Diphenol Category Products Market Size, By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2026 to 2033 (Financial Impact Analysis)

ID : MRU_ 441868 | Date : Feb, 2026 | Pages : 245 | Region : Global | Publisher : MRU

Diphenol Category Products Market Size

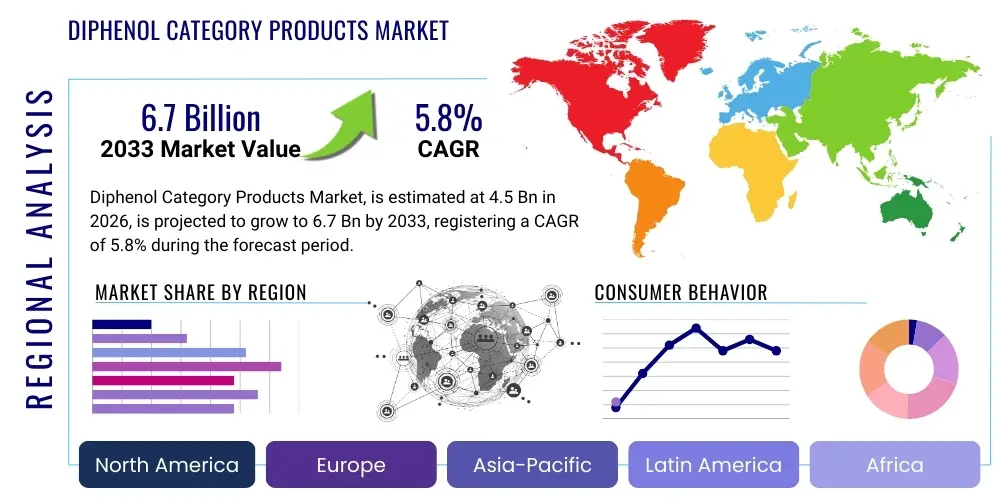

The Diphenol Category Products Market is projected to grow at a Compound Annual Growth Rate (CAGR) of 5.8% between 2026 and 2033. The market is estimated at USD 4.5 Billion in 2026 and is projected to reach USD 6.7 Billion by the end of the forecast period in 2033.

Diphenol Category Products Market introduction

The Diphenol Category Products Market encompasses a range of organic chemical compounds characterized by two hydroxyl groups attached to an aromatic ring. Key members of this category include catechol (1,2-dihydroxybenzene), resorcinol (1,3-dihydroxybenzene), and hydroquinone (1,4-dihydroxybenzene). These foundational chemicals are indispensable building blocks in modern industrial chemistry, serving as critical intermediates in the synthesis of high-performance polymers, specialized agrochemicals, advanced antioxidants, and various pharmaceutical compounds. The utility of diphenols stems from their diverse chemical reactivity, making them crucial for cross-linking, stabilization, and functional group introduction in complex molecules. Their demand is intrinsically linked to the expansion of downstream industries, particularly in construction, automotive, and electronics sectors where high-durability materials are required.

Major applications of diphenols are found primarily in the polymer and rubber industries, where they function as powerful polymerization inhibitors and stabilizers, preventing degradation and extending the lifespan of materials under harsh conditions. For instance, resorcinol is vital for producing specialized adhesive resins used in tire manufacturing, enhancing rubber-to-cord bonding strength. Hydroquinone derivatives are widely utilized in cosmetic and dermatological applications, notably for skin lightening and as potent antioxidants in oils and fats. Furthermore, the burgeoning demand for sustainable and high-efficiency agrochemicals drives the consumption of diphenols as precursors for herbicides and fungicides, ensuring crop protection and yield improvement globally. The inherent benefits, such as enhanced material performance, reduced oxidative stress, and cost-effective synthesis routes, solidify their importance in the global chemical landscape.

Driving factors for market expansion include the increasing regulatory emphasis on fire retardancy and material durability in construction and transportation, boosting the need for diphenol-derived flame retardants and specialty resins. Rapid industrialization in the Asia-Pacific region, coupled with substantial investments in infrastructure development, significantly escalates the demand for coatings, adhesives, and elastomers that rely on diphenol intermediates. Additionally, technological advancements in catalytic processes are leading to more efficient and environmentally friendly production methods for key diphenols, reducing manufacturing costs and improving supply chain stability. This combination of robust end-user demand and optimized production technologies provides a strong momentum for sustained market growth throughout the forecast period.

Diphenol Category Products Market Executive Summary

The Diphenol Category Products Market demonstrates robust business trends driven by strong integration into high-growth sectors such as high-performance polymers, specialized agrochemicals, and dermatological formulations. A key business trend is the ongoing shift toward bio-based or green diphenol synthesis methods, particularly in response to tightening environmental regulations in North America and Europe. Strategic mergers and acquisitions are common among large chemical manufacturers aiming to secure raw material supply, optimize production efficiency through vertical integration, and expand geographical presence, especially into fast-developing economies. Furthermore, sustained research and development efforts are focusing on creating novel diphenol derivatives with enhanced functionality, specifically tailored for extreme-condition applications in aerospace and advanced electronics, ensuring continuous product innovation and premium pricing potential.

Regionally, the Asia Pacific (APAC) currently dominates the market share due to its massive manufacturing base, particularly in China and India, which are global hubs for polymer production, textile manufacturing, and agricultural output. The substantial domestic consumption and export-oriented chemical processing capabilities in APAC fuel an unparalleled demand for catechol and hydroquinone. Conversely, North America and Europe, while mature markets, are leading in terms of value addition and regulatory compliance, characterized by high demand for high-purity, specialty-grade diphenols used in regulated sectors like pharmaceuticals and advanced coatings. Investment trends show increasing capital expenditure directed towards expanding existing production capacities in key APAC countries, alongside modernization and compliance upgrades in Western facilities to meet stringent quality standards.

Segmentation trends highlight the increasing prominence of Resorcinol derivatives driven by escalating demand in the tire and rubber industry for high-performance adhesives necessary for improved vehicle safety and efficiency. Within the application segments, the Antioxidants and Polymer & Resins categories remain the largest consumers, benefiting directly from the automotive and construction recovery post-pandemic. However, the Pharmaceutical and Agrochemical segments are exhibiting the fastest growth rates, spurred by global population expansion, increased focus on crop yield protection, and the rapid development of new drug formulations requiring high-purity chemical intermediates. Producers are increasingly differentiating their offerings based on purity grade and particle size distribution, catering specifically to the exacting requirements of the pharmaceutical industry, which commands significantly higher margins compared to bulk chemical applications.

AI Impact Analysis on Diphenol Category Products Market

Common user questions regarding AI's impact on the Diphenol Category Products Market often center on optimizing synthesis routes, predicting raw material fluctuations, and enhancing quality control in complex chemical processing. Users frequently inquire about how AI can accelerate the discovery of novel diphenol derivatives with specific performance characteristics, such as enhanced UV stability or lower toxicity profiles, thus driving product innovation faster than traditional R&D cycles. Furthermore, significant concern is raised about the integration costs and necessary skill development required to implement advanced machine learning models for predictive maintenance in large-scale chemical reactors, ensuring high uptime and reducing the probability of costly production halts. These questions collectively underscore the expectation that AI will primarily revolutionize operational efficiency, safety, and the speed of chemical innovation within the diphenol value chain.

AI’s influence is beginning to manifest most strongly in optimizing chemical reaction conditions and modeling complex molecular interactions within diphenol production. Machine learning algorithms are being deployed to analyze vast datasets pertaining to temperature, pressure, catalyst concentration, and reaction time, leading to identification of optimum synthesis parameters that maximize yield and minimize energy consumption. This optimization not only reduces operational expenditure but also improves the environmental footprint of highly energy-intensive chemical processes. Companies are leveraging predictive analytics to forecast the stability and shelf life of diphenol-based antioxidants and polymers under various environmental stressors, ensuring product quality and adherence to regulatory standards before large-scale commercialization, effectively streamlining quality assurance protocols.

Beyond process optimization, Artificial Intelligence plays a crucial role in enhancing supply chain resilience and raw material procurement strategies, a significant challenge given the volatility of petrochemical feedstocks. AI-driven forecasting models integrate real-time market data, geopolitical risks, and production schedules to predict potential supply disruptions, allowing manufacturers to proactively adjust procurement volumes and inventory levels. This strategic application of AI minimizes exposure to raw material price volatility and ensures a stable supply of key precursors like benzene and phenol. Over the long term, generative AI models hold the promise of designing entirely new catalytic systems for diphenol synthesis, potentially unlocking sustainable production methods that rely on non-fossil fuel derived inputs, fundamentally altering the production landscape.

- Enhanced Yield Optimization: AI algorithms fine-tune synthesis parameters (temperature, pressure) to maximize diphenol output per batch.

- Predictive Maintenance: Machine learning models anticipate equipment failure in reactors, minimizing unplanned downtime and maximizing asset utilization.

- Accelerated Material Discovery: AI speeds up the screening and design of novel diphenol derivatives for specific high-performance applications.

- Supply Chain Risk Mitigation: Predictive analytics forecasts feedstock price volatility and supply disruptions, enabling proactive inventory management.

- Improved Quality Control: Computer vision and data analytics ensure high-purity standards are maintained throughout the crystallization and purification stages.

- Reduced Energy Consumption: AI models optimize overall plant operations to lower energy intensity associated with large-scale chemical manufacturing.

DRO & Impact Forces Of Diphenol Category Products Market

The Diphenol Category Products Market is subject to a complex interplay of Drivers, Restraints, and Opportunities (DRO), which collectively shape its growth trajectory and competitive landscape. Key drivers propelling the market include the robust demand from the global polymer and resin sector, particularly the rising need for specialty adhesives and elastomers in the fast-growing automotive and infrastructure industries. The increasing utilization of diphenol derivatives as essential building blocks in the synthesis of high-efficacy agrochemicals and pharmaceuticals further strengthens market momentum. These drivers are fundamentally linked to global economic growth, urbanization trends, and increasing agricultural productivity needs, ensuring sustained baseline demand for diphenol intermediates across diverse end-use sectors.

Significant restraints challenging the market growth involve the volatility of raw material prices, primarily derived from petrochemical sources such as benzene and propylene, which directly impacts the profitability of manufacturers. Furthermore, increasingly stringent environmental regulations, particularly regarding the handling and disposal of certain diphenol isomers (like hydroquinone in some regions), necessitate substantial investment in advanced waste treatment and cleaner production technologies, increasing operational costs. The synthesis processes for high-purity grades, essential for pharmaceuticals, are complex and energy-intensive, posing technological barriers and requiring specialized infrastructure, thereby limiting the entry of new players and constraining supply agility.

Opportunities for market expansion are abundant, centered around the rapid development of bio-based diphenols derived from sustainable feedstocks, which offer a compelling solution to petrochemical dependence and environmental concerns. The expanding applications in high-tech fields, such as photoresists for semiconductors and advanced display materials, represent high-margin, niche growth areas. Moreover, geographical expansion into emerging economies in Southeast Asia and Africa, where industrialization and infrastructure projects are accelerating, provides manufacturers with new avenues for market penetration. The continuous innovation in polymerization processes and the development of new functional materials that incorporate diphenol structures promise to unlock new revenue streams, particularly in areas requiring extreme thermal and chemical resistance.

Segmentation Analysis

The Diphenol Category Products Market is comprehensively segmented based on Type, Application, and Region, allowing for a detailed analysis of consumption patterns and growth dynamics across diverse industrial landscapes. Understanding these segments is crucial for strategic planning, as the market value and growth potential differ significantly between high-volume commodity grades (like industrial-grade hydroquinone for polymerization) and high-purity specialty grades (like catechol derivatives for pharmaceuticals). The segmentation reflects the varied functionality of the three main isomers and their tailored use in specific end-user environments, ranging from stabilizing food ingredients to synthesizing complex engineering plastics.

The segmentation by Type, specifically Catechol, Resorcinol, and Hydroquinone, reveals distinct market drivers. Hydroquinone historically dominates due to its widespread use as a photographic chemical, polymerization inhibitor, and antioxidant, though regulatory scrutiny in cosmetic use is shifting demand toward alternatives. Catechol derivatives are witnessing rapid growth, propelled by the demand for high-performance agrochemicals and specialty flavors/fragrances, offering high value despite lower volume compared to hydroquinone. Resorcinol is predominantly captive-consumed or sold into specialized areas like rubber tackifiers and UV stabilizers, maintaining a steady, application-specific demand profile.

Application-wise, the market is characterized by the dominance of the Polymer & Resins segment, driven by the need for superior material properties in construction, automotive, and electronics. The second largest segment, Agrochemicals, is experiencing accelerated growth fueled by global food security concerns and the necessity for effective pest and disease control, utilizing diphenols as precursors for key active ingredients. The pharmaceutical sector, while smaller in volume, commands the highest prices due to the requirement for ultra-high purity and compliance with strict GMP (Good Manufacturing Practice) standards, making it a critical focus area for value-driven manufacturers.

- By Type:

- Catechol

- Hydroquinone

- Resorcinol

- Other Diphenols (e.g., Alkylphenols)

- By Application:

- Polymers & Resins

- Antioxidants

- Agrochemicals (Herbicides, Fungicides)

- Pharmaceuticals

- Dyes & Pigments

- Flavor & Fragrance

- Rubber Processing Chemicals

- Others (e.g., Photography, Cosmetics)

- By Region:

- North America

- Europe

- Asia Pacific (APAC)

- Latin America

- Middle East & Africa (MEA)

Value Chain Analysis For Diphenol Category Products Market

The value chain for Diphenol Category Products is complex, starting with the upstream sourcing of crucial petrochemical feedstocks. The primary raw materials are typically benzene, phenol, and propylene, which are sourced from major oil refineries and petrochemical complexes. The cost and availability of these upstream components significantly dictate the manufacturing cost of diphenols, making successful market participants those who have robust backward integration or long-term supply agreements with major petrochemical providers. The manufacturing stage involves intricate chemical reactions, such as hydroxylation, sulfonation, and peroxide-based oxidations, requiring high capital investment in specialized reaction units and purification technologies to produce various diphenol isomers with required purity levels.

The distribution channel is multifaceted, relying on both direct and indirect sales models. Direct sales are prevalent for large-volume, industrial-grade diphenols supplied to major polymer producers, tire manufacturers, or integrated agrochemical companies, where long-term contracts and tailored logistics are standard. For specialty and high-purity grades (e.g., pharmaceutical intermediates), the distribution often involves specialized chemical distributors and agents who manage complex regulatory compliance, small batch handling, and technical support required by sophisticated end-users. The effective management of transportation, storage (often requiring specific temperature and light controls), and regulatory compliance is paramount in ensuring product integrity across the supply chain.

The downstream sector represents the final point of consumption, where diphenols are incorporated into finished products. Key downstream industries include compounders for engineering plastics, specialty chemical formulators creating herbicides or fungicides, pharmaceutical manufacturers synthesizing Active Pharmaceutical Ingredients (APIs), and cosmetic manufacturers formulating specialized skincare products. The profitability across the value chain varies significantly; while upstream raw material providers face commodity price volatility, the midstream manufacturers specializing in differentiated, high-purity diphenol derivatives capture higher margins. Success downstream is predicated on effective application development and robust formulation expertise utilizing the specific stabilizing or reactive properties of the diphenol intermediate.

Diphenol Category Products Market Potential Customers

Potential customers for Diphenol Category Products are highly diverse, spanning multiple industrial sectors where high-performance chemicals are essential for material formulation and chemical synthesis. The largest consumer base resides within the Polymer and Resin manufacturing industries, including producers of polycarbonates, epoxy resins, and phenolic resins, who rely on diphenols as monomers, cross-linking agents, or polymerization inhibitors to control reaction kinetics and enhance product durability. These customers require bulk quantities of standard industrial grades, focusing heavily on consistent quality and competitive pricing to manage their high-volume manufacturing costs.

Another crucial customer segment is the Agrochemical and Pharmaceutical sectors. Agrochemical companies utilize diphenols as core intermediates for synthesizing proprietary herbicides, insecticides, and fungicides that require specific chemical functionality for efficacy and stability. Pharmaceutical companies demand ultra-high purity diphenol derivatives for synthesizing life-saving APIs and excipients, making rigorous quality assurance, batch consistency, and stringent regulatory documentation (such as Drug Master Files) mandatory prerequisites for supply. These customers prioritize purity and regulatory compliance over volume or price, defining the specialty market niche for diphenols.

Other significant end-users include cosmetic and personal care manufacturers, who use hydroquinone and its derivatives for skin depigmentation treatments and as antioxidants in product preservation, subject to varying regional regulations. Additionally, manufacturers of rubber products, particularly tire companies, are major buyers of resorcinol-based resins used to enhance the bonding between rubber and textile or steel cords, improving tire safety and longevity. Finally, the food and beverage industry consumes limited volumes of diphenol derivatives, primarily as specialized antioxidants to prevent spoilage and extend the shelf life of oils and fats, requiring food-grade certification and strict traceability.

| Report Attributes | Report Details |

|---|---|

| Market Size in 2026 | USD 4.5 Billion |

| Market Forecast in 2033 | USD 6.7 Billion |

| Growth Rate | 5.8% CAGR |

| Historical Year | 2019 to 2024 |

| Base Year | 2025 |

| Forecast Year | 2026 - 2033 |

| DRO & Impact Forces |

|

| Segments Covered |

|

| Key Companies Covered | Solvay, Mitsui Chemicals, Lanxess, Sumitomo Chemical, Ube Industries, Jiangsu Sanmu Group, Eastman Chemical, SI Group, DIC Corporation, BASF SE, Arkema, Kumiai Chemical Industry, Zhejiang Longsheng Group, Sinopec, Merck KGaA, Avantor, Spectrum Chemical, TCI Chemicals, Lonza Group, Emerald Performance Materials |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Enquiry Before Buy | Have specific requirements? Send us your enquiry before purchase to get customized research options. Request For Enquiry Before Buy |

Diphenol Category Products Market Key Technology Landscape

The technological landscape for the Diphenol Category Products Market is dominated by established industrial processes, but is rapidly evolving due to necessity for enhanced efficiency and sustainability. Traditionally, the production of hydroquinone involves the oxidation of aniline or the alkylation of phenol followed by oxidation, while catechol and resorcinol often utilize sulfonation or peroxide-based hydroxylation methods. The prevailing technology emphasizes continuous flow processes over batch processing to achieve economies of scale, reduce reaction variability, and improve energy integration. Current R&D efforts are focused intensely on developing highly selective catalysts that can minimize unwanted side products, thereby increasing yield purity and reducing costly downstream separation requirements, particularly crucial for high-grade pharmaceutical diphenols.

A significant technological shift is the increasing adoption of "green chemistry" principles, spurred by environmental regulations and market demand for sustainable products. This includes the development of cleaner synthetic routes, such as the direct hydroxylation of benzene or phenol using environmentally benign oxidants like hydrogen peroxide, minimizing the generation of hazardous waste products. Furthermore, advancements in biotechnology and fermentation processes are paving the way for bio-based diphenols, utilizing renewable biomass or genetically modified microorganisms as starting materials. Although these bio-based routes are currently more expensive than traditional petrochemical routes, improvements in fermentation efficiency and downstream purification are expected to enhance their commercial viability, especially as carbon taxes and sustainability mandates become more pervasive globally.

Digitalization and smart manufacturing technologies are also fundamentally altering the production landscape. Advanced process control (APC) systems, coupled with machine learning, are being integrated into large-scale diphenol plants to monitor reaction kinetics in real-time, predict equipment failure, and optimize energy usage based on fluctuating production demands and raw material purity. Spectroscopic techniques, such as Near-Infrared (NIR) and Raman spectroscopy, are being employed for continuous, in-line quality monitoring, replacing slower, less efficient off-line laboratory testing. This technological convergence ensures tighter quality specifications, particularly essential for specialty applications like electronics and APIs, while simultaneously lowering operational risks associated with high-pressure and high-temperature chemical synthesis.

Regional Highlights

- Asia Pacific (APAC): The APAC region commands the largest market share, driven by robust industrial growth in China, India, and Southeast Asia. The region is characterized by immense manufacturing output in textiles, automotive components, and electronics, all heavy consumers of diphenols for polymers, antioxidants, and dyes. Furthermore, significant agricultural production in this region fuels high demand for catechol-based agrochemicals. Investment in new capacity expansion is concentrated here, although regulatory pressures regarding pollution control are starting to necessitate the adoption of cleaner technologies, mirroring trends seen in Western markets. The competitive landscape is intensely fragmented, with numerous regional players competing on cost-effectiveness and volume.

- North America: North America represents a mature, high-value market focused on specialty and regulated applications, particularly high-purity diphenols for the pharmaceutical and specialty coating industries. Demand is steady, primarily driven by strict performance standards in aerospace, automotive safety, and infrastructure resilience, requiring advanced polymer stabilizers and adhesives (resorcinol derivatives). Regulatory constraints, especially concerning chemicals deemed endocrine disruptors, influence product innovation, encouraging a shift towards safer, substitute formulations and bio-based alternatives. Technological leadership in process automation and R&D ensures high-quality production despite limited capacity expansion.

- Europe: Europe is characterized by stringent environmental and chemical regulations, notably the REACH framework, which dictates the pace of innovation and product introduction. The market prioritizes sustainability, high quality, and specialized products, driving demand for innovative, low-toxicity diphenol derivatives used in advanced coatings, high-performance rubbers (tires), and specialized plastics. Consumption growth is moderate but stable, supported by strong end-user industries like automotive (EV production) and healthcare. European manufacturers lead in the transition towards sustainable sourcing and closed-loop manufacturing processes, commanding a premium for environmentally compliant products.

- Latin America: The Latin American market exhibits promising growth potential, primarily fueled by expanding agricultural activities in countries like Brazil and Argentina, creating strong demand for agrochemical intermediates (catechol and hydroquinone derivatives). Infrastructure development and a growing automotive manufacturing base also boost consumption of polymers and rubber chemicals. The market structure is heavily reliant on imports from APAC and North America, but increasing foreign direct investment in local chemical processing facilities is expected to enhance self-sufficiency over the forecast period, addressing local demand more effectively.

- Middle East and Africa (MEA): The MEA region is predominantly influenced by petrochemical production capabilities, particularly in the Middle East, where raw material availability provides a cost advantage for basic chemical synthesis. While local consumption remains relatively small compared to other regions, strategic investments aim to develop downstream industries, including specialty plastics and construction materials, to diversify economic output. Africa represents a nascent but rapidly growing market, driven by urbanization and basic infrastructure development, primarily importing finished goods and chemical intermediates required for localized manufacturing.

Top Key Players

The market research report includes a detailed profile of leading stakeholders in the Diphenol Category Products Market.- Solvay

- Mitsui Chemicals

- Lanxess

- Sumitomo Chemical

- Ube Industries

- Jiangsu Sanmu Group

- Eastman Chemical

- SI Group

- DIC Corporation

- BASF SE

- Arkema

- Kumiai Chemical Industry

- Zhejiang Longsheng Group

- Sinopec

- Merck KGaA

- Avantor

- Spectrum Chemical

- TCI Chemicals

- Lonza Group

- Emerald Performance Materials

Frequently Asked Questions

Analyze common user questions about the Diphenol Category Products market and generate a concise list of summarized FAQs reflecting key topics and concerns.What are the primary growth drivers for the Diphenol Category Products Market?

The primary drivers are robust demand from the global polymer and resin industries, particularly in automotive and construction sectors requiring high-performance materials, alongside rapidly escalating usage of diphenols as precursors for advanced agrochemicals and specialized pharmaceutical intermediates globally.

Which diphenol type holds the largest market share by volume?

Hydroquinone historically holds the largest market share by volume due to its extensive application as a potent polymerization inhibitor, antioxidant, and chemical intermediate in high-volume industrial processes, although demand growth for catechol and resorcinol derivatives is accelerating.

How is environmental regulation impacting the future market direction of diphenols?

Environmental regulations, particularly in Europe (REACH), are necessitating significant investment in cleaner production technologies and driving innovation towards bio-based and sustainable diphenol synthesis routes. Regulations also restrict the use of certain isomers in consumer-facing applications, encouraging product substitution and high-purity specialty manufacturing.

Which geographical region is expected to exhibit the fastest growth in diphenol consumption?

The Asia Pacific (APAC) region is projected to exhibit the fastest market growth, fueled by substantial ongoing infrastructure development, rapid urbanization, and increasing output from its massive manufacturing base across the polymer, textile, and agricultural sectors, notably in China and India.

What role does Artificial Intelligence (AI) play in the diphenol manufacturing process?

AI is increasingly used to optimize diphenol manufacturing by fine-tuning reactor parameters for maximum yield, implementing predictive maintenance to reduce downtime, and analyzing complex datasets to accelerate the discovery and testing of new, highly selective catalysts for sustainable production routes.

To check our Table of Contents, please mail us at: sales@marketresearchupdate.com

Research Methodology

The Market Research Update offers technology-driven solutions and its full integration in the research process to be skilled at every step. We use diverse assets to produce the best results for our clients. The success of a research project is completely reliant on the research process adopted by the company. Market Research Update assists its clients to recognize opportunities by examining the global market and offering economic insights. We are proud of our extensive coverage that encompasses the understanding of numerous major industry domains.

Market Research Update provide consistency in our research report, also we provide on the part of the analysis of forecast across a gamut of coverage geographies and coverage. The research teams carry out primary and secondary research to implement and design the data collection procedure. The research team then analyzes data about the latest trends and major issues in reference to each industry and country. This helps to determine the anticipated market-related procedures in the future. The company offers technology-driven solutions and its full incorporation in the research method to be skilled at each step.

The Company's Research Process Has the Following Advantages:

- Information Procurement

The step comprises the procurement of market-related information or data via different methodologies & sources.

- Information Investigation

This step comprises the mapping and investigation of all the information procured from the earlier step. It also includes the analysis of data differences observed across numerous data sources.

- Highly Authentic Source

We offer highly authentic information from numerous sources. To fulfills the client’s requirement.

- Market Formulation

This step entails the placement of data points at suitable market spaces in an effort to assume possible conclusions. Analyst viewpoint and subject matter specialist based examining the form of market sizing also plays an essential role in this step.

- Validation & Publishing of Information

Validation is a significant step in the procedure. Validation via an intricately designed procedure assists us to conclude data-points to be used for final calculations.

×

Request Free Sample:

Related Reports

Select License

Why Choose Us

We're cost-effective and Offered Best services:

We are flexible and responsive startup research firm. We adapt as your research requires change, with cost-effectiveness and highly researched report that larger companies can't match.

Information Safety

Market Research Update ensure that we deliver best reports. We care about the confidential and personal information quality, safety, of reports. We use Authorize secure payment process.

We Are Committed to Quality and Deadlines

We offer quality of reports within deadlines. We've worked hard to find the best ways to offer our customers results-oriented and process driven consulting services.

Our Remarkable Track Record

We concentrate on developing lasting and strong client relationship. At present, we hold numerous preferred relationships with industry leading firms that have relied on us constantly for their research requirements.

Best Service Assured

Buy reports from our executives that best suits your need and helps you stay ahead of the competition.

Customized Research Reports

Our research services are custom-made especially to you and your firm in order to discover practical growth recommendations and strategies. We don't stick to a one size fits all strategy. We appreciate that your business has particular research necessities.

Service Assurance

At Market Research Update, we are dedicated to offer the best probable recommendations and service to all our clients. You will be able to speak to experienced analyst who will be aware of your research requirements precisely.

Contact With Our Sales Team

Customer Testimonials

The content of the report is always up to the mark. Good to see speakers from expertise authorities.

Privacy requested , Managing Director

A lot of unique and interesting topics which are described in good manner.

Privacy requested, President

Well researched, expertise analysts, well organized, concrete and current topics delivered in time.

Privacy requested, Development Manager