Disposable Plastic Spoon and Fork Market Size, By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2026 to 2033 (Financial Impact Analysis)

ID : MRU_ 442092 | Date : Feb, 2026 | Pages : 258 | Region : Global | Publisher : MRU

Disposable Plastic Spoon and Fork Market Size

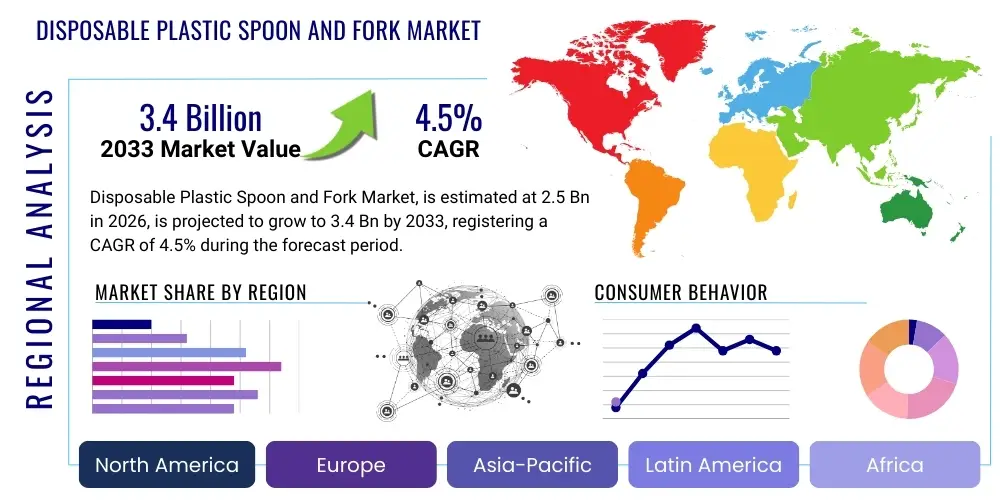

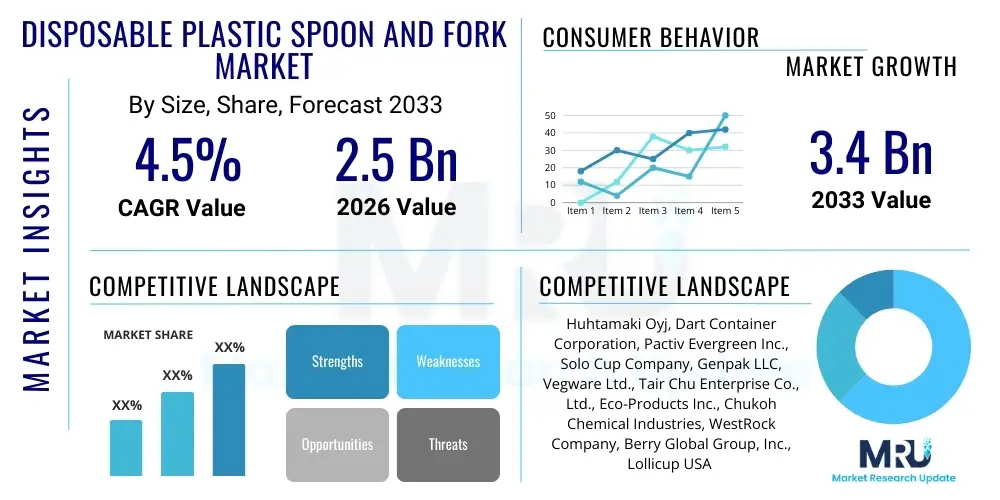

The Disposable Plastic Spoon and Fork Market is projected to grow at a Compound Annual Growth Rate (CAGR) of 4.5% between 2026 and 2033. The market is estimated at USD 2.5 Billion in 2026 and is projected to reach USD 3.4 Billion by the end of the forecast period in 2033.

Disposable Plastic Spoon and Fork Market introduction

The Disposable Plastic Spoon and Fork Market encompasses the production, distribution, and consumption of lightweight, single-use cutlery made primarily from petrochemical-derived polymers such as Polypropylene (PP), Polystyrene (PS), and increasingly, bio-based alternatives like Polylactic Acid (PLA) and Crystallized Polylactic Acid (CPLA). These products are fundamentally designed for convenience, hygiene, and efficiency in settings where reuse and washing are impractical or undesirable. Key product characteristics often revolve around affordability, tensile strength adequate for various food types, and compliance with food contact safety regulations across global jurisdictions. The intrinsic value proposition of disposables is rooted in minimizing operational overhead for end-users, particularly in high-volume, quick-service environments.

Major applications driving market demand include the rapidly expanding Quick Service Restaurant (QSR) sector, institutional catering services (hospitals, schools, airlines), corporate events, and household use for picnics and large gatherings. The convenience factor associated with 'to-go' and delivery services, bolstered significantly by global urbanization and changing consumer lifestyles, forms the bedrock of demand. Furthermore, stringent public health focus, especially post-pandemic, continues to emphasize the need for single-use, sanitary serving items, favoring disposable options over traditional reusable cutlery in many commercial settings.

The market benefits significantly from high economic throughput in the food service industry and the low cost of raw material inputs (despite volatile petroleum pricing). Driving factors include the continuous rise in packaged meal consumption, the expansion of food delivery platforms, and the increasing globalization of Westernized fast-food models. However, the market faces structural challenges due to escalating environmental concerns, leading to regulatory shifts such as the EU Single-Use Plastics Directive and similar bans implemented across North America and parts of Asia, compelling manufacturers to pivot towards sustainable materials and offering compostable or biodegradable alternatives.

Disposable Plastic Spoon and Fork Market Executive Summary

The Disposable Plastic Spoon and Fork Market is navigating a complex transition, characterized by robust demand from emerging economies counterbalanced by aggressive sustainability mandates in mature markets. Business trends highlight a dichotomy: continued reliance on cost-effective traditional plastics (PP, PS) in developing regions, while developed economies witness a significant surge in R&D and manufacturing capacity for bio-plastics (PLA, PHA). This shift necessitates substantial capital investment in new processing equipment, modifying traditional injection molding lines, and establishing reliable supply chains for plant-based feedstocks, impacting profit margins for traditional players and creating high-growth potential for specialized bio-plastic firms. Strategic partnerships focused on end-of-life solutions, such as industrial composting infrastructure development, are becoming critical competitive differentiators.

Regionally, Asia Pacific (APAC) stands out as the primary growth engine, fueled by rapid expansion of organized retail, foodservice chains, and high population density driving ‘on-the-go’ consumption. Conversely, Europe and North America are defined by regulatory hurdles. The EU’s stringent regulations are pushing the market towards full bio-degradability or reusable models, accelerating material innovation. North America exhibits a patchwork of regulations, with state and municipal bans driving localized shifts toward compliant products, often leading to increased material costs that are passed onto consumers and businesses, prompting vertical integration strategies among major manufacturers to control the supply chain from raw material to finished product.

Segment trends demonstrate a clear shift away from Polystyrene (PS), traditionally the cheapest option, due to environmental toxicity concerns and difficulty in recycling. Polypropylene (PP) maintains a strong market share due to its superior heat resistance and durability, especially in hot food applications. However, the fastest-growing segment is bio-plastics, specifically PLA, which is gaining traction in general catering applications. The institutional end-use segment remains the largest consumer, driven by immense bulk requirements and rigid specifications for hygiene. Manufacturers are focusing on lightweighting initiatives—reducing the overall plastic content per unit—to achieve marginal cost savings and improve overall material efficiency, thereby positioning products as marginally more sustainable while complying with regulatory weight restrictions.

AI Impact Analysis on Disposable Plastic Spoon and Fork Market

User inquiries regarding AI's influence in the disposable cutlery sector typically center on three core themes: operational efficiency, materials innovation, and demand predictability amidst regulatory volatility. Consumers and industry stakeholders are keen to understand how AI can mitigate rising operational costs, especially related to complex bio-plastic processing, and how it can assist in rapidly identifying and validating novel, sustainable materials (e.g., cellulose-based alternatives) that meet performance criteria. A major concern is whether AI-driven supply chain optimization can sufficiently lower costs to make sustainable products price-competitive with traditional plastics before mandatory bans take effect. Furthermore, users often seek information on how machine learning models can accurately forecast sudden shifts in demand caused by localized plastic bans or macroeconomic shocks to the petrochemical supply chain.

AI's primary near-term impact is observed in manufacturing optimization. Machine learning algorithms are being applied to injection molding processes to fine-tune variables such as temperature, pressure, and cooling cycles in real-time. This sophisticated control minimizes material waste, enhances the structural integrity of the finished product, particularly crucial for more brittle bio-plastics like PLA, and significantly improves energy efficiency per unit produced. By continuously analyzing sensor data from machinery, AI systems can preemptively predict equipment failure and schedule maintenance, leading to maximized operational uptime, which is vital in a high-volume, low-margin industry where downtime can severely impact profitability.

Furthermore, AI and generative design tools are revolutionizing product development and material science. Deep learning models can rapidly analyze millions of molecular structures to identify polymers with optimal characteristics for heat tolerance, biodegradability, and structural rigidity. In the supply chain, predictive analytics tools use historical data, weather patterns, and global regulatory updates to forecast localized demand with high accuracy, allowing manufacturers to strategically position inventory of compliant products, thereby reducing warehousing costs and minimizing the risk of obsolescence associated with banned materials. This strategic forecasting capability is crucial for navigating the market’s inherent regulatory instability.

- AI optimizes injection molding parameters, reducing material waste and energy consumption.

- Machine learning algorithms enhance predictive maintenance, maximizing equipment uptime.

- Generative design accelerates the discovery and validation of novel, sustainable biopolymers (e.g., PHA variants).

- Predictive analytics forecasts regional demand fluctuations driven by regulatory changes or seasonal events.

- Automated quality control systems utilize computer vision to inspect products, ensuring structural compliance and uniformity at high speeds.

- AI-driven procurement models optimize sourcing of volatile raw materials (petrochemicals or agricultural feedstock).

DRO & Impact Forces Of Disposable Plastic Spoon and Fork Market

The market dynamics are defined by a powerful convergence of consumer convenience demands, stringent regulatory constraints, and technological innovation focused on sustainability. Drivers such as the global proliferation of food delivery services (e.g., Uber Eats, DoorDash), the inherent hygiene advantages of single-use items in institutional settings, and the general growth in disposable income globally continue to provide foundational support for market expansion. Restraints, predominantly driven by governmental interventions, include widespread bans on specific plastic types (e.g., PS) and mandates for recycled content or compostability, which significantly increase complexity and production cost. Opportunities lie squarely in the accelerated development and commercial scaling of advanced bio-plastics and the establishment of robust circular economy models, including advanced recycling and centralized composting programs.

The primary driving force remains the pervasive culture of convenience and speed in modern life. As urban populations rely increasingly on quick-service food options and prepared meals, the demand for accompanying disposable cutlery escalates linearly. The low unit cost of traditional plastic cutlery also allows businesses to absorb the expense without significantly impacting menu pricing. Furthermore, the rise of large-scale international sporting events, festivals, and corporate campus catering necessitates efficient, sanitary, high-volume solutions that disposables uniquely fulfill. This reliance on efficiency often outweighs the immediate environmental cost considerations for high-volume commercial buyers operating under tight logistical constraints.

The most significant restraint impacting mature markets is the legislative and consumer-driven backlash against plastic waste, particularly concerning marine pollution and landfill accumulation. Regulatory actions, such as outright bans or steep taxes on non-compostable plastics, force manufacturers to invest heavily in costly bio-plastic alternatives that often face performance issues (e.g., lower heat resistance, increased brittleness) or lack viable end-of-life infrastructure (e.g., industrial composting facilities are scarce). This mismatch between regulatory deadlines and infrastructural readiness poses a serious challenge. Impact forces include technological breakthroughs in polymer chemistry (driving opportunities) and powerful public opinion shifts (driving restraints), creating a market environment where agility and adaptability to rapidly changing material requirements are paramount for sustaining market share.

Segmentation Analysis

The Disposable Plastic Spoon and Fork Market is fundamentally segmented based on the type of material utilized, the specific product type, and the ultimate end-use application. Understanding these segments is crucial for manufacturers to align production capabilities with evolving regulatory requirements and shifting consumer preferences, particularly the rapid migration towards sustainable substitutes. The material segmentation (PP, PS, PLA, etc.) is currently the most dynamic area, directly influenced by global environmental policies, dictating market access across regions. Product segmentation, while seemingly straightforward (spoons, forks), also involves nuanced differences in design, size, and weight optimization for specific food types (e.g., heavy-duty versus lightweight dessert cutlery).

End-use segmentation delineates between the dominant commercial sector and the relatively smaller, though stable, household market. Commercial application categories, such as foodservice and institutional use, demand immense volumes, standardized sizing, and high cost-efficiency, often favoring cheaper, durable options like PP, especially in regions without strict plastic bans. Conversely, specialized commercial buyers, such as eco-friendly catering companies or premium airline services, may prioritize high-end, aesthetically pleasing, and certified compostable materials, justifying a higher unit cost to meet corporate sustainability goals and brand image requirements.

The strategic implication of segmentation lies in managing a dual market strategy: supplying economical, conventional plastic products to regulation-lenient markets while simultaneously scaling up high-performance, compliant bio-plastic portfolios for markets with restrictive regulations. This often requires running parallel production lines and managing complex inventory logistics to ensure localized product compliance. The rising adoption of combination packs (e.g., spoon-fork-knife sets) also represents an emerging sub-segment focusing on convenience and optimizing logistics for food delivery platforms, further diversifying the product portfolio requirements for market participants.

- By Material Type:

- Polypropylene (PP)

- Polystyrene (PS)

- Polylactic Acid (PLA) and CPLA

- Other Bio-plastics (e.g., PHA, Starch-based)

- By Product Type:

- Spoons

- Forks

- Knives

- Combo Packs/Sets

- By End-Use Application:

- Foodservice (Restaurants, QSRs, Cafes)

- Institutional (Airlines, Hospitals, Schools, Corporate Catering)

- Household & Retail

- Events & Festivals

Value Chain Analysis For Disposable Plastic Spoon and Fork Market

The value chain for disposable plastic cutlery is characterized by high volume, low margin, and dependence on both petrochemical and increasingly, agricultural inputs. The upstream segment involves the extraction and processing of raw materials. For traditional plastics (PP, PS), this relies heavily on the petrochemical industry, linking the industry's profitability directly to global crude oil and natural gas prices. For bio-plastics (PLA), the upstream involves sourcing and refining agricultural feedstocks, such as corn starch, sugarcane, or cassava. Volatility in commodity prices for both oil and agricultural products poses a constant challenge, requiring sophisticated hedging strategies from major manufacturers to maintain stable production costs and manage input risk across various geographical sourcing regions.

The manufacturing process—the core of the midstream—is dominated by high-speed, precision injection molding and thermoforming techniques. Efficiency in this stage is critical, focusing on minimizing cycle times, achieving minimal wall thickness (lightweighting), and integrating high-volume automated packaging solutions. Manufacturers typically operate large, centralized production facilities to leverage economies of scale. The transition to bio-plastics introduces complexities, as materials like PLA require specific temperature controls and often longer cooling cycles than traditional plastics, demanding adaptation of existing machinery or investment in specialized equipment, which raises capital expenditure requirements and manufacturing complexity.

Downstream analysis focuses on distribution channels, which are predominantly B2B. Products move through large wholesale distributors, institutional suppliers, and direct sales to major foodservice chains and institutional buyers. Indirect channels, facilitated by general foodservice supply companies like Sysco or Aramark, account for the largest volume. Direct channels, often managed through e-commerce platforms, are growing, particularly for niche bio-plastic products targeting environmentally conscious small-to-medium enterprises (SMEs) and specialized retail buyers. Effective logistics, rapid inventory fulfillment, and adherence to varying international packaging and labeling standards are key downstream competitive factors.

Disposable Plastic Spoon and Fork Market Potential Customers

Potential customers for disposable plastic spoons and forks primarily encompass entities operating within the vast HORECA (Hotel, Restaurant, Catering) sector and large-scale institutional buyers. The largest cohort consists of Quick Service Restaurants (QSRs) and fast-casual dining establishments that rely entirely on disposable solutions to manage high customer throughput without the cost, space, or labor associated with dishwashing facilities. These customers prioritize bulk availability, guaranteed supply chain reliability, and the lowest possible unit cost, although regulatory compliance (e.g., needing compostable cutlery in specific jurisdictions) is increasingly overriding the cost factor.

Institutional end-users represent another significant buyer segment, including hospitals, educational facilities, corporate cafeterias, and transport providers (airlines and railways). Their purchasing decisions are often based on large, multi-year tender agreements that prioritize stringent hygiene standards, product durability (especially for hot foods), and adherence to institutional budgetary constraints. For airlines and healthcare facilities, weight reduction and specialized packaging for sterile dispensing are often critical technical specifications that influence buyer choice. These large buyers require detailed material certifications and often favor manufacturers capable of providing customized solutions or consistent global supply.

A rapidly expanding segment of potential customers includes online food delivery aggregators and the multitude of virtual or cloud kitchens that operate exclusively on delivery and take-out models. These customers necessitate highly functional, visually appealing, and environmentally compliant cutlery sets that integrate seamlessly into their delivery packaging. For these digital-first businesses, the ability to communicate the sustainability credentials of the cutlery (e.g., "100% Compostable PLA") directly to the end consumer is becoming a crucial marketing tool, pushing demand specifically toward premium bio-based products over traditional inexpensive plastics, even at a higher acquisition cost, reflecting a willingness to invest in brand perception.

| Report Attributes | Report Details |

|---|---|

| Market Size in 2026 | USD 2.5 Billion |

| Market Forecast in 2033 | USD 3.4 Billion |

| Growth Rate | CAGR 4.5% |

| Historical Year | 2019 to 2024 |

| Base Year | 2025 |

| Forecast Year | 2026 - 2033 |

| DRO & Impact Forces |

|

| Segments Covered |

|

| Key Companies Covered | Huhtamaki Oyj, Dart Container Corporation, Pactiv Evergreen Inc., Solo Cup Company, Genpak LLC, Vegware Ltd., Tair Chu Enterprise Co., Ltd., Eco-Products Inc., Chukoh Chemical Industries, WestRock Company, Berry Global Group, Inc., Lollicup USA Inc., Dixie Consumer Products LLC, Benders Paper Cups, Fuling Global Inc., Novolex, Gold Plast SpA, Reynolds Consumer Products Inc., The Clorox Company, Hoffmaster Group Inc. |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Enquiry Before Buy | Have specific requirements? Send us your enquiry before purchase to get customized research options. Request For Enquiry Before Buy |

Disposable Plastic Spoon and Fork Market Key Technology Landscape

The technological landscape of the disposable cutlery market is undergoing a rapid evolution, moving away from conventional commodity plastic processing towards high-precision manufacturing centered on sustainable materials. The core technologies remain rooted in advanced injection molding and high-speed thermoforming, but with significant modifications. Modern injection molding machines now incorporate precise thermal management systems specifically designed to handle materials with lower melting points and varying crystallization rates, such as PLA and CPLA. Achieving sufficient durability and heat resistance using bio-plastics requires highly controlled process parameters and innovative mold designs that enable rapid cooling while maintaining optimal material molecular structure, preventing brittleness and ensuring functional performance equivalent to traditional plastics.

A key focus is on material science innovation, particularly in the development of next-generation biodegradable polymers. Research is heavily concentrated on Polyhydroxyalkanoates (PHA), derived from bacterial fermentation, which offers superior biodegradability in diverse environments, including marine settings, compared to PLA. Furthermore, advancements in cellulose and lignin-based composites, utilizing agricultural waste streams, are aimed at creating sturdy, cost-effective, and fully compostable cutlery. These developments often involve blending natural fibers with base polymers to improve rigidity and reduce reliance on purely petrochemical or conventional plant-based inputs, addressing both cost pressures and environmental performance criteria for disposal.

Automation and quality control technologies are also paramount for market leaders. High-speed robotics are integrated throughout the packaging and palletizing phases to handle the massive volumes required by institutional buyers, minimizing human contact and ensuring sanitation. Computer vision systems, utilizing AI algorithms, are increasingly deployed on production lines to detect minute defects, such as structural weaknesses or irregular finishes, especially critical when dealing with thinner, lightweighted products. Furthermore, the push for compliant products drives demand for robust traceability systems, using technologies like RFID or advanced serialization, to verify material sourcing and regulatory adherence across complex global supply chains.

Regional Highlights

- Asia Pacific (APAC): APAC is the largest and fastest-growing regional market, primarily driven by the massive expansion of the middle-class consumer base, rapid urbanization, and the corresponding growth in organized food retail and delivery services, particularly in China, India, and Southeast Asia. While regulatory scrutiny on plastics is increasing (e.g., India's phased ban), implementation is often staggered, allowing conventional plastics (PP) to dominate due to their cost-effectiveness and ready availability. This region is a major manufacturing hub, benefiting from low labor and production costs, fueling global export capabilities.

- North America: This region is characterized by a fragmented regulatory environment, where federal inaction contrasts sharply with aggressive state- and city-level bans (e.g., California, New York). This regulatory uncertainty necessitates complex inventory management. Market demand is high, driven by a mature QSR sector, but the push towards certified compostable or recycled content is strong, leading to high adoption rates of premium PLA and CPLA products, particularly in the West Coast markets.

- Europe: Europe is the global frontrunner in strict plastic regulation, largely governed by the Single-Use Plastics (SUP) Directive, which has effectively banned several conventional plastic items. This has forced immediate and widespread adoption of certified compostable or alternative materials (e.g., wood, paper-based). The market is highly saturated with innovative bio-plastic offerings, but growth is tempered by the high cost of compliance and the relatively slow development of industrial composting infrastructure required for true circularity.

- Latin America (LATAM): The LATAM market is experiencing strong growth, fueled by urbanization and the influx of international foodservice chains. While environmental awareness is rising, economic constraints often favor the most cost-effective solutions. Brazil and Mexico are key markets, showing early signs of localized plastic reduction policies, but penetration of high-cost bio-plastics remains lower than in Europe, maintaining reliance on durable plastics like PP for hot food applications.

- Middle East and Africa (MEA): Growth in the MEA region is driven by infrastructure development, tourism, and expanding institutional catering sectors (e.g., large construction sites, expatriate housing, major events like the World Cup). Saudi Arabia and the UAE are strategic markets with high per-capita consumption in foodservice. While regulatory focus is lower than in the West, sustainability initiatives are being adopted by major international hotel and retail chains operating in the region to align with global corporate standards.

Top Key Players

The market research report includes a detailed profile of leading stakeholders in the Disposable Plastic Spoon and Fork Market.- Huhtamaki Oyj

- Dart Container Corporation

- Pactiv Evergreen Inc.

- Solo Cup Company

- Genpak LLC

- Vegware Ltd.

- Tair Chu Enterprise Co., Ltd.

- Eco-Products Inc.

- Chukoh Chemical Industries

- WestRock Company

- Berry Global Group, Inc.

- Lollicup USA Inc.

- Dixie Consumer Products LLC

- Benders Paper Cups

- Fuling Global Inc.

- Novolex

- Gold Plast SpA

- Reynolds Consumer Products Inc.

- The Clorox Company

- Hoffmaster Group Inc.

Frequently Asked Questions

Analyze common user questions about the Disposable Plastic Spoon and Fork market and generate a concise list of summarized FAQs reflecting key topics and concerns.What is the primary driving factor for the shift towards bio-plastic disposable cutlery?

The main factor driving the transition towards bio-plastic cutlery, such as PLA and PHA, is stringent governmental regulation, notably the EU Single-Use Plastics Directive and similar bans globally, aimed at reducing plastic waste and ensuring circular economy principles are met by commercial entities.

How is the volatility of petrochemical prices impacting the disposable cutlery market?

Volatile petrochemical prices directly affect the manufacturing cost of traditional plastics like PP and PS. This instability encourages manufacturers to diversify their material portfolios and invest in bio-based alternatives, seeking to stabilize supply chain costs by reducing dependency on fossil fuel inputs.

Which material segment currently holds the largest market share globally?

Polypropylene (PP) currently holds a significant share due to its excellent heat resistance, durability, and cost-effectiveness, making it highly favored in large-scale foodservice and institutional applications, particularly in regions where environmental regulations are less restrictive than in Europe or North America.

What challenges do manufacturers face when scaling up PLA-based cutlery production?

Manufacturers face challenges related to material performance (e.g., lower heat tolerance of standard PLA), the need for specialized industrial composting infrastructure for disposal, and increased capital expenditure required to modify or purchase new injection molding equipment optimized for bio-plastic polymers.

Is disposable cutlery currently compliant with circular economy models?

Traditional disposable plastic cutlery (PS, PP) is generally not compliant with circular economy models due to low recycling rates. However, advanced bio-plastic cutlery (PHA, compostable certified PLA) is designed to be compliant, provided that the necessary industrial composting or advanced recycling infrastructure is available and utilized effectively.

To check our Table of Contents, please mail us at: sales@marketresearchupdate.com

Research Methodology

The Market Research Update offers technology-driven solutions and its full integration in the research process to be skilled at every step. We use diverse assets to produce the best results for our clients. The success of a research project is completely reliant on the research process adopted by the company. Market Research Update assists its clients to recognize opportunities by examining the global market and offering economic insights. We are proud of our extensive coverage that encompasses the understanding of numerous major industry domains.

Market Research Update provide consistency in our research report, also we provide on the part of the analysis of forecast across a gamut of coverage geographies and coverage. The research teams carry out primary and secondary research to implement and design the data collection procedure. The research team then analyzes data about the latest trends and major issues in reference to each industry and country. This helps to determine the anticipated market-related procedures in the future. The company offers technology-driven solutions and its full incorporation in the research method to be skilled at each step.

The Company's Research Process Has the Following Advantages:

- Information Procurement

The step comprises the procurement of market-related information or data via different methodologies & sources.

- Information Investigation

This step comprises the mapping and investigation of all the information procured from the earlier step. It also includes the analysis of data differences observed across numerous data sources.

- Highly Authentic Source

We offer highly authentic information from numerous sources. To fulfills the client’s requirement.

- Market Formulation

This step entails the placement of data points at suitable market spaces in an effort to assume possible conclusions. Analyst viewpoint and subject matter specialist based examining the form of market sizing also plays an essential role in this step.

- Validation & Publishing of Information

Validation is a significant step in the procedure. Validation via an intricately designed procedure assists us to conclude data-points to be used for final calculations.

×

Request Free Sample:

Related Reports

Select License

Why Choose Us

We're cost-effective and Offered Best services:

We are flexible and responsive startup research firm. We adapt as your research requires change, with cost-effectiveness and highly researched report that larger companies can't match.

Information Safety

Market Research Update ensure that we deliver best reports. We care about the confidential and personal information quality, safety, of reports. We use Authorize secure payment process.

We Are Committed to Quality and Deadlines

We offer quality of reports within deadlines. We've worked hard to find the best ways to offer our customers results-oriented and process driven consulting services.

Our Remarkable Track Record

We concentrate on developing lasting and strong client relationship. At present, we hold numerous preferred relationships with industry leading firms that have relied on us constantly for their research requirements.

Best Service Assured

Buy reports from our executives that best suits your need and helps you stay ahead of the competition.

Customized Research Reports

Our research services are custom-made especially to you and your firm in order to discover practical growth recommendations and strategies. We don't stick to a one size fits all strategy. We appreciate that your business has particular research necessities.

Service Assurance

At Market Research Update, we are dedicated to offer the best probable recommendations and service to all our clients. You will be able to speak to experienced analyst who will be aware of your research requirements precisely.

Contact With Our Sales Team

Customer Testimonials

The content of the report is always up to the mark. Good to see speakers from expertise authorities.

Privacy requested , Managing Director

A lot of unique and interesting topics which are described in good manner.

Privacy requested, President

Well researched, expertise analysts, well organized, concrete and current topics delivered in time.

Privacy requested, Development Manager