Digital Accessibility Service Market Size, By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2026 to 2033 (Financial Impact Analysis)

ID : MRU_ 441370 | Date : Feb, 2026 | Pages : 255 | Region : Global | Publisher : MRU

Digital Accessibility Service Market Size

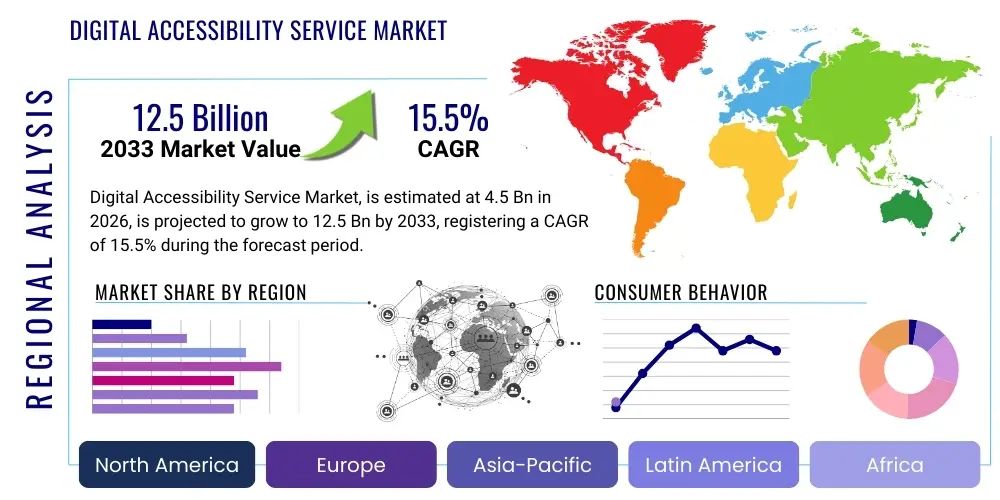

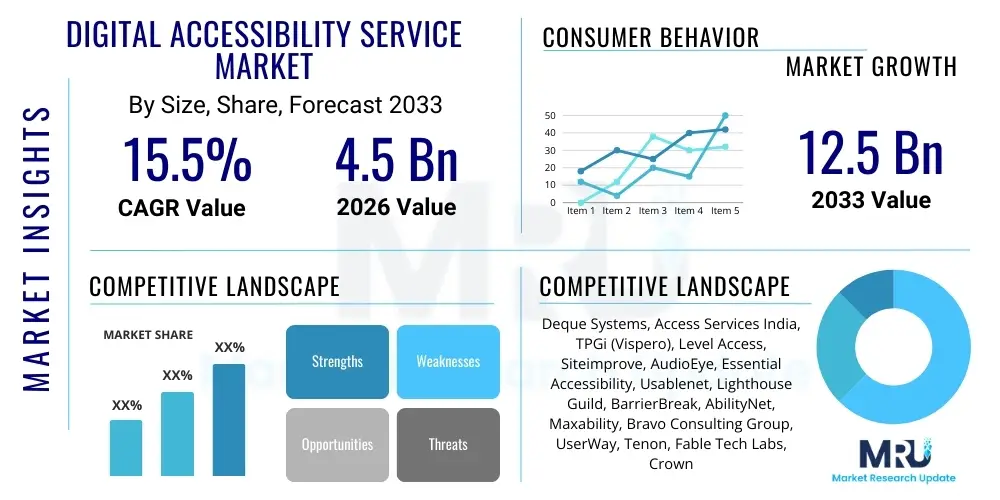

The Digital Accessibility Service Market is projected to grow at a Compound Annual Growth Rate (CAGR) of 15.5% between 2026 and 2033. The market is estimated at USD 4.5 Billion in 2026 and is projected to reach USD 12.5 Billion by the end of the forecast period in 2033.

Digital Accessibility Service Market introduction

The Digital Accessibility Service Market encompasses a comprehensive suite of consulting, auditing, remediation, and support services aimed at ensuring digital products—including websites, mobile applications, software, and electronic documents—are fully usable by individuals with diverse abilities and disabilities. This mandate goes beyond mere compliance, focusing on creating an inclusive digital ecosystem that adheres to international standards, primarily the Web Content Accessibility Guidelines (WCAG). These services are critical in mitigating legal risks associated with non-compliance with regulations such as the Americans with Disabilities Act (ADA) in the U.S. and the European Accessibility Act (EAA), while simultaneously enhancing corporate reputation and expanding potential customer bases by addressing the needs of a significant segment of the global population.

The primary driving factors for market growth include the escalating volume of digital content and online interactions, mandatory regulatory frameworks that are becoming increasingly stringent globally, and the growing recognition that digital inclusivity is a fundamental human right and a core component of Corporate Social Responsibility (CSR). The market structure is highly dependent on specialized expertise, combining technical understanding of code structure and user experience design (UX) with deep knowledge of different disability types, including visual, auditory, cognitive, and motor impairments. Furthermore, the product description extends to automated testing tools, manual expert audits, and ongoing monitoring solutions designed to maintain compliance in dynamic digital environments.

Major applications span across virtually all sectors that maintain a significant digital presence, including government portals, e-commerce platforms, financial services (BFSI), healthcare providers, and educational institutions. The benefits realized by organizations adopting these services are multifaceted, ranging from increased market penetration and improved search engine optimization (SEO) performance—since accessibility features often overlap with SEO best practices—to reduced exposure to costly accessibility-related lawsuits. The continuous updates to WCAG standards (e.g., WCAG 2.2 and future versions) necessitate continuous engagement with specialized service providers, fueling sustained market demand throughout the forecast period.

Digital Accessibility Service Market Executive Summary

The Digital Accessibility Service Market is experiencing robust expansion, driven primarily by the global shift towards stricter legal mandates and the increasing operational reliance on digital platforms across all industry verticals. Key business trends indicate a strong move toward end-to-end accessibility solutions, integrating services from initial design consultation (shifting left in the development lifecycle) through to continuous monitoring and governance, rather than reactive remediation. Technological innovation, specifically the integration of Artificial Intelligence (AI) and Machine Learning (ML) for automated testing and preliminary compliance checks, is revolutionizing service delivery, although human expertise remains indispensable for comprehensive auditing, cognitive assessments, and complex remediation tasks. Furthermore, mergers and acquisitions activity among niche accessibility specialists and larger digital consultancies is accelerating, aiming to consolidate market expertise and expand geographical reach.

Regionally, North America remains the leading market due to the high volume of litigation under the ADA Title III, compelling proactive investment in compliance, particularly within the retail and financial sectors. Europe is projected for rapid growth, underpinned by the implementation and enforcement of the European Accessibility Act (EAA), which standardized requirements across member states for public and private sector entities. The Asia Pacific (APAC) region is emerging as a significant growth hub, influenced by large populations with disabilities and nascent, yet rapidly developing, regulatory frameworks in countries like India and Japan. The heterogeneity of regulations across APAC, however, requires highly localized service strategies, presenting both a challenge and an opportunity for market participants.

Segmentation trends reveal that the demand for remediation services, especially for legacy systems and existing non-compliant content, continues to dominate revenue streams, but consulting and training segments are witnessing the highest growth rates as organizations prioritize internal capability building and preventative accessibility strategies. Vertical segment analysis highlights government, education, and healthcare as consistent adopters due to mandatory public service requirements, while the BFSI and e-commerce sectors show intensified investment spurred by high user engagement and significant financial risk exposure from non-compliance. The shift from basic conformance (Level A/AA) towards delivering truly accessible and usable experiences (UX/UI testing involving users with disabilities) represents a critical evolution in service demand.

AI Impact Analysis on Digital Accessibility Service Market

Common user inquiries regarding AI’s influence on the Digital Accessibility Service Market frequently revolve around automation efficacy, cost reduction potential, and the risk of over-reliance on technology that may fail to capture the nuances of human experience and cognitive accessibility. Users often ask: Can AI fully replace manual accessibility auditors? How reliable are automated AI tools in meeting WCAG 2.2 standards? What are the ethical implications concerning AI-driven personalization for users with disabilities? Based on this analysis, the key themes summarize that while AI is viewed as an indispensable tool for speed and scalability—particularly in initial scanning and large-scale, repetitive tasks—concerns persist regarding its limitations in handling subjective cognitive barriers, complex contextual interpretation, and the critical need for human judgment to ensure genuine usability beyond technical compliance checks. The expectation is that AI will augment, not replace, expert human services, transforming the market toward hybrid service models.

AI's primary role is currently concentrated in enhancing the efficiency of the accessibility lifecycle. Machine learning algorithms are increasingly sophisticated at rapidly scanning vast digital inventories to identify common accessibility violations, such as missing alt-text, poor color contrast ratios, or improperly coded form elements, drastically reducing the time required for preliminary audits. This capability allows human accessibility experts to focus their limited time on high-complexity issues that require deep semantic understanding or user testing, optimizing the overall remediation workflow and lowering the initial cost barrier for organizations beginning their accessibility journey. However, the accuracy of automated remediation suggestions varies significantly, requiring human oversight to prevent the introduction of new, subtle violations.

Furthermore, Generative AI holds promise for advanced personalization and dynamic content adaptation. AI models are being developed to automatically adjust interfaces based on detected user needs or known user profiles, offering adaptive experiences that go beyond static compliance. For instance, AI could automatically summarize complex texts for users with cognitive disabilities or generate descriptive transcripts for video content in real-time. This proactive, personalized approach, however, raises significant ethical and privacy concerns, particularly regarding data security and ensuring that automated modifications do not inadvertently introduce new barriers or biases against specific disability groups. Consequently, service providers must integrate robust validation frameworks into AI solutions to maintain trust and ethical standards.

- AI accelerates preliminary automated auditing and compliance checks across large websites.

- Machine Learning (ML) improves the accuracy of identifying common structural WCAG violations (e.g., contrast, heading structure).

- Generative AI supports dynamic content adaptation and automated alt-text generation, reducing manual effort.

- AI tools assist in quality assurance by continuously monitoring digital assets for newly introduced accessibility regressions.

- Risk of false positives and inability to adequately address cognitive or usability barriers remains a major limitation requiring human intervention.

- Development of personalized accessibility profiles using AI is driving innovation in user experience.

DRO & Impact Forces Of Digital Accessibility Service Market

The dynamics of the Digital Accessibility Service Market are primarily governed by an interplay between mandatory regulatory enforcement (Drivers), the specialized and often costly nature of expert intervention (Restraints), and the massive untapped potential in emerging technologies and global regions (Opportunities). The central impact force is the accelerating pace of digital transformation across global economies, which exponentially increases the scope and necessity of compliance. Regulatory bodies worldwide are transitioning from passive guidance to active enforcement, evidenced by the rising number of legal actions filed against non-compliant entities, making accessibility investment a critical risk mitigation strategy rather than an optional expense. This environment establishes a strong, positive feedback loop for market growth, ensuring continuous demand for specialized service providers who can navigate complex, evolving standards like WCAG 2.2 and region-specific laws.

Key drivers sustaining market momentum include the continuous evolution and tightening of international standards, such as the mandated adoption timelines for the European Accessibility Act (EAA), which affects a wide range of products and services including e-commerce, banking, and media. Furthermore, the increasing global awareness and advocacy campaigns by disability rights organizations are significantly pressuring corporations to prioritize inclusion, often formalized through robust corporate social responsibility (CSR) programs. Demographic shifts, specifically the aging global population, which correlates with an increased prevalence of age-related functional limitations, expands the immediate addressable market for accessible digital experiences. These forces collectively establish a robust foundation for consistent, double-digit market growth.

However, significant restraints temper growth potential, particularly the high initial costs associated with comprehensive accessibility audits and subsequent deep-level remediation of large, complex, or legacy digital platforms. A parallel restraint is the severe global shortage of certified, skilled professionals proficient in both development/design practices and expert accessibility auditing (CPWA and WAS certified professionals), leading to inflated service costs and project backlogs. Opportunities, conversely, lie in the rapid integration of advanced technologies like AI to streamline routine tasks, allowing human experts to focus on strategic consulting and complex usability testing. Moreover, geographical expansion into underserved markets in Latin America and Southeast Asia, where regulatory frameworks are nascent but rapidly developing, provides substantial long-term growth avenues.

Segmentation Analysis

The Digital Accessibility Service Market is highly fragmented and segmented primarily based on the nature of the service delivered, the technology utilized in the delivery process, and the specific end-user industry seeking compliance. The analysis reveals a clear trend where foundational compliance services, such as technical auditing and expert remediation, form the bulk of current market revenue, while strategic services like ongoing governance, training, and inclusive design consulting are experiencing accelerated growth as organizations move towards maturity in their accessibility programs. Understanding these segments is crucial for service providers tailoring their offerings, whether focusing on large-scale government contracts demanding high-volume compliance or specialized consulting for innovative fintech platforms requiring advanced mobile accessibility expertise.

Service segmentation is critical for market differentiation. Remediation remains revenue-intensive, focusing on fixing existing violations in code, content, and design. Audit services provide the initial diagnostic reports, utilizing a mix of automated tools and manual expert testing. Crucially, the consulting and training segment addresses the systemic root causes of inaccessibility, building internal organizational knowledge and embedding accessibility into the Software Development Life Cycle (SDLC), thereby offering higher long-term value and recurring revenue streams. Technology segmentation includes specialized software for testing (automated scanners, contrast checkers) and assistive technologies (screen readers, voice control software) which are often used during the validation phase of service delivery.

From an end-user perspective, the segmentation reflects regulatory intensity and litigation exposure. Government and public sector entities are often mandated to comply fully, driving substantial, stable contract volumes. Conversely, high-risk, high-transaction sectors like Banking, Financial Services, and Insurance (BFSI), alongside e-commerce and retail, are driven by severe litigation risks and the desire to maximize customer reach. Healthcare and education follow closely, motivated both by compliance and the inherent ethical need to serve diverse populations, ensuring equitable access to vital information and learning resources. These diverse demands necessitate highly specialized knowledge, segmenting the service providers themselves into experts serving specific regulatory landscapes or industry technical stacks.

- By Service Type:

- Consulting & Strategy Development

- Accessibility Auditing & Testing (Automated, Manual/Expert Reviews)

- Remediation Services (Code, Content, Design Fixes)

- Training & Education

- Managed Accessibility Services & Governance

- By Technology/Platform:

- Web Accessibility

- Mobile Application Accessibility (iOS, Android)

- Document & Media Accessibility (PDF, Video Captioning)

- Software & Platform Accessibility

- By End-Use Industry:

- Banking, Financial Services, and Insurance (BFSI)

- Information Technology & Telecommunication

- Government & Public Sector

- Retail & E-commerce

- Healthcare

- Education

- Media & Entertainment

Value Chain Analysis For Digital Accessibility Service Market

The Value Chain for the Digital Accessibility Service Market begins with upstream activities focused on research, standards interpretation, and tool development. This stage involves deep expertise in developing proprietary methodologies for auditing against WCAG and local laws, alongside the creation or licensing of specialized automated testing software. Key upstream components include maintaining up-to-date knowledge of evolving legal landscapes (e.g., ADA, EAA, Section 508 updates) and continuously refining training materials for internal teams. Service providers must invest heavily in human capital—hiring and retaining certified professionals—as specialized manual auditing skills form the bedrock of service quality and reliability, differentiating high-value providers from those relying solely on rudimentary automated checks.

The midstream involves the core service delivery process, encompassing client engagement, initial discovery, comprehensive auditing, and the subsequent phases of remediation and quality assurance. Distribution channels are varied, involving direct sales teams targeting large enterprises, partnerships with digital agencies and system integrators (indirect channels), and, increasingly, platform-based delivery models for continuous monitoring services (SaaS/Managed Services). Direct channels are crucial for high-value strategic consulting contracts, requiring executive-level engagement, whereas indirect partnerships allow accessibility providers to scale their reach by integrating their specialized services into the broader digital transformation projects led by large consulting firms or development houses.

Downstream activities focus on post-remediation support, ongoing monitoring, and governance. This involves implementing robust quality gates to prevent accessibility regressions, providing legal compliance documentation and defense support, and offering continuous training to the client's internal development and content teams. The success of the downstream phase is measured by sustained compliance and the client’s ability to internalize accessibility practices. Continuous managed services, which often involve a mix of recurring technical checks and periodic expert review, represent the highest-margin downstream opportunity, ensuring long-term customer relationships and reducing the client’s exposure to legal non-compliance risks over time.

Digital Accessibility Service Market Potential Customers

Potential customers for Digital Accessibility Services are broad-ranging, encompassing any organization that provides goods, services, or information digitally to the public or its employees, particularly those operating in jurisdictions with stringent disability rights laws. The primary end-users or buyers are typically Chief Information Officers (CIOs), Chief Digital Officers (CDOs), Legal Counsel (General Counsel), and Chief Marketing Officers (CMOs) who recognize the dual imperative of risk mitigation and market expansion. High-volume buyers are generally large multinational corporations and governmental bodies, where the complexity of their digital infrastructure necessitates external expert intervention for auditing and remediation projects, often involving hundreds or thousands of digital assets.

Organizations facing the highest direct risk from litigation, such as major retail chains, e-commerce giants, and all entities within the BFSI sector, represent premium customers who frequently invest in proactive, preventative accessibility strategies, often adopting continuous managed services. Educational institutions (K-12 and Higher Education) and healthcare providers are also critical customer segments, driven by both ethical responsibilities and specific sectoral regulations (e.g., HIPAA compliance interplaying with digital access). These sectors require specialized services focusing on document accessibility, e-learning platforms, and secure patient/student portals.

Furthermore, small and medium enterprises (SMEs) represent a rapidly growing customer base, often accessing services through more affordable automated testing subscriptions or simplified, template-based remediation packages. While their individual spending may be lower, their collective volume and increasing digitalization make them a vital target segment. Ultimately, any organization committed to corporate social responsibility (CSR) and brand integrity, seeking to align their public image with inclusive practices, will engage with these services to ensure equitable access for all citizens and consumers.

| Report Attributes | Report Details |

|---|---|

| Market Size in 2026 | USD 4.5 Billion |

| Market Forecast in 2033 | USD 12.5 Billion |

| Growth Rate | 15.5% CAGR |

| Historical Year | 2019 to 2024 |

| Base Year | 2025 |

| Forecast Year | 2026 - 2033 |

| DRO & Impact Forces |

|

| Segments Covered |

|

| Key Companies Covered | Deque Systems, Access Services India, TPGi (Vispero), Level Access, Siteimprove, AudioEye, Essential Accessibility, Usablenet, Lighthouse Guild, BarrierBreak, AbilityNet, Maxability, Bravo Consulting Group, UserWay, Tenon, Fable Tech Labs, Crownpeak, Monsido, SSB BART Group (acquired by Level Access), A-Z Compliance. |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Enquiry Before Buy | Have specific requirements? Send us your enquiry before purchase to get customized research options. Request For Enquiry Before Buy |

Digital Accessibility Service Market Key Technology Landscape

The technological landscape of the Digital Accessibility Service Market is defined by a blend of sophisticated automated tools and specialized assistive technologies, all focused on supporting the delivery of expert human services. At the core are automated accessibility scanning engines, which use proprietary algorithms and AI/ML to rapidly check web pages and mobile applications against hundreds of WCAG success criteria. These tools are critical for initial assessment and continuous integration/continuous delivery (CI/CD) pipelines, enabling developers to catch basic errors early in the development cycle. Leading solutions offer API integrations, allowing accessibility checks to be embedded directly into source code repositories and deployment environments, a necessary technological shift known as "shifting accessibility left."

Beyond automation, a crucial part of the technology landscape involves technologies used in manual testing and validation. This includes a wide array of assistive technologies (AT), such as various screen readers (JAWS, NVDA, VoiceOver, TalkBack), magnification software, keyboard-only navigation simulators, and voice control software. Expert auditors must maintain proficiency across these diverse AT environments, as true accessibility validation requires testing the user experience exactly as a person with a disability would encounter it. Furthermore, the market is seeing increased adoption of cloud-based continuous monitoring platforms (Managed Accessibility Services), which track compliance scores in real-time and provide alerts for regressions, allowing organizations to maintain an accessible state without costly, full-scale re-audits.

A burgeoning area of technology development is related to cognitive accessibility and personalized user experiences. Emerging platforms leverage AI to offer dynamic overlays or widget implementations that allow end-users to customize the site's presentation (e.g., simplifying language, adjusting font sizes, or removing distracting animations). While these overlays remain controversial within the core accessibility community regarding genuine compliance, the underlying technology points towards future solutions that dynamically adapt content based on complex user needs. Additionally, technologies focused on media accessibility, such as advanced AI-driven tools for generating accurate captions, transcripts, and audio descriptions for video content, are experiencing rapid improvement and adoption across the media and education sectors.

Regional Highlights

- North America: Market Dominance Fueled by Litigation and Regulation

North America, particularly the United States, commands the largest share of the global Digital Accessibility Service Market, a position solidified by the robust enforcement of the Americans with Disabilities Act (ADA) and Section 508 of the Rehabilitation Act. The legal landscape is highly litigious, with thousands of ADA Title III website accessibility lawsuits filed annually, creating a powerful market driver where proactive compliance is seen as mandatory risk mitigation. Consequently, U.S.-based companies, especially in retail, e-commerce, and BFSI, invest heavily in comprehensive auditing and ongoing managed services to avoid costly settlements. The technological maturity and high adoption rate of advanced digital platforms further necessitate specialized services, ensuring the region remains at the forefront of market innovation and expenditure throughout the forecast period.

Service demand in North America is highly sophisticated, focusing not just on technical WCAG compliance but also on deep user experience (UX) testing involving diverse panels of users with disabilities. Canadian provinces, while having distinct accessibility laws (such as the AODA in Ontario), contribute significantly to the regional demand, often aligning their digital strategies closely with U.S. standards due to cross-border operational integration. The market sees strong growth in the adoption of hybrid service models, combining advanced AI tools for initial scanning with critical expert manual testing required by legal professionals to demonstrate due diligence and robust conformance.

The regulatory environment, including anticipated updates to existing legislation, forces continuous upgrades to digital infrastructures. This constant need for remediation and continuous monitoring ensures high recurring revenue for service providers. Furthermore, the strong presence of major technology firms and early adoption of cloud-based software services in the region means that platform accessibility consulting for complex enterprise resource planning (ERP) systems and proprietary business applications is a significant sub-segment driving value growth.

- Europe: Rapid Growth Driven by the European Accessibility Act (EAA)

Europe is positioned for the fastest growth trajectory in the digital accessibility market, primarily propelled by the comprehensive and mandatory implementation of the European Accessibility Act (EAA), scheduled for full enforcement across the bloc. Unlike the U.S. litigation-driven approach, Europe's market growth is driven by standardized, government-mandated compliance based on the EN 301 549 standard, which aligns closely with WCAG 2.1 Level AA. This legislative certainty provides a clear roadmap for all covered entities—including manufacturers, service providers, and governmental bodies—resulting in large-scale, planned investments in accessibility infrastructure across all 27 EU member states and associated countries.

The focus in Europe is particularly strong on public sector compliance, mandated by the Web Accessibility Directive, but the EAA significantly expands the scope to private sector services such as e-commerce, banking, electronic communication services, and transportation. This creates a massive, unified demand pool for service providers capable of delivering multilingual accessibility solutions that adhere to nuanced local regulations alongside the main EAA framework. The fragmented language and cultural landscapes necessitate a localized approach to content and technical auditing, often requiring service providers with regional expertise and certifications.

Key markets within Europe include Germany, the UK, France, and the Nordic countries, known for their high standards of social welfare and existing strong consumer protection laws. The European market emphasizes proactive design integration (accessibility by design) and extensive internal training to embed compliance into corporate culture, driving demand for consulting and educational services at an accelerated rate compared to traditional remediation work.

- Asia Pacific (APAC): Emerging Opportunities and Regulatory Development

The APAC region presents vast, untapped market potential, characterized by rapid digital penetration and highly diverse regulatory maturity across nations. While historically compliance has been less strictly enforced than in the West, major economies like Australia (Disability Discrimination Act), Japan (similar non-discrimination laws), and India (Rights of Persons with Disabilities Act) are increasingly focusing on digital inclusion. Australia and New Zealand, in particular, exhibit high maturity, aligning closely with North American and European standards and driving robust demand within the financial and government sectors.

The burgeoning economies of Southeast Asia and India, with massive populations accessing the internet primarily via mobile devices, present a significant opportunity. The challenge here is the lack of standardized regulation and the focus on highly complex multilingual and multi-script digital content. Service providers entering this region must specialize in mobile application accessibility and low-bandwidth accessibility solutions. Government projects, especially those related to e-governance and digital public infrastructure, are initial anchor clients for accessibility services, setting precedence for private sector adoption.

The APAC market is characterized by a strong demand for cost-effective solutions and localized language support. Many companies initially opt for hybrid or partially automated solutions before committing to comprehensive, expert-driven audits. The growth in APAC is expected to accelerate significantly as regional economic agreements increasingly include provisions related to digital harmonization and accessibility standards, forcing large domestic companies to adopt global best practices.

- Latin America (LATAM): Nascent Market with High Growth Potential

The Latin American Digital Accessibility Service Market is currently nascent but shows substantial potential, driven by accelerating digital adoption, urbanization, and improving local legislation in key countries such as Brazil (Law 13.146/2015, Statute of the Person with Disability) and Mexico. Demand is largely concentrated in major urban centers and among large multinational corporations operating within the region that must comply with global corporate standards in addition to local laws.

Market development is often hampered by budget constraints and a lack of pervasive governmental enforcement. However, the rapidly expanding e-commerce and fintech sectors are beginning to recognize accessibility not just as a compliance requirement but as a crucial market differentiator to capture the disposable income of citizens with disabilities. Service delivery often requires highly adaptable models, integrating basic training with targeted remediation for critical, high-traffic digital assets, focusing primarily on web accessibility standards.

- Middle East and Africa (MEA): Regulatory Adoption and Infrastructure Investment

The MEA region is characterized by substantial governmental investment in smart city initiatives and digital transformation, particularly in the Gulf Cooperation Council (GCC) states. These governmental initiatives often incorporate global accessibility standards (WCAG) as part of tender requirements, driving initial market demand. Countries like the UAE and Saudi Arabia are making concerted efforts to integrate digital accessibility into their national strategies for inclusion, creating dedicated governmental contracts for auditing and consulting services.

In Africa, the market is highly fragmented, with South Africa showing the highest maturity due to its robust constitutional framework regarding disability rights. Across the continent, infrastructural limitations (such as connectivity and device affordability) mean that accessibility services often prioritize simple, low-data solutions. The primary customers are telecom operators, large multinational organizations, and government agencies involved in essential public services, driving focused investment in foundational web accessibility and mobile solutions.

Top Key Players

The market research report includes a detailed profile of leading stakeholders in the Digital Accessibility Service Market.- Deque Systems

- TPGi (Vispero)

- Level Access (including acquired SSB BART Group)

- Access Services India

- Siteimprove

- AudioEye

- Essential Accessibility

- Usablenet

- Lighthouse Guild

- BarrierBreak

- AbilityNet

- Maxability

- Bravo Consulting Group

- UserWay

- Tenon

- Fable Tech Labs

- Crownpeak

- Monsido

- Adimian

- Interactive Accessibility

Frequently Asked Questions

Analyze common user questions about the Digital Accessibility Service market and generate a concise list of summarized FAQs reflecting key topics and concerns.What are the primary standards governing digital accessibility globally?

The primary global standards are the Web Content Accessibility Guidelines (WCAG), currently at version 2.1 and 2.2, published by the World Wide Web Consortium (W3C). These standards form the technical basis for most national and regional regulations, including the U.S. ADA, Section 508, and the European Accessibility Act (EAA).

How does the Digital Accessibility Service Market address legal compliance risks for enterprises?

Services address legal risks by providing comprehensive accessibility audits (manual and automated) to identify violations, followed by expert remediation to correct non-compliant digital assets. They also offer legal documentation and compliance reports, demonstrating a proactive effort to conform with regulations like the ADA, thereby mitigating high-stakes litigation exposure.

What is the difference between automated accessibility testing and manual auditing?

Automated testing uses software, often leveraging AI, to quickly scan code for clear, technical violations (e.g., missing alt text). Manual auditing involves expert human testers, often using screen readers and assistive technologies, to assess complex and subjective barriers, particularly usability and cognitive accessibility, which automated tools cannot reliably detect.

Which industry vertical is currently the fastest adopter of digital accessibility services?

The Banking, Financial Services, and Insurance (BFSI) sector, along with E-commerce and Retail, are the fastest growing adopters, driven by high transaction volumes, heavy reliance on digital platforms, and the extreme financial and reputational risks associated with accessibility lawsuits in regions like North America and Europe.

How is Artificial Intelligence (AI) influencing the cost structure of accessibility services?

AI is lowering the barrier to entry by reducing the cost of preliminary testing and continuous monitoring through automation. While AI cannot fully replace expensive human auditors, it allows human experts to focus on complex issues, ultimately streamlining workflows and making maintenance services more economically viable for sustained compliance.

To check our Table of Contents, please mail us at: sales@marketresearchupdate.com

Research Methodology

The Market Research Update offers technology-driven solutions and its full integration in the research process to be skilled at every step. We use diverse assets to produce the best results for our clients. The success of a research project is completely reliant on the research process adopted by the company. Market Research Update assists its clients to recognize opportunities by examining the global market and offering economic insights. We are proud of our extensive coverage that encompasses the understanding of numerous major industry domains.

Market Research Update provide consistency in our research report, also we provide on the part of the analysis of forecast across a gamut of coverage geographies and coverage. The research teams carry out primary and secondary research to implement and design the data collection procedure. The research team then analyzes data about the latest trends and major issues in reference to each industry and country. This helps to determine the anticipated market-related procedures in the future. The company offers technology-driven solutions and its full incorporation in the research method to be skilled at each step.

The Company's Research Process Has the Following Advantages:

- Information Procurement

The step comprises the procurement of market-related information or data via different methodologies & sources.

- Information Investigation

This step comprises the mapping and investigation of all the information procured from the earlier step. It also includes the analysis of data differences observed across numerous data sources.

- Highly Authentic Source

We offer highly authentic information from numerous sources. To fulfills the client’s requirement.

- Market Formulation

This step entails the placement of data points at suitable market spaces in an effort to assume possible conclusions. Analyst viewpoint and subject matter specialist based examining the form of market sizing also plays an essential role in this step.

- Validation & Publishing of Information

Validation is a significant step in the procedure. Validation via an intricately designed procedure assists us to conclude data-points to be used for final calculations.

×

Request Free Sample:

Related Reports

Select License

Why Choose Us

We're cost-effective and Offered Best services:

We are flexible and responsive startup research firm. We adapt as your research requires change, with cost-effectiveness and highly researched report that larger companies can't match.

Information Safety

Market Research Update ensure that we deliver best reports. We care about the confidential and personal information quality, safety, of reports. We use Authorize secure payment process.

We Are Committed to Quality and Deadlines

We offer quality of reports within deadlines. We've worked hard to find the best ways to offer our customers results-oriented and process driven consulting services.

Our Remarkable Track Record

We concentrate on developing lasting and strong client relationship. At present, we hold numerous preferred relationships with industry leading firms that have relied on us constantly for their research requirements.

Best Service Assured

Buy reports from our executives that best suits your need and helps you stay ahead of the competition.

Customized Research Reports

Our research services are custom-made especially to you and your firm in order to discover practical growth recommendations and strategies. We don't stick to a one size fits all strategy. We appreciate that your business has particular research necessities.

Service Assurance

At Market Research Update, we are dedicated to offer the best probable recommendations and service to all our clients. You will be able to speak to experienced analyst who will be aware of your research requirements precisely.

Contact With Our Sales Team

Customer Testimonials

The content of the report is always up to the mark. Good to see speakers from expertise authorities.

Privacy requested , Managing Director

A lot of unique and interesting topics which are described in good manner.

Privacy requested, President

Well researched, expertise analysts, well organized, concrete and current topics delivered in time.

Privacy requested, Development Manager