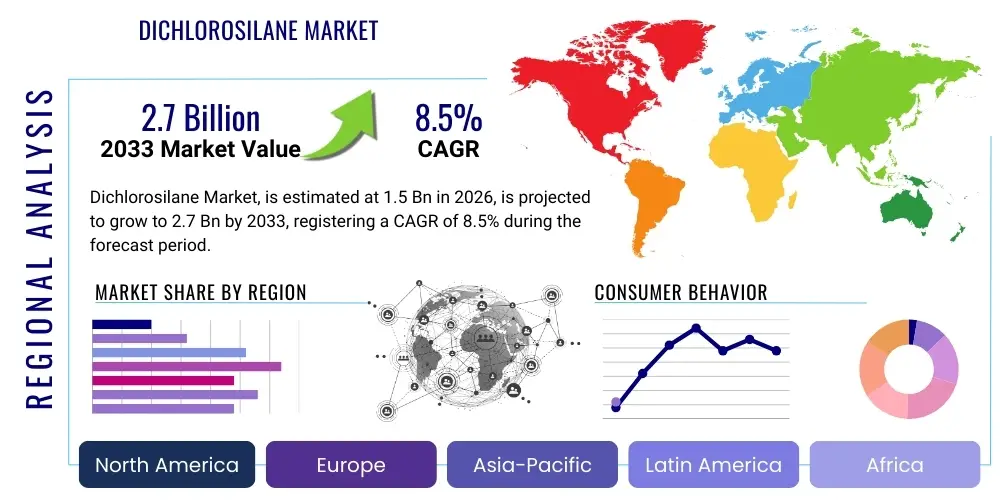

Dichlorosilane Market Size, By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2026 to 2033 (Financial Impact Analysis)

ID : MRU_ 442890 | Date : Feb, 2026 | Pages : 242 | Region : Global | Publisher : MRU

Dichlorosilane Market Size

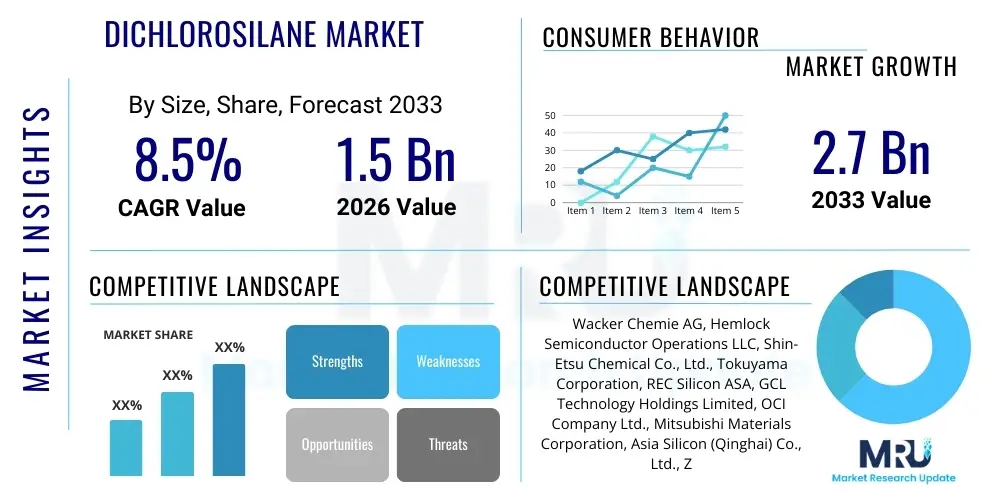

The Dichlorosilane Market is projected to grow at a Compound Annual Growth Rate (CAGR) of 8.5% between 2026 and 2033. The market is estimated at USD 1.5 Billion in 2026 and is projected to reach USD 2.7 Billion by the end of the forecast period in 2033.

Dichlorosilane Market introduction

Dichlorosilane (DCS, SiH2Cl2) is a colorless, highly flammable, and reactive gas that serves as a crucial intermediate chemical primarily utilized in the electronics and solar energy sectors. It is one of the foundational chlorosilanes used in the production cycle of ultra-high purity materials. Its primary industrial function is as a precursor for generating high-purity polysilicon, a vital material for photovoltaic (PV) cells and semiconductor wafers. The intrinsic purity and controlled chemical properties of DCS make it indispensable in demanding manufacturing processes where contamination control is paramount for device performance and yield.

Major applications of Dichlorosilane extend beyond polysilicon to include the synthesis of specialty silicon compounds, epitaxial silicon layers, and certain advanced silicone derivatives. The burgeoning global demand for renewable energy solutions, particularly solar photovoltaics, is the most significant driving force behind the sustained expansion of the DCS market. Furthermore, its role in the complex chemical vapor deposition (CVD) processes used in microelectronics fabrication—specifically in depositing silicon and silicon nitride films—underscores its strategic importance in the development of next-generation integrated circuits and memory chips.

The key benefits derived from using Dichlorosilane include its superior efficiency in polysilicon production compared to silane (SiH4) or trichlorosilane (TCS) in specific reactor designs, offering reduced energy consumption and higher throughput in the modified Siemens process. Driving factors for market growth include supportive government policies promoting solar installations, massive investments in semiconductor fabrication facilities (Fabs) globally, and continuous technological advancements aimed at improving the purity standards required for 300mm and 450mm silicon wafers. Maintaining safe handling protocols and managing the highly corrosive nature of DCS and its byproducts remain central challenges for market players.

Dichlorosilane Market Executive Summary

The Dichlorosilane market is characterized by robust growth, primarily anchored by the relentless expansion of the photovoltaic (PV) and microelectronics industries. Business trends indicate significant capital expenditure in Asia Pacific, particularly China, which dominates the global polysilicon production capacity and acts as the largest consumer of DCS. Market participants are increasingly focusing on vertical integration strategies, ensuring a stable supply chain from metallurgical silicon sourcing to final high-purity polysilicon output, thereby mitigating volatility risks associated with raw material price fluctuations. Innovation is centered around developing more energy-efficient production cycles, specifically enhancing the utilization rate of DCS in fluid bed reactors (FBR) as an alternative to the energy-intensive Siemens process, aiming to improve sustainability metrics and reduce operational costs across the value chain.

Regionally, Asia Pacific maintains its supremacy due to concentrated manufacturing bases for solar components and semiconductors. While China is the manufacturing powerhouse, regions like Taiwan, South Korea, and Japan remain critical consumers for electronic-grade DCS due to their established semiconductor fabrication ecosystems. North America and Europe, while having smaller production footprints, are witnessing strategic resurgence in semiconductor manufacturing (driven by initiatives like the CHIPS Act and European Chips Act), promising future localized demand growth for ultra-high purity DCS. This regional diversification in demand, fueled by geopolitical stability concerns regarding critical supply chains, is a crucial trend shaping investment patterns in the forecast period.

Segment-wise, the Electronic Grade Dichlorosilane segment is projected to exhibit the highest purity standards and premium pricing, driven by the stringent quality requirements of advanced semiconductor devices (e.g., DRAM, NAND, microprocessors). However, in terms of volume consumption, the application in Polysilicon Production for solar cells dwarfs other uses, solidifying its position as the largest application segment. The rising adoption of N-type and TopCon solar technologies, which require higher purity silicon feedstocks, further reinforces demand across both the Electronic and Metallurgical grade categories, albeit with differing specification levels, necessitating continuous process control and certification standardization across the global supply base.

AI Impact Analysis on Dichlorosilane Market

Users frequently inquire about how Artificial Intelligence (AI) and Machine Learning (ML) can optimize the notoriously complex and energy-intensive manufacturing processes associated with Dichlorosilane and polysilicon production. Key concerns revolve around improving reactor efficiency, predicting equipment failure (preventative maintenance), ensuring ultra-high purity levels consistently, and optimizing the recycling and recovery of valuable byproducts like trichlorosilane. The underlying expectation is that AI systems can process the vast amounts of real-time sensor data generated in large-scale chemical plants—including temperature, pressure, flow rates, and spectral purity analysis—to identify non-linear relationships and automate adjustments far beyond human capabilities, leading to substantial reductions in waste, energy usage, and cost, while simultaneously enhancing product quality control necessary for advanced electronic applications.

- Implementation of AI for predictive maintenance in CVD and polysilicon reactors, minimizing unplanned downtime.

- Machine Learning algorithms optimizing chemical reaction parameters (e.g., temperature, pressure control) to maximize DCS conversion yield and purity.

- AI-driven sensor data analytics for real-time quality control and anomaly detection, ensuring consistent electronic-grade specifications.

- Optimization of energy consumption in distillation and purification columns through AI modeling of thermodynamic processes.

- Enhanced supply chain visibility and demand forecasting for critical precursors, improving inventory management of highly volatile DCS.

- Simulated process modeling (Digital Twins) utilizing AI to test new production efficiencies without physical risk or expenditure.

DRO & Impact Forces Of Dichlorosilane Market

The Dichlorosilane market is powerfully influenced by the dynamics of the global renewable energy transition and the ongoing digital revolution. The primary drivers include the exponential growth in solar PV installations worldwide, supported by decreasing solar electricity costs and robust governmental policies, creating an insatiable demand for polysilicon feedstock. Simultaneously, the persistent need for faster, smaller, and more powerful semiconductor devices drives the demand for electronic-grade DCS used in advanced epitaxial growth and thin-film deposition. These macro-level trends provide a strong foundational growth impetus, often overriding short-term market fluctuations.

Conversely, significant restraints hinder market potential. Dichlorosilane is classified as a hazardous, toxic, and highly flammable substance. This necessitates exceptionally strict safety regulations, complex handling procedures, and high capital investment in safety infrastructure, increasing operational expenditure. Furthermore, the industry is energy-intensive, particularly the conversion processes, making it vulnerable to volatile natural gas and electricity prices. Supply chain volatility, especially reliance on a few concentrated production hubs in Asia, poses geopolitical and logistical risks that can impact global pricing and availability, acting as a structural restraint.

Opportunities for expansion lie primarily in technological innovations. The shift toward higher-efficiency solar cell architectures (like heterojunction and PERC derivatives requiring ultra-pure silicon), combined with ongoing miniaturization in semiconductor technology (e.g., sub-5nm nodes), mandates even higher purity DCS, opening lucrative avenues for manufacturers capable of achieving these ultra-specifications. Furthermore, developing advanced recycling techniques for silicon waste and exploring alternative, safer synthesis methods present opportunities to improve sustainability and reduce operational risks, attracting new investments into modernized, Western-based production facilities.

Segmentation Analysis

The Dichlorosilane market segmentation is primarily defined by the required purity level (Grade) and the subsequent end-use application, reflecting the dichotomy between high-volume photovoltaic production and high-value semiconductor manufacturing. The rigorous specifications for electronic-grade material command a significant price premium, whereas metallurgical grade, used for basic polysilicon that often undergoes further purification, constitutes the bulk of the consumed volume. Understanding these segments is crucial as they dictate the complexity of the manufacturing infrastructure, the required quality control protocols, and the overall competitive landscape across different geographic regions.

- By Grade:

- Electronic Grade (Ultra-high Purity)

- Metallurgical Grade (Technical Purity)

- By Application:

- Polysilicon Production (Siemens Process, FBR)

- Silicones and Silane Coupling Agents

- Solar Cells/Photovoltaics Manufacturing

- Integrated Circuits (Epitaxial Deposition, Thin Films)

- Specialty Chemicals and Intermediates

- By End-Use Industry:

- Electronics and Semiconductor

- Solar Energy and Photovoltaics

- Chemical and Materials Science

- Aerospace and Defense (Niche Applications)

Value Chain Analysis For Dichlorosilane Market

The Dichlorosilane value chain begins with upstream activities focused on the procurement and initial refining of metallurgical grade silicon (MGS), the foundational raw material. MGS is reacted with hydrogen chloride (HCl) in a complex hydrochlorination process to yield a mixture of chlorosilanes, predominantly trichlorosilane (TCS). DCS is then derived from the disproportionation or distillation of TCS. The efficiency and cost-effectiveness of these upstream processes, especially energy management and raw material quality, directly influence the final cost structure of DCS. Key upstream suppliers include large-scale metallurgical silicon producers and industrial gas suppliers providing high-purity hydrogen and chlorine.

Midstream activities involve the highly technical, energy-intensive purification and distillation of the crude chlorosilane mixture to isolate Dichlorosilane at the required purity level (Electronic Grade demanding sub-parts-per-billion contamination control). This stage requires specialized equipment, stringent safety protocols due to the volatility of DCS, and continuous chemical monitoring. Major integrated polysilicon manufacturers often handle this purification in-house. Downstream, DCS is primarily delivered to captive polysilicon production plants, where it is subjected to chemical vapor deposition (CVD) to grow polysilicon rods or granules, which are then sliced into wafers for solar cells or semiconductor fabrication.

Distribution channels for DCS are heavily regulated and restricted due to its hazardous nature. Direct distribution dominates, involving specialized high-pressure tanks and transportation logistics designed for corrosive, flammable gases. Indirect distribution, involving third-party specialized chemical distributors, exists mainly for smaller volumes destined for specialty chemical applications or research facilities, but the bulk of electronic and solar grade DCS moves directly from the integrated producer to the polysilicon plant, often within the same industrial park to minimize transportation risks and costs associated with highly specialized shipping requirements.

Dichlorosilane Market Potential Customers

Potential customers for Dichlorosilane are overwhelmingly concentrated within the high-technology manufacturing sectors that rely upon high-purity silicon. The largest segment of buyers consists of large-scale polysilicon manufacturers who utilize DCS as a primary feedstock for the production of solar-grade polysilicon granules or electronic-grade polysilicon rods. These customers require enormous volumes and demand guaranteed long-term supply agreements and consistent quality control to support their capital-intensive production cycles. Their purchasing decisions are highly sensitive to global polysilicon pricing and the stability of energy costs.

A secondary, yet high-value, customer base includes semiconductor foundries and specialized wafer manufacturers (Epitaxial Houses). These entities purchase Electronic Grade DCS for use in complex chemical vapor deposition (CVD) processes to deposit ultra-thin, highly controlled layers of silicon and silicon nitride onto semiconductor substrates. These buyers prioritize purity, consistency, and compliance with rigorous material specifications over volume pricing, as the cost of material contamination can lead to catastrophic failure in microelectronic devices, highlighting the critical nature of the material in their advanced manufacturing processes.

Other potential buyers include specialty chemical companies involved in synthesizing custom silane coupling agents, advanced materials for optics, and research laboratories. While these accounts constitute lower volumes, they represent important niche markets for ultra-specialized, small-batch Dichlorosilane derivatives. Overall, the market remains B2B-centric, dominated by integrated players in the PV and electronics sectors who manage substantial internal consumption.

| Report Attributes | Report Details |

|---|---|

| Market Size in 2026 | USD 1.5 Billion |

| Market Forecast in 2033 | USD 2.7 Billion |

| Growth Rate | 8.5% CAGR |

| Historical Year | 2019 to 2024 |

| Base Year | 2025 |

| Forecast Year | 2026 - 2033 |

| DRO & Impact Forces |

|

| Segments Covered |

|

| Key Companies Covered | Wacker Chemie AG, Hemlock Semiconductor Operations LLC, Shin-Etsu Chemical Co., Ltd., Tokuyama Corporation, REC Silicon ASA, GCL Technology Holdings Limited, OCI Company Ltd., Mitsubishi Materials Corporation, Asia Silicon (Qinghai) Co., Ltd., Zhejiang Zhongning Silicon Materials Co., Ltd., China National Bluestar (Group) Co, Ltd., Momentive Performance Materials Inc., Dow Corning (now Dow), Air Products and Chemicals, Inc., Linde plc, Praxair (now Linde), Merck KGaA, Avantor, Inc. |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Enquiry Before Buy | Have specific requirements? Send us your enquiry before purchase to get customized research options. Request For Enquiry Before Buy |

Dichlorosilane Market Key Technology Landscape

The core technology surrounding Dichlorosilane production is fundamentally tied to the overall chlorosilane manufacturing loop, starting with the reaction of metallurgical silicon and anhydrous hydrogen chloride (HCl) to produce trichlorosilane (TCS). DCS is then produced via either the controlled disproportionation of TCS or through complex, multi-stage fractional distillation processes designed to separate DCS from other chlorosilanes (Monochlorosilane, Trichlorosilane, and Silicon Tetrachloride). The technological focus is centered on increasing the yield and energy efficiency of the disproportionation reaction and enhancing the purity achieved during the subsequent distillation steps, especially for electronic-grade applications where metallic and non-metallic contaminants must be reduced to parts per billion (ppb) or parts per trillion (ppt) levels.

A critical technological area involves the closed-loop recycling and management of byproducts, notably silicon tetrachloride (STC). Efficient conversion of STC back into usable TCS or DCS feedstock is vital for minimizing waste, reducing environmental impact, and significantly lowering operational costs. Advanced reactor designs, such as high-pressure hydrogenation reactors, are continuously being refined to maximize the conversion rate of STC, thereby maintaining a sustainable and cost-effective production cycle. Failure to efficiently recycle STC can severely impede the profitability of the entire polysilicon operation, making technological mastery of the chlorosilane conversion cycle a key competitive advantage.

Furthermore, the technology landscape includes the specialized equipment utilized in the application phase. In polysilicon manufacturing, this involves advanced Siemens reactors and, increasingly, Fluidized Bed Reactor (FBR) technology. FBRs offer advantages in continuous operation and energy reduction, requiring precise control over DCS injection and reaction conditions. For the semiconductor industry, the technological focus is on high-precision Chemical Vapor Deposition (CVD) tools capable of utilizing DCS as a precursor to deposit ultra-uniform silicon and silicon-nitride layers at lower temperatures compared to other precursors, crucial for fabricating nanoscale devices with high reliability and performance characteristics.

Regional Highlights

- Asia Pacific (APAC): APAC is the unquestioned global leader in both production and consumption of Dichlorosilane, primarily driven by the colossal polysilicon manufacturing capacity concentrated in China. The region benefits from lower production costs and strong governmental support for the solar energy sector. Key consumers also include South Korea, Taiwan, and Japan, which house the world's leading semiconductor fabrication plants, demanding ultra-high purity electronic-grade DCS for advanced node manufacturing. The rapid growth of data centers and consumer electronics further anchors APAC's market dominance, making it the central hub for market growth, supply chain investments, and technological advancement in chlorosilane chemistry.

- North America: North America represents a crucial market for electronic-grade Dichlorosilane, driven by revitalized efforts in domestic semiconductor manufacturing, supported by federal legislation aimed at securing critical material supply chains. While its solar manufacturing base is smaller than APAC's, the region hosts major producers and technology innovators focusing on advanced polysilicon and specialty gas formulations. Demand is high for high-specification materials, and regulatory compliance regarding hazardous material handling is exceptionally stringent, driving market participants toward highly automated and secure operational protocols.

- Europe: The European market for Dichlorosilane is characterized by a strong emphasis on sustainability, quality, and technological innovation. Although polysilicon production has faced competitive pressures, demand remains steady from the established European semiconductor and advanced materials industries. European initiatives focus heavily on developing localized, greener supply chains and high-efficiency PV technologies, stimulating demand for specialty DCS grades and innovative silicon precursor chemistry tailored for high-performance applications in automotive electronics and industrial power modules.

- Latin America (LATAM) and Middle East & Africa (MEA): These regions currently hold smaller market shares but exhibit significant growth potential, particularly in the solar energy sector. LATAM is seeing an increase in utility-scale solar projects, driving indirect demand for polysilicon and related precursors manufactured elsewhere. MEA, particularly the Gulf Cooperation Council (GCC) countries, is investing in large solar energy infrastructure projects and exploring opportunities to leverage low energy costs to establish localized production facilities for photovoltaic components, creating nascent but potentially large future demand centers for Dichlorosilane.

Top Key Players

The market research report includes a detailed profile of leading stakeholders in the Dichlorosilane Market.- Wacker Chemie AG

- Hemlock Semiconductor Operations LLC

- Shin-Etsu Chemical Co., Ltd.

- Tokuyama Corporation

- REC Silicon ASA

- GCL Technology Holdings Limited

- OCI Company Ltd.

- Mitsubishi Materials Corporation

- Asia Silicon (Qinghai) Co., Ltd.

- Zhejiang Zhongning Silicon Materials Co., Ltd.

- China National Bluestar (Group) Co, Ltd.

- Momentive Performance Materials Inc.

- Dow Chemical Company (Through Dow Corning Legacy)

- Air Products and Chemicals, Inc.

- Linde plc

- Merck KGaA

- Avantor, Inc.

- SUMCO Corporation

- Siltronic AG

- KCC Corporation

Frequently Asked Questions

Analyze common user questions about the Dichlorosilane market and generate a concise list of summarized FAQs reflecting key topics and concerns.What is Dichlorosilane primarily used for in modern industry?

Dichlorosilane (DCS) is primarily used as a high-purity precursor in the manufacturing of polysilicon. This polysilicon is essential for producing photovoltaic (PV) solar cells and ultra-pure silicon wafers required by the global semiconductor and microelectronics industries.

How does the Electronic Grade Dichlorosilane market differ from the Metallurgical Grade segment?

Electronic Grade DCS requires exceptionally stringent purity levels, often measured in parts per billion (ppb), suitable for sensitive semiconductor applications like epitaxial film growth. Metallurgical Grade DCS refers to the material used for large-volume polysilicon production for solar cells, which, while still high purity, has slightly more permissible contamination limits and is produced in much larger volumes.

What are the main safety challenges associated with handling and transporting Dichlorosilane?

The main safety challenges involve DCS being highly flammable, corrosive, and toxic. It requires specialized, pressurized containment vessels and strict regulatory compliance during transportation and storage to prevent catastrophic releases or combustion incidents, necessitating high operational investment in safety infrastructure.

Which geographical region dominates the global Dichlorosilane market consumption?

Asia Pacific (APAC), particularly China, dominates global Dichlorosilane consumption. This is driven by the massive concentration of polysilicon production facilities dedicated to the solar photovoltaic market and the presence of leading semiconductor manufacturing centers in countries like Taiwan and South Korea, which consume electronic-grade DCS.

How do energy costs influence the profitability of Dichlorosilane production?

Energy costs are a major operational factor because the purification processes (distillation) and the final polysilicon conversion processes (CVD or Siemens reaction) are highly energy-intensive. Volatility in natural gas and electricity prices directly impacts the production cost of DCS, making energy efficiency a critical competitive factor for producers globally.

The Dichlorosilane market stands at the intersection of two of the world's fastest-growing sectors: renewable energy and advanced electronics. Its strategic importance as an indispensable material in high-tech manufacturing guarantees sustained, long-term relevance. The market is defined by a dichotomy between the high-volume, cost-sensitive solar sector and the low-volume, ultra-purity focused semiconductor industry. Future growth will hinge heavily on technological breakthroughs in process efficiency, specifically the adoption of greener, less energy-intensive manufacturing methods for polysilicon and enhanced recycling of chlorosilane byproducts to improve overall supply chain sustainability and resilience. Geopolitical factors driving localized manufacturing in North America and Europe will counterbalance the current heavy concentration of production capacity in Asia, fostering investment opportunities in advanced purification and safe handling technologies globally.

Manufacturers are consistently investing in R&D to meet the ever-increasing purity demands required by next-generation silicon devices, especially for nodes below 5nm and for new high-efficiency solar architectures like heterojunction cells. This necessitates not only refining the distillation process but also developing advanced analytical tools capable of detecting impurities at the parts per trillion level. Strategic partnerships between chemical suppliers and semiconductor foundries are becoming more common to co-develop custom Dichlorosilane formulations that optimize the yield and performance of specific epitaxial growth or deposition techniques, further cementing the high-value nature of the electronic-grade segment.

The transition toward greater automation and data utilization, spearheaded by AI and ML integration, promises to revolutionize operational management within chlorosilane plants. Implementing predictive models for maintenance, reaction optimization, and quality assurance will be key to unlocking significant cost reductions and mitigating the high safety risks inherent in the production of highly reactive gases. Regulatory frameworks worldwide continue to tighten regarding environmental emissions and hazardous material handling, pressuring market players to adopt Best Available Technologies (BAT) and invest heavily in waste mitigation, particularly the disposal or conversion of silicon tetrachloride, thereby driving innovation towards closed-loop, zero-waste manufacturing systems within the forecast period.

Investment outlook remains positive, driven by long-term structural demand. While market concentration among a few integrated producers presents barriers to entry, the localized demand generated by initiatives like the U.S. CHIPS Act creates niche opportunities for specialized material suppliers who can offer geographically redundant and high-assurance supply chains. Critical success factors for market players include achieving superior economies of scale in polysilicon production, maintaining impeccable safety records, and continuously innovating purification technologies to stay ahead of the escalating purity specifications dictated by advanced device roadmaps across both the solar and semiconductor sectors. The stability of the global energy markets will also be a determinant factor, directly influencing the competitiveness and profitability of high-volume producers in Asia.

The Dichlorosilane market is strategically crucial, positioned as the chemical bridge between basic metallurgical silicon and the complex world of high-performance electronics and renewable energy. Its growth trajectory is inextricably linked to the success of global decarbonization efforts and the rapid digitalization of economies worldwide. Ongoing technological migration in the solar sector—moving from standard multicrystalline to high-efficiency monocrystalline and advanced cell types—guarantees a stable demand floor. Simultaneously, the relentless advancement of semiconductor fabrication geometries ensures a consistent, albeit smaller, premium market for ultra-pure electronic feedstock, insulating a portion of the market from cyclical commodity pressures.

Environmental concerns and sustainability requirements are increasingly influencing purchasing decisions, prompting end-users to favor suppliers who demonstrate robust waste management protocols and low carbon footprints. This shift could potentially benefit producers utilizing hydroelectric or renewable energy sources for their energy-intensive purification and conversion processes. Furthermore, global supply chain risks, exacerbated by recent geopolitical events, have spurred investment in diversified manufacturing bases outside the dominant Asian concentration. This focus on supply chain resilience means that new capacity additions, particularly in North America and Europe, are built leveraging state-of-the-art automation and safety technologies, positioning them as high-quality, high-cost suppliers catering to regional security needs.

In summary, the Dichlorosilane market is set for sustained high growth, primarily volume-driven by solar PV expansion, coupled with high-value growth from the advanced semiconductor sector. Successfully navigating this market requires mastery of complex chemical engineering, rigorous safety and environmental compliance, and continuous optimization through advanced digital technologies, ensuring that the supply meets the non-negotiable purity standards demanded by the modern digital and energy infrastructure.

The projected CAGR of 8.5% reflects the baseline expansion expected from current polysilicon capacity utilization and planned capacity additions through 2033. This projection assumes continued technological parity between the Siemens process and alternative methods like FBR, with ongoing innovation aimed at reducing the specific energy consumption per kilogram of polysilicon produced. Should FBR technology see widespread, rapid adoption across major producers, the overall cost structure of the market could shift dramatically, potentially accelerating demand beyond current expectations due to greater affordability of solar PV systems globally. However, the high capital outlay required for FBR conversion acts as a damper on immediate, large-scale shifts. The market valuation reaching $2.7 Billion by 2033 further solidifies Dichlorosilane’s position as a critical, high-value commodity in the specialty chemicals sector.

Market dynamics are also influenced by feedstock pricing. Dichlorosilane is derived from trichlorosilane (TCS), and silicon tetrachloride (STC) is a primary byproduct. Fluctuations in the availability and cost of metallurgical grade silicon (MGS) directly feed into the pricing of DCS. Companies capable of efficiently managing the internal chlorosilane cycle—maximizing TCS yield and minimizing STC waste—are best positioned to maintain cost competitiveness. This cyclical integration is characteristic of the major players in the market, who view DCS production not as a standalone venture but as a necessary and deeply integrated step within the broader polysilicon manufacturing value chain.

In the semiconductor sphere, the trend toward advanced packaging and 3D architecture (like FinFET and Gate-All-Around transistors) continues to heighten the need for high-quality thin film deposition, often relying on Dichlorosilane precursors. As feature sizes shrink, contamination from even trace impurities becomes a catastrophic yield killer. Consequently, the specifications for electronic-grade DCS are continuously being revised upwards, pushing manufacturers to invest in advanced cryogenic distillation and sophisticated filtration systems. This segment, while smaller in volume, acts as a technological driver for the entire market, establishing the quality benchmarks that eventually influence all grades of production.

The Dichlorosilane market structure is oligopolistic, dominated by a few large, vertically integrated chemical and polysilicon manufacturers. These key players possess the technological expertise, capital resources, and infrastructure required to safely handle and process these hazardous materials at scale. Competition centers not merely on price, but heavily on product purity, consistency of supply, and adherence to global safety and environmental standards. Newer entrants typically face significant regulatory and capital barriers, restricting the competitive field primarily to established specialty chemical giants and dedicated polysilicon producers.

Technological advancement is not limited to purification; logistics and containment solutions are also undergoing continuous improvement. Developing safer, lighter, and more durable specialized containers for DCS transportation helps reduce risks and lower costs associated with logistics insurance and compliance. Furthermore, digital transformation initiatives are increasingly being applied to logistics tracking and predictive risk modeling for shipments, particularly across international borders, ensuring timely delivery while minimizing exposure to regulatory hurdles and unforeseen incidents.

The future outlook for Dichlorosilane remains strong, intrinsically linked to global mandates for clean energy adoption and the exponential demand for computational power. Policy support, such as feed-in tariffs for solar energy and governmental subsidies for domestic semiconductor fabrication, acts as a macroeconomic stabilizer for the market. Market stakeholders must prioritize sustainable manufacturing practices and operational excellence to capture the long-term value inherent in this critical specialty chemical segment.

The expansion into emerging applications, such as high-performance ceramics and specialized coatings requiring silicon precursors, provides further diversification opportunities, although these remain minor compared to the core polysilicon demand. The flexibility of DCS in being converted into various other silane derivatives, including higher silanes, also supports its enduring market utility. The stability of the high-purity supply chain will be a primary focus for governments worldwide, ensuring that Dichlorosilane maintains its strategic status in the production of foundational technologies.

In conclusion, the Dichlorosilane market trajectory confirms its role as a high-growth, high-regulation sector fundamentally driving both the energy transition and the digital revolution. The critical importance of purity and safety dictates the competitive landscape, favoring integrated industry leaders capable of continuous technological investment and meticulous risk management. The projected market growth reflects confidence in the sustained global demand for both solar capacity and advanced electronic components, underpinning the substantial market valuation forecasts for 2033.

The ongoing trade tensions and focus on supply chain localization efforts, particularly between the U.S. and China, introduce an element of geopolitical complexity. This leads to a bifurcation of the market where regional, high-cost suppliers emerge to meet geopolitical security demands, while Asian suppliers continue to dominate the low-cost, high-volume segment. This dynamic necessitates that market participants adopt dual strategies: optimizing high-volume production efficiency while developing specialized, compliant supply lines for strategic Western markets. The success of these strategies will define competitive advantage in the coming decade.

Ultimately, the performance of the Dichlorosilane market is a direct barometer of industrial commitment to scaling renewable energy infrastructure and pushing the boundaries of microelectronics miniaturization. The need for DCS will only intensify as solar cells become more efficient (requiring purer silicon) and semiconductor nodes become smaller (requiring more precise deposition materials), reinforcing the positive outlook for the forecasted period.

To check our Table of Contents, please mail us at: sales@marketresearchupdate.com

Research Methodology

The Market Research Update offers technology-driven solutions and its full integration in the research process to be skilled at every step. We use diverse assets to produce the best results for our clients. The success of a research project is completely reliant on the research process adopted by the company. Market Research Update assists its clients to recognize opportunities by examining the global market and offering economic insights. We are proud of our extensive coverage that encompasses the understanding of numerous major industry domains.

Market Research Update provide consistency in our research report, also we provide on the part of the analysis of forecast across a gamut of coverage geographies and coverage. The research teams carry out primary and secondary research to implement and design the data collection procedure. The research team then analyzes data about the latest trends and major issues in reference to each industry and country. This helps to determine the anticipated market-related procedures in the future. The company offers technology-driven solutions and its full incorporation in the research method to be skilled at each step.

The Company's Research Process Has the Following Advantages:

- Information Procurement

The step comprises the procurement of market-related information or data via different methodologies & sources.

- Information Investigation

This step comprises the mapping and investigation of all the information procured from the earlier step. It also includes the analysis of data differences observed across numerous data sources.

- Highly Authentic Source

We offer highly authentic information from numerous sources. To fulfills the client’s requirement.

- Market Formulation

This step entails the placement of data points at suitable market spaces in an effort to assume possible conclusions. Analyst viewpoint and subject matter specialist based examining the form of market sizing also plays an essential role in this step.

- Validation & Publishing of Information

Validation is a significant step in the procedure. Validation via an intricately designed procedure assists us to conclude data-points to be used for final calculations.

×

Request Free Sample:

Related Reports

Select License

Why Choose Us

We're cost-effective and Offered Best services:

We are flexible and responsive startup research firm. We adapt as your research requires change, with cost-effectiveness and highly researched report that larger companies can't match.

Information Safety

Market Research Update ensure that we deliver best reports. We care about the confidential and personal information quality, safety, of reports. We use Authorize secure payment process.

We Are Committed to Quality and Deadlines

We offer quality of reports within deadlines. We've worked hard to find the best ways to offer our customers results-oriented and process driven consulting services.

Our Remarkable Track Record

We concentrate on developing lasting and strong client relationship. At present, we hold numerous preferred relationships with industry leading firms that have relied on us constantly for their research requirements.

Best Service Assured

Buy reports from our executives that best suits your need and helps you stay ahead of the competition.

Customized Research Reports

Our research services are custom-made especially to you and your firm in order to discover practical growth recommendations and strategies. We don't stick to a one size fits all strategy. We appreciate that your business has particular research necessities.

Service Assurance

At Market Research Update, we are dedicated to offer the best probable recommendations and service to all our clients. You will be able to speak to experienced analyst who will be aware of your research requirements precisely.

Contact With Our Sales Team

Customer Testimonials

The content of the report is always up to the mark. Good to see speakers from expertise authorities.

Privacy requested , Managing Director

A lot of unique and interesting topics which are described in good manner.

Privacy requested, President

Well researched, expertise analysts, well organized, concrete and current topics delivered in time.

Privacy requested, Development Manager