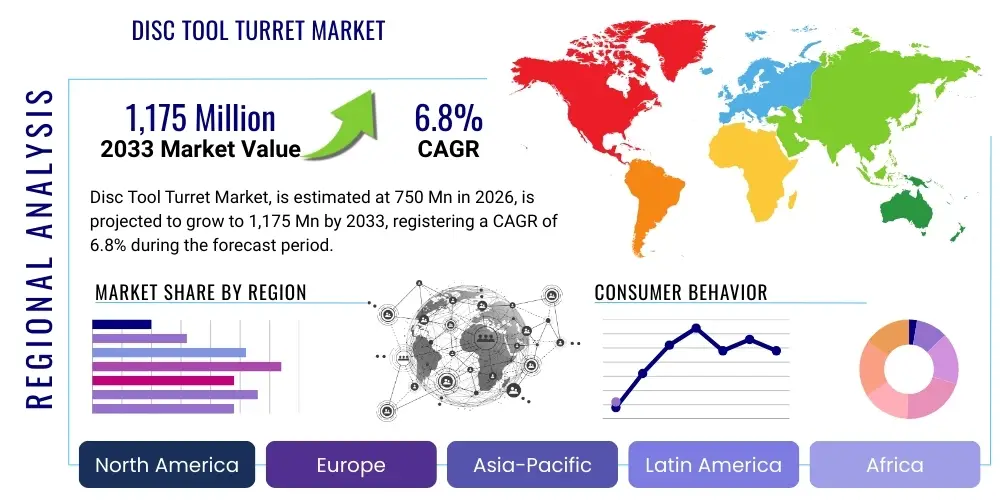

Disc Tool Turret Market Size, By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2026 to 2033 (Financial Impact Analysis)

ID : MRU_ 441575 | Date : Feb, 2026 | Pages : 242 | Region : Global | Publisher : MRU

Disc Tool Turret Market Size

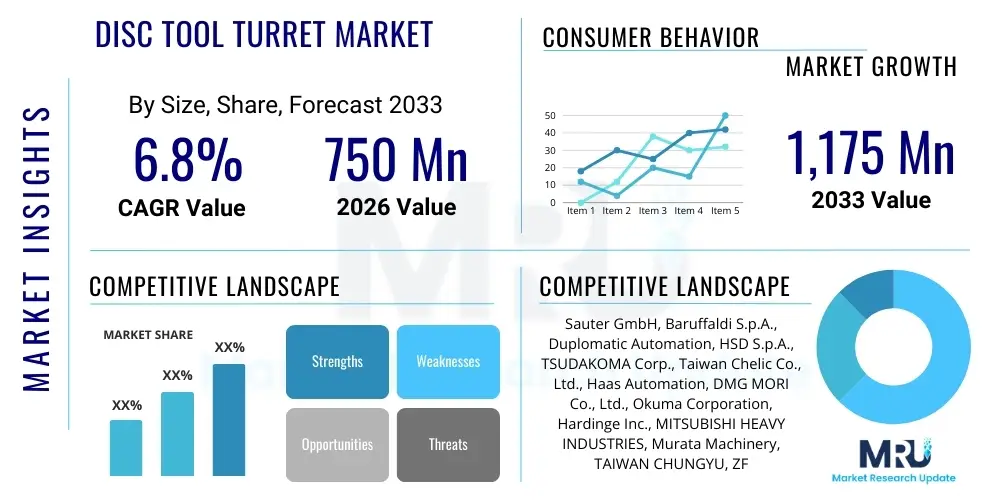

The Disc Tool Turret Market is projected to grow at a Compound Annual Growth Rate (CAGR) of 6.8% between 2026 and 2033. The market is estimated at $750 million in 2026 and is projected to reach $1,175 million by the end of the forecast period in 2033.

Disc Tool Turret Market introduction

The Disc Tool Turret Market encompasses essential components utilized primarily in Computer Numerical Control (CNC) turning and machining centers. These devices function as automated indexing mechanisms responsible for rapidly and precisely changing tools during complex machining operations. Disc tool turrets are distinguished by their rotational disc design, which holds multiple cutting tools, allowing the machine to switch seamlessly between operations like turning, drilling, and boring without manual intervention. This automation is critical in high-volume, precision manufacturing sectors where minimizing cycle time and maximizing accuracy are paramount. The reliability and indexing speed of these turrets directly impact the overall productivity and surface finish quality achieved by the CNC machine tool.

The core application of disc tool turrets lies in enhancing the versatility and efficiency of CNC lathes. By securely housing an array of standard and specialized tooling—often exceeding 8 or 12 stations—they facilitate intricate part geometries and reduced setup times. These turrets are engineered for high rigidity and thermal stability, crucial characteristics when processing demanding materials such as hardened steels, titanium, and advanced composites common in aerospace and medical device manufacturing. Furthermore, modern disc tool turrets often integrate specialized features such as live tooling capabilities, allowing secondary milling, drilling, or tapping operations to be performed on a single machine setup, thereby drastically improving throughput and reducing overall manufacturing complexity.

Market growth is significantly driven by the accelerating global trend towards industrial automation, particularly in emerging economies where manufacturing capacity is rapidly expanding. Key benefits include superior tool change repeatability, higher operational uptime, and improved safety standards compared to older manual or less sophisticated indexing systems. Driving factors include sustained investment in advanced manufacturing technologies across the automotive and aerospace industries, coupled with the increasing demand for high-precision components requiring complex multi-axis machining. The continuous innovation in servo-driven turret mechanisms, offering faster indexing times and higher precision locking systems, further fuels market expansion and technological adoption.

Disc Tool Turret Market Executive Summary

The Disc Tool Turret Market is characterized by robust growth, propelled primarily by global manufacturing modernization and the pervasive adoption of CNC technologies across industrial sectors. Business trends indicate a strong shift towards highly integrated, servo-driven turret systems offering superior indexing speeds and higher torque capacity for demanding operations. Key manufacturers are focusing on integrating smart technologies, such as embedded sensors for real-time monitoring of temperature and vibration, which contribute to predictive maintenance capabilities and extended tool life. Furthermore, there is a pronounced emphasis on modular designs that simplify tool holder changes and enhance overall system versatility, responding directly to the industry's need for flexibility in short-run, high-mix production environments.

Regionally, the Asia Pacific (APAC) market dominates the consumption and production landscape, driven by massive investments in manufacturing infrastructure, particularly in China, Japan, and South Korea, which are global hubs for automotive and electronics production. North America and Europe, while mature, exhibit high demand for premium, high-precision turrets suitable for specialized industries like aerospace, medical, and defense, focusing heavily on quality and technological sophistication rather than sheer volume. Regional strategies involve establishing localized service and support networks to cater to the stringent uptime requirements of sophisticated machine tool operators, ensuring rapid diagnostics and repair of complex turret mechanisms.

Segmentation trends highlight the increasing dominance of servo-driven turrets over traditional hydraulic or pneumatic variants, owing to their superior control, energy efficiency, and faster indexing cycles, which align perfectly with the Industry 4.0 paradigm. In terms of application, CNC lathes remain the primary end-user, though the use of highly specialized tool turrets in multi-tasking and turn-mill centers is experiencing the fastest growth. The automotive sector, requiring massive volumes of standardized components, continues to be the largest segment, followed closely by the aerospace industry, which demands absolute precision and stringent quality control, driving the adoption of high-end turrets with superior locking mechanisms and thermal stability features.

AI Impact Analysis on Disc Tool Turret Market

Common user questions regarding AI's impact on the Disc Tool Turret Market revolve primarily around enhancing predictive maintenance, optimizing tool utilization, and integrating automated decision-making into machining cycles. Users frequently inquire about how AI algorithms can anticipate turret component failures (e.g., locking mechanisms or indexing motor wear) before they lead to catastrophic downtime. There is also significant interest in using machine learning to analyze tooling performance data collected by sensors, automatically adjusting tool change sequences or selecting optimal cutting parameters based on material variations or dynamic load changes. Essentially, users expect AI to transition the turret from a passive indexing device to an intelligent, self-optimizing subsystem within the broader CNC architecture, significantly increasing overall equipment effectiveness (OEE) and reducing reliance on operator expertise for complex tool management decisions.

The integration of Artificial Intelligence transforms the operational paradigm of disc tool turrets from purely electromechanical components into smart, data-generating assets. AI processing facilitates the sophisticated analysis of high-frequency vibration and acoustic data captured by sensors mounted on the turret body and spindle. By applying machine learning models to this data, manufacturers can accurately diagnose the subtle onset of bearing wear, gear degradation, or misalignments in the coupling mechanism, thus shifting maintenance practices from reactive or time-based schedules to highly efficient condition-based maintenance. This capability maximizes the uptime of high-cost CNC machinery, a critical factor in competitive manufacturing sectors.

Furthermore, AI plays a crucial role in optimizing the tool inventory and selection processes managed by the turret. Algorithms can analyze historical data on tool wear patterns across different materials and machining strategies. This analysis informs automated decisions regarding when a tool needs replacement or refurbishment, minimizing both premature disposal and late replacements that lead to compromised part quality. This level of optimization, guided by AI, extends beyond simple tracking; it involves dynamic adjustment of feed rates and speeds based on real-time turret load data, ensuring that the tool turret operates within its optimal performance envelope under varying production demands, ultimately maximizing both tool life and machining precision.

- Enhanced Predictive Maintenance: AI algorithms analyze sensor data (vibration, temperature, current draw) to forecast potential failures in indexing mechanisms or locking systems, minimizing unexpected downtime.

- Optimized Tool Management: Machine learning models determine the optimal tool change frequency and sequence based on material properties, real-time wear assessment, and job priority.

- Adaptive Machining Control: AI adjusts cutting parameters (feed rate, spindle speed) dynamically based on the measured deflection or stability of the turret during operation, enhancing precision.

- Improved Energy Efficiency: Smart control systems use AI to optimize motor current usage during indexing, resulting in reduced power consumption compared to fixed control logic.

- Automated Quality Assurance: Integration with vision systems and deep learning identifies anomalies in tool seating or minor discrepancies immediately after tool changes, ensuring setup integrity.

DRO & Impact Forces Of Disc Tool Turret Market

The Disc Tool Turret Market is profoundly influenced by a complex interplay of Drivers, Restraints, and Opportunities (DRO). The primary driving forces include the sustained global push toward manufacturing automation and the indispensable role of CNC machine tools in achieving high-volume precision output, particularly in industries requiring complex part geometries like automotive powertrain components and aerospace engine parts. The continuous technological advancements, such as the adoption of high-speed servo motors and increasingly rigid turret designs, further accelerate market expansion by offering superior performance metrics, including sub-second indexing times and micro-level repeatability. However, market growth is restrained by the high initial capital expenditure associated with integrating advanced CNC machines equipped with high-performance turrets, particularly challenging for smaller and medium enterprises (SMEs). Furthermore, the lack of standardized interfacing protocols among various machine tool and turret manufacturers can pose integration challenges, complicating maintenance and upgrades.

Opportunities for growth are concentrated in the rapid industrialization witnessed across Southeast Asia and Latin America, where demand for sophisticated capital equipment is surging. The emerging trend of multi-tasking machines (turn-mill centers) presents a significant avenue for specialized turret designs capable of handling both turning and live tooling applications, thereby consolidating multiple processes onto a single platform. The integration of advanced diagnostics and Industry 4.0 connectivity, leveraging technologies like IoT and digital twins, offers manufacturers the chance to provide value-added services such as condition monitoring and remote maintenance, transforming the business model from product sales to comprehensive solution provision. These advancements allow users to significantly reduce total cost of ownership over the equipment lifecycle.

The impact forces within this market are substantial, driven largely by macroeconomic stability and geopolitical shifts affecting global supply chains. The rigorous demands from end-user industries for tighter tolerances and zero-defect manufacturing exert immense pressure on turret manufacturers to continuously enhance precision and reliability. Competitive intensity among key players pushes continuous innovation, particularly concerning quick-change tooling systems and high-pressure coolant integration through the turret body. Furthermore, fluctuating raw material costs, especially for high-grade steels and alloys used in turret construction, serve as a persistent external pressure, impacting overall manufacturing costs and final product pricing in a highly competitive global landscape.

Segmentation Analysis

The Disc Tool Turret Market is segmented based on critical technical and application parameters, reflecting the diverse needs of the global machine tool industry. Key segmentation criteria include the type of drive mechanism used for indexing and locking, the specific application or machine type the turret is integrated into, and the end-use industry that deploys the machinery. The segmentation provides crucial insights into technological preferences, capital investment patterns, and regional demand dynamics. The increasing demand for efficiency and versatility heavily influences the shift between segments, with high-performance segments showing disproportionately rapid growth.

- By Drive Type:

- Hydraulic Turrets

- Servo-driven Turrets

- Pneumatic Turrets

- By Application:

- CNC Lathes (Horizontal and Vertical)

- Multi-Tasking Machines / Turn-Mill Centers

- Specialized Dedicated Machine Tools

- By Tooling Capacity:

- 8-Station Turrets

- 10/12-Station Turrets

- Above 12-Station Turrets

- By End-Use Industry:

- Automotive

- Aerospace and Defense

- General Machinery Manufacturing

- Electronics and Precision Parts

- Medical Devices

Value Chain Analysis For Disc Tool Turret Market

The value chain for the Disc Tool Turret Market begins upstream with the procurement of critical raw materials and highly specialized precision components. This includes high-grade alloy steels for the turret body and locking mechanism components (which require exceptional hardness and dimensional stability), complex gearing systems, bearings, and advanced electronic components like servo motors, encoders, and proximity sensors. A strong reliance exists on specialized suppliers for these components, as the quality of these inputs directly dictates the turret's precision, lifespan, and repeatability. Manufacturers of the turrets then undertake complex precision machining, assembly, and rigorous testing processes to ensure the final product meets the stringent geometric tolerance and operational reliability demands of high-end CNC applications.

Midstream activities involve the integration of the finished turret unit into the final CNC machine tool. This stage is dominated by major global machine tool builders (OEMs like DMG MORI, Okuma, and Haas) who often specify and purchase turrets from specialized component suppliers (e.g., Sauter or Baruffaldi). The relationship between the turret manufacturer and the machine tool OEM is highly critical, often involving co-development to ensure seamless electronic and mechanical integration. Distribution of the turrets happens primarily indirectly through the sale of the complete CNC machine tool, where the turret is bundled as an essential subsystem. Direct sales channels, however, exist for replacement units, specialized retrofits, or for smaller machine builders who source components separately.

Downstream, the final product reaches the end-user (e.g., Tier 1 automotive suppliers or aerospace manufacturers). Post-sale activities, including installation support, operator training, and ongoing maintenance services, become crucial components of the value proposition. The aftermarket segment is significant, covering spare parts, consumable components (like specialized seals and bearings), and occasional unit replacements or upgrades. The efficiency of the distribution channel—whether through global machine tool distributors or specialized industrial equipment dealers—is key to ensuring prompt delivery and reliable service support, which are major determinants in the purchasing decisions of capital equipment buyers concerned with minimizing operational downtime.

Disc Tool Turret Market Potential Customers

Potential customers for disc tool turrets are predominantly organizations involved in high-precision, high-volume metalworking, and complex component manufacturing, where CNC turning centers are core to their operational capabilities. The largest buyer segment comprises the automotive manufacturing sector, including both Original Equipment Manufacturers (OEMs) and their Tier 1 and Tier 2 suppliers who rely heavily on disc tool turrets for machining engine components, transmission parts, chassis elements, and axle shafts with exceptionally tight tolerances and high material removal rates. These customers prioritize robustness, thermal stability, and speed to meet demanding production schedules.

Another critical customer base resides within the aerospace and defense industries. These sectors require components made from difficult-to-machine superalloys like Inconel and titanium, demanding turrets with superior clamping force, damping characteristics, and the capability to handle high-pressure coolant delivery. For these customers, factors such as unparalleled repeatability, certified quality standards, and integration with advanced monitoring systems are non-negotiable purchasing criteria. The medical device manufacturing sector, producing implants and surgical tools, also represents a growing segment, driven by the need for micro-precision components often machined on highly compact and specialized CNC lathes utilizing high-speed, high-accuracy servo turrets.

Furthermore, general engineering and machinery manufacturers, who produce items ranging from hydraulic fittings and valves to heavy construction equipment components, constitute a foundational customer segment. This group seeks a balance between cost-effectiveness and reliable performance across a variety of material types and batch sizes. Finally, specialized customers include custom job shops and prototyping facilities that require highly versatile turrets, often with larger tool capacities (12+ stations) and live tooling capabilities to maximize machine flexibility for handling diverse small-batch orders with rapid changeover requirements.

| Report Attributes | Report Details |

|---|---|

| Market Size in 2026 | $750 million |

| Market Forecast in 2033 | $1,175 million |

| Growth Rate | 6.8% CAGR |

| Historical Year | 2019 to 2024 |

| Base Year | 2025 |

| Forecast Year | 2026 - 2033 |

| DRO & Impact Forces |

|

| Segments Covered |

|

| Key Companies Covered | Sauter GmbH, Baruffaldi S.p.A., Duplomatic Automation, HSD S.p.A., TSUDAKOMA Corp., Taiwan Chelic Co., Ltd., Haas Automation, DMG MORI Co., Ltd., Okuma Corporation, Hardinge Inc., MITSUBISHI HEAVY INDUSTRIES, Murata Machinery, TAIWAN CHUNGYU, ZF Friedrichshafen AG (components), Sandvik Coromant (tooling systems). |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Enquiry Before Buy | Have specific requirements? Send us your enquiry before purchase to get customized research options. Request For Enquiry Before Buy |

Disc Tool Turret Market Key Technology Landscape

The technological landscape of the Disc Tool Turret Market is rapidly evolving, driven by the need for higher precision, speed, and integration capabilities within modern machine tools. The most significant advancement is the shift towards high-performance servo-driven turrets. Unlike older hydraulic systems, servo technology offers superior control over the indexing process, allowing for variable speed control and precise angular positioning, which dramatically reduces tool change time, often down to fractions of a second. These servo systems utilize sophisticated closed-loop control with high-resolution encoders to ensure exceptional repeatability (typically within 1 micron), which is crucial for achieving the tight tolerances required in specialized manufacturing sectors like semiconductor equipment and advanced engine components. Furthermore, servo mechanisms are significantly more energy-efficient and generate less heat compared to hydraulic counterparts, contributing to a more stable machining environment.

Another crucial technological development involves the integration of advanced clamping and coupling systems, notably Capto, HSK, and proprietary quick-change interfaces. These systems facilitate extremely rapid and precise tool holder changes, optimizing machine utilization by minimizing downtime associated with setup and measurement. Modern turrets are also incorporating high-pressure coolant (HPC) delivery capabilities, allowing coolant to be directed precisely at the cutting edge through channels bored directly into the turret disc and tool holder, improving chip evacuation, extending tool life, and supporting high-speed machining of exotic materials. The effective management of HPC requires robust sealing mechanisms and material selection resistant to erosion and high pressures.

Furthermore, the incorporation of smart manufacturing technologies is transforming the turret into an intelligent sub-system. Advanced turrets now feature integrated sensor packages—including temperature, vibration, and torque sensors—that feed data back to the CNC control or external monitoring platforms. This allows for real-time health monitoring of the turret mechanisms, enabling predictive maintenance that anticipates component wear (such as clutch engagement failure or gearing issues). This reliance on data analysis, often leveraging machine learning as described previously, is foundational to maximizing OEE. Additionally, digital twin technology is increasingly being used in the design and optimization phases, allowing manufacturers to simulate turret performance under extreme load conditions before physical production, ensuring optimal design robustness and reliability.

Regional Highlights

The geographical distribution of the Disc Tool Turret Market reveals distinct patterns of demand and technological adoption across major economic blocs, heavily influenced by regional manufacturing maturity and investment cycles. Asia Pacific (APAC) stands as the largest and fastest-growing market, primarily due to the massive scale of manufacturing operations in China, which serves as the world's factory for electronics, automotive, and general machinery. Countries like Japan and South Korea contribute significantly through their advanced machine tool manufacturing sectors, leading in the production and adoption of high-precision, technologically sophisticated turrets utilized in captive production environments.

Europe represents a mature yet high-value market, characterized by stringent demand for quality and innovation, particularly within Germany, Italy, and Switzerland. These countries are global leaders in specialized engineering and aerospace components, driving the demand for premium, customized turret solutions that excel in thermal stability and high dynamic performance. European manufacturers often lead in the adoption of quick-change tooling standards and advanced diagnostic integration, focusing intensely on efficiency and long-term reliability due to high labor costs.

North America, particularly the United States, focuses investment heavily on high-technology sectors such as aerospace & defense, medical devices, and specialized energy components. While the volume demand may be lower than in APAC, the requirement for absolute precision, advanced material compatibility, and adherence to defense-related manufacturing standards ensures sustained high demand for the most sophisticated, high-end servo turrets. Latin America and the Middle East & Africa (MEA) currently represent smaller markets, but they offer significant growth opportunities, driven by increasing localized manufacturing capacity, especially in automotive assembly and infrastructure projects, necessitating the import of reliable CNC machinery and associated components.

- Asia Pacific (APAC): Dominates the market size due to massive industrialization and high volume manufacturing in China, adoption of advanced CNC technology in Japan and South Korea, driving demand for both standard and high-speed turrets.

- Europe: High-value market focused on precision engineering, aerospace, and luxury automotive sectors, leading to strong demand for premium, customized turrets with superior stability and integrated live tooling capabilities (Germany, Italy).

- North America: Driven by technological sophistication in aerospace, defense, and medical device manufacturing, requiring robust, high-precision servo-driven turrets and advanced quick-change interfaces (U.S., Canada).

- Latin America: Emerging market characterized by increasing foreign direct investment in automotive and heavy machinery sectors, fueling demand for reliable, mid-range CNC solutions incorporating standard disc tool turrets.

- Middle East and Africa (MEA): Primarily focused on oil & gas infrastructure maintenance and regional defense spending; demand for rugged, dependable turrets capable of operating under harsh industrial conditions.

Top Key Players

The market research report includes a detailed profile of leading stakeholders in the Disc Tool Turret Market.- Sauter GmbH

- Baruffaldi S.p.A.

- Duplomatic Automation

- HSD S.p.A.

- TSUDAKOMA Corp.

- Taiwan Chelic Co., Ltd.

- Haas Automation (As an OEM integrator and producer)

- DMG MORI Co., Ltd. (As an OEM integrator)

- Okuma Corporation (As an OEM integrator)

- Hardinge Inc. (As an OEM integrator)

- MITSUBISHI HEAVY INDUSTRIES (Relevant in machinery)

- Murata Machinery, Ltd.

- TAIWAN CHUNGYU Machine Tool Co., Ltd.

- ZF Friedrichshafen AG (Specific components supply)

- Sandvik Coromant (Indirectly through tooling interface standards)

- Yama Seiki CNC Machine Tools

- Pneumax S.p.A. (Relevant in pneumatic systems)

- Bosch Rexroth (Relevant in servo and hydraulic components)

Frequently Asked Questions

Analyze common user questions about the Disc Tool Turret market and generate a concise list of summarized FAQs reflecting key topics and concerns.What is the primary technical advantage of servo-driven disc tool turrets over hydraulic systems?

Servo-driven turrets offer superior indexing speed, precise angular control, and exceptional repeatability (often <1 micron) due to closed-loop encoder feedback. They are also more energy-efficient and enable faster, more dynamic tool changes necessary for modern high-speed CNC applications, minimizing non-cutting time.

How does the integration of Industry 4.0 technologies impact the operational life of disc tool turrets?

Industry 4.0 integration, utilizing IoT sensors for vibration and temperature monitoring, enables predictive maintenance. This data-driven approach allows operators to anticipate mechanical failures in the locking or indexing mechanism, significantly increasing turret uptime and extending the component's overall operational life while minimizing catastrophic downtime.

Which end-use industry is the largest consumer of disc tool turrets globally?

The Automotive industry is the largest global consumer segment for disc tool turrets. High-volume manufacturing of engine, transmission, and chassis components requires reliable, fast, and precise tool changing capabilities provided by these turrets within dedicated CNC turning centers.

What key factors determine the optimal selection of a disc tool turret for a new CNC machine?

Optimal selection depends on required indexing speed, clamping force (for rigidity during heavy cuts), number of tool stations (capacity), the need for live tooling capabilities, and compatibility with specific quick-change tooling systems (e.g., Capto or HSK) mandated by the manufacturing process.

What role do specialized quick-change tooling interfaces play in the market?

Quick-change tooling interfaces (like HSK or Capto) integrated into the turret mechanism drastically reduce manual setup time and measurement downtime. They ensure high repeatability of tool position after changes, maximizing machine utilization and supporting flexible manufacturing strategies for small batch sizes.

To check our Table of Contents, please mail us at: sales@marketresearchupdate.com

Research Methodology

The Market Research Update offers technology-driven solutions and its full integration in the research process to be skilled at every step. We use diverse assets to produce the best results for our clients. The success of a research project is completely reliant on the research process adopted by the company. Market Research Update assists its clients to recognize opportunities by examining the global market and offering economic insights. We are proud of our extensive coverage that encompasses the understanding of numerous major industry domains.

Market Research Update provide consistency in our research report, also we provide on the part of the analysis of forecast across a gamut of coverage geographies and coverage. The research teams carry out primary and secondary research to implement and design the data collection procedure. The research team then analyzes data about the latest trends and major issues in reference to each industry and country. This helps to determine the anticipated market-related procedures in the future. The company offers technology-driven solutions and its full incorporation in the research method to be skilled at each step.

The Company's Research Process Has the Following Advantages:

- Information Procurement

The step comprises the procurement of market-related information or data via different methodologies & sources.

- Information Investigation

This step comprises the mapping and investigation of all the information procured from the earlier step. It also includes the analysis of data differences observed across numerous data sources.

- Highly Authentic Source

We offer highly authentic information from numerous sources. To fulfills the client’s requirement.

- Market Formulation

This step entails the placement of data points at suitable market spaces in an effort to assume possible conclusions. Analyst viewpoint and subject matter specialist based examining the form of market sizing also plays an essential role in this step.

- Validation & Publishing of Information

Validation is a significant step in the procedure. Validation via an intricately designed procedure assists us to conclude data-points to be used for final calculations.

×

Request Free Sample:

Related Reports

Select License

Why Choose Us

We're cost-effective and Offered Best services:

We are flexible and responsive startup research firm. We adapt as your research requires change, with cost-effectiveness and highly researched report that larger companies can't match.

Information Safety

Market Research Update ensure that we deliver best reports. We care about the confidential and personal information quality, safety, of reports. We use Authorize secure payment process.

We Are Committed to Quality and Deadlines

We offer quality of reports within deadlines. We've worked hard to find the best ways to offer our customers results-oriented and process driven consulting services.

Our Remarkable Track Record

We concentrate on developing lasting and strong client relationship. At present, we hold numerous preferred relationships with industry leading firms that have relied on us constantly for their research requirements.

Best Service Assured

Buy reports from our executives that best suits your need and helps you stay ahead of the competition.

Customized Research Reports

Our research services are custom-made especially to you and your firm in order to discover practical growth recommendations and strategies. We don't stick to a one size fits all strategy. We appreciate that your business has particular research necessities.

Service Assurance

At Market Research Update, we are dedicated to offer the best probable recommendations and service to all our clients. You will be able to speak to experienced analyst who will be aware of your research requirements precisely.

Contact With Our Sales Team

Customer Testimonials

The content of the report is always up to the mark. Good to see speakers from expertise authorities.

Privacy requested , Managing Director

A lot of unique and interesting topics which are described in good manner.

Privacy requested, President

Well researched, expertise analysts, well organized, concrete and current topics delivered in time.

Privacy requested, Development Manager