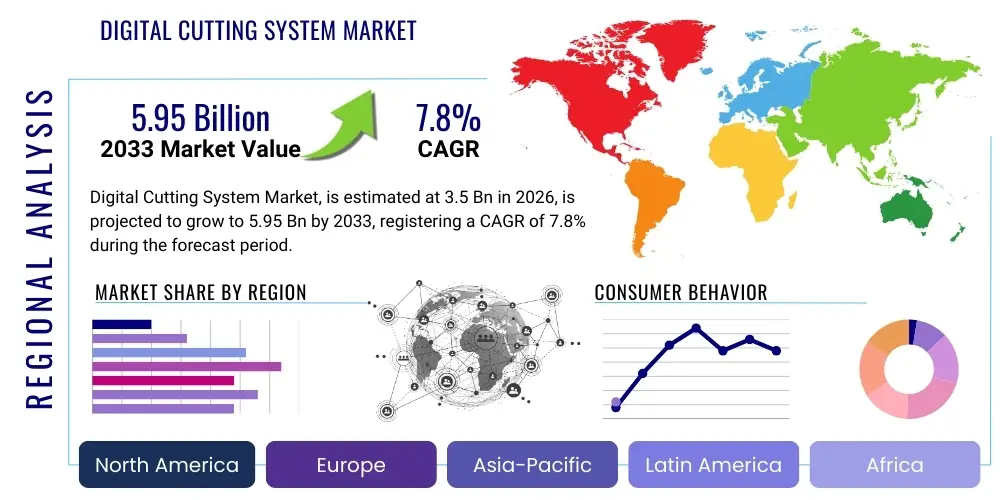

Digital Cutting System Market Size, By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2026 to 2033 (Financial Impact Analysis)

ID : MRU_ 443527 | Date : Feb, 2026 | Pages : 248 | Region : Global | Publisher : MRU

Digital Cutting System Market Size

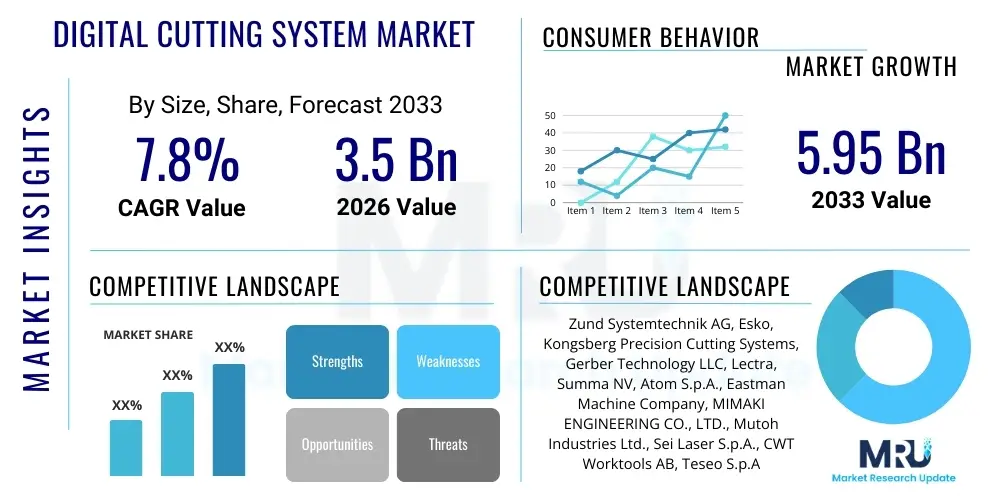

The Digital Cutting System Market is projected to grow at a Compound Annual Growth Rate (CAGR) of 7.8% between 2026 and 2033. The market is estimated at USD 3.5 Billion in 2026 and is projected to reach USD 5.95 Billion by the end of the forecast period in 2033.

Digital Cutting System Market introduction

The Digital Cutting System Market encompasses advanced, highly automated machinery designed for precision processing of flexible and rigid materials across various industries, replacing traditional manual cutting or die-cutting methods. These systems utilize sophisticated technologies such as laser, knife (oscillating, drag, rotary), and router cutting integrated with computer-aided design (CAD) software, ensuring minimal material waste and achieving complex geometric tolerances. The primary products include large-format flatbed cutters, roll-fed cutters, and multi-functional hybrid systems, crucial for mass customization and short-run production environments, particularly in packaging, textiles, signage, and automotive sectors.

Major applications of digital cutting technology span from intricate kiss-cutting in vinyl graphics and labels to heavy-duty routing in composite materials for aerospace, and complex pattern matching in the garment industry. These systems enhance operational efficiency significantly by drastically reducing setup times, eliminating the need for expensive physical dies, and facilitating rapid prototyping. The non-contact nature of some cutting technologies, like laser cutting, also allows for processing materials that are traditionally challenging to handle, such as highly delicate fabrics or intricate foam structures, driving their adoption across specialized manufacturing niches.

The primary driving factor behind the market expansion is the accelerating demand for bespoke products and rapid delivery models across retail and industrial sectors, commonly referred to as Industry 4.0 paradigms. Furthermore, the increasing penetration of sustainable packaging solutions, which often require complex geometries and lightweight materials handled best by digital cutters, fuels demand. The technological advancements leading to faster throughput speeds, greater cutting accuracy, and the ability to process a wider variety of substrates simultaneously contribute substantially to market dynamism and widespread industrial adoption globally.

Digital Cutting System Market Executive Summary

The Digital Cutting System Market is characterized by a strong shift toward automation and integration, driven by the need for manufacturing flexibility and efficiency in response to consumer demand for customized goods. Business trends highlight a strong emphasis on multi-functional systems capable of handling diverse materials (e.g., acrylic, corrugated board, textiles) and processes (e.g., cutting, creasing, engraving) within a single platform, thereby maximizing asset utilization for end-users. Strategic collaborations focusing on software integration, especially between CAD providers and machine manufacturers, are crucial for enhancing workflow optimization and reducing pre-press time. The market is consolidating, with key players investing heavily in smart factory readiness features, including IoT integration and predictive maintenance capabilities.

Regionally, Asia Pacific is anticipated to exhibit the fastest growth, largely propelled by the massive expansion of the packaging industry, particularly in China and India, alongside the booming automotive and electronics manufacturing sectors seeking precision component cutting. North America and Europe currently represent the largest revenue share, characterized by mature adoption in graphic arts, aerospace, and high-fashion textile manufacturing, focusing primarily on advanced automation and high-speed industrial solutions. Regulatory pressure across regions demanding reduced material waste and improved resource efficiency further bolsters the transition from conventional mechanical cutting toward digitally controlled systems.

Segment trends reveal that the packaging and corrugated sectors maintain dominance due to the high volume of short-run customized box production necessitated by e-commerce expansion. Technology-wise, oscillating knife cutting systems are witnessing significant uptake for versatile material processing, offering a favorable balance of speed and precision without heat distortion. The software component, specifically workflow management and nesting optimization tools, is emerging as a critical value differentiator, ensuring maximum material yield and integrating seamlessly with enterprise resource planning (ERP) systems, thus shifting the focus from mere hardware performance to comprehensive system solutions.

AI Impact Analysis on Digital Cutting System Market

Common user questions regarding AI’s influence typically center on three core themes: operational optimization, predictive maintenance, and design automation. Users frequently ask how AI can optimize cutting paths in real-time to minimize material waste (nesting efficiency), whether AI can predict mechanical failures before downtime occurs, and if AI algorithms can automate complex pattern grading or shape recognition for flexible materials like textiles and leather. The consensus expectation is that AI integration will shift digital cutting systems from automated tools to intelligent decision-making platforms, fundamentally improving material utilization rates and machine uptime. Key concerns revolve around data security, the cost of retrofitting existing machinery with AI capabilities, and the need for new skill sets among operators to manage these sophisticated, self-optimizing systems.

The implementation of AI/Machine Learning (ML) algorithms is set to revolutionize the pre-press stage, particularly in complex nesting scenarios where heuristic algorithms often fall short of optimal material utilization. AI-powered nesting software can process millions of potential layouts in minutes, factoring in material flaws, grain direction, and subsequent assembly requirements, leading to yield improvements exceeding 5-10% compared to traditional methods. Furthermore, AI enables dynamic quality control; integrated vision systems utilizing deep learning can identify and compensate for material deformation or alignment errors instantaneously during the cutting process, ensuring absolute precision even at high speeds.

Beyond immediate production efficiency, AI significantly contributes to the longevity and reliability of digital cutting assets. Predictive maintenance models, trained on sensor data regarding motor vibrations, temperature fluctuations, and cutting force variability, can accurately forecast component failure days or weeks in advance. This capability drastically reduces unscheduled downtime—a major impediment in high-volume production environments—by allowing maintenance to be performed during planned breaks. Ultimately, AI transforms the digital cutting system into a self-monitoring, self-optimizing manufacturing cell, facilitating lights-out operation and minimizing human intervention required for routine adjustments and troubleshooting.

- AI-Enhanced Nesting: Real-time optimization of cutting layouts, reducing material waste by generating optimal patterns based on geometry and material properties.

- Predictive Maintenance: Utilization of machine learning on sensor data to forecast component failures, maximizing system uptime and minimizing repair costs.

- Automated Quality Control: Deep learning-based vision systems detect material flaws or cutting imperfections instantaneously, triggering automatic compensation or rejection.

- Adaptive Feed Rate Control: AI dynamically adjusts cutting speed and power based on material density and cutter head wear, maintaining consistent output quality.

- Generative Design Integration: AI assists in automating pattern generation for custom packaging or textile layouts based on input specifications and constraints.

DRO & Impact Forces Of Digital Cutting System Market

The market trajectory is primarily propelled by technological advancements enabling higher processing speeds and versatility, coupled with the global push towards automation in manufacturing sectors (Drivers). However, high initial capital expenditure for industrial-grade digital cutting systems and the complexity associated with integrating these machines into existing heterogeneous manufacturing ecosystems pose significant barriers to entry, particularly for Small and Medium-sized Enterprises (SMEs) (Restraints). The widespread adoption of e-commerce necessitates rapid turnaround for customized packaging and point-of-sale displays, creating substantial opportunities for high-volume, flexible digital cutting solutions. These factors collectively exert a powerful, accelerating influence, characterized by simultaneous upward pressure from automation demand and frictional forces related to investment costs and skill gaps (Impact Forces).

Key Drivers include the increasing global demand for mass customization across industries like automotive interiors, specialized electronics components, and personalized signage and display graphics. The move toward short-run production capabilities means traditional die-cutting becomes economically unviable due to the fixed cost of tooling, positioning digital systems as the necessary flexible alternative. Furthermore, environmental regulations promoting sustainable material use, such as recycled board and biodegradable polymers, favor digital cutters that offer precise control over delicate substrates without damaging them through excessive mechanical force or thermal stress, promoting faster ROI on the investment.

Restraints are heavily concentrated around the total cost of ownership (TCO). While the elimination of tooling costs saves money in the long term, the initial purchase price, coupled with the need for specialized software licenses and highly trained technical staff for operation and maintenance, can deter smaller operations. Additionally, certain ultra-high-volume manufacturing environments, such as those producing simple, standardized corrugated boxes, still find highly specialized, traditional mechanical stamping presses faster and cheaper for long, homogenous runs, limiting digital penetration in those specific niches. The availability of reliable, high-speed material handling automation (feeding and stacking) that can keep up with the machine's speed remains an infrastructural challenge in certain emerging markets.

Opportunities are significant in developing markets where manufacturing infrastructure is rapidly modernizing, seeking to leapfrog older technologies directly into advanced digital fabrication. The textile and fashion industry presents a vast untapped potential, as digital systems dramatically improve fabric utilization and reduce human error in intricate pattern cutting. Furthermore, the rising adoption of additive manufacturing (3D printing) creates a symbiotic relationship; digital cutters are essential for post-processing and finishing auxiliary materials or components adjacent to 3D-printed parts, opening new avenues for integrated workflow solutions spanning multiple fabrication technologies. Service-based models, such as cutting-as-a-service, lower the financial hurdle for SMEs, driving rapid market expansion.

Segmentation Analysis

The Digital Cutting System Market is broadly segmented based on technology type, offering type, application industry, and operational mode, allowing for detailed analysis tailored to specific end-user requirements and material characteristics. Understanding these segmentations is critical, as machine choice heavily depends on factors such as required precision, maximum throughput, material rigidity, and budget constraints. For instance, high-volume graphic arts typically require fast, non-contact laser or drag knife systems, whereas specialized aerospace manufacturers processing composites need high-power, multi-tool router and oscillating knife combinations, necessitating differentiated product strategies across the market.

The technology segmentation differentiates machines based on the physical cutting mechanism employed, determining suitability for material type (e.g., oscillating knives for soft materials, lasers for fine details and non-contact processing, and routers for rigid substrates). Offering type distinguishes between the actual cutting machinery (Hardware) and the essential elements of control and optimization (Software and Services). Application industry delineates the key consuming sectors, with packaging, signage, and textiles representing the major revenue contributors, each possessing unique material handling and precision requirements. Finally, the operational mode distinguishes between systems optimized for handling flexible rolled materials versus those designed for rigid flatbed processing.

The growth trajectory within these segments is uneven; the oscillating knife segment leads in terms of adoption due to its versatility and ability to handle materials ranging from thin films to thick foam board. The software and services segment, though smaller in absolute terms than hardware, is projected to experience the fastest CAGR, driven by the increasing need for advanced nesting, workflow automation, and predictive maintenance subscriptions. This shift reflects a market focus moving beyond the mere hardware acquisition toward integrated, intelligence-driven manufacturing solutions.

- Technology Type:

- Laser Cutting

- Knife Cutting (Oscillating, Drag, Rotary)

- Router Cutting

- Waterjet Cutting

- Offering Type:

- Hardware (Machines)

- Software & Services (CAD/CAM, Nesting, Maintenance)

- Application Industry:

- Packaging & Corrugated Board

- Signage & Display Graphics

- Textiles & Garments

- Automotive & Transportation

- Aerospace & Defense

- Leather Goods

- Others (Gaskets, Medical Devices)

- Operational Mode:

- Flatbed Systems

- Roll-Fed Systems

- Hybrid Systems

Value Chain Analysis For Digital Cutting System Market

The Digital Cutting System value chain initiates with upstream component suppliers, which provide critical, high-precision elements such as motion control systems (servomotors, linear guides), advanced optical components (for laser systems), specialized cutting tools (blades, routers), and high-power generation modules. These suppliers are critical as the performance, accuracy, and longevity of the final cutting system are directly dependent on the quality and reliability of these core technical components. Manufacturers then integrate these components with proprietary cutting heads, sophisticated machine frames, and customized control software to build the final equipment, focusing on robustness, speed, and user interface design to gain a competitive edge.

The distribution channel for digital cutting systems is typically bifurcated into direct sales channels for major industrial customers requiring extensive consultation and customized integration, and indirect channels relying on authorized distributors and regional agents, particularly important for reaching SMEs and specialized market niches globally. Distributors often provide localized support, training, and maintenance services, adding significant value downstream. Post-sale services, including installation, calibration, preventive maintenance, and software updates, form a crucial part of the value proposition, ensuring optimal performance throughout the machine lifecycle and representing a significant recurring revenue stream for OEMs.

Downstream analysis involves the direct relationship with end-users, encompassing diverse sectors from high-volume corrugated box makers to bespoke interior design firms. The efficiency gained by the end-user (e.g., reduced material waste, faster time-to-market) validates the high initial investment in the system. The feedback loop from these end-users is vital, informing future R&D efforts related to speed, material compatibility, and specialized tool development. The move towards subscription-based software services and advanced technical support, facilitated through connected machines (IoT), solidifies the downstream relationship, transforming a transactional sale into a long-term partnership focused on continuous operational improvement.

Digital Cutting System Market Potential Customers

Potential customers for digital cutting systems span the breadth of manufacturing and creative industries, unified by the requirement for high-precision, flexible material processing without the constraints of fixed tooling. Key buyers include large commercial printers and signage fabricators who utilize these systems for producing point-of-purchase displays, large format graphics, and intricate vinyl decals. The core value proposition for these end-users is the ability to handle small batches and complex geometries quickly, responding instantaneously to dynamic marketing campaigns and customization requests, eliminating the cost and delay associated with traditional die creation for prototypes and short runs.

Another major segment comprises manufacturers in the packaging industry, particularly those involved in producing personalized or short-run corrugated and folding carton boxes required by the surging e-commerce sector. These customers seek systems that integrate seamlessly with pre-press workflows, offering rapid creasing, scoring, and cutting of various board thicknesses. The shift towards sustainable packaging materials further drives demand, as digital cutters offer superior handling and precision when working with novel, sometimes sensitive, substrates compared to conventional methods.

Furthermore, specialized industrial sectors, including automotive interior component manufacturing (seat covers, floor mats, insulation), aerospace composite cutting, and technical textile production (e.g., protective gear, geotextiles), represent high-value customers. These buyers prioritize absolute accuracy, repeatability, and the ability to process extremely durable or difficult materials (like carbon fiber prepregs or heavy industrial fabrics). For these users, digital cutting systems are not just about efficiency, but about meeting stringent quality standards and traceability requirements necessary for mission-critical components.

| Report Attributes | Report Details |

|---|---|

| Market Size in 2026 | USD 3.5 Billion |

| Market Forecast in 2033 | USD 5.95 Billion |

| Growth Rate | 7.8% CAGR |

| Historical Year | 2019 to 2024 |

| Base Year | 2025 |

| Forecast Year | 2026 - 2033 |

| DRO & Impact Forces |

|

| Segments Covered |

|

| Key Companies Covered | Zund Systemtechnik AG, Esko, Kongsberg Precision Cutting Systems, Gerber Technology LLC, Lectra, Summa NV, Atom S.p.A., Eastman Machine Company, MIMAKI ENGINEERING CO., LTD., Mutoh Industries Ltd., Sei Laser S.p.A., CWT Worktools AB, Teseo S.p.A., AXYZ International, Huanan CNC Machine Co., Ltd., Aristo Graphic Systeme GmbH, Bullmer GmbH, Graphtec Corporation, Highcon Systems Ltd., Vicsign CNC. |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Enquiry Before Buy | Have specific requirements? Send us your enquiry before purchase to get customized research options. Request For Enquiry Before Buy |

Digital Cutting System Market Key Technology Landscape

The technological core of the Digital Cutting System market is defined by the diversification of cutting mechanisms optimized for specific material characteristics and precision levels. The prevailing technologies include highly versatile oscillating and drag knife systems, which employ rapid mechanical motion ideal for flexible materials like foam, cardboard, vinyl, and soft plastics, offering excellent speed-to-cost ratios. Router cutting, conversely, utilizes high-speed spindles and durable bits, essential for processing rigid, thick, or composite materials such as wood, acrylic, and aluminum sheet, often incorporating complex multi-axis motion control for angled cuts and bevels. The ongoing trend is toward modular tool heads, allowing a single machine to rapidly switch between knife, router, creasing, and plotting tools, maximizing adaptability for mixed-material jobs and eliminating manual changeovers.

Laser cutting technology continues to advance, particularly in CO2 and fiber laser applications, crucial for industries requiring non-contact, ultra-fine precision cutting of textiles, thin plastics, and specialized foils. Fiber lasers, known for their high energy efficiency and ability to cut reflective materials, are increasingly used for cutting metals in auxiliary post-processing tasks within digital fabrication environments. A critical component driving the efficiency of these systems is the adoption of advanced motion control architecture, utilizing linear motors and high-resolution encoder systems to achieve micron-level accuracy at significantly elevated speeds. This integration ensures minimal vibration and maximum repeatability, meeting the stringent demands of aerospace and medical device manufacturing.

Furthermore, the technology landscape is heavily influenced by software innovation, forming the intelligence layer necessary for high-performance operation. Advanced Computer-Aided Manufacturing (CAM) software, specifically nesting algorithms, utilizes complex mathematical modeling to arrange parts optimally on material sheets, minimizing scrap material, which is a key driver for sustainability and profitability. The incorporation of integrated vision systems and registration marks reading technology allows for highly accurate cutting of printed materials (print-and-cut workflows), automatically compensating for material stretch or distortion. Connectivity via Industrial IoT (IIoT) protocols enables remote diagnostics, performance monitoring, and secure software updates, underpinning the trend toward smart factory integration and remote support services.

Regional Highlights

- Asia Pacific (APAC): APAC is projected to be the fastest-growing region, driven by the massive scale of manufacturing in China, India, and Southeast Asia. The rapid adoption is fueled by investment in automated production lines across textiles, automotive components, and the burgeoning electronics and packaging sectors. Government initiatives promoting advanced manufacturing techniques and substantial foreign direct investment into modern factories accelerate the replacement of traditional manual and die-cutting methods. The region's high volume of e-commerce activities necessitates huge investments in localized, customized packaging production capabilities.

- North America: North America holds a significant market share, characterized by high adoption rates in graphic arts, specialized signage, and high-value industrial sectors such as aerospace and defense. Demand here focuses heavily on high-speed, high-automation systems integrated with comprehensive MES/ERP solutions, prioritizing productivity and reducing labor dependency. The established textile industry, particularly technical textiles and non-wovens, drives continued investment in large-format roll-fed cutting systems that prioritize material efficiency and precision repeatability necessary for regulatory compliance.

- Europe: Europe represents a mature but technologically advanced market, focusing on sustainability, precision engineering, and luxury goods manufacturing. Strong demand comes from the automotive sector for high-precision interior cutting (leather, fabric, composites) and from the fashion industry seeking rapid prototyping and short-run garment production to support fast fashion and customization trends. Regulatory push for waste reduction strongly encourages the use of nesting software capabilities, reinforcing the growth of the software and services component of the market.

- Latin America (LATAM) and Middle East & Africa (MEA): These regions show promising growth potential, especially as industrialization accelerates. LATAM's growth is tied to rising consumer demand for packaged goods and developing automotive manufacturing bases. MEA, particularly the Gulf Cooperation Council (GCC) countries, is investing in large infrastructure and construction projects, driving demand for digital cutting systems in architectural signage, interior fit-outs, and construction materials processing, facilitated by rapid urbanization and diversification efforts away from oil economies.

Top Key Players

The market research report includes a detailed profile of leading stakeholders in the Digital Cutting System Market.- Zund Systemtechnik AG

- Esko

- Kongsberg Precision Cutting Systems

- Gerber Technology LLC

- Lectra

- Summa NV

- Atom S.p.A.

- Eastman Machine Company

- MIMAKI ENGINEERING CO., LTD.

- Mutoh Industries Ltd.

- Sei Laser S.p.A.

- CWT Worktools AB

- Teseo S.p.A.

- AXYZ International

- Huanan CNC Machine Co., Ltd.

- Aristo Graphic Systeme GmbH

- Bullmer GmbH

- Graphtec Corporation

- Highcon Systems Ltd.

- Vicsign CNC

Frequently Asked Questions

Analyze common user questions about the Digital Cutting System market and generate a concise list of summarized FAQs reflecting key topics and concerns.What is the primary difference between oscillating knife, drag knife, and router cutting systems?

The primary difference lies in the mechanism and material suitability. Oscillating knife systems use a rapidly vibrating blade (up to 20,000 strokes per minute) and are ideal for cutting thicker, softer, or dense materials like foam, corrugated board, and heavy gaskets, achieving clean edges without material drag. Drag knife systems use a fixed blade that is passively dragged across the material, rotating based on the machine's movement, best suited for thin vinyl, paper, and low-density materials where extreme precision and speed are required at a lower cost. Router cutting systems utilize a high-speed rotating spindle and milling bit, designed for rigid, thick materials such as aluminum, wood, acrylic, and heavy composites, providing the high force necessary for deep cutting and beveling, typically used in industrial fabrication and signage production where material hardness necessitates abrasive removal rather than shearing.

How does the integration of digital cutting systems contribute to manufacturing sustainability and waste reduction?

Digital cutting systems significantly enhance manufacturing sustainability primarily through advanced nesting optimization software. Unlike traditional die-cutting, which often relies on fixed layouts, digital systems use complex algorithms (often AI-enhanced) to arrange geometric parts on the material sheet with maximum density, minimizing the unused scrap material (waste) often by 5% to 15% compared to manual or legacy methods. Furthermore, the absence of physical tooling eliminates the resource consumption associated with die fabrication and storage. By achieving higher accuracy, digital systems reduce the production of defective parts that would otherwise be scrapped, ensuring superior resource utilization across high-value substrates like technical fabrics and aerospace composites, which is critical for reducing environmental footprint and lowering operational costs.

What is the typical Return on Investment (ROI) period for adopting a high-end flatbed digital cutting system in the packaging industry?

The typical ROI period for a high-end flatbed digital cutting system in the packaging industry generally ranges between 18 to 36 months, though this is highly dependent on utilization rate and the elimination of outsourced die-making costs. The rapid ROI is driven by three factors: Elimination of Tooling Costs: By replacing physical dies, the system immediately generates savings, particularly for short-run or customized jobs. Increased Throughput Flexibility: The ability to rapidly switch between jobs with zero setup time allows companies to handle a much higher volume of diverse orders (mass customization). Reduced Material Waste: Superior nesting and precision cutting directly translate into lower raw material expenditure. Businesses with high-mix, low-volume production benefit most rapidly, often realizing full return closer to the 18-month mark, whereas those focused on consistent, high-volume, standardized products might see a longer horizon.

What role does Industrial IoT (IIoT) play in the latest generation of digital cutting systems, and how does it improve productivity?

IIoT is fundamental to the latest generation of digital cutting systems, transforming them into interconnected, data-generating assets within a smart factory ecosystem. IIoT connectivity enables real-time performance monitoring, transmitting data on parameters like cutting head temperature, motor load, and throughput statistics to centralized Manufacturing Execution Systems (MES) or ERP platforms. This data is crucial for calculating Overall Equipment Effectiveness (OEE). Crucially, IIoT supports predictive maintenance by allowing the system to flag potential component failures based on anomalous sensor data (e.g., unusual vibrations) before a catastrophic breakdown occurs, minimizing unscheduled downtime, which is the biggest detriment to productivity in high-volume industrial environments. Remote diagnostics and firmware updates, facilitated by secure IIoT links, also ensure that machines are always operating at peak efficiency with the latest software enhancements.

Which application segment currently drives the highest revenue growth, and why is this segment expanding so rapidly?

The Packaging and Corrugated Board segment currently drives the highest revenue growth within the Digital Cutting System Market. This rapid expansion is primarily attributed to the unprecedented growth of the global e-commerce industry, which necessitates constant innovation in box design, structure, and personalization (custom-sized boxes, branded packaging inserts). Digital cutters are indispensable here because they offer the flexibility needed for short-run, on-demand box production—a requirement traditional high-volume die cutters cannot meet economically or quickly. Additionally, the increasing complexity of protective packaging and the shift towards structurally elaborate, sustainable materials that require highly accurate creasing and scoring, reinforce the dependence on the precision capabilities offered exclusively by advanced digital flatbed cutting solutions, leading to massive capital investment in this segment globally.

To check our Table of Contents, please mail us at: sales@marketresearchupdate.com

Research Methodology

The Market Research Update offers technology-driven solutions and its full integration in the research process to be skilled at every step. We use diverse assets to produce the best results for our clients. The success of a research project is completely reliant on the research process adopted by the company. Market Research Update assists its clients to recognize opportunities by examining the global market and offering economic insights. We are proud of our extensive coverage that encompasses the understanding of numerous major industry domains.

Market Research Update provide consistency in our research report, also we provide on the part of the analysis of forecast across a gamut of coverage geographies and coverage. The research teams carry out primary and secondary research to implement and design the data collection procedure. The research team then analyzes data about the latest trends and major issues in reference to each industry and country. This helps to determine the anticipated market-related procedures in the future. The company offers technology-driven solutions and its full incorporation in the research method to be skilled at each step.

The Company's Research Process Has the Following Advantages:

- Information Procurement

The step comprises the procurement of market-related information or data via different methodologies & sources.

- Information Investigation

This step comprises the mapping and investigation of all the information procured from the earlier step. It also includes the analysis of data differences observed across numerous data sources.

- Highly Authentic Source

We offer highly authentic information from numerous sources. To fulfills the client’s requirement.

- Market Formulation

This step entails the placement of data points at suitable market spaces in an effort to assume possible conclusions. Analyst viewpoint and subject matter specialist based examining the form of market sizing also plays an essential role in this step.

- Validation & Publishing of Information

Validation is a significant step in the procedure. Validation via an intricately designed procedure assists us to conclude data-points to be used for final calculations.

×

Request Free Sample:

Related Reports

Select License

Why Choose Us

We're cost-effective and Offered Best services:

We are flexible and responsive startup research firm. We adapt as your research requires change, with cost-effectiveness and highly researched report that larger companies can't match.

Information Safety

Market Research Update ensure that we deliver best reports. We care about the confidential and personal information quality, safety, of reports. We use Authorize secure payment process.

We Are Committed to Quality and Deadlines

We offer quality of reports within deadlines. We've worked hard to find the best ways to offer our customers results-oriented and process driven consulting services.

Our Remarkable Track Record

We concentrate on developing lasting and strong client relationship. At present, we hold numerous preferred relationships with industry leading firms that have relied on us constantly for their research requirements.

Best Service Assured

Buy reports from our executives that best suits your need and helps you stay ahead of the competition.

Customized Research Reports

Our research services are custom-made especially to you and your firm in order to discover practical growth recommendations and strategies. We don't stick to a one size fits all strategy. We appreciate that your business has particular research necessities.

Service Assurance

At Market Research Update, we are dedicated to offer the best probable recommendations and service to all our clients. You will be able to speak to experienced analyst who will be aware of your research requirements precisely.

Contact With Our Sales Team

Customer Testimonials

The content of the report is always up to the mark. Good to see speakers from expertise authorities.

Privacy requested , Managing Director

A lot of unique and interesting topics which are described in good manner.

Privacy requested, President

Well researched, expertise analysts, well organized, concrete and current topics delivered in time.

Privacy requested, Development Manager