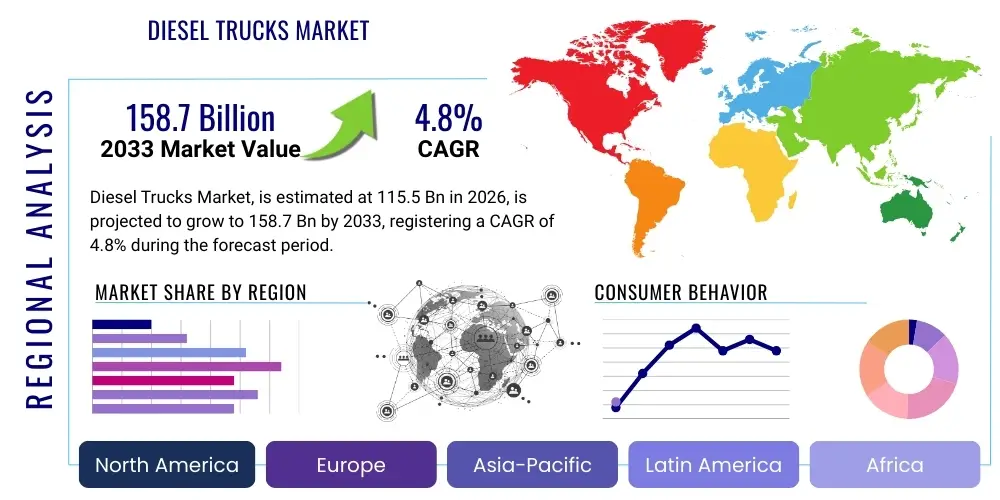

Diesel Trucks Market Size, By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2026 to 2033 (Financial Impact Analysis)

ID : MRU_ 442980 | Date : Feb, 2026 | Pages : 258 | Region : Global | Publisher : MRU

Diesel Trucks Market Size

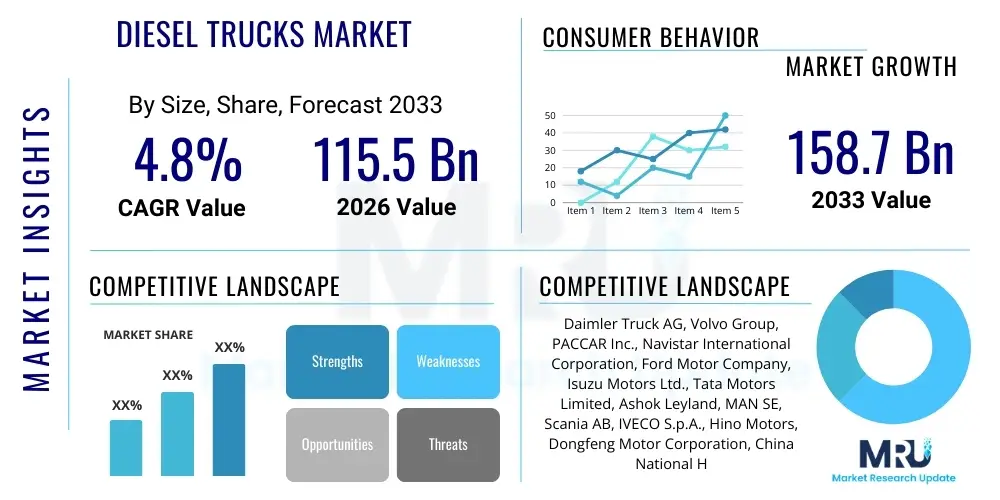

The Diesel Trucks Market is projected to grow at a Compound Annual Growth Rate (CAGR) of 4.8% CAGR between 2026 and 2033. The market is estimated at USD 115.5 Billion in 2026 and is projected to reach USD 158.7 Billion by the end of the forecast period in 2033.

Diesel Trucks Market introduction

The Diesel Trucks Market serves as the foundational backbone for global logistics and commercial transportation, playing a critical role in the movement of goods across diverse sectors including construction, mining, retail distribution, and heavy-duty freight haulage. Diesel engines have historically dominated this sector due to their unparalleled torque, durability, and fuel density, which translate into superior long-haul capabilities and reliability under heavy loads, a combination yet to be fully matched by emerging alternative fuel technologies in the high-tonnage segment. The market encompasses a wide range of vehicle classes, from light-duty commercial trucks utilized for urban delivery to massive Class 8 heavy-duty trucks designed for cross-country and international transport routes, emphasizing operational efficiency and total cost of ownership (TCO) as primary metrics for fleet operators.

Product descriptions within this market highlight continuous engineering advancements focused on optimizing engine efficiency, reducing nitrogen oxide (NOx) and particulate matter (PM) emissions through sophisticated aftertreatment systems (such as Selective Catalytic Reduction (SCR) and Diesel Particulate Filters (DPF)), and integrating advanced telematics for improved fleet management. Major applications span general freight transportation, specialized construction operations (e.g., dump trucks, cement mixers), waste management, and heavy industrial logistics, requiring customized chassis and powertrain configurations to meet rigorous operating environments. The primary benefits of modern diesel trucks include high power density, established refueling infrastructure, proven ruggedness, and relatively rapid refueling times compared to current battery-electric alternatives, maintaining their dominance in demanding, high-utilization scenarios.

Key driving factors supporting the market's sustained growth include robust expansion in global e-commerce necessitating increased last-mile and middle-mile delivery fleets, significant governmental investments in infrastructure development (roads, ports, utilities) requiring heavy equipment transport, and the overall recovery and expansion of industrial production worldwide. While the industry faces concurrent pressure from stringent global emission standards (like Euro 7 and various EPA regulations) and the long-term trend toward electrification, diesel technology continues to evolve, offering improved fuel economy and lower lifetime emissions profiles, thereby ensuring its relevance for the foreseeable future, particularly in developing economies where electric charging infrastructure remains nascent.

Diesel Trucks Market Executive Summary

The Diesel Trucks Market is currently characterized by a duality: short-term growth driven by resilient global supply chains and high demand for freight capacity, juxtaposed with long-term strategic transformation dictated by decarbonization mandates and technological shifts. Business trends indicate a focus among Original Equipment Manufacturers (OEMs) on producing highly connected, digitally enabled diesel trucks that integrate predictive maintenance, route optimization software, and advanced safety features, enhancing driver performance and minimizing operational downtime. Furthermore, fleet replacement cycles, which were postponed during initial economic volatility, are now accelerating, providing a significant boost to new truck sales, especially those models compliant with the latest environmental standards, often incorporating bio-diesel compatibility or hybrid diesel powertrains to bridge the transition to zero-emission vehicles.

Regional trends reveal disparate adoption rates of alternative fuels, ensuring diesel’s continued prominence in specific geographical areas. North America and Europe are prioritizing medium-duty and regional haul electrification, but diesel remains undisputed in long-haul Class 8 applications due to range and weight concerns. Conversely, the Asia Pacific (APAC) region, fueled by rapid urbanization and massive infrastructure projects in China, India, and Southeast Asia, exhibits strong, sustained demand for new diesel trucks across all weight classes, primarily driven by economic expansion and less aggressive immediate regulatory deadlines compared to Western markets. This regional divergence requires OEMs to maintain diverse product portfolios catering to localized performance and compliance requirements, particularly concerning engine sizing and emission control systems suitable for varying fuel quality.

Segment trends highlight the growing importance of the heavy-duty segment (over 16 tonnes gross vehicle weight) which generates the highest revenue due to its crucial role in large-scale logistics and international trade. Technology segmentation shows accelerating adoption of advanced telematics platforms, transforming trucks from simple transport assets into complex, data-generating hubs essential for optimized fleet operations and compliance reporting. While the total volume share of diesel trucks will gradually erode as electric and hydrogen alternatives gain traction in regional and localized transport, the absolute demand for diesel engines, especially efficient, high-horsepower variants, will persist across specialized applications and developing markets where robust, cost-effective power sources are paramount for sustaining economic momentum and infrastructure buildup.

AI Impact Analysis on Diesel Trucks Market

Common user questions regarding AI’s influence on the Diesel Trucks Market frequently center on the feasibility and safety of Level 4 autonomous driving in complex highway environments, the tangible return on investment (ROI) derived from AI-powered predictive maintenance programs, and how machine learning algorithms optimize dynamic routing and load matching to maximize fuel efficiency and minimize empty miles. Users are particularly keen on understanding how AI will integrate with existing diesel powertrain electronics to manage engine performance and emissions in real-time under varying loads and ambient conditions, ensuring regulatory compliance while improving operational throughput. Concerns often revolve around data security, the required telematics infrastructure investment, and the workforce implications, specifically the future role of the human driver in increasingly automated logistics chains, pushing OEMs and technology providers to demonstrate practical, reliable, and scalable AI solutions.

The integration of Artificial Intelligence (AI) is fundamentally reshaping the operational landscape of diesel trucks, moving far beyond simple connectivity into deep data analysis and automated decision-making. AI-driven systems are pivotal in enabling advanced driver-assistance systems (ADAS), enhancing collision avoidance, lane-keeping, and adaptive cruise control, thereby significantly improving vehicle safety and reducing accident frequency, which lowers insurance costs for fleet operators. Furthermore, machine learning algorithms analyze vast streams of engine operational data (temperature, pressure, vibration, duty cycles) to execute highly accurate predictive maintenance schedules, anticipating component failures long before they occur, thus drastically reducing unexpected roadside breakdowns and maximizing vehicle uptime—a critical metric in the high-utilization trucking industry where downtime represents substantial revenue loss.

Beyond vehicle performance, AI optimizes the macroscopic aspects of trucking logistics. Sophisticated route optimization software considers real-time traffic conditions, weather patterns, road restrictions, and cargo load to calculate the most fuel-efficient routes, directly impacting the consumption of diesel fuel and reducing carbon footprint per kilometer traveled. This optimization capability is particularly relevant for diesel fleets operating under tight delivery schedules and volatile fuel prices. Moreover, AI facilitates load matching and consolidation through intelligent brokerage platforms, minimizing deadheading (driving empty) and ensuring that the diesel truck assets are utilized at peak efficiency, which further cements the economic viability of diesel fleets in high-volume freight movement.

- AI enables sophisticated predictive maintenance by analyzing telematics data, reducing unplanned downtime by identifying imminent component failures.

- Integration of AI algorithms enhances Advanced Driver-Assistance Systems (ADAS), significantly improving highway safety and driver fatigue monitoring.

- Machine learning optimizes dynamic route planning, minimizing fuel consumption and travel time based on real-time operational variables.

- AI-driven fleet management platforms optimize trailer utilization and load matching, substantially reducing the costly practice of driving empty (deadheading).

- Automated diagnostics using AI accelerates maintenance procedures and lowers repair complexity and labor costs for complex modern diesel engines.

DRO & Impact Forces Of Diesel Trucks Market

The Diesel Trucks Market is shaped by a powerful confluence of drivers and constraints, creating a dynamic environment that necessitates continuous innovation from manufacturers. Primary drivers include the rapid expansion of global trade and e-commerce, which exponentially increases the demand for reliable, high-capacity transport solutions, alongside substantial governmental stimulus focusing on infrastructure renewal projects across major economies. However, these growth catalysts are strongly tempered by significant restraints, chiefly the ever-tightening global emission regulations (such as stringent NOx and CO2 reduction targets) that dramatically increase the complexity and manufacturing cost of modern diesel powertrains, alongside aggressive legislative pushes toward vehicle electrification in urban and regional transport segments. This regulatory pressure forces OEMs to dedicate massive R&D budgets to both optimizing diesel technology and developing parallel electric and hydrogen fuel cell alternatives, straining capital resources.

Opportunities within the sector largely revolve around leveraging existing diesel infrastructure for next-generation fuels and integrating digital solutions. The development and adoption of advanced bio-diesel fuels (like HVO and B100) and synthetic diesel offer a pathway for fleets to significantly lower their carbon intensity without massive capital expenditure on new vehicles or charging networks, extending the lifespan of current diesel assets. Furthermore, the integration of advanced telematics, IoT sensors, and data analytics provides lucrative opportunities for manufacturers to offer high-value digital services, moving beyond selling hardware to generating recurring revenue streams through software-as-a-service models focused on fleet efficiency, asset tracking, and regulatory compliance reporting, turning operational data into actionable intelligence for fleet managers.

The primary impact forces driving strategic decisions include the escalating geopolitical pressure to meet national decarbonization goals, which drives legislative frameworks favoring zero-emission vehicles, coupled with fluctuating global energy prices that profoundly affect the total cost of ownership (TCO) for fleet operators, making fuel efficiency paramount. Furthermore, the competitive impact of alternative powertrains, particularly battery electric vehicles (BEVs) in medium-duty and short-haul applications, forces diesel OEMs to aggressively defend their long-haul segment dominance through proven reliability and performance advantages. These forces collectively compel stakeholders to balance performance, cost-effectiveness, and environmental compliance, influencing investment in advanced engine design, lightweighting materials, and sophisticated aftertreatment technologies essential for maintaining market relevance in a rapidly evolving logistics landscape.

Segmentation Analysis

The Diesel Trucks Market is highly segmented based on key operational parameters that define vehicle utilization, regulatory requirements, and performance characteristics. The segmentation framework allows for a granular understanding of demand patterns across different commercial applications and geographical regions, reflecting variations in freight density, road networks, and specific industry needs. Key segmentation categories include vehicle weight class (which determines payload capacity and operational suitability), application type (reflecting industry-specific usage such as construction, mining, or general cargo), and engine configuration or technology, reflecting the level of emission compliance and integration of advanced features like hybridization or specialized fueling capabilities. Analyzing these segments provides strategic insights for OEMs regarding product development pipelines and market penetration strategies, especially as regulatory environments increasingly differentiate between light, medium, and heavy-duty vehicles.

- By Weight Class

- Light-Duty Trucks (Class 1-3)

- Medium-Duty Trucks (Class 4-6)

- Heavy-Duty Trucks (Class 7-8)

- By Application

- Logistics and Freight Transport

- Construction and Mining

- Waste Management and Municipal Services

- Defense and Military

- Specialized Industrial Transport

- By Engine Type and Technology

- Conventional Diesel Engines

- Advanced Diesel (SCR, DPF equipped)

- Diesel-Electric Hybrid Powertrains

- Bio-diesel Compatible Engines

- By Axle Configuration

- 4x2

- 6x2

- 6x4

- 8x4 and others

Value Chain Analysis For Diesel Trucks Market

The value chain for the Diesel Trucks Market begins with the upstream segment, dominated by specialized component manufacturers and raw material suppliers. This segment involves the production of highly engineered components crucial for diesel engine performance and emission control, including fuel injection systems, turbochargers, sophisticated aftertreatment systems (DPF, SCR components), and advanced engine control units (ECUs). Key suppliers in the upstream phase are characterized by intensive R&D to meet stringent efficiency and longevity standards, focusing on materials science for lightweighting and thermal management, which directly impacts the final cost and performance characteristics of the truck. The competitiveness in this segment is driven by patented technology and strong intellectual property rights related to emissions reduction and fuel efficiency gains, requiring strong, integrated partnerships with the major OEMs.

The midstream segment involves the Original Equipment Manufacturers (OEMs) who are responsible for engine assembly, chassis fabrication, cab production, and final vehicle integration. This is the stage where branding, marketing, and the incorporation of proprietary technologies, such as advanced telematics hardware and custom body configurations, occur. OEMs maintain extensive, globally distributed manufacturing facilities, focusing on assembly line optimization, quality control, and adherence to varying international safety and environmental standards. Distribution channels, forming the crucial connection between manufacturing and the end-user, rely heavily on large, authorized dealer networks (indirect channels) that provide sales, financing, and, critically, comprehensive after-sales service and genuine parts supply. Direct sales channels, increasingly utilized for large fleet purchasing contracts, allow OEMs to bypass traditional dealers for key accounts, offering custom-built solutions and integrated maintenance packages.

The downstream segment primarily consists of the maintenance, repair, and operational support services, alongside the end-user fleet operators and leasing companies. After-sales support is a significant revenue driver, involving scheduled maintenance, complex engine repairs, software updates for ECU/telematics systems, and the supply of certified spare parts, often managed through the same dealer network that handles sales. The effectiveness of the indirect distribution channel, particularly the quality and geographical reach of service centers, is a major factor influencing purchasing decisions, especially for long-haul operators who require rapid service turnaround times to minimize vehicle downtime. Financing and leasing companies also play a pivotal role, offering capital solutions that enable fleets to acquire high-cost assets, further integrating them into the overall value delivery mechanism of the diesel truck industry.

Diesel Trucks Market Potential Customers

The potential customers and primary end-users of the Diesel Trucks Market are fundamentally segmented based on their operational focus, requiring tailored vehicle classes and specialized body configurations. The largest consumer group consists of third-party logistics (3PL) providers and large-scale private fleet operators specializing in general freight and temperature-controlled transport, relying heavily on Class 8 heavy-duty trucks for long-distance, inter-city, and international cargo movement. These customers prioritize fuel efficiency, driver comfort, and the ability to integrate advanced telematics for optimization, as their business success is directly proportional to vehicle utilization and minimal operating costs per mile. Their purchasing decisions are heavily influenced by Total Cost of Ownership (TCO) assessments over a 5-10 year lifecycle.

Another significant customer segment includes companies operating within the construction, mining, and resource extraction industries. These end-users require highly robust, specialized medium and heavy-duty trucks (e.g., dump trucks, mixers, specialized articulated haulers) designed for off-road durability, severe duty cycles, and high torque capacity, often utilizing specific axle configurations (like 6x4 or 8x4). For this segment, reliability in harsh environments and adherence to strict safety standards are prioritized over pure highway fuel economy, making engine power and chassis strength critical purchasing criteria. These buyers frequently enter into long-term maintenance contracts with OEMs due to the complexity and intensity of repairs required by their operating conditions.

Governmental and municipal bodies represent a stable, recurring customer base, purchasing medium-duty trucks for public services such as waste management, utility maintenance, emergency services, and defense applications. These customers often have procurement mandates related to environmental sustainability and local content requirements, driving demand for trucks compliant with the latest municipal emissions standards or capable of utilizing bio-diesel blends. Lastly, small and medium enterprises (SMEs) engaged in localized delivery, farming, or regional distribution constitute a fragmented but vital customer group, typically relying on light and medium-duty trucks. These buyers are highly sensitive to initial purchase price and local dealer support, often opting for proven, high-reliability models with strong local parts availability rather than the most advanced, expensive technologies.

| Report Attributes | Report Details |

|---|---|

| Market Size in 2026 | USD 115.5 Billion |

| Market Forecast in 2033 | USD 158.7 Billion |

| Growth Rate | 4.8% CAGR |

| Historical Year | 2019 to 2024 |

| Base Year | 2025 |

| Forecast Year | 2026 - 2033 |

| DRO & Impact Forces |

|

| Segments Covered |

|

| Key Companies Covered | Daimler Truck AG, Volvo Group, PACCAR Inc., Navistar International Corporation, Ford Motor Company, Isuzu Motors Ltd., Tata Motors Limited, Ashok Leyland, MAN SE, Scania AB, IVECO S.p.A., Hino Motors, Dongfeng Motor Corporation, China National Heavy Duty Truck Group (Sinotruk), Kenworth Truck Company, Peterbilt Motors Company, Freightliner Trucks, BYD Auto (Diesel offerings), GAZ Group, Western Star Trucks |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Enquiry Before Buy | Have specific requirements? Send us your enquiry before purchase to get customized research options. Request For Enquiry Before Buy |

Diesel Trucks Market Key Technology Landscape

The contemporary technology landscape of the Diesel Trucks Market is defined by intense efforts to achieve ultra-low emissions and maximize operational efficiency while maintaining diesel’s core performance attributes. A critical technological cornerstone is the highly advanced aftertreatment system, including Selective Catalytic Reduction (SCR) systems, which use Diesel Exhaust Fluid (DEF) to neutralize NOx emissions, and Diesel Particulate Filters (DPF), which trap and periodically incinerate soot. These systems are managed by sophisticated Engine Control Units (ECUs) utilizing complex algorithms to adjust fuel injection timing, turbocharging pressure, and aftertreatment cycles in real-time based on driving conditions and load, ensuring compliance with standards like EPA 2027 and Euro 7 readiness while minimizing fuel economy penalties. Furthermore, OEMs are increasingly integrating lightweight engine components and optimizing aerodynamic designs to reduce parasitic drag, directly improving miles-per-gallon performance.

Beyond the engine itself, connectivity and digital integration form the second pillar of technological advancement. Telematics systems, leveraging 4G/5G connectivity and IoT sensors, are standard features, providing real-time data on everything from engine health and fuel consumption to driver behavior and geographical location. This data feeds into proprietary fleet management software that enables predictive maintenance, dynamic route optimization (often AI-enhanced), and remote diagnostics, drastically increasing vehicle uptime and efficiency. Advanced Driver-Assistance Systems (ADAS), including features like automated emergency braking (AEB), lane departure warnings, and electronic stability control (ESC), are becoming mandatory safety features, driven by regulatory demands in major markets like North America and Europe, utilizing radar, cameras, and sensor fusion technology to mitigate accident risks.

Finally, there is a growing technological push towards hybridization and fuel flexibility to provide transitional solutions. While fully electric powertrains target urban delivery, diesel-electric hybrid trucks are emerging for regional haul applications, using electric motors to assist the diesel engine during acceleration and regenerative braking to recapture energy, yielding significant fuel savings in stop-and-go conditions. Additionally, technological readiness for alternative fuels like Hydrotreated Vegetable Oil (HVO) and Bio-diesel (B20/B100) is key. Engine designers are adjusting fuel system components and seals to reliably handle these chemically different fuels, offering fleets a practical, immediate pathway to lower their carbon intensity without abandoning the established operational benefits and infrastructure associated with the diesel platform, thus ensuring the platform remains viable through continuous technological adaptation.

Regional Highlights

- North America: The market here is dominated by Class 8 heavy-duty trucks, crucial for transcontinental freight. Regulatory pressures, especially from California (CARB) and the EPA, are aggressive, pushing early adoption of advanced emission controls and accelerated investment in electrification for port and regional applications. Diesel remains indispensable for long-haul operations due to the vast distances and established fueling infrastructure. Demand is largely driven by replacement cycles and e-commerce logistics growth, focusing on trucks equipped with high-level ADAS and advanced telematics for driver safety and fuel management optimization.

- Europe: Characterized by stringent emission standards (Euro VI currently, transitioning to Euro 7), the European market focuses heavily on clean diesel technology and aerodynamic efficiency due to higher fuel costs. The fragmentation of national logistics and border crossing complexities drive demand for flexible, compliant vehicles. Governments and OEMs are strongly backing battery electric vehicles (BEVs) for urban and medium-distance haulage, creating a split market where diesel retains the heavy-duty, international transport segment, while localized distribution quickly shifts toward alternative fuels.

- Asia Pacific (APAC): This region is the largest and fastest-growing segment globally, fueled by rapid industrialization, burgeoning trade, and massive state-sponsored infrastructure projects, particularly in China and India. Demand spans all weight classes. While emission standards are tightening in key metropolitan areas, the overall rate of compliance and enforcement is slower than in Western economies, maintaining a strong demand for cost-effective, durable diesel trucks. High population density and growing middle-class consumption sustain unprecedented logistics demand, ensuring the high-volume procurement of new diesel vehicles.

- Latin America: Market growth is variable, influenced heavily by commodity prices and economic stability. Diesel penetration is extremely high across all segments due to historical reliance, poor electrification infrastructure, and challenging road conditions requiring rugged, high-clearance vehicles. The focus here is primarily on durability, low operating cost, and service network availability rather than cutting-edge emission technology, though major global OEMs introduce models that meet regional regulatory requirements derived from Euro standards (e.g., Euro V and VI adoption).

- Middle East and Africa (MEA): This region is heavily reliant on diesel power for logistics, construction, and resource extraction (mining and oil & gas). Extreme climates and high fuel prices in some areas drive the need for highly reliable cooling systems and fuel-efficient engines. The market is primarily served by imported vehicles from Europe and Asia, with demand often spiking in connection with major regional infrastructure development projects. Diesel’s robust performance in remote areas where refueling infrastructure is limited ensures its continued market dominance.

Top Key Players

The market research report includes a detailed profile of leading stakeholders in the Diesel Trucks Market.- Daimler Truck AG

- Volvo Group

- PACCAR Inc. (Kenworth and Peterbilt)

- Navistar International Corporation (Traton Group)

- Ford Motor Company

- Isuzu Motors Ltd.

- Tata Motors Limited

- Ashok Leyland

- MAN SE

- Scania AB

- IVECO S.p.A.

- Hino Motors

- Dongfeng Motor Corporation

- China National Heavy Duty Truck Group (Sinotruk)

- General Motors (GM)

- Fuso Truck and Bus Corporation

- Renault Trucks (Volvo Group subsidiary)

- Kamaz

- Western Star Trucks (Daimler Truck subsidiary)

- GAZ Group

Frequently Asked Questions

Analyze common user questions about the Diesel Trucks market and generate a concise list of summarized FAQs reflecting key topics and concerns.What is the primary factor driving current demand in the Diesel Trucks Market?

The central factor driving current market demand is the sustained, robust expansion of global e-commerce and logistics networks, necessitating rapid fleet expansion and replacement cycles to handle increased freight volumes across long-haul and regional transport corridors. Additionally, significant global infrastructure investment bolsters demand for heavy-duty construction and specialized transport vehicles, where diesel power offers unmatched performance and range.

How are new emission regulations impacting the cost and performance of modern diesel trucks?

New emission regulations, such as EPA and Euro 7 standards, significantly increase vehicle complexity and manufacturing costs due to the required integration of sophisticated aftertreatment technologies like Selective Catalytic Reduction (SCR) and high-efficiency particulate filters (DPF). While these systems ensure ultra-low emissions, they require precise control and maintenance, necessitating higher upfront investment and sometimes slightly reduced fuel efficiency compared to older models without comparable emission controls.

Is the electrification trend expected to completely replace diesel trucks in all segments?

No, complete replacement is not anticipated in the foreseeable future, particularly in the heavy-duty, long-haul segment (Class 8) and specialized off-road applications. While battery electric vehicles (BEVs) are rapidly gaining market share in light- and medium-duty regional haulage and urban delivery due to range limitations and charging infrastructure requirements, diesel remains the indispensable solution for transcontinental freight haulage, high-payload transport, and severe-duty operations due to its energy density and refueling speed.

What role does telematics and AI play in enhancing diesel truck efficiency?

Telematics and AI are crucial for optimizing efficiency by transforming trucks into connected data hubs. AI analyzes real-time data to facilitate predictive maintenance, dramatically reducing unplanned downtime, and executes dynamic route optimization to minimize fuel usage and travel time. These digital tools improve asset utilization, driver safety, and regulatory compliance, directly lowering the Total Cost of Ownership (TCO) for fleet operators.

Which geographical region exhibits the fastest growth potential for diesel truck sales?

The Asia Pacific (APAC) region, driven by large economies like China, India, and Southeast Asian nations, demonstrates the fastest growth potential. This growth is underpinned by rapid urbanization, massive infrastructural development initiatives, and increasing cross-border trade, leading to high-volume demand for reliable diesel-powered vehicles across all commercial weight categories to support sustained economic expansion and logistics requirements.

To check our Table of Contents, please mail us at: sales@marketresearchupdate.com

Research Methodology

The Market Research Update offers technology-driven solutions and its full integration in the research process to be skilled at every step. We use diverse assets to produce the best results for our clients. The success of a research project is completely reliant on the research process adopted by the company. Market Research Update assists its clients to recognize opportunities by examining the global market and offering economic insights. We are proud of our extensive coverage that encompasses the understanding of numerous major industry domains.

Market Research Update provide consistency in our research report, also we provide on the part of the analysis of forecast across a gamut of coverage geographies and coverage. The research teams carry out primary and secondary research to implement and design the data collection procedure. The research team then analyzes data about the latest trends and major issues in reference to each industry and country. This helps to determine the anticipated market-related procedures in the future. The company offers technology-driven solutions and its full incorporation in the research method to be skilled at each step.

The Company's Research Process Has the Following Advantages:

- Information Procurement

The step comprises the procurement of market-related information or data via different methodologies & sources.

- Information Investigation

This step comprises the mapping and investigation of all the information procured from the earlier step. It also includes the analysis of data differences observed across numerous data sources.

- Highly Authentic Source

We offer highly authentic information from numerous sources. To fulfills the client’s requirement.

- Market Formulation

This step entails the placement of data points at suitable market spaces in an effort to assume possible conclusions. Analyst viewpoint and subject matter specialist based examining the form of market sizing also plays an essential role in this step.

- Validation & Publishing of Information

Validation is a significant step in the procedure. Validation via an intricately designed procedure assists us to conclude data-points to be used for final calculations.

×

Request Free Sample:

Related Reports

Select License

Why Choose Us

We're cost-effective and Offered Best services:

We are flexible and responsive startup research firm. We adapt as your research requires change, with cost-effectiveness and highly researched report that larger companies can't match.

Information Safety

Market Research Update ensure that we deliver best reports. We care about the confidential and personal information quality, safety, of reports. We use Authorize secure payment process.

We Are Committed to Quality and Deadlines

We offer quality of reports within deadlines. We've worked hard to find the best ways to offer our customers results-oriented and process driven consulting services.

Our Remarkable Track Record

We concentrate on developing lasting and strong client relationship. At present, we hold numerous preferred relationships with industry leading firms that have relied on us constantly for their research requirements.

Best Service Assured

Buy reports from our executives that best suits your need and helps you stay ahead of the competition.

Customized Research Reports

Our research services are custom-made especially to you and your firm in order to discover practical growth recommendations and strategies. We don't stick to a one size fits all strategy. We appreciate that your business has particular research necessities.

Service Assurance

At Market Research Update, we are dedicated to offer the best probable recommendations and service to all our clients. You will be able to speak to experienced analyst who will be aware of your research requirements precisely.

Contact With Our Sales Team

Customer Testimonials

The content of the report is always up to the mark. Good to see speakers from expertise authorities.

Privacy requested , Managing Director

A lot of unique and interesting topics which are described in good manner.

Privacy requested, President

Well researched, expertise analysts, well organized, concrete and current topics delivered in time.

Privacy requested, Development Manager