground transportation infrastructure, leading to massive requirements for deep foundation solutions.

How do advancements in AI and sensors affect the operational efficiency of diaphragm wall construction?

AI and sensor integration, through systems like Electronic Measuring Systems (EMS) and telematics, dramatically enhance operational efficiency by providing real-time data on trench verticality, allowing for instant automatic corrections. This reduces deviations, minimizes the risk of costly structural rework, and optimizes digging sequences based on immediate soil condition feedback, improving overall productivity.

What are the main applications driving demand in the Diaphragm Wall Grab Market?

The main demand drivers are large-scale transportation infrastructure projects, particularly the construction of metropolitan subway lines, deep underground tunnels, and complex multi-level underground parking structures for commercial and residential high-rise buildings. Environmental cutoff walls and specialized foundation work also contribute significantly to market size.

What challenges restrain market growth despite increasing infrastructure spending?

Major restraints include the extremely high initial capital cost required for advanced hydraulic grabs and their base carriers, which restricts entry for smaller contractors. Additionally, the specialized nature of the equipment necessitates a highly skilled and often scarce workforce for both operation and complex maintenance procedures, increasing operational complexity and risk.

To check our Table of Contents, please mail us at: sales@marketresearchupdate.com

Research Methodology

The Market Research Update offers technology-driven solutions and its full integration in the research process to be skilled at every step. We use diverse assets to produce the best results for our clients. The success of a research project is completely reliant on the research process adopted by the company. Market Research Update assists its clients to recognize opportunities by examining the global market and offering economic insights. We are proud of our extensive coverage that encompasses the understanding of numerous major industry domains.

Market Research Update provide consistency in our research report, also we provide on the part of the analysis of forecast across a gamut of coverage geographies and coverage. The research teams carry out primary and secondary research to implement and design the data collection procedure. The research team then analyzes data about the latest trends and major issues in reference to each industry and country. This helps to determine the anticipated market-related procedures in the future. The company offers technology-driven solutions and its full incorporation in the research method to be skilled at each step.

The Company's Research Process Has the Following Advantages:

- Information Procurement

The step comprises the procurement of market-related information or data via different methodologies & sources.

- Information Investigation

This step comprises the mapping and investigation of all the information procured from the earlier step. It also includes the analysis of data differences observed across numerous data sources.

- Highly Authentic Source

We offer highly authentic information from numerous sources. To fulfills the client’s requirement.

- Market Formulation

This step entails the placement of data points at suitable market spaces in an effort to assume possible conclusions. Analyst viewpoint and subject matter specialist based examining the form of market sizing also plays an essential role in this step.

- Validation & Publishing of Information

Validation is a significant step in the procedure. Validation via an intricately designed procedure assists us to conclude data-points to be used for final calculations.

×

Request Free Sample:

Related Reports

Select License

Why Choose Us

We're cost-effective and Offered Best services:

We are flexible and responsive startup research firm. We adapt as your research requires change, with cost-effectiveness and highly researched report that larger companies can't match.

Information Safety

Market Research Update ensure that we deliver best reports. We care about the confidential and personal information quality, safety, of reports. We use Authorize secure payment process.

We Are Committed to Quality and Deadlines

We offer quality of reports within deadlines. We've worked hard to find the best ways to offer our customers results-oriented and process driven consulting services.

Our Remarkable Track Record

We concentrate on developing lasting and strong client relationship. At present, we hold numerous preferred relationships with industry leading firms that have relied on us constantly for their research requirements.

Best Service Assured

Buy reports from our executives that best suits your need and helps you stay ahead of the competition.

Customized Research Reports

Our research services are custom-made especially to you and your firm in order to discover practical growth recommendations and strategies. We don't stick to a one size fits all strategy. We appreciate that your business has particular research necessities.

Service Assurance

At Market Research Update, we are dedicated to offer the best probable recommendations and service to all our clients. You will be able to speak to experienced analyst who will be aware of your research requirements precisely.

Contact With Our Sales Team

Customer Testimonials

The content of the report is always up to the mark. Good to see speakers from expertise authorities.

Privacy requested , Managing Director

A lot of unique and interesting topics which are described in good manner.

Privacy requested, President

Well researched, expertise analysts, well organized, concrete and current topics delivered in time.

Privacy requested, Development Manager