Diet Food and Beverages Market Size, By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2026 to 2033 (Financial Impact Analysis)

ID : MRU_ 442145 | Date : Feb, 2026 | Pages : 245 | Region : Global | Publisher : MRU

Diet Food and Beverages Market Size

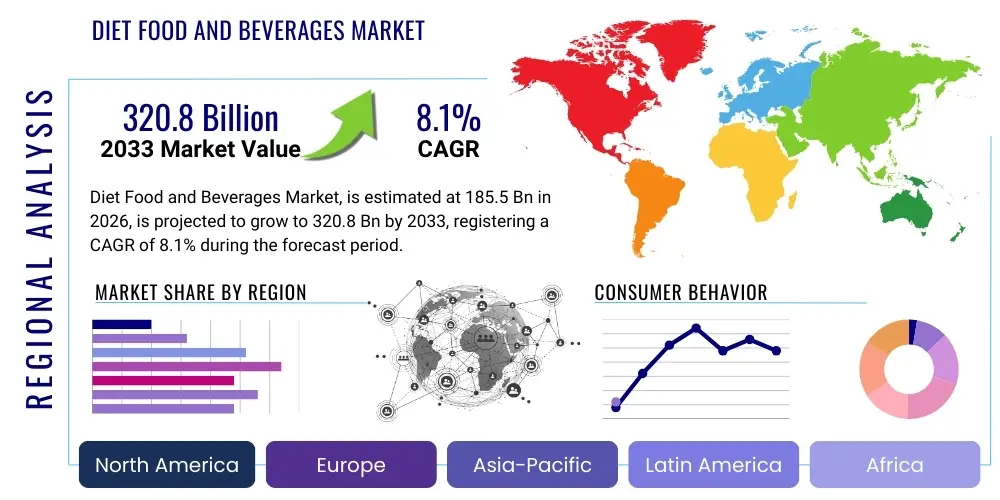

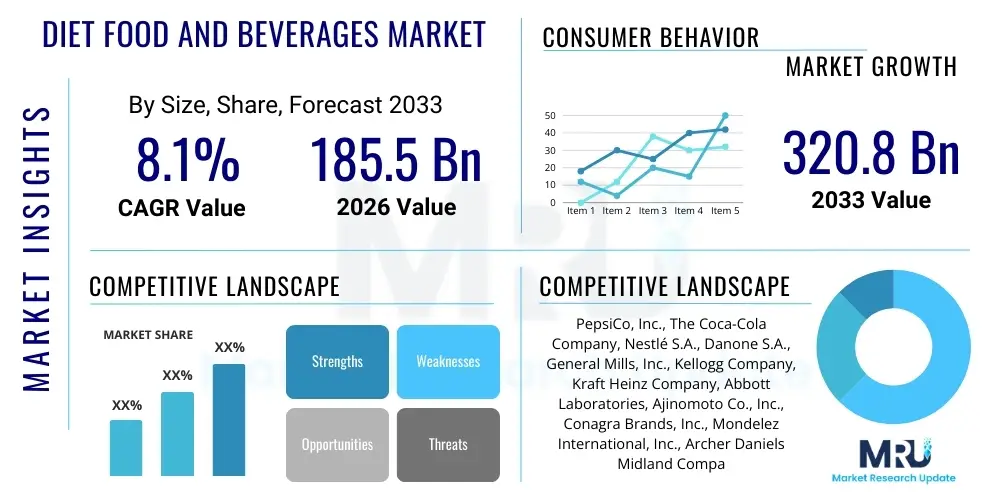

The Diet Food and Beverages Market is projected to grow at a Compound Annual Growth Rate (CAGR) of 8.1% between 2026 and 2033. The market is estimated at $185.5 Billion in 2026 and is projected to reach $320.8 Billion by the end of the forecast period in 2033.

Diet Food and Beverages Market introduction

The Diet Food and Beverages Market encompasses a wide array of products specifically formulated to assist consumers in managing weight, controlling caloric intake, or adhering to dietary restrictions related to conditions such as diabetes. These products are characterized by reduced or eliminated content of sugar, fat, sodium, or overall calories, achieved through the use of non-nutritive sweeteners, fat substitutes, and dietary fibers. The fundamental product category spans diet soft drinks, zero-sugar confectionery, low-calorie dairy items, and prepared diet meals. The development of this market is intrinsically linked to global epidemiological trends, particularly the increasing prevalence of obesity, coupled with heightened consumer awareness regarding the long-term health implications of excessive consumption of refined sugars and saturated fats. Manufacturers are increasingly prioritizing product innovation to improve flavor profiles and textural attributes, bridging the gap between diet alternatives and their traditional counterparts, thereby driving mainstream adoption.

Major applications for diet food and beverages are broadly segmented into proactive health and wellness maintenance, and clinical dietary management. In the former, consumers utilize these products as part of a lifestyle choice focused on preventative health and energy balance, often integrating them into specific weight loss regimens such as ketogenic or low-carb diets. For clinical applications, these products are crucial for individuals managing type 2 diabetes, where strict carbohydrate and sugar control is paramount, and for patients recovering from bariatric surgery or other conditions requiring modified nutrient absorption. The global shift toward personalized nutrition further amplifies the utility of these products, allowing consumers to select options tailored to specific metabolic needs or genetic predispositions, often guided by nutritional professionals or specialized health applications.

The substantial benefits derived from the consumption of diet foods and beverages include improved glycemic control, support for effective weight management strategies, and a reduction in the risk factors associated with metabolic syndrome and cardiovascular diseases. These benefits serve as powerful driving factors for market expansion. Furthermore, significant investment in research and development, particularly focusing on natural, non-caloric sweeteners like stevia and monk fruit, and functional ingredients such as prebiotics and high-quality protein isolates, is fueling consumer confidence and expanding the market's demographic reach beyond traditional dieters. Regulatory support in several key economies, mandating clearer labeling and imposing sugar taxes, is structurally encouraging both the supply side to innovate and the demand side to seek healthier alternatives, solidifying the market's robust growth trajectory over the forecast period.

Diet Food and Beverages Market Executive Summary

The Diet Food and Beverages Market is experiencing robust expansion driven by pronounced macroeconomic shifts, evolving regulatory environments, and fundamental changes in consumer health priorities. Current business trends indicate a strong focus on the integration of clean-label ingredients, eliminating artificial additives, and transitioning towards plant-based diet formulations, particularly in the dairy and protein supplement segments. Key industry participants are increasingly engaging in strategic acquisitions of specialized functional food companies to rapidly expand their low-calorie and fortified product portfolios. Furthermore, there is a visible trend towards premiumization, where specialized dietary needs, such as gluten-free or keto-friendly, command higher price points, indicating consumer willingness to invest significantly in perceived quality and efficacy. The digitalization of retail, specifically the rapid growth of online subscription boxes focused on health and fitness, provides new, direct-to-consumer distribution channels that bypass traditional retail barriers and offer personalized product recommendations.

Regionally, North America and Europe maintain dominance, characterized by high consumer awareness, stringent regulatory frameworks encouraging healthier product formulations, and substantial disposable income facilitating the purchase of premium diet options. However, the Asia Pacific (APAC) region is projected to exhibit the fastest growth trajectory, primarily fueled by rising middle-class populations, the adoption of Westernized dietary habits contributing to lifestyle diseases, and increasing governmental interventions aimed at public health improvement, notably in populous countries like China and India. Latin America and the Middle East & Africa (MEA) are emerging markets, where growth is currently concentrated in urban centers, driven by increased availability of global brands and rising awareness of preventable health risks associated with high sugar intake. Localization of diet product formulations to meet regional taste preferences remains a critical success factor for global market penetration in these high-growth areas.

Segment trends reveal a rapid ascendancy of the beverages category, particularly functional zero-sugar hydration products and sparkling waters infused with vitamins or botanicals, reflecting consumer preference for convenient, low-calorie consumption methods. Within the food segment, low-carb and keto-friendly snack bars and meal replacements are demonstrating exceptional growth, supported by the mainstream popularity of highly restrictive diets. The distribution channel dynamics show a strong shift toward online retail, offering consumers transparency regarding nutritional information and greater access to niche or imported specialty diet brands. Technological innovation, particularly in ingredient science focusing on highly effective natural fat and sugar replacers, is creating new sub-segments and accelerating product launch cycles across all categories, ensuring continuous market evolution aligned with shifting consumer health mandates and nutritional science breakthroughs.

AI Impact Analysis on Diet Food and Beverages Market

User queries regarding the impact of Artificial Intelligence (AI) on the Diet Food and Beverages Market predominantly center on personalized nutrition, optimized supply chain transparency, and predictive consumer demand modeling. Consumers and stakeholders are keen to understand how AI can move beyond basic calorie counting to provide prescriptive dietary recommendations based on individual biometric data, gut microbiome analysis, and genetic profiles, enabling the creation of 'hyper-personalized' diet products. Key concerns revolve around data privacy when integrating health trackers and genetic data, and the accuracy of AI algorithms in complex metabolic contexts. Users anticipate that AI-driven quality control and ingredient sourcing optimization will significantly enhance the trustworthiness and nutritional consistency of diet products, ultimately lowering production costs and improving product efficacy for targeted health outcomes, particularly in chronic disease management and athletic performance enhancement.

The integration of machine learning algorithms is revolutionizing product development by accelerating the discovery and formulation of novel low-calorie ingredients that replicate the sensory experience of traditional foods without compromising on health attributes. AI-powered sensory analysis tools can rapidly evaluate vast datasets of ingredient combinations, predicting consumer acceptance and optimizing flavor profiles much faster than conventional R&D methods. Furthermore, AI systems are crucial in analyzing complex supply chain data, identifying potential vulnerabilities related to the sourcing of specialty ingredients—such as high-quality natural sweeteners or plant-based proteins—ensuring sustainability and compliance with strict dietary labeling requirements, which are paramount for consumer trust in the diet food sector.

In the realm of consumer engagement, AI is instrumental in enhancing the retail experience. Chatbots and virtual nutritionists provide instant, context-aware dietary advice and product recommendations, driving purchase decisions for specific diet categories like keto or vegan options. Predictive analytics inform inventory management and localized marketing strategies, allowing retailers and manufacturers to accurately stock diet products that align with real-time demographic and health trends in specific geographic areas, thereby minimizing waste and maximizing profitability. This synergy between personalized consumption advice and optimized logistics marks AI as a transformative force, shifting the diet food sector from mass-market offerings to a highly individualized, data-driven ecosystem.

- AI-driven Personalized Nutrition: Algorithms create bespoke diet plans and recommend specific diet products based on biometric, genetic, and microbiome data, enhancing efficacy.

- Optimized Ingredient Formulation: Machine learning accelerates the identification and testing of novel natural, low-calorie sweeteners and fat replacers, improving taste and texture.

- Predictive Consumer Demand Modeling: AI analyzes social media trends, sales data, and health app usage to forecast demand for niche diet categories (e.g., specific allergen-free or keto products).

- Supply Chain Transparency and Quality Control: Utilizing blockchain and AI to track specialty ingredients from source to shelf, ensuring purity and compliance with strict dietary specifications.

- Enhanced Retail Experience: Implementation of virtual nutritionists and recommendation engines for guiding consumers through complex diet product choices online and in-store.

DRO & Impact Forces Of Diet Food and Beverages Market

The Diet Food and Beverages Market dynamics are profoundly shaped by a convergence of driving forces (D), critical restraints (R), and compelling opportunities (O), all interacting to define the strategic landscape. The primary driver is the escalating global health crisis, particularly the epidemic rise in obesity and diabetes prevalence, necessitating dietary modifications across vast populations. This is powerfully supported by proactive governmental health policies, including sugar taxes and clear nutritional labeling mandates, which structurally favor the consumption and production of diet alternatives. Conversely, the market faces significant restraints, notably the persistent consumer skepticism regarding the safety and long-term health effects of artificial sweeteners (such as aspartame or sucralose), leading to 'clean label' demands that complicate formulation. Furthermore, the higher cost associated with producing specialized diet ingredients and maintaining premium quality often translates into higher retail prices, acting as a barrier for price-sensitive consumer segments. Opportunities abound in leveraging the 'clean label' movement by focusing heavily on natural, plant-derived sweeteners like stevia and monk fruit, alongside capitalizing on the burgeoning demand for functional diet products that offer added health benefits, such as high protein, high fiber, or mood-enhancing compounds. These elements create a complex interplay of impact forces dictating market evolution.

The interplay of these factors creates significant impact forces across the market ecosystem. Regulatory impact forces are compelling manufacturers to reformulate existing product lines, often resulting in significant R&D investments but ultimately paving the way for differentiated, health-conscious offerings. Economic impact forces are defined by the rising cost of living in many regions, which, when coupled with the typically higher price of specialized diet foods, could temporarily suppress volume growth, yet consumer prioritization of health maintains resilience in premium segments. Sociocultural impact forces, fueled by pervasive social media narratives emphasizing body positivity and preventative wellness, strongly encourage consumers to seek out transparent and effective diet alternatives. This creates a market environment where authenticity and scientifically validated health claims are powerful determinants of brand success.

Technological impact forces are arguably the most transformative, as advancements in ingredient science, especially precision fermentation for producing sustainable and zero-calorie proteins and flavor enhancers, offer solutions to address both taste/texture restraints and clean label opportunities. Furthermore, the refinement of supply chain technologies, leveraging AI and IoT, enhances the efficiency of sourcing specialty diet ingredients, thereby mitigating some of the economic pressures associated with production. The overarching impact is a structural shift away from purely calorie-restricted products towards functional diet formulations, where low caloric content is a baseline expectation, complemented by enhanced nutritional value, driving sustained innovation and competitive intensity in the global market landscape.

Segmentation Analysis

The Diet Food and Beverages Market is meticulously segmented based on product type, target consumer, distribution channel, and ingredient profile, reflecting the diverse landscape of consumer needs and technological capabilities. This segmentation is crucial for stakeholders to tailor product development, marketing strategies, and distribution logistics effectively. The product landscape is dominated by beverages, driven by consumer preference for convenient, immediate low-calorie options, while the food segment sees rapid growth in specialized diet snacks and meal replacements catering to structured dietary programs. Target consumers are defined not just by weight management goals but increasingly by specific clinical needs (diabetics) and broad preventative health and wellness seeking demographics, indicating a shift from remedial to proactive consumption patterns. Understanding these fine-grained market divisions allows companies to launch highly targeted, niche products that command strong consumer loyalty and premium pricing, ultimately maximizing market penetration and profitability across geographic boundaries.

Within the ingredient segment, the competitive dynamics between artificial and natural sweeteners are defining the future trajectory of product formulation. While artificial sweeteners offer cost-effectiveness and proven zero-calorie attributes, the intense consumer pushback has elevated natural alternatives—such as stevia, erythritol, and allulose—to prominence, despite their often higher sourcing costs and inherent formulation challenges regarding flavor profile stabilization. Concurrently, the rise of functional additives, including complex fibers and specialized protein isolates, is blurring the lines between traditional diet products and functional nutritional supplements. Distribution remains highly bifurcated, with mass retail (supermarkets/hypermarkets) serving as the volume driver, while specialized online platforms and direct-to-consumer models facilitate the growth of emerging, innovative brands that appeal directly to informed, health-conscious early adopters. The granularity of this segmentation highlights the need for dynamic strategies that can adapt to rapid shifts in consumer preferences and emerging nutritional science breakthroughs.

- Type:

- Diet Soft Drinks (Carbonated and Non-Carbonated)

- Low-Calorie Snacks (Chips, Bars, Popcorn)

- Sugar-Free Confectionery (Chocolates, Candies, Chewing Gum)

- Zero-Sugar Dairy Products (Yogurts, Milk Alternatives, Ice Creams)

- Prepared Diet Meals and Substitutes

- Target Consumer:

- Weight Management Consumers

- Diabetic Consumers (Sugar Control)

- General Health and Wellness Seekers

- Athletic and Performance Nutrition Users

- Distribution Channel:

- Supermarkets/Hypermarkets (Mass Retail)

- Convenience Stores (Impulse Purchases)

- Online Retail (E-commerce Platforms and D2C)

- Specialty Stores (Health Food Stores, Pharmacies)

- Ingredient:

- Artificial Sweeteners (Aspartame, Sucralose)

- Natural Sweeteners (Stevia, Monk Fruit, Erythritol)

- Fat Replacers (Oat Fibers, Protein Isolates)

- Fiber Additives and Prebiotics

Value Chain Analysis For Diet Food and Beverages Market

The Value Chain for the Diet Food and Beverages Market is intricate, beginning with the highly specialized upstream procurement of zero-calorie ingredients and concluding with omnichannel distribution to the discerning end-consumer. The upstream phase is characterized by intensive R&D focused on raw material discovery and refinement, particularly in bioprocessing natural sweeteners (like stevia extraction or fermentation-derived ingredients) and developing functional fat/sugar replacers. Key activities involve cultivating, extracting, or synthesizing these specialty compounds, often requiring high levels of technological expertise and strict quality control measures to ensure purity and stability, which significantly influences the final product cost. Suppliers in this phase include specialized chemical companies, agricultural biotechnology firms, and flavor houses that provide proprietary low-calorie formulations and enhancers. The negotiation power of these upstream suppliers is substantial, given the technical specificity and limited availability of certain desirable natural ingredients, making long-term supply agreements crucial for manufacturing stability and cost optimization.

The core manufacturing and midstream processes involve formulation, blending, processing, and packaging. This stage demands sophisticated manufacturing infrastructure capable of handling delicate ingredients and ensuring microbiological stability without relying on conventional preservatives. Manufacturers must rigorously adhere to stringent health regulations regarding nutritional claims, ingredient sourcing, and allergen control—a critical differentiator in the health-focused market. Downstream activities involve managing a complex distribution network, ranging from refrigerated logistics for specialized diet products (e.g., zero-sugar dairy) to ambient storage for packaged snacks and beverages. The trend toward customized, smaller batch production for niche diet segments (e.g., keto, vegan) requires agile and flexible manufacturing capabilities, moving away from large-scale, standardized production runs.

Distribution channels are categorized into direct and indirect routes. Direct distribution involves manufacturer-owned websites and subscription services (D2C), offering superior control over brand messaging and valuable consumer data insights crucial for personalized marketing, albeit at higher logistical complexity. Indirect distribution, which represents the bulk of market volume, relies heavily on large-scale organized retail (supermarkets, hypermarkets) and a rapidly growing e-commerce sector. The channel choice significantly impacts product visibility and margin potential. Successful market players strategically manage a hybrid distribution model, leveraging the broad reach of indirect channels for mass-market products while utilizing direct channels to cultivate loyalty and test innovative niche offerings, ensuring efficient inventory management and minimizing product obsolescence in a market characterized by frequent product innovation and short life cycles for specialized items.

Diet Food and Beverages Market Potential Customers

The potential customers for the Diet Food and Beverages Market constitute a vast and increasingly diversified demographic that extends far beyond the traditional weight-loss consumer. Primary end-users include individuals proactively engaging in weight management strategies, ranging from mild calorie restriction to intensive diet plans such as ketogenic or paleo, who seek low-calorie and low-carbohydrate alternatives to conventional snacks and beverages. This segment values products that maintain sensory satisfaction while delivering reduced caloric load, often prioritizing convenience and portability. A secondary, yet medically critical, customer segment comprises individuals managing chronic conditions, particularly Type 1 and Type 2 diabetes, who rely on zero-sugar formulations to maintain stable blood glucose levels and prevent associated health complications. For these users, product efficacy, strict nutritional accuracy, and medical professional recommendation are paramount purchasing criteria, driving demand for clinically backed and highly controlled product lines.

Furthermore, the market benefits significantly from the pervasive health and wellness movement, attracting a large segment of consumers (General Health and Wellness Seekers) who may not be actively dieting but are consciously reducing sugar and artificial ingredient intake as a preventative health measure. These consumers often favor products containing natural sweeteners, functional ingredients (like added protein, vitamins, or probiotics), and clean labels, viewing diet alternatives as part of a holistic, healthy lifestyle. This demographic is highly influenced by social media trends and nutritional information transparency, often driving the adoption of premium and boutique diet brands. The athletic and performance nutrition demographic represents another critical customer base, utilizing zero-sugar protein drinks, low-carb energy bars, and hydration solutions to optimize body composition and enhance physical recovery without excessive sugar intake, prioritizing high-quality protein and specific functional additives.

The geographical penetration of potential customers is also broadening, moving beyond developed Western economies. As disposable incomes rise in the Asia Pacific and Latin American regions, and as awareness of lifestyle diseases grows, urban populations in these areas are rapidly adopting diet foods and beverages. Manufacturers must increasingly focus on localizing flavor profiles and ingredient sourcing to capture this emerging, culturally diverse customer base. Overall, the market's trajectory indicates a shift towards personalized consumption, where future potential customers will demand highly specialized, evidence-based diet products tailored not only to general health goals but also to specific metabolic profiles and unique dietary restrictions, necessitating continuous innovation in formulation and marketing personalization to maintain engagement and market share.

| Report Attributes | Report Details |

|---|---|

| Market Size in 2026 | $185.5 Billion |

| Market Forecast in 2033 | $320.8 Billion |

| Growth Rate | 8.1% CAGR |

| Historical Year | 2019 to 2024 |

| Base Year | 2025 |

| Forecast Year | 2026 - 2033 |

| DRO & Impact Forces |

|

| Segments Covered |

|

| Key Companies Covered | PepsiCo, Inc., The Coca-Cola Company, Nestlé S.A., Danone S.A., General Mills, Inc., Kellogg Company, Kraft Heinz Company, Abbott Laboratories, Ajinomoto Co., Inc., Conagra Brands, Inc., Mondelez International, Inc., Archer Daniels Midland Company (ADM), Tate & Lyle PLC, Ingredion Incorporated, Arla Foods amba, DSM-Firmenich, Cargill, Incorporated, The Hain Celestial Group, Inc., Herbalife Nutrition Ltd., Südzucker AG. |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Enquiry Before Buy | Have specific requirements? Send us your enquiry before purchase to get customized research options. Request For Enquiry Before Buy |

Diet Food and Beverages Market Key Technology Landscape

The Diet Food and Beverages Market is profoundly shaped by continuous technological innovation, primarily focusing on ingredient science, formulation techniques, and manufacturing precision. A crucial area of technological advancement is the discovery and commercial scale production of next-generation sweetening agents. This includes optimizing the extraction yield and purity of natural high-intensity sweeteners, such as various glycosides from the Stevia rebaudiana plant or mogrosides from Monk fruit, utilizing advanced fractionation and purification techniques to eliminate off-tastes. Furthermore, the development of rare sugars (e.g., allulose) and sugar alcohols (e.g., erythritol) through microbial fermentation or enzymatic processes represents a significant technological leap, offering caloric reduction without the perceived health risks associated with older artificial sweeteners. These technologies enable manufacturers to closely mimic the volumetric and textural properties of sugar, which is essential for success in highly sensitive categories like baking mixes and confectionery, thereby directly addressing the primary restraint of consumer skepticism regarding taste compromise.

Beyond sweeteners, sophisticated formulation technologies are being deployed to address fat replacement and texture enhancement in low-calorie products. Techniques involving microencapsulation are utilized to protect functional ingredients, such as probiotics or specific micronutrients, ensuring their viability through the harsh processing environments and enhancing shelf stability in diet beverages and snacks. Advanced homogenization and emulsion technology are critical for creating stable, palatable low-fat dairy and dressing alternatives, using modified starches, hydrocolloids, and specialized protein structures to replicate the mouthfeel typically provided by full-fat ingredients. These precision formulation methods allow companies to develop "better-for-you" products that not only reduce calories but also introduce functional benefits such as improved satiety or enhanced digestive health, fundamentally redefining the competitive landscape of the diet segment toward functional nutrition.

Manufacturing and processing technologies are also undergoing radical modernization, particularly through the implementation of highly controlled, continuous processing systems. High-Pressure Processing (HPP) is increasingly adopted for diet beverages and fresh prepared meals, offering a non-thermal pasteurization method that preserves the nutritional integrity and fresh flavor profiles often degraded by traditional heat treatments, which is critical for maintaining consumer perception of quality in premium diet products. Furthermore, the integration of automation and sensor technology in production lines ensures meticulous adherence to dietary labeling standards—such as precise measurement of low-sodium or zero-sugar formulations—reducing batch variability and ensuring regulatory compliance. The technological landscape is thus moving towards sustainable ingredient sourcing, superior sensory experiences, and enhanced nutritional preservation, utilizing bioprocessing, material science, and advanced automation to deliver highly effective and trustworthy diet food and beverage solutions globally.

Regional Highlights

- North America: This region maintains the largest market share, characterized by high consumer awareness regarding diet and wellness, substantial healthcare expenditure, and a well-established infrastructure for specialty ingredient distribution. The United States and Canada are primary drivers, fueled by the persistent high prevalence of obesity and the mainstream acceptance of structured diets (Keto, Paleo, Low-Carb). Regulatory bodies, such as the FDA, have played a pivotal role in establishing labeling transparency, though debates regarding specific artificial sweeteners continue to influence consumer trust. The market is saturated with both major global brands and innovative startups, fostering intense competition focused on natural alternatives, functional benefits (e.g., gut health), and protein fortification in diet products. High disposable income levels support the premium pricing associated with clean-label and certified organic diet offerings, driving significant investment in high-end substitution technology.

- Europe: The European market, particularly led by Western European nations such as Germany, the UK, and France, is defined by strong regulatory intervention, notably the implementation of sugar taxes in several key economies (e.g., the UK's soft drink industry levy). This structural pressure has compelled major beverage and food manufacturers to aggressively reformulate their product portfolios, prioritizing low- and zero-sugar variants to maintain market viability. European consumers demonstrate a heightened demand for sustainability and traceability; consequently, diet products emphasizing locally sourced, minimally processed ingredients and robust ethical supply chain practices gain significant traction. The penetration of specialty diet foods is high, supported by sophisticated retail logistics and high engagement with preventative healthcare initiatives, focusing on non-caloric and functional additions to daily consumption.

- Asia Pacific (APAC): APAC is projected to be the fastest-growing region, driven by rapid urbanization, increasing disposable income, and the alarming rise of lifestyle diseases, particularly Type 2 diabetes, linked to shifting dietary habits. Countries like China, India, Japan, and Australia are spearheading growth. While traditional diets remain prevalent, the influence of Western health trends, coupled with localized public health campaigns, accelerates the demand for healthier alternatives. Key growth factors include the expansion of the cold chain infrastructure necessary for distributing specialized perishable diet items, and the entry of global players adapting their diet formulations to local flavor preferences (e.g., zero-sugar green tea-based beverages). The demand in APAC is particularly strong for functional diet products that integrate traditional Eastern health concepts with modern low-calorie science.

- Latin America (LATAM): The LATAM market is experiencing significant growth, primarily in major economies like Brazil and Mexico, both of which face severe public health challenges related to high sugar consumption and obesity. Governmental implementation of aggressive anti-sugar labeling and taxation policies, similar to those seen in Chile and Mexico, is forcefully accelerating market transformation toward diet and zero-sugar products. Consumer education remains a key element; however, the visibility and affordability of global diet brands in urban centers are rapidly shifting consumption patterns. The focus is currently on high-volume, affordable diet beverages and basic packaged goods substitutes, though demand for specialized keto or diabetic-friendly items is gradually increasing among middle and high-income segments.

- Middle East and Africa (MEA): Growth in the MEA region is segmented, with high-income Gulf Cooperation Council (GCC) countries showing strong demand for premium, imported diet foods and beverages, driven by high prevalence of diabetes and affinity for Westernized health products. These countries possess robust retail infrastructure and high per capita spending. In contrast, the African segment is nascent, concentrated primarily in major metropolitan hubs, where local manufacturers are beginning to introduce basic low-sugar alternatives. Government awareness campaigns regarding diet-related health issues are rising across the region, providing a foundation for future market penetration, although price sensitivity and fragmented distribution networks remain prevailing challenges in many African nations, necessitating culturally relevant and economically accessible diet solutions.

Top Key Players

The market research report includes a detailed profile of leading stakeholders in the Diet Food and Beverages Market.- PepsiCo, Inc.

- The Coca-Cola Company

- Nestlé S.A.

- Danone S.A.

- General Mills, Inc.

- Kellogg Company

- Kraft Heinz Company

- Abbott Laboratories

- Ajinomoto Co., Inc.

- Conagra Brands, Inc.

- Mondelez International, Inc.

- Archer Daniels Midland Company (ADM)

- Tate & Lyle PLC

- Ingredion Incorporated

- Arla Foods amba

- DSM-Firmenich

- Cargill, Incorporated

- The Hain Celestial Group, Inc.

- Herbalife Nutrition Ltd.

- Südzucker AG

Frequently Asked Questions

Analyze common user questions about the Diet Food and Beverages market and generate a concise list of summarized FAQs reflecting key topics and concerns.What is the primary driver for growth in the Diet Food and Beverages Market?

The primary driver is the accelerating global prevalence of lifestyle diseases, particularly obesity and Type 2 diabetes. This epidemic necessitates widespread dietary modifications, coupled with proactive governmental health initiatives, such as sugar taxation and enhanced nutritional labeling, which compel consumers and manufacturers towards reduced-sugar and low-calorie product formulations for preventative health management.

Are artificial sweeteners in diet foods safe, and what are the natural alternatives gaining popularity?

While major regulatory bodies globally, including the FDA and EFSA, deem approved artificial sweeteners (like aspartame and sucralose) safe at established acceptable daily intake levels, persistent consumer skepticism regarding long-term effects continues to influence purchasing behavior. Consequently, natural high-intensity sweeteners such as Stevia and Monk Fruit extract (Luo Han Guo), along with rare sugars like Allulose and sugar alcohols like Erythritol, are rapidly gaining market traction due to their perception as clean-label, plant-derived alternatives that satisfy the zero-calorie requirement.

How is the "clean label" trend impacting product development in the diet segment?

The clean label trend is fundamentally redefining product development by prioritizing transparency and demanding the removal of synthetic ingredients, artificial colors, flavors, and preservatives. This shift forces manufacturers to invest heavily in advanced ingredient technology—like natural flavor systems and bioprocessed thickeners—to maintain product stability and sensory appeal while adhering to minimalistic, recognizable ingredient lists, significantly increasing the complexity and cost of formulation for premium diet products.

Which distribution channel is exhibiting the fastest growth for diet food and beverages?

Online retail (e-commerce) is demonstrating the fastest growth rate in the distribution of diet food and beverages. This acceleration is driven by the channel's ability to offer specialized, niche products (e.g., specific keto or allergen-free brands) not typically stocked by mass retailers, coupled with the convenience of personalized subscription services and detailed nutritional information transparency sought by highly health-conscious consumers.

What role does Artificial Intelligence (AI) play in the future of the Diet Food and Beverages Market?

AI is set to revolutionize the market by enabling true hyper-personalization, utilizing machine learning algorithms to analyze genetic and biometric data to recommend bespoke dietary plans and specific products tailored to individual metabolic needs. Furthermore, AI optimizes R&D by speeding up the discovery of new low-calorie ingredients and enhances supply chain integrity, ensuring superior product quality and sourcing transparency, thereby building crucial consumer trust in specialized diet formulations.

To check our Table of Contents, please mail us at: sales@marketresearchupdate.com

Research Methodology

The Market Research Update offers technology-driven solutions and its full integration in the research process to be skilled at every step. We use diverse assets to produce the best results for our clients. The success of a research project is completely reliant on the research process adopted by the company. Market Research Update assists its clients to recognize opportunities by examining the global market and offering economic insights. We are proud of our extensive coverage that encompasses the understanding of numerous major industry domains.

Market Research Update provide consistency in our research report, also we provide on the part of the analysis of forecast across a gamut of coverage geographies and coverage. The research teams carry out primary and secondary research to implement and design the data collection procedure. The research team then analyzes data about the latest trends and major issues in reference to each industry and country. This helps to determine the anticipated market-related procedures in the future. The company offers technology-driven solutions and its full incorporation in the research method to be skilled at each step.

The Company's Research Process Has the Following Advantages:

- Information Procurement

The step comprises the procurement of market-related information or data via different methodologies & sources.

- Information Investigation

This step comprises the mapping and investigation of all the information procured from the earlier step. It also includes the analysis of data differences observed across numerous data sources.

- Highly Authentic Source

We offer highly authentic information from numerous sources. To fulfills the client’s requirement.

- Market Formulation

This step entails the placement of data points at suitable market spaces in an effort to assume possible conclusions. Analyst viewpoint and subject matter specialist based examining the form of market sizing also plays an essential role in this step.

- Validation & Publishing of Information

Validation is a significant step in the procedure. Validation via an intricately designed procedure assists us to conclude data-points to be used for final calculations.

×

Request Free Sample:

Related Reports

Select License

Why Choose Us

We're cost-effective and Offered Best services:

We are flexible and responsive startup research firm. We adapt as your research requires change, with cost-effectiveness and highly researched report that larger companies can't match.

Information Safety

Market Research Update ensure that we deliver best reports. We care about the confidential and personal information quality, safety, of reports. We use Authorize secure payment process.

We Are Committed to Quality and Deadlines

We offer quality of reports within deadlines. We've worked hard to find the best ways to offer our customers results-oriented and process driven consulting services.

Our Remarkable Track Record

We concentrate on developing lasting and strong client relationship. At present, we hold numerous preferred relationships with industry leading firms that have relied on us constantly for their research requirements.

Best Service Assured

Buy reports from our executives that best suits your need and helps you stay ahead of the competition.

Customized Research Reports

Our research services are custom-made especially to you and your firm in order to discover practical growth recommendations and strategies. We don't stick to a one size fits all strategy. We appreciate that your business has particular research necessities.

Service Assurance

At Market Research Update, we are dedicated to offer the best probable recommendations and service to all our clients. You will be able to speak to experienced analyst who will be aware of your research requirements precisely.

Contact With Our Sales Team

Customer Testimonials

The content of the report is always up to the mark. Good to see speakers from expertise authorities.

Privacy requested , Managing Director

A lot of unique and interesting topics which are described in good manner.

Privacy requested, President

Well researched, expertise analysts, well organized, concrete and current topics delivered in time.

Privacy requested, Development Manager