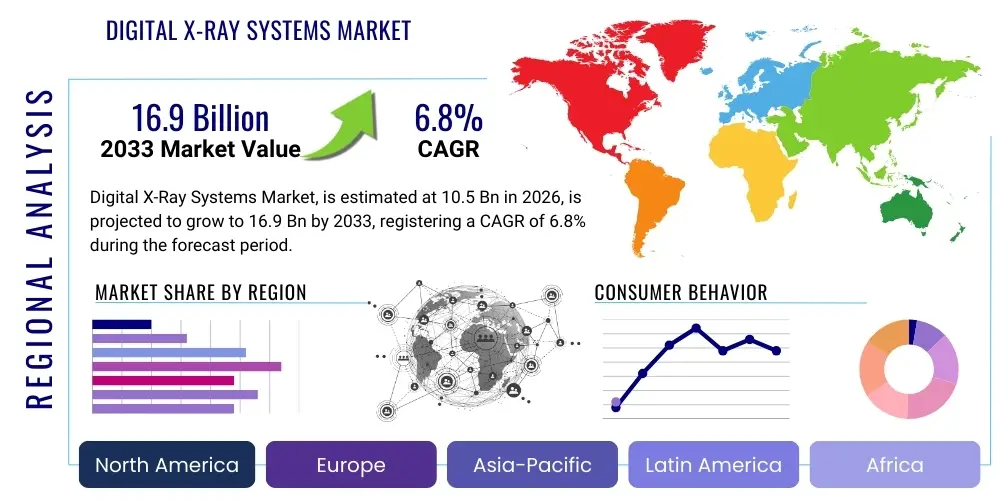

Digital X-Ray Systems Market Size, By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2026 to 2033 (Financial Impact Analysis)

ID : MRU_ 441177 | Date : Feb, 2026 | Pages : 245 | Region : Global | Publisher : MRU

Digital X-Ray Systems Market Size

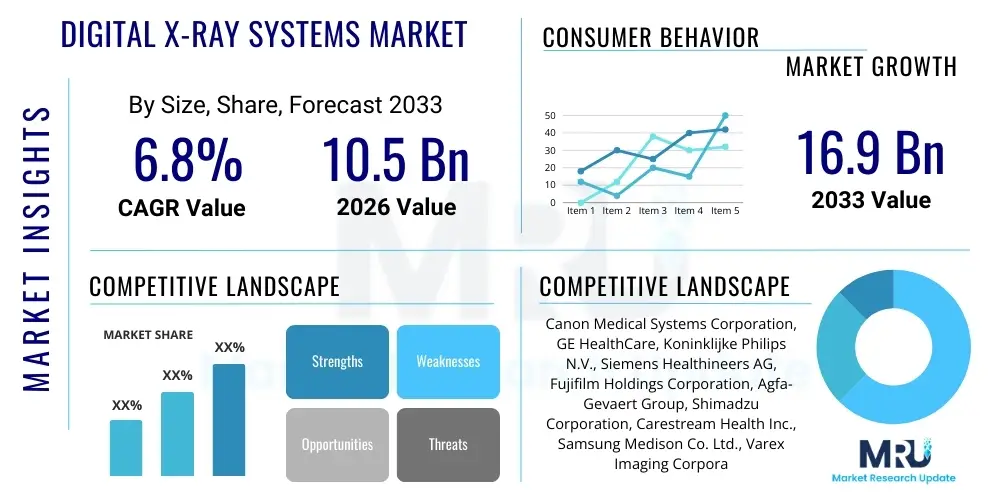

The Digital X-Ray Systems Market is projected to grow at a Compound Annual Growth Rate (CAGR) of 6.8% between 2026 and 2033. The market is estimated at $10.5 Billion in 2026 and is projected to reach $16.9 Billion by the end of the forecast period in 2033.

Digital X-Ray Systems Market introduction

The Digital X-Ray Systems Market encompasses advanced medical imaging devices that convert X-ray photons into digital images, replacing traditional film-based radiography. These systems, primarily categorized into Computed Radiography (CR) and Direct Radiography (DR), offer significant advantages, including immediate image processing, enhanced image quality through post-processing capabilities, reduced radiation exposure, and seamless integration with Picture Archiving and Communication Systems (PACS) and Electronic Health Records (EHR). The fundamental shift towards digital modalities is driven by the global imperative to improve diagnostic workflow efficiency and patient outcomes, particularly in high-volume settings like emergency rooms and primary care centers.

Major applications for digital X-ray systems span general radiography, fluoroscopy, mammography, and dental imaging. General radiography remains the largest segment, utilized for diagnosing musculoskeletal conditions, chest infections, and internal injuries. The key benefit of digitalization lies in workflow optimization; digital images can be viewed remotely, shared instantaneously with specialists, and stored efficiently without physical archiving costs. This accessibility speeds up the diagnostic cycle, crucial for time-sensitive treatments. Furthermore, the inherent dose reduction capabilities associated with modern DR detectors address patient safety concerns, positioning digital systems as the standard of care globally.

Driving factors propelling market expansion include the increasing prevalence of chronic diseases (such as cardiovascular and respiratory ailments) requiring consistent imaging surveillance, coupled with a rapidly aging global population that demands sophisticated diagnostic tools. Significant technological advancements, notably in flat-panel detectors (FPDs) offering higher resolution and increased portability, are stimulating replacement cycles in developed economies and initial adoption in emerging markets. Government initiatives supporting healthcare infrastructure modernization and mandating the adoption of digital health technologies further cement the market's robust growth trajectory, pushing providers towards fully integrated digital imaging suites.

Digital X-Ray Systems Market Executive Summary

The Digital X-Ray Systems Market is characterized by intense technological innovation, focusing heavily on enhancing portability, improving dose efficiency, and integrating Artificial Intelligence (AI) for automated image analysis and workflow optimization. Business trends indicate a strong preference among healthcare providers for Direct Radiography (DR) systems over legacy Computed Radiography (CR) systems due to DR's superior speed and image fidelity. Furthermore, strategic collaborations and mergers acquisitions among key players are common, aimed at consolidating market share and expanding product portfolios, especially concerning sophisticated detectors and value-added software solutions. The shift toward subscription-based models (X-ray as a Service) is emerging, offering smaller clinics access to high-end technology with lower upfront capital expenditure.

Regional trends highlight North America and Europe as mature markets driven primarily by technological replacements and regulatory standards demanding high diagnostic quality. Conversely, the Asia Pacific (APAC) region is poised for the highest growth, fueled by massive government investment in expanding public healthcare infrastructure, rising medical tourism, and a burgeoning patient pool in large economies like China and India. Latin America and the Middle East Africa (MEA) are also experiencing accelerated adoption, often bypassing older technologies directly for advanced digital systems, supported by increasing private investment in modern hospitals and diagnostic centers. Localization of manufacturing and service networks is critical for success in these high-growth emerging regions.

Segment trends emphasize the rapid growth of the portable/mobile segment, essential for critical care units, operating rooms, and remote imaging needs. Detector technology is converging on dynamic flat-panel detectors for advanced applications like fluoroscopy and angiography. In terms of end-users, hospitals continue to be the primary purchasers, but specialized diagnostic centers and ambulatory surgical centers are increasing their procurement volume, favoring compact and highly efficient standalone digital systems. The software segment, encompassing AI tools for detection and PACS integration, is growing faster than the hardware segment, reflecting the increasing importance of informatics in optimizing diagnostic pathways and clinical decision-making across diverse healthcare settings.

AI Impact Analysis on Digital X-Ray Systems Market

User inquiries regarding the impact of AI on the Digital X-Ray Systems Market frequently center on automation reliability, diagnostic accuracy improvement, regulatory approval timelines, and the potential displacement of human radiographers. Key themes reveal a strong expectation that AI will revolutionize workflow efficiency by prioritizing critical scans (triage) and automating repetitive tasks like measurement and reporting standardization. Users are concerned about data security and algorithmic bias, but simultaneously recognize AI's indispensable role in addressing the global shortage of skilled radiologists, especially in complex areas like fracture detection, lung nodule analysis, and early-stage disease identification. The consensus highlights that AI integration will shift the radiologist's role from primary image interpretation to complex case review and interventional procedures.

- AI-Powered Triage and Workflow Optimization: Algorithms rapidly analyze studies to identify high-priority or critical findings, automatically flagging them for immediate radiologist attention, significantly decreasing turnaround times in high-volume settings like emergency departments.

- Enhanced Diagnostic Consistency: AI tools offer objective measurements and lesion detection capabilities, reducing inter-observer variability and improving the consistency and reliability of standard radiographic diagnoses, particularly for subtle findings.

- Dose Optimization and Quality Control: Machine learning models assist in real-time image processing, ensuring optimal image quality with the lowest possible radiation dose, and automating quality assurance checks on system performance.

- Automated Reporting and Structured Data Generation: AI facilitates the drafting of preliminary reports and converts complex image findings into standardized, quantifiable data points, enabling faster documentation and better integration with EHR systems for clinical decision support.

- Integration into Mobile and Point-of-Care Systems: AI processing capabilities embedded directly into portable X-ray units allow for immediate, preliminary interpretations at the patient's bedside, accelerating care decisions outside the central imaging department.

DRO & Impact Forces Of Digital X-Ray Systems Market

The Digital X-Ray Systems Market is significantly influenced by a dynamic set of driving forces and strategic restraints, balanced by substantial long-term opportunities. The primary driver is the accelerating shift from analog to digital modalities, fueled by regulatory mandates and the undeniable efficiency gains offered by digital imaging. Restraints largely center on the high initial capital investment required for advanced DR systems, which poses a significant hurdle for smaller clinics and healthcare providers in developing economies, coupled with complex interoperability challenges between different vendor systems and existing hospital informatics infrastructure. The impact forces show a strong push towards innovation, where the demand for lower radiation exposure and rapid diagnostic results outweighs the initial cost barrier for major healthcare networks, solidifying the market's expansion despite economic fluctuations.

Opportunities abound in emerging markets where modernization is ongoing, presenting greenfield potential for the installation of entirely new digital infrastructures. Furthermore, the ongoing evolution of detector materials (e.g., CMOS technology) promises lower manufacturing costs and higher performance, potentially mitigating the current high price point restraint. The integration of advanced computational techniques, particularly AI and deep learning, opens new service avenues, allowing vendors to offer highly specialized analytical software alongside hardware. The cumulative impact of these forces suggests sustained, though uneven, market growth, with technological advancements acting as the primary catalyst, continuously redefining the standard of care in medical imaging.

- Drivers: Growing prevalence of chronic diseases; increasing preference for efficiency and reduced radiation dose; technological advancements in flat-panel detectors (FPDs); government initiatives supporting digital health infrastructure.

- Restraints: High initial investment costs for DR systems; complex regulatory approval pathways for advanced AI-integrated devices; lack of skilled professionals to operate and maintain sophisticated digital systems in certain regions.

- Opportunities: Untapped potential in high-growth emerging economies; development of low-cost, high-performance detector technologies; expansion of mobile and portable X-ray solutions; integration of Artificial Intelligence for enhanced diagnostics and workflow.

- Impact Forces: Technology Adoption (High); Regulatory Scrutiny (Medium); Healthcare Spending (High); Competitive Rivalry (High).

Segmentation Analysis

The Digital X-Ray Systems Market is extensively segmented based on technology, portability, application, and end-user, providing a granular view of market dynamics. Technology segmentation distinguishes between Direct Radiography (DR) and Computed Radiography (CR), with DR systems dominating new installations due to their superior speed and image quality, although CR still holds significant market share in resource-constrained settings or as an affordable upgrade from analog systems. The application segments are crucial, reflecting specific clinical demands, ranging from highly specialized fields like mammography to the high-volume requirements of general radiography. Understanding these segment dynamics is essential for market participants to tailor their R&D investments and go-to-market strategies effectively.

The portability segment is witnessing transformative growth, driven by the increasing need for point-of-care diagnostics, infection control measures (reducing patient transport), and improved accessibility in decentralized healthcare models. Mobile systems are designed to be lightweight, easy to maneuver, and often include battery power, making them ideal for intensive care units and operating rooms. Stationary systems remain the backbone for high-throughput dedicated imaging departments. End-user segmentation reveals that hospitals, due to their comprehensive service offerings and high patient volume, are the largest consumers of digital X-ray technology, but the fastest growth rate is observed in specialized diagnostic centers and clinics due to the increasing trend toward outpatient care.

- By Technology:

- Direct Radiography (DR) Systems

- Computed Radiography (CR) Systems

- By Portability:

- Stationary Digital X-ray Systems

- Portable Digital X-ray Systems (Mobile Units)

- By Application:

- General Radiography

- Fluoroscopy

- Mammography

- Dental Imaging (Intraoral, Panoramic)

- Others (e.g., Veterinary, Security)

- By End-User:

- Hospitals and Clinics

- Diagnostic Centers

- Ambulatory Surgical Centers (ASCs)

- Other Healthcare Facilities

Value Chain Analysis For Digital X-Ray Systems Market

The value chain for Digital X-Ray Systems begins with specialized upstream suppliers providing critical raw materials and components, such as semiconductor materials, scintillators (like Gadolinium Oxysulfide or Cesium Iodide), and complex electronics necessary for the fabrication of high-performance flat-panel detectors. Research and Development activities, particularly those focused on AI algorithms and advanced detector physics, are crucial at this stage, setting the technological benchmark for the final product. Key activities include detector panel manufacturing, software development (PACS/EHR integration), and system assembly, which demand high precision and stringent quality control, defining the initial cost structure and technical capability of the resulting systems.

The middle segment of the chain involves system manufacturing and assembly, dominated by major multinational OEMs who integrate components sourced globally. Distribution channels are varied and highly regulated. Direct sales are common for high-value contracts with large hospital networks, allowing OEMs to control pricing, service delivery, and direct training. Indirect distribution, leveraging authorized dealers and distributors, is crucial for penetrating smaller regional markets, particularly in APAC and Latin America, where local market knowledge and established service networks are essential. Service agreements and maintenance contracts constitute a significant part of the revenue stream, ensuring long-term customer relationships and stable post-sales income.

Downstream analysis focuses on installation, user training, and continuous maintenance provided to end-users like hospitals and diagnostic centers. The effective integration of the digital X-ray system with existing hospital IT infrastructure (PACS, RIS) is a critical downstream activity that determines customer satisfaction and system utilization. Potential customers, including healthcare providers and governmental health agencies, derive value from the system's ability to deliver rapid, high-quality diagnostic images, thereby improving clinical workflow and patient care quality, ultimately impacting the entire healthcare ecosystem and reducing operational costs associated with traditional film methods.

Digital X-Ray Systems Market Potential Customers

The primary consumers of Digital X-Ray Systems are institutional healthcare providers requiring high-volume imaging capabilities and seamless integration with digital medical records. Hospitals, both public and private, represent the largest segment of potential buyers, particularly academic and large tertiary care centers that demand advanced, high-throughput stationary DR systems for their radiology departments and mobile units for emergency and critical care. These institutions prioritize systems that offer superior diagnostic certainty, low dose capabilities, and robust service support, often engaging in large capital procurement cycles.

Secondary but rapidly expanding customer segments include specialized diagnostic imaging centers and smaller ambulatory surgical centers (ASCs). These entities often seek compact, efficient, and cost-effective digital systems, such as dedicated dental or orthopedic imaging units. The shift toward outpatient procedures increases the purchasing power of these smaller facilities. Furthermore, government health agencies purchasing systems for public health clinics, military hospitals, and community care centers in emerging markets represent substantial potential customers, often favoring robust, easy-to-use CR or value-tier DR systems to expand access to basic imaging services across wider geographical areas.

| Report Attributes | Report Details |

|---|---|

| Market Size in 2026 | $10.5 Billion |

| Market Forecast in 2033 | $16.9 Billion |

| Growth Rate | CAGR 6.8% |

| Historical Year | 2019 to 2024 |

| Base Year | 2025 |

| Forecast Year | 2026 - 2033 |

| DRO & Impact Forces |

|

| Segments Covered |

|

| Key Companies Covered | Canon Medical Systems Corporation, GE HealthCare, Koninklijke Philips N.V., Siemens Healthineers AG, Fujifilm Holdings Corporation, Agfa-Gevaert Group, Shimadzu Corporation, Carestream Health Inc., Samsung Medison Co. Ltd., Varex Imaging Corporation, Konica Minolta Inc., Lunit Inc., Analogic Corporation, Trivitron Healthcare, DEL Medical. |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Enquiry Before Buy | Have specific requirements? Send us your enquiry before purchase to get customized research options. Request For Enquiry Before Buy |

Digital X-Ray Systems Market Key Technology Landscape

The technological landscape of the Digital X-Ray Systems Market is defined by the ongoing transition from amorphous silicon (a-Si) and amorphous selenium (a-Se) detectors to more advanced complementary metal-oxide-semiconductor (CMOS) and dynamic flat-panel detectors (FPDs). CMOS technology offers significantly higher resolution, lower electronic noise, and faster frame rates compared to older materials, making it increasingly preferred for high-precision applications like mammography and real-time fluoroscopy. Furthermore, the miniaturization and ruggedization of FPDs are enabling the proliferation of ultra-portable and handheld X-ray units, extending diagnostic capabilities outside of traditional fixed imaging suites and into community health settings and military applications.

Another crucial technological development is the pervasive integration of artificial intelligence (AI) directly into the image processing chain. AI algorithms are no longer confined to post-processing interpretation but are being used in real-time to optimize image acquisition parameters, ensuring perfect exposure while minimizing patient dose. These embedded intelligence features reduce retakes and increase departmental throughput. The development of dual-energy X-ray technology is also notable, allowing for the separation of different tissue components (e.g., bone and soft tissue) in a single exposure, providing clinicians with richer diagnostic information without resorting to more complex and expensive cross-sectional imaging modalities.

Connectivity and interoperability remain fundamental technological challenges and areas of active development. Modern digital X-ray systems must flawlessly communicate with various hospital information systems (HIS), radiology information systems (RIS), and cloud-based platforms. Cloud computing is enabling centralized image storage, remote diagnostics (teleradiology), and the pooling of vast datasets for AI training and optimization. The focus is shifting towards developing open architecture systems that facilitate easy integration of third-party software and AI applications, moving away from proprietary, closed ecosystems to foster innovation and customization at the clinical user level.

Regional Highlights

- North America: This region holds a dominant share, characterized by high healthcare expenditure, rapid adoption of cutting-edge DR and AI technologies, and stringent regulatory requirements that drive continuous system replacement cycles. The presence of major market players and a well-established teleradiology infrastructure further solidify its leadership, focusing on maximizing workflow efficiency in high-throughput environments.

- Europe: Driven by government mandates for digital healthcare transformation and the widespread utilization of advanced FPD technology, Europe represents a mature but steady growth market. Countries like Germany, France, and the UK prioritize dose reduction protocols and integrated digital solutions, stimulating demand for premium stationary and high-end mobile systems.

- Asia Pacific (APAC): APAC is the fastest-growing market, primarily fueled by massive infrastructural investments in countries like China, India, and Southeast Asian nations aimed at expanding access to essential medical services. The market exhibits high demand for cost-effective, durable, and increasingly portable systems, addressing the immense patient burden and geographical dispersion in this region.

- Latin America (LATAM): Growth is steady, propelled by increasing private sector investment in modernizing hospital facilities and a rising middle class demanding better healthcare access. Price sensitivity is a key factor, leading to a strong demand balance between affordable CR upgrades and entry-level DR installations, particularly in Brazil and Mexico.

- Middle East and Africa (MEA): This region is witnessing concentrated growth in key economic hubs (UAE, Saudi Arabia, South Africa) driven by government Vision 2030 healthcare goals and increasing medical tourism. The focus is on acquiring high-technology systems for newly constructed, state-of-the-art medical cities and ensuring long-term maintenance infrastructure.

Top Key Players

The market research report includes a detailed profile of leading stakeholders in the Digital X-Ray Systems Market.- Canon Medical Systems Corporation

- GE HealthCare

- Koninklijke Philips N.V.

- Siemens Healthineers AG

- Fujifilm Holdings Corporation

- Agfa-Gevaert Group

- Shimadzu Corporation

- Carestream Health Inc.

- Samsung Medison Co. Ltd.

- Varex Imaging Corporation

- Konica Minolta Inc.

- Lunit Inc.

- Analogic Corporation

- Trivitron Healthcare

- DEL Medical

- Hologic, Inc.

- Mindray Medical International Limited

- Rayence Co., Ltd.

- Stephanix

- Swissray Global Healthcare Holding, Ltd.

Frequently Asked Questions

Analyze common user questions about the Digital X-Ray Systems market and generate a concise list of summarized FAQs reflecting key topics and concerns.What is the primary difference between Direct Radiography (DR) and Computed Radiography (CR)?

DR systems use flat-panel detectors to convert X-rays directly into digital images almost instantaneously, offering superior image quality and workflow speed. CR systems use phosphor plates that require scanning in a separate reader, making them slower but generally more affordable for initial digital transition.

How is Artificial Intelligence (AI) currently being utilized in digital X-ray systems?

AI is primarily used for automated quality control, dose optimization, and diagnostic assistance, particularly in triaging urgent cases, detecting subtle lung nodules, and identifying fractures, thereby increasing radiologist efficiency and reducing diagnostic errors.

Which segment of the Digital X-Ray Systems Market is experiencing the fastest growth?

The portable and mobile digital X-ray systems segment is growing the fastest, driven by the increasing need for bedside imaging in critical care units, operating rooms, and the expansion of community-based or point-of-care diagnostic services globally.

What is the major market restraint limiting the adoption of high-end digital X-ray technology?

The most significant restraint is the high initial capital expenditure required for purchasing and installing advanced Direct Radiography (DR) systems and integrating them with existing hospital IT infrastructure, particularly impacting smaller or resource-limited healthcare facilities.

Which geographic region presents the most significant growth opportunities for digital X-ray systems manufacturers?

The Asia Pacific (APAC) region offers the highest growth opportunities, propelled by large-scale government investments in healthcare infrastructure modernization, growing populations, and increasing medical awareness, leading to a high demand for new imaging equipment.

Further Detailed Market and Strategic Analysis

Detector Technology and Market Influence

The core innovation driving the Digital X-Ray Systems Market resides in detector technology, specifically the evolution of Flat Panel Detectors (FPDs). Amorphous Silicon (a-Si) detectors, while mature and reliable, are increasingly being challenged by newer materials like Cesium Iodide (CsI) coupled with Thin Film Transistors (TFTs), which offer enhanced detective quantum efficiency (DQE) and reduced noise. The high DQE allows for excellent image quality at lower radiation doses, addressing critical patient safety requirements and serving as a major selling point for premium systems in developed economies. The cost of these detectors, however, remains a major component of the overall system price, influencing pricing strategies and market segmentation.

A recent and influential trend is the shift toward Complementary Metal-Oxide-Semiconductor (CMOS) technology, which excels in dynamic imaging applications, such as fluoroscopy and cone-beam CT. CMOS detectors offer faster readout speeds, superior spatial resolution, and generally smaller pixel pitch than a-Si, optimizing them for high-precision, real-time procedures. Vendors are focusing R&D efforts on improving the ruggedness and long-term stability of CMOS sensors to make them viable for general radiography, further diversifying the market. The competitive landscape for detector manufacturing, dominated by specialized component suppliers like Varex Imaging, determines the rate of innovation and pricing pressure across the entire digital X-ray value chain.

The standardization of detector panel sizes (e.g., 14x17 inches) facilitates easier retrofitting of existing analog systems with digital capabilities, providing a cost-effective pathway to digitalization for smaller hospitals. Furthermore, tethered versus wireless detector configurations heavily influence operational workflow. Wireless detectors are crucial for mobile and bedside imaging, reducing contamination risks and improving maneuverability, driving their accelerated adoption, especially post-pandemic, where infection control and rapid deployment became paramount clinical considerations.

Driving Forces by Application Segment

General radiography remains the foundation of the market, accounting for the largest volume share, driven by its necessity in emergency departments, orthopedics, and routine chest imaging. However, specialized applications are showing robust growth rates. Mammography, specifically digital breast tomosynthesis (DBT), is a high-growth segment, mandated by increasing screening programs globally and technological advances that provide 3D layering for improved cancer detection compared to traditional 2D mammography. The integration of specialized digital detectors and advanced iterative reconstruction algorithms is critical for improving the precision and throughput of mammography suites.

Fluoroscopy and angiography, which require dynamic real-time imaging, are increasingly transitioning to digital systems utilizing high-frame-rate flat-panel detectors, replacing older image intensifier technology. The ability of modern digital fluoroscopy systems to perform dose-saving pulsed imaging and seamless image archiving supports complex interventional procedures. The dental segment is witnessing a near-complete transition to digital sensors and panoramic/cephalometric systems, driven by patient demand for lower radiation exposure and dentists' need for immediate, high-resolution imagery for complex treatment planning, such as implants and orthodontics.

The increasing prevalence of cardiovascular diseases and trauma cases globally further sustains the demand for high-performance general radiography systems, particularly in large urban hospitals. The versatility of mobile digital X-ray units in supporting these diverse applications—from trauma bay imaging to cardiac care—makes them essential assets, ensuring that application-specific demands translate directly into varied product development pathways for manufacturers.

Regulatory Environment and Reimbursement Policies

The regulatory landscape significantly impacts the Digital X-Ray Systems Market, requiring manufacturers to navigate complex approval processes across different jurisdictions. In North America and Europe, regulatory bodies like the FDA and the European Medicines Agency (EMA) impose strict standards regarding device safety, efficacy, and radiation output. The approval of AI-integrated diagnostic software presents an added layer of complexity, demanding clinical validation demonstrating that the algorithms do not introduce bias and improve diagnostic confidence or workflow efficiency.

Reimbursement policies are a critical determinant of market demand, particularly for high-cost DR systems. Favorable reimbursement rates for digital imaging procedures incentivize healthcare providers to upgrade their equipment, whereas inadequate coverage can delay replacement cycles. In the US, Medicare and private insurer policies regarding bundled payments and coding for digital radiography procedures directly influence purchasing decisions. Furthermore, government initiatives in developed nations often include subsidies or tax incentives for adopting certified electronic health record systems and associated digital imaging equipment, accelerating market penetration.

In emerging markets, regulations may be less stringent initially, focusing more on ensuring basic operational safety. However, as these markets mature, regulatory harmonization with international standards becomes a competitive advantage for global vendors. Compliance with environmental and safety standards (e.g., RoHS, WEEE) also plays a role in manufacturing and distribution logistics, impacting the overall cost and complexity of bringing a digital X-ray system to market globally.

Market Competitive Analysis and Strategic Positioning

The Digital X-Ray Systems Market is highly competitive, dominated by a few multinational conglomerates that possess comprehensive medical imaging portfolios (Canon, GE, Siemens, Philips). These market leaders leverage their vast distribution networks, established brand loyalty, and significant R&D budgets to maintain technological superiority, particularly in advanced DR and integrated AI solutions. Their strategic positioning often involves offering complete ecosystem solutions, linking X-ray systems seamlessly with other modalities and hospital IT platforms.

Mid-tier players and specialized manufacturers (e.g., Carestream, Agfa, Shimadzu) compete effectively by focusing on specific segments, such as highly efficient mobile units, retrofit solutions, or specialized applications like veterinary imaging. These companies often emphasize value proposition, offering robust performance at a more competitive price point compared to the top four OEMs. The competitive pressure is particularly intense in the detector market, where specialized component vendors are constantly innovating to provide lighter, faster, and more sensitive panels, often supplying technology to multiple system assemblers.

A crucial competitive dimension is service and maintenance support. Given the high reliance on these systems for daily operations, the quality, speed, and comprehensiveness of post-sale servicing and uptime guarantees are vital differentiators. Furthermore, the increasing emergence of pure-play AI software companies (like Lunit) that partner with hardware manufacturers is reshaping the competitive dynamics, forcing traditional OEMs to rapidly develop or acquire integrated software capabilities to remain relevant in the increasingly AI-driven diagnostic workflow.

Future Market Outlook and Emerging Trends

The future outlook for the Digital X-Ray Systems Market remains overwhelmingly positive, driven by persistent demographic shifts and technological leaps. One major emerging trend is the democratization of diagnostic imaging through ultra-low dose and portable X-ray devices powered by advanced battery technology and robust wireless connectivity. This decentralization will push imaging capabilities out of centralized hospital settings and into physician offices, remote clinics, and home healthcare, significantly expanding the market's reach.

Furthermore, spectral (dual-energy) X-ray imaging is poised for wider commercial acceptance. As the technology matures and becomes more cost-effective, its ability to provide functional information alongside anatomical data will position it as a critical bridge between standard radiography and more complex modalities like CT. This advancement promises improved tissue characterization and reduced reliance on contrast agents in certain scenarios, enhancing patient safety and diagnostic depth.

Finally, the continued maturation of regulatory frameworks surrounding Software as a Medical Device (SaMD), particularly for AI components, will accelerate the deployment of advanced diagnostic software. The evolution toward subscription-based models for both software and hardware (X-ray as a Service) will lower barriers to entry for smaller providers, particularly in developing regions, ensuring sustained replacement and expansion demand throughout the forecast period. Manufacturers who successfully integrate superior AI, robust connectivity, and cost-efficient high-performance detectors will lead the next phase of market growth.

To check our Table of Contents, please mail us at: sales@marketresearchupdate.com

Research Methodology

The Market Research Update offers technology-driven solutions and its full integration in the research process to be skilled at every step. We use diverse assets to produce the best results for our clients. The success of a research project is completely reliant on the research process adopted by the company. Market Research Update assists its clients to recognize opportunities by examining the global market and offering economic insights. We are proud of our extensive coverage that encompasses the understanding of numerous major industry domains.

Market Research Update provide consistency in our research report, also we provide on the part of the analysis of forecast across a gamut of coverage geographies and coverage. The research teams carry out primary and secondary research to implement and design the data collection procedure. The research team then analyzes data about the latest trends and major issues in reference to each industry and country. This helps to determine the anticipated market-related procedures in the future. The company offers technology-driven solutions and its full incorporation in the research method to be skilled at each step.

The Company's Research Process Has the Following Advantages:

- Information Procurement

The step comprises the procurement of market-related information or data via different methodologies & sources.

- Information Investigation

This step comprises the mapping and investigation of all the information procured from the earlier step. It also includes the analysis of data differences observed across numerous data sources.

- Highly Authentic Source

We offer highly authentic information from numerous sources. To fulfills the client’s requirement.

- Market Formulation

This step entails the placement of data points at suitable market spaces in an effort to assume possible conclusions. Analyst viewpoint and subject matter specialist based examining the form of market sizing also plays an essential role in this step.

- Validation & Publishing of Information

Validation is a significant step in the procedure. Validation via an intricately designed procedure assists us to conclude data-points to be used for final calculations.

×

Request Free Sample:

Related Reports

- Digital X-Ray Systems Market Size Report By Type (CR Tech Digital X-Ray System, DR Tech Digital X-Ray System), By Application (Dental, Orthopedics, General Surgery, Veterinarian, Others), By Region (North America, Latin America, Europe, Asia Pacific, Middle East, and Africa) - Share, Trends, Outlook and Forecast 2025-2032

- Digital X-Ray Systems Market Size, Share, Trends, & Covid-19 Impact Analysis By Type (Digital, Analog), By Application (Hospitals, Diagnostic centers, Mobile imaging centers), By Region - North America, Latin America, Europe, Asia Pacific, Middle East, and Africa | In-depth Analysis of all factors and Forecast 2023-2030

Select License

Why Choose Us

We're cost-effective and Offered Best services:

We are flexible and responsive startup research firm. We adapt as your research requires change, with cost-effectiveness and highly researched report that larger companies can't match.

Information Safety

Market Research Update ensure that we deliver best reports. We care about the confidential and personal information quality, safety, of reports. We use Authorize secure payment process.

We Are Committed to Quality and Deadlines

We offer quality of reports within deadlines. We've worked hard to find the best ways to offer our customers results-oriented and process driven consulting services.

Our Remarkable Track Record

We concentrate on developing lasting and strong client relationship. At present, we hold numerous preferred relationships with industry leading firms that have relied on us constantly for their research requirements.

Best Service Assured

Buy reports from our executives that best suits your need and helps you stay ahead of the competition.

Customized Research Reports

Our research services are custom-made especially to you and your firm in order to discover practical growth recommendations and strategies. We don't stick to a one size fits all strategy. We appreciate that your business has particular research necessities.

Service Assurance

At Market Research Update, we are dedicated to offer the best probable recommendations and service to all our clients. You will be able to speak to experienced analyst who will be aware of your research requirements precisely.

Contact With Our Sales Team

Customer Testimonials

The content of the report is always up to the mark. Good to see speakers from expertise authorities.

Privacy requested , Managing Director

A lot of unique and interesting topics which are described in good manner.

Privacy requested, President

Well researched, expertise analysts, well organized, concrete and current topics delivered in time.

Privacy requested, Development Manager