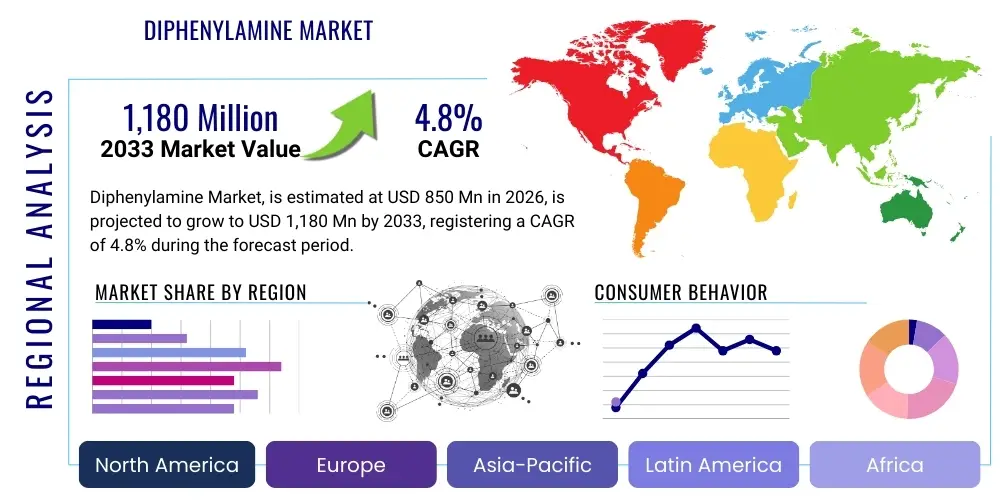

Diphenylamine Market Size, By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2026 to 2033 (Financial Impact Analysis)

ID : MRU_ 442073 | Date : Feb, 2026 | Pages : 248 | Region : Global | Publisher : MRU

Diphenylamine Market Size

The Diphenylamine Market is projected to grow at a Compound Annual Growth Rate (CAGR) of 4.8% between 2026 and 2033. The market is estimated at $550 Million in 2026 and is projected to reach $775 Million by the end of the forecast period in 2033.

Diphenylamine Market introduction

The Diphenylamine (DPA) market centers around a key organic chemical compound, C₁₂H₁₁N, characterized by its mild, floral odor and its physical state as a white crystalline solid. DPA is synthesized primarily through the reaction of aniline with phenol or through the high-temperature catalytic reaction of aniline alone. Its intrinsic properties, particularly its high thermal stability and potent antioxidant capabilities, make it indispensable across diverse industrial sectors. Historically, DPA has served critical roles in stabilizing nitrocellulose-based explosives and propellants, acting as an intermediate in dye production, and as a corrosion inhibitor. However, its most significant commercial applications today are overwhelmingly concentrated in the rubber compounding industry, where it is utilized extensively as a precursor for generating antiozonants and rubber antioxidants, thereby extending the lifespan and performance characteristics of automotive tires and industrial rubber goods. Furthermore, its efficacy as a post-harvest fungicide and anti-scald agent ensures its robust demand within the agricultural supply chain, specifically for preserving fruits like apples and pears during long-term storage and transportation. The sustained growth of the market is fundamentally underpinned by the continuous expansion of the global automotive sector, particularly the surging demand for replacement and OEM tires in developing economies, coupled with increasingly sophisticated global food logistics requiring advanced preservation solutions. Regulatory dynamics, especially concerning its use in food applications and potential environmental impact, represent the primary constraints shaping the geographical distribution and adoption rates of specific DPA grades and derivatives. The shift towards higher purity grades for specialty applications and the drive toward sustainable manufacturing processes are key technological thrusts defining the contemporary market landscape.

Diphenylamine Market Executive Summary

The Diphenylamine Market is currently characterized by moderate, steady growth, driven primarily by robust demand from the tire manufacturing sector and increasing sophistication in global food preservation techniques. Business trends highlight a consolidation among major DPA producers, focusing on optimizing production efficiencies and securing long-term contracts with large-scale rubber processors and agricultural cooperatives. Investment is increasingly being channeled into specialized derivatives of DPA, such as octylated diphenylamine (ODPA) and others, which offer enhanced performance attributes, particularly for high-stress rubber applications required in commercial vehicles and off-road equipment. Geographically, the market dominance remains vested in the Asia Pacific region, fueled by the massive concentration of tire production facilities in China, India, and Southeast Asia, coupled with substantial governmental support for agricultural infrastructure improvements and export capabilities. North America and Europe, while slower in volume growth, command higher revenue shares due to stringent quality requirements, specialized applications in aerospace and defense, and a strong preference for high-purity, low-impurity DPA derivatives used in pharmaceutical intermediates and sensitive polymer stabilizers. Segmentally, the Rubber Processing Chemicals segment consistently holds the largest market share, directly correlating with the automotive industry's cyclical yet continuous expansion, whereas the Agrochemicals segment exhibits the highest growth potential, largely due to innovative formulations designed to comply with evolving food safety regulations while maintaining efficacy against storage diseases and superficial fruit damage. The market is also witnessing a gradual pivot towards bio-based alternatives and cleaner synthesis methods, though traditional DPA remains cost-competitive, necessitating strategic differentiation among producers based on supply reliability and compliance.

AI Impact Analysis on Diphenylamine Market

Analysis of common user inquiries regarding AI's influence on the Diphenylamine market reveals key themes centered around process optimization, supply chain resilience, and the accelerated discovery of novel DPA derivatives. Users frequently ask how machine learning can predict fluctuations in petrochemical feedstock prices (like aniline), optimize complex chemical reaction parameters for maximum yield and purity, and enhance quality control in rubber compounding, which traditionally relies heavily on empirical testing. Furthermore, a significant area of interest is AI's role in screening and modeling potential toxicity and environmental impact of existing and new DPA-based compounds, a critical concern given regulatory pressures. Expectations suggest that AI adoption will lead to substantial cost reductions in synthesis, higher consistency in product quality, and the rapid development of specialized, regulatory-compliant DPA formulations needed for advanced materials in electric vehicles (EVs) and demanding infrastructure projects. AI integration is viewed not as a disruptive replacement for the chemical itself, but rather as an indispensable tool for operational efficiency and regulatory foresight within the specialized chemical manufacturing domain.

- Predictive Maintenance and Efficiency: AI algorithms enhance operational efficiency in DPA synthesis plants by forecasting equipment failure, optimizing reactor conditions (temperature, pressure, catalyst load) in real-time, thereby reducing energy consumption and maximizing yield.

- Supply Chain and Logistics Optimization: Machine learning models predict demand fluctuations from rubber and agriculture sectors, optimizing raw material (aniline) procurement and distribution logistics to minimize inventory costs and prevent supply disruptions.

- Accelerated Derivative Discovery: AI-driven material informatics speeds up the research and development process for new DPA derivatives, enabling rapid screening of molecular structures for improved antioxidant performance, reduced toxicity, and better regulatory compliance.

- Enhanced Quality Control: AI vision systems and sensor data analysis automate the inspection of DPA product quality, ensuring consistent purity levels necessary for sensitive downstream applications like pharmaceutical intermediates or high-performance polymers.

- Regulatory Compliance Modeling: Predictive AI modeling assists manufacturers in understanding the environmental fate and toxicological profiles of DPA and its derivatives, proactively guiding formulation adjustments to meet evolving global chemical regulations (e.g., REACH, EPA standards).

DRO & Impact Forces Of Diphenylamine Market

The Diphenylamine (DPA) market operates under a specific confluence of Drivers, Restraints, and Opportunities (DRO), collectively constituting the market's impact forces. A primary driver is the pervasive and non-substitutable role of DPA derivatives, specifically para-phenylenediamines (PPDs) derived from DPA, as critical antiozonants in the burgeoning global tire and rubber goods manufacturing sector, particularly in high-growth automotive markets across Asia. This demand is further amplified by the mandatory need for tire longevity and safety standards enforced internationally. The increasing complexities of the global agricultural supply chain, requiring enhanced post-harvest longevity for exported perishables, also provides a significant demand impetus for DPA-based anti-scald agents. Conversely, the market faces considerable restraints, dominated by severe regulatory scrutiny, particularly in developed regions like the EU, concerning the potential environmental persistence and chronic toxicity associated with certain DPA derivatives, leading to phase-out discussions and strict usage limitations in agrochemical applications. Fluctuations in the price and availability of key petrochemical precursors, notably aniline, due to volatile oil and gas markets, introduce inherent cost instability. The key opportunity lies in the burgeoning electric vehicle (EV) segment, which demands highly specialized, extremely durable, and lighter rubber components, creating a niche for next-generation, high-purity DPA antioxidants. Furthermore, developing advanced, less toxic DPA derivatives that fully satisfy stringent regulatory requirements without compromising performance presents a pathway for substantial market penetration and premium pricing, thereby transforming perceived restraints into strategic advantages for innovators.

Segmentation Analysis

The Diphenylamine market is comprehensively segmented based on its grade, primary application area, and the derivative type utilized, allowing for granular analysis of demand patterns and strategic market positioning. Understanding these segmentations is crucial because the required purity levels, regulatory hurdles, and competitive landscapes vary drastically between the high-volume rubber industry and the specialized, high-value agricultural or defense sectors. The segment analysis highlights how manufacturers must tailor their product offerings, purification processes, and supply chain logistics to meet the specific requirements of each end-user vertical, ranging from technical grade DPA used in explosives stabilization to refined grades required for sensitive pharmaceutical synthesis. Furthermore, the segmentation by derivative type underscores the industry's shift away from pure DPA towards functionalized compounds like alkylated or octylated DPA, which provide superior performance metrics, especially in modern rubber formulations designed for extreme weather conditions or extended duty cycles, demonstrating a structural evolution in material science within this market.

- By Grade:

- Technical Grade

- Refined Grade (High Purity)

- By Application:

- Rubber Processing Chemicals (Antioxidants/Antiozonants)

- Agrochemicals (Fungicides/Anti-scald Agents)

- Dye Intermediates

- Pharmaceutical Intermediates

- Stabilizers for Explosives and Propellants

- Other Specialty Chemicals

- By Derivative Type:

- Pure Diphenylamine

- Alkyl Diphenylamine Derivatives (e.g., ODPA)

- Substituted Diphenylamine Compounds

- By End-Use Industry:

- Automotive and Transportation

- Agriculture and Food Storage

- Plastics and Polymers

- Defense and Aerospace

- Chemical and Pharmaceutical Manufacturing

Value Chain Analysis For Diphenylamine Market

The value chain of the Diphenylamine market commences with the upstream extraction and processing of essential petrochemical feedstock, predominantly involving benzene, which is converted into aniline, the primary raw material for DPA synthesis. Major petrochemical conglomerates and large-scale chemical producers dominate this initial phase, influencing DPA production costs significantly through their control over aniline supply and pricing dynamics. Manufacturing complexity arises during the synthesis stage, where high temperatures and pressures are required for the catalytic condensation of aniline. Efficiency in this stage—measured by yield optimization, catalyst lifetime, and energy consumption—directly dictates the final competitiveness of the DPA product. Producers must maintain rigorous purity standards, particularly for pharmaceutical or agrochemical-grade DPA, often necessitating advanced purification steps like vacuum distillation and crystallization, adding considerable complexity and cost to the midstream process.

The midstream segment involves the actual production of raw DPA and its subsequent transformation into specialized derivatives. Integration between DPA synthesis and derivative manufacturing is a key strategic advantage, as producing functionalized compounds (such as rubber antioxidants derived from DPA) closer to the primary production site allows for streamlined logistics and tighter quality control. This segment is characterized by intense focus on intellectual property regarding proprietary catalysts and reaction pathways designed to minimize undesirable byproducts. The downstream segment encompasses the formulation, distribution, and end-use application of DPA and its derivatives across various industrial sectors. The distribution channel is multifaceted, relying heavily on specialized chemical distributors who possess expertise in handling regulated chemicals and maintaining the purity of technical and refined grades, particularly when servicing niche end-users like defense contractors or small-scale specialized chemical formulators. Direct distribution, however, remains prevalent for large-volume customers, such as multinational tire manufacturers, who require consistent, just-in-time supply directly from the producer.

The indirect channel leverages regional chemical wholesalers and agents, particularly crucial in fragmented markets like Southeast Asia and Latin America, where local compliance knowledge and extensive logistical networks are essential for market penetration. High regulatory barriers necessitate specialized packaging, transportation, and storage protocols throughout the entire value chain, significantly increasing the cost structure but also creating barriers to entry for smaller, non-compliant manufacturers. Ultimately, value capture is highest in the synthesis of highly specialized, high-performance DPA derivatives used in modern tire compounding and in the formulation of next-generation, regulatory-approved anti-scald agents, where performance differentiation justifies premium pricing and provides a hedge against commodity price volatility in the upstream segment.

Diphenylamine Market Potential Customers

The primary cohort of potential customers for Diphenylamine products resides within the global automotive supply chain, specifically encompassing major tire manufacturers and their associated rubber compounding partners. These customers represent the largest volume segment, utilizing DPA derivatives (like PPDs) as essential antioxidants and antiozonants critical for preventing the degradation of rubber compounds due to oxygen, heat, and ozone exposure, thereby ensuring tire safety and extended tread life. Their purchasing decisions are driven predominantly by product consistency, high purity specifications (to avoid undesirable side reactions), price competitiveness, and most critically, guaranteed long-term supply stability. As the global vehicle parc expands, including the rapid adoption of electric vehicles which place specialized demands on tire durability, the foundational requirement for high-quality DPA-based stabilizers from this customer segment remains robust and non-negotiable, often secured through multi-year supply agreements that emphasize regulatory compliance documentation.

A second major customer group is the expansive agricultural sector, focused on post-harvest preservation for global trade, particularly apple and pear growers, packers, and international cold storage operators. DPA is utilized as a highly effective anti-scald agent, preventing superficial browning and extending the marketable life of fruit during prolonged storage periods before export or domestic distribution. Customers in this vertical are highly sensitive to regulatory changes, especially those governing Maximum Residue Limits (MRLs) in key import markets like the EU and the US. Their demand profile favors specialized, low-dose formulations and requires rigorous certification documentation to prove compliance with international food safety standards. The increasing globalization of fresh produce trade amplifies the need for reliable anti-scald solutions, making major agricultural chemical formulators and large-scale cooperative storage facilities key target buyers.

Further specialized customer bases include manufacturers of dyes and pigments, who use DPA as a chemical intermediate in synthesizing complex coloration agents, and defense industry contractors involved in manufacturing military-grade explosives and propellants, where DPA serves as a crucial chemical stabilizer to manage propellant decomposition and ensure safe handling and storage over extended periods. These specialty customers prioritize extremely high purity grades, sometimes requiring custom synthesis, and their purchasing cycles are often tied to government contracts and stringent military specifications (MIL-SPECs). While low in volume compared to the rubber industry, these specialized sectors provide high-margin opportunities and demand exceptional technical support and rigorous quality assurance from DPA suppliers, offering resilience against cyclical downturns in the general automotive market.

| Report Attributes | Report Details |

|---|---|

| Market Size in 2026 | $550 Million |

| Market Forecast in 2033 | $775 Million |

| Growth Rate | 4.8% CAGR |

| Historical Year | 2019 to 2024 |

| Base Year | 2025 |

| Forecast Year | 2026 - 2033 |

| DRO & Impact Forces |

|

| Segments Covered |

|

| Key Companies Covered | Merck KGaA, BASF SE, Lanxess AG, R.T. Vanderbilt Holding Company Inc., Eastman Chemical Company, Jiahua Chemical, Jiangsu Guoxin Union Energy Co. Ltd., Shandong Xinchu Chemical Co. Ltd., Sino-King Chemical, Chem-Sino Inc., Mitsui Chemicals, UBE Corporation, Sumitomo Chemical, Arkema Group, Kingland Chemical, Kothari Chemicals, FENOX Chemical, Nanjing Chemical, Liaoning Shixing Pharmaceutical, SI Group. |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Enquiry Before Buy | Have specific requirements? Send us your enquiry before purchase to get customized research options. Request For Enquiry Before Buy |

Diphenylamine Market Key Technology Landscape

The core technology underpinning the Diphenylamine market revolves around optimized chemical synthesis processes designed to maximize yield and purity while minimizing energy consumption and hazardous byproduct generation. The predominant industrial method involves the catalytic condensation of aniline, often employing continuous flow reactors operating under elevated temperatures (300°C–400°C) and pressures. Technological advancements in this area focus heavily on catalyst development; specifically, the utilization of highly selective heterogeneous catalysts, such as modified metal oxides or zeolites, which enhance the conversion rate of aniline to DPA and reduce the formation of unwanted side products like triphenylamine. A critical technical challenge is the efficient separation and purification of the crude DPA mixture. Modern facilities employ sophisticated vacuum distillation towers and multi-stage crystallization units, technologies that are continuously being refined to meet the ultra-high purity specifications demanded by pharmaceutical and refined-grade agrochemical applications, where impurity levels must be controlled in parts per million (ppm).

Furthermore, the technology landscape is being shaped significantly by environmental and regulatory pressures, spurring research into "green chemistry" approaches for DPA manufacturing. This includes exploring cleaner solvent systems, improving thermal integration within the plant to reuse waste heat, and developing closed-loop systems for catalyst regeneration and recycling. Innovations in microreactor technology, while not yet standard for large-scale DPA production, show potential for better process control, safer handling of exothermic reactions, and enhanced scalability for specialized, high-value DPA derivatives. These technological shifts aim to reduce the overall carbon footprint of DPA production, providing manufacturers in developed economies a competitive edge through demonstrable sustainability credentials, which are increasingly important to multinational end-users, particularly those in the automotive supply chain focused on ESG (Environmental, Social, and Governance) compliance.

In the application sphere, technology focuses on derivative formulation science. For the rubber industry, R&D is directed towards developing novel DPA-derived antiozonants that offer superior protection against ozone cracking without contributing to vulcanization interference or staining, a common issue with older formulations. This involves sophisticated blending and functionalization techniques, leading to derivatives optimized for high-performance elastomers used in run-flat tires and specialized seals. For the agrochemical market, technological innovation centers on creating microencapsulation and controlled-release formulations of DPA anti-scald agents. These formulations ensure effective, long-lasting protection of fruit while drastically reducing the required dosage and minimizing residue accumulation on the fruit surface, directly addressing consumer and regulatory concerns regarding food safety. The successful implementation of these advanced formulation technologies is vital for manufacturers aiming to maintain market share in environmentally sensitive regions.

Regional Highlights

- Asia Pacific (APAC): APAC is the unequivocally dominant region in the Diphenylamine market, both in terms of production capacity and consumption volume. This prominence is attributable to the region housing the world’s largest manufacturing base for tires, particularly in countries like China, India, and Thailand, which drives immense demand for DPA-based rubber antioxidants. The favorable cost structure of chemical manufacturing in China, coupled with substantial domestic demand from its massive agricultural sector requiring anti-scald agents for exported produce, firmly establishes APAC as the primary growth engine. Continuous infrastructure investment and the rapid expansion of the automotive sector, including significant EV manufacturing growth, further ensure the region’s market leadership throughout the forecast period.

- North America: North America represents a mature, high-value segment characterized by stringent regulatory environments and a focus on specialized, high-purity DPA applications. While the regional rubber industry is significant, the most substantial growth pockets often lie in niche sectors such as aerospace, defense (stabilizers for propellants), and advanced materials where compliance with highly specific quality certifications is mandatory. Demand is often inelastic to price changes, favoring suppliers capable of consistent, verifiable quality and adherence to complex environmental regulations imposed by agencies like the EPA and USDA.

- Europe: The European DPA market is heavily constrained yet highly profitable, primarily due to rigorous chemical legislation such as REACH, which necessitates ongoing evaluation and potential restriction of certain DPA uses, especially in agrochemicals. Consequently, European consumption leans heavily toward industrial applications where DPA derivatives are critical (e.g., specific polymer stabilizers) and where producers have successfully registered cleaner, compliant formulations. The market emphasizes sustainable sourcing and circular economy principles, forcing manufacturers to innovate in derivative chemistry and synthesis methods to maintain market access.

- Latin America (LATAM): LATAM exhibits robust potential for growth, mainly driven by the expanding automotive and replacement tire market in Brazil and Mexico, coupled with significant agricultural export operations across the continent. Market dynamics are heavily influenced by imports from APAC, but local production capacity is gradually increasing to mitigate logistical risks. The need for enhanced rubber performance in varied climate zones and the sophisticated export requirements for perishable goods drive consistent, albeit volume-dependent, demand.

- Middle East and Africa (MEA): The MEA region is emerging as a critical growth frontier, linked primarily to the expansion of regional petrochemical capacity and the increasing industrialization of key economies like Saudi Arabia and the UAE. Investment in transportation infrastructure and the gradual development of local tire manufacturing capabilities contribute to incremental demand for DPA as a foundational chemical input. Political and economic stability remain crucial factors influencing investment and market penetration in this highly diverse region.

Top Key Players

The market research report includes a detailed profile of leading stakeholders in the Diphenylamine Market.- Merck KGaA

- BASF SE

- Lanxess AG

- R.T. Vanderbilt Holding Company Inc.

- Eastman Chemical Company

- Jiahua Chemical

- Jiangsu Guoxin Union Energy Co. Ltd.

- Shandong Xinchu Chemical Co. Ltd.

- Sino-King Chemical

- Chem-Sino Inc.

- Mitsui Chemicals

- UBE Corporation

- Sumitomo Chemical

- Arkema Group

- Kingland Chemical

- Kothari Chemicals

- FENOX Chemical

- Nanjing Chemical

- Liaoning Shixing Pharmaceutical

- SI Group

Frequently Asked Questions

Analyze common user questions about the Diphenylamine market and generate a concise list of summarized FAQs reflecting key topics and concerns.What is the primary commercial application driving Diphenylamine market growth?

The primary commercial application driving the Diphenylamine (DPA) market is its use as a precursor for highly effective antioxidants and antiozonants in the rubber processing industry, critical for extending the durability and lifespan of automotive tires and industrial rubber goods.

How do regulatory changes, such as those in the EU, affect the demand for Diphenylamine?

Regulatory changes, particularly in the EU (via REACH), impose strict limitations on the use of DPA as an agrochemical (anti-scald agent) due to environmental and toxicity concerns. This shifts demand towards specialized, compliant DPA derivatives for industrial applications, necessitating technological innovation in product formulation.

Which geographical region dominates Diphenylamine production and consumption?

The Asia Pacific (APAC) region dominates the Diphenylamine market in both production capacity and consumption volume. This dominance is driven by the vast concentration of the global automotive and tire manufacturing industries, alongside significant agricultural export activity requiring DPA-based preservatives.

What are the key substitutes or alternatives emerging for Diphenylamine-based antiozonants?

While DPA derivatives are highly effective and cost-efficient, research is focusing on non-staining, non-toxic alternatives derived from hindered phenols or specialty sulfur-containing compounds. However, these alternatives often face challenges in matching the performance and cost-effectiveness of DPA derivatives like PPDs for general-purpose tire applications.

In the specialty segment, how is Diphenylamine used outside of rubber and agriculture?

In specialty segments, Diphenylamine is crucial as an intermediate in synthesizing high-value dyes and pigments, a chemical precursor for certain pharmaceutical compounds, and most notably, as a stabilizer agent essential for ensuring the safe, long-term storage and handling of nitrocellulose-based explosives and solid propellants used in defense applications.

The strategic dynamics within the global Diphenylamine sector are fundamentally shaped by the delicate balance between robust industrial demand, primarily from the non-substitutable requirements of the tire industry, and the increasing regulatory scrutiny applied to all chemical inputs affecting consumer safety and the environment. This tension creates a bifurcated market, where high-volume, commodity-grade production is increasingly concentrated in cost-efficient regions of Asia Pacific, while sophisticated, high-value derivative manufacturing, requiring intense R&D and strict compliance documentation, maintains strong bases in North America and Europe. Future market success for manufacturers will hinge on their ability to invest in process optimization, leveraging technologies such as AI for predictive efficiency, while simultaneously developing next-generation DPA derivatives that offer superior performance profiles alongside documented environmental compliance, thereby addressing the conflicting pressures of cost optimization and sustainability mandates across the diverse customer base.

Technological advancement in synthesis, purification, and application formulation is not merely a competitive advantage but a necessity for survival in segments where DPA usage is scrutinized. The market requires innovative solutions, such as microencapsulation for agricultural use and highly optimized PPD derivatives for modern elastomer systems in electric vehicles, which demand higher thermal and dynamic stress resistance than traditional applications. Suppliers who effectively bridge the gap between traditional chemical processing and advanced material science, utilizing data analytics to refine processes and predict market shifts, are poised to capture the premium market segments and ensure supply chain resilience against geopolitical and regulatory volatility. Furthermore, the capacity for large-scale producers to manage volatility in aniline feedstock prices, potentially through vertical integration or sophisticated hedging strategies, will remain a critical determinant of operational profitability and long-term market leadership within this foundational chemical commodity sector.

To check our Table of Contents, please mail us at: sales@marketresearchupdate.com

Research Methodology

The Market Research Update offers technology-driven solutions and its full integration in the research process to be skilled at every step. We use diverse assets to produce the best results for our clients. The success of a research project is completely reliant on the research process adopted by the company. Market Research Update assists its clients to recognize opportunities by examining the global market and offering economic insights. We are proud of our extensive coverage that encompasses the understanding of numerous major industry domains.

Market Research Update provide consistency in our research report, also we provide on the part of the analysis of forecast across a gamut of coverage geographies and coverage. The research teams carry out primary and secondary research to implement and design the data collection procedure. The research team then analyzes data about the latest trends and major issues in reference to each industry and country. This helps to determine the anticipated market-related procedures in the future. The company offers technology-driven solutions and its full incorporation in the research method to be skilled at each step.

The Company's Research Process Has the Following Advantages:

- Information Procurement

The step comprises the procurement of market-related information or data via different methodologies & sources.

- Information Investigation

This step comprises the mapping and investigation of all the information procured from the earlier step. It also includes the analysis of data differences observed across numerous data sources.

- Highly Authentic Source

We offer highly authentic information from numerous sources. To fulfills the client’s requirement.

- Market Formulation

This step entails the placement of data points at suitable market spaces in an effort to assume possible conclusions. Analyst viewpoint and subject matter specialist based examining the form of market sizing also plays an essential role in this step.

- Validation & Publishing of Information

Validation is a significant step in the procedure. Validation via an intricately designed procedure assists us to conclude data-points to be used for final calculations.

×

Request Free Sample:

Related Reports

- Diphenylamine Market Size By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2026 to 2033

- Diphenylamine Market Size Report By Type (Molten Diphenylamine, Diphenylamine Chip), By Application (Rubber Antioxidant, Lubricant Antioxidant, Dyes, Pharmaceutical, Gunpowder Stabilizer, Others, By End-User, Automotive, Agriculture, Cosmetics & Personal Care, General, Plastics & Rubber, Others), By Region (North America, Latin America, Europe, Asia Pacific, Middle East, and Africa) - Share, Trends, Outlook and Forecast 2025-2032

Select License

Why Choose Us

We're cost-effective and Offered Best services:

We are flexible and responsive startup research firm. We adapt as your research requires change, with cost-effectiveness and highly researched report that larger companies can't match.

Information Safety

Market Research Update ensure that we deliver best reports. We care about the confidential and personal information quality, safety, of reports. We use Authorize secure payment process.

We Are Committed to Quality and Deadlines

We offer quality of reports within deadlines. We've worked hard to find the best ways to offer our customers results-oriented and process driven consulting services.

Our Remarkable Track Record

We concentrate on developing lasting and strong client relationship. At present, we hold numerous preferred relationships with industry leading firms that have relied on us constantly for their research requirements.

Best Service Assured

Buy reports from our executives that best suits your need and helps you stay ahead of the competition.

Customized Research Reports

Our research services are custom-made especially to you and your firm in order to discover practical growth recommendations and strategies. We don't stick to a one size fits all strategy. We appreciate that your business has particular research necessities.

Service Assurance

At Market Research Update, we are dedicated to offer the best probable recommendations and service to all our clients. You will be able to speak to experienced analyst who will be aware of your research requirements precisely.

Contact With Our Sales Team

Customer Testimonials

The content of the report is always up to the mark. Good to see speakers from expertise authorities.

Privacy requested , Managing Director

A lot of unique and interesting topics which are described in good manner.

Privacy requested, President

Well researched, expertise analysts, well organized, concrete and current topics delivered in time.

Privacy requested, Development Manager