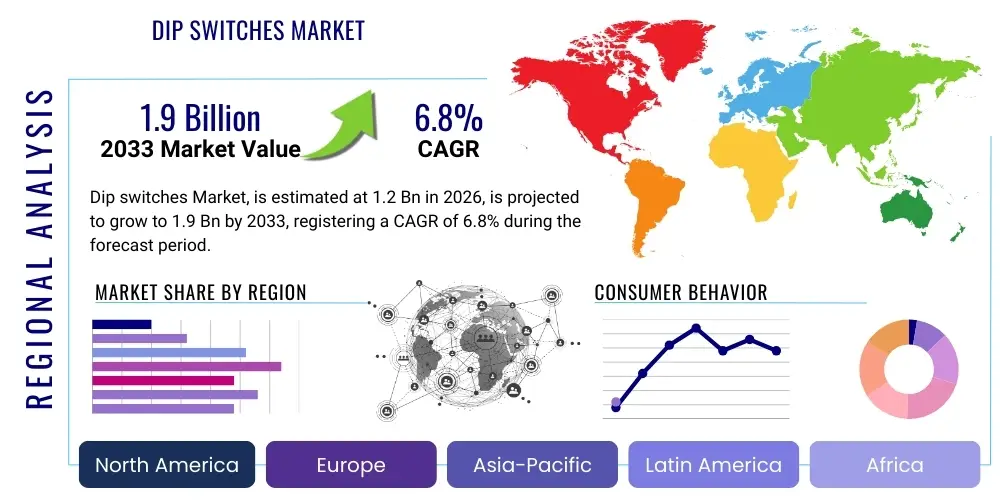

Dip switches Market Size, By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2026 to 2033 (Financial Impact Analysis)

ID : MRU_ 442994 | Date : Feb, 2026 | Pages : 258 | Region : Global | Publisher : MRU

Dip switches Market Size

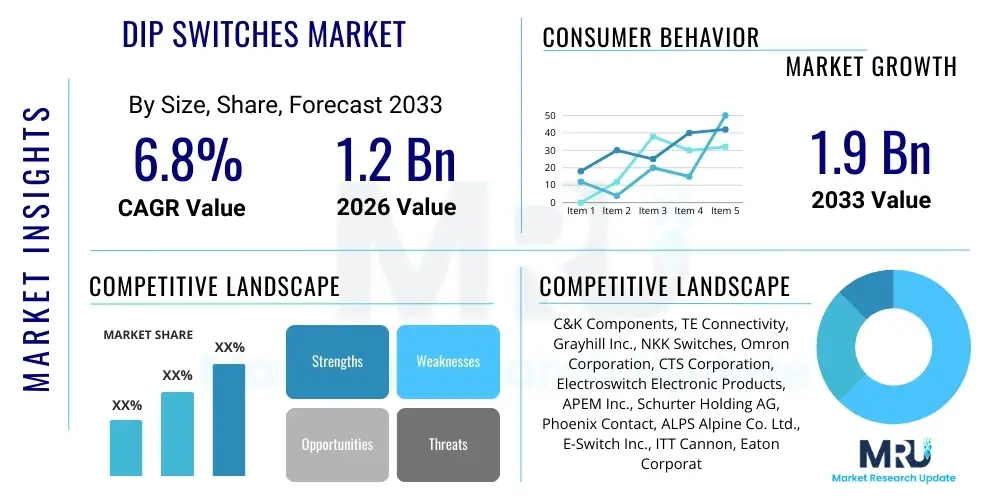

The Dip switches Market is projected to grow at a Compound Annual Growth Rate (CAGR) of 6.8% between 2026 and 2033. The market is estimated at USD 1.2 Billion in 2026 and is projected to reach USD 1.9 Billion by the end of the forecast period in 2033.

Dip switches Market introduction

Dip switches, short for Dual In-line Package switches, are essential electromechanical components used to configure hardware settings or operational modes in electronic devices. These compact components are typically mounted on printed circuit boards (PCBs) and consist of an array of miniature switches that can be individually toggled between ON and OFF positions, providing a binary coding mechanism. The primary function of dip switches is to establish initial configuration parameters, such as addressing, input voltage ranges, or protocol selection, without requiring complex software interaction or reprogramming. They are valued for their simplicity, reliability, and low cost in applications where semi-permanent configuration changes are necessary.

The product's architecture usually involves a housing molded from thermoplastic material, containing movable contacts and stationary terminals. Major applications span industrial control systems, telecommunications equipment, computer peripherals, and consumer electronics where they facilitate device setup and function selection. In industrial settings, for instance, dip switches are critical for configuring motor drives, programmable logic controllers (PLCs), and safety systems, ensuring reliable operation across diverse manufacturing environments. Their durability and resistance to environmental factors make them indispensable in rugged applications.

Key benefits driving their continued adoption include ease of use, physical tamper resistance (once mounted inside a device enclosure), and their non-volatile nature, meaning the configuration settings are retained even when power is lost. Driving factors for market growth involve the expansion of the industrial Internet of Things (IIoT), increasing demand for customized electronic control modules, and the steady requirement for reliable configuration solutions in high-reliability systems like medical devices and aerospace electronics. Although microcontrollers can often replace configuration tasks, dip switches maintain their niche due to their robust physical interface and straightforward implementation.

Dip switches Market Executive Summary

The Dip switches Market is currently experiencing robust growth, primarily fueled by the continued proliferation of complex industrial automation systems and the necessity for reliable hardware configuration in data center infrastructure. Key business trends indicate a significant shift towards miniaturization, with Surface Mount Technology (SMT) compatible dip switches gaining substantial traction over traditional through-hole versions. This shift is driven by the density requirements of modern PCBs and the need for automated assembly processes, improving manufacturing efficiency and reducing overall device size. Furthermore, heightened focus on quality and extended operational life in mission-critical applications is pushing manufacturers to adopt higher-grade materials and improved sealing technologies, ensuring performance in harsh environments.

Regional trends highlight the Asia Pacific (APAC) as the dominant and fastest-growing region, attributed to the immense concentration of electronics manufacturing hubs in countries like China, Taiwan, and South Korea. Rapid industrialization and heavy investment in 5G infrastructure and consumer electronics production in APAC necessitate high volumes of reliable configuration components. North America and Europe, while mature markets, demonstrate steady demand driven by stringent regulatory environments requiring certified components for medical and automotive electronics, focusing on high-reliability, sealed, and application-specific dip switch variants. The Middle East and Africa (MEA) and Latin America are emerging, spurred by infrastructure development and increasing adoption of smart grid technologies.

Segment trends reveal that the slide dip switch type holds a substantial market share due to its intuitive design and versatility, while the rocker and piano types cater to specific ergonomic or space constraints. In terms of packaging, SMT is rapidly displacing through-hole technology, especially in high-volume consumer and automotive electronics where automated assembly is mandatory. The application landscape is broadening, with Industrial Control and Automation remaining the largest segment, though the Telecommunications and Networking segment is exhibiting high growth due to continuous build-out of fiber optics and data networking equipment requiring physical configuration interfaces.

AI Impact Analysis on Dip switches Market

The emergence of Artificial Intelligence (AI) and Machine Learning (ML) primarily influences the Dip switches Market indirectly, impacting the electronic systems where these switches are deployed, rather than the core switch technology itself. Common user questions often revolve around whether AI-driven self-configuring systems will eliminate the need for physical switches, or how AI-optimized manufacturing processes might change the procurement of these components. Users are concerned about the long-term relevance of manual configuration components versus autonomous, software-driven systems. Analysis suggests that while AI facilitates automated configuration in large, interconnected systems (e.g., cloud servers), dip switches retain their essential role in providing fail-safe, local, hardware-level baseline settings, offering a reliable manual override or initial setup before software takes over. The key theme is the coexistence of advanced AI logic with simple, robust physical interfaces.

AI's influence is most pronounced in optimizing the design and placement of dip switches on highly complex PCBs destined for AI-powered devices (e.g., specialized AI accelerators or high-performance computing units). AI algorithms assist in predictive maintenance within industrial machinery configured by dip switches, flagging potential failures in associated systems, but the switch itself remains a manually configurable element. Furthermore, the massive amount of data processing required for AI training necessitates substantial data center build-outs; these centers rely heavily on networking equipment and server racks where dip switches are routinely used for defining bus termination, addressing, and backup configurations.

In essence, AI adoption increases the complexity and sophistication of the host electronic systems, paradoxically enhancing the need for simple, physical, and reliable configuration defaults. AI may automate runtime operations, but the initial, hardware-dependent settings often still require the non-volatile and physically defined state provided by a dip switch. This duality ensures dip switches remain relevant, especially in safety-critical applications where relying solely on software for foundational configuration is deemed too risky or non-compliant with functional safety standards.

- AI drives miniaturization and precision assembly requirements for SMT dip switches used in AI hardware.

- Increased demand for robust, sealed dip switches in edge computing devices powered by AI.

- AI-optimized electronic design automation (EDA) tools influence optimal placement and routing of dip switches on PCBs.

- AI-driven automated network configuration reduces reliance on complex software menus, but dip switches retain role for initial hardware addressing and fail-safe mode setup.

- AI proliferation in industrial IoT necessitates high-reliability dip switches for sensor and gateway configuration.

DRO & Impact Forces Of Dip switches Market

The Dip switches Market is subject to a balanced array of driving forces, restraining factors, and significant opportunities, which collectively shape its trajectory and competitive landscape. A primary driver is the accelerating pace of industrial automation globally, requiring vast quantities of reliable, simple components for setting operational parameters in PLCs, motor controllers, and robotic systems. Concurrently, the proliferation of specialized electronic devices, from high-performance networking gear to medical diagnostic equipment, mandates physical configuration mechanisms where software complexity is deliberately avoided for foundational settings. These driving forces emphasize reliability, cost-effectiveness, and the intrinsic simplicity of dip switches over sophisticated digital interfaces.

However, the market faces notable restraints, chiefly the increasing trend toward software-defined configuration and flash memory-based solutions, particularly in high-volume, low-cost consumer electronics where manufacturing complexity must be minimized. For highly integrated modern chips (ASICs, FPGAs), configuration parameters are often set internally via registers or firmware, diminishing the need for external physical switches. Additionally, the physical space consumed by a dip switch, even an SMT version, can be a deterrent in ultra-compact wearables or smartphones where maximizing battery or sensor real estate is paramount. Price competition, especially from Asian manufacturers, also constrains profit margins for specialized or standard through-hole variants.

Significant opportunities exist in the burgeoning markets of high-reliability and sealed switches, catering specifically to harsh environmental applications like automotive electronics (engine control units), offshore oil and gas instrumentation, and military/aerospace systems. The shift towards half-pitch and smaller packaging formats opens avenues in dense PCB layouts. Furthermore, the development of intelligent dip switches integrated with diagnostic capabilities or network connectivity, although complex, presents a future opportunity for bridging the gap between simple hardware configuration and sophisticated software monitoring. The growing maintenance and retrofit market for legacy industrial systems also provides a long-tail opportunity for existing product lines.

Segmentation Analysis

The Dip switches Market is strategically segmented based on crucial attributes including switch type, mounting style, number of positions, and end-use application. Analyzing these segments provides a clear map of consumption patterns, technological preferences, and growth hot spots across various industries. The primary functional segmentation revolves around the physical mechanism used, differentiating between slide, rocker, piano, and rotary types, each optimized for specific access requirements and physical constraints. Mounting style remains a critical differentiator, dividing the market between traditional through-hole technology (THT) and modern surface-mount technology (SMT), reflecting the broader trends in PCB manufacturing processes.

In terms of switch type, slide dip switches currently dominate due to their commonality, ease of operation, and robust nature. However, the SMT mounting style is rapidly gaining share, particularly in sectors demanding high component density and high-speed automated assembly, such as telecommunications and automotive electronics. Application analysis reveals Industrial Control and Automation as the largest consuming segment, driven by the continuous upgrade cycles and expansion of smart factories, requiring high component longevity and sealing capabilities. The detailed segmentation assists manufacturers in tailoring product specifications and marketing strategies to meet the divergent needs of specialized end-user sectors.

- By Type:

- Slide Dip Switches

- Rocker Dip Switches

- Piano Dip Switches

- Rotary Dip Switches

- By Number of Positions:

- 2 Position

- 4 Position

- 8 Position

- 10 Position

- 12 Position and Above

- By Mounting Style:

- Through-Hole Technology (THT)

- Surface Mount Technology (SMT)

- By Application/End-Use:

- Industrial Control and Automation (PLCs, Motor Drives)

- Telecommunications and Networking (Routers, Switches, Data Center Equipment)

- Computer and Peripherals (PC Motherboards, Expansion Cards)

- Consumer Electronics (Home Appliances, Entertainment Systems)

- Automotive Electronics (ECUs, Infotainment Systems)

- Medical Devices (Diagnostic Equipment, Monitoring Systems)

- Military and Aerospace

Value Chain Analysis For Dip switches Market

The value chain for the Dip switches Market begins with upstream activities focusing on raw material procurement, primarily encompassing high-grade thermoplastics (like PPS, PBT) for housings and durable metals (often gold-plated copper alloys) for contacts and terminals. Component manufacturing is characterized by highly specialized injection molding and precision stamping processes to ensure the tight tolerances required for reliable mechanical action. Key upstream challenges involve managing fluctuating raw material costs and ensuring the supply of specialized compounds that offer high heat resistance necessary for wave soldering or reflow soldering processes.

Midstream activities involve the core manufacturing and assembly of the dip switch components, including automated insertion of contacts, encapsulation, and rigorous quality assurance testing (e.g., life cycle testing, resistance testing). Major manufacturers typically integrate highly automated production lines to handle the massive volumes demanded by the electronics industry. Distribution channels are complex, leveraging a mix of direct sales to large OEMs (Original Equipment Manufacturers), and indirect sales through a robust network of global and regional electronic component distributors (e.g., Avnet, Arrow, Digi-Key) who manage inventory and provide technical support to smaller clients and repair shops.

Downstream activities center on the integration of dip switches into the end electronic products across diverse industries, including industrial automation integrators, telecom infrastructure builders, and medical device assemblers. Direct sales are crucial for strategic partnerships with Tier 1 automotive suppliers or large defense contractors who require specific customizations and secure supply lines. Indirect channels facilitate the broad accessibility of standard dip switch components for MRO (Maintenance, Repair, and Operations) markets and R&D prototyping. The efficiency of the distribution network directly impacts lead times and availability, which are critical performance indicators in the fast-paced electronics manufacturing sector.

Dip switches Market Potential Customers

Potential customers for dip switches are predominantly large Original Equipment Manufacturers (OEMs) and Electronics Manufacturing Services (EMS) providers across several high-tech sectors. The most significant buyers are companies involved in industrial automation, including manufacturers of Programmable Logic Controllers (PLCs), Human-Machine Interfaces (HMIs), and specialized robotic equipment, which rely on dip switches for defining I/O addresses and operational modes. These customers prioritize components that offer high longevity (high cycle count) and environmental sealing (IP ratings) to ensure reliability in harsh factory settings.

The telecommunications and networking sectors constitute another major customer base, encompassing manufacturers of routers, network switches, server blades, and fiber optic transmission equipment. In these applications, dip switches are essential for setting configuration parameters such as bus termination resistance or network addressing protocols. These buyers look for compact, SMT-compatible switches that facilitate high-density board designs and rapid, automated assembly.

Furthermore, medical device manufacturers, particularly those producing diagnostic imaging equipment, patient monitoring systems, and infusion pumps, represent high-value customers. For these applications, the non-volatile and physically defined state provided by dip switches is often mandated by safety regulations, requiring extremely high reliability and stringent quality control. Automotive electronics suppliers, using dip switches within complex Engine Control Units (ECUs) or infotainment modules, also represent a growing segment, driven by the increasing electronic content in modern vehicles.

| Report Attributes | Report Details |

|---|---|

| Market Size in 2026 | USD 1.2 Billion |

| Market Forecast in 2033 | USD 1.9 Billion |

| Growth Rate | 6.8% CAGR |

| Historical Year | 2019 to 2024 |

| Base Year | 2025 |

| Forecast Year | 2026 - 2033 |

| DRO & Impact Forces |

|

| Segments Covered |

|

| Key Companies Covered | C&K Components, TE Connectivity, Grayhill Inc., NKK Switches, Omron Corporation, CTS Corporation, Electroswitch Electronic Products, APEM Inc., Schurter Holding AG, Phoenix Contact, ALPS Alpine Co. Ltd., E-Switch Inc., ITT Cannon, Eaton Corporation, TT Electronics, Yamaichi Electronics, Switchcraft, Panasonic Industry, Honeywell International Inc., Copal Electronics. |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Enquiry Before Buy | Have specific requirements? Send us your enquiry before purchase to get customized research options. Request For Enquiry Before Buy |

Dip switches Market Key Technology Landscape

The core technology surrounding dip switches remains centered on reliable electromechanical contact closure, but significant innovations are focused on packaging, sealing, and material science to meet modern PCB manufacturing demands. A critical technological evolution is the standardization and refinement of Surface Mount Technology (SMT) packaging. SMT dip switches must withstand high-temperature reflow soldering processes without degradation of the housing material or internal contacts, necessitating the use of specialized high-temperature plastics like LCP (Liquid Crystal Polymer) or high-performance thermosets. This transition to SMT enables higher component density and compatibility with automated pick-and-place assembly lines, crucial for mass-produced electronics.

Another key area of technological advancement involves enhancing the sealing capabilities of dip switches. Standard open-base switches are prone to contamination during the soldering and cleaning phases of PCB production. Consequently, manufacturers are heavily invested in developing fully sealed or partially sealed switches, often employing top-tape seals, removable washing seals, or permanently encapsulated designs using epoxy or robust plastic molding. These sealed units protect the internal mechanism from fluxes, solvents, dust, and moisture, extending the operational lifespan, particularly in industrial, outdoor, or automotive environments where exposure to contaminants is common.

Furthermore, technology development is focused on miniaturization, moving towards half-pitch (1.27mm) and fine-pitch versions to align with the relentless drive for smaller electronic devices. Contact technology also sees continuous improvement, with gold-plated contacts remaining standard for low-current, high-reliability applications to prevent oxidation and ensure stable contact resistance over thousands of cycles. Specialized ergonomic designs, such as recessed actuators requiring a tool to adjust settings, are also becoming prevalent in security-conscious applications, representing a blend of mechanical design and system security requirements.

Regional Highlights

- Asia Pacific (APAC): APAC is the epicenter of global electronics manufacturing, driving the highest volume demand for dip switches. Countries like China, South Korea, Japan, and Taiwan house major EMS providers and OEMs producing everything from consumer gadgets to sophisticated telecom infrastructure. The region exhibits strong demand for SMT dip switches due to its automated, high-volume manufacturing environments. Rapid deployment of 5G networks, expansion of automotive electronics assembly, and increasing complexity of consumer devices fuel market growth. The competitive landscape here is intense, characterized by a mix of local giants and multinational component suppliers.

- North America: This region is characterized by high demand for specialized, high-reliability dip switches, particularly in the medical, military, and aerospace sectors where stringent quality standards and long-term supply assurance are critical. While manufacturing volumes are lower compared to APAC, the Average Selling Price (ASP) of switches sold here is higher due to customization requirements and regulatory compliance. Growth is steady, driven by advancements in industrial IoT platforms and the refresh cycle of data center equipment.

- Europe: Europe represents a mature market focusing heavily on industrial automation (especially Germany's manufacturing sector) and advanced automotive electronics. European regulations, such as those governing functional safety (e.g., ISO 26262), drive demand for certified and sealed components. There is a strong preference for robust, sealed piano and rocker style switches suitable for demanding operational environments within machinery and control cabinets. Sustainability and compliance with environmental directives also influence material selection and packaging innovations.

- Latin America (LATAM): LATAM is an emerging market with moderate growth, primarily driven by infrastructure development, including smart grid projects and increasing localized assembly of consumer electronics and industrial machinery in countries like Brazil and Mexico. Demand is mostly for standard through-hole and cost-effective slide switches used in entry-to-mid-level equipment configuration. Market penetration is often dependent on established global distributors.

- Middle East and Africa (MEA): This region is experiencing nascent growth, linked to major investments in oil & gas infrastructure, telecommunications expansion, and smart city initiatives in the Gulf Cooperation Council (GCC) states. The demand profile is highly skewed towards durable, environmentally sealed switches due to extreme temperature and harsh conditions prevalent in the operational environment. Telecommunications network build-out is a primary driver in the near term.

Top Key Players

The market research report includes a detailed profile of leading stakeholders in the Dip switches Market.- C&K Components

- TE Connectivity

- Grayhill Inc.

- NKK Switches

- Omron Corporation

- CTS Corporation

- Electroswitch Electronic Products

- APEM Inc.

- Schurter Holding AG

- Phoenix Contact

- ALPS Alpine Co. Ltd.

- E-Switch Inc.

- ITT Cannon

- Eaton Corporation

- TT Electronics

- Yamaichi Electronics

- Switchcraft

- Panasonic Industry

- Honeywell International Inc.

- Copal Electronics

Frequently Asked Questions

Analyze common user questions about the Dip switches market and generate a concise list of summarized FAQs reflecting key topics and concerns.What are the primary advantages of using Dip switches over software configuration?

Dip switches offer inherent advantages of non-volatile configuration memory, physical tamper resistance, and fail-safe operation. They provide a simple, reliable hardware-level setting that is retained even without power, making them crucial for initial boot settings and critical system defaults where reliance on complex software is undesirable.

Which Dip switch mounting style is dominating the market?

While Through-Hole Technology (THT) dip switches maintain significant volume in legacy and repair applications, Surface Mount Technology (SMT) is the fastest-growing and increasingly dominant segment. SMT is favored for modern, high-density PCBs and automated manufacturing processes across consumer and telecom electronics.

How does the Industrial Automation sector utilize Dip switches?

The Industrial Automation sector uses dip switches extensively in Programmable Logic Controllers (PLCs), motor drives, and sensor interface modules to set device addresses, select operating voltage ranges, define communication protocols (like bus termination), and configure initial input/output modes quickly and reliably on-site.

What is driving the demand for sealed Dip switches?

Demand for sealed dip switches is driven by the need for enhanced reliability in harsh operating environments, such as automotive electronics, outdoor equipment, and industrial settings involving dust, moisture, or chemical exposure. Sealing protects the contacts from soldering residues and environmental contaminants, extending the operational lifespan.

Will integrated circuits (ICs) fully replace the need for physical configuration switches?

Integrated Circuits (ICs) and firmware-based configurations are replacing dip switches in many high-volume consumer products. However, dip switches remain indispensable for safety-critical applications, industrial equipment, and networking hardware where a robust, manually adjustable hardware override or baseline configuration method is required for system integrity and regulatory compliance.

What role does miniaturization play in the Dip switches Market?

Miniaturization is critical, driven by the shrinking size of electronic devices. Manufacturers are developing half-pitch (1.27mm) and low-profile SMT dip switches to accommodate high component density on PCBs, enabling complex functionality within compact device footprints, crucial for modern telecom and computing hardware.

Which geographical region shows the highest growth potential for Dip switches?

Asia Pacific (APAC) exhibits the highest growth potential, largely due to its status as the global manufacturing hub for consumer electronics, telecommunications equipment, and industrial machinery. Investment in 5G infrastructure and rapid industrialization in countries like China and India sustain this high growth trajectory.

How do competitive pricing pressures affect the profitability of Dip switch manufacturers?

Competitive pricing, particularly from high-volume manufacturers in Asia, compresses profit margins on standard through-hole and common SMT dip switch variants. Manufacturers counter this by focusing on high-margin, specialized products such as sealed, customized, or high-reliability switches used in medical and aerospace sectors.

What are 'piano style' Dip switches and where are they typically used?

Piano style dip switches have actuators that hinge upward like piano keys, making them easy to operate when the PCB is mounted vertically near an access panel. They are typically used in rack-mounted equipment, such as telecommunications switches, server chassis, and large industrial control cabinets, where front-panel accessibility is necessary.

What materials are commonly used for the housing of high-performance Dip switches?

High-performance dip switch housings often utilize engineering thermoplastics such as Polyphenylene Sulfide (PPS) or Liquid Crystal Polymer (LCP). These materials offer superior resistance to high temperatures, necessary to survive modern soldering processes, along with excellent mechanical strength and dimensional stability.

What is the 'cycle life' of a typical Dip switch and why is it important?

The cycle life refers to the number of times a switch can be reliably toggled (ON/OFF) before failure, typically ranging from 1,000 to 20,000 cycles. A high cycle life is critical in industrial and test equipment applications where frequent configuration changes occur, ensuring component longevity and reducing maintenance costs.

How is the automotive industry integrating Dip switches?

The automotive industry integrates dip switches into specialized electronic control units (ECUs), dashboard modules, and infotainment systems. They are used for setting operational modes, regional configurations, or diagnostic parameters, demanding sealed, vibration-resistant, and high-temperature tolerant SMT components that meet rigorous AEC-Q standards.

What is the significance of gold-plated contacts in Dip switch technology?

Gold-plated contacts are essential in dip switches, especially those handling low current or utilized in high-reliability applications. Gold prevents oxidation and contamination of the contact surface, ensuring stable, low contact resistance over the operational life, which is vital for maintaining signal integrity in sensitive electronic circuits.

Does the rise of IIoT (Industrial IoT) increase or decrease the demand for Dip switches?

The rise of IIoT generally increases the demand for dip switches, particularly sealed and robust versions. While data transmission and monitoring are software-driven, the end-devices, sensors, and gateways in an IIoT network still require reliable hardware configuration (addressing, mode selection) provided by durable physical switches at the edge.

What are the main risks associated with using non-sealed Dip switches during manufacturing?

Non-sealed dip switches are highly susceptible to contamination during the PCB assembly process. Solder flux, cleaning solvents, and moisture can infiltrate the switch mechanism, leading to intermittence, high contact resistance, or complete failure. This necessitates the use of sealed versions or careful process management to avoid defects.

How do Dip switches contribute to network equipment reliability?

In network equipment (routers, switches), dip switches are used for critical initial configurations, such as setting bus termination resistors or unique hardware addresses. This hard-coded physical configuration ensures the device can boot and communicate reliably, acting as a foundational layer before software configuration takes over, thereby enhancing overall system reliability.

Which switch type is preferred for maximum density on a PCB?

Slide dip switches configured in an SMT package are generally preferred for maximum density. Their low profile and compatibility with automated pick-and-place machines allow them to be efficiently integrated into highly compact circuit board layouts, such as those found in portable electronics and small peripherals.

What is the role of distributors in the Dip switches market value chain?

Electronic component distributors (indirect channel) play a crucial role by providing inventory management, logistics, and technical support. They ensure the wide availability of standard dip switch components to small and medium-sized enterprises (SMEs), repair shops (MRO), and R&D facilities worldwide, significantly extending the manufacturer's reach.

What defines a half-pitch Dip switch?

A half-pitch dip switch refers to components where the pin spacing (pitch) is reduced to 1.27 millimeters (0.050 inches), half the standard 2.54mm pitch. This design allows for a substantial reduction in the physical footprint of the switch on the PCB, supporting high-density electronic designs.

How do rotational Dip switches differ from slide or rocker types?

Rotational dip switches utilize a dial or rotary mechanism instead of linear sliding or rocker actions. They typically encode settings using a binary or hexadecimal format based on the dial position, offering a higher number of positions or specific coding output from a single physical component, often preferred for digital logic addressing.

What are the key considerations for selecting a Dip switch for medical applications?

For medical applications (e.g., patient monitors, diagnostic devices), key considerations include high reliability (often requiring 10,000+ cycle life), stringent quality control, material biocompatibility (where relevant), and robust sealing to withstand frequent cleaning and sterilization processes. Compliance with relevant medical device standards is non-negotiable.

How is the shift towards lead-free soldering affecting Dip switch manufacturing?

The transition to lead-free soldering mandates higher reflow temperatures (typically above 240°C). Dip switch manufacturers must use advanced, high-temperature resistant plastics for housings to prevent warping or degradation during the soldering process, driving innovation in material science within the component sector.

What is the impact of customizing Dip switches on manufacturing costs?

Customization—such as specific body colors, unique sealing methods, or proprietary pin configurations—significantly increases manufacturing complexity and reduces economies of scale, leading to higher unit costs. Custom orders are primarily placed by large OEMs in specialized sectors like aerospace or military where standard off-the-shelf components are insufficient.

Beyond configuration, what secondary applications do Dip switches fulfill?

Beyond primary hardware configuration, dip switches are sometimes used in safety systems as a physical interlock or mode selector, in testing environments for diagnostic signal routing, or as simple, tactile user interface inputs for mode selection where digital screens are impractical or undesirable due to cost or environmental constraints.

Why is the forecast CAGR for the Dip switches Market considered moderate despite technological substitution risks?

The CAGR is moderate because while technological substitution (by ICs/firmware) exists, the core demand from high-reliability sectors (industrial, telecom infrastructure, medical) requiring non-volatile, physical configuration remains strong and constant. Growth is sustained by miniaturization trends and infrastructure build-out, counterbalancing losses in basic consumer electronics.

How are environmental regulations influencing Dip switch production?

Environmental regulations like RoHS (Restriction of Hazardous Substances) heavily influence dip switch production, requiring manufacturers to ensure that materials used for contacts, plating, and housing are free from banned substances. This necessitates complex tracking and certification processes throughout the supply chain and affects material selection for compliance.

What challenges do manufacturers face regarding the global supply chain for Dip switches?

Manufacturers face challenges related to the volatility of raw material prices (especially for precious metals like gold used in contacts), geopolitical instability affecting manufacturing concentration in APAC, and the need for rigorous inventory management to meet highly varied global demand for thousands of different switch configurations.

In what way does the design of the actuator impact end-user experience?

The design of the actuator (slide, rocker, piano) dictates the accessibility and ease of adjustment. Recessed actuators require a tool for deliberate changes, reducing accidental toggling, while protruding rockers offer easier finger access. This choice is critical for defining the user interface and security level of the host device configuration.

What is the primary characteristic of a 'low profile' Dip switch?

A 'low profile' dip switch is characterized by a significantly reduced height above the PCB surface, minimizing vertical clearance requirements within a device enclosure. This design is highly sought after in densely packed electronic systems where space optimization both horizontally and vertically is paramount.

How do Dip switches support legacy industrial systems?

Dip switches are essential for the ongoing maintenance, repair, and operation (MRO) of vast installed bases of legacy industrial machinery and control systems that were designed decades ago. Since these systems often rely on specific, non-volatile hardware addressing, the availability of compatible through-hole dip switches remains a critical requirement for longevity.

To check our Table of Contents, please mail us at: sales@marketresearchupdate.com

Research Methodology

The Market Research Update offers technology-driven solutions and its full integration in the research process to be skilled at every step. We use diverse assets to produce the best results for our clients. The success of a research project is completely reliant on the research process adopted by the company. Market Research Update assists its clients to recognize opportunities by examining the global market and offering economic insights. We are proud of our extensive coverage that encompasses the understanding of numerous major industry domains.

Market Research Update provide consistency in our research report, also we provide on the part of the analysis of forecast across a gamut of coverage geographies and coverage. The research teams carry out primary and secondary research to implement and design the data collection procedure. The research team then analyzes data about the latest trends and major issues in reference to each industry and country. This helps to determine the anticipated market-related procedures in the future. The company offers technology-driven solutions and its full incorporation in the research method to be skilled at each step.

The Company's Research Process Has the Following Advantages:

- Information Procurement

The step comprises the procurement of market-related information or data via different methodologies & sources.

- Information Investigation

This step comprises the mapping and investigation of all the information procured from the earlier step. It also includes the analysis of data differences observed across numerous data sources.

- Highly Authentic Source

We offer highly authentic information from numerous sources. To fulfills the client’s requirement.

- Market Formulation

This step entails the placement of data points at suitable market spaces in an effort to assume possible conclusions. Analyst viewpoint and subject matter specialist based examining the form of market sizing also plays an essential role in this step.

- Validation & Publishing of Information

Validation is a significant step in the procedure. Validation via an intricately designed procedure assists us to conclude data-points to be used for final calculations.

×

Request Free Sample:

Related Reports

- DIP Switches Market Size Report By Type (Rotary-style, Slide-style, Rocker-style, Others), By Application (Consumer Electronics & Appliances, Telecommunications, Others), By Region (North America, Latin America, Europe, Asia Pacific, Middle East, and Africa) - Share, Trends, Outlook and Forecast 2025-2032

- DIP Switches Market Statistics 2025 Analysis By Application (Consumer Electronics & Appliances, Telecommunications), By Type (Rotary-style, Slide-style, Rocker-style), and By Region (North America, Latin America, Europe, Asia Pacific, Middle East, and Africa) - Size, Share, Outlook, and Forecast 2025 to 2032

Select License

Why Choose Us

We're cost-effective and Offered Best services:

We are flexible and responsive startup research firm. We adapt as your research requires change, with cost-effectiveness and highly researched report that larger companies can't match.

Information Safety

Market Research Update ensure that we deliver best reports. We care about the confidential and personal information quality, safety, of reports. We use Authorize secure payment process.

We Are Committed to Quality and Deadlines

We offer quality of reports within deadlines. We've worked hard to find the best ways to offer our customers results-oriented and process driven consulting services.

Our Remarkable Track Record

We concentrate on developing lasting and strong client relationship. At present, we hold numerous preferred relationships with industry leading firms that have relied on us constantly for their research requirements.

Best Service Assured

Buy reports from our executives that best suits your need and helps you stay ahead of the competition.

Customized Research Reports

Our research services are custom-made especially to you and your firm in order to discover practical growth recommendations and strategies. We don't stick to a one size fits all strategy. We appreciate that your business has particular research necessities.

Service Assurance

At Market Research Update, we are dedicated to offer the best probable recommendations and service to all our clients. You will be able to speak to experienced analyst who will be aware of your research requirements precisely.

Contact With Our Sales Team

Customer Testimonials

The content of the report is always up to the mark. Good to see speakers from expertise authorities.

Privacy requested , Managing Director

A lot of unique and interesting topics which are described in good manner.

Privacy requested, President

Well researched, expertise analysts, well organized, concrete and current topics delivered in time.

Privacy requested, Development Manager