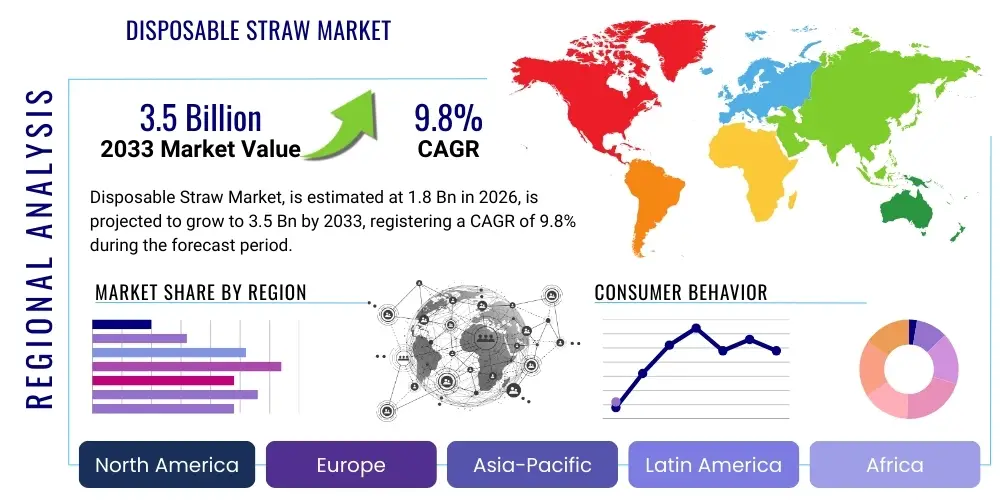

Disposable Straw Market Size, By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2026 to 2033 (Financial Impact Analysis)

ID : MRU_ 441020 | Date : Feb, 2026 | Pages : 249 | Region : Global | Publisher : MRU

Disposable Straw Market Size

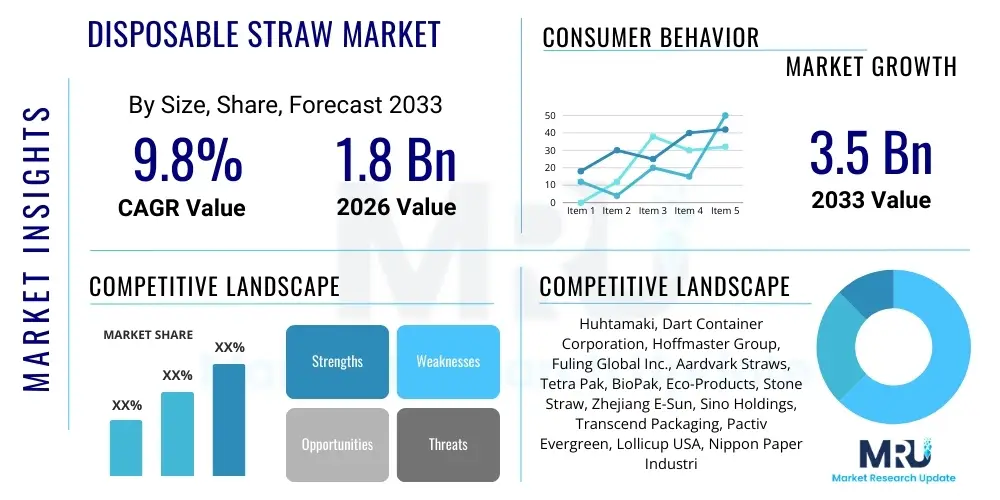

The Disposable Straw Market is projected to grow at a Compound Annual Growth Rate (CAGR) of 9.8% between 2026 and 2033. The market is estimated at $1.8 Billion in 2026 and is projected to reach $3.5 Billion by the end of the forecast period in 2033.

Disposable Straw Market introduction

The Disposable Straw Market encompasses the global production, distribution, and consumption of single-use drinking implements designed for immediate disposal after use. Historically dominated by plastic polymers, the market has undergone a radical transformation driven by global sustainability mandates and widespread consumer awareness regarding plastic pollution, particularly ocean plastic waste. This shift has necessitated rapid innovation, leading to a proliferation of biodegradable, compostable, and fiber-based alternatives such as paper, PLA (Polylactic Acid), bamboo, and various starch-based polymers. Product descriptions now heavily emphasize environmental certifications, material origins, and end-of-life disposability, distinguishing modern disposable straws from their traditional plastic counterparts.

Major applications for disposable straws span the entire food and beverage service industry, including Quick Service Restaurants (QSRs), full-service restaurants, institutional catering (hospitals, schools, corporate cafeterias), convenience stores, and specialized beverage outlets like coffee shops and juice bars. While traditionally viewed as a convenience item, the functional importance of straws remains high for accessibility purposes and for minimizing spillage, particularly in take-away and delivery services, which have seen exponential growth globally. The utility of these products is inextricably linked to the efficiency and hygiene standards of mass-market beverage consumption, dictating stringent requirements for material safety and structural integrity.

The primary benefit driving the evolution of this market is environmental sustainability, focusing on reducing the ecological footprint associated with waste. For businesses, adopting sustainable disposable straws is a critical component of Corporate Social Responsibility (CSR) strategies, improving brand perception and ensuring regulatory compliance in jurisdictions enforcing single-use plastic bans. Key driving factors include the escalating global implementation of plastic prohibitions (e.g., in the EU, specific US states, and major Asian economies), the increasing volume of global beverage consumption, and aggressive R&D investments by manufacturers to overcome the historical performance limitations (e.g., sogginess, texture) of paper and plant-based alternatives, making them commercially viable substitutes for plastic.

Disposable Straw Market Executive Summary

The Disposable Straw Market is characterized by a profound transition from commoditized, low-cost plastic production to a highly specialized, innovation-driven sector focused on sustainable materials. Business trends highlight strategic investments in pulp and paper processing facilities capable of producing high-performance, food-grade paper straws, alongside the development of advanced bioplastics like PHA (polyhydroxyalkanoates) that offer superior biodegradability compared to earlier PLA formulations. Manufacturers are increasingly forming strategic partnerships with raw material suppliers and major food service chains to secure large-volume contracts, prioritizing scalability and stable pricing for sustainable options. A significant trend involves the development of specialized coatings and multi-ply structures for paper straws to enhance durability in diverse beverage applications, including hot drinks and thick milkshakes.

Regional trends indicate substantial market divergence based on regulatory maturity. Europe and North America, particularly specific coastal and state jurisdictions, serve as the primary growth engines for advanced sustainable straw adoption due to early and strict enforcement of single-use plastic prohibitions, driving demand for premium paper and certified compostable products. Conversely, the Asia Pacific (APAC) region, while representing the largest volume market globally due to sheer population and consumer base, presents a mixed regulatory landscape. While countries like India and China have implemented significant bans, rapid urbanization and reliance on cost-effective, high-volume disposable solutions mean that the penetration rate of high-cost sustainable alternatives remains uneven, though growing rapidly, offering immense future growth potential.

Segment trends confirm the rapid displacement of the traditional plastic segment. The paper straw segment is currently dominating growth, benefiting from established infrastructure and relative cost-effectiveness compared to complex bioplastics, despite ongoing challenges related to performance. The compostable/PLA segment is seeing increased scrutiny regarding industrial composting requirements, spurring innovation toward home-compostable and marine-degradable materials. The food service application segment, encompassing QSRs and restaurants, remains the largest end-user, but the institutional segment is exhibiting accelerated adoption, driven by large-scale public tenders and corporate sustainability mandates. The premium beverage sector is focusing heavily on aesthetics and user experience, incorporating features like flavored straws or those made from premium, durable materials like bamboo or wheat stems for specialized markets.

AI Impact Analysis on Disposable Straw Market

User queries regarding the impact of Artificial Intelligence (AI) on the Disposable Straw Market primarily revolve around how AI can enhance supply chain efficiency, optimize material innovation, and improve regulatory compliance tracking in a rapidly changing legislative environment. Common user concerns focus on whether AI can accurately predict shifts in consumer preference towards specific sustainable materials, thereby reducing inventory waste, or if AI-driven manufacturing processes can lower the currently high production costs of non-plastic alternatives, making them more competitive against illicitly supplied plastic straws. Expectations center on utilizing machine learning for predictive maintenance in complex paper straw manufacturing lines, ensuring consistent quality, and deploying image recognition systems to monitor waste streams and recycling infrastructure effectiveness, linking product design directly to end-of-life metrics.

Specifically in raw material sourcing and research, AI is being leveraged to accelerate the discovery and testing of novel biodegradable polymers and bio-coatings. Machine learning algorithms can analyze vast datasets concerning molecular structure, environmental degradation rates, and material performance under various temperature and humidity conditions, significantly shortening the R&D cycle for sustainable materials that meet both performance and ecological standards. Furthermore, in logistics and distribution, AI optimization algorithms are crucial for managing the complex international supply chains inherent in sustainable sourcing (e.g., sourcing specialized pulp, bamboo, or starch components), dynamically adjusting inventory levels based on real-time regulatory changes in different global markets, and minimizing carbon emissions associated with transportation.

For manufacturers, the deployment of AI-powered quality control systems using computer vision is essential for ensuring that high-speed production of paper and compostable straws maintains tight dimensional tolerances and structural integrity, preventing flaws like premature breakdown or irregular diameter which negatively impact consumer experience. Moreover, AI aids in sophisticated market forecasting, allowing companies to strategically scale up production of materials that are likely to receive future regulatory favor, mitigating the risk of obsolescence associated with materials like PLA, whose future viability depends heavily on expanding industrial composting infrastructure. This proactive, data-driven approach positions companies to maintain compliance and capitalize on shifting consumer demands efficiently.

- AI optimizes supply chain logistics, predicting material demand and reducing inventory holding costs for sustainable raw inputs.

- Machine learning accelerates R&D for next-generation biodegradable coatings and novel plant-based polymers.

- AI-powered predictive maintenance minimizes downtime in high-speed manufacturing lines for complex paper and bioplastic products.

- Computer vision systems enhance quality control, ensuring structural consistency and preventing defects in sustainable straw batches.

- AI algorithms assist in real-time regulatory compliance mapping, directing distribution efforts to markets aligned with product certifications.

- Data analytics platforms predict consumer shifts towards specific materials (e.g., away from PLA towards PHA or cellulose) based on socio-economic and environmental reporting.

- Smart manufacturing integrates resource usage optimization, potentially reducing the energy and water footprint associated with paper pulp processing.

DRO & Impact Forces Of Disposable Straw Market

The Disposable Straw Market is primarily propelled by stringent global regulatory changes banning single-use plastic items, coupled with powerful consumer-led movements advocating for environmentally responsible consumption. These drivers necessitate immediate innovation and high capital investment in alternative materials, creating a powerful market pull. However, the market faces significant restraints, chiefly the substantially higher cost base of sustainable alternatives compared to traditional plastic, which pressures profit margins, especially for high-volume, low-margin food service providers. Additionally, performance compromises, such as the perceived lack of durability or texture issues with current paper and plant-based straws, occasionally lead to consumer dissatisfaction and resistance in certain applications, tempering adoption rates. These simultaneous drivers and restraints create a high-impact force environment characterized by volatile material sourcing costs and rapid technological iteration.

Opportunities within the market center on advancements in marine-degradable and home-compostable technologies, effectively solving the "end-of-life" disposal complexity that plagues many current bioplastics requiring industrial facilities. Geographically, emerging economies in APAC and Latin America present massive untapped potential as environmental consciousness grows and regional governments begin phased-in plastic bans, requiring sustainable solutions at scale. Furthermore, diversification into specialized, niche products—such as straws designed for specific beverage viscosities (e.g., boba/bubble tea straws made from durable, certified compostable material) or highly aesthetic, branded solutions—allows premium pricing and market differentiation beyond simple commodity status. Strategic acquisition of raw material patents and vertical integration are key competitive strategies currently being pursued.

The principal impact forces shaping the market trajectory include regulatory pressure (the strongest force, dictating market existence), evolving material science capabilities, and fluctuating raw material commodity prices (e.g., wood pulp, starch). The collective power of these forces is accelerating market transformation, forcing companies to move away from legacy business models towards sustainable, high-tech manufacturing processes. This rapid evolution means that companies that successfully manage the cost-performance trade-off of sustainable straws and establish resilient, eco-certified supply chains are poised for substantial market leadership, while those reliant on delayed plastic phase-outs risk sudden regulatory exclusion and market loss.

Segmentation Analysis

The segmentation of the Disposable Straw Market is primarily defined by the material composition, reflecting the profound shift from traditional petroleum-based products to innovative sustainable alternatives, which now drive all growth metrics. Secondary segmentations focus on the physical attributes, such as diameter and length, crucial for suitability across different beverage types (standard drinks vs. thick shakes or bubble tea), and the end-user application, highlighting the intense demand from the Quick Service Restaurant (QSR) sector versus the more specialized, quality-focused institutional or premium hospitality sectors. Analyzing these segments provides critical insights into manufacturing priorities and necessary product specifications required for market penetration in specific verticals.

- By Material:

- Paper Straws (Coated, Uncoated, Multi-ply)

- Plastic Straws (PP, PET - rapidly declining)

- Compostable/Biodegradable Straws (PLA, CPLA, PHA, Starch-based)

- Natural Fiber/Plant-based (Bamboo, Wheat Stem, Sugarcane Bagasse)

- By Diameter:

- Standard/Jumbo (under 6mm)

- Cocktail/Small (2-4mm)

- Jumbo/Large (6-8mm)

- Bubble Tea/Milkshake (8mm+)

- By Application:

- Food Service (QSRs, Full-service Restaurants, Cafes)

- Institutional (Hospitals, Schools, Corporate Offices)

- Retail/Household Use

- By Distribution Channel:

- Direct Sales (B2B to large chains)

- Distributors/Wholesalers

- E-commerce

Value Chain Analysis For Disposable Straw Market

The Value Chain for the Disposable Straw Market has become increasingly complex due to the shift towards sustainable materials, requiring specialized sourcing and manufacturing expertise. Upstream activities are dominated by the acquisition and processing of raw materials. For paper straws, this involves securing certified food-grade pulp (often from sustainable forestry sources like FSC-certified suppliers), along with high-performance, non-toxic adhesives and water-resistant coatings. For bioplastics, the upstream stage involves sourcing and refining natural polymers (e.g., corn starch, sugarcane, or advanced fermentation-derived materials like PHA), demanding significant investment in biotechnological processing capabilities. The cost and stability of these raw materials directly influence the final product price and market competitiveness.

Midstream activities involve the specialized manufacturing and conversion processes. This includes high-speed extrusion, molding, or wrapping/gluing operations. For paper straws, precision cutting and rolling techniques are critical to ensure durability and consistency, requiring highly automated machinery. Quality control (QC) is vital at this stage to test structural integrity, liquid resistance, and compliance with food contact safety standards. Downstream activities focus on packaging, logistics, and distribution. Packaging must be efficient, hygienic, and often tailored to specific client needs (e.g., individual wrapping for hygiene in QSRs, or bulk packaging for institutional use). Effective inventory management is paramount, particularly given the shorter shelf life or sensitivity to moisture of some sustainable materials.

The distribution channel landscape involves both Direct and Indirect pathways. Direct sales are common for major manufacturers targeting large multinational QSR chains or institutional buyers, allowing for tailored contracts, centralized quality assurance, and high-volume, predictable sales. Indirect channels rely on a vast network of food service distributors and wholesalers (e.g., Sysco, US Foods) who aggregate orders from thousands of smaller independent restaurants, cafes, and hospitality businesses. E-commerce platforms are increasingly serving smaller household and retail segments, offering a wide array of specialized, premium sustainable options. Success in this fragmented market relies on robust channel management and the ability to fulfill high-volume orders efficiently while managing diverse regulatory requirements across various geographic markets.

Disposable Straw Market Potential Customers

Potential customers for the Disposable Straw Market are primarily large-scale commercial entities that generate high volumes of beverage consumption requiring convenience and hygiene standards. The largest segment remains the Quick Service Restaurant (QSR) sector, including global burger chains, coffee giants, and international snack retailers, who prioritize cost-efficiency, high-speed dispensing, and mandatory compliance with local single-use plastic regulations. Following closely are the broader hospitality and tourism industries, including hotels, resorts, and cruise lines, which require high-quality, often branded, disposable items to maintain guest standards and meet internal corporate sustainability goals, often favoring premium paper or durable bioplastic alternatives.

Institutional buyers represent another critical segment, encompassing healthcare facilities (hospitals), educational institutions (universities and schools), and large corporate campuses. For these buyers, accessibility (ensuring straws are available for individuals with disabilities) and strict hygiene protocols are primary purchasing criteria, alongside compliance with local government procurement sustainability mandates. These customers typically operate through centralized bidding processes, seeking long-term, stable supply contracts for large quantities of certified products.

Finally, the rapidly expanding convenience retail and e-commerce food delivery sectors are increasingly crucial end-users. Convenience stores and gas stations require durable, individually wrapped straws for grab-and-go beverages, while the explosive growth of third-party food and beverage delivery services (like DoorDash, Uber Eats) has amplified the demand for disposable, robust packaging components that survive transit without degradation. These diverse end-users necessitate a highly flexible product portfolio capable of meeting requirements spanning ultra-low cost high-volume (QSR) to premium, customized, high-performance needs (specialty coffee shops).

| Report Attributes | Report Details |

|---|---|

| Market Size in 2026 | $1.8 Billion |

| Market Forecast in 2033 | $3.5 Billion |

| Growth Rate | 9.8% CAGR |

| Historical Year | 2019 to 2024 |

| Base Year | 2025 |

| Forecast Year | 2026 - 2033 |

| DRO & Impact Forces |

|

| Segments Covered |

|

| Key Companies Covered | Huhtamaki, Dart Container Corporation, Hoffmaster Group, Fuling Global Inc., Aardvark Straws, Tetra Pak, BioPak, Eco-Products, Stone Straw, Zhejiang E-Sun, Sino Holdings, Transcend Packaging, Pactiv Evergreen, Lollicup USA, Nippon Paper Industries, Bioraj, The Paper Straw Company, Green Planet Products, Straws & Stripes, Bambu |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Enquiry Before Buy | Have specific requirements? Send us your enquiry before purchase to get customized research options. Request For Enquiry Before Buy |

Disposable Straw Market Key Technology Landscape

The technological landscape of the Disposable Straw Market is highly dynamic, driven by the imperative to replicate the low cost and high performance of plastic using environmentally benign materials. A core technological focus is the development of advanced paper processing and coating techniques. This involves multi-ply paper rolling machines capable of higher density and tighter spiral winding to improve structural rigidity. Crucially, R&D is heavily invested in barrier coatings, moving away from petroleum-derived waxes and toward certified biodegradable and compostable alternatives, such as advanced aqueous coatings or specialized natural resins, which prevent the straw from degrading prematurely when exposed to liquid, heat, or high acidity beverages. Consistency in these coatings is vital for maintaining mass market acceptance.

Another major technological front lies in the field of bioplastics and fermentation technology. While earlier generations relied heavily on PLA (derived from starches), which requires specific industrial composting conditions, current innovation targets PHA (polyhydroxyalkanoates). PHA is derived from microbial fermentation of organic waste streams and possesses superior physical properties, crucially offering genuine marine degradability. This technology requires substantial capital investment in fermentation and purification facilities but represents a significant leap forward in addressing the end-of-life disposal problem, positioning it as a potentially long-term sustainable replacement for traditional plastic polymers in durable disposable applications.

Furthermore, technology is applied to optimizing the manufacturing process itself. High-speed, precision automation, often integrated with AI-driven quality assurance systems, is essential to minimize waste and maximize output velocity, thereby driving down the unit cost of sustainable alternatives. Additionally, the development of injection molding techniques for plant-based materials like sugarcane bagasse and wheat straw fiber allows for the creation of unique shapes and specialized functionality (e.g., bending straws or specialized caps) that were previously difficult or cost-prohibitive to achieve with paper-based solutions, allowing for better customization for high-value QSR partners seeking unique branding opportunities and improved user experience.

Regional Highlights

The global Disposable Straw Market exhibits heterogeneous growth patterns strongly correlated with regional legislative action and economic maturity. Understanding these regional dynamics is paramount for strategic market entry and supply chain planning, especially concerning the complex logistics of sourcing and distributing certified sustainable materials.

-

North America: This region is a mature, high-value market characterized by rapid innovation, particularly in US states and Canadian provinces that have enacted comprehensive plastic bans. Demand is overwhelmingly skewed towards high-performance paper and bioplastic alternatives. The market is highly sensitive to corporate sustainability reporting and is dominated by large QSR chains demanding reliable supply and consistent product quality. Adoption rates are high, though price sensitivity remains a factor in lower-margin segments.

The stringent regulatory environment, especially in coastal states like California and New York, drives investment into marine-degradable solutions, creating a strong market for premium, certified compostable products. The institutional sector (universities, corporate catering) in the US is rapidly converting away from legacy plastic, providing reliable, high-volume contracts for compliant suppliers. Competitive advantage is gained through robust supply chain transparency and verifiable environmental claims.

The U.S. market, in particular, demonstrates a strong preference for functional consistency, meaning manufacturers must invest heavily in proprietary coatings to ensure paper straws do not disintegrate prematurely in ice-cold sodas or milkshakes, a technical challenge that remains a significant hurdle for universal adoption across all beverage types. Canada follows similar legislative trends, focusing heavily on national strategies to eliminate single-use plastics entirely.

-

Europe: Europe represents the global benchmark for regulatory-driven market transformation due to the implementation of the Single-Use Plastics Directive (SUPD), which effectively eliminated most plastic straws across the European Union. This has resulted in a near-complete conversion to certified compostable and paper straws, solidifying Europe as the largest consumer of premium, eco-friendly alternatives. Germany, France, and the UK are primary consumers, prioritizing EU-compliant labeling and stringent biodegradability standards (e.g., EN 13432 certification).

The market environment is highly competitive, with numerous local manufacturers leveraging proximity to source sustainable European pulp. Emphasis is placed not just on the straw material, but on the overall packaging and logistics footprint, aligning with ambitious decarbonization goals. Manufacturers succeeding in Europe must demonstrate full lifecycle assessment compliance and robust traceability of raw materials. Cost differences between paper and plastic are less of a competitive factor here than in other regions, given the regulatory exclusion of plastic.

A key challenge in Southern European countries is infrastructure variability; while demand for bioplastics is high, the accessibility of industrial composting facilities is uneven, leading consumers and businesses to increasingly seek out home-compostable solutions, creating an emerging high-growth niche within the region. Innovation focus includes optimizing high-speed manufacturing processes to meet the persistent demand spikes generated by regulatory timelines.

-

Asia Pacific (APAC): APAC is projected to be the fastest-growing market in volume due to dense populations, rapid urbanization, and massive food service expansion, particularly in emerging economies. The region is highly diversified; major markets like China and India have implemented significant national or municipal plastic bans, spurring rapid domestic manufacturing of alternatives, often at highly competitive prices. However, plastic leakage remains high in Southeast Asian countries where enforcement is often challenging.

The unique QSR and specialty beverage markets, such as the massive bubble tea industry prevalent across East and Southeast Asia, require specialized, large-diameter, durable straw solutions. Meeting this demand with sustainable, non-plastic alternatives (often customized PLA or robust sugarcane bagasse straws) is a key growth area. Price sensitivity in APAC is generally higher than in Western markets, meaning cost optimization for sustainable materials is critical for mass penetration.

Japan and South Korea represent mature APAC markets, focusing on high-quality, aesthetically pleasing sustainable products, often integrating Japanese paper technology for superior texture and strength. Investment in local biodegradable material production, particularly utilizing indigenous agricultural waste streams (like rice husks), is a rising trend, reducing reliance on global pulp markets and enhancing circular economy initiatives.

-

Latin America (LATAM) and Middle East & Africa (MEA): These regions are characterized by nascent but rapidly developing market structures. Brazil, Mexico, and certain UAE states are emerging as leaders through specific urban or national bans targeting single-use plastics in tourism and hospitality sectors. Growth here is primarily driven by tourism industry standards and international corporate presence demanding compliance with global environmental policies.

In LATAM, the challenge lies in scaling sustainable production domestically and competing with imported, cost-effective plastic solutions where bans are not universally enforced. Opportunities exist for manufacturers who can establish local processing plants utilizing regional agricultural byproducts. The MEA region, particularly the Gulf Cooperation Council (GCC) countries, shows increasing demand tied to large infrastructure projects, global events (like expos and sports tournaments), and high-end hospitality, favoring imported, certified premium paper and bioplastic options.

Logistical challenges and high import duties sometimes restrict the adoption of premium sustainable straws in these regions, necessitating a focus on efficient, resilient supply chains and materials that withstand high heat and humidity conditions without structural degradation during storage or use.

Top Key Players

The market research report includes a detailed profile of leading stakeholders in the Disposable Straw Market. These companies are driving innovation in sustainable material science, optimizing high-speed manufacturing, and establishing robust global distribution networks.- Huhtamaki

- Dart Container Corporation

- Hoffmaster Group

- Fuling Global Inc.

- Aardvark Straws

- Tetra Pak

- BioPak

- Eco-Products

- Stone Straw

- Zhejiang E-Sun

- Sino Holdings

- Transcend Packaging

- Pactiv Evergreen

- Lollicup USA

- Nippon Paper Industries

- Bioraj

- The Paper Straw Company

- Green Planet Products

- Straws & Stripes

- Bambu

- Sulapac

- TIPA Corp

- Novolex

- Genpak LLC

- Karstedt Partners

Frequently Asked Questions

Analyze common user questions about the Disposable Straw market and generate a concise list of summarized FAQs reflecting key topics and concerns.What is driving the transition from plastic to sustainable disposable straws?

The transition is primarily driven by global regulatory mandates, such as the EU Single-Use Plastics Directive, coupled with high consumer and corporate demand for environmentally responsible products to mitigate ocean plastic pollution. Manufacturers are responding by focusing on certified compostable and fiber-based alternatives.

Are paper straws truly biodegradable, and what are the main performance issues?

Yes, certified paper straws are generally biodegradable and compostable. The main performance issues relate to structural integrity; they can soften or disintegrate prematurely in liquids, especially acidic or hot beverages, necessitating advanced, yet eco-friendly, barrier coatings and multi-ply construction to ensure durability.

What role do bioplastics like PLA and PHA play in the disposable straw market?

Bioplastics offer functional performance closer to traditional plastic. PLA (Polylactic Acid) is starch-based but typically requires industrial composting facilities. PHA (Polyhydroxyalkanoates) represents the next generation, offering superior marine degradability and is often seen as a critical long-term solution for compliance in strict regulatory environments.

How is the cost of sustainable disposable straws impacting QSR profitability?

Sustainable straws currently have a significantly higher unit cost than legacy plastic straws, which pressures the profit margins of Quick Service Restaurants (QSRs) operating on high volumes and low margins. Companies are investing in automation and vertical integration to reduce this cost differential and improve commercial viability at scale.

Which geographical region leads the global demand for advanced sustainable straw technology?

Europe, driven by the strict implementation of the Single-Use Plastics Directive (SUPD), currently leads the global demand for and adoption of certified compostable and high-performance paper straw technology, serving as a primary innovation hub for materials and manufacturing processes.

To check our Table of Contents, please mail us at: sales@marketresearchupdate.com

Research Methodology

The Market Research Update offers technology-driven solutions and its full integration in the research process to be skilled at every step. We use diverse assets to produce the best results for our clients. The success of a research project is completely reliant on the research process adopted by the company. Market Research Update assists its clients to recognize opportunities by examining the global market and offering economic insights. We are proud of our extensive coverage that encompasses the understanding of numerous major industry domains.

Market Research Update provide consistency in our research report, also we provide on the part of the analysis of forecast across a gamut of coverage geographies and coverage. The research teams carry out primary and secondary research to implement and design the data collection procedure. The research team then analyzes data about the latest trends and major issues in reference to each industry and country. This helps to determine the anticipated market-related procedures in the future. The company offers technology-driven solutions and its full incorporation in the research method to be skilled at each step.

The Company's Research Process Has the Following Advantages:

- Information Procurement

The step comprises the procurement of market-related information or data via different methodologies & sources.

- Information Investigation

This step comprises the mapping and investigation of all the information procured from the earlier step. It also includes the analysis of data differences observed across numerous data sources.

- Highly Authentic Source

We offer highly authentic information from numerous sources. To fulfills the client’s requirement.

- Market Formulation

This step entails the placement of data points at suitable market spaces in an effort to assume possible conclusions. Analyst viewpoint and subject matter specialist based examining the form of market sizing also plays an essential role in this step.

- Validation & Publishing of Information

Validation is a significant step in the procedure. Validation via an intricately designed procedure assists us to conclude data-points to be used for final calculations.

×

Request Free Sample:

Related Reports

Select License

Why Choose Us

We're cost-effective and Offered Best services:

We are flexible and responsive startup research firm. We adapt as your research requires change, with cost-effectiveness and highly researched report that larger companies can't match.

Information Safety

Market Research Update ensure that we deliver best reports. We care about the confidential and personal information quality, safety, of reports. We use Authorize secure payment process.

We Are Committed to Quality and Deadlines

We offer quality of reports within deadlines. We've worked hard to find the best ways to offer our customers results-oriented and process driven consulting services.

Our Remarkable Track Record

We concentrate on developing lasting and strong client relationship. At present, we hold numerous preferred relationships with industry leading firms that have relied on us constantly for their research requirements.

Best Service Assured

Buy reports from our executives that best suits your need and helps you stay ahead of the competition.

Customized Research Reports

Our research services are custom-made especially to you and your firm in order to discover practical growth recommendations and strategies. We don't stick to a one size fits all strategy. We appreciate that your business has particular research necessities.

Service Assurance

At Market Research Update, we are dedicated to offer the best probable recommendations and service to all our clients. You will be able to speak to experienced analyst who will be aware of your research requirements precisely.

Contact With Our Sales Team

Customer Testimonials

The content of the report is always up to the mark. Good to see speakers from expertise authorities.

Privacy requested , Managing Director

A lot of unique and interesting topics which are described in good manner.

Privacy requested, President

Well researched, expertise analysts, well organized, concrete and current topics delivered in time.

Privacy requested, Development Manager