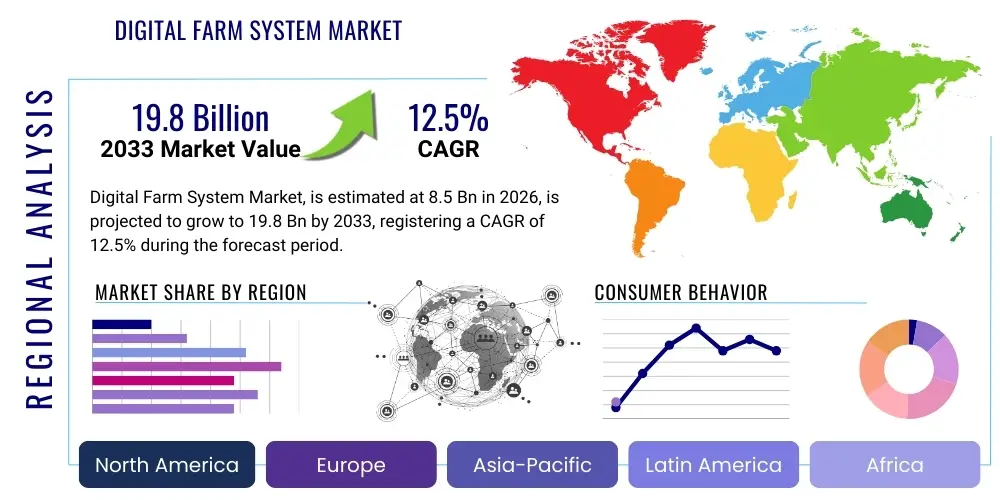

Digital Farm System Market Size, By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2026 to 2033 (Financial Impact Analysis)

ID : MRU_ 442629 | Date : Feb, 2026 | Pages : 245 | Region : Global | Publisher : MRU

Digital Farm System Market Size

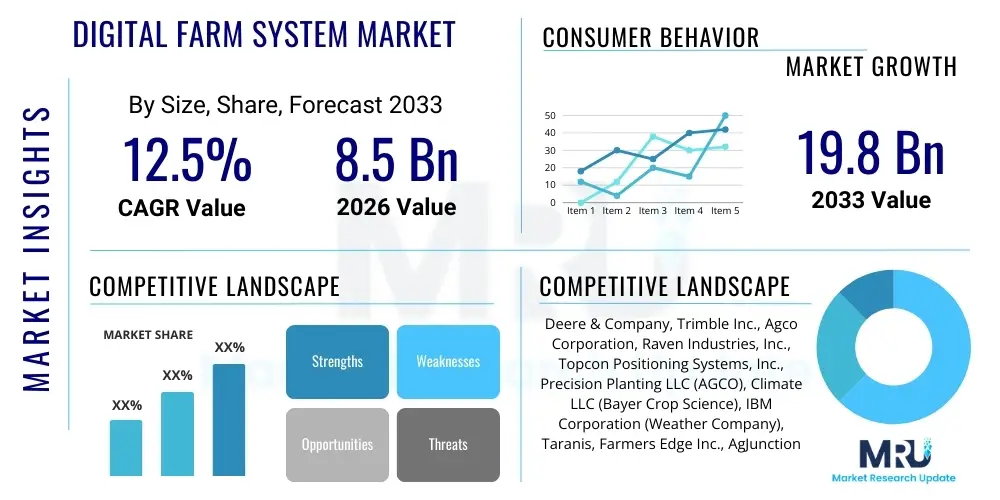

The Digital Farm System Market is projected to grow at a Compound Annual Growth Rate (CAGR) of 12.5% between 2026 and 2033. The market is estimated at USD 8.5 billion in 2026 and is projected to reach USD 19.8 billion by the end of the forecast period in 2033.

Digital Farm System Market introduction

The Digital Farm System Market encompasses the integration of advanced technologies, including the Internet of Things (IoT), sophisticated sensor networks, data analytics, cloud computing, and automation tools, into agricultural practices. These systems are designed to optimize farm management by providing real-time insights into crop health, soil conditions, weather patterns, and livestock status, thereby enabling data-driven decision-making. The core objective of these digital platforms is to enhance productivity, reduce operational costs, minimize resource wastage—particularly water and fertilizer—and ensure sustainable food production in the face of escalating global demand and environmental pressures.

The primary applications of Digital Farm Systems span precision agriculture, livestock monitoring, supply chain traceability, and farm automation. Precision agriculture utilizes these systems for variable rate application of inputs, detailed yield mapping, and prescriptive guidance for planting and harvesting. The product portfolio ranges from software-as-a-service (SaaS) platforms for data visualization and management to interconnected hardware components like automated irrigation systems, drones for field scouting, and robotic harvesting machinery. The market is highly influenced by the increasing complexity of global supply chains requiring stringent quality control and verifiable sustainability metrics, which digital systems inherently provide.

Key benefits driving the market include improved operational efficiency, higher crop yields per unit of land, enhanced sustainability through targeted resource use, and better risk management against unpredictable climatic events. These systems facilitate the transition from traditional, reactive farming methods to proactive, predictive models, directly addressing challenges such as labor shortages and volatile commodity prices. The underlying driving factors are the necessity to feed a rapidly growing global population, coupled with diminishing arable land and the imperative for agriculture to reduce its environmental footprint, positioning digital solutions as essential tools for the future of farming.

Digital Farm System Market Executive Summary

The Digital Farm System Market is characterized by robust growth, propelled primarily by technological convergence and increased institutional investment in agricultural innovation. Business trends indicate a significant shift toward subscription-based SaaS models, making high-level analytics accessible to smaller farming operations, complementing the traditional capital expenditure associated with hardware installation. Furthermore, strategic partnerships between AgTech startups, established agricultural machinery manufacturers, and telecommunications providers are accelerating the deployment of integrated solutions, focusing heavily on interoperability and seamless data exchange across different farm devices and platforms. The push for agricultural resilience and resource efficiency acts as a central theme driving product development and market penetration globally.

Regional trends demonstrate North America and Europe retaining dominance due to high adoption rates of advanced precision farming techniques, strong governmental support for sustainable agriculture, and well-developed digital infrastructure. However, the Asia Pacific region, particularly countries like India and China, is projected to exhibit the fastest growth, driven by large-scale government initiatives promoting modernization, increasing awareness of the benefits of digitalization among smallholder farmers, and the necessity to dramatically increase domestic food production efficiency. Latin America is also emerging as a key growth area, focusing on optimizing high-value crop production through satellite imagery and advanced telemetry systems.

Segment trends reveal that the software and services segment, including data analytics, farm management software (FMS), and consulting services, holds the largest market share and is expected to grow rapidly, reflecting the increasing value placed on actionable intelligence over raw data collection. Among hardware components, sensors and monitoring devices are crucial foundational elements, while the adoption of fully autonomous machinery, though nascent, represents a high-potential future segment. The crop management application sub-segment remains the largest, but livestock monitoring is witnessing accelerated demand driven by concerns over animal welfare, disease prevention, and optimized breeding schedules.

AI Impact Analysis on Digital Farm System Market

User inquiries regarding Artificial Intelligence (AI) in the Digital Farm System Market frequently center on its practical applications in enhancing decision support, managing risks, and reducing dependency on manual labor. Common questions address how AI-powered predictive analytics can optimize irrigation schedules, whether computer vision algorithms are reliable for pest and disease detection, and the economic viability of integrating machine learning models into existing farm infrastructure. There is also significant user concern about data privacy, ownership of proprietary algorithms, and the necessary technical expertise required to manage these sophisticated systems. These analyses converge on the theme that users expect AI to transition farming from reactive management to highly autonomous and prescriptive operation, prioritizing systems that offer clear Return on Investment (ROI) through enhanced yield prediction and ultra-precise resource allocation, while demanding transparency and accessibility in implementation.

AI's primary influence lies in its ability to process the massive volumes of heterogeneous data generated by IoT sensors, drones, and satellites, transforming it into prescriptive insights far beyond the capabilities of conventional statistical methods. Machine learning (ML) models are integral to creating highly localized climate forecasts, optimizing seed variability based on micro-climatic zone mapping, and developing highly specific nutrient application strategies. Furthermore, AI-driven automation systems, such as robotic weeders utilizing deep learning for identification, are addressing critical labor shortages and enhancing operational precision. This technological integration is shifting the market focus from merely collecting data to generating highly personalized and actionable intelligence for every square meter of farmland.

The generative capabilities of AI are beginning to influence the development cycle of farm management software, enabling personalized user interfaces and automating complex reporting requirements for regulatory compliance. AI contributes significantly to breeding programs by analyzing genetic markers and phenotypic data at scale, accelerating the development of climate-resilient crop varieties. This deeper integration ensures that Digital Farm Systems evolve from simple monitoring tools into comprehensive, intelligent production management platforms that autonomously adapt to environmental variability, thereby boosting farm sustainability and overall economic efficiency across diverse agricultural ecosystems globally.

- Predictive Analytics: AI models optimize planting, irrigation, and harvesting timing by integrating historical data with real-time sensor feedback and advanced weather forecasts, leading to higher yield stability.

- Disease and Pest Identification: Computer vision and deep learning algorithms analyze drone imagery and stationary camera feeds to detect early signs of crop stress, disease outbreaks, or pest infestations with high accuracy, enabling targeted intervention.

- Automated Robotics: AI drives the navigation, task execution, and learning capabilities of autonomous tractors, robotic harvesters, and precision sprayers, minimizing human error and reducing labor costs.

- Resource Optimization: Machine learning fine-tunes variable rate application (VRA) technologies for seeds, fertilizers, and pesticides, ensuring inputs are delivered only where needed, dramatically reducing waste and environmental impact.

- Supply Chain Traceability: AI processes blockchain-integrated data to ensure verifiable provenance and quality control from farm to consumer, enhancing transparency and mitigating food safety risks.

DRO & Impact Forces Of Digital Farm System Market

The Digital Farm System Market is primarily propelled by the critical need for global food security, which mandates increased output efficiency without expanding arable land usage. Key drivers include supportive governmental policies promoting agricultural modernization, the continuous decline in sensor and connectivity hardware costs, making systems more accessible, and the undeniable long-term threat of climate change necessitating resilient, resource-efficient farming methods. However, the market faces significant restraints, notably the high initial capital investment required for comprehensive digital infrastructure setup, the steep learning curve and lack of technical literacy among aging farming populations, and persistent challenges related to data interoperability and security across disparate technology platforms. These opposing forces dictate the pace and geography of market adoption.

Opportunities within the sector are extensive, particularly the development of customized, hyper-localized solutions targeting smallholder farms in emerging economies, a demographic often underserved by current enterprise-scale systems. The expansion of 5G and low-power wide-area network (LPWAN) connectivity offers a massive opportunity to deploy robust IoT networks even in remote rural areas, unlocking new markets. Furthermore, the convergence of digital farming data with financial services, such as parametric insurance based on real-time climate data, presents a novel avenue for risk mitigation and business model innovation. The global pressure for environmental, social, and governance (ESG) compliance is also creating a strong opportunity, as digital systems provide the necessary auditable data for sustainable certifications.

The impact forces within this market are substantial and multifaceted. Economically, digital systems offer enhanced profitability through waste reduction and optimized output, creating a strong positive incentive for adoption. Socially, these technologies are transforming the role of the farmer, requiring higher-level analytical skills and offering solutions to demographic challenges like rural depopulation and labor shortages. Environmentally, the impact is overwhelmingly positive, enabling significant reductions in chemical runoff and greenhouse gas emissions through precision application. Technologically, the rapid advancements in AI, edge computing, and sensor miniaturization ensure a continuous evolution of capabilities, maintaining a high level of dynamism within the competitive landscape and consistently lowering the barriers to achieving truly autonomous farm operations.

Segmentation Analysis

The Digital Farm System market is intricately segmented based on technology, application, components, farm type, and region, allowing for detailed analysis of adoption trends and investment foci across the agricultural spectrum. Segmentation by component is foundational, differentiating between the revenue streams generated by hardware (sensors, drones, robotic machinery), software (Farm Management Systems, data analytics platforms), and services (consulting, integration, maintenance). Application segmentation highlights the primary use cases, with Crop Management systems dominating, followed by Yield Monitoring, Field Mapping, Irrigation Management, and Livestock Monitoring solutions, each addressing distinct operational needs within the farming enterprise. These classifications enable stakeholders to target specific technological pain points and optimize their product portfolios for specialized farming needs.

Furthermore, segmentation by farm type—ranging from large industrial farms (which are early and high-volume adopters) to small and medium-sized family farms (which require cost-effective, scalable solutions)—reveals differing demands for complexity and investment capacity. Geographically, the market analysis is crucial for understanding regulatory nuances and infrastructure readiness, with established markets like North America driving innovation in robotics and emerging markets like APAC focusing on leveraging mobile technology for data dissemination. The interconnected nature of these segments means that innovation in one area, such as sensor technology, rapidly influences the capabilities and growth rates of related applications, such as predictive irrigation scheduling, driving holistic market expansion.

- Component:

- Hardware (Sensors, GPS/GNSS, Drones, Robotics, Automation Machinery)

- Software (Farm Management Software, Data Analytics Platforms, SaaS)

- Services (Consulting, System Integration, Managed Services)

- Application:

- Yield Monitoring and Management

- Field Mapping and Variable Rate Technology (VRT)

- Irrigation Management

- Crop Scouting and Pest Management

- Livestock Monitoring and Management

- Inventory Management and Logistics

- Farm Type:

- Large Farms (Industrial Scale)

- Small and Medium Farms (SMEs)

- Technology Type:

- Precision Farming

- Smart Greenhouse Farming

- Vertical Farming

Value Chain Analysis For Digital Farm System Market

The value chain for the Digital Farm System Market begins with upstream activities focused on the development and manufacturing of foundational technologies. This includes the production of high-precision sensors, advanced GPS/GNSS modules, specialized farm machinery components, and the core development of complex data management and AI algorithms by technology providers and semiconductor manufacturers. This stage requires significant R&D investment and standardization efforts to ensure the reliability and interoperability of data captured in diverse agricultural environments. Key participants here include component suppliers and high-tech R&D institutions that form the technological bedrock of the entire digital ecosystem, focusing on miniaturization, power efficiency, and connectivity standards like 5G and LoRaWAN.

The midstream of the value chain involves the system integrators, software developers, and platform providers who aggregate raw hardware components and vast datasets into functional, user-friendly Digital Farm Systems. This stage is crucial for translating complex technological outputs into actionable agricultural insights (e.g., prescriptive application maps or predictive disease alerts). Distribution channels play a vital role here; direct channels involve large agricultural equipment manufacturers offering proprietary integrated solutions bundled with their machinery, ensuring seamless compatibility and direct farmer support. Indirect channels involve value-added resellers (VARs), agricultural cooperatives, and specialized AgTech distributors who provide customization, training, and maintenance services, adapting global platforms to local farming practices and regulatory requirements.

Downstream activities focus on the end-user adoption and sustained usage of these systems. This includes data hosting and cloud service provision, ongoing technical support, and the continuous flow of data feedback that improves algorithm accuracy. The sustainability of the market hinges on the effective distribution of reliable and affordable connectivity, coupled with robust training and support services to maximize farmer ROI. Furthermore, the downstream includes secondary users of the farm data, such as crop insurance companies utilizing real-time yield estimates for risk modeling and food processors requiring verifiable sustainability data, demonstrating the expanding influence of digital systems beyond the farm gate and across the entire food supply chain.

Digital Farm System Market Potential Customers

The primary and most significant end-users of Digital Farm Systems are large-scale commercial farming enterprises, particularly those engaged in high-value, commodity crops like corn, soy, wheat, and specialty crops such as fruits and vegetables. These customers possess the necessary capital expenditure capacity to invest in advanced hardware like autonomous machinery and drones, and their scale ensures a high return on investment from optimizing input costs (fertilizer, water, pesticides). Their key procurement drivers are efficiency gains, regulatory compliance, and the ability to demonstrate sustainability metrics to corporate buyers and consumers. Their demand leans toward comprehensive, integrated platforms that manage operations across multiple fields and potentially different geographies, requiring sophisticated API integration and cloud infrastructure.

A rapidly growing segment of potential customers includes small and medium-sized family farms, especially in regions with government subsidies or cooperative support for technology adoption. While these farms may initially adopt simpler, connectivity-focused solutions (e.g., mobile-based soil sensing and basic farm management software), their collective number represents a vast untapped market potential. The systems developed for this segment must prioritize affordability, ease of use, and compatibility with existing, older equipment. Livestock operations, including large feedlots and dairy farms, constitute another critical customer base, requiring specialized digital systems for automated health monitoring, feeding optimization, and traceability mandated by strict animal welfare standards and health regulations.

Beyond traditional farmers, institutional buyers also serve as crucial customers. These include agricultural cooperatives, which purchase and manage digital infrastructure on behalf of their members; governmental and non-governmental agricultural research organizations, which use these systems for advanced field trials and data collection; and environmental conservation agencies, which leverage precision farming data to monitor and manage watershed health and biodiversity. These institutional clients drive demand for specialized, high-resolution data collection tools and advanced analytical reporting capabilities, further diversifying the market demand profile beyond core production efficiency.

| Report Attributes | Report Details |

|---|---|

| Market Size in 2026 | USD 8.5 billion |

| Market Forecast in 2033 | USD 19.8 billion |

| Growth Rate | 12.5% CAGR |

| Historical Year | 2019 to 2024 |

| Base Year | 2025 |

| Forecast Year | 2026 - 2033 |

| DRO & Impact Forces |

|

| Segments Covered |

|

| Key Companies Covered | Deere & Company, Trimble Inc., Agco Corporation, Raven Industries, Inc., Topcon Positioning Systems, Inc., Precision Planting LLC (AGCO), Climate LLC (Bayer Crop Science), IBM Corporation (Weather Company), Taranis, Farmers Edge Inc., AgJunction Inc., Bosch Deepfield Robotics, Fasal, Granular (Corteva Agriscience), Hexagon AB, CNH Industrial N.V. (Case IH), Sentera, CropX Technologies, Pessl Instruments GmbH, Autostead (Kubota) |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Enquiry Before Buy | Have specific requirements? Send us your enquiry before purchase to get customized research options. Request For Enquiry Before Buy |

Digital Farm System Market Key Technology Landscape

The technological landscape of the Digital Farm System Market is defined by the synergistic integration of several cutting-edge fields. Central to this is the Internet of Agricultural Things (IoAT), which utilizes a dense network of connected devices, including high-resolution soil sensors, weather stations, and telemetry devices on machinery, to gather granular, real-time data from the field. This vast data flow necessitates robust communication protocols, predominantly leveraging low-power wide-area network (LPWAN) technologies like LoRa and NB-IoT for sensor data transmission, complemented by 4G and emerging 5G networks to support high-bandwidth applications like drone and autonomous vehicle control. The advancement in sensor technology, particularly multi-spectral and hyperspectral sensors mounted on unmanned aerial vehicles (UAVs), provides unprecedented detail regarding plant health and soil composition, forming the primary input source for predictive models.

Data processing and analysis constitute the second major pillar. Cloud computing platforms (e.g., AWS, Microsoft Azure, Google Cloud) provide the scalable infrastructure required to store and process petabytes of agricultural data. Critically, the adoption of edge computing—processing data directly on the farm machinery or local gateways—is gaining traction. This reduces latency for time-sensitive tasks, such as immediate adjustments to sprayer nozzles or robotic guidance systems, enabling true real-time automation. The efficacy of these systems relies heavily on sophisticated farm management software (FMS) which serves as the central operational dashboard, integrating data visualization, prescription mapping, and record-keeping, often utilizing open-source APIs to ensure compatibility across heterogeneous farm equipment fleets.

Furthermore, positioning technologies, primarily highly accurate Real-Time Kinematic (RTK) enabled GPS/GNSS, are indispensable for enabling sub-centimeter accuracy required by autonomous machinery and Variable Rate Technology (VRT) applications, ensuring precise input delivery. Artificial Intelligence (AI) and Machine Learning (ML) algorithms are woven throughout this ecosystem, transforming raw data into prescriptive models for optimized resource use, pest management, and yield forecasting. Advanced robotics, encompassing autonomous tractors, weeding robots, and automated harvesting systems, integrate computer vision and AI to execute tasks previously demanding extensive manual labor. This convergence of hardware, connectivity, and intelligent software defines the modern technological capability and future trajectory of digital farming.

Regional Highlights

- North America (NA): Characterized by large farm sizes, high capital investment capacity, and early, widespread adoption of precision agriculture, North America remains the leading market. Adoption is driven by major players like the U.S. and Canada prioritizing productivity and efficiency. Strong government support for R&D and established technological infrastructure, coupled with the dominance of major agricultural equipment manufacturers investing heavily in integrated digital platforms, solidify its market leadership. The focus here is on autonomous operations and advanced analytics for commodity crops.

- Europe: The European market is highly regulated, prioritizing sustainability, reduced chemical use, and environmental conservation. This regulatory environment strongly drives the demand for digital systems that provide granular data for compliance and traceability. High broadband penetration and EU funding programs for digital innovation (e.g., Common Agricultural Policy modernization) support growth, focusing intensely on Smart Greenhouse systems, advanced yield monitoring, and livestock health management solutions to meet stringent welfare standards.

- Asia Pacific (APAC): APAC is projected to be the fastest-growing region, owing to massive populations demanding increased food production and extensive government initiatives promoting smart farming (e.g., Digital India, China’s agricultural modernization plans). Although adoption is highly fragmented between large commercial plantations and millions of smallholder farms, the availability of low-cost mobile and IoT solutions is driving exponential growth, particularly in telemetry, basic data services, and subsidized access to digital advice. The sheer volume of farming operations provides immense growth potential.

- Latin America (LATAM): Growth in LATAM is concentrated in agricultural powerhouses like Brazil and Argentina, specializing in large-scale commodity exports. The market is driven by the need to optimize vast land areas using satellite imagery, robust data analytics for yield mapping, and efficient resource deployment to manage high input costs. Connectivity challenges in remote areas are being addressed through hybrid satellite and cellular IoT solutions, focusing on systems that optimize fertilizer and water usage in volatile climate zones.

- Middle East and Africa (MEA): This region presents unique challenges and opportunities, primarily driven by severe water scarcity and the need for localized food security. Digital Farm System adoption is focused on high-tech solutions like controlled environment agriculture (CEA), smart irrigation, and precision fertilization in arid climates. Government investment in food security projects, particularly in the UAE and Saudi Arabia, and increasing private investment in African AgTech startups are the key catalysts for digital deployment.

Top Key Players

The market research report includes a detailed profile of leading stakeholders in the Digital Farm System Market.- Deere & Company

- Trimble Inc.

- Agco Corporation

- Raven Industries, Inc.

- Topcon Positioning Systems, Inc.

- Precision Planting LLC (AGCO)

- Climate LLC (Bayer Crop Science)

- IBM Corporation (Weather Company)

- Taranis

- Farmers Edge Inc.

- AgJunction Inc.

- Bosch Deepfield Robotics

- Fasal

- Granular (Corteva Agriscience)

- Hexagon AB

- CNH Industrial N.V. (Case IH)

- Sentera

- CropX Technologies

- Pessl Instruments GmbH

- Autostead (Kubota)

Frequently Asked Questions

Analyze common user questions about the Digital Farm System market and generate a concise list of summarized FAQs reflecting key topics and concerns.What is the primary factor driving the growth of the Digital Farm System Market?

The primary driver is the critical global necessity for achieving food security and enhancing agricultural sustainability under escalating environmental pressures. Digital Farm Systems enable precision resource allocation, minimizing waste and maximizing yields, which is essential given diminishing arable land and climate volatility.

How does AI contribute to the efficiency of Digital Farm Systems?

AI, specifically machine learning, processes vast sensor data to deliver prescriptive insights. This enables automated decision-making in irrigation, targeted pest detection via computer vision, and highly accurate predictive yield modeling, moving farming from reactive to fully optimized operations.

Which geographical region holds the largest market share in Digital Farm Systems?

North America currently holds the largest market share, driven by large commercial farming operations, high levels of technology adoption, and significant corporate and governmental investment in precision agriculture hardware and software platforms.

What are the main restraints hindering widespread adoption of Digital Farm Systems?

Key restraints include the substantial initial capital investment required for implementing integrated systems, challenges related to ensuring data interoperability between different vendor platforms, and the skills gap or lack of technical training among the existing agricultural workforce.

What role do IoT sensors play in modern Digital Farm Systems?

IoT sensors are foundational components, providing the raw, real-time data input necessary for system functionality. They monitor crucial parameters such as soil moisture levels, nutrient content, ambient temperature, and machine performance, enabling precision intervention via automated hardware.

To check our Table of Contents, please mail us at: sales@marketresearchupdate.com

Research Methodology

The Market Research Update offers technology-driven solutions and its full integration in the research process to be skilled at every step. We use diverse assets to produce the best results for our clients. The success of a research project is completely reliant on the research process adopted by the company. Market Research Update assists its clients to recognize opportunities by examining the global market and offering economic insights. We are proud of our extensive coverage that encompasses the understanding of numerous major industry domains.

Market Research Update provide consistency in our research report, also we provide on the part of the analysis of forecast across a gamut of coverage geographies and coverage. The research teams carry out primary and secondary research to implement and design the data collection procedure. The research team then analyzes data about the latest trends and major issues in reference to each industry and country. This helps to determine the anticipated market-related procedures in the future. The company offers technology-driven solutions and its full incorporation in the research method to be skilled at each step.

The Company's Research Process Has the Following Advantages:

- Information Procurement

The step comprises the procurement of market-related information or data via different methodologies & sources.

- Information Investigation

This step comprises the mapping and investigation of all the information procured from the earlier step. It also includes the analysis of data differences observed across numerous data sources.

- Highly Authentic Source

We offer highly authentic information from numerous sources. To fulfills the client’s requirement.

- Market Formulation

This step entails the placement of data points at suitable market spaces in an effort to assume possible conclusions. Analyst viewpoint and subject matter specialist based examining the form of market sizing also plays an essential role in this step.

- Validation & Publishing of Information

Validation is a significant step in the procedure. Validation via an intricately designed procedure assists us to conclude data-points to be used for final calculations.

×

Request Free Sample:

Related Reports

Select License

Why Choose Us

We're cost-effective and Offered Best services:

We are flexible and responsive startup research firm. We adapt as your research requires change, with cost-effectiveness and highly researched report that larger companies can't match.

Information Safety

Market Research Update ensure that we deliver best reports. We care about the confidential and personal information quality, safety, of reports. We use Authorize secure payment process.

We Are Committed to Quality and Deadlines

We offer quality of reports within deadlines. We've worked hard to find the best ways to offer our customers results-oriented and process driven consulting services.

Our Remarkable Track Record

We concentrate on developing lasting and strong client relationship. At present, we hold numerous preferred relationships with industry leading firms that have relied on us constantly for their research requirements.

Best Service Assured

Buy reports from our executives that best suits your need and helps you stay ahead of the competition.

Customized Research Reports

Our research services are custom-made especially to you and your firm in order to discover practical growth recommendations and strategies. We don't stick to a one size fits all strategy. We appreciate that your business has particular research necessities.

Service Assurance

At Market Research Update, we are dedicated to offer the best probable recommendations and service to all our clients. You will be able to speak to experienced analyst who will be aware of your research requirements precisely.

Contact With Our Sales Team

Customer Testimonials

The content of the report is always up to the mark. Good to see speakers from expertise authorities.

Privacy requested , Managing Director

A lot of unique and interesting topics which are described in good manner.

Privacy requested, President

Well researched, expertise analysts, well organized, concrete and current topics delivered in time.

Privacy requested, Development Manager