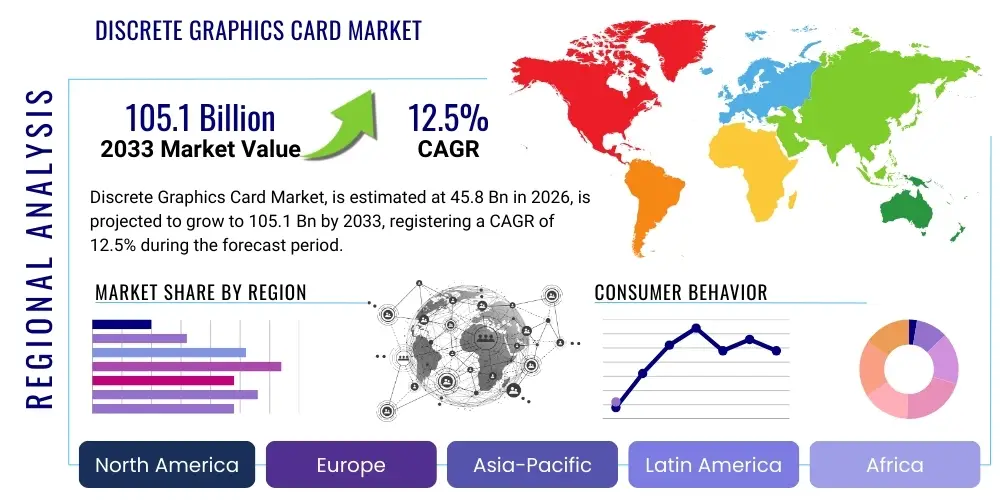

Discrete Graphics Card Market Size, By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2026 to 2033 (Financial Impact Analysis)

ID : MRU_ 442301 | Date : Feb, 2026 | Pages : 258 | Region : Global | Publisher : MRU

Discrete Graphics Card Market Size

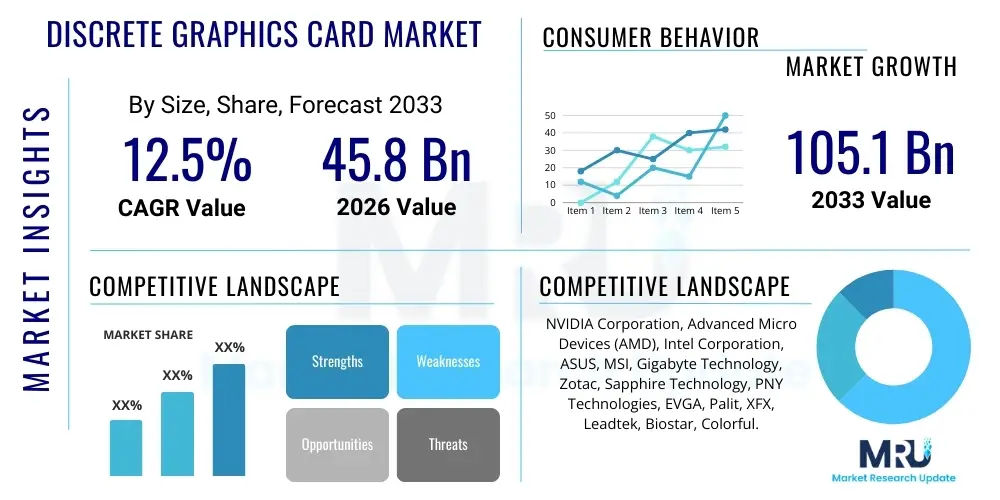

The Discrete Graphics Card Market is projected to grow at a Compound Annual Growth Rate (CAGR) of 12.5% between 2026 and 2033. The market is estimated at USD 45.8 Billion in 2026 and is projected to reach USD 105.1 Billion by the end of the forecast period in 2033.

This robust growth trajectory is primarily fueled by the accelerating demands from the gaming sector, which continuously requires higher computational power for advanced rendering techniques like ray tracing and higher resolutions. Furthermore, the massive infrastructural buildout supporting Artificial Intelligence (AI) and Machine Learning (ML) workloads in data centers mandates specialized, high-performance discrete GPUs, transitioning the market reliance from solely consumer applications to enterprise solutions.

The fluctuating dynamics of supply chain logistics, particularly concerning semiconductor fabrication capacity and advanced packaging techniques, play a crucial role in determining short-term market availability and pricing structures. Strategic investments by key market players in next-generation architectures and process nodes (e.g., 5nm and 3nm) are essential for maintaining competitive edge and catering to the escalating demands for energy efficiency alongside raw processing throughput across professional and consumer segments. Geopolitical stability and trade policies also significantly influence the manufacturing and distribution pathways for these complex components globally.

Discrete Graphics Card Market introduction

The Discrete Graphics Card Market encompasses specialized processing units designed to handle visual rendering, complex calculations, and parallel processing tasks independently of the Central Processing Unit (CPU). These cards, distinct from integrated GPUs, are essential components in high-performance computing systems, offering dedicated memory (VRAM) and powerful cores optimized for simultaneous thread execution. The primary applications span high-fidelity gaming, professional content creation (video editing, 3D modeling), and increasingly, demanding AI/ML training and inference operations within data center environments, leveraging their massive parallel processing capabilities.

The core benefit of discrete graphics cards lies in their ability to dramatically accelerate graphical output and mathematical operations that are computationally prohibitive for standard CPUs, thereby enabling immersive experiences, rapid rendering, and significant time savings in professional workflows. Key driving factors include the continuous evolution of AAA gaming titles requiring photorealistic graphics, the widespread adoption of 4K and higher resolution displays, the burgeoning field of cryptocurrency, and the institutional recognition of the GPU as the fundamental engine for modern AI infrastructure. Market growth is structurally linked to advancements in silicon process technology, enabling more transistors per die and subsequent performance gains per watt.

Technological innovation is currently centered on enhancing ray tracing performance, integrating specialized AI tensor cores for features like deep learning supersampling (DLSS), and transitioning to faster bus standards like PCIe 5.0 to minimize latency between the GPU and other system components. Furthermore, the market is undergoing diversification, with traditional gaming GPUs competing intensely with highly optimized data center accelerators. This dual focus ensures market resilience, linking performance gains in the consumer space (driven by volume and price sensitivity) with critical infrastructure growth in the enterprise space (driven by raw efficiency and specialized hardware requirements).

Discrete Graphics Card Market Executive Summary

The Discrete Graphics Card Market executive summary reveals robust expansion driven by synergistic demands across three major areas: high-end gaming, AI/ML computing, and professional visualization. Business trends indicate intensified competition between dominant market leaders, NVIDIA and AMD, with Intel rapidly gaining traction, particularly in the entry-level and mid-range segments. The market exhibits characteristic cyclical volatility influenced by product refresh cycles, cryptocurrency market fluctuations, and the dynamic state of semiconductor supply chains, necessitating agile inventory management and strategic pricing policies by Add-in-Board (AIB) partners.

Regional trends highlight the Asia Pacific (APAC) region as the fastest-growing market, primarily due to massive gaming penetration, expanding professional service industries in China and India, and significant government and private sector investment in AI research and data center construction. North America remains the leading revenue generator, characterized by early adoption of cutting-edge technologies and a robust ecosystem for cloud computing and enterprise-level AI solutions. Europe shows steady, mature growth, driven by professional visualization and high-end enthusiast PC building, albeit often constrained by higher energy costs impacting large-scale data center operations compared to other regions.

Segment trends underscore the increasing divergence between consumer and enterprise products, with professional/data center GPUs commanding significantly higher average selling prices (ASPs) and demonstrating less price elasticity than their gaming counterparts. The adoption of high-bandwidth memory (HBM) is becoming standard for flagship AI accelerators, while gaming cards continue to leverage advancements in GDDR technology (e.g., GDDR6X). The mid-range market, offering the best performance-per-dollar, is the key volume driver, influencing mainstream market penetration and setting performance baselines for the majority of the gaming user base globally.

AI Impact Analysis on Discrete Graphics Card Market

Users commonly question how the exponential growth of Artificial Intelligence (AI) and Machine Learning (ML) directly influences the availability and pricing of consumer discrete graphics cards, given the massive computational needs of large language models (LLMs) and generative AI applications. Key concerns revolve around whether data center demand will perpetually strain supply chains, leading to inflated costs for gaming enthusiasts. Furthermore, users seek clarification on the functional divergence between consumer GPUs (optimized for rendering) and specialized AI accelerators (optimized for tensor operations and energy efficiency), examining which architectural features—like NVIDIA's Tensor Cores or AMD’s Matrix Cores—will become critical differentiators moving forward, and how these specialized requirements dictate future market segmentation and innovation roadmaps.

The symbiotic relationship between AI development and the discrete GPU market is undeniably the single largest structural factor shaping future growth and technological investment. AI training necessitates unprecedented levels of parallel processing, a task inherently suited to the architecture of discrete GPUs, particularly those with dedicated AI acceleration hardware. This demand shifts the primary revenue driver from cyclical consumer electronics to stable, high-value enterprise infrastructure. The necessity for high-speed interconnects (like NVLink or Infinity Fabric) for multi-GPU communication in massive AI clusters is now a major R&D focus, pushing performance envelopes beyond traditional graphics rendering requirements and accelerating the development of specialized memory solutions like HBM.

This immense enterprise demand not only drives profitability but also funds the extensive research and development needed for advanced fabrication techniques (e.g., chiplets, 3D stacking) that ultimately trickle down and benefit consumer products. However, the persistent high demand from hyperscalers and cloud providers creates significant supply allocation challenges, occasionally causing market shortages and driving up ASPs across the board, particularly for high-end silicon. Consequently, manufacturers must strategically balance the allocation of cutting-edge dies between highly lucrative data center contracts and the high-volume consumer market to ensure long-term market stability and brand loyalty.

- Enterprise AI/ML training is the fastest growing revenue segment for high-end discrete GPUs.

- Increased demand from hyperscalers leads to supply constraints and elevated Average Selling Prices (ASPs).

- GPU architectures are increasingly optimized with dedicated hardware (Tensor Cores/Matrix Cores) specifically for AI workloads.

- The need for high-speed inter-GPU communication (e.g., NVLink) drives innovation in packaging and interconnect technology.

- Generative AI models and edge computing applications necessitate greater deployment of GPUs outside centralized data centers.

- The convergence of ray tracing and AI-powered upscaling (DLSS/FSR) enhances the overall gaming ecosystem.

DRO & Impact Forces Of Discrete Graphics Card Market

The dynamics of the Discrete Graphics Card Market are determined by a complex interplay of Drivers, Restraints, and Opportunities (DRO), which collectively constitute the critical Impact Forces shaping its trajectory. Key drivers include the relentless advancement in gaming requiring real-time ray tracing and higher resolutions (4K and beyond), coupled with the exponential demand from the AI and Machine Learning sectors for parallel processing capabilities in training large language models. The growing adoption of professional visualization technologies, including virtual reality (VR) and high-fidelity simulation in engineering and medical fields, further bolsters this demand. Conversely, the market faces significant restraints, chiefly concerning semiconductor supply chain volatility, which results in intermittent shortages and elevated component costs, alongside the inherent price sensitivity of the mainstream consumer segment. Furthermore, the intense power consumption and thermal management challenges associated with ultra-high-performance GPUs present ongoing design limitations.

Opportunities for expansion are primarily concentrated in emerging technology domains such as the Metaverse and edge AI computing, where the processing must occur closer to the data source, demanding rugged, efficient discrete GPU solutions outside traditional data centers. The transition towards more sustainable manufacturing practices and the development of power-efficient architectures also present long-term opportunities to appeal to environmentally conscious consumers and reduce operational expenditure for large-scale data centers. The advent of new bus interfaces like PCIe 5.0 and advancements in high-bandwidth memory (HBM) offer performance headroom, enabling manufacturers to differentiate their products based on technological superiority and sustained throughput under heavy load conditions, thereby cementing future market positioning.

The impact forces generated by this DRO analysis are substantial. High demand elasticity in the consumer market means price fluctuations severely affect sales volume, while inelastic demand in the data center market provides a stable, high-margin revenue stream. Regulatory shifts regarding energy efficiency, especially in European and Asian markets, necessitate focused innovation toward performance-per-watt metrics. Moreover, the entrance of new competitors, such as Intel, intensifies pricing pressure in the mid-range and democratizes access to discrete graphics technology, forcing incumbent leaders to accelerate their innovation cycles. Successful navigation of these forces requires strategic capacity planning, diversification into high-margin enterprise segments, and continued investment in architectural optimization for both rendering and compute applications.

Segmentation Analysis

The Discrete Graphics Card Market is segmented based on key criteria including the underlying GPU Type, the primary Application Area, and the Bus Interface used for connectivity. This segmentation is crucial as it reflects the distinct technological requirements and purchasing behaviors across various end-user groups, from cost-sensitive mainstream gamers to hyperscale cloud service providers requiring multi-million-dollar AI clusters. Understanding these segments allows manufacturers to tailor product specifications, pricing strategies, and marketing efforts to maximize penetration and profitability in highly specialized niches.

The delineation between segments is becoming sharper, particularly between compute-focused professional cards (like NVIDIA’s H-series or AMD’s Instinct line) and traditional consumer gaming cards. Segmentation by application dictates core architectural priorities, such as the balance between texture units, RT cores, and Tensor/Matrix cores. Meanwhile, the segmentation by bus interface highlights the current transition toward high-throughput standards like PCIe 5.0, which is critical for minimizing data transfer bottlenecks in high-resolution gaming and large-scale data processing environments, influencing backward compatibility and system integration complexity for end-users.

- By Type: RTX Series, Radeon RX Series, Quadro/Professional, Intel Arc Series, Others

- By Application: Gaming, Data Centers/AI, Cryptocurrency Mining, Professional Visualization, Edge Computing, Industrial Automation

- By Bus Interface: PCIe 4.0, PCIe 5.0, Older Standards (e.g., PCIe 3.0)

- By Memory Type: GDDR6X, GDDR6, HBM (High Bandwidth Memory)

- By Memory Capacity: 8GB and Below, 10GB–16GB, 24GB and Above

Value Chain Analysis For Discrete Graphics Card Market

The value chain for the Discrete Graphics Card Market is intricate, starting with upstream activities dominated by fabless semiconductor design giants who innovate and architect the GPU core (e.g., NVIDIA, AMD). This stage involves extensive R&D in microarchitecture, process technology optimization, and intellectual property development. The middle segment is dominated by capital-intensive foundry operations (e.g., TSMC, Samsung Foundry) responsible for manufacturing the complex silicon dies using advanced process nodes (e.g., 5nm, 3nm). This manufacturing phase is a critical bottleneck, dictating supply capacity and yield rates, and thus heavily influences the entire market’s stability and pricing structure.

Downstream activities involve the Add-in-Board (AIB) partners (e.g., ASUS, MSI, Gigabyte) who purchase the silicon dies and related components (VRAM, PCBs, cooling solutions) to assemble the final discrete graphics card products, handling cooling system design, power delivery optimization, branding, and packaging. Distribution channels are bifurcated: Direct distribution involves sales to large hyperscalers and OEM partners (system builders like Dell, HP) for high-volume enterprise and pre-built PC markets. Indirect distribution relies heavily on regional distributors, e-commerce platforms (Amazon, Newegg), and specialized retail channels catering to individual PC builders and enthusiasts, often involving intensive inventory management due to product volatility.

The flow of revenue and risk is concentrated at the top and bottom of the chain. Fabless companies capture significant margin due to their IP control, while AIB partners navigate competitive pricing and inventory risks. The shift towards proprietary interconnects and specialized enterprise solutions increasingly favors direct distribution models between the GPU designer and the end-user data center, bypassing traditional retail channels entirely. This trend is crucial for maintaining performance and optimizing massive cluster deployments, yet it further separates the enterprise and consumer supply chains in terms of technological complexity and delivery method.

Discrete Graphics Card Market Potential Customers

The potential customer base for discrete graphics cards is highly diversified, spanning dedicated hardware enthusiasts, major institutional investors, and professional organizations. Historically, the largest segment comprised high-end PC gamers who purchase cards to achieve maximum frame rates and graphical fidelity in the latest interactive titles, demanding rapid refresh cycles and strong price-to-performance ratios. This segment remains crucial for volume, heavily influenced by benchmarks and peer recommendations, seeking continuous technological upgrades to maintain competitive gaming experiences on high-resolution monitors and VR headsets.

Increasingly, the most lucrative potential customers are hyper-scale cloud service providers (CSPs) like Amazon Web Services, Microsoft Azure, and Google Cloud, who purchase GPUs in massive quantities for their data centers to power AI/ML services, big data analytics, and high-performance computing (HPC). These institutional buyers prioritize energy efficiency, raw throughput (measured in TFLOPS/TOPS), and specialized features like high-bandwidth memory (HBM) and advanced interconnectivity (NVLink) over traditional gaming features, driving the demand for specialized, enterprise-grade accelerators designed purely for compute tasks rather than rendering.

Other significant buyers include cryptocurrency miners (though volatile), professional content creators (e.g., film studios, architectural visualization firms, industrial design houses), and large governmental or academic research institutions focused on complex simulations, weather modeling, or physics research. These professional end-users require guaranteed stability, certified drivers, and extended memory capacity, often opting for professional-grade cards (like NVIDIA Quadro or AMD Radeon Pro series) which offer specific software optimizations and robust technical support unavailable to consumer-grade cards. The convergence of AI and professional visualization means many software packages now leverage AI capabilities directly, intertwining these two customer segments.

| Report Attributes | Report Details |

|---|---|

| Market Size in 2026 | USD 45.8 Billion |

| Market Forecast in 2033 | USD 105.1 Billion |

| Growth Rate | 12.5% CAGR |

| Historical Year | 2019 to 2024 |

| Base Year | 2025 |

| Forecast Year | 2026 - 2033 |

| DRO & Impact Forces |

|

| Segments Covered |

|

| Key Companies Covered | NVIDIA Corporation, Advanced Micro Devices (AMD), Intel Corporation, ASUS, MSI, Gigabyte Technology, Zotac, Sapphire Technology, PNY Technologies, EVGA, Palit, XFX, Leadtek, Biostar, Colorful. |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Enquiry Before Buy | Have specific requirements? Send us your enquiry before purchase to get customized research options. Request For Enquiry Before Buy |

Discrete Graphics Card Market Key Technology Landscape

The Discrete Graphics Card Market is currently defined by intense competition in technological advancements centered on three pillars: microarchitecture efficiency, advanced silicon fabrication, and specialized hardware acceleration. Core architectural designs, such as NVIDIA's Ada Lovelace (featuring 3rd Gen RT Cores and 4th Gen Tensor Cores) and AMD's RDNA architecture (focused on enhanced compute unit efficiency and ray tracing acceleration), dictate the card's overall performance profile and feature set. The move towards chiplet designs is a critical trend, allowing manufacturers to integrate multiple smaller, specialized dies onto a single package, improving manufacturing yields and scalability, exemplified by some of AMD’s current GPU designs aimed at maximizing performance while mitigating the high cost of monolithic high-end silicon.

Fabrication technology is leveraging cutting-edge process nodes, primarily 5nm and transitioning rapidly toward 3nm, provided by leading foundries. Shrinking transistor sizes allows for increased transistor density, dramatically improving power efficiency (performance per watt) and enabling higher clock speeds, which are essential for maintaining generational performance leaps. Furthermore, advancements in memory technology, specifically the implementation of GDDR6X for high-end consumer cards and High Bandwidth Memory (HBM) for enterprise AI accelerators, are crucial for feeding the immense data requirements of modern GPUs, ensuring memory bandwidth does not become a performance bottleneck under heavy computational load.

Specialized hardware acceleration, particularly for ray tracing and AI tasks, remains a critical differentiator. Ray tracing capabilities offer highly realistic lighting, shadows, and reflections, becoming a standard expectation in new titles. Simultaneously, the integration of dedicated tensor cores and matrix engines directly accelerates deep learning operations, essential not only for AI training but also for in-game features like upscaling (DLSS/FSR) and frame generation, which significantly boost effective frame rates. The adoption of PCIe 5.0 and proprietary high-speed interconnects is finalizing the technology landscape, ensuring that the entire system ecosystem can support the overwhelming data throughput generated by these advanced graphical processors, minimizing I/O latency.

Regional Highlights

- Asia Pacific (APAC): APAC is projected to be the engine of growth for the Discrete Graphics Card Market, driven by the world’s largest PC gaming population, especially in markets like China, South Korea, and Japan. Massive governmental investment in digitalization, coupled with the rapid expansion of regional cloud service providers and the proliferation of internet cafes upgrading their hardware, establishes APAC as both a volume and high-growth market. Furthermore, its role as the global manufacturing hub for electronic components ensures close proximity to the supply chain, though regional trade complexities remain a key consideration.

- North America: North America holds the largest market share in terms of revenue, primarily attributed to early adoption of cutting-edge technologies, the robust presence of hyperscale cloud providers, and the dominance of major tech companies heavily investing in AI infrastructure. The demand here is bifurcated, with a substantial high-end enthusiast PC market driving consumer ASPs and unparalleled enterprise demand for specialized, high-margin data center accelerators, often requiring custom integration solutions and advanced cooling technologies.

- Europe: The European market displays steady and mature growth, characterized by strong demand from professional visualization sectors (e.g., automotive design, architecture, and VFX studios) and a dedicated PC enthusiast base, particularly in Western Europe (Germany, UK, France). Regulatory frameworks focused on sustainability and energy efficiency significantly influence procurement decisions in large data centers, promoting the adoption of GPUs optimized for performance per watt. Political stability and energy costs are key factors influencing long-term investment in regional data center capacities.

- Latin America (LATAM): LATAM represents an emerging market characterized by increasing disposable income, improving internet infrastructure, and a rapidly expanding middle class adopting PC gaming. While smaller in scale compared to APAC or North America, the region shows high growth potential, driven primarily by mainstream consumer gaming and expanding small-to-medium enterprise data centers seeking affordable virtualization and basic AI capabilities.

- Middle East and Africa (MEA): The MEA region is developing, propelled by significant government-led digitalization initiatives (e.g., Saudi Arabia’s Vision 2030, UAE’s technological investments). Growth is concentrated in data center establishment, particularly within the Gulf Cooperation Council (GCC) countries, focusing on establishing regional cloud hubs and supporting local professional industries (oil & gas simulation, financial modeling), necessitating enterprise-grade graphics solutions.

Top Key Players

The market research report includes a detailed profile of leading stakeholders in the Discrete Graphics Card Market.- NVIDIA Corporation

- Advanced Micro Devices (AMD)

- Intel Corporation

- ASUS

- MSI

- Gigabyte Technology

- Zotac

- Sapphire Technology

- PNY Technologies

- EVGA

- Palit

- XFX

- Leadtek

- Biostar

- Colorful

Frequently Asked Questions

Analyze common user questions about the Discrete Graphics Card market and generate a concise list of summarized FAQs reflecting key topics and concerns.What is driving the current high cost and volatility in the Discrete Graphics Card Market?

The primary drivers of volatility are persistent supply chain constraints for advanced silicon fabrication (3nm/5nm nodes), intense, competitive procurement by hyperscale data centers for AI accelerators, and historical cyclical demand from cryptocurrency mining operations, all contributing to elevated Average Selling Prices (ASPs).

How is Artificial Intelligence (AI) reshaping the architecture of discrete GPUs?

AI is forcing architectural specialization, leading to the incorporation of dedicated hardware cores (e.g., Tensor or Matrix Cores) optimized for machine learning calculations. Furthermore, AI workloads demand higher memory bandwidth, driving the adoption of HBM and advanced inter-GPU communication fabrics like NVLink for massive cluster scalability.

Which geographical region dominates the Discrete Graphics Card Market?

North America currently dominates the market in terms of revenue value, primarily due to the massive concentration of high-end data centers and leading cloud service providers. However, the Asia Pacific (APAC) region is projected to exhibit the highest Compound Annual Growth Rate (CAGR) due to rapid expansion in PC gaming and regional AI investments.

What are the key technological differentiators between gaming and professional discrete graphics cards?

Gaming cards prioritize clock speeds and rasterization performance, while professional cards (used in data centers and visualization) prioritize certified stability, significantly larger VRAM capacity (often HBM), ECC memory support for data integrity, and specialized interconnectivity like NVLink for multi-GPU arrays.

What role does PCIe 5.0 play in the future growth of the market?

PCIe 5.0 doubles the bandwidth of PCIe 4.0, which is crucial for preventing I/O bottlenecks when handling the immense data throughput required by high-resolution gaming textures and large datasets in AI processing. It ensures the CPU-to-GPU communication channel keeps pace with generational GPU performance leaps.

To check our Table of Contents, please mail us at: sales@marketresearchupdate.com

Research Methodology

The Market Research Update offers technology-driven solutions and its full integration in the research process to be skilled at every step. We use diverse assets to produce the best results for our clients. The success of a research project is completely reliant on the research process adopted by the company. Market Research Update assists its clients to recognize opportunities by examining the global market and offering economic insights. We are proud of our extensive coverage that encompasses the understanding of numerous major industry domains.

Market Research Update provide consistency in our research report, also we provide on the part of the analysis of forecast across a gamut of coverage geographies and coverage. The research teams carry out primary and secondary research to implement and design the data collection procedure. The research team then analyzes data about the latest trends and major issues in reference to each industry and country. This helps to determine the anticipated market-related procedures in the future. The company offers technology-driven solutions and its full incorporation in the research method to be skilled at each step.

The Company's Research Process Has the Following Advantages:

- Information Procurement

The step comprises the procurement of market-related information or data via different methodologies & sources.

- Information Investigation

This step comprises the mapping and investigation of all the information procured from the earlier step. It also includes the analysis of data differences observed across numerous data sources.

- Highly Authentic Source

We offer highly authentic information from numerous sources. To fulfills the client’s requirement.

- Market Formulation

This step entails the placement of data points at suitable market spaces in an effort to assume possible conclusions. Analyst viewpoint and subject matter specialist based examining the form of market sizing also plays an essential role in this step.

- Validation & Publishing of Information

Validation is a significant step in the procedure. Validation via an intricately designed procedure assists us to conclude data-points to be used for final calculations.

×

Request Free Sample:

Related Reports

Select License

Why Choose Us

We're cost-effective and Offered Best services:

We are flexible and responsive startup research firm. We adapt as your research requires change, with cost-effectiveness and highly researched report that larger companies can't match.

Information Safety

Market Research Update ensure that we deliver best reports. We care about the confidential and personal information quality, safety, of reports. We use Authorize secure payment process.

We Are Committed to Quality and Deadlines

We offer quality of reports within deadlines. We've worked hard to find the best ways to offer our customers results-oriented and process driven consulting services.

Our Remarkable Track Record

We concentrate on developing lasting and strong client relationship. At present, we hold numerous preferred relationships with industry leading firms that have relied on us constantly for their research requirements.

Best Service Assured

Buy reports from our executives that best suits your need and helps you stay ahead of the competition.

Customized Research Reports

Our research services are custom-made especially to you and your firm in order to discover practical growth recommendations and strategies. We don't stick to a one size fits all strategy. We appreciate that your business has particular research necessities.

Service Assurance

At Market Research Update, we are dedicated to offer the best probable recommendations and service to all our clients. You will be able to speak to experienced analyst who will be aware of your research requirements precisely.

Contact With Our Sales Team

Customer Testimonials

The content of the report is always up to the mark. Good to see speakers from expertise authorities.

Privacy requested , Managing Director

A lot of unique and interesting topics which are described in good manner.

Privacy requested, President

Well researched, expertise analysts, well organized, concrete and current topics delivered in time.

Privacy requested, Development Manager