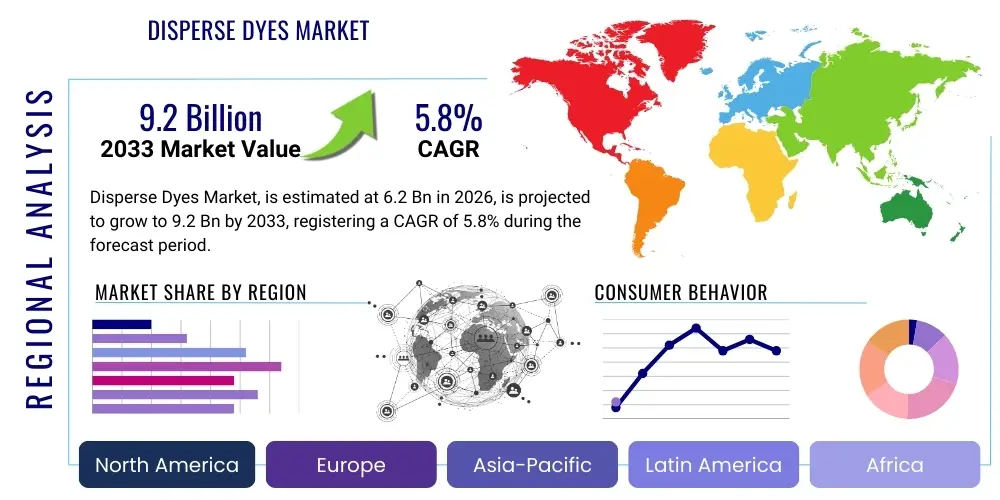

Disperse Dyes Market Size, By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2026 to 2033 (Financial Impact Analysis)

ID : MRU_ 442733 | Date : Feb, 2026 | Pages : 258 | Region : Global | Publisher : MRU

Disperse Dyes Market Size

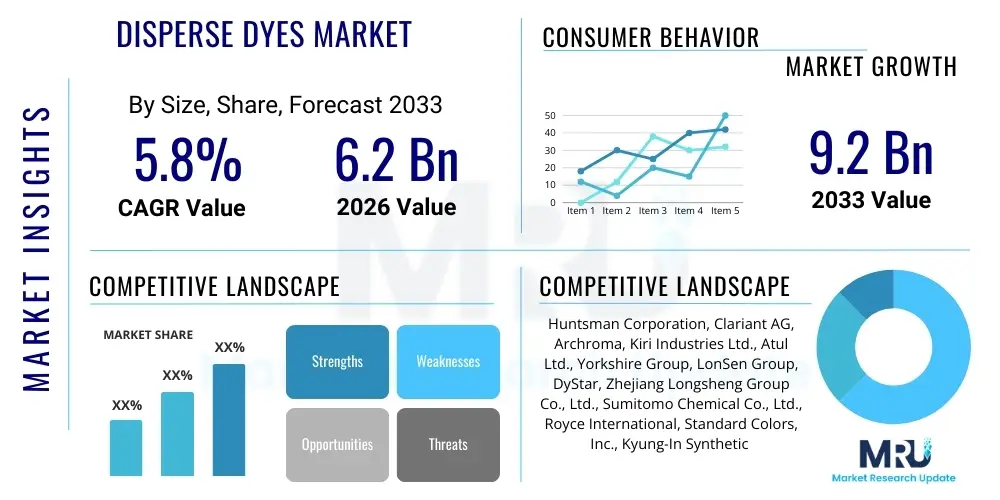

The Disperse Dyes Market is projected to grow at a Compound Annual Growth Rate (CAGR) of 5.8% between 2026 and 2033. The market is estimated at USD 6.2 Billion in 2026 and is projected to reach USD 9.2 Billion by the end of the forecast period in 2033. This substantial expansion is fundamentally driven by the escalating global demand for synthetic fibers, particularly polyester, which is the primary substrate for disperse dyes application. Technological advancements in dye manufacturing processes, focusing on high-fastness, low-energy dyeing methods, and eco-friendly formulations, are pivotal in enabling this robust market progression, positioning disperse dyes as indispensable colorants across various modern industries.

Disperse Dyes Market introduction

The Disperse Dyes Market encompasses synthetic organic colorants primarily utilized for dyeing hydrophobic fibers such as polyester, acetate, and triacetate. These dyes are characterized by their extremely low aqueous solubility, necessitating their application in fine, aqueous dispersion form stabilized by dispersing agents. Historically developed in the 1920s, disperse dyes have evolved significantly, now offering a comprehensive spectrum of shades with excellent color fastness properties, crucial for demanding applications in the textile and automotive sectors. Their ability to sublime under heat makes them ideally suited for thermosol dyeing and transfer printing processes, particularly critical in the rapidly expanding athleisure and technical textile segments where durability and color performance are paramount.

The major applications of disperse dyes span textile dyeing and printing, automotive textiles, carpets, and digital textile printing inks. In textiles, they are indispensable for coloring high-performance polyester fabrics used in apparel, home furnishings, and technical applications requiring high light fastness and wash fastness. Beyond traditional immersion dyeing, the rise of specialized applications such as sublimation printing for sportswear and signage, and the coloration of plastics and polymers, are fueling diversified demand. The core benefit of these dyes lies in their affinity for non-polar fibers, providing vibrant, deep colors that withstand rigorous laundering and environmental exposure, thereby enhancing the commercial value and longevity of the colored products.

Driving factors propelling this market forward include rapid urbanization and increasing disposable incomes in emerging economies, leading to higher consumption of polyester-based apparel and home textiles. Furthermore, stricter environmental regulations in developed regions are pushing manufacturers toward novel, eco-friendly formulations, such as low-energy and short-liquor ratio disperse dyes that reduce water and energy consumption during the dyeing process. The continuous innovation in polyester fiber technology, introducing specialized fabrics requiring specific coloration chemistries, ensures sustained relevance and growth for high-performance disperse dye variants globally.

Disperse Dyes Market Executive Summary

The Disperse Dyes Market is characterized by intense competition driven by capacity expansions in the Asia Pacific region and a strong shift towards sustainability and high-performance product development globally. Business trends indicate a consolidation among major players focusing on backward integration to secure raw material supply, particularly intermediates derived from petroleum products. Furthermore, strategic alliances and mergers are becoming prevalent, aimed at acquiring specialized dyeing technologies, such as those optimized for super-critical carbon dioxide dyeing, which is a key process innovation aimed at reducing water usage. Key manufacturers are also heavily investing in R&D to develop non-toxic, Azo-free dye formulations compliant with stringent regulations like REACH and OEKO-TEX standards, thereby securing access to premium international markets.

Regionally, Asia Pacific dominates the market, accounting for the largest share due to the concentration of textile manufacturing hubs in China, India, Vietnam, and Bangladesh. This dominance is bolstered by lower operational costs and robust export markets for finished textiles. Europe and North America, while having mature textile industries, exhibit high demand for premium, specialized disperse dyes used in technical textiles, automotive interiors, and highly sustainable apparel lines, driving higher average selling prices in these regions. Latin America and the Middle East & Africa are emerging as high-growth potential regions, spurred by domestic textile production modernization and increasing consumer sophistication regarding color vibrancy and fastness performance in synthetic fabrics.

Segmentation trends highlight the increasing prominence of high-temperature dyeing types (HT) and medium-energy dyes, reflecting the continued dominance of standard polyester dyeing processes. However, low-energy and ultra-low-energy dyes are gaining traction due to energy conservation mandates in high-volume production facilities. Application-wise, the apparel sector remains the largest consumer, but the automotive and technical textile segments are exhibiting the fastest growth rates, driven by stringent quality requirements regarding heat resistance, light fastness, and compatibility with specialized polymer coatings. There is also a notable shift towards specialized printing applications, including inkjet and thermal transfer printing, demanding highly purified, sub-micron particle-sized dye formulations.

AI Impact Analysis on Disperse Dyes Market

User inquiries regarding AI's influence on the Disperse Dyes Market predominantly center on optimization of coloration processes, predictive quality control, and accelerated novel dye molecule discovery. Common questions include: "How can AI optimize dye formulation to reduce waste?", "Can machine learning predict the fastness properties of new dye structures?", and "What is the role of AI in supply chain logistics for dye intermediates?". The prevailing user concern is the successful integration of complex AI models into traditional chemical manufacturing and textile finishing environments. Expectations are high regarding AI’s ability to minimize batch-to-batch variation, ensure color consistency across vast production volumes, and swiftly adapt formulations based on real-time raw material fluctuations, thereby significantly enhancing efficiency and reducing operational expenditure across the dyeing value chain.

AI is expected to fundamentally transform how disperse dyes are synthesized, applied, and managed. In synthesis, machine learning algorithms are accelerating the prediction of chromophore stability and solubility, drastically reducing the time and cost associated with laboratory screening of new, high-performance dye candidates. During application, AI-driven process control systems monitor parameters like temperature profiles, pH levels, and dye bath exhaustion in real-time, adjusting feeding rates and chemical dosage to achieve perfect shade reproducibility, moving the industry closer to zero-defect manufacturing. This sophisticated automation not only boosts productivity but also ensures environmental compliance by optimizing water and chemical usage.

Furthermore, AI-powered tools are revolutionizing supply chain resilience and demand forecasting. By analyzing market trends, consumer preferences (e.g., predicted seasonal color palettes), and geopolitical risks, AI models help manufacturers proactively manage inventory of critical intermediates, preventing costly shortages or surpluses. This granular data analysis capability allows dye producers to offer customized, just-in-time solutions for large textile mills, creating a competitive advantage based on responsiveness and minimized lead times, effectively streamlining the complex global distribution network of disperse dyes and colored materials.

- AI-driven optimization of dyeing recipes leading to reduced chemical usage and effluent discharge.

- Predictive modeling of color fastness and physical properties for newly synthesized dye molecules.

- Enhanced quality control systems using machine vision and AI to detect shade variations instantly.

- Optimization of supply chain logistics for raw materials (intermediates and dispersants) based on global demand signals.

- Automation of dyeing equipment parameters to ensure precise batch-to-batch color consistency.

- Accelerated discovery of eco-friendly, bio-based disperse dye alternatives using computational chemistry models.

DRO & Impact Forces Of Disperse Dyes Market

The Disperse Dyes Market is primarily driven by the unstoppable growth of the polyester fiber industry, particularly in the fast fashion and technical textile sectors, demanding high-performance coloration solutions. However, the market faces significant restraints, chiefly regulatory pressure demanding the phase-out of certain Azo-based dyes and the inherent volatility in the prices of key petrochemical raw materials like anthracene and toluene derivatives used for dye intermediate synthesis. Opportunities lie in the shift towards innovative, green dyeing technologies, such as supercritical carbon dioxide dyeing systems and the development of sustainable, non-toxic pigment dispersions. These dynamics create powerful impact forces, where environmental stewardship and regulatory compliance act as both drivers for innovation and hurdles for traditional manufacturing processes, necessitating capital-intensive upgrades.

Drivers: The increasing penetration of polyester and related synthetic fibers across apparel, home textiles, and automotive interiors remains the most significant demand driver. Consumers increasingly seek durable, easy-care fabrics, aligning perfectly with the technical capabilities of disperse dyes. Furthermore, technological leaps in digital textile printing (DTP) are opening new avenues; DTP utilizes specialized high-purity disperse ink formulations, enabling complex designs, quicker prototyping, and shorter production runs. This shift is particularly strong in responsive, fashion-driven markets, reinforcing the need for flexible and high-quality coloration chemistry. The rising global standards for textile color performance in terms of UV resistance and washing durability further mandate the use of advanced disperse dye chemistries.

Restraints: Environmental scrutiny constitutes a major restraint. The disposal of dye effluents remains a challenge, and regulatory bodies globally, notably the EU’s REACH initiative, continuously restrict or ban certain dye classes suspected of carcinogenic properties or high environmental persistence. This mandates significant R&D spending to reformulate products, increasing manufacturing costs. Secondly, the raw material supply chain, heavily reliant on crude oil derivatives, is susceptible to geopolitical instability and price volatility, impacting profitability margins for dye producers who cannot fully pass on these costs to competitive textile mills. The emergence of competing dyeing technologies, though niche, such as dope dyeing (mass coloration), also provides a minor restraint on the growth of traditional disperse dye application methods.

Opportunities: The primary opportunity lies in developing sustainable disperse dye portfolios. This includes low-temperature dyeing dyes (reducing energy consumption), highly concentrated liquid dispersions (minimizing solid waste), and bio-based dye substitutes derived from renewable sources. Furthermore, targeting specialized high-growth sectors such as technical textiles (e.g., geotextiles, medical textiles) and high-end automotive upholstery offers higher profit margins compared to bulk apparel dyeing. The expansion of powderless dyeing systems, like foam dyeing and supercritical CO2 dyeing, which require specialized, robust disperse dye formulations, represents a powerful niche opportunity for dye manufacturers focused on technological leadership.

Impact Forces: The most prominent impact force is the regulatory compliance burden, which accelerates the obsolescence of older chemistries while creating a mandate for innovation in greener alternatives. The technological force, driven by DTP and automation, pushes for ultra-pure, finely dispersed products. Economically, the cost-efficiency demand from high-volume textile producers pressures dye manufacturers to streamline synthesis and offer highly standardized products globally. These intertwined forces necessitate continuous investment in compliance technologies, high-throughput screening, and process modernization to maintain market relevance.

Segmentation Analysis

The Disperse Dyes Market is comprehensively segmented based on dye type, application temperature, end-use application, and form. Understanding these segmentations is critical for market participants to tailor their product offerings and marketing strategies effectively. The categorization by dye type primarily differentiates products based on their chemical structure (e.g., Azo, Anthraquinone, Methine) and performance characteristics, particularly sublimation fastness and affinity for different polyester variants. The application temperature spectrum further dictates usage efficiency, dividing the market into low, medium, and high-energy dye classes, corresponding directly to the required operational temperatures of the dyeing machinery and the specific synthetic fiber being treated.

Crucially, the market is defined by end-use application, with the Apparel and Textile segment dominating due to its massive scale. However, non-apparel applications like Automotive Textiles, Carpets, and Printing Inks represent high-value growth niches, demanding superior fastness properties against heat, abrasion, and light, often exceeding the requirements of standard apparel. Segmentation by form—powder, granule, and liquid dispersion—reflects the operational preferences of dyeing facilities, where liquid dispersions are increasingly favored for automated systems due to ease of handling, improved dosing accuracy, and reduced dust hazards, driving a noticeable trend away from traditional powder formats in highly advanced manufacturing settings.

Analyzing these segments reveals a strategic market focus. While Azo dyes maintain volume leadership due to cost-effectiveness, the fastest growth is observed in environmentally safe, non-Azo classes. Furthermore, the high-energy disperse dyes segment, used predominantly for premium polyester and polyester blends, is forecasted for strong growth due to increasing quality standards globally. Manufacturers are specializing their portfolios to cater precisely to these defined segments, offering tailored solutions that maximize efficiency and color yield for specific fiber types and processing methods, such as continuous dyeing versus exhaust dyeing processes.

- By Dye Type:

- Azo Dyes

- Anthraquinone Dyes

- Methine Dyes

- Others (E.g., Quinophthalone)

- By Energy Class/Application Temperature:

- Low Energy Dyes (LE)

- Medium Energy Dyes (ME)

- High Energy Dyes (HE)

- By Form:

- Powder

- Granules

- Liquid Dispersions

- By End-Use Application:

- Apparel and Textiles (Woven & Knitted)

- Automotive Textiles (Upholstery, Seat Belts)

- Technical Textiles (Geotextiles, Medical, Filtration)

- Digital Textile Printing Inks

- Plastics and Polymers

Value Chain Analysis For Disperse Dyes Market

The value chain for the Disperse Dyes Market is intricate, spanning from the petrochemical industry to the final consumer market. The upstream segment involves the synthesis of key chemical intermediates, which are predominantly derived from crude oil and natural gas (e.g., benzene, naphthalene, and anthracene). Major chemical producers supply these intermediates to dye manufacturers. Price volatility and stability of supply in this initial stage significantly impact the overall cost structure of disperse dyes. Backward integration by major dye producers into key intermediate production is a strategic move to secure cost advantages and supply reliability, especially for specialized, proprietary intermediates necessary for high-performance dye formulations. Quality control at this raw material stage is paramount, as impurity levels directly affect the final dye performance, including shade consistency and fastness properties.

The core manufacturing stage involves complex chemical reactions, including diazotization, coupling, and condensation, followed by physical processing steps such as particle size reduction (milling) and dispersion stabilization. This requires significant technological expertise and specialized equipment. Once manufactured, the dyes are distributed through a dual channel structure: direct and indirect. Direct distribution involves large dye manufacturers selling directly to major textile mills, particularly those requiring technical support for complex recipes and custom shades, ensuring closer collaboration and faster feedback loops. This channel is crucial for high-volume, long-term contracts in the apparel and automotive sectors.

The downstream segment includes wholesalers, distributors, local agents, and specialized dye houses before reaching the end-users (textile, automotive, and printing companies). Indirect channels utilize specialized distributors who manage inventory, small-volume orders, and technical service for smaller textile units across diverse geographic locations, offering localized support and efficient logistics management. Effective distribution relies heavily on maintaining the stability and quality of the dye dispersions during transit and storage, especially for liquid formulations sensitive to temperature extremes. The final stage involves the successful application of the dye by the end-user, requiring precise dosing and sophisticated effluent treatment facilities before the finished colored textile enters the retail supply chain.

Disperse Dyes Market Potential Customers

The primary potential customers and buyers of disperse dyes are manufacturers operating within the textile and related hydrophobic fiber processing industries. This encompasses large integrated textile mills specializing in synthetic fabric production, particularly polyester, nylon 6,6, and acetate fibers. These mills require bulk quantities of standardized dyes for continuous processing methods (thermosol or pad-steam) and exhaust dyeing. Their purchasing decisions are heavily influenced by factors such as the dye's color yield, batch consistency, compliance with Restricted Substances Lists (RSLs), and the supplier’s ability to provide prompt technical support for troubleshooting dyeing defects. The high-volume nature of apparel production makes this segment the dominant consumer base globally.

A rapidly growing customer segment is the specialized textile industry, including manufacturers of high-performance and technical textiles. This includes producers of automotive interiors (seat fabrics, headliners), safety wear, industrial filters, and outdoor gear. These buyers prioritize ultra-high fastness properties (light, heat, and sublimation) and often demand custom, high-purity dye formulations suitable for extreme processing conditions or stringent regulatory environments, such as the VDA 278 standard for automotive materials. Furthermore, producers of digital textile printing inks represent a high-value customer base, requiring highly purified, sub-micron disperse dye concentrates that ensure printhead reliability and vibrant color reproduction in high-speed inkjet systems.

Other vital customers include carpet manufacturers, who use disperse dyes for nylon and polyester carpeting, and, to a lesser extent, polymer compounders and plastics manufacturers who incorporate disperse dyes for mass coloration of synthetic materials used in packaging and molded parts. Geographically, potential customers are concentrated in Asia Pacific—specifically China, India, and Southeast Asian nations—due to the concentration of global textile manufacturing. However, high-value technical dye customers are more dispersed across North America and Europe, seeking specialized, innovative products compliant with strict Western environmental and performance specifications. Building strong, collaborative relationships with technical experts within these customer organizations is critical for dye suppliers.

| Report Attributes | Report Details |

|---|---|

| Market Size in 2026 | USD 6.2 Billion |

| Market Forecast in 2033 | USD 9.2 Billion |

| Growth Rate | CAGR 5.8% |

| Historical Year | 2019 to 2024 |

| Base Year | 2025 |

| Forecast Year | 2026 - 2033 |

| DRO & Impact Forces |

|

| Segments Covered |

|

| Key Companies Covered | Huntsman Corporation, Clariant AG, Archroma, Kiri Industries Ltd., Atul Ltd., Yorkshire Group, LonSen Group, DyStar, Zhejiang Longsheng Group Co., Ltd., Sumitomo Chemical Co., Ltd., Royce International, Standard Colors, Inc., Kyung-In Synthetic Corporation (KISCO), Pidilite Industries Ltd., Chromatech Incorporated, Victory Colours, BASF SE, ChemStar, Colourtex Industries Private Limited, Hangzhou Hongda Chemicals Co., Ltd. |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Enquiry Before Buy | Have specific requirements? Send us your enquiry before purchase to get customized research options. Request For Enquiry Before Buy |

Disperse Dyes Market Key Technology Landscape

The technology landscape for the Disperse Dyes Market is dominated by advancements aimed at increasing efficiency, improving environmental performance, and catering to specialized printing methods. Traditional disperse dyeing relies on high-temperature, high-pressure exhaust dyeing or thermosol processes, which are energy and water intensive. The crucial technological focus currently involves optimizing the physical characteristics of the dye particles. Ultra-fine grinding and homogenization techniques are essential for creating stable, sub-micron liquid dispersions required for modern high-speed dyeing and, critically, for inkjet printing applications where particle size must be rigorously controlled to prevent nozzle clogging and ensure precise color delivery. New dispersing agents are being developed using polymer science to enhance dispersion stability and minimize agglomeration, even under fluctuating temperature conditions in the dye bath.

A paradigm shift is occurring with the development and scaling of waterless dyeing technologies, most notably Supercritical Carbon Dioxide (sc-CO2) Dyeing. This pioneering technology utilizes CO2 in its supercritical fluid state as the dyeing medium, replacing water entirely. sc-CO2 dyeing offers zero water consumption, eliminates the need for dyeing auxiliaries, and significantly reduces energy consumption by bypassing the need for drying. This approach is highly compatible with disperse dyes, which exhibit high solubility in supercritical CO2. Although initial capital investment for sc-CO2 systems is high, the long-term operational and environmental savings make it a highly desirable technology for forward-thinking manufacturers, posing a long-term disruption risk to conventional wet processes and demanding specialized, ultra-high-purity disperse dye formulations.

Furthermore, technology is rapidly evolving in the area of automation and control. Continuous monitoring systems, often incorporating spectrophotometers and closed-loop feedback mechanisms, ensure consistent color reproduction across different production batches. In terms of chemical synthesis, novel green chemistry routes are being explored to synthesize chromophores and intermediates using biocatalysis or milder reaction conditions, reducing hazardous byproducts. The incorporation of advanced heat-stable and UV-absorbing groups into the dye structure is also a key technological focus, addressing the increasingly stringent durability requirements of automotive and outdoor textile applications, cementing the market’s move towards functional, high-performance coloration.

Regional Highlights

- Asia Pacific (APAC): APAC is the global engine for the Disperse Dyes Market, holding the majority market share. This dominance is attributed to the presence of the world's largest textile manufacturing bases in countries like China, India, and Southeast Asian nations (Vietnam, Indonesia, Bangladesh). China, in particular, is the largest consumer and producer of both polyester fibers and disperse dyes. While cost-effectiveness remains a key focus, tightening environmental regulations in China and India are simultaneously driving investment in modern, high-efficiency dyeing equipment and sustainable dye chemistries. Growth is supported by robust domestic consumption and massive textile exports to Western markets.

- Europe: The European market is mature but characterized by high-value consumption, stringent regulatory adherence (REACH), and a strong focus on technical textiles and specialized applications, such as high-performance automotive fabrics and eco-certified apparel. Demand is concentrated on premium, low-temperature, and non-toxic dye formulations, often driving innovation in supercritical CO2 dyeing technology adoption. European manufacturers prioritize sustainability and traceability, demanding certified dyes that meet complex compliance standards like OEKO-TEX and GOTS.

- North America: North America is a highly concentrated market focused on niche, technical applications and digital textile printing. While large-scale commodity textile production has shifted overseas, domestic demand for high-fastness dyes in automotive, medical, and protective apparel remains strong. The market exhibits high readiness for advanced technologies, including digital printing inks and low-impact dyeing systems, driven by consumer demand for sustainable and locally sourced textile products, often resulting in higher average selling prices for specialty disperse dyes.

- Latin America (LATAM): LATAM is an emerging region displaying moderate but accelerating growth, primarily centered in Brazil and Mexico, fueled by local apparel consumption and regional trade. Market growth is spurred by modernization initiatives in the textile sector and increasing local production capacity for synthetic fibers. Demand often leans towards cost-effective, medium-energy dyes for standard polyester and blend dyeing applications, though compliance requirements are gradually increasing, influencing procurement decisions.

- Middle East & Africa (MEA): MEA presents the smallest but fastest-growing market, driven by expanding textile manufacturing in Turkey, Egypt, and certain parts of Africa. Investments in polyester production and textile finishing plants are increasing. Demand is split between commodity textile needs and high-quality dyes required for the domestic production of carpets and upholstery, often utilizing imported technology and materials, necessitating compliance with international performance standards.

Top Key Players

The market research report includes a detailed profile of leading stakeholders in the Disperse Dyes Market.- Huntsman Corporation

- Clariant AG

- Archroma

- Kiri Industries Ltd.

- Atul Ltd.

- DyStar

- Zhejiang Longsheng Group Co., Ltd. (LonSen)

- Sumitomo Chemical Co., Ltd.

- Royce International

- Standard Colors, Inc.

- Kyung-In Synthetic Corporation (KISCO)

- Pidilite Industries Ltd.

- Chromatech Incorporated

- Victory Colours

- BASF SE

- Yorkshire Group

- ChemStar

- Colourtex Industries Private Limited

- Runhe Chemical Industry Co., Ltd.

- Hangzhou Hongda Chemicals Co., Ltd.

Frequently Asked Questions

Analyze common user questions about the Disperse Dyes market and generate a concise list of summarized FAQs reflecting key topics and concerns.What are disperse dyes primarily used for and why are they preferred for synthetic fabrics?

Disperse dyes are primarily used for coloring hydrophobic synthetic fibers, especially polyester, acetate, and nylon. They are preferred because their non-ionic nature and small molecular size allow them to penetrate the densely packed internal structure of these water-repellent fibers during high-temperature processing, resulting in high color fastness to light, washing, and sublimation, which is essential for durable apparel and technical textiles.

How do environmental regulations impact the future growth and innovation strategies within the Disperse Dyes Market?

Environmental regulations, particularly those concerning Azo compounds and heavy metal content (e.g., REACH, OEKO-TEX), significantly restrict the use of non-compliant dyes. This forces manufacturers to invest heavily in R&D to develop safer, non-toxic, and biodegradable dye alternatives, such as certified Azo-free disperse dyes and low-temperature dyeing systems that reduce energy and water consumption, thus steering the market towards sustainable chemistry.

What is the significance of the shift towards digital textile printing (DTP) for disperse dye manufacturers?

The shift to DTP is highly significant as it creates demand for specialized, high-purity, and highly stable disperse dye inks in liquid dispersion form. These inks require exceptionally small particle sizes (often nano-scale) and precise rheological properties to ensure successful high-speed jetting and consistent color reproduction, opening a premium, technology-driven sub-segment of the market.

Which geographic region dominates the consumption and production of disperse dyes, and what factors drive this?

The Asia Pacific (APAC) region, led by China and India, dominates both the production and consumption of disperse dyes. This is driven by the massive concentration of the global textile and apparel manufacturing industry in these countries, favorable labor costs, established supply chains for petrochemical intermediates, and high export volumes of synthetic finished goods to Western markets.

What are the different energy classes of disperse dyes and how does this classification affect dyeing processes?

Disperse dyes are classified into Low Energy (LE), Medium Energy (ME), and High Energy (HE) classes, based on their sublimation fastness and the minimum temperature required for effective dyeing. HE dyes require the highest temperature (typically above 130°C) but offer superior fastness, while LE dyes can be applied at lower temperatures, offering energy savings but potentially lower wash fastness, impacting the chosen dyeing method and fiber type.

To check our Table of Contents, please mail us at: sales@marketresearchupdate.com

Research Methodology

The Market Research Update offers technology-driven solutions and its full integration in the research process to be skilled at every step. We use diverse assets to produce the best results for our clients. The success of a research project is completely reliant on the research process adopted by the company. Market Research Update assists its clients to recognize opportunities by examining the global market and offering economic insights. We are proud of our extensive coverage that encompasses the understanding of numerous major industry domains.

Market Research Update provide consistency in our research report, also we provide on the part of the analysis of forecast across a gamut of coverage geographies and coverage. The research teams carry out primary and secondary research to implement and design the data collection procedure. The research team then analyzes data about the latest trends and major issues in reference to each industry and country. This helps to determine the anticipated market-related procedures in the future. The company offers technology-driven solutions and its full incorporation in the research method to be skilled at each step.

The Company's Research Process Has the Following Advantages:

- Information Procurement

The step comprises the procurement of market-related information or data via different methodologies & sources.

- Information Investigation

This step comprises the mapping and investigation of all the information procured from the earlier step. It also includes the analysis of data differences observed across numerous data sources.

- Highly Authentic Source

We offer highly authentic information from numerous sources. To fulfills the client’s requirement.

- Market Formulation

This step entails the placement of data points at suitable market spaces in an effort to assume possible conclusions. Analyst viewpoint and subject matter specialist based examining the form of market sizing also plays an essential role in this step.

- Validation & Publishing of Information

Validation is a significant step in the procedure. Validation via an intricately designed procedure assists us to conclude data-points to be used for final calculations.

×

Request Free Sample:

Related Reports

Select License

Why Choose Us

We're cost-effective and Offered Best services:

We are flexible and responsive startup research firm. We adapt as your research requires change, with cost-effectiveness and highly researched report that larger companies can't match.

Information Safety

Market Research Update ensure that we deliver best reports. We care about the confidential and personal information quality, safety, of reports. We use Authorize secure payment process.

We Are Committed to Quality and Deadlines

We offer quality of reports within deadlines. We've worked hard to find the best ways to offer our customers results-oriented and process driven consulting services.

Our Remarkable Track Record

We concentrate on developing lasting and strong client relationship. At present, we hold numerous preferred relationships with industry leading firms that have relied on us constantly for their research requirements.

Best Service Assured

Buy reports from our executives that best suits your need and helps you stay ahead of the competition.

Customized Research Reports

Our research services are custom-made especially to you and your firm in order to discover practical growth recommendations and strategies. We don't stick to a one size fits all strategy. We appreciate that your business has particular research necessities.

Service Assurance

At Market Research Update, we are dedicated to offer the best probable recommendations and service to all our clients. You will be able to speak to experienced analyst who will be aware of your research requirements precisely.

Contact With Our Sales Team

Customer Testimonials

The content of the report is always up to the mark. Good to see speakers from expertise authorities.

Privacy requested , Managing Director

A lot of unique and interesting topics which are described in good manner.

Privacy requested, President

Well researched, expertise analysts, well organized, concrete and current topics delivered in time.

Privacy requested, Development Manager