Distribution Cabinets Market Size, By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2026 to 2033 (Financial Impact Analysis)

ID : MRU_ 442461 | Date : Feb, 2026 | Pages : 257 | Region : Global | Publisher : MRU

Distribution Cabinets Market Size

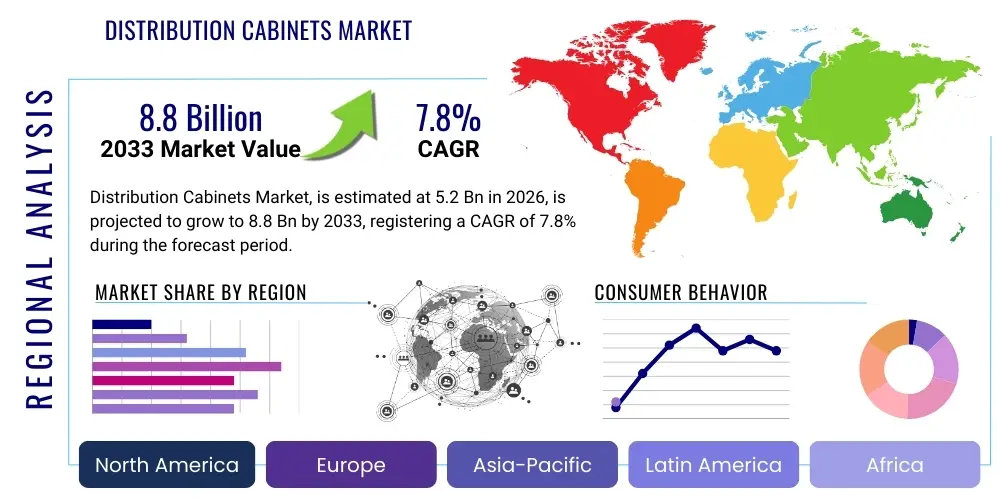

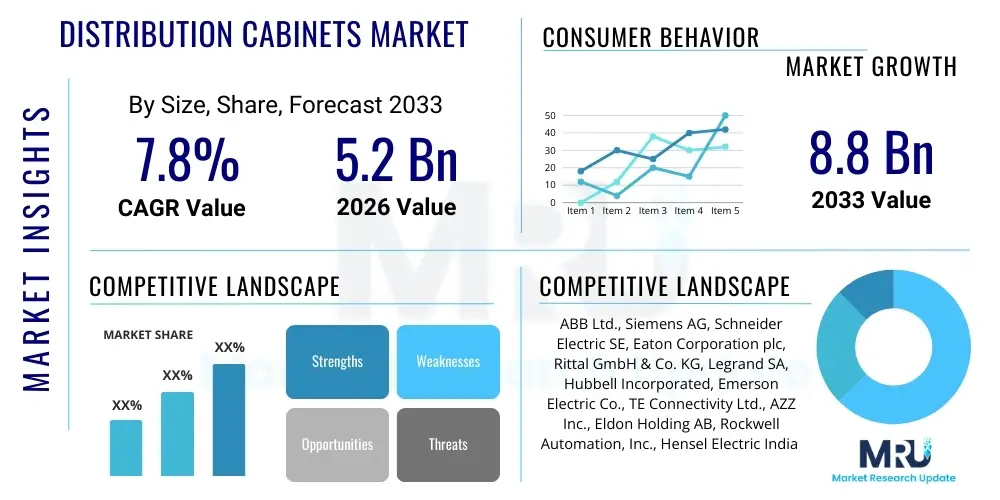

The Distribution Cabinets Market is projected to grow at a Compound Annual Growth Rate (CAGR) of 7.8% between 2026 and 2033. The market is estimated at USD 5.2 Billion in 2026 and is projected to reach USD 8.8 Billion by the end of the forecast period in 2033.

Distribution Cabinets Market introduction

Distribution cabinets, often referred to as electrical enclosures or switchgear cabinets, are critical components within electrical distribution systems. These robust enclosures house essential equipment such as circuit breakers, metering devices, wiring terminals, and protective relays, serving as the interface between power sources and end-user loads. Their primary function is to ensure the safe, organized, and reliable distribution of electrical power, protecting sensitive internal components from environmental factors like dust, moisture, and temperature fluctuations, while also safeguarding personnel from electrical hazards. Modern distribution cabinets are increasingly modular, customizable, and designed to integrate seamlessly with smart grid technologies and industrial automation systems, adapting to evolving electrical standards and infrastructure requirements across various sectors.

The major applications for distribution cabinets span across utility infrastructure, commercial buildings, industrial facilities, and telecommunications networks. In the utility sector, they are crucial for managing secondary distribution networks, providing overload protection and isolation capabilities. Within industrial settings, they support machine control, motor management centers, and process automation lines, requiring high ingress protection (IP) ratings and durability. The market benefits significantly from global urbanization trends, rapid development of smart cities, and the burgeoning demand for reliable electricity fueled by the integration of renewable energy sources, which necessitate more complex and intelligent distribution management solutions.

Key driving factors propelling the growth of this market include massive investments in modernizing aging electrical grids, particularly in developed economies, and aggressive infrastructure spending in emerging markets like the Asia Pacific region. Furthermore, stringent regulatory mandates concerning electrical safety and efficiency, coupled with the rising adoption of industrial IoT (IIoT) across manufacturing and utility operations, are pushing manufacturers toward developing smart distribution cabinets equipped with monitoring, diagnostic, and remote control capabilities. These advancements enhance operational efficiency, reduce downtime, and improve overall network resilience, cementing the role of distribution cabinets as foundational elements of modern energy systems.

Distribution Cabinets Market Executive Summary

The Distribution Cabinets Market is experiencing robust expansion driven primarily by global infrastructure renaissance and the imperative for smart grid deployment. Business trends indicate a strong move toward digitalization, with manufacturers integrating sensors, communication modules (like 4G/5G, LoRaWAN), and cloud connectivity into cabinets to facilitate predictive maintenance and real-time asset management. Key industry players are focusing on modular designs, corrosion-resistant materials (such as reinforced plastics and specialized metal alloys), and enhanced thermal management solutions to meet demanding industrial and outdoor application requirements, optimizing total cost of ownership (TCO) for end-users.

Regionally, Asia Pacific (APAC) stands out as the fastest-growing market, propelled by rapid industrialization, urbanization, and large-scale renewable energy projects in countries like China and India, which require extensive power distribution infrastructure. North America and Europe, while mature, are characterized by high demand for sophisticated, high-efficiency smart cabinets as utilities undertake grid modernization programs focusing on resiliency, integration of distributed energy resources (DERs), and cybersecurity compliance. Regulatory alignment with IEC and NEMA standards is a significant regional differentiator influencing product design and market entry strategies.

Segment-wise, the market sees heightened demand for low-voltage (LV) cabinets due to their ubiquitous use in commercial and residential construction, while the medium-voltage (MV) segment is growing steadily, anchored by utility and large-scale industrial projects. In terms of protection material, durable and environmentally resistant materials like GRP (Glass Reinforced Polyester) and specialized aluminum are gaining traction over traditional steel, particularly for harsh environmental installations. The service component, including installation, maintenance, and system integration, is also emerging as a high-growth segment, reflecting the increasing complexity of networked distribution systems requiring specialized expertise.

AI Impact Analysis on Distribution Cabinets Market

Common user questions regarding AI's impact on the Distribution Cabinets Market typically revolve around operational optimization, predictive failure detection, and enhanced security features. Users frequently ask: "How can AI optimize power flow within complex distribution cabinet networks?" "Will AI integration reduce maintenance costs and prevent unexpected downtime?" and "What role does machine learning play in cybersecurity for networked smart cabinets?" The key thematic expectation is the transformation of distribution cabinets from passive protection enclosures into active, intelligent nodes capable of self-diagnosis and autonomous decision-making. This shift is crucial for managing the intermittency of renewable energy sources and balancing dynamic grid loads.

The implementation of AI and Machine Learning (ML) algorithms is revolutionizing cabinet functionality by processing vast streams of data collected from integrated sensors—including temperature, vibration, current, and voltage monitors. This data analysis allows for highly accurate predictive maintenance schedules, moving away from time-based servicing to condition-based servicing, significantly extending asset lifespan and reducing operational expenditures. Furthermore, AI is utilized in optimizing the internal layout and thermal dissipation within the cabinet design process, ensuring components operate within optimal temperature ranges, which is vital for high-density power electronics often housed in these enclosures.

Looking ahead, AI will underpin the next generation of smart distribution networks, enabling features such as automated fault isolation and dynamic load management based on real-time consumption patterns. For manufacturers, AI models can refine production processes, optimize material usage, and enhance quality control during assembly. For utilities and industrial operators, the ability of AI to detect subtle anomalies that precede equipment failure—such as minor changes in harmonic distortion or slight temperature increases—provides a critical competitive advantage, ensuring ultra-high reliability of power delivery, especially critical for data centers and mission-critical infrastructure.

- AI-driven Predictive Maintenance: Utilizing sensor data to forecast component failures (e.g., circuit breaker wear, insulation degradation) accurately.

- Optimized Power Flow Management: Real-time ML algorithms balancing load distribution to prevent overheating and improve energy efficiency.

- Automated Anomaly Detection: Identifying cyber threats or physical tampering attempts on networked smart cabinets instantly.

- Enhanced Thermal Management: AI optimizing fan speeds and climate control settings based on internal and external environmental conditions.

- Design Optimization: Using generative AI tools to simulate and optimize cabinet dimensions and material distribution for superior performance and cost-efficiency.

DRO & Impact Forces Of Distribution Cabinets Market

The Distribution Cabinets Market is influenced by a complex interplay of Drivers (D), Restraints (R), Opportunities (O), and pervasive Impact Forces. Key drivers include accelerating global urbanization and industrial expansion, demanding robust and scalable electrical infrastructure, alongside massive governmental and private sector investments dedicated to modernizing outdated electrical grids and integrating Distributed Energy Resources (DERs) such as solar and wind power. These factors necessitate sophisticated, standardized, and secure distribution cabinets capable of handling bidirectional power flow and variable load conditions, pushing market volume upwards significantly.

However, the market faces significant restraints, primarily centered around the high initial capital expenditure associated with implementing smart and networked distribution cabinets, particularly in developing regions. Furthermore, the inherent complexity involved in integrating diverse digital monitoring and control systems from multiple vendors poses interoperability challenges. A persistent restraint is the cyclical nature of construction and infrastructure projects, which can introduce volatility into demand forecasting, coupled with the continuous pressure on pricing driven by intense competition among established global and regional manufacturers, often leading to squeezed profit margins.

Opportunities abound, specifically within the expanding industrial IoT (IIoT) ecosystem and the global push toward microgrids and resilient power solutions. The transition to advanced metering infrastructure (AMI) and smart city initiatives creates a fertile ground for high-value, digitally enabled distribution cabinets. Significant growth potential lies in the development of lightweight, highly resistant, and sustainable cabinet materials, catering to sectors like offshore wind farms or extreme climate installations. The impact forces acting on the market include geopolitical instability affecting global supply chains for critical components, evolving international safety standards (e.g., stricter arc-flash mitigation requirements), and the pervasive technological force of digitalization dictating product development cycles toward intelligent, networked solutions.

Segmentation Analysis

The Distribution Cabinets Market is meticulously segmented based on critical parameters including Voltage Level, Component Type, End-User Industry, Protection Material, and Application. This stratification allows for a granular understanding of demand dynamics across varied operational environments, from residential power consumption to heavy industrial power transmission. The segmentation by voltage level, specifically Low Voltage (LV) and Medium Voltage (MV), remains foundational, reflecting the difference in application scale and required protective features. LV cabinets dominate volume due to their widespread use in every infrastructure project, while MV cabinets command higher average selling prices (ASPs) due to their complex structure and specialized utility applications. Understanding these segments is vital for manufacturers tailoring specific product lines for utility, commercial, or industrial applications.

Further segmentation by component type reveals the increasing importance of integrated digital components such as supervisory control and data acquisition (SCADA) systems, remote terminal units (RTUs), and sophisticated metering modules, shifting the focus from purely hardware enclosure to system integration. In terms of end-user adoption, the Utility & Power Generation sector remains the largest consumer, driven by continuous grid maintenance and expansion. However, the commercial and residential sector is showing the fastest growth rate, fueled by smart building technologies and high-rise developments globally. Protection material segmentation highlights the trend toward non-metallic, high-performance enclosures (GRP, polycarbonates) offering superior insulation and corrosion resistance, particularly for outdoor or chemically aggressive settings.

- By Voltage Level:

- Low Voltage (LV) Distribution Cabinets (<1 kV)

- Medium Voltage (MV) Distribution Cabinets (1 kV to 36 kV)

- By Component Type:

- Busbars and Connectors

- Circuit Breakers (MCCBs, MCBs)

- Switchgear and Control Modules

- Metering Devices and Relays

- Protective Enclosures and Housing

- By End-User Industry:

- Utility & Power Generation

- Industrial (Oil & Gas, Manufacturing, Mining)

- Commercial & Residential Construction

- Infrastructure & Transportation (Railways, Airports)

- Data Centers & Telecommunications

- By Protection Material:

- Steel (Mild Steel, Stainless Steel)

- Aluminum

- Glass Reinforced Polyester (GRP)

- Polycarbonate/Thermoplastics

- By Application:

- Indoor Applications

- Outdoor Applications

- By Functionality:

- Standard/Passive Cabinets

- Smart/Intelligent Cabinets (Networked, IoT-enabled)

Value Chain Analysis For Distribution Cabinets Market

The value chain for the Distribution Cabinets Market begins with upstream suppliers, focusing heavily on raw material providers, particularly steel mills, aluminum manufacturers, and specialized polymer and composite suppliers. High-quality electrical components, such as circuit breakers, relays, and busbar materials (copper/aluminum), form the second tier of the upstream segment. The cost and quality of these raw materials and components directly influence the final product price and performance metrics, making robust supply chain management crucial. Manufacturers typically engage in highly specialized metal fabrication and component assembly, utilizing advanced welding, coating, and testing procedures to meet stringent IP ratings and safety certifications.

The midstream of the value chain is dominated by distribution cabinet manufacturers, who range from large multinational conglomerates offering fully integrated power solutions to specialized regional fabricators focusing on custom designs. These manufacturers invest heavily in R&D to incorporate modularity, smart features (IoT connectivity), and enhanced thermal management. The distribution channel, which bridges manufacturers and end-users, is heterogeneous, comprising both direct sales to major utilities and EPC (Engineering, Procurement, and Construction) companies, and indirect channels relying on electrical distributors, wholesalers, and system integrators. Indirect distribution often handles standardized or high-volume LV cabinet sales to commercial construction projects.

The downstream segment involves installation, commissioning, maintenance, and system integration services, which are increasingly vital for complex smart cabinets. End-users, including utilities, factory owners, and infrastructure developers, rely on certified service providers for efficient deployment and ongoing operational assurance. The shift toward intelligent cabinets necessitates specialized training and expertise at the downstream level. Direct distribution channels ensure close customer relationships, crucial for bespoke utility projects requiring high customization and specific technical compliance, while indirect channels provide market reach and quick access to standard components for small-to-medium enterprises and contractors.

Distribution Cabinets Market Potential Customers

The core potential customers and end-users of distribution cabinets are broadly segmented based on their consumption scale and operational requirements. Utility companies, including electric transmission and distribution operators, remain the single largest buying group. These entities require high-reliability, long-lifecycle medium-voltage cabinets for substations and vast low-voltage cabinets for last-mile distribution networks. Their procurement decisions are heavily influenced by regulatory compliance, standardization, and the ability of the cabinets to integrate with existing Supervisory Control and Data Acquisition (SCADA) systems and upcoming smart grid infrastructure rollouts.

The second major cohort comprises the industrial sector, including heavy manufacturing, petrochemical plants, mining operations, and large-scale renewable energy farms. Industrial customers demand distribution cabinets with superior ingress protection (high IP ratings), robust construction (often stainless steel or GRP), and specialized features for motor control centers (MCCs) and harsh environments. The selection criteria here focus on durability, resistance to chemicals and dust, and capacity for high-current loads, ensuring minimal operational downtime in critical processes.

Finally, the commercial and residential construction sectors represent a high-volume, rapidly expanding customer base. Commercial buyers, such as real estate developers, building management firms, and data center operators, prioritize compact, aesthetically pleasing, and highly efficient cabinets that comply with local building codes. Data centers, in particular, require specialized power distribution units (PDUs) and high-density cabinets with advanced thermal management. Residential customers, typically serviced through electrical contractors and wholesalers, rely on standardized, cost-effective LV consumer units and small distribution boards for safe indoor power management.

| Report Attributes | Report Details |

|---|---|

| Market Size in 2026 | USD 5.2 Billion |

| Market Forecast in 2033 | USD 8.8 Billion |

| Growth Rate | 7.8% CAGR |

| Historical Year | 2019 to 2024 |

| Base Year | 2025 |

| Forecast Year | 2026 - 2033 |

| DRO & Impact Forces |

|

| Segments Covered |

|

| Key Companies Covered | ABB Ltd., Siemens AG, Schneider Electric SE, Eaton Corporation plc, Rittal GmbH & Co. KG, Legrand SA, Hubbell Incorporated, Emerson Electric Co., TE Connectivity Ltd., AZZ Inc., Eldon Holding AB, Rockwell Automation, Inc., Hensel Electric India Pvt. Ltd., nVent Electric plc, Wiegmann Enclosures, Allied Moulded Products, Inc., ZPAS Group, Mapal Group, Socomec Group, Ningbo Hongyi Electric Co., Ltd. |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Enquiry Before Buy | Have specific requirements? Send us your enquiry before purchase to get customized research options. Request For Enquiry Before Buy |

Distribution Cabinets Market Key Technology Landscape

The technology landscape of the Distribution Cabinets Market is rapidly evolving from basic enclosures toward highly sophisticated, interconnected systems. A primary technological driver is the integration of Industrial Internet of Things (IIoT) sensors and communication modules directly into the cabinet structure. This technology enables real-time monitoring of crucial parameters such as internal temperature, humidity, vibration, and electrical load status, transmitting data via protocols like Modbus, OPC UA, or wireless connections (4G/5G, LoRaWAN) to cloud-based or on-premises management platforms. This digitalization allows for sophisticated condition monitoring, minimizing the need for manual inspections and dramatically improving the overall asset uptime and operational efficiency of the electrical grid or industrial facility.

Material science and thermal management represent another critical area of innovation. Manufacturers are increasingly utilizing advanced composite materials, such as Glass Reinforced Polyester (GRP) and high-performance thermoplastics, which offer superior resistance to corrosion, UV exposure, and fire, coupled with excellent electrical insulation properties, making them ideal for outdoor and extreme environment applications. Alongside materials, advanced cooling techniques are paramount, especially for cabinets housing variable frequency drives (VFDs) or power electronics in demanding industrial environments. Innovations include highly efficient heat exchangers, specialized liquid cooling loops, and integrated ventilation systems managed by intelligent controllers to maintain internal operational temperatures and prolong the life of sensitive electronic components within the enclosure.

Furthermore, the focus on enhancing safety standards has led to technological advancements in arc-flash mitigation and protection features. Modern distribution cabinets incorporate specialized design elements, such as pressure relief vents, internal component segregation, and arc-resistant features, complying with standards like IEEE C37.20.7. The incorporation of smart diagnostics, including thermal imaging capabilities and partial discharge monitoring, allows operators to detect potential issues before they escalate into hazardous failures. This technological convergence—combining advanced physical protection with intelligent monitoring and communication—defines the future of distribution cabinets as essential smart infrastructure elements, capable of high-level interaction within the modern decentralized energy system.

Regional Highlights

- Asia Pacific (APAC): APAC is anticipated to be the fastest-growing market globally, characterized by massive infrastructure development and rapid industrialization, particularly in China, India, and Southeast Asian nations. The region's growth is fueled by aggressive governmental targets for renewable energy integration (solar and wind) and significant investment in new smart city projects, demanding large volumes of both LV and MV distribution cabinets. The focus is increasingly shifting toward high-quality, standardized products to meet expanding middle-class energy needs and the proliferation of large manufacturing hubs.

- North America: North America represents a mature yet dynamic market, driven by the necessity of replacing aging electrical infrastructure and substantial investment in grid modernization programs to improve resilience against severe weather events and cyber threats. The U.S. and Canada are leading the adoption of smart, network-enabled cabinets equipped with advanced monitoring and cybersecurity features, mandated by strict NERC CIP standards and focusing on enhancing the integration of distributed energy resources (DERs) and electric vehicle (EV) charging infrastructure.

- Europe: The European market is characterized by stringent energy efficiency and environmental regulations, driving demand for technologically advanced and eco-friendly distribution cabinet solutions. Growth is propelled by the widespread adoption of industrial automation (Industry 4.0) and significant investment in cross-border energy interconnectors. European utilities prioritize high-reliability components and modular designs compliant with strict IEC standards, focusing on optimizing energy distribution within smart residential and commercial complexes and expanding offshore wind power infrastructure.

- Latin America (LATAM): LATAM is a developing market with significant potential, primarily driven by urbanization, commercial construction booms in major cities (e.g., São Paulo, Mexico City), and necessary expansion of electrical access to underserved rural areas. While price sensitivity is high, there is a growing demand for durable, robust cabinets capable of withstanding local climatic variations and ensuring reliable power delivery in the face of variable grid conditions.

- Middle East and Africa (MEA): The MEA region is experiencing substantial growth linked to mega-projects in the GCC nations (e.g., NEOM, ambitious industrial cities) and sustained investment in oil and gas infrastructure, which requires specialized, highly protected cabinets for harsh desert environments. The African market is gradually expanding, fueled by off-grid power solutions and initial stages of infrastructure development, focusing on cost-effective, robust electrical distribution components.

Top Key Players

The market research report includes a detailed profile of leading stakeholders in the Distribution Cabinets Market.- ABB Ltd.

- Siemens AG

- Schneider Electric SE

- Eaton Corporation plc

- Rittal GmbH & Co. KG

- Legrand SA

- Hubbell Incorporated

- Emerson Electric Co.

- TE Connectivity Ltd.

- AZZ Inc.

- Eldon Holding AB

- Rockwell Automation, Inc.

- Hensel Electric India Pvt. Ltd.

- nVent Electric plc

- Wiegmann Enclosures

- Allied Moulded Products, Inc.

- ZPAS Group

- Mapal Group

- Socomec Group

- Ningbo Hongyi Electric Co., Ltd.

Frequently Asked Questions

Analyze common user questions about the Distribution Cabinets market and generate a concise list of summarized FAQs reflecting key topics and concerns.What are the primary differences between LV and MV Distribution Cabinets?

Low Voltage (LV) distribution cabinets manage power below 1 kV, serving residential and commercial end-use points, and are typically characterized by smaller, standardized dimensions. Medium Voltage (MV) cabinets operate between 1 kV and 36 kV, are physically larger, house more complex switchgear, and are primarily used in utility substations and heavy industrial power transfer applications, requiring advanced isolation and protection features.

How is the integration of IoT influencing the design of modern distribution cabinets?

IoT integration transforms cabinets into smart assets by embedding sensors for monitoring temperature, vibration, and electrical parameters, enabling remote diagnostics and condition-based monitoring. This allows for predictive maintenance, optimized power flow management, reduced unplanned downtime, and enhanced overall grid resilience and operational efficiency.

Which material is preferred for distribution cabinets installed in harsh outdoor environments?

For harsh outdoor environments (e.g., coastal areas, high humidity, chemical exposure), Glass Reinforced Polyester (GRP) and high-grade stainless steel are often preferred over mild steel. GRP offers superior resistance to corrosion, UV degradation, and provides excellent electrical insulation, ensuring durability and longevity in challenging climatic conditions.

What major regulatory standards govern the manufacturing and deployment of distribution cabinets globally?

Globally, distribution cabinets must comply with crucial safety and performance standards, primarily IEC (International Electrotechnical Commission) standards, especially IEC 61439 for low-voltage switchgear and controlgear assemblies. In North America, NEMA (National Electrical Manufacturers Association) ratings and ANSI standards govern enclosure types and performance, ensuring adherence to local electrical codes.

What is the main driver for the Distribution Cabinets Market growth in the Asia Pacific region?

The primary driver in the Asia Pacific region is the rapid pace of urbanization, large-scale industrial expansion (particularly manufacturing and mining), and extensive governmental investment in developing smart grid infrastructure and renewable energy generation projects. This necessitates vast quantities of new distribution and protective electrical enclosures.

How do smart cabinets contribute to reducing operational expenditure (OPEX) for utility companies?

Smart cabinets reduce OPEX by enabling highly accurate predictive maintenance through continuous data monitoring, allowing utilities to move from expensive time-based maintenance to efficient condition-based servicing. This minimizes unnecessary site visits, extends the lifespan of internal components, and significantly reduces downtime costs associated with unexpected component failure.

What role does arc-flash mitigation technology play in distribution cabinet design?

Arc-flash mitigation is critical for personnel safety. Modern cabinet designs incorporate technologies such as arc-resistant construction, pressure relief venting systems, and fast-acting protective relays that rapidly de-energize circuits upon sensing an arc fault, drastically minimizing the risk of severe injury and equipment damage during an internal electrical fault.

How does the shift towards decentralized energy generation impact distribution cabinet requirements?

Decentralized energy, such as solar and wind farms, introduces bidirectional power flow and greater variability into the grid. This requires distribution cabinets to be more robust, incorporate advanced controls and protection relays, and be equipped to manage the dynamic balancing of power between distributed energy resources (DERs) and the main utility grid, often necessitating intelligent, network-ready solutions.

What are the primary challenges related to the supply chain in the Distribution Cabinets Market?

Key supply chain challenges include price volatility of raw materials (steel, copper, aluminum), dependence on global semiconductor supply for smart components and sensors, and logistical disruptions affecting the timely delivery of large, fabricated enclosures. Geopolitical factors also influence sourcing and lead times for specialized electrical components.

In the industrial sector, what specific features are prioritized in distribution cabinets?

Industrial users prioritize superior Ingress Protection (IP) ratings (e.g., IP65 or higher) for resistance against dust and water, robust material construction (e.g., stainless steel for corrosive environments), integrated motor control center (MCC) capabilities, and enhanced thermal management systems to handle high operational loads effectively and ensure reliability in demanding factory environments.

How are environmental concerns driving innovation in cabinet materials?

Environmental concerns are driving manufacturers to explore sustainable, recyclable, and lightweight materials, reducing the carbon footprint associated with manufacturing and transportation. Furthermore, the selection of materials is scrutinized for resistance to extreme climate effects, minimizing the need for frequent replacements and reducing lifecycle environmental impact.

What is the long-term outlook for the demand for non-metallic distribution cabinets?

The long-term outlook for non-metallic cabinets (GRP, polycarbonate) is highly positive, driven by their superior corrosion resistance, lighter weight, and inherent electrical insulation properties. They are increasingly favored in specialized applications such as telecommunication infrastructure, chemical processing plants, and coastal utilities where metal enclosures suffer rapid degradation.

How important is cybersecurity in the design of intelligent distribution cabinets?

Cybersecurity is critically important for intelligent, networked cabinets, as they represent entry points into critical infrastructure. Designs must incorporate secure communication protocols, robust authentication mechanisms, and tamper detection features to prevent unauthorized access or malicious manipulation that could lead to widespread grid disruptions or safety hazards.

What is the typical lifecycle of a standard distribution cabinet, and how does smart technology affect it?

A standard high-quality distribution cabinet can last 20 to 30 years, depending on environmental conditions and maintenance. Smart technology, through continuous health monitoring and predictive maintenance, can potentially extend the effective, operational lifespan by ensuring components are replaced exactly when needed, rather than waiting for catastrophic failure or relying on arbitrary schedules.

What is the role of system integrators in the Distribution Cabinets Market value chain?

System integrators play a vital role, especially in the smart cabinet segment, by combining the physical enclosure and components with software, communication modules, and control systems. They ensure seamless interoperability between the cabinet and the end-user's wider SCADA or building management system, providing a complete, turnkey solution tailored to specific application needs.

How do global economic trends, such as inflation, affect the market?

Global inflation significantly impacts the Distribution Cabinets Market by increasing the cost of raw materials (metals, polymers) and energy, leading to higher manufacturing costs. This often results in upward pressure on final product prices and can sometimes delay large infrastructure projects, causing fluctuations in market demand and potentially impacting vendor profitability.

What key factors drive utility companies to upgrade existing distribution cabinets rather than installing new ones?

Utility companies often prioritize upgrading older cabinets due to regulatory pressure to enhance system reliability, improve energy efficiency, and incorporate modern safety features like arc-flash mitigation. Retrofitting existing enclosures with new smart components (sensors, RTUs) is often more cost-effective and less disruptive than full system replacement, especially for non-obsolete hardware.

How is the growth of electric vehicle (EV) infrastructure influencing distribution cabinet demand?

The rapid expansion of EV charging infrastructure necessitates the deployment of numerous new, high-capacity distribution cabinets to manage the substantial and often variable power demand at charging hubs and stations. These cabinets require specialized thermal management and precise metering capabilities to handle large electrical loads efficiently and safely.

What are the main technical considerations for distribution cabinets used in data centers?

Data centers require specialized power distribution units (PDUs) and cabinets focused intensely on space optimization (high density), ultra-high reliability (redundancy), precise power quality monitoring, and advanced thermal dissipation due to the continuous high-heat load generated by server equipment, demanding specialized liquid or direct cooling compatibility.

What are the long-term implications of modular design on the cabinet manufacturing process?

Modular design simplifies manufacturing by allowing standardized sub-components to be quickly assembled into various configurations, reducing customization lead times and inventory costs. For end-users, modularity facilitates easy scalability, future upgrades, and rapid repair, making maintenance more efficient over the long operational lifecycle of the cabinet.

How does the demand for renewable energy affect the complexity of cabinet wiring?

Renewable energy integration increases wiring complexity because distribution cabinets must accommodate equipment for grid synchronization, anti-islanding protection, and battery energy storage systems (BESS). This requires more sophisticated busbar layouts and specialized protective relays to manage the bidirectional flow of power effectively and safely.

What key strategic initiatives are top market players undertaking to maintain competitive advantage?

Leading market players are focusing on vertical integration (controlling component supply), aggressive expansion into high-growth APAC markets, developing proprietary smart grid software platforms, and strategic acquisitions of specialized technology firms to enhance their portfolio of IoT-enabled, high-efficiency distribution solutions.

What is the difference between IP ratings and NEMA ratings for distribution cabinets?

IP (Ingress Protection) ratings, primarily used internationally (IEC), define the degree of protection against solids (dust) and liquids (water). NEMA (National Electrical Manufacturers Association) ratings, prevalent in North America, also cover protection against solids and liquids but additionally specify protection against corrosion, icing, and often include requirements for hazardous (explosion-proof) locations.

How does specialized coating technology enhance the lifespan of metal distribution cabinets?

Specialized coating technologies, such as powder coating, galvanization, and epoxy-based paints, create a protective barrier against moisture, rust, and chemical agents. These coatings are essential for mild steel cabinets, significantly prolonging their useful life in challenging outdoor or industrial environments by preventing material degradation and maintaining aesthetic integrity.

What are the key factors driving the need for better thermal management in modern cabinets?

The need for better thermal management is driven by the increasing density of heat-generating components (VFDs, power supplies, integrated electronics) within limited cabinet space, coupled with a higher demand for continuous, reliable operation. Excessive heat reduces component lifespan and efficiency, making sophisticated cooling solutions (fans, AC units, heat exchangers) essential for maintaining optimal internal temperatures.

To check our Table of Contents, please mail us at: sales@marketresearchupdate.com

Research Methodology

The Market Research Update offers technology-driven solutions and its full integration in the research process to be skilled at every step. We use diverse assets to produce the best results for our clients. The success of a research project is completely reliant on the research process adopted by the company. Market Research Update assists its clients to recognize opportunities by examining the global market and offering economic insights. We are proud of our extensive coverage that encompasses the understanding of numerous major industry domains.

Market Research Update provide consistency in our research report, also we provide on the part of the analysis of forecast across a gamut of coverage geographies and coverage. The research teams carry out primary and secondary research to implement and design the data collection procedure. The research team then analyzes data about the latest trends and major issues in reference to each industry and country. This helps to determine the anticipated market-related procedures in the future. The company offers technology-driven solutions and its full incorporation in the research method to be skilled at each step.

The Company's Research Process Has the Following Advantages:

- Information Procurement

The step comprises the procurement of market-related information or data via different methodologies & sources.

- Information Investigation

This step comprises the mapping and investigation of all the information procured from the earlier step. It also includes the analysis of data differences observed across numerous data sources.

- Highly Authentic Source

We offer highly authentic information from numerous sources. To fulfills the client’s requirement.

- Market Formulation

This step entails the placement of data points at suitable market spaces in an effort to assume possible conclusions. Analyst viewpoint and subject matter specialist based examining the form of market sizing also plays an essential role in this step.

- Validation & Publishing of Information

Validation is a significant step in the procedure. Validation via an intricately designed procedure assists us to conclude data-points to be used for final calculations.

×

Request Free Sample:

Related Reports

Select License

Why Choose Us

We're cost-effective and Offered Best services:

We are flexible and responsive startup research firm. We adapt as your research requires change, with cost-effectiveness and highly researched report that larger companies can't match.

Information Safety

Market Research Update ensure that we deliver best reports. We care about the confidential and personal information quality, safety, of reports. We use Authorize secure payment process.

We Are Committed to Quality and Deadlines

We offer quality of reports within deadlines. We've worked hard to find the best ways to offer our customers results-oriented and process driven consulting services.

Our Remarkable Track Record

We concentrate on developing lasting and strong client relationship. At present, we hold numerous preferred relationships with industry leading firms that have relied on us constantly for their research requirements.

Best Service Assured

Buy reports from our executives that best suits your need and helps you stay ahead of the competition.

Customized Research Reports

Our research services are custom-made especially to you and your firm in order to discover practical growth recommendations and strategies. We don't stick to a one size fits all strategy. We appreciate that your business has particular research necessities.

Service Assurance

At Market Research Update, we are dedicated to offer the best probable recommendations and service to all our clients. You will be able to speak to experienced analyst who will be aware of your research requirements precisely.

Contact With Our Sales Team

Customer Testimonials

The content of the report is always up to the mark. Good to see speakers from expertise authorities.

Privacy requested , Managing Director

A lot of unique and interesting topics which are described in good manner.

Privacy requested, President

Well researched, expertise analysts, well organized, concrete and current topics delivered in time.

Privacy requested, Development Manager