Disposable Paper Cup Market Size, By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2026 to 2033 (Financial Impact Analysis)

ID : MRU_ 441323 | Date : Feb, 2026 | Pages : 246 | Region : Global | Publisher : MRU

Disposable Paper Cup Market Size

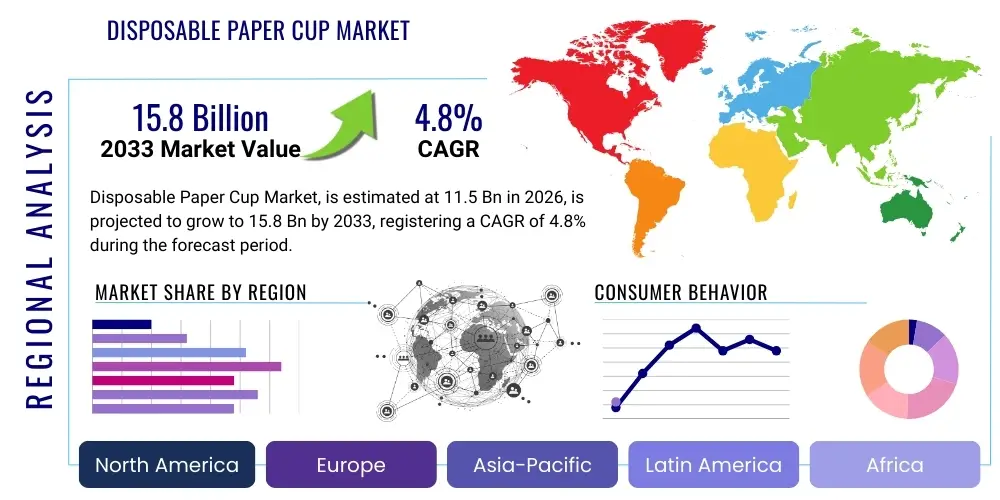

The Disposable Paper Cup Market is projected to grow at a Compound Annual Growth Rate (CAGR) of 4.8% between 2026 and 2033. The market is estimated at USD 11.5 Billion in 2026 and is projected to reach USD 15.8 Billion by the end of the forecast period in 2033.

Disposable Paper Cup Market introduction

The Disposable Paper Cup Market encompasses the manufacturing and distribution of single-use cups primarily made from paperboard, often lined with materials like polyethylene (PE) or polylactic acid (PLA) to enhance moisture resistance and structural integrity. These products are ubiquitous across the food service industry, catering to the growing global demand for ready-to-consume beverages, both hot and cold. The foundational product description involves paper cups designed for convenience, hygiene, and rapid disposal, minimizing the need for washing and reutilization, which aligns perfectly with fast-paced consumer lifestyles and the operational demands of quick-service restaurants (QSRs).

Major applications of disposable paper cups span commercial settings such as cafes, corporate offices, airlines, convenience stores, and institutional environments like hospitals and educational facilities. The primary benefits driving their adoption include superior insulation properties for hot drinks, portability, and reduced cross-contamination risks, especially critical in post-pandemic operational standards. Furthermore, the inherent surface area offers significant branding and marketing opportunities for beverage providers, contributing to product differentiation in competitive markets.

Key driving factors accelerating market expansion include the proliferation of coffee shop chains globally, the increasing consumption of packaged and take-away food and beverages, and stringent public health standards emphasizing single-use hygiene. While the market faces significant environmental scrutiny regarding non-recyclable coatings, the surge in development and adoption of eco-friendly, compostable, and biodegradable paper cups coated with sustainable barriers such as PLA or water-based alternatives is fueling the current growth trajectory, transforming the industry towards greener packaging solutions.

Disposable Paper Cup Market Executive Summary

The disposable paper cup market is experiencing a paradigm shift characterized by intensified regulatory scrutiny and a strong pivot toward sustainable material science. Business trends indicate a robust investment in advanced barrier technologies, moving away from traditional PE coatings toward bio-based and recyclable materials to meet evolving consumer expectations and impending governmental bans on single-use plastics. Key industry players are focusing on vertical integration and strategic acquisitions to secure raw material supply chains and enhance global production capacity, particularly targeting fast-growing economies in the Asia Pacific region where disposable culture is rapidly expanding.

Regionally, the market presents varied dynamics. North America and Europe, while mature, are leading innovation in sustainability, driven by strict mandates like the EU Single-Use Plastics Directive, leading to higher adoption rates of premium, certified compostable cups. In contrast, the Asia Pacific (APAC) region, spearheaded by populous nations such as China and India, exhibits the highest growth potential, largely due to rapid urbanization, increasing disposable income, and the expansion of organized retail and QSR chains. Latin America and MEA are slower to adopt highly sustainable options but show consistent volume growth in basic paper cup usage driven by convenience.

Segmentation trends highlight the dominance of the hot drinks cup type, although the cold drinks segment is gaining traction due to the popularity of iced beverages and large-format convenience drinks. From a material perspective, while PE-coated cups currently hold the largest volume share due to cost-effectiveness, PLA-coated and water-based barrier cups are the fastest-growing sub-segments. Commercial applications, particularly QSRs and high-traffic institutional settings, remain the primary revenue drivers, emphasizing durability, insulation, and high-volume dispensing capabilities.

AI Impact Analysis on Disposable Paper Cup Market

User queries regarding AI's influence in the disposable paper cup market frequently revolve around how artificial intelligence can mitigate the industry's significant environmental footprint, improve manufacturing efficiency, and enhance supply chain resilience. Common concerns include the application of AI in discovering truly biodegradable coating materials, optimizing complex recycling processes for coated paper, and using predictive analytics to minimize waste during mass production. Users also inquire about AI-driven demand forecasting, especially related to seasonal peaks and logistical challenges in a fragmented global market, seeking confirmation that AI can lead to smarter, more sustainable, and cost-effective operations.

AI's analytical capabilities are increasingly being leveraged in material science research, particularly in simulating molecular structures to fast-track the development of next-generation barrier coatings that are fully biodegradable or easily separable during recycling. On the manufacturing floor, AI-powered computer vision systems are deployed for advanced quality control, identifying micro-defects at high line speeds, thus reducing material waste and ensuring product safety compliance. Furthermore, predictive maintenance models, fueled by machine learning algorithms analyzing operational data, minimize unexpected downtime of high-speed cup forming and printing equipment, significantly improving overall equipment effectiveness (OEE).

In logistics and supply chain management, AI optimizes inventory placement and transportation routes, crucial for a high-volume, low-margin product like paper cups, especially across vast international networks. AI systems process real-time sales data, weather patterns, and public events to generate highly accurate demand forecasts, allowing manufacturers to tailor production runs precisely to anticipated needs. This precision not only prevents stockouts but also substantially reduces the risk of overproduction and subsequent storage or disposal challenges, contributing to a more streamlined and environmentally responsible supply chain.

- AI-driven optimization of raw material sourcing and inventory management, ensuring just-in-time delivery of paperboard and coatings.

- Machine Learning models accelerate the R&D of sustainable coatings (e.g., PLA, PHA, or water-based barriers) by simulating performance and degradation profiles.

- Advanced computer vision systems automate quality control on production lines, detecting defects (leaks, structural flaws, print errors) at extremely high speeds.

- Predictive maintenance analytics minimize equipment failures in high-speed cup forming machines, enhancing manufacturing efficiency (OEE).

- AI algorithms improve demand forecasting accuracy, minimizing waste related to overproduction and ensuring optimal regional distribution.

DRO & Impact Forces Of Disposable Paper Cup Market

The dynamics of the Disposable Paper Cup Market are governed by a complex interplay of positive forces driving growth (Drivers) and powerful constraints (Restraints), tempered by key strategic avenues (Opportunities) that dictate future innovation. The primary driver remains the fundamental shift towards convenience and hygiene, heavily amplified by the expansion of the global Quick Service Restaurant (QSR) sector, coffee culture, and institutional requirements for single-use products. Conversely, the market is severely restricted by mounting environmental pressure and the widespread legislative response imposing bans or high taxes on all single-use packaging, particularly those incorporating conventional plastics.

Impact forces dictate that the market must rapidly transition towards sustainable solutions. The inertia of low-cost, PE-coated cups struggles against the accelerating consumer demand for eco-friendly alternatives, forcing manufacturers to invest heavily in compostable and recyclable technologies. This technological shift is both a restraint (due to higher material and production costs) and a major opportunity (creating premium, defensible product lines). Regulatory compliance acts as a pivotal force, compelling uniformity in sustainability standards across international supply chains and fostering innovation in certified industrial composting and recycling infrastructure.

Strategic opportunities lie predominantly in the realm of circular economy initiatives, focusing on creating cups that are either readily recyclable alongside standard paper waste or fully compostable within home or industrial settings. Developing advanced moisture barriers derived from non-fossil fuel sources, such as bio-plastics or plant-based waxes, represents a high-growth opportunity. Furthermore, targeting emerging markets in Asia and Latin America with cost-effective, yet sustainably compliant, products offers significant scope for volume expansion, offsetting slower growth in highly saturated Western economies.

Segmentation Analysis

The Disposable Paper Cup Market is comprehensively segmented based on material type, cup type, and end-use application, providing a granular view of demand patterns and technological adoption across various consumer groups and commercial settings. Understanding these segments is critical for manufacturers to tailor their product offerings, focusing on specific performance characteristics—such as insulation for hot drinks or durability for cold drinks—while navigating complex regional sustainability mandates. The material segmentation particularly highlights the industry's commitment to transition away from traditional polyethylene barriers toward more environmentally sound alternatives.

Segmentation by cup type distinguishes between vessels designed for hot beverages and those for cold beverages, reflecting distinct manufacturing requirements. Hot drink cups require superior insulation capabilities, often achieved through double-walled or ripple-walled designs, and high heat resistance from the coating. Cold drink cups, conversely, prioritize structural rigidity and resistance to condensation-induced breakdown. The application segment dictates volume and specification, with the Commercial sector (QSRs, restaurants, cafes) dominating due to high throughput and the need for standardized branding, contrasting with the institutional sector which prioritizes bulk purchasing and robust hygiene standards.

- Material:

- PE-Coated Paper (Polyethylene)

- PLA-Coated Paper (Polylactic Acid)

- Wax-Coated Paper

- Other Coatings (e.g., Water-based Barriers, Biodegradable Polymers)

- Cup Type:

- Hot Drinks

- Cold Drinks

- Application:

- Commercial (QSR, Restaurants, Cafes, Vending Machines)

- Institutional (Hospitals, Schools, Corporate Offices)

- Residential

Value Chain Analysis For Disposable Paper Cup Market

The disposable paper cup value chain begins with upstream activities focused on sourcing and processing raw materials, primarily virgin and recycled paperboard, pulp, and barrier coating compounds (PE, PLA, or biopolymers). Key upstream suppliers include global forestry companies and specialized chemical manufacturers. The quality and sustainability certification (e.g., FSC) of the paperboard are paramount, heavily influencing the final product's environmental profile and market acceptance. Fluctuations in pulp commodity prices and the availability of sustainable barrier coatings significantly impact the manufacturing stage.

The central phase involves converting the paperboard into finished cups, which includes printing, die-cutting, coating, and high-speed cup-forming processes. This manufacturing stage represents the highest value addition, where technological efficiency, quality control, and scale determine profitability. Downstream analysis focuses on distribution channels. The dominant path is typically indirect, utilizing large-scale food service distributors, wholesalers, and specialized packaging suppliers who serve the vast network of QSRs, cafeterias, and institutional buyers globally. Direct sales channels are often reserved for large, proprietary accounts or major corporate clients seeking customized branding and supply agreements.

Effective management of the distribution channel is crucial, given the low-margin, high-volume nature of the product. Manufacturers must optimize logistics to deliver bulky, yet relatively light, products efficiently to diverse end-users. The final link involves the end-user consumption and, increasingly importantly, the post-consumption waste management infrastructure, including industrial composting or specialized recycling facilities, which completes the product lifecycle and influences overall sustainability metrics demanded by regulatory bodies.

Disposable Paper Cup Market Potential Customers

The disposable paper cup market targets a vast and varied spectrum of end-users, defined primarily by their need for sanitary, convenient, and rapid serving solutions for beverages. The largest segment of potential customers resides within the Commercial Food Service sector, where the high turnover and standardization offered by paper cups are indispensable for efficient operation. This includes global quick-service restaurant (QSR) chains like McDonald's and Starbucks, independent coffee shops, high-volume corporate caterers, and vending machine operators, all requiring reliable, branded packaging solutions that often need to meet specific thermal performance standards.

The Institutional segment constitutes another critical customer base, driven primarily by non-negotiable hygiene requirements and bulk purchasing needs. Hospitals, for instance, utilize disposable cups extensively to minimize cross-contamination risks and streamline patient care routines. Similarly, educational institutions, government facilities, and large corporate offices rely on paper cups for water dispensers, staff canteens, and meeting services. These buyers often prioritize cost-effectiveness and volume supply stability over bespoke aesthetics, although sustainable certifications are rapidly becoming mandatory procurement criteria.

While smaller in volume share, the Residential and Small Office Home Office (SOHO) segments represent potential customers seeking convenience, particularly for parties, events, or environments where permanent dishware is impractical. Growth in this segment is driven by accessibility through mass retail channels, including supermarkets and online e-commerce platforms. Manufacturers increasingly tailor specific bulk packs and aesthetic designs for this retail consumer, emphasizing ease of storage and disposal alongside increasing demands for home compostable alternatives.

| Report Attributes | Report Details |

|---|---|

| Market Size in 2026 | USD 11.5 Billion |

| Market Forecast in 2033 | USD 15.8 Billion |

| Growth Rate | 4.8% ( CAGR ) |

| Historical Year | 2019 to 2024 |

| Base Year | 2025 |

| Forecast Year | 2026 - 2033 |

| DRO & Impact Forces |

|

| Segments Covered |

|

| Key Companies Covered | Huhtamaki, Dart Container, Solo Cup Company, Berry Global, International Paper, Dixie Consumer Products, Fuling Global, Genpak, Konie Cups International, Detpak, Duni Group, Go-Pak, Graphic Packaging International, Benders Paper Cups, Seda International Packaging Group, Lollicup USA Inc., Pactiv Evergreen Inc., ConverPack. |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Enquiry Before Buy | Have specific requirements? Send us your enquiry before purchase to get customized research options. Request For Enquiry Before Buy |

Disposable Paper Cup Market Key Technology Landscape

The technology landscape for disposable paper cups is highly centered on optimizing production efficiency, enhancing barrier performance, and achieving environmental compliance. High-speed cup forming machinery remains the backbone of the industry, with continual innovations focused on maximizing output (cups per minute) while minimizing material waste and energy consumption. Modern forming machines incorporate precision servo motors and advanced sensor technologies to ensure accurate folding, sealing, and rim rolling, which are critical for preventing leaks and ensuring structural integrity, especially for multi-layered or ripple-walled designs.

A major area of technological focus is the development of advanced moisture barrier coatings. Traditional polyethylene (PE) coating technology, while effective and cost-efficient, is being rapidly superseded by alternative polymers and dispersion techniques. Key advancements include extrusion coating with Polylactic Acid (PLA), a bio-based polymer offering compostability, and the introduction of water-based or aqueous dispersion coatings. These new coatings aim to provide comparable moisture and grease resistance to PE while allowing the resulting cup to be pulped and recycled alongside standard paper, addressing the central challenge of recyclability.

Furthermore, digital printing technology is increasingly being integrated into the production process. While flexographic and offset printing remain standard for high-volume, standardized runs, digital printing allows for shorter lead times, highly customized graphics, and variable data printing for promotional campaigns. This technological shift enables faster time-to-market for seasonal products and branded merchandise, providing a competitive edge to manufacturers who can offer high-definition, flexible branding solutions to their commercial clients. Coupled with automation and quality assurance systems, these technologies are defining the next generation of disposable cup production.

Regional Highlights

- North America: This region is characterized by high consumption rates, driven primarily by the strong prevalence of QSRs, coffee culture, and corporate catering. The market here is mature but is seeing rapid consolidation and a shift towards premium, insulated, and sustainably certified products (e.g., BPI certified compostable). Regulatory action in states and cities concerning single-use plastics is accelerating the adoption of PLA and water-based barrier cups, forcing major players to restructure their product portfolios significantly.

- Europe: Europe represents a highly regulated and sustainability-focused market. The implementation of the EU Single-Use Plastics Directive has been a major catalyst, driving significant market transition away from conventional plastic-lined cups. Western European nations, particularly Germany, the UK, and the Nordics, prioritize recyclable and industrially compostable solutions. Manufacturers must navigate complex national labeling and waste sorting schemes, demanding high levels of certification for product acceptance.

- Asia Pacific (APAC): APAC is the fastest-growing region globally, fueled by rapid urbanization, burgeoning middle-class consumption, and the expansion of Western QSR and coffee chains, particularly in China, India, and Southeast Asia. While cost-sensitivity remains a factor, regulatory pushes towards sustainability are emerging in major metropolitan areas, leading to a dual market structure: high-volume, low-cost cups coexist with premium, eco-friendly options tailored for international brands and discerning local consumers.

- Latin America (LATAM): The LATAM market shows steady growth driven by convenience and hygiene benefits, although the adoption of high-cost sustainable coatings is slower compared to North America and Europe. Key markets like Brazil and Mexico are witnessing increased investment in local manufacturing facilities to serve growing food service demands. Price competition is fierce, making economical PE-coated cups still dominant, although biodegradable options are starting to penetrate institutional and premium segments.

- Middle East and Africa (MEA): Growth in MEA is concentrated in the Gulf Cooperation Council (GCC) countries, driven by significant tourism, urbanization, and reliance on imported food service concepts. Hygiene and convenience are paramount drivers. The region is initiating sustainability mandates, particularly concerning packaging waste reduction, suggesting a future pivot towards recyclable paper solutions, though the initial transition phase is reliant on established, cost-effective technologies.

Top Key Players

The market research report includes a detailed profile of leading stakeholders in the Disposable Paper Cup Market.- Huhtamaki

- Dart Container

- Solo Cup Company (A subsidiary of Dart Container)

- Berry Global

- International Paper

- Dixie Consumer Products (A division of Georgia-Pacific)

- Fuling Global

- Genpak (A division of The Pactiv Evergreen Group)

- Konie Cups International

- Detpak (A division of Detmold Group)

- Duni Group

- Go-Pak

- Graphic Packaging International

- Benders Paper Cups

- Seda International Packaging Group

- Lollicup USA Inc.

- Pactiv Evergreen Inc.

- ConverPack

- Greiner Packaging International GmbH

- Paper Cup Company

Frequently Asked Questions

Analyze common user questions about the Disposable Paper Cup market and generate a concise list of summarized FAQs reflecting key topics and concerns.What is the primary driving force behind the adoption of sustainable paper cups?

The primary driving force is stringent government regulations, particularly plastic bans (like the EU SUP Directive), coupled with strong consumer demand for environmentally responsible packaging alternatives. This mandates the shift towards materials such as PLA-coated or water-based barrier paper cups that offer improved recyclability or compostability.

How do PE-coated paper cups differ environmentally from PLA-coated paper cups?

PE (polyethylene) coating is petroleum-based and makes standard paper cups difficult to recycle through conventional paper mills, often ending up in landfills. PLA (Polylactic Acid) is a bio-based polymer that, while still requiring specific conditions, allows cups to be industrially compostable, presenting a better end-of-life scenario for packaging waste.

Which geographical region exhibits the highest growth rate for disposable paper cups?

The Asia Pacific (APAC) region, specifically emerging economies like China and India, is projected to exhibit the highest growth rate. This is attributed to rapid urbanization, increasing disposable income, and the massive expansion of organized retail, fast-food, and cafe chains throughout the region.

What technological advancements are critical for improving the recyclability of paper cups?

Critical technological advancements include the development and widespread adoption of water-based dispersion barrier coatings and advanced polymer separation techniques. These coatings facilitate the easy separation of the barrier layer from the paper fiber during standard pulping processes, making the cups more compatible with existing paper recycling infrastructure.

What are the main restraints hindering the growth of the sustainable paper cup segment?

The main restraints include the significantly higher cost of sustainable raw materials (such as PLA and specialized barrier coatings) compared to traditional PE, and the lack of comprehensive, standardized industrial composting and dedicated recycling infrastructure required to effectively process these advanced sustainable cup variants.

To check our Table of Contents, please mail us at: sales@marketresearchupdate.com

Research Methodology

The Market Research Update offers technology-driven solutions and its full integration in the research process to be skilled at every step. We use diverse assets to produce the best results for our clients. The success of a research project is completely reliant on the research process adopted by the company. Market Research Update assists its clients to recognize opportunities by examining the global market and offering economic insights. We are proud of our extensive coverage that encompasses the understanding of numerous major industry domains.

Market Research Update provide consistency in our research report, also we provide on the part of the analysis of forecast across a gamut of coverage geographies and coverage. The research teams carry out primary and secondary research to implement and design the data collection procedure. The research team then analyzes data about the latest trends and major issues in reference to each industry and country. This helps to determine the anticipated market-related procedures in the future. The company offers technology-driven solutions and its full incorporation in the research method to be skilled at each step.

The Company's Research Process Has the Following Advantages:

- Information Procurement

The step comprises the procurement of market-related information or data via different methodologies & sources.

- Information Investigation

This step comprises the mapping and investigation of all the information procured from the earlier step. It also includes the analysis of data differences observed across numerous data sources.

- Highly Authentic Source

We offer highly authentic information from numerous sources. To fulfills the client’s requirement.

- Market Formulation

This step entails the placement of data points at suitable market spaces in an effort to assume possible conclusions. Analyst viewpoint and subject matter specialist based examining the form of market sizing also plays an essential role in this step.

- Validation & Publishing of Information

Validation is a significant step in the procedure. Validation via an intricately designed procedure assists us to conclude data-points to be used for final calculations.

×

Request Free Sample:

Related Reports

Select License

Why Choose Us

We're cost-effective and Offered Best services:

We are flexible and responsive startup research firm. We adapt as your research requires change, with cost-effectiveness and highly researched report that larger companies can't match.

Information Safety

Market Research Update ensure that we deliver best reports. We care about the confidential and personal information quality, safety, of reports. We use Authorize secure payment process.

We Are Committed to Quality and Deadlines

We offer quality of reports within deadlines. We've worked hard to find the best ways to offer our customers results-oriented and process driven consulting services.

Our Remarkable Track Record

We concentrate on developing lasting and strong client relationship. At present, we hold numerous preferred relationships with industry leading firms that have relied on us constantly for their research requirements.

Best Service Assured

Buy reports from our executives that best suits your need and helps you stay ahead of the competition.

Customized Research Reports

Our research services are custom-made especially to you and your firm in order to discover practical growth recommendations and strategies. We don't stick to a one size fits all strategy. We appreciate that your business has particular research necessities.

Service Assurance

At Market Research Update, we are dedicated to offer the best probable recommendations and service to all our clients. You will be able to speak to experienced analyst who will be aware of your research requirements precisely.

Contact With Our Sales Team

Customer Testimonials

The content of the report is always up to the mark. Good to see speakers from expertise authorities.

Privacy requested , Managing Director

A lot of unique and interesting topics which are described in good manner.

Privacy requested, President

Well researched, expertise analysts, well organized, concrete and current topics delivered in time.

Privacy requested, Development Manager