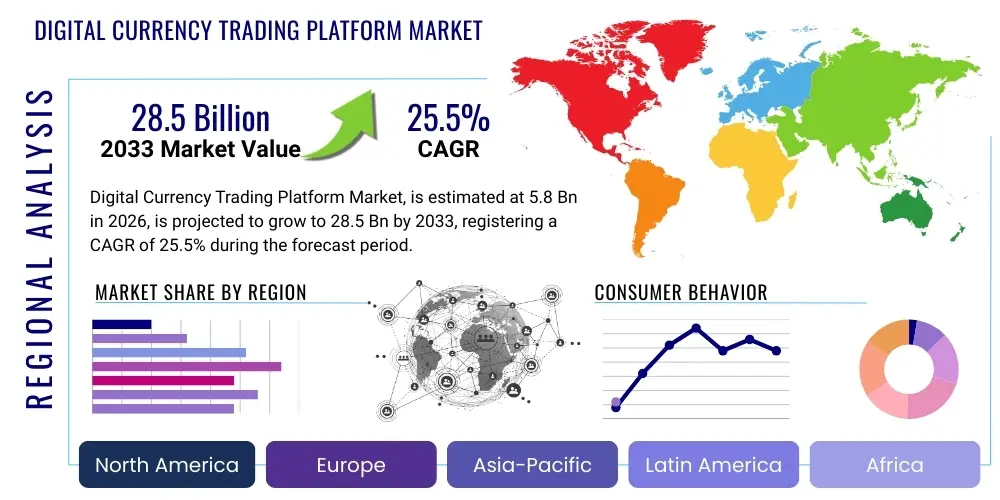

Digital Currency Trading Platform Market Size, By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2026 to 2033 (Financial Impact Analysis)

ID : MRU_ 441048 | Date : Feb, 2026 | Pages : 249 | Region : Global | Publisher : MRU

Digital Currency Trading Platform Market Size

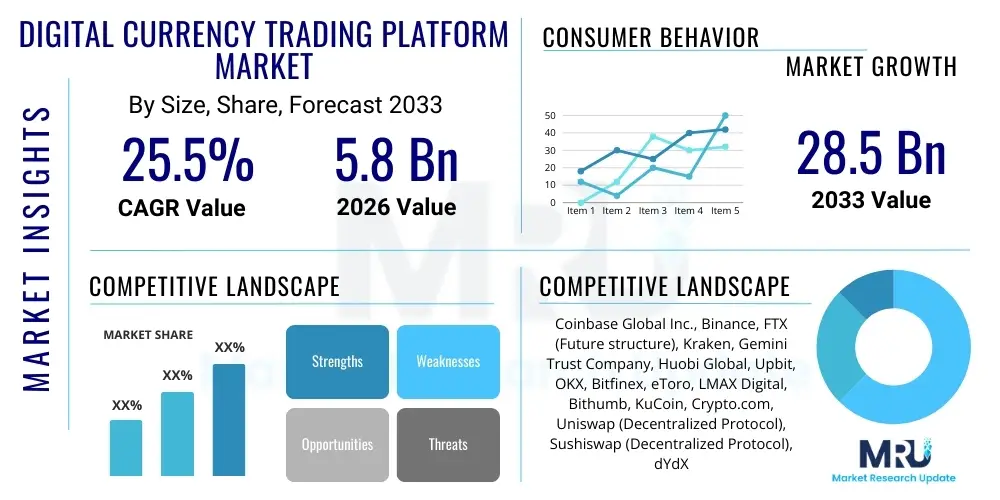

The Digital Currency Trading Platform Market is projected to grow at a Compound Annual Growth Rate (CAGR) of 25.5% between 2026 and 2033. The market is estimated at $5.8 Billion in 2026 and is projected to reach $28.5 Billion by the end of the forecast period in 2033.

The monumental expansion of the digital currency trading platform market is fundamentally driven by the escalating global adoption of cryptocurrencies as both speculative assets and viable means of exchange. Institutional interest, particularly from hedge funds, asset managers, and major financial institutions seeking diversification and exposure to decentralized finance (DeFi), has provided a substantial injection of capital and necessitated the development of sophisticated, high-performance trading infrastructure. Furthermore, regulatory clarity, albeit nascent and fragmented across jurisdictions, often serves to legitimize the sector, attracting risk-averse retail and institutional traders who demand robust security, high liquidity, and stringent compliance protocols from their chosen trading venues. The technological race among platform providers, focusing on features like high-frequency trading capabilities, advanced charting tools, and seamless integration with decentralized protocols, further fuels market valuation and user engagement across geographies.

Geographic market size distribution is heavily influenced by regional regulatory environments, technological readiness, and cultural acceptance of digital assets. While North America and Europe currently represent the highest transaction volumes due to mature financial ecosystems and high institutional participation, the Asia-Pacific (APAC) region is demonstrating the most explosive growth, propelled by massive retail investor bases, particularly in Southeast Asia and parts of East Asia. This dynamic shift necessitates trading platforms to develop scalable, multilingual interfaces and localized compliance strategies. The ongoing infrastructure investments in custody solutions, cross-chain interoperability, and the expansion of fiat on-ramps are critical components that support and validate the long-term upward trajectory of market size projections, moving digital asset trading from a niche activity to a mainstream financial service.

Digital Currency Trading Platform Market introduction

The Digital Currency Trading Platform Market encompasses a diverse ecosystem of online venues and software infrastructure enabling users to buy, sell, and exchange digital assets, primarily cryptocurrencies like Bitcoin, Ethereum, and thousands of altcoins. These platforms range from centralized exchanges (CEXs) offering high liquidity and robust regulatory adherence, to decentralized exchanges (DEXs) operating non-custodially via smart contracts, embodying the core principles of decentralized finance. The product description spans various operational models, including spot trading, margin trading, derivatives trading (futures and options), and yield generation services like staking and lending. Major applications include portfolio diversification for institutional investors, rapid wealth transfer, hedging against traditional market volatility, and retail speculation. Key benefits are 24/7 market access, high transparency on DEXs, often lower transaction costs compared to traditional banking rails, and unprecedented user control over assets (in non-custodial models). Driving factors include increasing internet penetration, decreasing trust in centralized fiat currencies, technological advancements in blockchain scalability, and widespread media coverage legitimizing digital assets as a new asset class.

Digital Currency Trading Platform Market Executive Summary

The Digital Currency Trading Platform market is characterized by intense competition driven by technological superiority and regulatory arbitrage, dominating current business trends. Platforms are increasingly diversifying revenue streams beyond simple transaction fees, incorporating advanced financial products like structured products, yield farms, and institutional-grade custody solutions to capture high-value clients. Regional trends indicate a significant regulatory divergence; while jurisdictions like Singapore, Switzerland, and parts of the UAE are actively fostering innovation through clear licensing frameworks, major markets like the US and EU grapple with conflicting regulatory interpretations, impacting market entry strategies. Segment trends show rapid growth in the Decentralized Finance (DeFi) segment, challenging the dominance of traditional centralized exchanges, particularly due to the demand for non-custodial solutions and higher yield opportunities. Furthermore, the segmentation by platform type highlights the escalating battle for market share between established CEX giants and emerging DEX aggregators, focusing heavily on enhancing user experience, security, and the variety of listed token pairings. The overall market trajectory suggests continued consolidation among smaller players and expansion into novel asset classes like tokenized real-world assets (RWAs).

AI Impact Analysis on Digital Currency Trading Platform Market

User inquiries regarding the impact of Artificial Intelligence (AI) on digital currency trading platforms predominantly revolve around three critical areas: enhanced trading efficiency, risk management and security, and the personalization of user experience. Users frequently ask if AI-driven algorithms will eliminate the need for manual trading decisions, questioning the efficacy and ethics of black-box trading bots managing significant capital. A major concern is AI's role in detecting and preventing sophisticated market manipulation and wash trading, thereby ensuring fairer market conditions. Furthermore, platform users are keen to understand how AI can personalize market data delivery, predict subtle market shifts, and dynamically adjust risk parameters based on individual trading patterns and regulatory changes. The underlying theme is the expectation that AI should lead to superior returns, reduced latency, and an impenetrable security infrastructure, while simultaneously democratizing access to complex trading strategies previously exclusive to high-frequency trading firms.

AI is fundamentally reshaping the operational landscape of digital currency trading platforms, moving beyond simple pattern recognition to predictive modeling and advanced behavioral analysis. Platforms leverage machine learning (ML) algorithms to optimize order matching and execution, significantly reducing slippage and increasing market depth efficiency. This optimization is crucial in highly volatile markets, ensuring that high-volume institutional trades are handled discreetly and effectively. Beyond execution, AI is instrumental in developing dynamic fee structures and implementing sophisticated liquidity provision strategies, allowing platforms to maintain competitive edge by offering the most favorable trading conditions tailored to real-time market stress and volume profiles. The integration of Natural Language Processing (NLP) further allows platforms to analyze vast quantities of unstructured data—such as social media sentiment, regulatory announcements, and developer activity—to provide actionable market insights faster than human analysts, offering a significant competitive advantage to platforms that integrate these insights directly into their trading interfaces.

However, the deployment of advanced AI also introduces complex regulatory and ethical challenges. Questions surrounding algorithmic accountability, bias amplification in trading models, and the potential for AI to create flash crashes or liquidity vacuums require careful governance. Trading platforms must invest heavily in explainable AI (XAI) capabilities to ensure that regulatory bodies and users can understand the logic behind crucial trading decisions. Moreover, AI-powered systems are central to bolstering cybersecurity, constantly learning and identifying new attack vectors, ranging from phishing attempts to highly sophisticated smart contract exploits. The competitive advantage is increasingly shifting toward platforms that can successfully deploy AI not just for profit generation, but also for establishing a trusted, compliant, and hyper-secure trading environment that protects user assets and maintains market integrity against rapidly evolving digital threats.

- AI-driven algorithmic trading optimizing execution speed and minimizing slippage.

- Machine Learning models enhancing regulatory compliance checks (KYC/AML) and anomaly detection.

- NLP analyzing social media and news sentiment for real-time market prediction signals.

- Advanced fraud detection and cybersecurity protocols using behavioral biometric analysis.

- Personalized risk management and portfolio rebalancing recommendations for retail users.

- Automated market making (AMM) optimization in Decentralized Exchanges (DEXs) for liquidity pools.

- Predictive analytics assisting in dynamic fee structure adjustment based on network congestion.

DRO & Impact Forces Of Digital Currency Trading Platform Market

The market dynamics are governed by a complex interplay of Drivers, Restraints, and Opportunities, collectively molding the impact forces that dictate growth trajectories. Key drivers include the exponential increase in global crypto adoption, the maturation of institutional infrastructure (custody, prime brokerage), and the inherent advantages of blockchain technology such as transparency and low latency. However, substantial restraints persist, primarily stemming from regulatory uncertainty, especially concerning token classifications (securities vs. commodities), high volatility inherent in digital assets which deter conservative investors, and persistent security risks related to hacking and operational failures. Opportunities are abundant in the expansion into emerging markets, the development of sophisticated DeFi products (insurance, tokenized assets), and the successful integration of traditional finance protocols (TradFi) with decentralized ledger technology (DLT). These factors create powerful impact forces, where technological acceleration and regulatory frameworks are the primary mechanisms shaping market concentration and innovation speed.

The primary driving force underpinning market expansion is the continuous, widespread acceptance of cryptocurrencies beyond early adopters. This normalization is fueled by major corporations and payment processors integrating digital assets, signaling long-term viability and ease of use. Furthermore, the global search for yield in a prolonged low-interest-rate environment has pushed investors, both retail and institutional, toward high-yield opportunities provided by staking, lending, and liquidity farming offered through these platforms. The inherent decentralization promise attracts users wary of traditional financial institutions, fostering a community-driven development environment that rapidly iterates new features and security measures, thereby sustaining organic demand and platform usage. The development of layer-2 scaling solutions and improved network throughput also directly impacts trading platforms by lowering transaction costs and increasing processing speed, addressing previous scalability limitations that often hindered mass adoption during peak market activity.

Conversely, regulatory risks represent the most significant restraint on market growth and stability. The fragmented and often contradictory legal status of digital assets across major economic blocs introduces high compliance costs and potential operational shutdowns, forcing platforms to deploy complex, region-specific strategies. This uncertainty discourages major banks and institutional players from fully committing to the sector, despite evident interest. Security threats remain a perennial issue; high-profile exchange hacks not only result in significant financial losses but also severely damage consumer trust, requiring platforms to perpetually reinvest in state-of-the-art cold storage, multi-factor authentication, and audited smart contracts. However, these restraints concurrently create lucrative opportunities, specifically for platforms that can successfully navigate the regulatory landscape and establish themselves as compliant, insured, and technologically secure providers, positioning compliance and security as competitive differentiators rather than mere burdens, unlocking vast pools of traditionally risk-averse institutional capital.

Segmentation Analysis

The Digital Currency Trading Platform market is complexly segmented based on operational mechanism, asset type, end-user profile, and service offering, reflecting the diverse needs of crypto participants globally. Segmentation by mechanism differentiates between Centralized Exchanges (CEXs), which offer ease of use, high liquidity, and custody services, and Decentralized Exchanges (DEXs), which prioritize non-custodial trading, censorship resistance, and reliance on automated market makers (AMMs). Asset types further divide the market into platforms specializing in major coins (e.g., Bitcoin/Ethereum focus), altcoins, stablecoins, derivatives (futures/options), and emerging segments like Non-Fungible Tokens (NFTs) and tokenized securities. End-user categorization separates retail investors, who prioritize user experience and simple interfaces, from institutional traders, who demand high throughput, API access, and advanced risk management tools. Understanding these segments is crucial for platforms aiming to tailor their product offerings, marketing strategies, and compliance efforts to specific, high-growth niches within the broader digital asset ecosystem.

- By Platform Type:

- Centralized Exchanges (CEX)

- Decentralized Exchanges (DEX)

- Hybrid Exchanges

- Peer-to-Peer (P2P) Platforms

- By Asset Type:

- Major Cryptocurrencies (BTC, ETH)

- Altcoins and Tokens

- Stablecoins

- Derivatives (Futures, Options, Perpetual Swaps)

- Tokenized Assets (Securities, Real Estate)

- By End-User:

- Retail Investors

- Institutional Investors (Hedge Funds, Family Offices)

- High-Frequency Trading (HFT) Firms

- Asset Managers and Corporate Treasuries

- By Service Offered:

- Spot Trading

- Margin Trading and Lending

- Staking and Yield Generation

- Custody and Wallet Services

Value Chain Analysis For Digital Currency Trading Platform Market

The value chain of the Digital Currency Trading Platform market is intricate, involving multiple specialized layers from foundational technology to the final consumer transaction. The upstream segment is dominated by core technology providers, including blockchain developers responsible for protocol maintenance (e.g., Ethereum Foundation, Solana Labs), layer-1 and layer-2 scaling solution developers, and specialized data providers that supply market data feeds, block explorers, and network health monitoring tools. These upstream entities ensure the underlying infrastructure is secure, scalable, and operationally efficient. The competitive dynamics in this phase focus on maximizing decentralization, ensuring high transactional throughput, and minimizing gas fees, which directly affect the profitability and utility of the downstream platforms built upon them.

The core middle layer of the value chain involves the trading platforms themselves, whether centralized or decentralized. Centralized exchanges focus heavily on liquidity aggregation, security auditing, maintaining regulatory licenses, and developing advanced proprietary trading engines. They manage fiat on/off-ramps and provide sophisticated user interfaces and customer support. Decentralized platforms, conversely, focus on smart contract security, auditability, and liquidity pool optimization through Automated Market Makers (AMMs). The integration of robust custody solutions, often provided by third-party specialized firms, is also a critical midstream function, ensuring the secure holding of billions of dollars worth of assets, thereby mitigating systemic risk.

The downstream distribution channels primarily involve direct and indirect access methods to the end-user. Direct channels include the platform’s own web interface and dedicated mobile applications, offering a proprietary experience. Indirect channels involve integration with third-party software, such as crypto portfolio trackers, trading APIs utilized by brokerage services, and crypto payment gateways. The proliferation of digital wallets that integrate directly with DEX aggregators (like MetaMask or Trust Wallet) represents a crucial indirect distribution channel, enabling seamless interaction with decentralized applications (DApps). Success in the downstream market depends on broad accessibility, competitive pricing (low fees), and superior integration with the rapidly expanding ecosystem of DeFi and Web3 services, ensuring high user retention and continuous transaction flow.

Digital Currency Trading Platform Market Potential Customers

Potential customers for Digital Currency Trading Platforms span a vast spectrum, categorized primarily into sophisticated financial institutions seeking high throughput and robust compliance, technology-savvy retail investors looking for speculative opportunities, and emerging users in developing economies requiring efficient cross-border payment solutions. Institutional end-users include hedge funds and proprietary trading firms demanding low-latency API access, co-location services, deep liquidity pools for block trades, and specialized prime brokerage services to manage counterparty risk and collateral. These customers prioritize regulatory clarity, insurance coverage, and segregated cold storage solutions, often preferring highly regulated centralized platforms or bespoke OTC (Over-The-Counter) desks that can handle large volumes without market impact.

The largest segment, however, remains the global cohort of retail investors, ranging from novice entrants seeking simple, fiat-to-crypto conversion tools to experienced traders engaging in margin and futures trading. These customers are highly sensitive to user experience (UX), mobile accessibility, fee structures, and the variety of altcoins available. A critical and fast-growing segment within retail is the DeFi participant, who actively utilizes DEXs for yield farming, liquidity provision, and governance token participation, prioritizing smart contract reliability and the ability to retain custody of their assets. Platforms must cater to this dichotomy—offering simplicity for the masses while providing professional-grade tools for advanced retail participants.

Furthermore, a growing segment comprises corporate treasuries, particularly technology companies, who use digital currency platforms for treasury management, holding cryptocurrency reserves, and facilitating international payments. This segment values enterprise-grade security, reliable custody solutions integrated with existing financial reporting systems, and regulatory adherence tailored to corporate finance needs. Finally, cryptocurrency miners and validators represent specialized customers who rely on trading platforms to liquidate block rewards and manage hedged positions against price fluctuations. Tailoring interfaces and services, such as specialized API endpoints for high-volume settlements or institutional-grade compliance reporting, is essential for maximizing market penetration across these diverse customer profiles.

| Report Attributes | Report Details |

|---|---|

| Market Size in 2026 | $5.8 Billion |

| Market Forecast in 2033 | $28.5 Billion |

| Growth Rate | 25.5% CAGR |

| Historical Year | 2019 to 2024 |

| Base Year | 2025 |

| Forecast Year | 2026 - 2033 |

| DRO & Impact Forces |

|

| Segments Covered |

|

| Key Companies Covered | Coinbase Global Inc., Binance, FTX (Future structure), Kraken, Gemini Trust Company, Huobi Global, Upbit, OKX, Bitfinex, eToro, LMAX Digital, Bithumb, KuCoin, Crypto.com, Uniswap (Decentralized Protocol), Sushiswap (Decentralized Protocol), dYdX, LedgerX, Circle (Poloniex). |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Enquiry Before Buy | Have specific requirements? Send us your enquiry before purchase to get customized research options. Request For Enquiry Before Buy |

Digital Currency Trading Platform Market Key Technology Landscape

The technology landscape for digital currency trading platforms is defined by a relentless pursuit of speed, security, and smart contract innovation. At the core, high-frequency trading (HFT) matching engines, capable of processing millions of orders per second with microsecond latency, are essential for competitive centralized exchanges (CEXs). These proprietary systems often utilize specialized hardware and sophisticated queuing algorithms to ensure fairness and efficiency, directly impacting platform profitability and institutional client attraction. Concurrent with this speed requirement is the paramount need for robust cybersecurity, which involves implementing multilayered defenses including advanced encryption standards, multi-signature wallet technology (multi-sig), and cold storage solutions to protect customer funds from sophisticated network threats and internal collusion.

In the decentralized finance (DeFi) sphere, the technological focus shifts heavily to smart contract auditing and the development of highly efficient Automated Market Maker (AMM) protocols. AMMs like Uniswap and Curve utilize specialized mathematical formulas and liquidity pools to facilitate trades without traditional order books. Key innovations here include concentrated liquidity mechanisms, which allow liquidity providers to allocate capital within specific price ranges, dramatically improving capital efficiency compared to previous constant-product formulas. Furthermore, platforms are investing heavily in cross-chain interoperability solutions (e.g., bridges and rollups like Arbitrum and Optimism) to allow assets to move seamlessly between different blockchains, thereby expanding the tradable universe and enhancing overall market liquidity and flexibility.

A burgeoning technological requirement across all platform types is the integration of advanced compliance and risk management tools. This includes AI-driven Know Your Customer (KYC) and Anti-Money Laundering (AML) systems that utilize pattern recognition and big data analysis to flag suspicious transactions in real-time, satisfying increasingly strict global regulatory demands. Additionally, the adoption of zero-knowledge proofs (ZKPs) is gaining traction, particularly for DEXs, offering the potential to verify transactional integrity and balances without revealing sensitive underlying data, thus providing enhanced privacy and scalability while maintaining compliance standards, representing the cutting edge of privacy-preserving financial technology.

Regional Highlights

Regional variations in regulatory structure, technological adoption, and investor culture profoundly influence the distribution and growth of the Digital Currency Trading Platform Market.

- North America (NA): Dominates institutional trading volume, driven by clarity in certain crypto-related financial products (e.g., Bitcoin ETFs) and a strong venture capital ecosystem. Key markets include the US and Canada, where platforms prioritize regulatory compliance (SEC, FinCEN) and offer institutional-grade services like prime brokerage and sophisticated custody solutions. The region is a hotbed for technological innovation in security and high-frequency trading infrastructure.

- Europe: Characterized by fragmented yet progressing regulatory frameworks such as MiCA (Markets in Crypto-Assets), aiming for harmonization across the EU. Western European countries like Switzerland and the UK serve as major hubs for crypto innovation and banking integration. Growth is steady, focusing on regulatory clarity, strong consumer protection, and the integration of crypto assets into traditional banking products.

- Asia Pacific (APAC): The fastest-growing region, powered by massive retail adoption in countries like South Korea, Japan, and Vietnam, alongside significant institutional activity in financial hubs like Singapore and Hong Kong. APAC platforms often excel in multilingual support, localized payment methods, and high leverage derivative products, catering to a highly active, high-volume retail trading culture, despite varied governmental approaches (e.g., China's strict stance vs. Singapore’s permissive approach).

- Latin America (LATAM): Growth is accelerated by economic instability and high inflation rates, driving demand for stablecoin trading and cross-border remittance solutions. Countries like Brazil and Argentina show strong adoption rates, where platforms serve as necessary alternatives to failing traditional financial systems, focusing on accessible mobile interfaces and robust local currency support.

- Middle East and Africa (MEA): Emerging markets with significant potential. The UAE (Dubai, Abu Dhabi) is actively establishing itself as a global crypto hub through clear licensing and regulatory sandboxes, attracting global exchanges and institutional investment. Africa sees high P2P (Peer-to-Peer) trading volumes, driven by financial exclusion and remittance needs, where platforms prioritize low transaction costs and mobile accessibility.

Top Key Players

The market research report includes a detailed profile of leading stakeholders in the Digital Currency Trading Platform Market.- Coinbase Global Inc.

- Binance

- Kraken

- Gemini Trust Company

- Huobi Global

- Upbit

- OKX

- Bitfinex

- eToro

- LMAX Digital

- Bithumb

- KuCoin

- Crypto.com

- Uniswap (Decentralized Protocol)

- Sushiswap (Decentralized Protocol)

- dYdX

- LedgerX

- Circle (Poloniex)

- CME Group (Futures Trading)

- Bakkt

Frequently Asked Questions

Analyze common user questions about the Digital Currency Trading Platform market and generate a concise list of summarized FAQs reflecting key topics and concerns.What is the primary difference between CEX and DEX trading platforms?

A Centralized Exchange (CEX) operates under a single authority, requiring users to deposit assets (custodial), offering high liquidity and robust customer support. A Decentralized Exchange (DEX) operates via smart contracts, allowing users to trade directly from their personal wallets (non-custodial), prioritizing censorship resistance and ownership control.

How is market volatility impacting the development of trading platforms?

High volatility necessitates platforms to invest in superior technological infrastructure, including ultra-low latency matching engines and sophisticated risk management systems to prevent market manipulation, manage liquidations efficiently, and ensure platform stability during rapid price swings. It also drives demand for derivatives and stablecoin pairs.

Which regulatory trends are most significantly affecting global platforms?

The most significant trends are the classification of digital assets as securities or commodities, the mandatory implementation of rigorous KYC/AML procedures across all jurisdictions, and the push for global harmonization of licensing frameworks, such as the EU’s MiCA regulation, which dramatically impacts operational scale and compliance costs.

What role does Artificial Intelligence (AI) play in platform security?

AI is crucial for real-time threat detection, identifying anomalies in transaction patterns indicative of fraud or market manipulation, optimizing cold storage strategies, and strengthening phishing and social engineering defenses by constantly learning new attack vectors based on vast data sets.

What are the key drivers for institutional investors entering the crypto trading platform market?

Institutional entry is driven by the search for portfolio diversification, the development of regulated financial products (ETFs, futures), the maturation of professional custody solutions, and the demand for high-throughput, API-driven trading environments that meet the stringent demands of traditional financial operating standards.

What is the importance of fiat on-ramps in platform adoption?

Fiat on-ramps are critical gateways allowing users to easily convert traditional currency into digital assets. Their efficiency, security, and low fees directly correlate with mass market adoption, especially for new retail users, by reducing the barrier to entry into the crypto ecosystem.

How are Layer-2 solutions transforming DEX operations?

Layer-2 scaling solutions (like Arbitrum and Polygon) move computational load off the main blockchain, significantly reducing transaction costs (gas fees) and increasing transaction speed, making decentralized trading competitive with centralized counterparts, especially for high-frequency or small retail transactions.

What is meant by the term "yield farming" in the context of trading platforms?

Yield farming refers to the process where cryptocurrency holders lend or stake their assets on DeFi platforms (often facilitated by DEXs or specialized lending pools) to earn high interest rates or protocol governance tokens as rewards, essentially optimizing returns on idle crypto assets.

Why is API access crucial for institutional trading platforms?

API (Application Programming Interface) access allows institutional traders and algorithmic funds to connect their proprietary trading bots directly to the exchange's matching engine, enabling automated, high-speed execution, complex order placement, and real-time data streaming essential for high-frequency trading strategies.

What impact is tokenization having on the trading platform market?

Tokenization is expanding the asset class beyond traditional cryptocurrencies to include real-world assets (RWAs) like real estate, equities, and commodities, broadening the appeal of trading platforms to users seeking fractional ownership and enhanced liquidity for previously illiquid assets.

How do platforms manage risks associated with smart contract vulnerability?

Platforms manage smart contract risk through rigorous third-party security audits, deploying bug bounty programs to incentivize vulnerability reporting, implementing insurance funds to cover potential losses, and utilizing time-lock mechanisms or upgradeability features for emergency patch deployment.

What are the competitive advantages of Hybrid Exchanges?

Hybrid Exchanges attempt to combine the best features of CEXs (high speed, order book depth) with the advantages of DEXs (user custody control), aiming to deliver regulatory compliance alongside reduced counterparty risk and increased transparency through on-chain settlement.

How is the market addressing the need for enhanced environmental sustainability?

Platforms are increasingly listing tokens and blockchains that utilize Proof-of-Stake (PoS) consensus mechanisms, which are significantly more energy-efficient than Proof-of-Work (PoW). They also face pressure to offer carbon-neutral trading options or invest in carbon offset programs to appeal to environmentally conscious investors.

Why is custody service integration becoming essential for platforms?

As institutions enter the market, they require professional, insured, and segregated custody solutions to meet fiduciary duties. Platforms that integrate or partner with high-security custody providers gain a critical advantage in attracting large institutional capital and mitigating systemic risk.

What role do decentralized autonomous organizations (DAOs) play in DEX governance?

DAOs allow holders of a DEX's native governance token to vote on critical protocol parameters, such as fee structures, liquidity pool incentives, and smart contract upgrades, decentralizing decision-making and ensuring the platform evolves in line with community interests.

How do platforms handle data security outside of asset custody?

Data security involves encrypting user personal data (KYC information), employing advanced firewalls and intrusion detection systems, and ensuring compliance with global data privacy regulations (e.g., GDPR), protecting users not just from asset theft but also from identity compromise.

What are the current trends in mobile trading applications for digital currency platforms?

Mobile applications are prioritizing ultra-smooth user interfaces (UX), simplified fiat on-ramps, integrated social trading features, and robust biometric authentication methods, catering to the increasingly dominant retail segment that prefers trading on the go.

What distinguishes institutional-grade platforms from retail-focused ones?

Institutional platforms offer deeper liquidity, specialized OTC desks, dedicated account management, complex hedging tools, and rigorous auditing and reporting capabilities required by large financial entities, contrasting with retail platforms focused on simplicity and accessibility.

How do stablecoins influence overall market liquidity and stability?

Stablecoins provide a crucial safe haven during periods of high volatility, act as highly efficient collateral for DeFi lending, and serve as the primary trading pair against volatile cryptocurrencies, dramatically enhancing overall market liquidity and enabling rapid trading executions without constant conversion to fiat.

What are perpetual swaps and why are they popular on crypto platforms?

Perpetual swaps are a type of derivative contract, highly popular because they lack an expiration date, mimic the benefits of margin trading, and allow traders to leverage positions extensively. They are favored by experienced traders for speculative and hedging purposes due to the funding rate mechanism that keeps the price close to the underlying asset.

How do different global regions approach cryptocurrency taxation?

Taxation varies widely; some regions (like the US) treat crypto as property subject to capital gains tax, while others (like Germany) may offer tax exemptions for assets held over a specified period. Platforms must provide robust transaction reporting tools to help users comply with these complex, varying national tax regimes.

What technology is used for identity verification on centralized exchanges?

Centralized exchanges utilize advanced digital identity verification technology, including biometric scanning, liveness detection, optical character recognition (OCR) for document verification, and integration with government databases to satisfy stringent Know Your Customer (KYC) mandates rapidly and securely.

Why is cross-chain interoperability a critical technological goal?

Interoperability allows assets and data to move seamlessly between previously isolated blockchain networks (e.g., Ethereum, Solana, Polkadot), dramatically increasing the overall market's liquidity, efficiency, and utility by enabling complex applications that utilize multiple blockchain ecosystems simultaneously.

How do crypto platforms ensure fair pricing mechanisms?

Centralized platforms rely on proprietary matching engines that adhere to strict time-priority rules. DEXs rely on AMMs and decentralized oracle networks (like Chainlink) to feed tamper-proof external data for asset valuation and liquidation mechanisms, preventing manipulative flash loans and ensuring robust price feeds.

What is the significance of the shift toward institutional-grade DeFi?

The shift signifies the creation of decentralized protocols specifically designed with institutional needs in mind, featuring whitelisting for KYC-verified participants, specialized lending pools, and integration with traditional legal structures, aiming to merge the transparency of DeFi with the regulatory requirements of TradFi.

How are platforms mitigating risks associated with high leverage trading?

Platforms mitigate high leverage risks by implementing sophisticated automated margin call and liquidation systems, utilizing risk-based margin tiers, and maintaining insurance funds (often funded by liquidation fees) to absorb potential losses and prevent cascading defaults across the platform.

Why are non-custodial wallets gaining popularity in conjunction with trading platforms?

Non-custodial wallets give the user complete control over their private keys, eliminating counterparty risk associated with centralized exchanges and aligning with the core ethos of decentralized finance, making them essential for interacting with DEXs and utilizing DeFi applications directly.

What are the energy consumption concerns related to trading platforms?

The concerns primarily relate to the underlying blockchain networks they support, especially Proof-of-Work (PoW) chains like Bitcoin. Platforms respond by promoting PoS assets and focusing on energy-efficient operational technologies for their data centers and matching engines.

How do centralized exchanges compete with the zero-fee models of some DEXs?

CEXs compete by offering superior user experience, advanced charting tools, reliable customer support, fiat integration, and specialized services like lending and staking. While they charge fees, they justify them through the security, liquidity, and regulatory clarity they provide, which DEXs often cannot fully match.

What is the future outlook for the integration of traditional banking and crypto platforms?

The outlook suggests deeper integration, with banks potentially offering crypto custody, trading, and asset management services directly to clients through partnerships or acquisition of established crypto platforms, bridging the operational and trust gap between traditional and decentralized finance.

To check our Table of Contents, please mail us at: sales@marketresearchupdate.com

Research Methodology

The Market Research Update offers technology-driven solutions and its full integration in the research process to be skilled at every step. We use diverse assets to produce the best results for our clients. The success of a research project is completely reliant on the research process adopted by the company. Market Research Update assists its clients to recognize opportunities by examining the global market and offering economic insights. We are proud of our extensive coverage that encompasses the understanding of numerous major industry domains.

Market Research Update provide consistency in our research report, also we provide on the part of the analysis of forecast across a gamut of coverage geographies and coverage. The research teams carry out primary and secondary research to implement and design the data collection procedure. The research team then analyzes data about the latest trends and major issues in reference to each industry and country. This helps to determine the anticipated market-related procedures in the future. The company offers technology-driven solutions and its full incorporation in the research method to be skilled at each step.

The Company's Research Process Has the Following Advantages:

- Information Procurement

The step comprises the procurement of market-related information or data via different methodologies & sources.

- Information Investigation

This step comprises the mapping and investigation of all the information procured from the earlier step. It also includes the analysis of data differences observed across numerous data sources.

- Highly Authentic Source

We offer highly authentic information from numerous sources. To fulfills the client’s requirement.

- Market Formulation

This step entails the placement of data points at suitable market spaces in an effort to assume possible conclusions. Analyst viewpoint and subject matter specialist based examining the form of market sizing also plays an essential role in this step.

- Validation & Publishing of Information

Validation is a significant step in the procedure. Validation via an intricately designed procedure assists us to conclude data-points to be used for final calculations.

×

Request Free Sample:

Related Reports

Select License

Why Choose Us

We're cost-effective and Offered Best services:

We are flexible and responsive startup research firm. We adapt as your research requires change, with cost-effectiveness and highly researched report that larger companies can't match.

Information Safety

Market Research Update ensure that we deliver best reports. We care about the confidential and personal information quality, safety, of reports. We use Authorize secure payment process.

We Are Committed to Quality and Deadlines

We offer quality of reports within deadlines. We've worked hard to find the best ways to offer our customers results-oriented and process driven consulting services.

Our Remarkable Track Record

We concentrate on developing lasting and strong client relationship. At present, we hold numerous preferred relationships with industry leading firms that have relied on us constantly for their research requirements.

Best Service Assured

Buy reports from our executives that best suits your need and helps you stay ahead of the competition.

Customized Research Reports

Our research services are custom-made especially to you and your firm in order to discover practical growth recommendations and strategies. We don't stick to a one size fits all strategy. We appreciate that your business has particular research necessities.

Service Assurance

At Market Research Update, we are dedicated to offer the best probable recommendations and service to all our clients. You will be able to speak to experienced analyst who will be aware of your research requirements precisely.

Contact With Our Sales Team

Customer Testimonials

The content of the report is always up to the mark. Good to see speakers from expertise authorities.

Privacy requested , Managing Director

A lot of unique and interesting topics which are described in good manner.

Privacy requested, President

Well researched, expertise analysts, well organized, concrete and current topics delivered in time.

Privacy requested, Development Manager