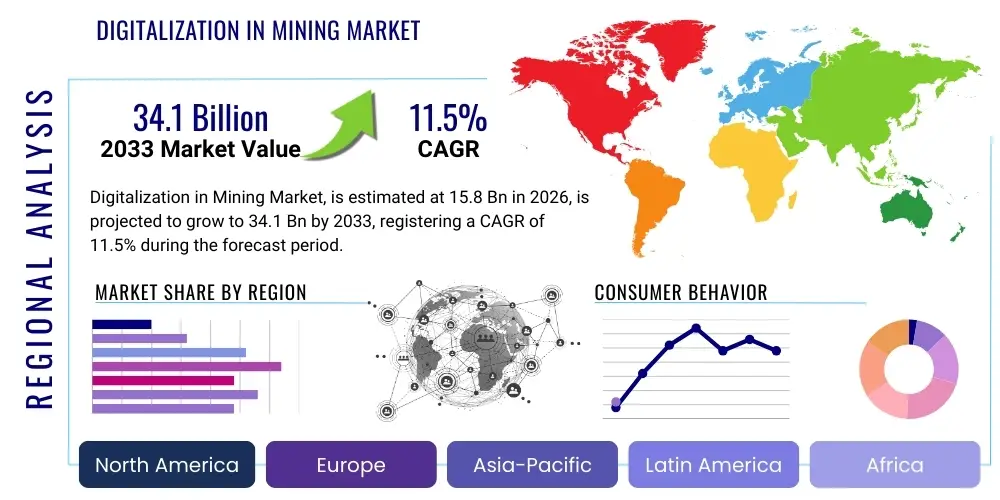

Digitalization in Mining Market Size, By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2026 to 2033 (Financial Impact Analysis)

ID : MRU_ 441760 | Date : Feb, 2026 | Pages : 258 | Region : Global | Publisher : MRU

Digitalization in Mining Market Size

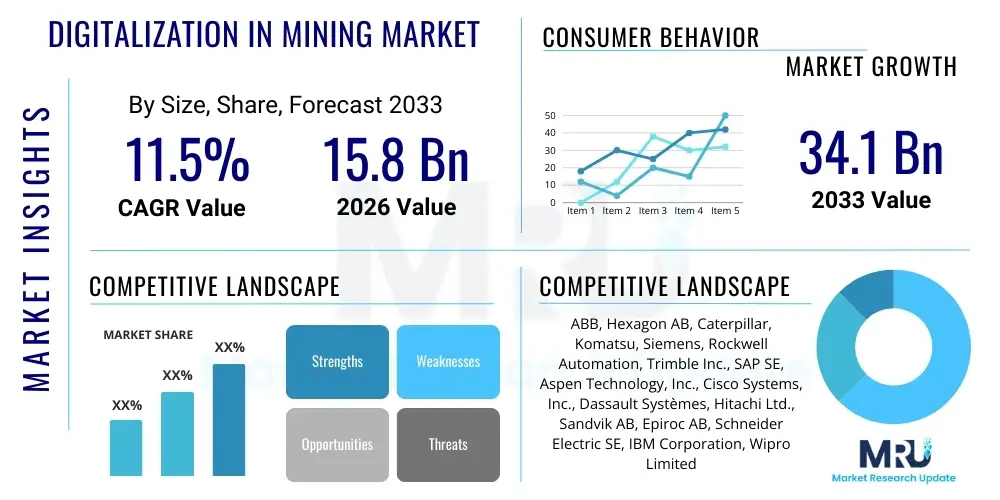

The Digitalization in Mining Market is projected to grow at a Compound Annual Growth Rate (CAGR) of 11.5% between 2026 and 2033. The market is estimated at USD 15.8 Billion in 2026 and is projected to reach USD 34.1 Billion by the end of the forecast period in 2033.

Digitalization in Mining Market introduction

The Digitalization in Mining Market encompasses the integration of advanced technologies, including the Internet of Things (IoT), artificial intelligence (AI), machine learning (ML), cloud computing, and big data analytics, into various stages of the mining value chain. This transformation aims to optimize operations, enhance safety, reduce environmental impact, and improve overall profitability. The market scope covers solutions deployed across exploration, planning, extraction, processing, and logistics, transforming traditional labor-intensive processes into highly automated, data-driven systems. Key products involved include fleet management systems, remote sensing tools, enterprise resource planning (ERP) software tailored for mining, and sophisticated modeling and simulation platforms used for resource assessment and operational optimization.

Major applications of digitalization are concentrated in areas requiring precision and efficiency, such as autonomous drilling and hauling, real-time asset monitoring for predictive maintenance, and optimized resource blending. These applications directly address critical industry challenges like declining ore grades, rising operational costs, and stringent regulatory requirements related to environmental, social, and governance (ESG) standards. The inherent benefits derived from these digital deployments include significant reductions in downtime, improved energy efficiency, lower personnel exposure to hazardous environments, and enhanced accuracy in geological modeling, leading to improved yield rates and overall capital efficiency across mine sites globally.

The primary driving factors propelling this market forward are the pervasive need for increased operational efficiency amidst volatile commodity prices and the imperative for heightened worker safety across both surface and underground operations. Furthermore, the global mandate towards sustainable mining practices necessitates better environmental monitoring and resource utilization, which is only achievable through granular data collection and advanced analytical capabilities provided by digital platforms. The convergence of accessible cloud infrastructure and robust wireless connectivity (5G/LTE private networks) at remote mine sites makes large-scale data processing and real-time decision-making feasible, accelerating the adoption curve for digital solutions worldwide.

Digitalization in Mining Market Executive Summary

The Digitalization in Mining market is characterized by robust business trends centered on automation, integration of advanced analytics, and the shift towards ‘Mine-to-Mill’ optimization strategies, driven by vendors offering comprehensive, integrated platform solutions rather than fragmented technologies. Companies are focusing heavily on developing interoperable systems that can seamlessly integrate legacy infrastructure with new AI-powered tools, enabling predictive maintenance across heavy machinery and optimizing complex logistical chains. Strategic partnerships between technology providers and mining operators are becoming prevalent, focusing on joint development efforts to address unique geological and operational challenges, while the growing investment in cybersecurity measures reflects the increasing dependence on interconnected digital infrastructure and sensitive operational data.

Regional trends indicate that mature mining markets in North America and Australia are leading in the deployment of fully autonomous fleets and advanced data centers located at the mine site, leveraging high labor costs as an impetus for rapid automation adoption. Conversely, emerging mining regions, particularly in Latin America and Africa, are prioritizing digital solutions focused on improving regulatory compliance, optimizing localized energy consumption, and implementing basic asset tracking systems, often constrained by limitations in high-bandwidth connectivity and initial capital outlay. The Asia Pacific region, led by China and India, shows accelerating demand, primarily driven by massive production targets and governmental pushes toward modernization and environmental compliance in state-owned mining enterprises, driving substantial investment in IoT sensors and industrial control systems.

Segment trends highlight the dominance of the Operational Technology (OT) segment, particularly in automation and control systems, as mines prioritize solutions that directly impact production outputs and safety compliance. Within the software segment, sophisticated analytical platforms focusing on geological modeling and process optimization are experiencing the fastest growth, moving beyond basic reporting into prescriptive analytics that guide daily operational decisions. Furthermore, the demand for underground mining digitalization solutions is outpacing surface mining adoption rates in certain highly mechanized jurisdictions, fueled by the greater inherent safety risks and logistical complexities associated with subsurface operations, necessitating remote monitoring, precision guidance, and real-time ventilation management systems.

AI Impact Analysis on Digitalization in Mining Market

Common user questions regarding AI's impact on the Digitalization in Mining Market frequently revolve around its practical return on investment (ROI), particularly concerning equipment failure prediction, optimizing energy usage, and transforming exploration efficiency. Users are concerned about the necessary data infrastructure required to feed machine learning models, the skills gap among current mining personnel to manage AI systems, and the ethical implications concerning job displacement due to increased automation. The key expectations center on AI's ability to transition mining from reactive maintenance schedules to highly efficient, prescriptive operations, unlocking hidden efficiencies in waste reduction, improving safety protocol adherence through real-time monitoring, and accelerating the discovery of new, viable resource deposits by analyzing vast sets of unstructured geological data faster and more accurately than traditional methods.

AI's core influence lies in its ability to process petabytes of heterogeneous data—from seismic readings and sensor data to drilling logs and financial metrics—to generate actionable insights that human operators cannot readily discern. This capability is fundamentally reshaping decision-making, moving it from instinct and experience to data-backed certainty. In extraction, AI algorithms are optimizing blast patterns for fragmentation control and maximizing recovery rates in processing plants by adjusting chemical inputs in real-time. This level of autonomous, continuous optimization drives down per-ton costs significantly, directly influencing the economic viability of complex mining projects.

The long-term impact of AI is fostering an ecosystem where mines evolve into "smart mines," characterized by zero-entry operations and completely autonomous supply chains from pit to port. This necessitates a profound shift in workforce requirements, favoring data scientists, remote operational managers, and AI maintenance specialists over traditional roles. Furthermore, AI is crucial for enhancing ESG performance, allowing for precise monitoring of emissions, water usage, and tailings dam stability, thereby helping mining companies meet increasingly stringent global regulatory standards and improving public perception of the industry.

- AI optimizes predictive maintenance schedules, minimizing unplanned downtime and extending equipment lifespan.

- Machine Learning algorithms enhance geological modeling accuracy, improving exploration success rates and resource yield estimation.

- AI drives full autonomy in drilling, hauling, and processing, reducing human exposure to hazardous environments.

- Real-time data processing facilitates dynamic adjustment of operational parameters, maximizing energy efficiency and reducing fuel consumption.

- Advanced computer vision and AI analytics monitor worker safety protocols and fatigue levels in real-time to prevent accidents.

- AI enables sophisticated mineral sorting and recovery optimization in processing plants, maximizing output from lower-grade ores.

DRO & Impact Forces Of Digitalization in Mining Market

The Digitalization in Mining Market is significantly influenced by a potent combination of Drivers, Restraints, and Opportunities (DRO) that collectively shape its trajectory and determine the speed of technology adoption. The primary drivers include the critical need for operational safety enhancement, the pressure to reduce soaring operational expenses through efficiency gains, and the escalating demand for metals and minerals worldwide, necessitating high-volume, reliable extraction methods. Conversely, market growth is restrained by substantial initial capital expenditures required for digital transformation projects, the integration challenges associated with disparate legacy systems, and the persistent lack of robust, high-speed network infrastructure, especially in remote geographical locations where mining typically occurs. Opportunities abound in leveraging the global push for ESG compliance, the development of modular and scalable cloud-based solutions tailored for smaller operations, and the massive potential in leveraging prescriptive analytics for resource optimization and circular economy integration.

Impact forces within the market are predominantly driven by technological innovations and regulatory shifts. The innovation force is strong, particularly concerning the maturation of autonomous vehicle technology and the declining cost of IoT sensors, making large-scale deployment economically viable. Economically, volatile commodity prices exert dual pressure: they incentivize efficiency gains (driving digitalization) while simultaneously constraining capital spending (restraining large projects). Regulatory impact forces, particularly those related to decarbonization mandates and stricter environmental protection laws, necessitate real-time monitoring and reporting capabilities, fundamentally achievable only through advanced digitalization, thus pushing reluctant operators toward investment. Societal forces, concerning community engagement and the future of work, also influence adoption, requiring companies to ensure responsible implementation strategies that address workforce transition and local economic impact.

The interplay of these forces suggests a widening gap between technologically advanced tier-one miners, who can absorb high initial costs and benefit rapidly from returns on automation, and smaller operators facing greater financial barriers and resource constraints. The critical enabling factor remains the development of industry standards for data interoperability and robust cybersecurity frameworks. If these challenges are overcome, the synergistic effects of automation, AI-driven optimization, and enhanced safety protocols will cement digitalization as a non-negotiable aspect of modern, sustainable mining, fundamentally transforming the industry's risk profile and profitability metrics over the forecast period.

Segmentation Analysis

The Digitalization in Mining Market segmentation provides a granular view of technology adoption across different operational aspects and deployment models, enabling stakeholders to focus on areas of highest growth and specific technical demand. The market is typically segmented based on component (hardware, software, services), technology (IoT, AI/ML, Connectivity, Robotics), deployment mode (on-premise vs. cloud), application (exploration, extraction, processing, logistics), and type of mining (surface vs. underground). Understanding these segments is vital for strategic planning, as distinct needs drive investment in specific technologies—for instance, underground mining places a premium on connectivity and remote control systems, while surface mining focuses heavily on large-scale autonomous fleet management and high-volume data analytics for process optimization.

- By Component:

- Hardware (Sensors, RFID Tags, Control Systems, Autonomous Vehicles)

- Software (Data Analytics, ERP, Geological Modeling, Mine Planning)

- Services (Consulting, Integration, Maintenance, Managed Services)

- By Technology:

- Internet of Things (IoT)

- Artificial Intelligence and Machine Learning (AI/ML)

- Robotics and Autonomous Systems

- Cloud Computing

- Connectivity (5G, Private LTE, Satellite Communication)

- By Deployment Mode:

- On-Premise

- Cloud

- By Application:

- Exploration

- Mining Operations (Extraction & Drilling)

- Processing (Mineral Separation & Recovery)

- Logistics and Supply Chain Management

- By Mine Type:

- Surface Mining

- Underground Mining

Value Chain Analysis For Digitalization in Mining Market

The Value Chain for the Digitalization in Mining Market begins upstream with core technology providers, including sensor manufacturers, semiconductor companies, industrial equipment OEMs, and specialized software developers focused on geology and simulation. These upstream participants supply the essential technological building blocks—high-precision GPS, ruggedized IoT sensors capable of operating in harsh environments, and sophisticated analytical engines—that form the foundation of any digital transformation initiative. Their strategic importance lies in driving innovation, cost reduction through mass production of components, and ensuring the industrial ruggedness and reliability necessary for continuous operation in mining environments. Partnerships at this stage, particularly between hardware manufacturers and industrial networking specialists, are crucial for ensuring seamless data flow and low-latency control systems.

Midstream activities involve system integrators, managed service providers, and specialized mining technology firms that take the components and software and tailor them into comprehensive, site-specific solutions. This stage includes complex tasks such as deploying private communication networks (LTE/5G), integrating new digital platforms with existing operational technology (OT) infrastructure, developing custom algorithms for predictive maintenance specific to the mine's fleet, and providing training and change management services. Direct interaction with the mining client is highest here, focusing on delivering measurable operational improvements in safety and efficiency. Companies specializing in geotechnical monitoring and remote operation centers are central to this part of the value chain.

Downstream analysis focuses on the end-users—the major and intermediate mining corporations—who utilize the implemented digital systems to achieve their business outcomes, such as reduced costs, increased output, and improved ESG compliance. The distribution channel is predominantly direct, especially for large, bespoke projects, involving direct contracts between the integrator/solution provider and the mining company. However, indirect channels, such as authorized resellers and distributors, play a role in supplying standardized IoT devices and off-the-shelf software solutions, particularly to smaller mining operations globally. The effectiveness of the digitalization value chain is ultimately measured by the tangible improvements in operational key performance indicators (KPIs) achieved by the final customer.

Digitalization in Mining Market Potential Customers

Potential customers for digitalization solutions span the entire spectrum of the mining industry, categorized primarily by size, commodity extracted, and operational complexity. Tier-one global mining companies (majors) represent the largest segment, characterized by high production volumes, multi-site operations across diverse geographies, and substantial capital budgets, making them ideal targets for full-scale autonomous fleets, integrated enterprise solutions, and cutting-edge AI deployments. These major miners are motivated by marginal efficiency gains at massive scale and meeting stringent global investor demands for ESG performance and resource transparency, driving significant, long-term investments in digital infrastructure and advanced analytics platforms across their extensive operations.

Intermediate and junior mining companies constitute the second major segment, often focusing on single or limited-site operations. While their capital budgets are smaller, they are increasingly seeking modular, scalable, cloud-based digitalization solutions to remain competitive and demonstrate operational viability to investors. For this group, the appeal of digitalization lies heavily in improving safety records quickly and optimizing basic process flow (e.g., asset tracking and basic data visualization) with minimal upfront infrastructural overhaul. Solution providers targeting this segment must offer flexible pricing models (e.g., subscription-based Software as a Service or SaaS) and easy deployment to meet their unique constraints.

Beyond traditional extractive miners, potential customers also include specialized service providers and regulatory bodies. Contract mining firms, which operate mines on behalf of owners, are critical buyers of digital fleet management and remote monitoring tools to maximize their efficiency guarantees. Furthermore, government geological surveys and environmental regulatory agencies represent an emerging customer base, utilizing advanced remote sensing, IoT, and data analytics technologies for enhanced regulatory oversight, resource mapping, and real-time environmental impact assessment, requiring specialized platforms for data collection and validation that align with public sector mandates.

| Report Attributes | Report Details |

|---|---|

| Market Size in 2026 | USD 15.8 Billion |

| Market Forecast in 2033 | USD 34.1 Billion |

| Growth Rate | CAGR 11.5% |

| Historical Year | 2019 to 2024 |

| Base Year | 2025 |

| Forecast Year | 2026 - 2033 |

| DRO & Impact Forces |

|

| Segments Covered |

|

| Key Companies Covered | ABB, Hexagon AB, Caterpillar, Komatsu, Siemens, Rockwell Automation, Trimble Inc., SAP SE, Aspen Technology, Inc., Cisco Systems, Inc., Dassault Systèmes, Hitachi Ltd., Sandvik AB, Epiroc AB, Schneider Electric SE, IBM Corporation, Wipro Limited, Microsoft Corporation, Accenture, Honeywell International Inc. |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Enquiry Before Buy | Have specific requirements? Send us your enquiry before purchase to get customized research options. Request For Enquiry Before Buy |

Digitalization in Mining Market Key Technology Landscape

The Digitalization in Mining market is underpinned by a rapidly evolving technological landscape, driven primarily by the need for real-time data acquisition, secure connectivity, and sophisticated analytical processing. Core technologies include the deployment of the Industrial Internet of Things (IIoT), which utilizes ruggedized sensors and gateways across the mine site to collect crucial operational data on equipment performance, environmental conditions, and material flow. Complementing IIoT is the massive adoption of secure, high-bandwidth private network solutions (Private LTE and emerging 5G technologies), which are essential for enabling low-latency communication required for remote operation centers and the control of autonomous vehicles, fundamentally bridging the connectivity gap inherent in remote mine locations.

Artificial Intelligence (AI) and Machine Learning (ML) represent the intelligence layer, moving beyond mere data aggregation to predictive and prescriptive decision-making. These technologies are applied across the value chain, from using ML algorithms to analyze vast seismic data for geological modeling during exploration, to optimizing the energy consumption of ventilation systems in underground mines, and enhancing mineral processing recovery rates by identifying complex patterns in plant performance data. Furthermore, advanced robotics and autonomous systems, including autonomous haul trucks, drilling rigs, and specialized inspection drones, rely heavily on integrated sensor fusion, high-definition mapping, and AI-driven navigation to operate safely and efficiently without human intervention, dramatically increasing operational utilization rates and reducing safety incidents.

Cloud and edge computing infrastructure are critical elements that support this digital ecosystem. Edge computing enables local, immediate data processing at the mine site, essential for real-time safety critical applications, such as collision avoidance and immediate response to equipment faults. Simultaneously, cloud platforms provide scalable storage and computational power necessary for long-term data archival, complex simulation modeling, and enterprise-wide data analysis and visualization. The integration of advanced geospatial technologies, high-precision GNSS/GPS, and Digital Twin technology allows operators to create highly accurate virtual replicas of the mine site, enabling scenario testing, training, and optimizing complex logistics before physical implementation, thereby significantly reducing execution risk and improving overall project planning effectiveness.

Regional Highlights

Regional dynamics significantly influence the pace and nature of digitalization investments in the mining sector, driven by local geological conditions, labor costs, regulatory environments, and connectivity infrastructure availability. North America (NAM) is a mature market, characterized by large-scale, deep-pit operations and a strong emphasis on automation to offset high labor costs. The US and Canada are leaders in deploying autonomous hauling systems, predictive maintenance platforms, and leveraging cloud infrastructure for centralized operational management. The regional focus is increasingly shifting toward integrating sustainability metrics into digital platforms, responding to heightened investor scrutiny regarding environmental performance and resource efficiency, making solutions related to water management and carbon footprint reduction highly sought after.

The Asia Pacific (APAC) region represents the fastest-growing market due to massive production volumes, especially in coal and iron ore, and significant governmental initiatives aimed at modernizing aging infrastructure and improving safety standards in populous mining nations like China, India, and Australia. Australia stands out as a global leader in pilot testing and deploying end-to-end autonomous mining systems and remote operation centers, driven by a shortage of skilled labor and high safety standards. In contrast, emerging markets within APAC are primarily adopting basic digitalization tools like asset tracking, connectivity upgrades, and foundational geological software, prioritizing immediate safety and operational visibility gains over complex AI systems, reflecting a phased investment approach dictated by capital constraints.

Europe, while having fewer large-scale extraction operations than other regions, focuses intensely on high-tech, highly specialized underground mining digitalization, particularly in Scandinavia and Eastern Europe, driven by innovation mandates and stringent environmental regulations. European efforts center on optimizing ventilation, energy efficiency, and worker safety through advanced remote control systems and specialized robotics adapted for narrow-vein mining. Latin America (LATAM) and the Middle East & Africa (MEA) are emerging regions facing unique challenges, including infrastructural deficits and political instability. Digitalization here is focused on optimizing logistics (port-to-mine communication), improving security, and adhering to international standards for responsible sourcing, with major copper and precious metals miners driving the initial adoption of fleet management and basic predictive maintenance systems, typically preferring on-premise or hybrid cloud solutions due to local connectivity concerns.

- North America: Focus on full autonomy (hauling/drilling), predictive maintenance, and integrating ESG performance monitoring into digital platforms. High adoption rates driven by high labor costs and established infrastructure.

- Asia Pacific (APAC): Highest volume growth, led by Australia in autonomy implementation and China/India in widespread deployment of IIoT sensors and basic automation for safety compliance and volume targets.

- Europe: Strong emphasis on specialized underground robotics, energy efficiency, and compliance with stringent environmental regulations. High R&D investment in modular mining solutions.

- Latin America (LATAM): Driven by copper and iron ore majors; prioritized investment in fleet management systems, logistics optimization, and security solutions. Adoption hampered by connectivity limitations in remote areas.

- Middle East & Africa (MEA): Emerging market focused on initial sensor deployment, basic operational visibility, and compliance with international responsible sourcing standards. Growth constrained by infrastructure and capital availability.

Top Key Players

The market research report includes a detailed profile of leading stakeholders in the Digitalization in Mining Market.- ABB

- Hexagon AB

- Caterpillar

- Komatsu

- Siemens

- Rockwell Automation

- Trimble Inc.

- SAP SE

- Aspen Technology, Inc.

- Cisco Systems, Inc.

- Dassault Systèmes

- Hitachi Ltd.

- Sandvik AB

- Epiroc AB

- Schneider Electric SE

- IBM Corporation

- Wipro Limited

- Microsoft Corporation

- Accenture

- Honeywell International Inc.

Frequently Asked Questions

Analyze common user questions about the Digitalization in Mining market and generate a concise list of summarized FAQs reflecting key topics and concerns.What are the primary challenges hindering the rapid adoption of mining digitalization?

The primary challenges include the substantial upfront capital expenditure required for integration, the difficulty in achieving seamless interoperability between legacy operational technology (OT) and modern IT systems, and the absence of high-speed, reliable network infrastructure necessary for real-time control in extremely remote or deep underground locations. Addressing the skills gap in the mining workforce concerning data science and advanced automation maintenance is also a critical hurdle.

How does digitalization specifically improve operational safety in the mining sector?

Digitalization improves safety fundamentally by enabling remote operation and autonomy, removing personnel from high-risk zones (e.g., autonomous trucks, remote drilling). Furthermore, real-time monitoring via IoT sensors detects structural instabilities, ventilation hazards, and equipment faults instantly, allowing for proactive intervention. AI-powered video analytics also monitor worker fatigue and adherence to safety protocols, significantly reducing accident potential.

Which technologies are driving the most significant ROI in digital mining today?

The technologies currently demonstrating the most significant Return on Investment (ROI) are autonomous fleet management systems (reducing labor and increasing utilization), advanced geological modeling software (improving resource targeting), and predictive maintenance platforms utilizing IIoT and AI (minimizing costly unplanned downtime and maximizing asset life). These technologies directly impact the two major cost centers: labor and equipment reliability.

What role does the push for ESG (Environmental, Social, and Governance) compliance play in market growth?

The growing global demand for robust ESG compliance is a major market driver. Digitalization provides the necessary tools for transparent reporting, allowing miners to track and optimize water usage, measure carbon emissions accurately, and manage tailings in real-time. This capability is vital for maintaining social license to operate and securing capital investment from funds adhering to strict sustainability mandates.

Is cloud deployment preferred over on-premise solutions for mining digitalization projects?

While on-premise solutions historically dominated due to remote connectivity issues and security concerns, the trend is strongly shifting towards hybrid and pure cloud deployment, especially for non-safety-critical analytics and large-scale data storage. Cloud deployment offers scalability, faster implementation, and access to sophisticated AI/ML processing power, making it the preferred model for new projects and advanced analytical applications.

To check our Table of Contents, please mail us at: sales@marketresearchupdate.com

Research Methodology

The Market Research Update offers technology-driven solutions and its full integration in the research process to be skilled at every step. We use diverse assets to produce the best results for our clients. The success of a research project is completely reliant on the research process adopted by the company. Market Research Update assists its clients to recognize opportunities by examining the global market and offering economic insights. We are proud of our extensive coverage that encompasses the understanding of numerous major industry domains.

Market Research Update provide consistency in our research report, also we provide on the part of the analysis of forecast across a gamut of coverage geographies and coverage. The research teams carry out primary and secondary research to implement and design the data collection procedure. The research team then analyzes data about the latest trends and major issues in reference to each industry and country. This helps to determine the anticipated market-related procedures in the future. The company offers technology-driven solutions and its full incorporation in the research method to be skilled at each step.

The Company's Research Process Has the Following Advantages:

- Information Procurement

The step comprises the procurement of market-related information or data via different methodologies & sources.

- Information Investigation

This step comprises the mapping and investigation of all the information procured from the earlier step. It also includes the analysis of data differences observed across numerous data sources.

- Highly Authentic Source

We offer highly authentic information from numerous sources. To fulfills the client’s requirement.

- Market Formulation

This step entails the placement of data points at suitable market spaces in an effort to assume possible conclusions. Analyst viewpoint and subject matter specialist based examining the form of market sizing also plays an essential role in this step.

- Validation & Publishing of Information

Validation is a significant step in the procedure. Validation via an intricately designed procedure assists us to conclude data-points to be used for final calculations.

×

Request Free Sample:

Related Reports

Select License

Why Choose Us

We're cost-effective and Offered Best services:

We are flexible and responsive startup research firm. We adapt as your research requires change, with cost-effectiveness and highly researched report that larger companies can't match.

Information Safety

Market Research Update ensure that we deliver best reports. We care about the confidential and personal information quality, safety, of reports. We use Authorize secure payment process.

We Are Committed to Quality and Deadlines

We offer quality of reports within deadlines. We've worked hard to find the best ways to offer our customers results-oriented and process driven consulting services.

Our Remarkable Track Record

We concentrate on developing lasting and strong client relationship. At present, we hold numerous preferred relationships with industry leading firms that have relied on us constantly for their research requirements.

Best Service Assured

Buy reports from our executives that best suits your need and helps you stay ahead of the competition.

Customized Research Reports

Our research services are custom-made especially to you and your firm in order to discover practical growth recommendations and strategies. We don't stick to a one size fits all strategy. We appreciate that your business has particular research necessities.

Service Assurance

At Market Research Update, we are dedicated to offer the best probable recommendations and service to all our clients. You will be able to speak to experienced analyst who will be aware of your research requirements precisely.

Contact With Our Sales Team

Customer Testimonials

The content of the report is always up to the mark. Good to see speakers from expertise authorities.

Privacy requested , Managing Director

A lot of unique and interesting topics which are described in good manner.

Privacy requested, President

Well researched, expertise analysts, well organized, concrete and current topics delivered in time.

Privacy requested, Development Manager