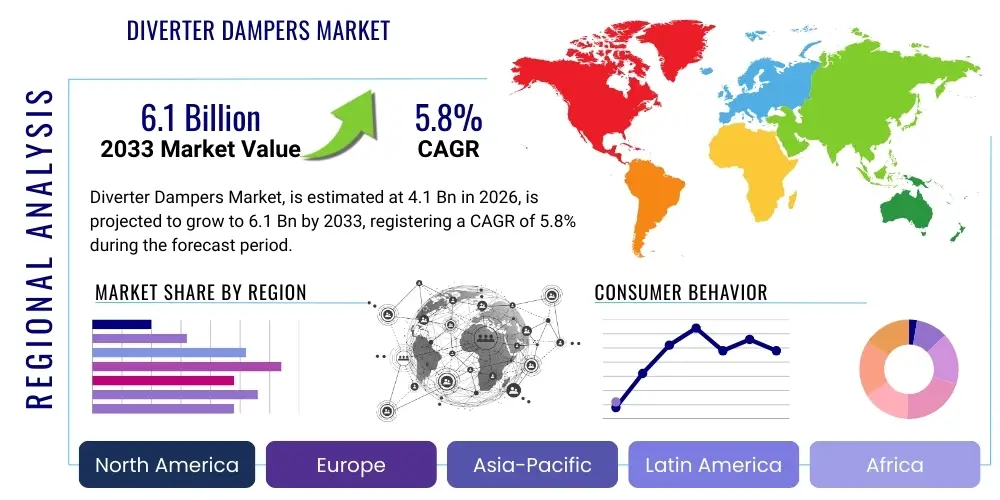

Diverter Dampers Market Size, By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2026 to 2033 (Financial Impact Analysis)

ID : MRU_ 442406 | Date : Feb, 2026 | Pages : 242 | Region : Global | Publisher : MRU

Diverter Dampers Market Size

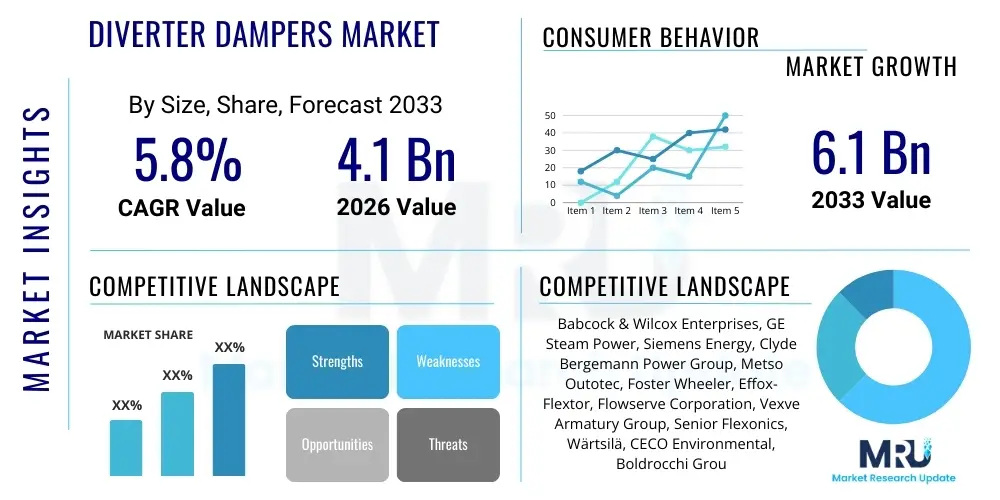

The Diverter Dampers Market is projected to grow at a Compound Annual Growth Rate (CAGR) of 5.8% between 2026 and 2033. The market is estimated at USD 4.1 Billion in 2026 and is projected to reach USD 6.1 Billion by the end of the forecast period in 2033.

Diverter Dampers Market introduction

The Diverter Dampers Market encompasses specialized flow control devices crucial for managing hot exhaust gases, particularly within combined cycle power plants (CCPP) and industrial heat recovery systems. These systems are essential for maximizing energy efficiency by channeling high-temperature gas streams, typically emanating from gas turbines, either into a Heat Recovery Steam Generator (HRSG) for electricity generation or directing them to a bypass stack during startup, shutdown, or maintenance cycles. The primary function of a diverter damper is to ensure seamless, safe, and efficient transition of exhaust flow, maintaining operational integrity and maximizing thermal output across various operating conditions.

Diverter dampers are generally robust, heavy-duty components designed to withstand extreme thermal conditions, high velocities, and corrosive environments. Their complex structure often involves a pivotal blade mechanism, robust sealing systems (such as metallic or composite seals), and highly reliable actuation systems, which can be hydraulic or electric. Key applications extend beyond traditional power generation to include petrochemical processing, cement production, and metallurgical industries where large volumes of high-temperature flue gases must be meticulously managed. The growing global focus on energy optimization and reduced carbon emissions, coupled with the continued expansion of combined cycle installations, significantly underpins the market trajectory.

The major benefits provided by these systems include enhanced operational flexibility, improved equipment longevity by mitigating thermal stress, and increased system efficiency through optimized heat recovery. Driving factors for market growth include stringent regulatory frameworks promoting energy efficiency, increasing demand for flexible power grid operations necessitating faster startup times for CCPP, and the continuous industrialization across developing economies, particularly in Asia Pacific, which drives the construction of new power infrastructure and waste heat recovery facilities.

- Product Description: Specialized flow control devices used primarily in combined cycle power plants to direct gas turbine exhaust flow to either a Heat Recovery Steam Generator (HRSG) or a bypass stack.

- Major Applications: Combined Cycle Power Plants (CCPP), Waste Heat Recovery Units, Industrial Process Heaters, and large-scale industrial exhaust systems.

- Benefits: Enhanced thermal efficiency, operational safety, rapid flow modulation, reduced maintenance downtime, and optimized energy output.

- Driving Factors: Global focus on energy efficiency, proliferation of CCPP installations, and regulatory mandates for waste heat utilization.

Diverter Dampers Market Executive Summary

The global Diverter Dampers market is experiencing steady growth, driven by fundamental shifts in energy generation infrastructure and increasing industrial thermal management requirements. Business trends highlight a strong emphasis on developing materials capable of handling increasingly higher operating temperatures and pressures, necessitating innovation in sealing technologies and actuation reliability. Key players are focusing on modular designs that simplify installation and maintenance, offering integrated solutions that combine the damper unit with expansion joints and auxiliary systems. Furthermore, the push towards digitalization in power plant operations is integrating smart monitoring and predictive maintenance capabilities into new diverter damper installations, transforming these mechanical components into data-enabled assets.

Regional trends indicate that the Asia Pacific (APAC) region remains the most dominant and rapidly growing market, fueled by massive infrastructure projects, robust energy demand growth, particularly in China and India, and significant governmental investment in combined heat and power (CHP) facilities. North America and Europe, while mature markets, are experiencing demand driven by the replacement and upgrade cycle of aging CCPP infrastructure, alongside stringent emissions control requirements that mandate precise gas flow management. The Middle East and Africa (MEA) region shows sustained growth, primarily linked to large-scale oil and gas sector investments requiring reliable thermal management solutions and new power generation projects.

Segment trends reveal that the Gas Turbine Size segment, specifically those serving large-scale industrial and utility applications (300 MW and above), constitutes the largest market share due to the associated high capital expenditure and specialized engineering required for ultra-large diverter units. Concurrently, the application segment focused on Waste Heat Recovery (WHR) is anticipated to exhibit the fastest growth rate, reflecting the worldwide transition toward circular economy models and maximizing secondary energy sources across diverse industrial sectors, including metallurgy and chemicals. Technological advancements in pneumatic and hydraulic actuators are also streamlining operational efficiency across all size segments.

- Business Trends: Focus on high-temperature sealing innovation, integration of smart sensors for predictive maintenance, and development of modular, lightweight designs.

- Regional Trends: APAC leads growth due to rapid infrastructure development; North America and Europe focus on upgrades and regulatory compliance; MEA driven by power generation expansion.

- Segments Trends: Large-scale Gas Turbine Size (above 300 MW) dominates revenue; Waste Heat Recovery application shows the highest growth potential.

AI Impact Analysis on Diverter Dampers Market

Common user questions regarding AI’s impact on the Diverter Dampers Market often revolve around predictive failure, optimization of switching cycles, and automated maintenance scheduling. Users frequently ask if AI can accurately predict damper blade fatigue or seal degradation based on real-time operational data, and how machine learning algorithms can minimize thermal stress during rapid load changes in a combined cycle plant. Concerns also focus on the feasibility of integrating complex AI systems into established, heavy mechanical infrastructure and the required investment in sensor technology (IoT). Expectations are high for AI to transition maintenance from reactive or time-based schedules to true condition-based monitoring, dramatically increasing Mean Time Between Failures (MTBF) and reducing unscheduled downtime.

The primary influence of Artificial Intelligence (AI) and Machine Learning (ML) on the diverter dampers market is the shift toward advanced operational optimization and enhanced asset performance management (APM). By analyzing vast datasets—including gas velocity, temperature differentials across the damper, actuation force requirements, and historical cycling frequency—AI algorithms can identify subtle patterns indicative of impending mechanical failure or performance degradation, such as minor seal leakage or actuator calibration drift. This predictive capability allows operators to schedule precise interventions, ensuring the damper remains fully functional and leak-tight, which is critical for maintaining maximum HRSG efficiency and preventing unnecessary heat loss through the bypass stack.

Furthermore, AI is instrumental in optimizing the operational sequencing of diverter dampers within flexible power generation scenarios. As grids demand faster ramp-up and ramp-down rates, the speed and accuracy with which the damper directs exhaust flow become vital. ML models can calculate the optimal trajectory and speed for damper movement based on real-time turbine output and grid demand, minimizing transient thermal shocks to the HRSG tubes and extending the lifespan of the damper mechanism itself. This integration transforms the damper from a simple mechanical switch into an intelligent component of the overall power plant control system, contributing significantly to improved responsiveness and long-term cost savings.

- Integration of real-time sensor data (temperature, vibration, pressure) into AI-driven predictive maintenance platforms.

- Optimization of damper switching algorithms to minimize thermal fatigue and stress on mechanical seals and blades during rapid cycling.

- Automated anomaly detection for seal integrity verification, reducing fugitive emissions and maximizing energy capture efficiency.

- Enhancement of actuator control systems using ML for precise positioning and reduced energy consumption during operation.

- Development of digital twins of damper systems to simulate operational scenarios and predict component wear under extreme conditions.

DRO & Impact Forces Of Diverter Dampers Market

The Diverter Dampers Market is propelled by several robust drivers, primarily the necessity for high efficiency in power generation, leading to the global proliferation of Combined Cycle Power Plants (CCPP), which inherently require reliable diverter technology. Simultaneously, industrial sectors are increasingly adopting waste heat recovery (WHR) systems to lower operational costs and meet sustainability goals, creating consistent demand for dampers capable of managing industrial exhaust streams. However, the market faces significant restraints, chiefly the extremely high capital cost associated with installing large, custom-engineered damper systems and the complexity of maintenance due to their placement in harsh, high-temperature operational environments. These factors necessitate specialized engineering and high-grade materials, adding to the overall system expense.

Opportunities for market expansion are concentrated in the transition toward green energy solutions. The growing implementation of co-generation (CHP) and decentralized power generation units creates new niches for smaller, standardized diverter damper systems. Furthermore, technological leaps in material science, focusing on advanced refractory materials and enhanced high-temperature sealing solutions, offer opportunities to develop products with superior longevity and reduced leakage rates, addressing a primary concern of plant operators. The aftermarket services segment, including specialized inspection, repair, and replacement of seals and actuators, also represents a lucrative growth avenue.

The market is subject to significant impact forces, where the intensity of competitive rivalry is high among established global manufacturers specializing in heavy industrial components. The bargaining power of buyers, particularly large utility companies and Engineering, Procurement, and Construction (EPC) firms, remains substantial due to the standardized specifications required for major power projects and the ability to choose from a limited pool of qualified suppliers. Supplier power is moderate, influenced heavily by the availability of specialized raw materials (e.g., specific high-nickel alloys) needed for high-temperature application components. The threat of substitutes is relatively low, as diverter dampers are essential, non-negotiable components for CCPP operation, although alternative energy recovery systems could indirectly affect demand.

- Drivers (D): Increased global CCPP installation, mandatory adoption of Waste Heat Recovery systems, and regulatory pressures for energy efficiency.

- Restraints (R): High initial investment and customized engineering costs, complexity of maintenance in high-temperature environments, and long procurement cycles.

- Opportunities (O): Growth in decentralized power generation (CHP), technological advancements in high-temperature sealing materials, and expansion of specialized aftermarket services.

- Impact Forces: High competitive intensity among key players; strong buyer bargaining power from utility and EPC firms; low threat of substitution for large-scale applications.

Segmentation Analysis

The Diverter Dampers Market is comprehensively segmented based on three key dimensions: Type, Gas Turbine Size, and End-User Application, providing granular insights into demand patterns across various industrial and power generation sectors. The Type segmentation distinguishes between single-blade and multi-blade designs, with the multi-blade configuration often preferred for larger duct sizes and scenarios demanding precise flow modulation capabilities. Understanding these segmentation nuances is crucial for manufacturers to tailor product specifications—such as materials selection, actuation mechanism, and sealing technology—to specific operational demands, including cyclic frequency and operating temperature range, thereby maximizing market penetration and addressing specialized industrial requirements effectively.

The Gas Turbine Size segmentation is paramount, directly correlating market investment with the scale of the power plant. Large-scale utility projects (above 300 MW) necessitate massive, custom-built diverter systems, dominating the market value segment, while smaller turbines (below 100 MW) utilized in industrial captive power or decentralized energy units drive the volume segment. This segmentation dictates the complexity of the damper design, moving from heavy-duty, high-integrity seals for large utility applications to potentially simpler, more cost-effective designs for smaller industrial installations. The End-User Application segmentation further separates demand into primary consumption sectors, recognizing the distinct operational environments and regulatory standards applicable to Combined Cycle Power Plants versus diverse industrial heat recovery processes like cement or petrochemicals.

Analyzing these segments reveals critical trends: the multi-blade segment is projected for sustained growth due to its superior sealing capability and operational flexibility, while the Waste Heat Recovery application segment shows the fastest CAGR, driven by global industrial efforts toward sustainable energy management and operational cost reduction. Manufacturers are increasingly focusing R&D efforts on developing standardized, modular designs suitable across different Gas Turbine Sizes to simplify inventory and procurement processes for EPC contractors, thereby addressing the customization challenges historically associated with this specialized market.

- By Type: Single-Blade Diverter Dampers, Multi-Blade Diverter Dampers.

- By Gas Turbine Size: Below 100 MW, 100 MW – 300 MW, Above 300 MW.

- By End-User Application: Combined Cycle Power Plants (CCPP), Waste Heat Recovery (WHR) Systems, Industrial Process Heat, Others (including incineration and metallurgical processes).

Value Chain Analysis For Diverter Dampers Market

The value chain for the Diverter Dampers Market begins with upstream activities focused on raw material procurement, which is highly specialized, involving the sourcing of high-grade steel alloys (such as stainless steel and high-nickel alloys), refractory materials for thermal insulation, and advanced composite materials for specialized sealing systems. Due to the high-temperature demands, material quality assurance and compliance with stringent international standards (e.g., ASME, EN) are crucial at this stage. Key challenges upstream include managing volatile alloy pricing and ensuring a reliable supply of bespoke, high-performance components like specialized actuators and heavy-duty bearings capable of operating reliably in harsh environments. Manufacturers often integrate backwards to control the quality of key component fabrication.

The middle segment involves core manufacturing and assembly, focusing on precision fabrication of the damper housing, blade mechanisms, and sealing elements. This stage is capital-intensive, requiring advanced welding techniques, precision machining, and extensive non-destructive testing (NDT). The distribution channel predominantly relies on direct sales and specialized engineering consulting. Due to the customized, project-specific nature of large diverter dampers, they are rarely stocked off-the-shelf. Direct channels involve the manufacturer working closely with Engineering, Procurement, and Construction (EPC) firms or directly with utility operators, ensuring the damper specifications perfectly match the gas turbine and HRSG interface requirements.

Downstream analysis focuses on installation, commissioning, and, critically, long-term aftermarket service. Installation requires highly specialized field teams due to the size and alignment precision needed for ductwork integration. The aftermarket component is a significant revenue driver, encompassing preventative maintenance, scheduled replacement of seals (which degrade over time due to heat cycling), actuator repair, and performance upgrades. Indirect sales channels, such as local agents or licensed distributors, play a role in providing regional support and facilitating faster delivery of spare parts, particularly in emerging markets where direct factory support may be geographically challenging. The long operational life of power plants ensures a sustained need for these essential maintenance and service functions.

Diverter Dampers Market Potential Customers

The primary end-users and buyers of diverter dampers are large organizations operating infrastructure that relies heavily on high-temperature gas processing and efficient energy recovery. The most significant customer base comprises major utility companies and independent power producers (IPPs) that manage and operate combined cycle power plants (CCPP). For these entities, the diverter damper is a mission-critical component directly impacting thermal efficiency, plant responsiveness to grid demand, and overall safety; thus, procurement decisions prioritize reliability, regulatory compliance, and proven operational history over mere cost minimization.

A secondary, yet rapidly expanding, customer segment includes large industrial enterprises across the chemical, petrochemical, cement, and metallurgical sectors. These companies utilize diverter dampers within their Waste Heat Recovery (WHR) units or process heating systems to capture thermal energy generated during their primary manufacturing processes. For industrial buyers, the focus is often split between operational robustness and the return on investment (ROI) derived from the recovered energy, making efficiency and long-term durability paramount purchasing factors.

Additionally, Engineering, Procurement, and Construction (EPC) companies serve as crucial intermediaries. EPC firms are responsible for designing and building new power plants and industrial facilities and are often the direct purchasers of diverter dampers, integrating them into the overall plant design. Their purchasing behavior is heavily influenced by project timelines, adherence to international engineering standards, and the manufacturer's ability to deliver specialized equipment on a complex, global supply chain schedule. Therefore, successful market penetration relies heavily on establishing strong, long-term partnerships with leading global EPC contractors.

| Report Attributes | Report Details |

|---|---|

| Market Size in 2026 | USD 4.1 Billion |

| Market Forecast in 2033 | USD 6.1 Billion |

| Growth Rate | CAGR 5.8% |

| Historical Year | 2019 to 2024 |

| Base Year | 2025 |

| Forecast Year | 2026 - 2033 |

| DRO & Impact Forces |

|

| Segments Covered |

|

| Key Companies Covered | Babcock & Wilcox Enterprises, GE Steam Power, Siemens Energy, Clyde Bergemann Power Group, Metso Outotec, Foster Wheeler, Effox-Flextor, Flowserve Corporation, Vexve Armatury Group, Senior Flexonics, Wärtsilä, CECO Environmental, Boldrocchi Group, Zhejiang Damper Equipment Co., Ltd., Fives Group, Macawber Engineering, Damper Technology Ltd., Indeck Power Equipment Co., Dongfang Electric Corporation, and KC Cottrell. |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Enquiry Before Buy | Have specific requirements? Send us your enquiry before purchase to get customized research options. Request For Enquiry Before Buy |

Diverter Dampers Market Key Technology Landscape

The technology landscape of the Diverter Dampers Market is defined by innovation aimed at improving sealing effectiveness, enhancing material robustness, and ensuring fail-safe actuation in extreme thermal cycling environments. A critical technological focus is on high-integrity sealing systems. Traditional metal seals are increasingly being supplemented or replaced by advanced composite and ceramic fiber seals, particularly in high-temperature applications (above 600°C), which offer superior leakage prevention (often targeting leakage rates below 0.5% of flow area) and better resilience against differential thermal expansion between the blade and the housing. Furthermore, sophisticated pressure-assisted sealing mechanisms are being developed to utilize external air or steam injection to create a thermal barrier, maximizing gas tightness and operational efficiency, thereby reducing heat loss and improving overall plant output.

Material science innovation is equally vital, driving the shift from standard carbon steel bodies to specialized high-temperature alloys like Inconel or specific stainless steel grades for internal components exposed to flue gases and thermal shock. Manufacturers are employing Computational Fluid Dynamics (CFD) modeling extensively during the design phase to predict flow patterns, minimize pressure drop across the damper, and optimize the aerodynamic profile of the blades. This technological approach ensures that the damper, when fully open, presents minimal obstruction to the gas flow, directly translating into lower operating costs for the power plant by minimizing fan power requirements and enhancing efficiency.

Automation and control systems represent another significant area of technological advancement. Modern diverter dampers feature robust, redundant actuation systems—typically high-torque hydraulic cylinders or electric motor drives—equipped with advanced position sensors and variable speed control capabilities. This allows for precise, rapid movement necessary for quick startup or shutdown sequences, which is increasingly essential for flexible power generation grids. Integration with plant Distributed Control Systems (DCS) often includes advanced diagnostic modules and predictive monitoring sensors (temperature, vibration) that feed data back to the central control room, facilitating condition-based maintenance strategies and ensuring compliance with operational safety standards.

Regional Highlights

The regional dynamics of the Diverter Dampers Market exhibit varied growth rates and maturity levels corresponding to local energy policies and industrial development stages. Asia Pacific (APAC) stands out as the global leader in market value and growth potential, primarily driven by massive investments in new combined cycle power infrastructure across China, India, and Southeast Asia, necessitated by soaring electricity demand and sustained industrial growth. Government initiatives promoting energy self-sufficiency and regulatory mandates encouraging waste heat utilization in sectors like cement and steel further solidify APAC's dominance. The region's focus is on scaling up manufacturing capacity and integrating cost-effective, high-reliability damper systems for large utility projects (Above 300 MW segment).

North America and Europe represent mature, stable markets characterized less by new construction and more by modernization, replacement, and strict environmental compliance. In these regions, demand is spurred by the need to upgrade existing, aging CCPP fleets to improve efficiency and reduce emissions. Furthermore, the increasing reliance on renewable energy sources necessitates CCPP units to operate flexibly, requiring diverter dampers capable of rapid, frequent cycling with guaranteed reliability—a factor driving technology adoption in advanced sealing and actuation systems. The European market, particularly Germany and the UK, shows focused demand in decentralized CHP installations.

The Middle East and Africa (MEA) region demonstrates robust, project-driven growth, tied fundamentally to the expansion of oil & gas processing facilities and new centralized power generation projects, particularly in Saudi Arabia, UAE, and Qatar. Investment in large-scale desalination plants, which often rely on associated power generation, also generates consistent demand for robust diverter damper systems capable of withstanding the challenging ambient conditions and ensuring continuous operation. Latin America, while smaller, presents targeted opportunities in countries like Brazil and Mexico where gas-fired power generation is expanding, requiring localized supply chains for timely project execution.

- Asia Pacific (APAC): Highest growth market; driven by new CCPP construction (China, India), rapid industrialization, and strong focus on large-scale utility projects and Waste Heat Recovery mandates.

- North America: Stable market focused on infrastructure modernization, replacement cycles, and demand for highly reliable dampers due to increased grid flexibility requirements.

- Europe: Mature market sustained by stringent environmental regulations, replacement demand, and significant adoption in Combined Heat and Power (CHP) applications.

- Middle East & Africa (MEA): Project-driven growth linked to major oil & gas infrastructure investments and new large-scale power generation capacities (e.g., GCC nations).

- Latin America: Emerging market with growing demand fueled by gas-fired power generation expansion and localized industrial investments.

Top Key Players

The market research report includes a detailed profile of leading stakeholders in the Diverter Dampers Market.- Babcock & Wilcox Enterprises

- GE Steam Power

- Siemens Energy

- Clyde Bergemann Power Group

- Metso Outotec

- Foster Wheeler

- Effox-Flextor

- Flowserve Corporation

- Vexve Armatury Group

- Senior Flexonics

- Wärtsilä

- CECO Environmental

- Boldrocchi Group

- Zhejiang Damper Equipment Co., Ltd.

- Fives Group

- Macawber Engineering

- Damper Technology Ltd.

- Indeck Power Equipment Co.

- Dongfang Electric Corporation

- KC Cottrell

Frequently Asked Questions

Analyze common user questions about the Diverter Dampers market and generate a concise list of summarized FAQs reflecting key topics and concerns.What is the primary function of a diverter damper in a power plant?

The primary function of a diverter damper is to precisely control the flow of hot exhaust gas from a gas turbine, directing it either into the Heat Recovery Steam Generator (HRSG) to generate electricity or diverting it to a bypass stack, particularly during periods of plant startup, shutdown, or maintenance. This capability ensures optimal operational flexibility and thermal efficiency in combined cycle power plants.

What technological advancements are crucial for improving damper performance?

Crucial technological advancements center on developing highly robust, high-integrity sealing systems, often utilizing advanced composite materials or ceramic fibers, to minimize leakage rates (targeting below 0.5%). Additionally, improved actuation reliability, high-temperature alloy usage, and the integration of predictive maintenance sensors are key for extended operational life and efficiency.

Which end-user segment drives the highest demand for diverter dampers?

The Combined Cycle Power Plants (CCPP) segment, particularly large-scale utility projects (Above 300 MW), drives the highest overall market value. However, the Waste Heat Recovery (WHR) application segment across diverse industrial processes is projected to exhibit the fastest growth rate due to global sustainability mandates.

How does the Gas Turbine Size segmentation impact the diverter damper design?

Gas Turbine Size directly correlates with the physical dimensions, required material thickness, and complexity of the diverter damper. Larger turbines (Above 300 MW) demand highly customized, heavy-duty designs with complex sealing and hydraulic actuation systems, whereas smaller industrial turbines allow for more standardized, cost-effective product solutions.

Why is the Asia Pacific region the fastest-growing market for diverter dampers?

The Asia Pacific region's rapid growth is fueled by extensive infrastructure development, significant government investments in new power generation capacity (CCPP), and increasing industrialization in countries like China and India, all of which require reliable flow control devices for energy optimization and waste heat utilization.

To check our Table of Contents, please mail us at: sales@marketresearchupdate.com

Research Methodology

The Market Research Update offers technology-driven solutions and its full integration in the research process to be skilled at every step. We use diverse assets to produce the best results for our clients. The success of a research project is completely reliant on the research process adopted by the company. Market Research Update assists its clients to recognize opportunities by examining the global market and offering economic insights. We are proud of our extensive coverage that encompasses the understanding of numerous major industry domains.

Market Research Update provide consistency in our research report, also we provide on the part of the analysis of forecast across a gamut of coverage geographies and coverage. The research teams carry out primary and secondary research to implement and design the data collection procedure. The research team then analyzes data about the latest trends and major issues in reference to each industry and country. This helps to determine the anticipated market-related procedures in the future. The company offers technology-driven solutions and its full incorporation in the research method to be skilled at each step.

The Company's Research Process Has the Following Advantages:

- Information Procurement

The step comprises the procurement of market-related information or data via different methodologies & sources.

- Information Investigation

This step comprises the mapping and investigation of all the information procured from the earlier step. It also includes the analysis of data differences observed across numerous data sources.

- Highly Authentic Source

We offer highly authentic information from numerous sources. To fulfills the client’s requirement.

- Market Formulation

This step entails the placement of data points at suitable market spaces in an effort to assume possible conclusions. Analyst viewpoint and subject matter specialist based examining the form of market sizing also plays an essential role in this step.

- Validation & Publishing of Information

Validation is a significant step in the procedure. Validation via an intricately designed procedure assists us to conclude data-points to be used for final calculations.

×

Request Free Sample:

Related Reports

Select License

Why Choose Us

We're cost-effective and Offered Best services:

We are flexible and responsive startup research firm. We adapt as your research requires change, with cost-effectiveness and highly researched report that larger companies can't match.

Information Safety

Market Research Update ensure that we deliver best reports. We care about the confidential and personal information quality, safety, of reports. We use Authorize secure payment process.

We Are Committed to Quality and Deadlines

We offer quality of reports within deadlines. We've worked hard to find the best ways to offer our customers results-oriented and process driven consulting services.

Our Remarkable Track Record

We concentrate on developing lasting and strong client relationship. At present, we hold numerous preferred relationships with industry leading firms that have relied on us constantly for their research requirements.

Best Service Assured

Buy reports from our executives that best suits your need and helps you stay ahead of the competition.

Customized Research Reports

Our research services are custom-made especially to you and your firm in order to discover practical growth recommendations and strategies. We don't stick to a one size fits all strategy. We appreciate that your business has particular research necessities.

Service Assurance

At Market Research Update, we are dedicated to offer the best probable recommendations and service to all our clients. You will be able to speak to experienced analyst who will be aware of your research requirements precisely.

Contact With Our Sales Team

Customer Testimonials

The content of the report is always up to the mark. Good to see speakers from expertise authorities.

Privacy requested , Managing Director

A lot of unique and interesting topics which are described in good manner.

Privacy requested, President

Well researched, expertise analysts, well organized, concrete and current topics delivered in time.

Privacy requested, Development Manager