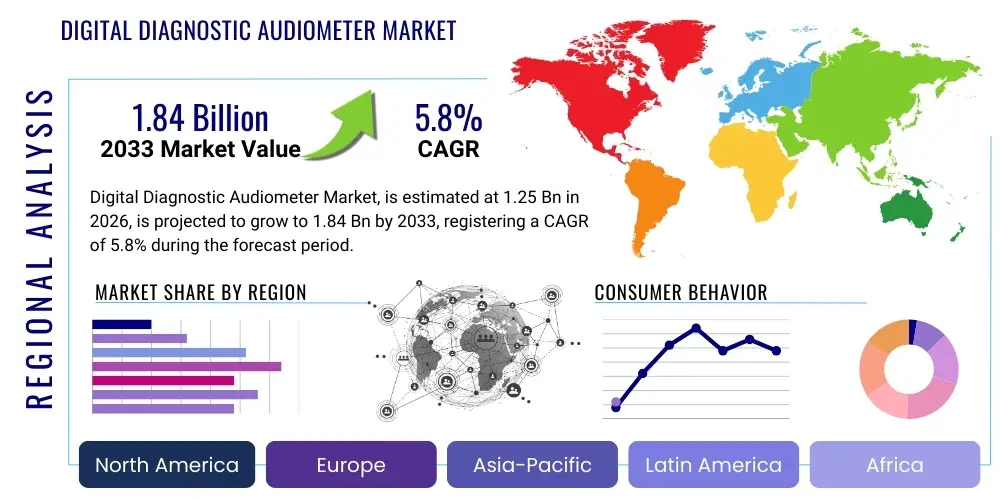

Digital Diagnostic Audiometer Market Size, By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2026 to 2033 (Financial Impact Analysis)

ID : MRU_ 443555 | Date : Feb, 2026 | Pages : 253 | Region : Global | Publisher : MRU

Digital Diagnostic Audiometer Market Size

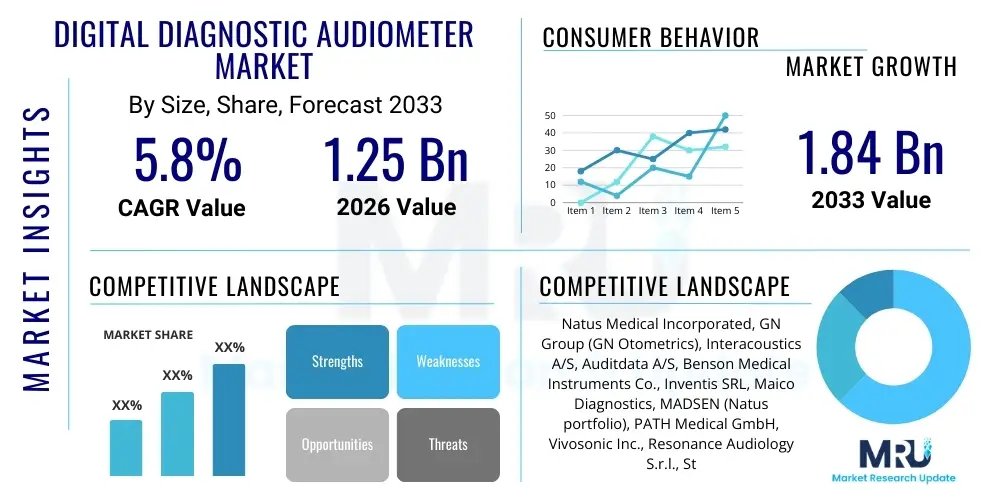

The Digital Diagnostic Audiometer Market is projected to grow at a Compound Annual Growth Rate (CAGR) of 5.8% between 2026 and 2033. The market is estimated at USD 1.25 billion in 2026 and is projected to reach USD 1.84 billion by the end of the forecast period in 2033. This consistent expansion is primarily fueled by the increasing global prevalence of age-related and noise-induced hearing loss, coupled with technological advancements leading to more precise, portable, and user-friendly diagnostic devices. The transition from traditional analog systems to advanced digital platforms, which offer superior data handling and integration capabilities, is a core driver of this market valuation growth over the coming years.

Digital Diagnostic Audiometer Market introduction

The Digital Diagnostic Audiometer Market encompasses advanced medical devices crucial for the objective assessment and quantitative measurement of an individual's hearing sensitivity across various frequencies. These sophisticated instruments utilize digital signal processing technology to generate pure tones, speech stimuli, or other calibrated acoustic signals necessary for performing comprehensive audiometric evaluations, including air conduction, bone conduction, and speech audiometry. The shift to digital platforms offers enhanced accuracy, calibration stability, and superior data management capabilities compared to outdated analog devices, positioning them as indispensable tools in modern audiological practice.

Major applications of digital diagnostic audiometers span clinical audiology, occupational health screening, otolaryngology practices, and public health initiatives aimed at early detection of hearing impairment in newborns and school-age children. These devices are fundamental in diagnosing the type, degree, and configuration of hearing loss, which dictates subsequent treatment protocols, such as prescribing hearing aids or cochlear implants. Their utility extends beyond simple diagnosis to monitoring the progression of hearing disorders and assessing the efficacy of therapeutic interventions, establishing them as essential capital equipment in healthcare settings worldwide.

The primary driving factors for market growth include the continuously expanding geriatric population—a demographic highly susceptible to presbycusis—and the escalating global noise exposure from industrial environments and recreational activities, leading to rising incidences of noise-induced hearing loss (NIHL). Furthermore, mandated universal newborn hearing screening programs in many developed and emerging economies necessitate the deployment of reliable, high-precision diagnostic tools. The benefits of these digital systems, such as improved diagnostic speed, enhanced data interoperability with electronic health records (EHRs), and the development of portable, PC-based models suitable for tele-audiology, further solidify their market position and projected growth trajectory.

Digital Diagnostic Audiometer Market Executive Summary

The global Digital Diagnostic Audiometer Market is characterized by robust business trends focusing on miniaturization, enhanced connectivity, and integrating sophisticated diagnostic algorithms. Key industry trends indicate a significant move towards PC-based and tablet-controlled audiometers, which offer superior portability and cost-effectiveness compared to bulky standalone clinical units, facilitating their adoption in resource-limited settings and primary care environments. Furthermore, stringent regulatory requirements concerning accuracy and calibration standards globally are forcing manufacturers to invest heavily in robust quality assurance processes, indirectly driving innovation in self-calibration mechanisms and remote maintenance capabilities, thereby reshaping the competitive landscape.

Regional trends reveal that North America continues to dominate the market, driven by high healthcare expenditure, established reimbursement frameworks, and the early adoption of advanced medical technologies, including tele-audiology solutions. However, the Asia Pacific (APAC) region is projected to register the highest Compound Annual Growth Rate (CAGR), fueled by expanding healthcare infrastructure in countries like China and India, increasing public awareness regarding hearing health, and large-scale government investments in combating occupational and congenital hearing loss. Europe maintains a steady growth rate, supported by comprehensive universal healthcare systems and a mature market for high-end clinical devices.

Segment trends highlight the dominance of clinical diagnostic audiometers in terms of revenue, attributed to their comprehensive testing capabilities required by specialized audiology centers and hospitals. However, the screening audiometer segment, particularly portable and handheld devices, is exhibiting faster growth due to its extensive use in school health programs and primary care settings for initial identification of hearing issues. The end-user segment is shifting, with private clinics and occupational health centers increasingly adopting advanced digital units to streamline workflow and improve patient throughput, leveraging the efficiency gains offered by modern digital diagnostic platforms.

AI Impact Analysis on Digital Diagnostic Audiometer Market

Common user questions regarding the impact of Artificial Intelligence (AI) on the Digital Diagnostic Audiometer Market frequently revolve around how AI can enhance diagnostic accuracy, automate workflow processes, and enable remote diagnostics. Users inquire about the feasibility of AI-driven interpretation of complex audiograms, the integration of machine learning for predictive modeling of hearing loss progression, and the role of AI in quality control and calibration of devices. A major concern is the regulatory pathway for AI-enabled medical devices and ensuring algorithmic transparency and reliability in critical diagnostic contexts. Furthermore, users are keenly interested in how AI can streamline data analysis from vast databases of hearing test results to identify subtle patterns and improve population health management strategies.

Based on these analytical themes, AI's influence is pivoting the market toward intelligent diagnostics and operational efficiency. The integration of AI algorithms allows audiometers to move beyond simple measurement to offering real-time diagnostic support, helping clinicians differentiate between various types of hearing loss—such as sensorineural versus conductive—with greater confidence and speed. AI is expected to significantly reduce the variability associated with manual interpretation, particularly in settings where specialist expertise might be limited. This shift not only accelerates diagnosis but also standardizes clinical practice, directly addressing user demands for higher reliability and efficiency in diagnostic tools.

The primary expectation is that AI will unlock new potential in tele-audiology and preventative care. Machine learning models, trained on extensive patient data, can flag 'at-risk' patients based on subtle changes in successive audiograms or demographic risk factors, transforming the reactive approach to hearing care into a proactive health strategy. While concerns about data privacy and the 'black box' nature of complex algorithms persist, manufacturers are increasingly developing explainable AI (XAI) tools to ensure clinicians understand the reasoning behind AI-assisted diagnoses, thereby fostering trust and accelerating clinical adoption.

- AI-driven interpretation of complex audiograms, reducing diagnostic variability.

- Automation of calibration checks and device maintenance, enhancing reliability.

- Integration of machine learning for predictive modeling of hearing loss progression.

- Enhanced tele-audiology capabilities through automated remote data analysis.

- Optimization of testing protocols, leading to faster and more efficient patient throughput.

- Support for complex noise analysis and sophisticated hearing aid fitting algorithms.

DRO & Impact Forces Of Digital Diagnostic Audiometer Market

The Digital Diagnostic Audiometer Market operates under a dynamic set of Drivers, Restraints, and Opportunities (DRO) that collectively shape its growth trajectory and competitive landscape. The primary drivers include the soaring global burden of hearing impairment, predominantly driven by the accelerating aging population worldwide and rising exposure to occupational and recreational noise pollution. The continuous evolution of diagnostic technology, specifically the shift toward high-precision digital systems offering modularity and networking capabilities, acts as a significant catalyst. Furthermore, supportive government initiatives, such as mandatory hearing screenings for neonates and robust occupational safety regulations demanding regular employee hearing tests, provide consistent market demand.

Despite strong underlying demand, the market faces notable restraints, chiefly the substantial initial investment cost associated with advanced clinical digital audiometers, which can hinder adoption, particularly in emerging economies or smaller private clinics. Coupled with high capital expenditure, the market suffers from a shortage of qualified and skilled audiologists and technicians globally who are proficient in operating and interpreting results from complex diagnostic equipment. Additionally, the regulatory environment requires continuous, costly calibration and maintenance of these precision instruments, which adds operational overhead and complexity for healthcare providers, slowing widespread deployment in decentralized settings.

Opportunities for market stakeholders primarily lie in the rapid expansion of tele-audiology and remote diagnostic services, facilitated by portable, internet-enabled digital audiometers. This allows healthcare access to be extended to geographically isolated populations, significantly expanding the addressable market. Furthermore, the convergence of audiology devices with Electronic Health Records (EHRs) and Artificial Intelligence (AI) tools presents a significant avenue for product differentiation and value creation, enabling more integrated and efficient patient care pathways. Impact forces are strong, driven predominantly by regulatory frameworks that emphasize diagnostic accuracy and patient safety, alongside the accelerating pace of digital transformation in healthcare, mandating interoperable and connected devices.

Segmentation Analysis

The Digital Diagnostic Audiometer Market is comprehensively segmented based on product type, modality, and end-user, providing nuanced insight into market demand patterns and technological preferences across different clinical settings. Segmentation is critical because the requirements of a large hospital audiology department differ significantly from those of a small, mobile screening service or an industrial occupational health clinic. The primary segmentation by product distinguishes between high-fidelity clinical audiometers, designed for detailed, comprehensive diagnosis in tertiary care, and simpler screening audiometers, utilized for quick pass/refer tests in primary care and schools.

Analysis by modality reveals a crucial bifurcation in technological deployment: standalone audiometers versus PC-based/portable systems. While standalone units remain the gold standard for high-volume clinical accuracy, PC-based systems, utilizing external hardware and proprietary software, are rapidly gaining traction due to their enhanced flexibility, lower footprint, and inherent ability to integrate with existing hospital information systems and cloud storage platforms. This trend towards PC-based solutions is accelerating due to the rising adoption of tele-health models globally, where portability and remote data transmission are paramount features for effective service delivery.

The end-user segmentation clearly indicates that hospitals and audiology clinics are the dominant revenue generators, requiring advanced, multi-frequency diagnostic capabilities. However, emerging growth segments include research institutes, which require specialized audiometers for complex psychoacoustic experiments, and industrial/occupational health settings, which mandate devices suitable for mass screening and regulatory compliance. Understanding these granular segment preferences allows manufacturers to tailor product development, focusing on features such as modularity, noise reduction software, and user interface design optimized for specific clinical workflows.

- By Product Type:

- Clinical Diagnostic Audiometers (High-end, comprehensive testing)

- Screening Audiometers (Portable, basic detection)

- By Modality:

- Standalone Devices (Traditional, dedicated hardware)

- PC-Based/Hybrid Systems (Software-driven, leveraging external computing power)

- Handheld/Portable Devices (Often used for screening or tele-audiology)

- By End User:

- Hospitals

- Audiology and Hearing Clinics

- Occupational Health Centers

- Academic and Research Institutes

- Government Public Health Programs

Value Chain Analysis For Digital Diagnostic Audiometer Market

The value chain for the Digital Diagnostic Audiometer Market initiates with upstream activities, predominantly involving specialized component manufacturing, including highly accurate digital signal processors (DSPs), calibrated transducers (headphones and bone conductors), and sophisticated acoustic components designed to meet stringent IEC and ANSI standards. Raw material procurement is highly specialized, requiring reliable sources for high-grade electronic components and biocompatible materials for patient interfaces. Suppliers in this segment face intense pressure to ensure component precision, as the diagnostic integrity of the final product hinges directly on the quality and calibration stability of these upstream inputs. Investment in proprietary software development and algorithmic testing is also a critical upstream cost center.

Midstream processes involve the integration, assembly, and rigorous testing of the audiometers. Manufacturing facilities must adhere to strict quality management systems (e.g., ISO 13485) required for medical devices. A crucial step in this stage is the extensive calibration and regulatory compliance process, including securing necessary certifications from bodies like the FDA, CE, and country-specific health ministries. Due to the precision nature of these devices, in-house calibration laboratories and quality control checks form a significant portion of manufacturing overhead. Successful companies differentiate themselves here through automation and efficient inventory management of high-value components.

Downstream activities focus heavily on distribution, sales, and post-market support. Distribution channels are typically dual: utilizing direct sales teams for large hospital networks and government tenders, and leveraging specialized medical device distributors for private clinics and regional market penetration. Indirect distribution through third-party distributors offers better geographical reach but requires robust channel management and training to ensure accurate product representation and installation support. Post-sales service, including mandatory periodic recalibration, technical support, and warranty provisions, represents a vital and continuous revenue stream, establishing long-term customer relationships and ensuring compliance with regulatory maintenance mandates.

Digital Diagnostic Audiometer Market Potential Customers

The primary customers and end-users of Digital Diagnostic Audiometers are specialized healthcare institutions and professional medical practitioners who rely on precise hearing assessment tools for clinical decision-making. Leading purchasers include large multi-specialty hospitals, particularly those with dedicated Ear, Nose, and Throat (ENT) departments and comprehensive audiology clinics. These institutions require high-throughput, highly configurable clinical audiometers capable of performing a wide range of advanced diagnostic tests, supporting complex patient loads, and integrating seamlessly with electronic patient management systems for efficiency and data traceability.

Audiology and dedicated hearing aid clinics constitute another significant customer base, often preferring versatile, high-fidelity PC-based or hybrid systems due to spatial constraints and the need for portability, especially in private practice settings or when conducting off-site services. These clinics often prioritize devices with robust software interfaces that simplify testing protocols, streamline reporting, and facilitate the direct interfacing of audiometric results with hearing aid fitting software. The increasing focus on patient-centric care means these customers often demand systems that enhance the patient experience while providing highly accurate diagnostic outcomes.

A rapidly growing customer segment encompasses occupational health centers and industrial clinics. These facilities purchase screening and portable diagnostic audiometers primarily to fulfill regulatory requirements concerning employee noise exposure monitoring and ongoing hearing conservation programs in industrial or military environments. For these buyers, ruggedness, ease of operation by non-specialist personnel, and the ability to handle high volumes of rapid screening tests are critical purchasing factors. Furthermore, government agencies managing public health initiatives, such as newborn hearing screening programs and school health checkups, are significant bulk purchasers of portable screening audiometers, driven by large-scale public mandates.

| Report Attributes | Report Details |

|---|---|

| Market Size in 2026 | USD 1.25 Billion |

| Market Forecast in 2033 | USD 1.84 Billion |

| Growth Rate | CAGR 5.8% |

| Historical Year | 2019 to 2024 |

| Base Year | 2025 |

| Forecast Year | 2026 - 2033 |

| DRO & Impact Forces |

|

| Segments Covered |

|

| Key Companies Covered | Natus Medical Incorporated, GN Group (GN Otometrics), Interacoustics A/S, Auditdata A/S, Benson Medical Instruments Co., Inventis SRL, Maico Diagnostics, MADSEN (Natus portfolio), PATH Medical GmbH, Vivosonic Inc., Resonance Audiology S.r.l., Starkey Hearing Technologies, Echo-Acoustics, Beijing Beier Bioengineering Co., Ltd., William Demant Holding A/S, e3 Diagnostics, MedRx Inc., RION Co., Ltd. |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Enquiry Before Buy | Have specific requirements? Send us your enquiry before purchase to get customized research options. Request For Enquiry Before Buy |

Digital Diagnostic Audiometer Market Key Technology Landscape

The technological landscape of the Digital Diagnostic Audiometer Market is rapidly advancing, moving away from rudimentary signal generators toward integrated diagnostic platforms. A core technology driving innovation is advanced digital signal processing (DSP), which enables the generation of highly calibrated, distortion-free stimuli across a wider frequency range, crucial for specialized testing like high-frequency audiometry. Modern audiometers incorporate sophisticated noise reduction algorithms that filter out ambient noise during testing, thereby improving the reliability of measurements, particularly in non-sound-proofed environments, a key requirement for portable and tele-audiology applications.

Another pivotal technological development involves enhanced connectivity and data management capabilities. Almost all new diagnostic systems are designed with native network integration features, utilizing standard protocols like HL7 for seamless data exchange with Electronic Health Records (EHR) and Hospital Information Systems (HIS). Cloud connectivity is becoming standard, facilitating remote data storage, backup, and critical for supporting tele-audiology workflows. This digitalization trend is heavily supported by the adoption of USB-based or proprietary hardware interfaces, transforming standard personal computers or tablets into functional diagnostic hubs, which significantly reduces the cost and physical footprint of the equipment.

Furthermore, significant focus is placed on calibration technology and quality assurance. Next-generation audiometers are incorporating self-diagnostic features and semi-automated calibration check mechanisms, reducing downtime and maintenance costs while ensuring continuous regulatory compliance. The utilization of smart transducers with embedded identification chips simplifies setup and ensures that the correct compensation curves are applied automatically. The future technological trajectory is geared toward miniaturization and enhanced computational power, enabling complex tests, such as Auditory Evoked Potential (AEP) measurements, to be integrated into portable, user-friendly diagnostic systems, thus broadening the range of services that can be delivered outside the traditional clinical setting.

Regional Highlights

The global Digital Diagnostic Audiometer Market exhibits distinct characteristics and growth potential across major geographical regions, influenced by healthcare infrastructure, regulatory mandates, and demographic factors.

- North America (NA): North America, comprising the United States and Canada, represents the most mature and dominant market globally for digital diagnostic audiometers. This leadership is underpinned by exceptionally high per capita healthcare spending, well-established reimbursement policies for audiological testing, and the pervasive presence of leading medical device manufacturers. The region demonstrates a high adoption rate of sophisticated, high-end clinical audiometers and is at the forefront of implementing tele-audiology solutions, heavily leveraging PC-based and internet-connected devices. Stringent occupational safety regulations also necessitate regular hearing monitoring, ensuring robust demand from industrial sectors.

- Europe: The European market is characterized by stringent medical device regulations (e.g., MDR compliance) and well-developed public and private healthcare systems, driving steady demand for high-quality, calibrated devices. Western European nations, such as Germany, the UK, and France, exhibit high penetration rates for advanced audiometers, driven by governmental emphasis on early detection of hearing loss, particularly in the elderly population. The region shows a preference for integrated solutions that meet standardized EU data privacy and interoperability requirements, pushing manufacturers towards advanced software platforms and centralized data management solutions.

- Asia Pacific (APAC): The APAC region is poised for the most accelerated growth over the forecast period. This rapid expansion is attributed to the monumental growth in patient population, increasing disposable income leading to higher healthcare expenditure, and substantial government investments aimed at modernizing healthcare infrastructure in countries like China, India, and Japan. While price sensitivity remains a factor in developing nations within the region, the increasing prevalence of geriatric hearing loss and the establishment of newborn screening programs are creating massive, untapped opportunities for portable and cost-effective digital screening audiometers.

- Latin America (LATAM): The LATAM market is currently characterized by moderate growth, primarily centered in larger economies such as Brazil and Mexico. Market penetration is generally lower compared to developed regions, restrained by fluctuating economic conditions and fragmented healthcare funding structures. However, there is growing interest and investment in public health programs aimed at addressing congenital hearing impairment and industrial hearing conservation, driving demand for robust, easy-to-maintain digital devices suitable for deployment in varied clinical environments.

- Middle East and Africa (MEA): The MEA market is highly heterogeneous. Growth in the Middle Eastern Gulf Cooperation Council (GCC) countries is strong, fueled by oil wealth funding high-standard healthcare systems and rapid urbanization, demanding high-end diagnostic equipment. Conversely, many African nations present low penetration rates, restricted by limited access to specialized healthcare professionals and financial constraints. Opportunities are emerging through non-governmental organizations and philanthropic initiatives focused on delivering basic screening and diagnostic services via highly portable digital technologies.

Top Key Players

The market research report includes a detailed profile of leading stakeholders in the Digital Diagnostic Audiometer Market.- Natus Medical Incorporated

- GN Group (GN Otometrics)

- Interacoustics A/S

- Auditdata A/S

- Benson Medical Instruments Co.

- Inventis SRL

- Maico Diagnostics

- PATH Medical GmbH

- Vivosonic Inc.

- Resonance Audiology S.r.l.

- Starkey Hearing Technologies

- Echo-Acoustics

- Beijing Beier Bioengineering Co., Ltd.

- William Demant Holding A/S (now Demant A/S)

- e3 Diagnostics

- MedRx Inc.

- RION Co., Ltd.

- Otometrics (now part of Natus)

- Kudox Medical

- Micromedical Technologies

Frequently Asked Questions

Analyze common user questions about the Digital Diagnostic Audiometer market and generate a concise list of summarized FAQs reflecting key topics and concerns.What is the primary factor driving the growth of the Digital Diagnostic Audiometer Market?

The predominant driver is the escalating global prevalence of hearing loss, especially among the aging population (presbycusis) and individuals exposed to high levels of industrial or recreational noise (noise-induced hearing loss, NIHL). Increased public health awareness and mandatory screening programs also contribute significantly to sustained market demand.

How are PC-based audiometers changing clinical practice?

PC-based audiometers enhance clinical practice by offering superior portability, reduced physical footprint, and seamless integration with Electronic Health Records (EHRs) and tele-audiology platforms. This modality significantly improves data management efficiency and enables remote diagnostics, extending services beyond traditional clinical settings.

Which geographical region holds the largest market share for digital diagnostic audiometers?

North America currently holds the largest market share, driven by high healthcare expenditure, established reimbursement frameworks, and the early adoption of advanced medical technologies, including high-end clinical and tele-audiology solutions.

What are the main technological advancements impacting the next generation of audiometers?

Key technological advancements include advanced Digital Signal Processing (DSP) for cleaner stimuli generation, integration of AI for assisted diagnosis and workflow automation, and sophisticated cloud connectivity to support remote calibration and maintenance, ensuring high data accuracy and interoperability.

What challenges exist regarding the adoption of digital audiometers in emerging markets?

Major challenges in emerging markets include the high initial cost of sophisticated digital diagnostic units, limited governmental healthcare budgets, and a critical shortage of trained audiology specialists required to operate and interpret results from these precision instruments effectively.

To check our Table of Contents, please mail us at: sales@marketresearchupdate.com

Research Methodology

The Market Research Update offers technology-driven solutions and its full integration in the research process to be skilled at every step. We use diverse assets to produce the best results for our clients. The success of a research project is completely reliant on the research process adopted by the company. Market Research Update assists its clients to recognize opportunities by examining the global market and offering economic insights. We are proud of our extensive coverage that encompasses the understanding of numerous major industry domains.

Market Research Update provide consistency in our research report, also we provide on the part of the analysis of forecast across a gamut of coverage geographies and coverage. The research teams carry out primary and secondary research to implement and design the data collection procedure. The research team then analyzes data about the latest trends and major issues in reference to each industry and country. This helps to determine the anticipated market-related procedures in the future. The company offers technology-driven solutions and its full incorporation in the research method to be skilled at each step.

The Company's Research Process Has the Following Advantages:

- Information Procurement

The step comprises the procurement of market-related information or data via different methodologies & sources.

- Information Investigation

This step comprises the mapping and investigation of all the information procured from the earlier step. It also includes the analysis of data differences observed across numerous data sources.

- Highly Authentic Source

We offer highly authentic information from numerous sources. To fulfills the client’s requirement.

- Market Formulation

This step entails the placement of data points at suitable market spaces in an effort to assume possible conclusions. Analyst viewpoint and subject matter specialist based examining the form of market sizing also plays an essential role in this step.

- Validation & Publishing of Information

Validation is a significant step in the procedure. Validation via an intricately designed procedure assists us to conclude data-points to be used for final calculations.

×

Request Free Sample:

Related Reports

Select License

Why Choose Us

We're cost-effective and Offered Best services:

We are flexible and responsive startup research firm. We adapt as your research requires change, with cost-effectiveness and highly researched report that larger companies can't match.

Information Safety

Market Research Update ensure that we deliver best reports. We care about the confidential and personal information quality, safety, of reports. We use Authorize secure payment process.

We Are Committed to Quality and Deadlines

We offer quality of reports within deadlines. We've worked hard to find the best ways to offer our customers results-oriented and process driven consulting services.

Our Remarkable Track Record

We concentrate on developing lasting and strong client relationship. At present, we hold numerous preferred relationships with industry leading firms that have relied on us constantly for their research requirements.

Best Service Assured

Buy reports from our executives that best suits your need and helps you stay ahead of the competition.

Customized Research Reports

Our research services are custom-made especially to you and your firm in order to discover practical growth recommendations and strategies. We don't stick to a one size fits all strategy. We appreciate that your business has particular research necessities.

Service Assurance

At Market Research Update, we are dedicated to offer the best probable recommendations and service to all our clients. You will be able to speak to experienced analyst who will be aware of your research requirements precisely.

Contact With Our Sales Team

Customer Testimonials

The content of the report is always up to the mark. Good to see speakers from expertise authorities.

Privacy requested , Managing Director

A lot of unique and interesting topics which are described in good manner.

Privacy requested, President

Well researched, expertise analysts, well organized, concrete and current topics delivered in time.

Privacy requested, Development Manager