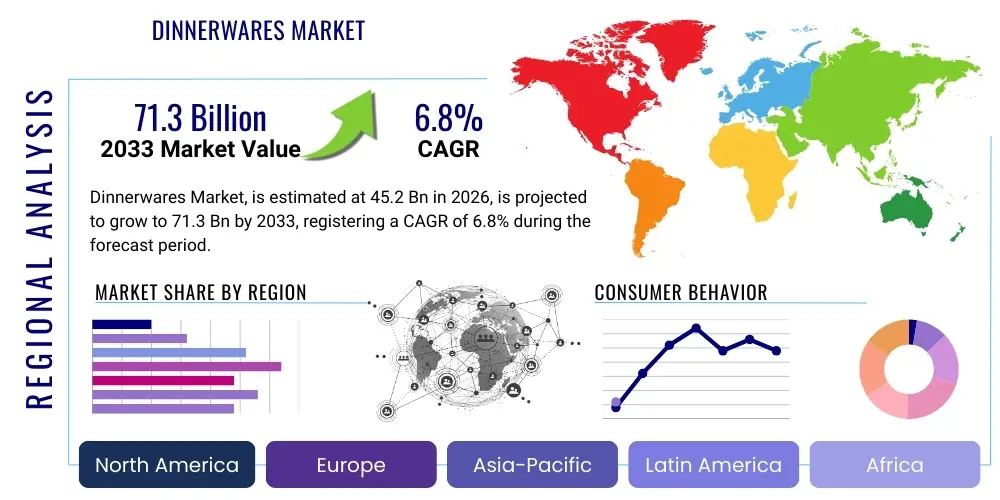

Dinnerwares Market Size, By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2026 to 2033 (Financial Impact Analysis)

ID : MRU_ 442416 | Date : Feb, 2026 | Pages : 258 | Region : Global | Publisher : MRU

Dinnerwares Market Size

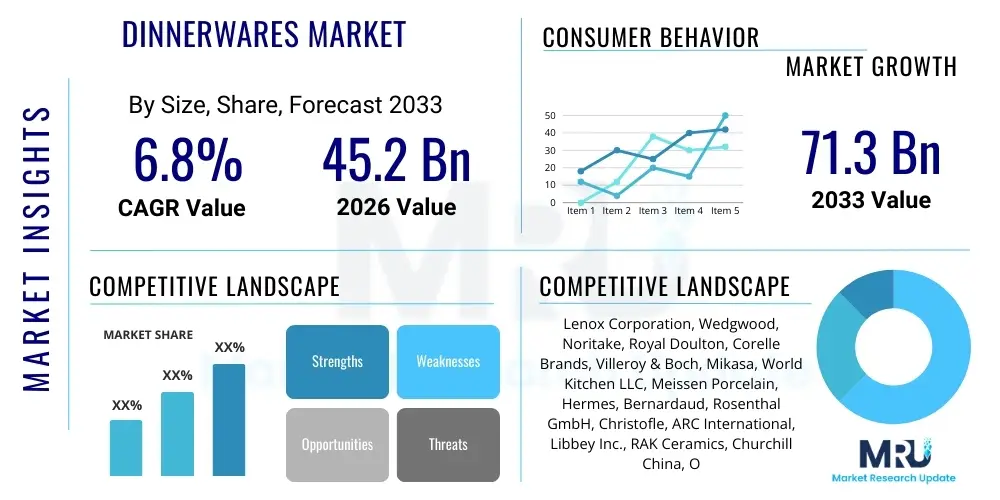

The Dinnerwares Market is projected to grow at a Compound Annual Growth Rate (CAGR) of 6.8% between 2026 and 2033. The market is estimated at USD 45.2 Billion in 2026 and is projected to reach USD 71.3 Billion by the end of the forecast period in 2033. This substantial expansion is fundamentally driven by rising disposable incomes across developing economies, coupled with significant shifts in consumer preferences towards aesthetic and premium dining experiences. Furthermore, the persistent growth in the hospitality sector, including luxury hotels, fine dining establishments, and specialized cafes, continuously necessitates high-quality, durable, and stylistically diverse dinnerware, acting as a critical demand catalyst throughout the forecast window.

The valuation reflects a robust post-pandemic recovery trajectory, where consumers globally prioritized home aesthetics and entertaining. This trend has fueled demand not just for basic utility dinnerware but also for specialized sets, sustainable materials, and customized designs. Market analysts note that the increasing integration of dinnerware as a fashion statement or a component of interior design—rather than merely a functional item—contributes significantly to both volume sales and average selling prices (ASPs), ensuring sustained market momentum well into 2033. The competitive landscape is characterized by established global brands focusing on innovation in material science and aesthetic appeal to capture the premium segment.

Dinnerwares Market introduction

The Dinnerwares Market encompasses the production, distribution, and sale of items used for serving, preparing, and consuming meals, primarily including plates, bowls, cups, mugs, and serving platters made from materials such as porcelain, ceramic, bone china, glass, and melamine. The fundamental product description involves goods that combine functional utility—durability, heat retention, and ease of cleaning—with aesthetic value, serving to enhance the overall dining experience in both residential and commercial settings. Major applications span residential households seeking daily use or formal dining sets, and commercial entities like restaurants, hotels, catering services, and institutional facilities, each requiring specific material strengths and design standards to accommodate high-volume usage and rigorous cleaning protocols.

The primary benefits associated with modern dinnerware include improved hygiene standards, material durability leading to longer product lifecycles, and significant design versatility that allows consumers and businesses to align dining settings with specific interior aesthetics or branding requirements. Driving factors for this market expansion are multifaceted, anchored by the global rise in discretionary spending, particularly in the APAC region, which stimulates demand for premium and branded dinnerware products. Additionally, global urbanization trends lead to increased consumer interest in sophisticated home décor and entertaining practices, directly influencing purchasing decisions towards higher-value, stylish dinner sets. Furthermore, the robust expansion of the global hospitality industry, coupled with the frequent replacement cycle necessitated by high-traffic commercial use, provides a continuous foundational demand base, ensuring consistent market growth across all geographical regions.

Technological advancements in manufacturing processes, such as the implementation of advanced glazing techniques and lead-free material compositions, are also bolstering the market by improving product quality, safety, and aesthetic appeal. The confluence of these economic, demographic, and technological drivers creates a favorable environment for sustained market growth, pushing manufacturers to continuously innovate in terms of material composition, sustainable production methods, and ergonomic design. The market is increasingly competitive, demanding strategic pricing and effective distribution network management, particularly leveraging e-commerce platforms to reach a globally dispersed consumer base seeking specialized, artisanal, and mass-market dinnerware options simultaneously.

Dinnerwares Market Executive Summary

The Dinnerwares Market Executive Summary highlights robust business trends characterized by a decisive shift toward premiumization and sustainability across all major segments. Business trends indicate strong investment in automated manufacturing processes to enhance output efficiency and maintain cost competitiveness, especially among large-scale producers focused on ceramic and porcelain lines. Regional trends reveal Asia Pacific (APAC) as the epicenter of growth, largely propelled by escalating disposable incomes, rapid urbanization, and deeply ingrained cultural emphasis on family dining and elaborate entertaining, making countries like China and India pivotal consumption hubs. Conversely, established markets in North America and Europe maintain consistent demand, driven primarily by replacement cycles, demand for highly specialized items (e.g., bone china sets), and a burgeoning interest in artisanal and custom-made dinnerware, reflecting sophisticated consumer tastes and preference for product authenticity and unique design elements.

Segment trends underscore the dominance of Ceramic and Porcelain materials due to their durability and versatile aesthetic qualities, though Bone China continues to capture significant value share within the luxury segment, catering specifically to high-end residential and five-star hospitality sectors. The Distribution Channel segment illustrates the accelerating importance of the Online retail sector, which offers unprecedented access to global brands, niche designers, and direct-to-consumer models, fundamentally transforming traditional purchasing patterns. While specialty stores and hypermarkets remain crucial for tangible product inspection, e-commerce platforms are leveraging digital visualization tools and enhanced logistics to overcome inherent challenges in shipping fragile goods. Furthermore, the residential segment accounts for the largest market share, but the commercial segment, particularly HORECA (Hotel, Restaurant, and Catering), demonstrates higher growth stability owing to non-discretionary procurement demands and quicker replacement timelines, driven by stringent quality standards and constant wear and tear inherent in professional environments.

A key finding is the market's increasing responsiveness to environmental concerns, with sustainable materials such as recycled glass, bamboo, and specialized bioplastics gaining traction, influencing both manufacturing practices and consumer purchasing decisions. This pivot towards eco-friendly options is not just a niche trend but a significant market driver affecting supply chain decisions and product development strategies globally. The competitive intensity remains high, necessitating continuous product differentiation through innovation in glazes, forms, and ergonomic design, alongside effective supply chain management to mitigate potential risks associated with volatile raw material procurement and complex international shipping logistics, ensuring market players can capitalize fully on the favorable macro-economic forecast.

AI Impact Analysis on Dinnerwares Market

Analysis of common user questions regarding the impact of Artificial Intelligence (AI) on the Dinnerwares Market reveals key themes centered around customization, supply chain efficiency, and predictive consumer demand modeling. Users frequently inquire about "How can AI personalize dinnerware design?" and "Will AI streamline the ceramic manufacturing process?" reflecting high expectations for customized product offerings and optimized production workflows. Concerns also revolve around the potential disruption to traditional artisan manufacturing and the efficacy of AI-driven tools in handling the complex logistics of fragile goods. Overall, users expect AI to transition dinnerware from a standardized commodity into a highly personalized and efficiently delivered consumer product, driving down lead times and matching design trends with real-time accuracy, while maintaining the perceived value associated with skilled craftsmanship, often questioning if AI tools can truly replicate the nuanced aesthetic judgment required for high-end product design.

The influence of AI is most profound in three critical areas: design optimization, manufacturing quality control, and intelligent supply chain management. In design, generative AI algorithms can process vast amounts of data related to current interior design trends, historical sales performance of specific patterns, and prevailing color palettes to suggest novel dinnerware geometries, glaze combinations, and surface textures that are statistically likely to appeal to targeted demographic segments. This significantly reduces the time and cost associated with traditional R&D cycles, allowing brands to launch trend-relevant collections much faster. Furthermore, integrating AI visual inspection systems into the manufacturing line allows for real-time defect detection at microscopic levels, far surpassing human capability, leading to drastic reductions in waste, improved quality consistency, and enhanced production throughput, particularly beneficial in large-scale porcelain and ceramic factories globally.

In the domain of market intelligence and consumer interaction, AI-powered predictive analytics are revolutionizing inventory management by forecasting regional demand fluctuations based on seasonality, major holidays, and macro-economic indicators, ensuring optimal stock levels and minimizing the financial burden of overstocking or the revenue loss associated with stockouts. Moreover, AI-driven chatbots and virtual assistants are being deployed on e-commerce platforms to offer highly personalized product recommendations, assisting consumers in navigating complex catalogs of dinnerware sets, coordinating different pieces, and even visualizing how specific dinnerware collections would look within their own dining room environment using augmented reality features, thereby significantly enhancing the digital shopping experience and reducing return rates often associated with fragile shipments and aesthetic mismatch issues.

- AI-driven personalized design recommendations based on user history and prevailing home décor trends.

- Predictive demand modeling optimizing inventory levels for seasonal and regional sales spikes.

- Automated quality control (QC) utilizing computer vision for defect detection in glazing and firing stages.

- Optimized supply chain routes and logistics planning to minimize fragility-related shipping damage.

- Generative design tools assisting manufacturers in creating novel ergonomic and aesthetic forms.

- Enhanced customer experience via AI-powered virtual try-on and visualization tools on e-commerce platforms.

DRO & Impact Forces Of Dinnerwares Market

The Dinnerwares Market is shaped by a critical balance of Drivers, Restraints, and Opportunities, collectively defined as Impact Forces. The primary Drivers revolve around accelerating global urbanization, which consistently elevates disposable incomes and promotes modern lifestyle consumption patterns, fueling demand for stylish and frequently updated home goods, including specialty dinnerware. Additionally, the rapid expansion of the global hospitality industry—hotels, restaurants, and catering services—creates a substantial, non-cyclical B2B demand for durable, high-quality, and aesthetically pleasing commercial-grade dinnerware, often requiring high-frequency replenishment. Conversely, the market faces significant Restraints, notably the volatility in the prices of key raw materials such as kaolin, feldspar, and specialized glazes, which directly impact manufacturing costs and ultimately compress profit margins for mid-to-low-tier producers. The presence of a large, fragmented unorganized sector, particularly in emerging markets offering inexpensive, unbranded alternatives, further restricts the market share and pricing power of established, high-quality brands, creating intense competitive friction and necessitating superior product differentiation strategies.

Significant Opportunities exist in the growing consumer preference for sustainable and eco-friendly products, pushing manufacturers toward innovative materials like recycled glass, bamboo fiber composites, and responsibly sourced porcelain clay, allowing companies to tap into the rapidly expanding segment of environmentally conscious buyers, justifying premium pricing structures. Furthermore, the sustained surge in e-commerce adoption presents a powerful channel Opportunity, enabling brands, especially niche artisanal producers, to reach a global consumer base without reliance on traditional brick-and-mortar retail intermediaries, thereby improving margin capture and market penetration rates. These combined Impact Forces dictate the strategic maneuvering required by market participants; successful entities must leverage drivers by prioritizing design innovation and maximizing e-commerce presence while simultaneously mitigating restraints through strategic, long-term raw material sourcing contracts and operational efficiencies, particularly in energy-intensive firing processes required for high-grade ceramic production.

The intensity of these forces ensures a dynamic competitive environment. Technological advancements in glazing and firing (Drivers) continuously improve product durability and aesthetics, enhancing consumer value proposition and stimulating replacement purchases. However, geopolitical risks and global trade uncertainties (Restraints) occasionally disrupt complex international supply chains necessary for sourcing raw materials and distributing finished fragile goods, requiring resilient logistics planning. Exploiting the Opportunity for customization, driven by digital printing and rapid prototyping technologies, allows key players to command higher prices and foster brand loyalty among affluent consumers seeking unique, personalized dining experiences, positioning premiumization as a core growth strategy over the forecast period and mitigating the impact of generic low-cost competition.

Segmentation Analysis

The Dinnerwares Market segmentation analysis reveals a highly differentiated landscape based on material composition, product type, distribution methodology, and ultimate end-user application, providing a granular view of consumption patterns and market potential. Material segmentation is crucial, as it dictates price points, aesthetic appeal, and functional properties like durability and heat resistance, with ceramic and porcelain commanding the largest volume share due to their balance of cost-effectiveness and widespread acceptance, while specialized materials like bone china drive high-value sales in the luxury sector. Product-wise, the market is categorized into sets and individual pieces, noting that full dinnerware sets, particularly those marketed for gifting or initial home setup, generate significant revenue, whereas individual components like specialized serving dishes or oversized mugs cater to evolving consumer preferences for mix-and-match aesthetics and specific utility needs, providing continuous market depth and variety.

Distribution segmentation highlights the ongoing digital transformation, where the Online channel is registering the highest growth rate, propelled by greater selection, convenience, and sophisticated supply chain logistics developed to minimize breakage risk during transit, transforming how fragile goods are purchased globally. However, the Offline channel, comprising supermarkets, hypermarkets, and specialty stores, remains vital for immediate purchases and tactile evaluation of product quality and weight, maintaining a large foundational market share, particularly for mass-market and daily-use items. End-user segmentation clearly delineates between Residential consumption, which drives volume and variety based on fashion and lifestyle trends, and Commercial consumption (HORECA), which focuses heavily on industrial durability, stackability, and standardized replacement items, often demanding customized branding and higher volume contractual procurement agreements, ensuring stability and bulk demand for key manufacturers.

Understanding these segment dynamics is paramount for strategic market entry and sustained success. For instance, companies targeting the Residential segment must invest heavily in branding and trend forecasting, frequently refreshing product lines to align with seasonal décor changes, while those focused on the Commercial segment must emphasize performance specifications, compliance with health standards, and establishing robust, efficient B2B sales and replenishment infrastructures. The consistent high performance of the ceramic material segment underscores the foundational nature of traditional dinnerware, even as new materials and distribution models continually innovate the consumer facing aspects of the entire market ecosystem, requiring a dual strategy of material excellence and digital channel mastery.

- Material:

- Porcelain

- Ceramic

- Bone China

- Glass

- Melamine

- Others (E.g., Stoneware, Earthenware)

- Product Type:

- Plates

- Bowls

- Cups & Mugs

- Serving Dishes

- Dinnerware Sets

- Distribution Channel:

- Online Retail

- Offline Retail (Supermarkets, Hypermarkets, Specialty Stores, Departmental Stores)

- End-User:

- Residential

- Commercial (Hotels, Restaurants, Cafes, Institutions)

Value Chain Analysis For Dinnerwares Market

The Value Chain Analysis for the Dinnerwares Market begins with Upstream Analysis, which focuses primarily on the sourcing and preparation of essential raw materials. This includes mining and refining specialized clays (kaolin, ball clay), feldspar, silica, and various minerals required for glazes and body composition, with the quality and consistency of these inputs directly influencing the final product's durability and aesthetic finish. Upstream suppliers hold significant bargaining power, especially for high-grade materials like calcined bone ash crucial for bone china production, necessitating strategic, long-term procurement contracts to mitigate cost volatility and ensure supply stability. Following material sourcing is the intensive manufacturing process, involving design, forming (casting, pressing), drying, firing (often multiple stages at very high temperatures, which is highly energy-intensive), glazing application, and final quality inspection, where technological efficiency and environmental compliance are critical determinants of competitive advantage and overall product cost structure.

The Midstream component of the value chain is dominated by the Distribution Channel, which acts as the crucial link between manufacturers and End-Users, managing the complex logistics inherent in transporting fragile goods globally. Distribution involves a mix of Direct and Indirect channels. Direct channels include manufacturer-owned retail outlets and, increasingly, dedicated brand e-commerce platforms, allowing for better margin control and direct consumer relationship management. Indirect channels involve wholesalers, large retail chains (Supermarkets/Hypermarkets), specialized dinnerware and home goods stores, and third-party e-commerce marketplaces (like Amazon or specialized home décor sites). The choice of channel is dictated by the target market segment; mass-market ceramics rely heavily on large retailers for volume, while luxury bone china often utilizes exclusive specialty stores and flagship retail locations to maintain brand prestige and control the customer experience precisely.

The Downstream Analysis involves the final marketing, sales, and post-sale service provided to the End-Users (Residential and Commercial). Effective marketing, particularly through lifestyle branding and digital content creation (Influencer collaborations, high-quality product photography), is essential for capturing the attention of the fashion-conscious residential segment. For the commercial sector, downstream success hinges on establishing robust B2B sales teams capable of handling large procurement contracts, managing bulk custom orders, and providing reliable, prompt replacement services to high-turnover clients like large hotel chains and restaurant groups. Optimization across the entire value chain—from sourcing sustainable raw materials to utilizing AI-optimized logistics for final delivery—is essential for achieving cost efficiencies, reducing breakage rates, and delivering maximum value to the diverse range of customers in the highly segmented global dinnerware market.

Dinnerwares Market Potential Customers

The Dinnerwares Market caters to a broad yet segmented array of Potential Customers, primarily categorized into Residential and Commercial end-users, each exhibiting distinct purchasing behaviors, volume requirements, and product priorities. Residential customers represent the largest volume segment and are highly sensitive to prevailing aesthetic trends, brand reputation, and discretionary income levels, purchasing dinnerware for daily use, formal entertaining, and gifting occasions. Within the residential category, potential buyers range from young adults setting up their first homes, typically seeking durable, entry-level melamine or stoneware sets, to affluent, established households investing in premium bone china or bespoke artisanal ceramic pieces as status symbols and interior design elements, emphasizing the need for broad product diversification across all price points to capture the full spectrum of consumer demand.

Commercial customers, dominated by the HORECA sector (Hotels, Restaurants, and Catering), constitute the most stable and high-volume procurement segment, prioritizing industrial-grade durability, stackability for efficient storage, chip resistance, and compliance with rigorous cleaning cycles (e.g., commercial dishwashers). These institutional buyers view dinnerware as an essential operational asset and a critical element of their brand presentation, often demanding customized branding (logo placement) and seeking long-term supply contracts that guarantee consistent product availability and rapid replacement of damaged items. High-end restaurants and luxury hotels specifically represent a crucial segment of the commercial market, frequently purchasing premium, customized porcelain or fine bone china to align the dining presentation with their luxury service standards, driving demand for specialized, aesthetically superior products that can withstand demanding professional usage.

Additionally, specialized potential customers include institutional buyers such as corporate cafeterias, healthcare facilities, and educational institutions, where the focus shifts heavily towards durability, cost-effectiveness, and compliance with health and safety regulations, often preferring low-cost, highly durable materials like melamine or robust thick ceramic designed for heavy, continuous operational usage. The emergence of specialized culinary arts academies and cooking schools also represents a growing niche customer segment, requiring specialized, high-quality dinnerware for training purposes and presentation events, reinforcing the need for manufacturers to maintain detailed product specifications and robust B2B sales infrastructure to effectively address the complex and differentiated demands across the entire spectrum of potential commercial and institutional purchasers globally.

| Report Attributes | Report Details |

|---|---|

| Market Size in 2026 | USD 45.2 Billion |

| Market Forecast in 2033 | USD 71.3 Billion |

| Growth Rate | 6.8% CAGR |

| Historical Year | 2019 to 2024 |

| Base Year | 2025 |

| Forecast Year | 2026 - 2033 |

| DRO & Impact Forces |

|

| Segments Covered |

|

| Key Companies Covered | Lenox Corporation, Wedgwood, Noritake, Royal Doulton, Corelle Brands, Villeroy & Boch, Mikasa, World Kitchen LLC, Meissen Porcelain, Hermes, Bernardaud, Rosenthal GmbH, Christofle, ARC International, Libbey Inc., RAK Ceramics, Churchill China, Oneida Group, Fiskars Group, Portmeirion Group PLC |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Enquiry Before Buy | Have specific requirements? Send us your enquiry before purchase to get customized research options. Request For Enquiry Before Buy |

Dinnerwares Market Key Technology Landscape

The Dinnerwares Market relies heavily on foundational ceramic manufacturing technologies, but the current technological landscape is defined by advancements aimed at improving efficiency, product aesthetics, and environmental sustainability. A primary technological focus involves advanced kiln technology, specifically optimizing roller kilns and tunnel kilns with sophisticated temperature monitoring and control systems (often integrating IoT sensors and AI algorithms) to ensure precise firing curves. This precision is essential for producing high-quality materials like bone china and fine porcelain, minimizing warping, cracking, and inconsistent glazing results, thereby significantly reducing energy consumption per unit and improving overall yield efficiency in highly energy-intensive stages of production, which is a key operating cost for manufacturers globally.

In terms of aesthetic and functional innovation, the market utilizes advanced material formulations, including the development of high-strength, lightweight ceramic bodies and specialized, lead-free glazes that enhance chip resistance and maintain color vibrancy even after prolonged use in commercial dishwashers, directly addressing the durability demands of the HORECA sector. Digital printing technology represents another critical advancement, allowing for the high-resolution application of complex, multi-color patterns directly onto the dinnerware surface, enabling mass customization and rapid prototyping of trend-specific designs without the high fixed costs associated with traditional decal application or manual painting techniques, significantly improving responsiveness to fast-changing consumer aesthetic preferences in the residential segment.

Furthermore, technology focused on the consumer-facing side, specifically in e-commerce, is transforming the purchasing experience. This includes the implementation of robust, data-driven packaging solutions that utilize shock-absorbing materials and optimized internal structuring to significantly reduce transit breakage rates for fragile items shipped globally, a historical bottleneck for online dinnerware sales. Moreover, augmented reality (AR) technology allows customers to virtually place dinnerware collections onto their own dining tables via smartphone apps, providing a realistic visualization of the product scale, color, and fit within their home environment, thereby boosting consumer confidence in online purchases and effectively bridging the sensory gap between digital browsing and tangible product evaluation, a necessary evolution for maximizing the profitability of the rapidly expanding direct-to-consumer digital channels.

Regional Highlights

- Asia Pacific (APAC): APAC is undeniably the fastest-growing and largest regional market, driven by powerful demographic shifts including rapid urbanization, the emergence of a massive middle class with expanding disposable incomes, and the strong cultural significance placed on home entertaining and formal dining traditions, particularly in China and India. The sheer scale of population and the accelerating adoption of westernized consumption patterns, coupled with robust domestic manufacturing capabilities, position APAC as the primary engine for global market volume and revenue growth, driving massive demand for both everyday functional ceramic ware and high-end luxury sets, often fueled by demand from rapidly expanding hospitality chains investing heavily in new hotels and dining infrastructure across major metropolitan centers.

- North America: The North American market is characterized by high consumer spending power, leading to significant demand for premium, branded, and specialized dinnerware, often driven by seasonal trends, holiday entertaining, and a strong culture of home renovation and décor updates. While growth rates are more moderate compared to APAC, the market value remains exceptionally high, defined by consumer preferences for durable, modern designs, and a growing interest in sustainable and artisan-made products. E-commerce penetration is extremely high in this region, necessitating advanced online retail strategies and sophisticated logistics networks capable of handling the high-volume, yet fragile, nature of dinnerware shipments, focusing heavily on convenience, rapid fulfillment, and strong return policies.

- Europe: Europe represents a mature market with a high concentration of heritage brands, particularly in countries like Germany, France, and the UK, known for their long-standing traditions in fine porcelain and bone china manufacturing. The market is characterized by consumer demand for quality, timeless aesthetics, and sustainable manufacturing practices, with stringent regulations regarding material safety and environmental impact influencing product development heavily. While replacement demand forms the core market activity, strong B2B sales driven by Europe’s sophisticated restaurant scene and high-end hotel industry ensure continued robust demand for high-quality, durable, and often bespoke commercial dinnerware solutions.

- Latin America & MEA: These regions are showing promising, albeit variable, growth. Latin America's market expansion is tied to improving economic stability and increasing urbanization, driving up residential and commercial construction, consequently boosting demand for dinnerware. The Middle East and Africa (MEA), particularly the GCC countries, show strong demand for luxury and imported dinnerware, fueled by high per capita incomes and significant investment in luxury hospitality infrastructure and high-end residential real estate developments, often purchasing premium brand collections imported from Europe and Asia, resulting in a market heavily influenced by global luxury brand positioning and distribution effectiveness.

Top Key Players

The market research report includes a detailed profile of leading stakeholders in the Dinnerwares Market.- Lenox Corporation

- Wedgwood

- Noritake

- Royal Doulton

- Corelle Brands

- Villeroy & Boch

- Mikasa

- World Kitchen LLC

- Meissen Porcelain

- Hermes

- Bernardaud

- Rosenthal GmbH

- Christofle

- ARC International

- Libbey Inc.

- RAK Ceramics

- Churchill China

- Oneida Group

- Fiskars Group

- Portmeirion Group PLC

Frequently Asked Questions

Analyze common user questions about the Dinnerwares market and generate a concise list of summarized FAQs reflecting key topics and concerns.What are the key materials driving the current growth of the Dinnerwares Market?

The primary materials driving growth are specialized Porcelain and advanced Ceramics, noted for their durability and aesthetic versatility. Bone China remains pivotal in the high-value luxury segment, while sustainable alternatives like recycled glass and bamboo composites are experiencing rapid adoption due to increasing consumer focus on eco-friendly products and ethical sourcing practices.

How is the shift towards e-commerce impacting the logistics and distribution of dinnerware?

The growth of e-commerce necessitates sophisticated logistics solutions, focusing heavily on specialized packaging and optimized handling protocols to minimize breakage rates during global transit. AI-driven route optimization and strategic warehouse placement are critical technologies being adopted to ensure efficient, safe, and cost-effective direct-to-consumer delivery of fragile dinnerware items.

Which geographical region holds the largest market share and why?

Asia Pacific (APAC) holds the largest market share, predominantly due to vast population size, rapid urbanization, significant growth in disposable income among the middle class, and robust expansion of both domestic manufacturing capabilities and the regional hospitality sector, collectively generating immense demand for all categories of dinnerware products.

What are the major challenges faced by dinnerware manufacturers in the current market environment?

Key challenges include significant volatility in the cost and reliable supply of raw materials (such as kaolin and specialized glazes), high energy consumption costs associated with the necessary firing processes, and intense pricing pressure stemming from the proliferation of low-cost, unorganized local competitors in emerging market segments worldwide.

In the commercial sector, what is the primary purchasing criteria for professional-grade dinnerware?

Commercial buyers, particularly those in the Hotel, Restaurant, and Catering (HORECA) segment, prioritize industrial-grade durability, chip resistance, stackability for space efficiency, compliance with stringent health and safety standards, and the ability to withstand frequent, high-temperature cleaning cycles required by professional food service operations globally.

To check our Table of Contents, please mail us at: sales@marketresearchupdate.com

Research Methodology

The Market Research Update offers technology-driven solutions and its full integration in the research process to be skilled at every step. We use diverse assets to produce the best results for our clients. The success of a research project is completely reliant on the research process adopted by the company. Market Research Update assists its clients to recognize opportunities by examining the global market and offering economic insights. We are proud of our extensive coverage that encompasses the understanding of numerous major industry domains.

Market Research Update provide consistency in our research report, also we provide on the part of the analysis of forecast across a gamut of coverage geographies and coverage. The research teams carry out primary and secondary research to implement and design the data collection procedure. The research team then analyzes data about the latest trends and major issues in reference to each industry and country. This helps to determine the anticipated market-related procedures in the future. The company offers technology-driven solutions and its full incorporation in the research method to be skilled at each step.

The Company's Research Process Has the Following Advantages:

- Information Procurement

The step comprises the procurement of market-related information or data via different methodologies & sources.

- Information Investigation

This step comprises the mapping and investigation of all the information procured from the earlier step. It also includes the analysis of data differences observed across numerous data sources.

- Highly Authentic Source

We offer highly authentic information from numerous sources. To fulfills the client’s requirement.

- Market Formulation

This step entails the placement of data points at suitable market spaces in an effort to assume possible conclusions. Analyst viewpoint and subject matter specialist based examining the form of market sizing also plays an essential role in this step.

- Validation & Publishing of Information

Validation is a significant step in the procedure. Validation via an intricately designed procedure assists us to conclude data-points to be used for final calculations.

×

Request Free Sample:

Related Reports

Select License

Why Choose Us

We're cost-effective and Offered Best services:

We are flexible and responsive startup research firm. We adapt as your research requires change, with cost-effectiveness and highly researched report that larger companies can't match.

Information Safety

Market Research Update ensure that we deliver best reports. We care about the confidential and personal information quality, safety, of reports. We use Authorize secure payment process.

We Are Committed to Quality and Deadlines

We offer quality of reports within deadlines. We've worked hard to find the best ways to offer our customers results-oriented and process driven consulting services.

Our Remarkable Track Record

We concentrate on developing lasting and strong client relationship. At present, we hold numerous preferred relationships with industry leading firms that have relied on us constantly for their research requirements.

Best Service Assured

Buy reports from our executives that best suits your need and helps you stay ahead of the competition.

Customized Research Reports

Our research services are custom-made especially to you and your firm in order to discover practical growth recommendations and strategies. We don't stick to a one size fits all strategy. We appreciate that your business has particular research necessities.

Service Assurance

At Market Research Update, we are dedicated to offer the best probable recommendations and service to all our clients. You will be able to speak to experienced analyst who will be aware of your research requirements precisely.

Contact With Our Sales Team

Customer Testimonials

The content of the report is always up to the mark. Good to see speakers from expertise authorities.

Privacy requested , Managing Director

A lot of unique and interesting topics which are described in good manner.

Privacy requested, President

Well researched, expertise analysts, well organized, concrete and current topics delivered in time.

Privacy requested, Development Manager