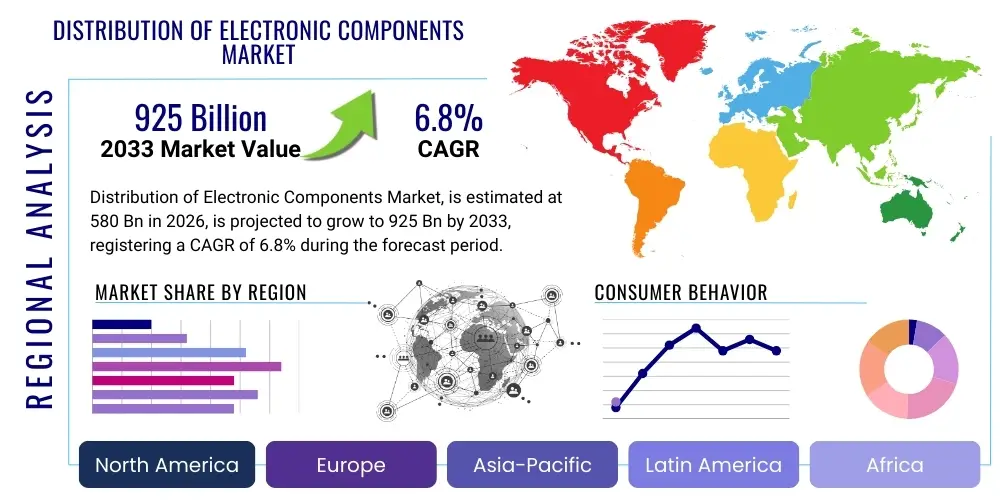

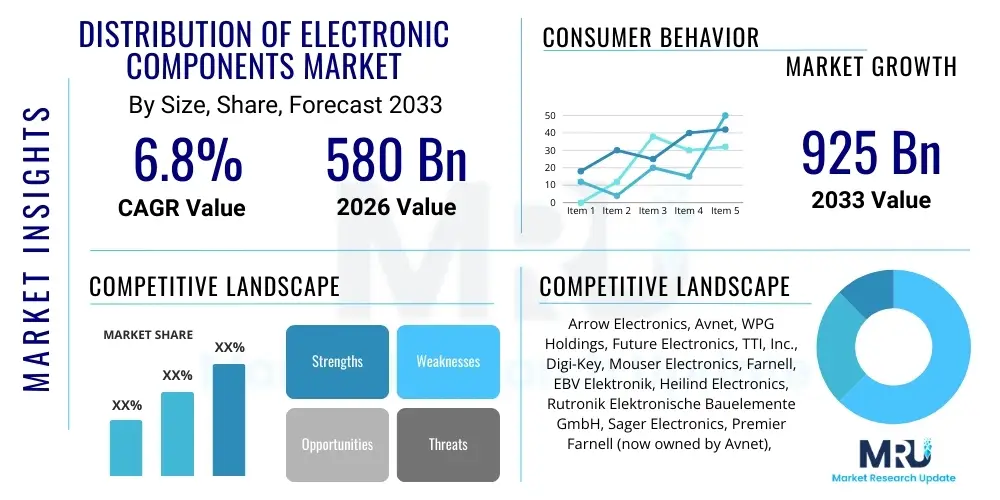

Distribution of Electronic Components Market Size, By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2026 to 2033 (Financial Impact Analysis)

ID : MRU_ 442657 | Date : Feb, 2026 | Pages : 245 | Region : Global | Publisher : MRU

Distribution of Electronic Components Market Size

The Distribution of Electronic Components Market is projected to grow at a Compound Annual Growth Rate (CAGR) of 6.8% between 2026 and 2033. The market is estimated at USD 580 Billion in 2026 and is projected to reach USD 925 Billion by the end of the forecast period in 2033.

Distribution of Electronic Components Market introduction

The Distribution of Electronic Components Market encompasses the global network and logistical infrastructure responsible for moving electronic parts—including semiconductors, passive components, and electromechanical components—from original equipment manufacturers (OEMs) and suppliers to end-users, such as Original Design Manufacturers (ODMs) and electronics manufacturing services (EMS) providers. This market is crucial for maintaining the efficiency and responsiveness of the global electronics supply chain, acting as a vital intermediary that provides specialized services like inventory management, technical support, warehousing, and crucial supply chain financing. The distribution channel minimizes risks associated with sourcing, managing complexity in component variety, and addressing the volatile demand cycles inherent in the high-tech sector.

Key applications driving this market include the burgeoning fields of automotive electronics, particularly electric vehicles (EVs) and advanced driver-assistance systems (ADAS), high-speed computing and data center infrastructure, and the massive consumer electronics segment, which demands high volume and rapid turnaround times. Furthermore, the industrial sector, driven by Industry 4.0 initiatives—including automation, IoT sensors, and smart factory implementations—relies heavily on efficient component distribution to ensure consistent production and maintenance. The fundamental product scope covers highly sophisticated integrated circuits (ICs), microprocessors, memory devices, resistors, capacitors, connectors, and power management devices, catering to almost every sector of the modern economy.

The primary benefit of a robust distribution system is accelerated time-to-market for end-products, enabled by streamlined procurement and localized inventory buffers. Driving factors include increasing global electronic content per device, the proliferation of IoT devices across commercial and industrial landscapes, and geopolitical dynamics compelling companies to diversify supply chains, thereby increasing the importance of broad-reaching, resilient distribution networks. Furthermore, the complexity of modern semiconductor technology necessitates distributors who can offer high-level technical consultation and design-in support to customers, effectively transitioning the role from a mere transactional entity to a crucial strategic partner in product development.

Distribution of Electronic Components Market Executive Summary

The global Distribution of Electronic Components Market is characterized by intense consolidation among key players, increasing focus on value-added services, and a significant shift toward digital transformation. Current business trends indicate a critical investment cycle in sophisticated logistics technologies, including automated warehousing and predictive inventory management systems, aiming to mitigate future supply chain shocks similar to those experienced post-2020. Distributors are increasingly diversifying their service offerings beyond basic fulfillment to include complex programming, sub-assembly, and specialized engineering support, thus capturing higher margins and strengthening customer loyalty within specialized vertical markets like aerospace and medical devices. Furthermore, sustainability and ethical sourcing are emerging as mandatory requirements, influencing procurement decisions and necessitating enhanced transparency throughout the supply chain.

Regionally, Asia Pacific (APAC), led by China, South Korea, and Taiwan, remains the dominant hub for both manufacturing and consumption, necessitating massive, intricate distribution operations optimized for speed and volume. However, North America and Europe are experiencing reshoring and localization trends, spurred by government incentives (such as the U.S. CHIPS Act) and supply chain resilience objectives. This localized production requires distributors to adapt their models to support smaller, highly complex domestic manufacturing ecosystems, focusing on high-mix, low-volume components quickly. Emerging markets in Southeast Asia and Latin America are exhibiting above-average growth rates, driven by expanding middle classes and rapid infrastructure development, presenting opportunities for strategic market entry and greenfield investment in logistical assets.

Segmentation trends highlight the rapid growth of the semiconductor distribution segment, fueled by demand for high-performance computing (HPC) and AI accelerators, eclipsing traditional passive components growth. Within distribution channels, the shift toward e-commerce platforms is accelerating, particularly for smaller orders (high-mix, low-volume) and design engineers seeking rapid prototyping components. Specialized distribution focusing on critical industry verticals, such as military/aerospace and rugged industrial applications, is showing resilience, prioritizing component reliability and long-term availability over pure cost metrics. These segments require rigorous quality control and specialized certification processes, differentiating them from the high-volume consumer segment distribution.

AI Impact Analysis on Distribution of Electronic Components Market

User inquiries regarding the impact of AI on the Distribution of Electronic Components Market primarily revolve around themes of operational efficiency, demand forecasting accuracy, and the required shift in distributor skill sets. Common questions address how AI can optimize complex global logistics routes, improve the notoriously difficult task of predicting volatile semiconductor lead times, and automate warehouse management for rapid fulfillment. There is significant interest in AI’s role in identifying fraudulent or counterfeit components within the supply chain and its potential to personalize technical support for design engineers. Users expect AI to fundamentally transform inventory risk management and enable 'just-in-time' procurement strategies that were previously impractical due to data complexity and market unpredictability.

- AI-driven Predictive Demand Forecasting: Utilization of machine learning algorithms to analyze historical sales, geopolitical events, and macroeconomic indicators, drastically improving the accuracy of component demand predictions and reducing stockouts or overstocking.

- Automated Warehouse Management: Implementation of AI-powered robotics, smart shelving systems, and automated guided vehicles (AGVs) to accelerate picking, packing, and sorting processes, enhancing throughput capacity.

- Supply Chain Optimization: Use of deep learning models to dynamically optimize routing, carrier selection, and modal shifts (air, sea, land) in real-time based on cost, urgency, and environmental factors.

- Quality Control and Counterfeit Detection: Deployment of AI and computer vision systems to inspect components, verifying authenticity and quality against known standards, thereby safeguarding supply chain integrity.

- Personalized Customer Service and Technical Support: AI-powered chatbots and recommendation engines that provide design-in assistance, product cross-referencing, and quick resolution of technical queries for engineers.

- Risk Management and Resilience Modeling: AI analysis of supply chain vulnerabilities, predicting the impact of natural disasters or geopolitical conflict on component availability, enabling proactive mitigation strategies.

- Pricing and Inventory Optimization: Dynamic pricing models that adjust based on real-time market scarcity, competition, and customer value segmentation, maximizing profitability while maintaining competitiveness.

DRO & Impact Forces Of Distribution of Electronic Components Market

The Distribution of Electronic Components Market is shaped by powerful drivers such as the relentless digitization across all industries and the explosive growth in connectivity technologies like 5G, IoT, and high-performance computing, which constantly elevate the demand for advanced integrated circuits. Simultaneously, regulatory and geopolitical constraints, particularly trade wars and export controls affecting critical technology transfers, pose significant restraints, forcing complex reshoring and decoupling efforts that fragment previously centralized supply chains. Opportunities abound in specializing within niche, high-growth sectors such as medical electronics, electric vehicle infrastructure, and space technology, which demand highly reliable components and specialized logistical support. The primary impact force is the balance between global sourcing efficiency and mandated regional supply chain resilience, coupled with the exponential velocity of technological change requiring distributors to constantly update inventory and technical expertise.

Segmentation Analysis

The Distribution of Electronic Components Market is structurally complex, segmented primarily by product type, application, and distribution channel, reflecting the varied needs of the expansive electronics industry. Analyzing these segments provides critical insights into growth vectors and operational specialization. The largest segment remains semiconductors, encompassing microprocessors, memory, and specialized ICs, largely driven by computing and communication applications. The Application segmentation highlights the growing dominance of automotive and industrial IoT segments, demanding robust, high-reliability components. Furthermore, the shift from traditional brick-and-mortar sales to sophisticated online distribution platforms defines the evolution of the channel segment, focusing on speed and accessibility for a global customer base.

- By Product Type:

- Semiconductors (Integrated Circuits, Microprocessors, Memory Devices, Discrete Semiconductors, Sensors)

- Passive Components (Resistors, Capacitors, Inductors, Transformers)

- Electromechanical Components (Connectors, Switches, Relays, Cable Assemblies)

- Display and Optoelectronics Components (LEDs, LCDs, OLEDs)

- Power Devices (Transistors, Diodes, Power Modules)

- By Application:

- Automotive Electronics (ADAS, Infotainment, EV Power Management)

- Industrial Automation (IoT, Robotics, PLCs)

- Consumer Electronics (Smartphones, Wearables, Home Appliances)

- Communication and Networking (5G Infrastructure, Data Centers)

- Aerospace and Defense

- Medical Devices

- By Distribution Channel:

- Online Distribution (E-commerce Platforms, Digital Marketplaces)

- Offline Distribution (Direct Sales, Traditional Brick-and-Mortar)

- Catalog Distributors

Value Chain Analysis For Distribution of Electronic Components Market

The value chain for electronic components distribution begins with upstream suppliers, primarily Original Component Manufacturers (OCMs) such as chip fabs (TSMC, Samsung) and specialized passive component makers. These manufacturers are responsible for the research, design, and mass production of the physical components. The efficiency of this upstream phase is critical, as any delays or capacity constraints directly impact the entire distribution network, exemplified by the recent global chip shortages. Managing these upstream relationships involves rigorous contract negotiations, supply assurance programs, and maintaining technical liaison to ensure component specifications meet global standards.

The core of the value chain resides in the distribution phase itself, where major global distributors acquire inventory, manage complex logistics, and provide critical value-added services. These services include kitting, device programming, specialized warehousing (e.g., temperature and moisture control), financial services (extending credit), and technical support (design-in services). The distribution channel leverages massive global footprints, often using both direct sales teams for key accounts (EMS providers and major OEMs) and indirect channels, such as e-commerce platforms and catalog sales, to reach smaller design houses and individual engineers. This phase optimizes inventory flow and mitigates demand variability, translating bulk manufacturing outputs into customized, timely deliveries.

The downstream analysis focuses on the end-users: Original Equipment Manufacturers (OEMs), Electronics Manufacturing Services (EMS) companies, and smaller contract manufacturers (CMs). These entities integrate the components into final products across diverse sectors like automotive, consumer, and industrial. The selection of distribution channels is strategic; large EMS firms often engage in highly negotiated, direct contracts with distributors for volume discounts and guaranteed supply, while R&D firms rely heavily on high-service online distributors (catalog distributors) for rapid prototyping and access to a wide variety of low-volume parts. The seamless integration between the distributor's inventory system and the customer's procurement system (often via APIs or EDI) is a key competitive differentiator in optimizing the final consumption and manufacturing process.

Distribution of Electronic Components Market Potential Customers

Potential customers for electronic component distribution are diverse, encompassing virtually every industry that relies on electronics for its operational or product base. The primary buyers are large Electronics Manufacturing Services (EMS) providers, such as Foxconn and Flextronics, who require high volumes of standardized components delivered under strict scheduling protocols to support their massive assembly operations. These firms prioritize logistical efficiency, global availability, and robust quality certifications.

Secondly, Original Equipment Manufacturers (OEMs) across sectors like Automotive (e.g., Tesla, BMW), Industrial (e.g., Siemens, ABB), and Telecom (e.g., Cisco, Ericsson) constitute a vital customer base. Automotive OEMs, in particular, demand long-term component availability, stringent failure rate tolerances, and comprehensive traceability, often utilizing specialized distributors focusing solely on ruggedized and certified parts. The shift towards electrification and connectivity in vehicles has made automotive electronics a fast-growing, highly demanding customer segment.

Lastly, Small and Medium-sized Enterprises (SMEs) and independent design houses represent a significant, high-mix, low-volume customer segment. These customers rely heavily on catalog distributors and e-commerce platforms for immediate access to small quantities of diverse components for prototyping, testing, and small-batch production. They value technical support, ease of online ordering, and rapid fulfillment, often using distributors as a critical resource for maintaining rapid product development cycles without the logistical overhead associated with direct manufacturer procurement.

| Report Attributes | Report Details |

|---|---|

| Market Size in 2026 | USD 580 Billion |

| Market Forecast in 2033 | USD 925 Billion |

| Growth Rate | 6.8% CAGR |

| Historical Year | 2019 to 2024 |

| Base Year | 2025 |

| Forecast Year | 2026 - 2033 |

| DRO & Impact Forces |

|

| Segments Covered |

|

| Key Companies Covered | Arrow Electronics, Avnet, WPG Holdings, Future Electronics, TTI, Inc., Digi-Key, Mouser Electronics, Farnell, EBV Elektronik, Heilind Electronics, Rutronik Elektronische Bauelemente GmbH, Sager Electronics, Premier Farnell (now owned by Avnet), Rochester Electronics, Master Electronics, World Peace Industrial Group (WPI). |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Enquiry Before Buy | Have specific requirements? Send us your enquiry before purchase to get customized research options. Request For Enquiry Before Buy |

Distribution of Electronic Components Market Key Technology Landscape

The technological landscape of electronic components distribution is rapidly shifting towards digitization and automation, fundamentally altering how inventory is managed and orders are processed. Central to this evolution is the increasing use of advanced Enterprise Resource Planning (ERP) systems integrated with specialized Supply Chain Management (SCM) software, often utilizing cloud-based architectures for real-time visibility across global inventory locations. These systems enable highly complex inventory segmentation and tiered warehousing strategies to handle volatile demand curves and varying component lifecycles, from high-volume standardized parts to end-of-life (EOL) or obsolete components managed by specialized long-term inventory partners. Furthermore, the adoption of blockchain technology is being explored by major distributors to enhance the traceability and provenance of high-value and sensitive components, providing an immutable record that combats the pervasive threat of counterfeiting, especially within regulated sectors like defense and medical.

Logistical automation represents another crucial pillar of technological advancement. Modern distribution centers rely heavily on Automated Storage and Retrieval Systems (AS/RS), intelligent conveyor belts, and robotics for picking, sorting, and packaging. This automation not only increases operational throughput and accuracy but also addresses labor shortages and improves workplace safety standards. Furthermore, predictive maintenance technologies, utilizing sensors and IoT data within the warehouse infrastructure, ensure continuous operation and minimize downtime. The data generated from these automated systems is then fed back into AI models to further refine warehouse layout optimization and workflow processes, creating a continuous improvement loop that drives efficiency gains across the entire fulfillment network.

In the customer-facing realm, the focus is on developing robust, user-friendly digital platforms. Key technology includes sophisticated e-commerce portals that offer deep technical documentation, high-fidelity 3D models of components, and specialized parametric search capabilities essential for design engineers. API integration capabilities are becoming standard, allowing customers (especially large EMS and OEMs) to directly connect their procurement systems with the distributor's real-time inventory and pricing data, enabling automated sourcing and procurement decisions. Furthermore, the development of Digital Twins of the entire supply chain allows distributors to simulate the impact of various external shocks (e.g., natural disasters, factory closures) and geopolitical shifts, significantly enhancing strategic planning and risk mitigation capabilities, thereby adding substantial strategic value beyond mere component delivery.

Regional Highlights

- Asia Pacific (APAC): APAC is the epicenter of global electronics manufacturing and component consumption, driven by mass production facilities in China, Taiwan, and South Korea, coupled with rapidly expanding consumer markets in India and Southeast Asia. The region is characterized by high volume, aggressive pricing pressure, and a complex network of local and international distributors. Growth is primarily fueled by the deployment of 5G infrastructure, massive data center construction, and the localization of electric vehicle manufacturing, creating intense demand for advanced semiconductor distribution services. Distributors in APAC must excel in high-speed, high-density logistics and possess deep integration with local manufacturing ecosystems.

- North America: North America is defined by high-value design and innovation, robust defense spending, and significant growth in cloud computing and data analytics. The distribution landscape here is increasingly influenced by government initiatives aimed at strengthening domestic semiconductor manufacturing (reshoring), leading to higher demand for specialized distribution services capable of handling complex, low-volume, high-mix component needs for R&D and specialized industrial applications. Key regional drivers include the expansion of hyperscale data centers and the burgeoning electric vehicle and aerospace markets, which demand stringent quality control and component traceability provided by tier-one distributors.

- Europe: The European market is characterized by a strong focus on industrial automation (Industry 4.0), high-end automotive manufacturing, and stringent regulatory environments (like RoHS and REACH). European distributors focus heavily on providing sophisticated value-added services, including tailored logistical solutions, compliance management, and specialized technical expertise, supporting complex, long-lifecycle products. Growth in Europe is particularly strong in medical technology and renewable energy sectors, where distributors must ensure component longevity and strict adherence to safety standards. Geopolitical uncertainties necessitate diversified sourcing strategies, increasing the strategic importance of reliable, localized inventory hubs across the continent.

- Latin America (LATAM): LATAM remains an emerging market for electronic component distribution, though it exhibits strong growth potential linked to infrastructure modernization, expanding consumer base, and the development of local electronics assembly operations, particularly in Mexico and Brazil. The market faces challenges related to logistics complexity, import duties, and currency volatility, requiring distributors to adopt localized inventory holding strategies and offer flexible financial arrangements. The primary drivers are the expansion of telecommunications networks and increasing penetration of consumer electronics.

- Middle East & Africa (MEA): The MEA region is characterized by significant investments in smart city projects, energy infrastructure (oil & gas modernization and renewables), and defense systems. Distribution here often requires handling highly customized logistical demands due to varying regulatory landscapes and difficult regional connectivity. While smaller in volume compared to APAC, the market for specialized and highly secured components, particularly those related to security and critical infrastructure, offers high growth potential for distributors willing to navigate the regional complexities and provide robust technical support.

Top Key Players

The market research report includes a detailed profile of leading stakeholders in the Distribution of Electronic Components Market.- Arrow Electronics

- Avnet

- WPG Holdings (World Peace Industrial Group)

- Future Electronics

- TTI, Inc. (A Berkshire Hathaway Company)

- Digi-Key Corporation

- Mouser Electronics (A TTI, Inc. Company)

- Farnell (Element14/Newark)

- EBV Elektronik (An Avnet Company)

- Heilind Electronics

- Rutronik Elektronische Bauelemente GmbH

- Sager Electronics

- Premier Farnell (now owned by Avnet)

- Rochester Electronics

- Master Electronics

- America II Electronics

- Electrocomponents plc (RS Group)

- CEI Group

- Setronik Components

- Macnica Fuji Electronics Holdings, Inc.

Frequently Asked Questions

Analyze common user questions about the Distribution of Electronic Components market and generate a concise list of summarized FAQs reflecting key topics and concerns.What is driving the current demand acceleration in the electronic components distribution sector?

The primary driver is the pervasive integration of electronics into industrial and consumer life, fueled by the rapid deployment of IoT devices, the transition to 5G communication infrastructure, and the explosive growth in electric vehicle (EV) manufacturing. These sectors require advanced, high-performance semiconductors and passive components in unprecedented volumes, necessitating efficient and responsive distribution networks.

How are geopolitical factors impacting the operational resilience of component distributors?

Geopolitical tensions, particularly concerning trade tariffs and technology export controls between major economic blocs, mandate that distributors diversify their sourcing and logistical operations. This has led to strategic investments in regionalizing inventory (reshoring) and developing dual supply chains to mitigate risk, significantly increasing operational complexity but enhancing supply chain resilience for end-users.

Which component segment is projected to experience the fastest growth rate?

The semiconductor segment, specifically advanced Integrated Circuits (ICs) and memory devices, is projected to exhibit the fastest growth. This is directly attributable to the increasing demand for high-performance computing (HPC), AI applications, and specialized processors required for complex systems like ADAS in automotive and hyperscale data centers globally.

What is the role of digital transformation and e-commerce platforms for major distributors?

Digital transformation is critical for speed and market reach. Major distributors are investing heavily in e-commerce platforms to provide 24/7 access to inventory, specialized technical data, and rapid ordering capabilities, particularly targeting high-service requirements from design engineers and smaller R&D firms. This transition optimizes the transactional process and provides rich data for demand forecasting.

How do electronic component distributors ensure against counterfeit components?

Distributors employ rigorous quality assurance protocols, including highly specialized visual and electrical component testing, strict adherence to traceability standards (source authentication), and increasingly, the implementation of blockchain technology to create secure, immutable records of component origins. Partnering exclusively with authorized manufacturers and implementing anti-counterfeiting measures are paramount to maintaining supply chain integrity.

To check our Table of Contents, please mail us at: sales@marketresearchupdate.com

Research Methodology

The Market Research Update offers technology-driven solutions and its full integration in the research process to be skilled at every step. We use diverse assets to produce the best results for our clients. The success of a research project is completely reliant on the research process adopted by the company. Market Research Update assists its clients to recognize opportunities by examining the global market and offering economic insights. We are proud of our extensive coverage that encompasses the understanding of numerous major industry domains.

Market Research Update provide consistency in our research report, also we provide on the part of the analysis of forecast across a gamut of coverage geographies and coverage. The research teams carry out primary and secondary research to implement and design the data collection procedure. The research team then analyzes data about the latest trends and major issues in reference to each industry and country. This helps to determine the anticipated market-related procedures in the future. The company offers technology-driven solutions and its full incorporation in the research method to be skilled at each step.

The Company's Research Process Has the Following Advantages:

- Information Procurement

The step comprises the procurement of market-related information or data via different methodologies & sources.

- Information Investigation

This step comprises the mapping and investigation of all the information procured from the earlier step. It also includes the analysis of data differences observed across numerous data sources.

- Highly Authentic Source

We offer highly authentic information from numerous sources. To fulfills the client’s requirement.

- Market Formulation

This step entails the placement of data points at suitable market spaces in an effort to assume possible conclusions. Analyst viewpoint and subject matter specialist based examining the form of market sizing also plays an essential role in this step.

- Validation & Publishing of Information

Validation is a significant step in the procedure. Validation via an intricately designed procedure assists us to conclude data-points to be used for final calculations.

×

Request Free Sample:

Related Reports

Select License

Why Choose Us

We're cost-effective and Offered Best services:

We are flexible and responsive startup research firm. We adapt as your research requires change, with cost-effectiveness and highly researched report that larger companies can't match.

Information Safety

Market Research Update ensure that we deliver best reports. We care about the confidential and personal information quality, safety, of reports. We use Authorize secure payment process.

We Are Committed to Quality and Deadlines

We offer quality of reports within deadlines. We've worked hard to find the best ways to offer our customers results-oriented and process driven consulting services.

Our Remarkable Track Record

We concentrate on developing lasting and strong client relationship. At present, we hold numerous preferred relationships with industry leading firms that have relied on us constantly for their research requirements.

Best Service Assured

Buy reports from our executives that best suits your need and helps you stay ahead of the competition.

Customized Research Reports

Our research services are custom-made especially to you and your firm in order to discover practical growth recommendations and strategies. We don't stick to a one size fits all strategy. We appreciate that your business has particular research necessities.

Service Assurance

At Market Research Update, we are dedicated to offer the best probable recommendations and service to all our clients. You will be able to speak to experienced analyst who will be aware of your research requirements precisely.

Contact With Our Sales Team

Customer Testimonials

The content of the report is always up to the mark. Good to see speakers from expertise authorities.

Privacy requested , Managing Director

A lot of unique and interesting topics which are described in good manner.

Privacy requested, President

Well researched, expertise analysts, well organized, concrete and current topics delivered in time.

Privacy requested, Development Manager