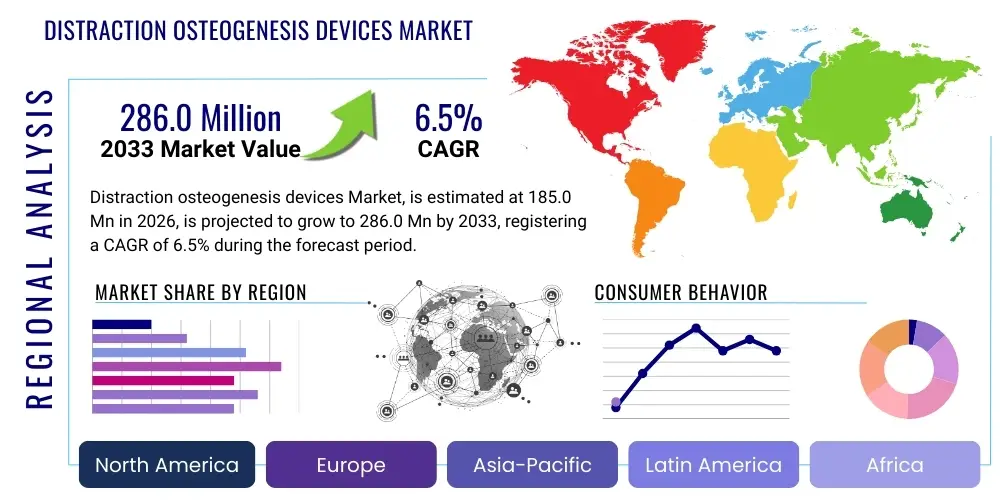

Distraction osteogenesis devices Market Size, By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2026 to 2033 (Financial Impact Analysis)

ID : MRU_ 443166 | Date : Feb, 2026 | Pages : 257 | Region : Global | Publisher : MRU

Distraction osteogenesis devices Market Size

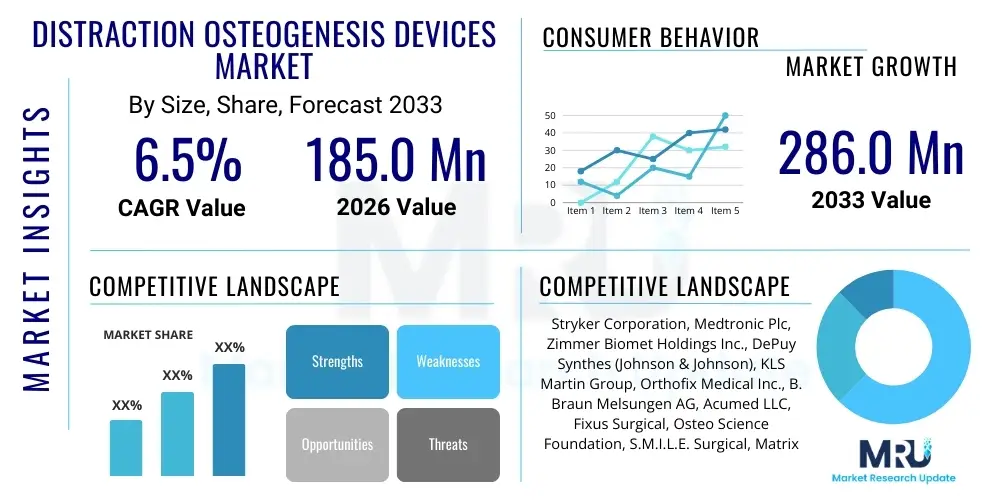

The Distraction osteogenesis devices Market is projected to grow at a Compound Annual Growth Rate (CAGR) of 6.5% between 2026 and 2033. The market is estimated at $185.0 Million in 2026 and is projected to reach $286.0 Million by the end of the forecast period in 2033. This consistent growth trajectory is driven by the increasing prevalence of craniofacial defects, orthopedic trauma, and advancements in bio-compatible materials used in device manufacturing, positioning distraction osteogenesis (DO) as a critical technique in reconstructive surgery globally.

Distraction osteogenesis devices Market introduction

The Distraction Osteogenesis (DO) devices market encompasses specialized surgical instruments and implants designed to facilitate the process of gradual bone regeneration by separating two bone segments. This technique, fundamentally distinct from traditional bone grafting, is utilized extensively in maxillofacial surgery, orthopedic reconstruction, and limb lengthening procedures. The product portfolio includes internal distractors, external distractors, resorbable devices, and hybrid systems, catering to diverse anatomical locations such as the mandible, maxilla, craniofacial vault, and long bones. Major applications span corrective procedures for congenital defects like cleft lip and palate, post-traumatic bone loss reconstruction, and cosmetic or functional limb lengthening, offering patients minimally invasive solutions with improved outcomes compared to conventional techniques.

The primary benefits of utilizing distraction osteogenesis devices include the creation of viable, naturally generated bone tissue, reduction in the need for donor site morbidity associated with bone grafting, and the ability to correct complex 3D skeletal deformities with precision and stability. Furthermore, DO allows for simultaneous stretching of adjacent soft tissues (muscles, nerves, and skin), mitigating the risks of soft tissue contracture often seen in acute corrective surgeries. Driving factors for market expansion include escalating global demand for aesthetic and reconstructive craniofacial surgeries, technological innovations such as computerized planning and customized devices, and the expanding adoption of minimally invasive surgical approaches facilitated by modern device designs.

The market landscape is characterized by continuous research and development focused on creating smaller, lighter, and more bio-integrated devices, particularly focusing on internal distraction systems that enhance patient comfort and reduce the risk of infection associated with external frames. Increasing healthcare expenditure in emerging economies and rising awareness regarding effective treatments for skeletal deformities further propel market growth. However, challenges related to the complexity of the procedure and the requirement for extensive post-operative monitoring necessitate specialized surgical expertise, which acts as a latent barrier to widespread adoption in low-resource settings.

Distraction osteogenesis devices Market Executive Summary

The Distraction osteogenesis devices market is exhibiting robust growth, propelled by strong clinical evidence supporting the efficacy of DO in complex skeletal reconstruction and the shifting preference toward internal fixation devices which offer enhanced patient compliance. Current business trends indicate a concentrated effort by key players to develop patient-specific solutions, leveraging 3D printing and advanced materials like PEEK and bio-resorbable polymers, thereby commanding premium pricing and expanding application areas beyond traditional maxillofacial procedures into complex orthopedic trauma and pediatric reconstruction. Strategic alliances, mergers, and acquisitions focused on integrating specialized technology portfolios are central to maintaining market competitiveness, particularly in penetrating rapidly expanding Asian Pacific markets where demand for aesthetic and corrective surgeries is surging.

Regionally, North America continues to dominate the market due to established reimbursement policies, high levels of surgical expertise, and significant investment in clinical research and advanced healthcare infrastructure. However, the Asia Pacific region is forecast to demonstrate the highest Compound Annual Growth Rate (CAGR), driven by increasing medical tourism, a large population base requiring corrective procedures, and improving accessibility to specialized orthopedic and plastic surgery centers, notably in China and India. Europe maintains a strong foothold, characterized by stringent regulatory environments ensuring high product quality and technological adoption focused on reducing treatment timelines and improving long-term stability outcomes.

Segment trends reveal that the application segment is heavily influenced by the adoption in craniofacial and maxillofacial surgeries, which account for the largest market share owing to the high incidence of congenital deformities and corrective jaw surgeries. Conversely, the long bone segment, encompassing limb lengthening and correction of non-union fractures, is projected for rapid growth, underpinned by advancements in motorized and automated internal lengthening systems. Device segmentation highlights the increasing dominance of internal distraction systems over bulky external frames, particularly devices designed for minimally invasive placement, responding directly to patient demand for improved cosmesis and reduced post-operative complication rates.

AI Impact Analysis on Distraction osteogenesis devices Market

User queries regarding the intersection of Artificial Intelligence (AI) and Distraction Osteogenesis (DO) devices predominantly revolve around the optimization of surgical planning, prediction of bone regeneration outcomes, and automation of the distraction process. Users seek clarity on how AI algorithms can enhance the precision of personalized device placement, reduce procedural risks, and determine the optimal rate and rhythm of distraction specific to an individual patient’s biology. Key themes emerging from these inquiries include the potential for AI-driven image analysis (CT/MRI) to accurately model bone strain and stress during the procedure, thus preventing device failure or premature consolidation, and the integration of machine learning tools into intraoperative navigation systems to guide surgeons more accurately. Furthermore, there is significant interest in how AI can monitor post-operative progress through automated analysis of radiological data, signaling shifts in tissue response that allow for proactive clinical intervention and personalized rehabilitation protocols.

- AI enhances pre-operative planning through advanced 3D modeling and virtual surgical simulation, optimizing vector selection and predicting soft tissue changes.

- Machine learning algorithms process large datasets of patient demographics and anatomical measurements to personalize the rate and rhythm of bone distraction, maximizing regeneration efficiency.

- Integration of AI in surgical navigation systems improves the precise placement and fixation of internal distraction devices, reducing malpositioning errors.

- Automated radiological assessment tools powered by deep learning enable continuous, objective monitoring of callus formation and consolidation, providing early alerts for potential complications.

- AI contributes to device design by optimizing material properties and mechanical specifications based on predicted patient-specific load bearing requirements and bio-integration characteristics.

- Predictive analytics assists clinicians in assessing long-term functional outcomes and determining the optimal duration for device retention or removal.

- Generative design tools, often leveraging AI, accelerate the development of complex, customized distraction plates and fixation components suitable for intricate anatomical geometries.

DRO & Impact Forces Of Distraction osteogenesis devices Market

The Distraction Osteogenesis devices market is significantly influenced by a dynamic interplay of market drivers, procedural restraints, and strategic opportunities, all mediated by critical impact forces encompassing technological progress and regulatory scrutiny. Key drivers include the rising global incidence of congenital craniofacial malformations such as micrognathia and cleft-related bone deficiencies, coupled with the increasing volume of reconstructive surgeries following trauma, oncological resections, or infection-related bone loss. The proven clinical advantages of DO over traditional grafting methods—such as simultaneous soft tissue expansion and reduced donor site morbidity—firmly establish its position as the preferred method for complex bone defects, particularly in pediatric orthopedics where growth potential is maximized. Furthermore, the continuous introduction of minimally invasive, patient-friendly internal distraction devices and advanced external fixation systems offering greater adjustability significantly mitigates historical compliance issues, accelerating market adoption.

However, substantial restraints impede unchecked market growth. Distraction osteogenesis procedures are technically complex, demanding highly specialized surgical training and comprehensive post-operative management, limiting its adoption in facilities lacking advanced surgical expertise and infrastructure. The relatively lengthy treatment duration, spanning several weeks to months of active distraction and consolidation, necessitates high patient compliance and consistent monitoring, which can be challenging in certain populations. Moreover, the high cost associated with advanced internal distraction systems, including computerized and motorized variants, and the limited reimbursement coverage in some developing economies, restrict market penetration, particularly for elective cosmetic procedures like aesthetic limb lengthening.

Opportunities for exponential market expansion lie primarily in leveraging advanced manufacturing techniques, specifically 3D printing and Computer-Aided Design (CAD), to create fully customized, patient-specific devices that minimize operating time and improve anatomical fit. The expansion of DO applications into challenging areas such as spinal column reconstruction and treatment of osteonecrosis offers new revenue streams. Additionally, focusing research efforts on developing smart, bio-resorbable distraction devices that eliminate the need for secondary removal surgery and potentially integrate drug delivery capabilities for enhanced bone healing represents a significant long-term opportunity. The strategic pursuit of regulatory approvals in emerging markets characterized by large unmet medical needs further solidifies potential growth pathways, provided localized training programs are simultaneously established to address the skill gap.

The market impact forces are categorized into three primary elements: technological advancements, regulatory landscape shifts, and patient demand evolution. Technological progress in materials science, particularly the use of specialized titanium alloys, PEEK, and biodegradable polymers, directly influences device durability, biocompatibility, and integration ease. Changes in regulatory frameworks, especially those emphasizing medical device safety and efficacy validation (e.g., MDR in Europe, evolving FDA requirements), dictate the speed and cost of product commercialization. Finally, evolving patient demand for improved cosmesis, reduced pain, shorter hospitalization, and faster recovery drives the industry towards internal, customized, and automated systems, forcing manufacturers to innovate aggressively to meet these expectations and maintain competitive advantage in a highly specialized surgical niche.

Segmentation Analysis

The Distraction Osteogenesis Devices Market is segmented primarily based on the product type, application area, mechanism, and end-user. Analyzing these segments provides a nuanced understanding of market dynamics, revealing where technological innovation is most impactful and where demand concentration is highest. The core product segmentation differentiates between highly sophisticated internal distraction systems, which offer superior aesthetic results and patient comfort, and external fixators, which remain critical for long bone reconstruction and complex, high-magnitude corrections. Application segmentation highlights the critical role of DO in craniofacial procedures, which traditionally holds the largest market share, alongside the rapidly evolving orthopedic applications, particularly in trauma and pediatric limb reconstruction.

The mechanism segment categorizes devices based on whether they are manually operated or utilize automated, often motorized, systems. Automated devices, while generally higher priced, reduce variability in the distraction process and improve compliance, thus experiencing faster growth in affluent regions. End-user analysis reveals that hospitals, equipped with the necessary high-acuity surgical theaters and comprehensive post-operative care units, remain the primary purchasers and consumers of these devices. However, specialized orthopedic and maxillofacial surgery centers are increasingly adopting advanced internal systems, positioning them as significant secondary end-users, especially for elective and technically complex procedures that require focused expertise and optimized patient throughput.

This segmented view underscores the market’s pivot towards internalization, customization, and automation. The high potential growth rate anticipated in the long bone reconstruction segment reflects the growing success of devices like intramedullary lengthening nails and specialized external ring fixators, addressing debilitating conditions such as skeletal dysplasias and severe limb length discrepancies. Investment strategies should therefore be tailored toward developing next-generation internal systems that offer greater biomechanical stability and are integrated with advanced monitoring technologies, ensuring they cater effectively to the specific needs of high-volume surgical centers seeking efficiency and superior clinical outcomes across all relevant anatomical applications.

- Product Type:

- Internal Distractors (Mandibular, Maxillary, Midface, Cranial Vault, Palatal)

- External Distractors (Monorail, Pin Fixation, Ring Fixation, Hybrid Systems)

- Mechanism:

- Manual/Mechanical Distractors

- Automated/Motorized Distractors (e.g., Intramedullary Lengthening Nails)

- Application:

- Craniofacial and Maxillofacial Applications (Mandibular Widening, Midface Advancement, Cleft Repair)

- Long Bone Reconstruction (Limb Lengthening, Non-union Correction, Deformity Correction)

- Small Bone Applications (Hand and Foot Reconstruction)

- Spinal Applications (Emerging)

- End-User:

- Hospitals and Surgical Centers

- Ambulatory Surgical Centers (ASCs)

- Specialized Orthopedic and Maxillofacial Clinics

Value Chain Analysis For Distraction osteogenesis devices Market

The value chain for the Distraction Osteogenesis devices market begins with upstream activities focused on the procurement and processing of high-quality raw materials, primarily medical-grade titanium alloys, stainless steel, and specialized polymers like PEEK (Polyetheretherketone) and bio-resorbable materials. Upstream analysis highlights the critical importance of secure supply chains for specialized materials and components, ensuring strict compliance with ISO standards for medical device manufacturing. Key value addition at this stage involves sophisticated metallurgical processing and precision machining necessary for creating the intricate and durable components required for both internal and external fixator systems. Suppliers of specialized micro-mechanics and automated components (motors, gears, and battery packs for motorized systems) hold significant leverage due to the specialized nature of these inputs and the high cost of quality assurance and regulatory clearance.

Midstream activities encompass research, design, manufacturing, and assembly. This is where the majority of intellectual property and competitive advantage resides, driven by complex CAD/CAM processes, 3D printing for patient-specific devices, and rigorous testing protocols to ensure biomechanical stability and longevity. Manufacturing efficiency, cleanroom assembly standards, and effective quality management systems are crucial for minimizing costs while maximizing compliance. Companies invest heavily in clinical trials and regulatory documentation to secure market access, particularly for novel motorized or bio-integrated devices. The ability to innovate rapidly in response to surgeon feedback regarding ease of use and long-term patient comfort is a key determinant of success in the midstream segment.

Downstream activities involve distribution, sales, and post-sales support. The distribution channel is often highly specialized, relying on dedicated medical device distributors who possess deep technical knowledge of orthopedic and maxillofacial procedures. Direct and indirect distribution strategies are both employed; large multinationals often favor direct sales channels in major, established markets (North America, Western Europe) to maintain margin control and direct relationship with key surgeons, while relying on indirect distributors for complex logistics and local regulatory navigation in emerging markets (APAC, MEA). Post-sales support, including surgical training programs, technical servicing of complex fixators, and clinical education, is essential, serving as a significant differentiator and a long-term revenue stream, given the technical nature of DO procedures and the specialized maintenance requirements for advanced internal devices.

Distraction osteogenesis devices Market Potential Customers

The primary end-users and potential customers for Distraction Osteogenesis devices are institutions and professionals specializing in reconstructive surgery, orthopedic trauma, and maxillofacial correction. The largest consumer group comprises general hospitals and university-affiliated medical centers, particularly those with dedicated departments for plastic and reconstructive surgery, pediatric orthopedics, and oral and maxillofacial surgery. These high-volume facilities require a wide range of devices, from standard external fixators for limb lengthening to specialized internal plates and screws for complex craniofacial reconstruction, often procured through centralized purchasing organizations or tenders, making long-term contractual agreements essential for manufacturers.

A rapidly growing segment of potential customers includes specialized orthopedic and trauma centers, especially those focusing on complex fracture management and correction of non-union or bone loss resulting from high-energy trauma. These centers prioritize advanced internal devices, such as telescoping intramedullary nails, due to the need for rapid patient mobilization and optimized functional recovery. Furthermore, private specialized surgical clinics, which often cater to elective procedures like aesthetic limb lengthening and complex cosmetic jaw surgeries, constitute a premium customer segment that often demands the latest, least invasive, and most aesthetically pleasing internal systems, driven by patient-centric care models and private funding mechanisms.

| Report Attributes | Report Details |

|---|---|

| Market Size in 2026 | $185.0 Million |

| Market Forecast in 2033 | $286.0 Million |

| Growth Rate | 6.5% CAGR |

| Historical Year | 2019 to 2024 |

| Base Year | 2025 |

| Forecast Year | 2026 - 2033 |

| DRO & Impact Forces |

|

| Segments Covered |

|

| Key Companies Covered | Stryker Corporation, Medtronic Plc, Zimmer Biomet Holdings Inc., DePuy Synthes (Johnson & Johnson), KLS Martin Group, Orthofix Medical Inc., B. Braun Melsungen AG, Acumed LLC, Fixus Surgical, Osteo Science Foundation, S.M.I.L.E. Surgical, Matrix Surgical USA, Integra LifeSciences, Piezosurgery Incorporated, Jeil Medical Corporation, Titamed GmbH, Custom Bone Inc., OsteoMed, Biomet Microfixation. |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Enquiry Before Buy | Have specific requirements? Send us your enquiry before purchase to get customized research options. Request For Enquiry Before Buy |

Distraction osteogenesis devices Market Key Technology Landscape

The technology landscape for the Distraction Osteogenesis devices market is rapidly evolving, moving beyond traditional mechanical systems towards sophisticated, integrated, and patient-specific solutions. A cornerstone of this evolution is the utilization of advanced materials science, focusing on creating devices from highly biocompatible and structurally robust materials such as specialized titanium alloys (e.g., Grade 5 and 9), PEEK, and innovative bio-resorbable polymers. These materials are chosen not only for their mechanical properties but also for their reduced artifact interference during post-operative imaging (especially PEEK) and the potential for complete biological integration or degradation (resorbable polymers), eliminating the need for a second device removal surgery, which is highly desirable for patient compliance and cost reduction.

Furthermore, digital technologies, particularly Computer-Aided Design (CAD), Computer-Aided Manufacturing (CAM), and 3D printing (Additive Manufacturing), are fundamentally transforming the design and production process. 3D printing enables the precise fabrication of patient-specific distractors and customized cutting guides, ensuring optimal anatomical fit and minimizing surgical time. This level of customization is crucial for complex, asymmetrical craniofacial defects. Planning software, often integrated with AI and Virtual Reality (VR), allows surgeons to perform virtual surgical rehearsals, accurately determine the distraction vector, and predict aesthetic and functional outcomes before entering the operating room, enhancing overall procedural safety and efficacy.

The most significant technological shift involves the development of automated and smart distraction systems. Motorized internal distractors, particularly those used in long bone lengthening (e.g., magnetic intramedullary nails), allow for non-invasive, precise control of the distraction rate via external remote controllers, greatly improving patient comfort and minimizing infection risk compared to percutaneous components. Future technological integration is expected to include sensors embedded within the devices to monitor local tissue strain, temperature, and bone regeneration progress in real-time. This real-time data feedback loop, managed potentially by external monitoring apps, will allow clinicians to adjust the distraction protocol dynamically, further optimizing biological outcomes and streamlining the healing process based on objective data rather than generalized protocols.

Regional Highlights

The global market for Distraction Osteogenesis devices demonstrates diverse growth patterns across key geographic regions, primarily influenced by healthcare expenditure, surgical expertise density, regulatory stringency, and prevalence rates of congenital or acquired deformities. North America, encompassing the United States and Canada, currently holds the largest market share. This dominance is attributed to robust healthcare infrastructure, high awareness and acceptance of advanced surgical techniques, substantial R&D investments leading to rapid technological adoption, and favorable reimbursement policies for complex reconstructive procedures. The U.S. remains the epicenter for innovation, particularly in the development and commercialization of motorized internal lengthening systems and patient-specific 3D-printed devices, driven by highly specialized maxillofacial and orthopedic surgeons.

Europe represents the second-largest market, characterized by stringent regulatory environments (such as the EU's Medical Device Regulation, MDR), ensuring high quality and safety standards. Western European countries, including Germany, the UK, and France, exhibit strong market penetration due to established medical technology manufacturing bases and high adoption rates of sophisticated distraction techniques in both publicly and privately funded healthcare systems. The focus in Europe often centers on clinical outcomes and long-term device stability, leading to strong growth in high-quality titanium and PEEK-based internal fixation systems, while Central and Eastern Europe are steadily increasing adoption as healthcare infrastructure modernization continues.

The Asia Pacific (APAC) region is projected to register the highest Compound Annual Growth Rate (CAGR) during the forecast period. This rapid expansion is fueled by expanding medical tourism, massive population pools leading to a high absolute number of congenital cases requiring correction, and rapidly improving healthcare accessibility and economic prosperity in key countries like China, India, Japan, and South Korea. While price sensitivity remains a factor, the increasing demand for high-end aesthetic procedures (e.g., cosmetic limb lengthening and orthognathic surgery) coupled with rising government investment in healthcare infrastructure are key drivers. Local manufacturers are intensely competitive, often focusing on producing cost-effective, high-quality devices tailored for regional market requirements, simultaneously driving down the average selling price and expanding overall market penetration.

Latin America and the Middle East & Africa (MEA) collectively represent nascent but rapidly growing markets. In Latin America, particularly Brazil and Mexico, market growth is primarily spurred by specialized clinics catering to orthopedic trauma and reconstructive plastic surgery, often supported by private healthcare financing and medical tourism initiatives. The MEA region is witnessing increasing adoption, specifically in the Gulf Cooperation Council (GCC) countries, due to significant government healthcare investments and the recruitment of international surgical talent. However, adoption in large parts of Africa remains constrained by infrastructural deficits, low per capita healthcare spending, and limited access to specialized surgical training, demanding a strategy focused on robust, cost-effective external and simpler internal fixation solutions.

- North America (U.S., Canada): Market leader due to advanced infrastructure, high R&D investment, rapid adoption of customized devices, and favorable reimbursement structures.

- Europe (Germany, UK, France): Strong, stable growth driven by strict regulatory standards, emphasis on quality, and established technological expertise in craniofacial and long bone reconstruction.

- Asia Pacific (China, India, Japan, South Korea): Fastest-growing market fueled by high prevalence of defects, increasing medical tourism, improving healthcare access, and a burgeoning demand for aesthetic procedures.

- Latin America (Brazil, Mexico): Growth driven by increasing surgical expertise, private healthcare sector expansion, and demand for complex trauma and cosmetic procedures.

- Middle East & Africa (GCC Nations): Emerging market expansion supported by government healthcare investments and growing penetration of specialized orthopedic centers.

Top Key Players

The market research report includes a detailed profile of leading stakeholders in the Distraction osteogenesis devices Market.- Stryker Corporation

- Medtronic Plc

- Zimmer Biomet Holdings Inc.

- DePuy Synthes (Johnson & Johnson)

- KLS Martin Group

- Orthofix Medical Inc.

- B. Braun Melsungen AG

- Acumed LLC

- Fixus Surgical

- Osteo Science Foundation

- S.M.I.L.E. Surgical

- Matrix Surgical USA

- Integra LifeSciences

- Piezosurgery Incorporated

- Jeil Medical Corporation

- Titamed GmbH

- Custom Bone Inc.

- OsteoMed

- Biomet Microfixation

- Tornier N.V. (now part of Wright Medical/Stryker)

Frequently Asked Questions

Analyze common user questions about the Distraction osteogenesis devices market and generate a concise list of summarized FAQs reflecting key topics and concerns.What are the primary clinical advantages of using Distraction Osteogenesis devices over traditional bone grafting?

Distraction Osteogenesis (DO) devices stimulate the creation of viable, natural new bone tissue, known as regenerate, minimizing the need for harvesting bone grafts from donor sites, thereby reducing associated morbidity. Crucially, DO also facilitates the simultaneous expansion of surrounding soft tissues (skin, muscles, nerves), which is essential for correcting large defects without tension or contracture.

How are 3D printing and customization impacting the future of Distraction Osteogenesis devices?

3D printing and Computer-Aided Design (CAD) allow for the rapid manufacture of patient-specific distraction devices and surgical guides. This customization ensures a perfect anatomical fit, minimizes intraoperative adjustments, optimizes the distraction vector, and ultimately reduces overall surgical time, leading to more predictable and superior functional outcomes for complex deformities.

Which device segment—internal or external distractors—is experiencing faster market growth?

The internal distractors segment is experiencing significantly faster market growth. This is driven by patient preference for enhanced cosmesis, greater comfort, and reduced risk of infection compared to external frames. Innovations, particularly motorized and minimally invasive internal systems, are further fueling adoption in both craniofacial and long bone reconstruction applications globally.

What are the main risks or restraints associated with the Distraction Osteogenesis procedure?

The primary restraints include the high technical complexity and requirement for specialized surgical training, the prolonged treatment period (distraction and consolidation phases), and the potential for device-related complications such as pin tract infections (for external devices), nerve damage, premature bone consolidation, or device failure if patient compliance is poor.

Which geographical region is projected to be the key growth engine for the DO devices market through 2033?

The Asia Pacific (APAC) region is projected to be the key growth engine, exhibiting the highest Compound Annual Growth Rate (CAGR). This acceleration is attributed to rapidly improving healthcare infrastructure, increasing prevalence rates of congenital defects, rising disposable incomes supporting elective cosmetic procedures, and expanding medical tourism within high-growth markets like China and India.

To check our Table of Contents, please mail us at: sales@marketresearchupdate.com

Research Methodology

The Market Research Update offers technology-driven solutions and its full integration in the research process to be skilled at every step. We use diverse assets to produce the best results for our clients. The success of a research project is completely reliant on the research process adopted by the company. Market Research Update assists its clients to recognize opportunities by examining the global market and offering economic insights. We are proud of our extensive coverage that encompasses the understanding of numerous major industry domains.

Market Research Update provide consistency in our research report, also we provide on the part of the analysis of forecast across a gamut of coverage geographies and coverage. The research teams carry out primary and secondary research to implement and design the data collection procedure. The research team then analyzes data about the latest trends and major issues in reference to each industry and country. This helps to determine the anticipated market-related procedures in the future. The company offers technology-driven solutions and its full incorporation in the research method to be skilled at each step.

The Company's Research Process Has the Following Advantages:

- Information Procurement

The step comprises the procurement of market-related information or data via different methodologies & sources.

- Information Investigation

This step comprises the mapping and investigation of all the information procured from the earlier step. It also includes the analysis of data differences observed across numerous data sources.

- Highly Authentic Source

We offer highly authentic information from numerous sources. To fulfills the client’s requirement.

- Market Formulation

This step entails the placement of data points at suitable market spaces in an effort to assume possible conclusions. Analyst viewpoint and subject matter specialist based examining the form of market sizing also plays an essential role in this step.

- Validation & Publishing of Information

Validation is a significant step in the procedure. Validation via an intricately designed procedure assists us to conclude data-points to be used for final calculations.

×

Request Free Sample:

Related Reports

Select License

Why Choose Us

We're cost-effective and Offered Best services:

We are flexible and responsive startup research firm. We adapt as your research requires change, with cost-effectiveness and highly researched report that larger companies can't match.

Information Safety

Market Research Update ensure that we deliver best reports. We care about the confidential and personal information quality, safety, of reports. We use Authorize secure payment process.

We Are Committed to Quality and Deadlines

We offer quality of reports within deadlines. We've worked hard to find the best ways to offer our customers results-oriented and process driven consulting services.

Our Remarkable Track Record

We concentrate on developing lasting and strong client relationship. At present, we hold numerous preferred relationships with industry leading firms that have relied on us constantly for their research requirements.

Best Service Assured

Buy reports from our executives that best suits your need and helps you stay ahead of the competition.

Customized Research Reports

Our research services are custom-made especially to you and your firm in order to discover practical growth recommendations and strategies. We don't stick to a one size fits all strategy. We appreciate that your business has particular research necessities.

Service Assurance

At Market Research Update, we are dedicated to offer the best probable recommendations and service to all our clients. You will be able to speak to experienced analyst who will be aware of your research requirements precisely.

Contact With Our Sales Team

Customer Testimonials

The content of the report is always up to the mark. Good to see speakers from expertise authorities.

Privacy requested , Managing Director

A lot of unique and interesting topics which are described in good manner.

Privacy requested, President

Well researched, expertise analysts, well organized, concrete and current topics delivered in time.

Privacy requested, Development Manager