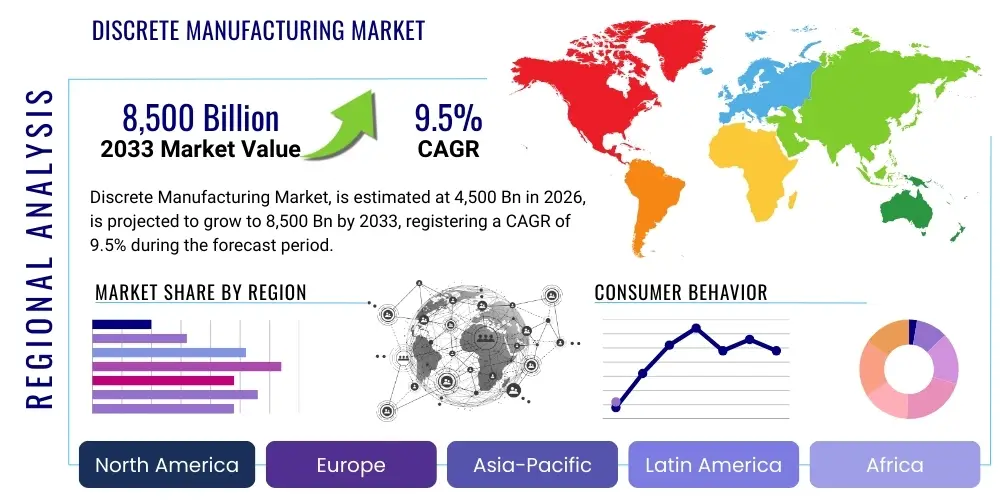

Discrete Manufacturing Market Size, By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2026 to 2033 (Financial Impact Analysis)

ID : MRU_ 443639 | Date : Feb, 2026 | Pages : 255 | Region : Global | Publisher : MRU

Discrete Manufacturing Market Size

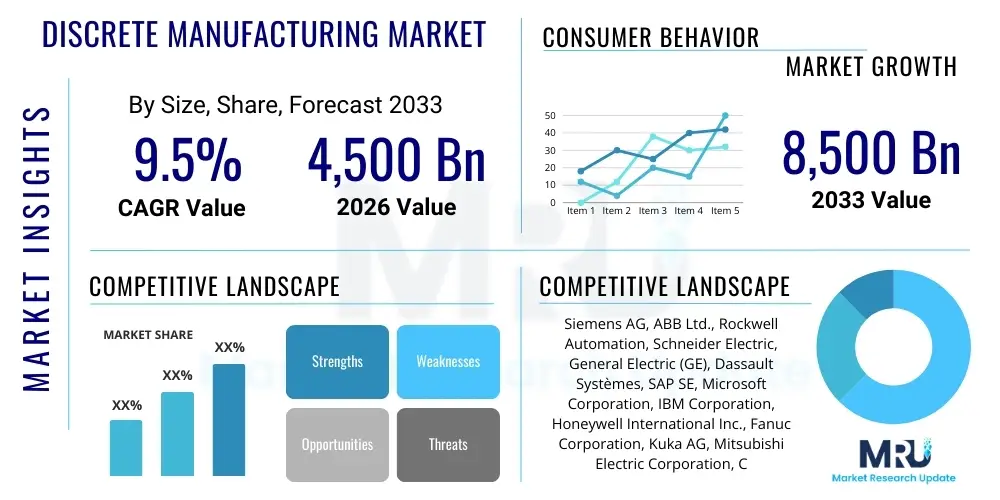

The Discrete Manufacturing Market is projected to grow at a Compound Annual Growth Rate (CAGR) of 9.5% between 2026 and 2033. The market is estimated at USD 4,500 Billion in 2026 and is projected to reach USD 8,500 Billion by the end of the forecast period in 2033. This substantial expansion is primarily driven by the pervasive adoption of Industry 4.0 technologies, increasing demand for customized products, and the ongoing necessity for operational efficiency across major industrial verticals such as automotive, aerospace, and electronics. The globalization of supply chains further necessitates advanced digital solutions to manage complexity, contributing significantly to market size acceleration.

Discrete Manufacturing Market introduction

The Discrete Manufacturing Market encompasses the production of distinct items or products that are easily counted, unlike continuous process manufacturing. Key sectors within this market include automotive manufacturing, aerospace and defense, industrial machinery, electronics, and medical devices. These industries rely heavily on assembly lines, component parts, and Bill of Materials (BOM) management. The core objectives of discrete manufacturing operations are high precision, stringent quality control, and optimized throughput, often dealing with low-volume, high-complexity products or high-volume, standardized goods.

Products within this domain range from complex jet engines and specialized robotics to consumer electronics and automobiles. Major applications revolve around automated assembly, quality inspection using vision systems, inventory management, and predictive maintenance protocols facilitated by the Industrial Internet of Things (IIoT). The immediate benefits of modern discrete manufacturing practices include reduced time-to-market, enhanced product quality through automated checks, and significant operational cost reduction achieved via leaner manufacturing processes and energy management systems.

Driving factors propelling market growth are fundamentally linked to global digital transformation initiatives. The increasing consumer demand for personalization necessitates flexible manufacturing systems capable of handling small batch sizes and complex product variations efficiently. Furthermore, government mandates supporting smart factory infrastructure development in regions like China, Germany, and the United States, coupled with intense global competition, force manufacturers to invest heavily in advanced technologies such as Artificial Intelligence (AI), robotics, and digital twin technology to maintain a competitive edge and ensure supply chain resilience.

Discrete Manufacturing Market Executive Summary

The Discrete Manufacturing market is witnessing rapid transformation fueled by overarching business trends focused on resilient supply chains and hyper-personalization. Digital transformation remains the central business trend, compelling manufacturers to integrate cloud-based Enterprise Resource Planning (ERP) and Manufacturing Execution Systems (MES) to synchronize global operations. Sustainability and circular economy principles are also becoming critical business drivers, pushing firms toward optimized material use and waste reduction, often achieved through real-time data analytics and simulation tools. Investment in cybersecurity solutions is also escalating as Operational Technology (OT) networks become increasingly connected to IT infrastructure, highlighting a strategic shift toward holistic digital risk management.

Regionally, Asia Pacific (APAC) stands as the dominant force, driven by robust automotive and consumer electronics production in China, Japan, South Korea, and emerging economies like India and Vietnam. This region benefits from favorable government policies promoting industrial modernization and large-scale investment in automation infrastructure. North America and Europe, while growing at a slightly slower pace, focus intensely on high-value, complex manufacturing, notably in aerospace and specialized machinery, leveraging advanced technologies like Additive Manufacturing (AM) and advanced robotics for highly localized, customized production runs.

Segment trends indicate a pronounced shift towards software and services, particularly concerning the deployment and integration of IIoT platforms, Machine Learning (ML) tools for quality control, and Digital Twin solutions for lifecycle management. Among application segments, the automotive industry holds the largest market share due to its stringent requirements for high throughput and precision, coupled with the rapid transition to Electric Vehicles (EVs), which demands entirely new manufacturing ecosystems. Furthermore, the industrial machinery and equipment segment is experiencing significant growth, driven by the requirement for intelligent, self-optimizing machinery capable of performing predictive maintenance and communicating diagnostics autonomously.

AI Impact Analysis on Discrete Manufacturing Market

Users frequently inquire about AI's practical implementation, particularly concerning its ability to enhance predictive maintenance schedules, improve quality control processes, and optimize complex supply chain logistics within discrete manufacturing environments. Common questions revolve around the necessary investment in data infrastructure, the complexity of integrating machine learning models with legacy Operational Technology (OT) systems, and the crucial concern regarding workforce upskilling and potential job displacement due to automation. The central expectation is that AI should provide demonstrable Return on Investment (ROI) by significantly reducing downtime and scrap rates while facilitating greater levels of product customization without compromising efficiency or quality standards.

The key themes emerging from user expectations center on operational intelligence and automated decision-making. Manufacturers seek AI solutions that can analyze vast amounts of sensor data collected from production lines—identifying anomalies before catastrophic failures occur, thereby transitioning maintenance from reactive or scheduled practices to truly predictive frameworks. Furthermore, AI is highly anticipated for enabling true mass customization, allowing automated systems to adjust production parameters dynamically based on individual customer specifications. This transition relies heavily on robust digital infrastructure and real-time data processing capabilities to ensure seamless execution across disparate manufacturing stages.

Ultimately, the influence of AI in discrete manufacturing is summarized by its role as an intelligence layer augmenting existing automation infrastructure. It moves the industry beyond mere programmed repetition toward cognitive automation. AI drives strategic planning by simulating multiple production scenarios, optimizing factory layouts, and ensuring optimal energy consumption, thus impacting both the factory floor and executive decision-making processes. The perceived complexity of implementation remains a key barrier, but the competitive advantages gained through AI-driven efficiency gains continue to drive widespread adoption globally.

- Enhanced Predictive Maintenance: AI algorithms analyze sensor data to predict equipment failure with high accuracy, minimizing unplanned downtime.

- Optimized Quality Control: Vision systems integrated with deep learning identify microscopic defects faster and more reliably than human inspection.

- Supply Chain Resilience: AI models predict logistical bottlenecks, optimize inventory levels, and recommend alternative sourcing strategies during disruptions.

- Generative Design: AI assists engineers in designing lighter, stronger, and more efficient parts, particularly beneficial for additive manufacturing processes.

- Robot Collaboration and Programming: Simplified teaching and deployment of collaborative robots (cobots) through machine learning, enabling flexible production lines.

- Energy Consumption Optimization: Real-time monitoring and adjustment of machinery operations to minimize energy usage based on production load.

- Mass Customization Enablement: Dynamic adjustment of assembly parameters to handle high-mix, low-volume orders efficiently.

DRO & Impact Forces Of Discrete Manufacturing Market

The Discrete Manufacturing Market growth trajectory is significantly influenced by powerful Drivers, substantial Restraints, and transformative Opportunities, collectively summarized as the DRO & Impact Forces. Key drivers include the acceleration of digital transformation, driven by competitive pressures and the global push toward Industry 4.0 standards, demanding connectivity, data utilization, and advanced automation. This is reinforced by the increasing consumer expectation for highly customized and personalized products, forcing manufacturers to adopt flexible production lines and smart factory concepts. The economic impact force is profoundly positive, generating increased productivity and higher quality outputs, though tempered by the initial investment hurdle.

Restraints primarily revolve around the high initial capital expenditure required for implementing advanced automation technologies, particularly for small and medium-sized enterprises (SMEs) that lack necessary financial resources or technical expertise. Cybersecurity risks represent a major operational restraint, as interconnected systems create large attack surfaces, making proprietary designs and production data vulnerable. Furthermore, the critical skill gap—the lack of personnel trained to manage and maintain sophisticated IT/OT convergence systems—significantly hinders the pace of technological adoption across various geographic segments.

Opportunities abound, centering on integrating emerging technologies such as 5G connectivity, which promises ultra-low latency necessary for real-time control systems and truly mobile automation solutions. The rise of Additive Manufacturing (3D Printing) offers unprecedented flexibility in prototyping and short-run production, particularly valuable in aerospace and medical device sectors. The growing emphasis on sustainability and circular manufacturing also creates a strong opportunity for companies offering data analytics tools that optimize material usage, track product lifecycles, and facilitate reverse logistics, aligning economic goals with environmental responsibilities.

Segmentation Analysis

The Discrete Manufacturing Market is comprehensively segmented based on technology, component, application, and end-user industry, reflecting the diverse operational requirements across different manufacturing sectors. Analysis of these segments is crucial for understanding market dynamics, investment hotspots, and competitive positioning. The technology segment is dominated by solutions facilitating connectivity and data management, such such as Industrial IoT platforms and specialized Manufacturing Execution Systems (MES), which serve as the central nervous system for modern factories. Component segmentation highlights the importance of hardware like industrial robotics and sensors, alongside essential software components such as CAD/CAM tools and supply chain management solutions, which are integral to the entire product lifecycle.

Application-based segmentation emphasizes critical operational areas, including quality management, predictive maintenance, resource optimization, and shop floor management. Predictive maintenance, leveraging AI and IIoT data, is rapidly gaining traction due to its direct correlation with reduced operational expenses and increased uptime. The end-user industry segmentation clearly defines where market growth is most concentrated, with Automotive and Transportation remaining the largest consumer due to scale and complexity, followed closely by the high-value Aerospace & Defense and high-volume Electronics and Semiconductor sectors.

- By Component:

- Hardware (Industrial Robotics, Sensors, Controllers, PLC/SCADA)

- Software (MES, ERP, PLM, CAD/CAM, Supply Chain Management, Analytics)

- Services (Consulting, Integration & Deployment, Managed Services)

- By Technology:

- Industrial Internet of Things (IIoT)

- Artificial Intelligence (AI) and Machine Learning (ML)

- Digital Twin

- Cloud Computing

- Additive Manufacturing (3D Printing)

- Augmented Reality (AR) and Virtual Reality (VR)

- By Application:

- Assembly and Packaging

- Quality Management and Inspection

- Predictive Maintenance

- Inventory and Warehouse Management

- Production Planning and Scheduling

- By End-User Industry:

- Automotive and Transportation

- Aerospace and Defense

- Electronics and Semiconductor

- Industrial Machinery and Equipment

- Medical Devices

- Other Industries (Consumer Goods, Textiles)

- By Region:

- North America

- Europe

- Asia Pacific (APAC)

- Latin America

- Middle East and Africa (MEA)

Value Chain Analysis For Discrete Manufacturing Market

The value chain for the Discrete Manufacturing Market spans from raw material sourcing to end-user consumption and recycling, characterized by intense collaboration and data exchange. Upstream activities involve the procurement of highly specialized raw materials, standardized components (e.g., semiconductors, specialized alloys), and machinery required for production. This segment is highly reliant on strategic partnerships and just-in-time delivery systems, emphasizing supplier quality management and cost efficiency. Critical upstream analysis focuses on mitigating geopolitical risks associated with key material sourcing and ensuring resilient component supply chains, particularly for advanced electronics and batteries.

Midstream activities encompass the core manufacturing processes, including design, engineering (utilizing PLM and CAD software), actual production, quality assurance, and assembly. This is the segment where the most significant technological investment occurs, notably in robotics, automation, and IIoT implementation. Efficiency gains achieved in the midstream through advanced scheduling (MES) and lean manufacturing practices are pivotal to profitability. Direct and indirect distribution channels dictate how the final product reaches the end-customer. Direct channels are common for high-value, complex equipment (like aircraft or large industrial machinery) where manufacturers manage sales, installation, and ongoing maintenance services internally. Indirect channels, involving distributors, retailers, and third-party logistics (3PL) providers, are prevalent for high-volume consumer electronics and automotive parts.

Downstream analysis focuses on post-sale services, including maintenance, repair, and overhaul (MRO), and increasingly, the implementation of circular economy practices. Manufacturers are shifting towards service-centric business models (Product-as-a-Service), where profitability is derived from continuous operational uptime and performance optimization, driven by data collected from the installed base. The efficiency of the entire value chain hinges upon seamless data interoperability between upstream suppliers, internal manufacturing systems (MES/ERP), and downstream logistical partners and end-users, underscoring the necessity of integrated digital platforms.

Discrete Manufacturing Market Potential Customers

Potential customers for Discrete Manufacturing technologies are defined by industries that produce countable, distinct finished goods requiring high precision, complex assembly, and stringent quality protocols. The Automotive and Transportation sector is the primary consumer, driven by the massive shift toward electric vehicle production and the demand for autonomous driving features, necessitating sophisticated sensor integration, battery module assembly, and complex body-in-white manufacturing. These customers require highly flexible assembly lines capable of accommodating mixed-model production and advanced quality inspection systems.

The Aerospace and Defense industry constitutes another critical customer segment, characterized by extremely low volumes and extraordinarily high complexity and lifecycle requirements. Customers in this sector demand technologies like Additive Manufacturing for lightweight components, advanced digital twin technology for performance simulation, and specialized quality assurance systems for mission-critical parts. Their buying decisions are heavily influenced by regulatory compliance, material traceability, and long-term asset performance metrics, making PLM and data management solutions essential investments.

Further potential customers include high-volume producers such as the Electronics and Semiconductor industry, which requires micro-level precision and high throughput rates to meet rapid consumer demand cycles. Similarly, the Medical Devices sector, governed by strict regulatory frameworks (FDA, CE), requires detailed traceability and validated processes, leading to high adoption rates of automated assembly, specialized robotics, and comprehensive data logging systems to ensure patient safety and compliance throughout the product lifecycle. All these end-users share a common need for integrated solutions that promise higher efficiency, reduced waste, and superior product quality compared to traditional methods.

| Report Attributes | Report Details |

|---|---|

| Market Size in 2026 | USD 4,500 Billion |

| Market Forecast in 2033 | USD 8,500 Billion |

| Growth Rate | 9.5% CAGR |

| Historical Year | 2019 to 2024 |

| Base Year | 2025 |

| Forecast Year | 2026 - 2033 |

| DRO & Impact Forces |

|

| Segments Covered |

|

| Key Companies Covered | Siemens AG, ABB Ltd., Rockwell Automation, Schneider Electric, General Electric (GE), Dassault Systèmes, SAP SE, Microsoft Corporation, IBM Corporation, Honeywell International Inc., Fanuc Corporation, Kuka AG, Mitsubishi Electric Corporation, Cisco Systems, Oracle Corporation, PTC Inc., Bosch Rexroth AG, Delta Electronics, Emerson Electric Co., Yokogawa Electric Corporation |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Enquiry Before Buy | Have specific requirements? Send us your enquiry before purchase to get customized research options. Request For Enquiry Before Buy |

Discrete Manufacturing Market Key Technology Landscape

The Discrete Manufacturing Market is fundamentally defined by the convergence of advanced digital and physical technologies, collectively forming the backbone of the smart factory paradigm. Central to this landscape is the Industrial Internet of Things (IIoT), which relies on millions of sensors and connected devices to collect vast amounts of operational data in real time. This data forms the essential input for sophisticated analytical tools, enabling comprehensive monitoring of machine health, production throughput, and energy usage. The proliferation of IIoT demands robust and secure networking infrastructure, increasingly leveraging 5G technology to support the necessary bandwidth and low latency required for mission-critical, real-time control applications, particularly in complex assembly environments where speed and precision are paramount.

Artificial Intelligence (AI) and Machine Learning (ML) capabilities are layered atop this data infrastructure, transforming raw data into actionable intelligence. AI algorithms are crucial for optimizing complex production schedules, dynamically balancing workloads across multiple machines, and executing predictive maintenance strategies that significantly reduce unplanned downtime. Furthermore, Digital Twin technology is emerging as a critical competitive differentiator. A digital twin—a virtual replica of a physical asset, process, or system—allows manufacturers to simulate changes, test new layouts, and predict performance outcomes without disrupting the actual production line. This capability drastically reduces the risk associated with new product introduction and process modifications, accelerating time-to-market and improving operational resilience by testing disaster recovery scenarios in a virtual environment.

Robotics, both traditional industrial robots and emerging Collaborative Robots (Cobots), continue to evolve, offering greater flexibility, speed, and precision in assembly and material handling tasks. Cobots, designed to work safely alongside human operators, are particularly valuable in high-mix, low-volume environments requiring frequent retooling. Complementing these physical tools are Augmented Reality (AR) and Virtual Reality (VR) solutions, which enhance workforce efficiency by providing real-time instructions, guided maintenance procedures, and immersive training simulations, effectively bridging the skill gap. Finally, integrated software systems like Manufacturing Execution Systems (MES) and Cloud-based Enterprise Resource Planning (ERP) provide the necessary command and control structure, synchronizing procurement, production, inventory, and logistics across the globally dispersed discrete manufacturing ecosystem.

- Industrial Internet of Things (IIoT): Facilitates real-time data collection from machines and assets, enabling condition monitoring and process transparency.

- Robotics and Automation: Includes high-precision industrial robots for heavy tasks and flexible cobots for human-robot collaboration in assembly.

- Digital Twin Technology: Creates virtual representations for simulation, testing, and optimization of products and production lines throughout their lifecycle.

- Artificial Intelligence (AI) & ML: Used for advanced analytics, defect detection (computer vision), predictive maintenance, and optimizing complex logistics.

- Additive Manufacturing (AM) / 3D Printing: Supports rapid prototyping, customized tooling, and production of complex, lightweight end-use parts.

- Cloud and Edge Computing: Provides scalable processing power and secure data storage, enabling remote management and real-time data processing at the production site (edge).

- Manufacturing Execution Systems (MES): Software connecting planning systems (ERP) with shop floor control, managing order dispatching, resource allocation, and production tracking.

- Augmented/Virtual Reality (AR/VR): Used for remote assistance, complex assembly guidance, maintenance procedures, and immersive operator training.

Regional Highlights

The global Discrete Manufacturing Market exhibits distinct characteristics across major geographical regions, reflecting varying levels of industrial maturity, technological adoption rates, and government regulatory support. North America (NA), comprising the United States and Canada, is characterized by early and high adoption of sophisticated, high-value technologies, particularly in the Aerospace & Defense and high-end Automotive sectors. The region’s focus is heavily on maintaining technological leadership, driving investment in AI, Digital Twin solutions, and cybersecurity to manage complex, highly regulated manufacturing processes. The presence of major technology providers and a strong emphasis on research and development contribute to North America’s role as a primary innovation hub, though manufacturing volume growth may be moderate compared to Asian counterparts.

Europe, driven by nations such as Germany, France, and Italy, emphasizes 'Smart Factory' initiatives, aligning with high standards of quality, precision, and environmental sustainability. The region is a leader in adopting advanced robotics and automation, especially within the industrial machinery and luxury automotive segments. Government-led initiatives, such as Germany’s Industry 4.0 strategy, actively promote the integration of IT and OT systems, fostering a strong ecosystem for specialized software solutions like MES and PLM. However, Europe faces challenges related to aging infrastructure and the need for significant upskilling of the legacy workforce to manage interconnected environments, prompting extensive investment in AR/VR-based training solutions.

Asia Pacific (APAC) represents the largest and fastest-growing market globally, driven by massive manufacturing volumes in consumer electronics, general machinery, and electric vehicles, primarily centered in China, Japan, and South Korea. China’s "Made in China 2025" strategy continues to aggressively push for modernization, leading to rapid adoption of industrial robotics and domestic development of IIoT platforms. Japan and South Korea lead in high-precision, low-defect manufacturing, leveraging advanced automation and AI for hyper-efficiency. The sheer scale of production, coupled with lower operating costs in emerging markets like Vietnam and India, cements APAC’s position as the global manufacturing powerhouse, demanding scalable and cost-effective digital solutions.

Latin America (LATAM), including Brazil and Mexico, is experiencing growing momentum driven by foreign direct investment (FDI) into the automotive and appliance manufacturing sectors. Market growth here is focused on optimizing existing infrastructure through basic automation, affordable cloud-based ERP solutions, and localized supply chain integration. While overall technological maturity lags behind NA and Europe, the region presents significant potential for growth in basic IIoT deployment and foundational digitalization efforts aimed at improving operational visibility and efficiency in fragmented industrial environments.

The Middle East and Africa (MEA) market is steadily expanding, particularly in the Gulf Cooperation Council (GCC) countries, leveraging diversification efforts away from oil dependence. Countries like Saudi Arabia and the UAE are investing heavily in establishing high-tech manufacturing bases (e.g., aerospace components, defense industries) as part of national vision strategies. The adoption of advanced technologies like digital twins and specialized automation is focused on strategic, high-value projects, often driven by government procurement and large infrastructure development funds, necessitating specialized consulting and integration services tailored to complex environmental conditions.

- North America: High penetration of AI, Digital Twin, and sophisticated cybersecurity in Aerospace and High-Tech manufacturing; focus on innovation and high-value production.

- Europe: Leadership in robotics, advanced automation, and Industry 4.0 policy implementation; strong emphasis on sustainable and highly precise manufacturing processes.

- Asia Pacific (APAC): Dominant market share and fastest growth; driven by high volume production in Electronics and Automotive, supported by strong government modernization mandates.

- Latin America (LATAM): Emerging market focused on fundamental digitalization, cloud solutions, and optimization of existing automotive and appliance manufacturing operations.

- Middle East and Africa (MEA): Growth driven by national industrial diversification strategies, particularly investment in specialized, high-tech manufacturing sectors and infrastructure projects.

Top Key Players

The market research report includes a detailed profile of leading stakeholders in the Discrete Manufacturing Market.- Siemens AG

- ABB Ltd.

- Rockwell Automation

- Schneider Electric

- General Electric (GE)

- Dassault Systèmes

- SAP SE

- Microsoft Corporation

- IBM Corporation

- Honeywell International Inc.

- Fanuc Corporation

- Kuka AG

- Mitsubishi Electric Corporation

- Cisco Systems

- Oracle Corporation

- PTC Inc.

- Bosch Rexroth AG

- Delta Electronics

- Emerson Electric Co.

- Yokogawa Electric Corporation

Frequently Asked Questions

Analyze common user questions about the Discrete Manufacturing market and generate a concise list of summarized FAQs reflecting key topics and concerns.What is the primary difference between discrete manufacturing and process manufacturing?

Discrete manufacturing produces distinct, countable items, such as cars or phones, utilizing a Bill of Materials (BOM) and assembly. Process manufacturing produces goods that cannot be easily counted, such as chemicals or liquids, requiring formulas and recipes.

How is Industry 4.0 reshaping the Discrete Manufacturing market?

Industry 4.0 integrates cyber-physical systems, IIoT, and AI into manufacturing, enabling smart factories that facilitate real-time data exchange, self-optimization, predictive maintenance, and greater flexibility for mass customization.

Which technology segment is expected to show the highest growth rate in discrete manufacturing?

The Artificial Intelligence and Machine Learning segment is projected to exhibit the highest growth rate, driven by the increasing need for advanced analytics, automated quality inspection (computer vision), and optimizing supply chain resilience.

What are the main challenges hindering the adoption of smart manufacturing solutions for SMEs?

Small and Medium-sized Enterprises (SMEs) face significant challenges primarily related to the high initial capital expenditure required for sophisticated automation, lack of specialized IT/OT integration expertise, and concerns regarding data security and system complexity.

Which end-user industry holds the largest market share in the Discrete Manufacturing sector?

The Automotive and Transportation industry holds the largest market share globally, owing to the high volume of production, the complexity of modern vehicle assembly, and massive ongoing investments related to the transition towards Electric Vehicles (EVs).

To check our Table of Contents, please mail us at: sales@marketresearchupdate.com

Research Methodology

The Market Research Update offers technology-driven solutions and its full integration in the research process to be skilled at every step. We use diverse assets to produce the best results for our clients. The success of a research project is completely reliant on the research process adopted by the company. Market Research Update assists its clients to recognize opportunities by examining the global market and offering economic insights. We are proud of our extensive coverage that encompasses the understanding of numerous major industry domains.

Market Research Update provide consistency in our research report, also we provide on the part of the analysis of forecast across a gamut of coverage geographies and coverage. The research teams carry out primary and secondary research to implement and design the data collection procedure. The research team then analyzes data about the latest trends and major issues in reference to each industry and country. This helps to determine the anticipated market-related procedures in the future. The company offers technology-driven solutions and its full incorporation in the research method to be skilled at each step.

The Company's Research Process Has the Following Advantages:

- Information Procurement

The step comprises the procurement of market-related information or data via different methodologies & sources.

- Information Investigation

This step comprises the mapping and investigation of all the information procured from the earlier step. It also includes the analysis of data differences observed across numerous data sources.

- Highly Authentic Source

We offer highly authentic information from numerous sources. To fulfills the client’s requirement.

- Market Formulation

This step entails the placement of data points at suitable market spaces in an effort to assume possible conclusions. Analyst viewpoint and subject matter specialist based examining the form of market sizing also plays an essential role in this step.

- Validation & Publishing of Information

Validation is a significant step in the procedure. Validation via an intricately designed procedure assists us to conclude data-points to be used for final calculations.

×

Request Free Sample:

Related Reports

Select License

Why Choose Us

We're cost-effective and Offered Best services:

We are flexible and responsive startup research firm. We adapt as your research requires change, with cost-effectiveness and highly researched report that larger companies can't match.

Information Safety

Market Research Update ensure that we deliver best reports. We care about the confidential and personal information quality, safety, of reports. We use Authorize secure payment process.

We Are Committed to Quality and Deadlines

We offer quality of reports within deadlines. We've worked hard to find the best ways to offer our customers results-oriented and process driven consulting services.

Our Remarkable Track Record

We concentrate on developing lasting and strong client relationship. At present, we hold numerous preferred relationships with industry leading firms that have relied on us constantly for their research requirements.

Best Service Assured

Buy reports from our executives that best suits your need and helps you stay ahead of the competition.

Customized Research Reports

Our research services are custom-made especially to you and your firm in order to discover practical growth recommendations and strategies. We don't stick to a one size fits all strategy. We appreciate that your business has particular research necessities.

Service Assurance

At Market Research Update, we are dedicated to offer the best probable recommendations and service to all our clients. You will be able to speak to experienced analyst who will be aware of your research requirements precisely.

Contact With Our Sales Team

Customer Testimonials

The content of the report is always up to the mark. Good to see speakers from expertise authorities.

Privacy requested , Managing Director

A lot of unique and interesting topics which are described in good manner.

Privacy requested, President

Well researched, expertise analysts, well organized, concrete and current topics delivered in time.

Privacy requested, Development Manager