Diving Support Vessel Market Size, By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2026 to 2033 (Financial Impact Analysis)

ID : MRU_ 441685 | Date : Feb, 2026 | Pages : 249 | Region : Global | Publisher : MRU

Diving Support Vessel Market Size

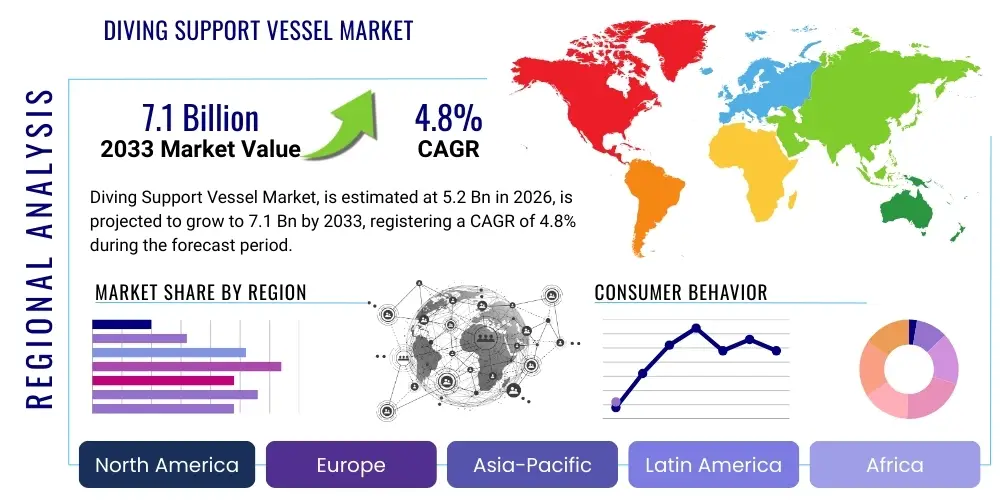

The Diving Support Vessel Market is projected to grow at a Compound Annual Growth Rate (CAGR) of 4.8% between 2026 and 2033. The market is estimated at $5.2 Billion in 2026 and is projected to reach $7.1 Billion by the end of the forecast period in 2033.

Diving Support Vessel Market introduction

The Diving Support Vessel (DSV) Market encompasses specialized marine vessels designed to support professional diving operations, primarily in the offshore oil and gas, renewable energy, and subsea cable installation sectors. These highly complex vessels are equipped with advanced diving systems, including saturation diving complexes, air diving spreads, remotely operated vehicles (ROVs), and integrated dynamic positioning (DP) systems, ensuring precise station keeping during sensitive subsea activities. The fundamental purpose of a DSV is to provide a stable, safe, and fully operational platform for divers to perform inspection, maintenance, repair (IMR), construction, and salvage tasks at significant water depths, thereby acting as a critical enabler for persistent subsea infrastructure management.

The primary applications driving the demand for DSVs are deeply rooted in the energy infrastructure lifecycle. In the conventional oil and gas industry, DSVs are essential for maintaining subsea pipelines, wellheads, and floating production storage and offloading (FPSO) units, often requiring saturation diving capabilities for deepwater operations. Beyond traditional energy, the rapid expansion of offshore wind farms necessitates DSVs for foundation inspection, inter-array cable repair, and general subsea asset integrity management. The versatility and specialized equipment aboard modern DSVs, capable of handling varying water depths and operational complexities, solidify their position as indispensable assets in the global maritime and subsea services landscape, underpinning trillions of dollars in offshore investment.

Key benefits provided by the DSV segment include enhanced operational efficiency, superior safety standards mandated by rigorous international regulations, and the ability to conduct complex operations in challenging environmental conditions, which are often beyond the scope of conventional support vessels. Driving factors for market growth include the increasing average age of subsea infrastructure requiring frequent IMR, the geopolitical focus on energy security accelerating offshore exploration and production (E&P) activities in frontier regions, and the significant governmental and private investment channeled into large-scale offshore renewable energy projects globally. These elements collectively reinforce the sustained long-term demand for high-specification diving support capabilities.

Diving Support Vessel Market Executive Summary

The global Diving Support Vessel (DSV) Market is characterized by robust recovery and strategic transformation driven by elevated oil prices stimulating deepwater E&P and unprecedented growth in the offshore wind sector. Current business trends indicate a critical shift toward hybrid-powered and environmentally compliant DSVs, prioritizing reduced fuel consumption and adherence to stringent emissions regulations, particularly in the North Sea and European waters. Operators are increasingly investing in high-specification, multi-functional vessels that can efficiently manage both saturation diving and advanced ROV operations, thereby maximizing utilization rates and enhancing operational cost-effectiveness. Furthermore, consolidation among key service providers and vertically integrated oil majors is streamlining the supply chain and concentrating high-end assets under fewer, larger entities, influencing pricing dynamics and contract structures across major maritime hubs.

Regional trends reveal the Middle East and Africa (MEA) as a critical hotspot for near-term growth, primarily due to ambitious national oil company projects focused on expanding gas infrastructure and maintaining mature deepwater fields in regions like the Gulf of Mexico and West Africa. Europe, conversely, is dominated by demand originating from the renewable sector, necessitating smaller, highly flexible DSVs for shallow-to-mid water maintenance of offshore wind parks. The Asia Pacific (APAC) region is experiencing balanced growth, spurred by both sustained conventional offshore activity in Southeast Asia and emerging offshore wind development in countries like Taiwan and South Korea, leading to increasing demand for localized vessel fleets and specialized crews capable of navigating diverse regulatory environments.

Segment trends highlight the dominance of the Saturation Diving segment in terms of revenue, reflecting the high costs and essential nature of deepwater operations required for major pipeline construction and deep-sea facility IMR. However, the Air Diving segment is showing faster volume growth, supported by the proliferation of shallow-to-mid water renewable energy installations that do not require ultra-deepwater capabilities. From a vessel class perspective, high-end, dynamically positioned (DP3) DSVs remain the most sought-after category due to their superior safety, stability, and ability to operate continuously in challenging weather conditions, establishing them as the benchmark for reliability in mission-critical subsea campaigns globally.

AI Impact Analysis on Diving Support Vessel Market

Common user questions regarding AI's impact on the DSV market frequently revolve around how artificial intelligence can enhance safety protocols, optimize vessel routing and resource allocation, and ultimately automate or semi-automate highly repetitive subsea inspection tasks currently performed by human divers or supervised ROVs. Users are keen to understand the potential for predictive maintenance enabled by machine learning (ML) algorithms, which could significantly reduce unexpected downtime—a costly operational risk inherent in DSV deployment. Furthermore, there is significant interest in AI's role in processing the massive datasets generated by subsea surveys and visual inspections, moving beyond manual review towards automated defect detection and classification, thus speeding up the decision-making process for integrity management.

The integration of advanced AI and ML capabilities is transforming the operational efficiency and risk profile of DSVs, moving the industry toward a model of data-driven subsea management. AI algorithms are increasingly being deployed to analyze real-time sensor data from the DP system, monitoring vessel motion, thruster performance, and environmental conditions to predict potential station-keeping failures, dramatically improving diver safety and operational uptime. Moreover, specialized ML models are crucial in optimizing diving schedules and gas mixtures based on historical performance, environmental forecasts, and specific project constraints, ensuring that resources (human and material) are utilized at peak efficiency during demanding saturation dives, which are characterized by high inherent operational costs.

Looking forward, AI is set to revolutionize the subsea inspection and maintenance (I&M) sector supported by DSVs. AI-powered computer vision systems are already capable of analyzing gigabytes of video footage captured by ROVs to autonomously identify corrosion, structural fatigue, and marine growth on subsea assets, requiring only human oversight for final verification. This capability substantially reduces the time spent on inspection cycles, freeing up DSV time for intervention tasks. The convergence of AI with advanced robotic manipulators and autonomous underwater vehicles (AUVs) launched from DSVs promises a future where routine IMR tasks are executed with minimized human exposure to hazardous environments, enhancing both the speed and reliability of subsea asset integrity management.

- Predictive Maintenance Optimization: AI analyzes equipment sensor data (compressors, thrusters, life support systems) to forecast failure points, reducing critical downtime and increasing asset utilization.

- Dynamic Positioning Enhancement: Machine learning models refine DP algorithms, improving station-keeping accuracy in high currents and adverse weather, critical for diver safety.

- Automated Data Interpretation: AI rapidly processes ROV survey data (video and sonar) to automatically detect and classify defects (e.g., pipeline dents, coating failures), accelerating IMR decision cycles.

- Operational Logistics Scheduling: AI optimizes dive planning, resource allocation, and mobilization schedules based on weather forecasts, maximizing operational windows and minimizing transit costs.

- Simulator Training and Safety: AI-driven simulations provide highly realistic scenarios for diver and vessel crew training, improving response protocols for emergencies such as blowouts or system failures.

DRO & Impact Forces Of Diving Support Vessel Market

The Diving Support Vessel Market's trajectory is fundamentally shaped by a dynamic interplay of potent drivers, structural restraints, and emerging opportunities, all magnified by significant external impact forces. Key drivers include the global prioritization of subsea asset integrity, particularly concerning aging infrastructure requiring life extension programs, alongside the exponential growth of offshore wind requiring installation and subsequent maintenance of vast cable networks. Restraints largely center on the intense capital expenditure associated with constructing high-specification DSVs and the cyclical volatility inherent in the oil and gas market, which directly impacts utilization rates and day rates. Opportunities are primarily concentrated in the deployment of next-generation, low-emission DSVs and the penetration of new geographical areas such as the Arctic (requiring specialized ice-class vessels) and nascent offshore renewable markets in Asia. These factors are critically influenced by impact forces like regulatory shifts toward decarbonization and the ever-present geopolitical risks affecting global energy trade.

The driving factors for sustained DSV demand are multi-faceted and rooted in long-term global energy needs. The increasing complexity of deepwater oil and gas fields necessitates highly reliable and technologically advanced vessels capable of supporting saturation dives up to 300 meters, a necessity that cannot be met by conventional vessels. Furthermore, strict environmental regulations imposed by bodies like the IMO and specific national governments mandate regular, high-quality inspection and maintenance of pipelines and offshore structures to prevent ecological disasters, thereby creating consistent contractual requirements for DSV services. The accelerating transition to renewable energy acts as a significant stabilizing driver, diversifying the client base beyond oil and gas and ensuring a steady flow of IMR work related to foundation, turbine, and cable maintenance, providing resilience against oil price volatility.

However, the market faces structural restraints that limit rapid expansion and profitability. The high cost of financing and insuring new DSV builds, coupled with specialized crew requirements, elevates the operational expenditure, making entry barriers substantial. Furthermore, the market suffered from an oversupply of vessels during previous downturns, and while fleet utilization has improved, occasional short-term dips in offshore project approvals can still lead to sharp reductions in day rates, impacting the financial health of pure-play DSV operators. Opportunities, conversely, lie in technological differentiation: operators who invest in high-specification vessels equipped with hybrid power systems (battery/diesel-electric) or those designed for specialized tasks like heavy lift or salvage operations, are better positioned to capture premium contracts and achieve higher utilization compared to older, less flexible tonnage. These investments help mitigate the primary operational risk: unexpected technical failure.

Analyzing the impact forces through a framework like Porter's Five Forces reveals high barriers to entry due to massive capital requirements and regulatory complexity. Supplier power is moderate, influenced by specialized equipment providers (e.g., saturation diving system manufacturers) who have concentrated market share. Buyer power is generally high, dominated by powerful oil majors, national oil companies, and large utility companies that possess significant negotiation leverage over day rates and contract terms, though this power diminishes significantly for highly specialized or newly designed vessels during peak demand cycles. The threat of substitutes is low; while ROVs and AUVs can handle inspection tasks, complex intervention, welding, and repair tasks at depth still fundamentally require human divers supported by a stable, reliable DSV platform. Competitive rivalry is intense, particularly in the standard DP2 class segment, forcing continuous innovation and competitive pricing among the leading global service providers.

Segmentation Analysis

The Diving Support Vessel (DSV) Market is comprehensively segmented based on the type of diving technology employed, the dynamic positioning classification of the vessel, the water depth capability, and the primary application driving the service contract. Understanding these segments is crucial as they directly correspond to the operational scope, inherent safety requirements, and resulting day rates commanded by the vessel. The segmentation by diving type—Air, Mixed Gas, and Saturation Diving—dictates the complexity and depth of work achievable, with saturation diving commanding the highest rates due to the required life support infrastructure and advanced medical oversight needed for deepwater missions. The distinction based on DP class (DP1, DP2, DP3) is vital for assessing safety and reliability, especially in close proximity to critical infrastructure, where DP3 vessels are mandated for the most sensitive operations due to their redundancy capabilities.

Further granularity in segmentation is provided by the application areas, reflecting the market’s diversification beyond its traditional reliance on hydrocarbon extraction. The segment related to Inspection, Maintenance, and Repair (IMR) constitutes the largest service segment, driven by the ongoing need to maintain asset integrity over the long lifespan of offshore fields and wind farms. Construction and installation support, while more cyclical, provides significant short-term revenue spikes, especially during major pipeline or subsea tie-back projects. The growing emphasis on offshore renewables has created a distinct and rapidly expanding application segment focused on turbine foundation maintenance and extensive cable burial/repair campaigns, often utilizing smaller, highly maneuverable DSVs optimized for mid-water depths in congested farm areas.

This detailed segmentation allows market participants, from vessel owners to equipment manufacturers, to strategically position their assets and services according to prevailing market needs. For instance, investing in a high-end DP3 DSV with integrated heavy-lift capabilities and a full saturation spread targets the premium, deepwater oil and gas construction segment, whereas smaller, faster DP2 vessels with advanced ROV capabilities are better suited for the high-volume, repetitive IMR tasks associated with large offshore wind portfolios. The continued drive toward greater operational efficiency and safety necessitates vessels that can seamlessly integrate multiple diving modalities and offer state-of-the-art life support systems, making high-specification assets highly inelastic in terms of demand despite fluctuating oil prices, underlining the importance of the capability-based segmentation.

- By Diving Type:

- Air Diving

- Mixed Gas Diving

- Saturation Diving

- By Vessel Class (Dynamic Positioning System):

- DP1 (Basic Level)

- DP2 (Redundant)

- DP3 (Highly Redundant, Mandated for Critical Operations)

- By Water Depth Capability:

- Shallow Water (Up to 50m)

- Mid Water (50m to 150m)

- Deep Water (150m and above)

- By Application:

- Inspection, Maintenance, and Repair (IMR)

- Construction and Installation Support

- Survey and Exploration

- Decommissioning and Salvage

- Offshore Renewables Maintenance (Wind, Wave, Tidal)

- By End-User:

- Oil and Gas Operators (IOCs, NOCs)

- Offshore Wind Developers and Utilities

- Subsea Cable Laying Companies

- Government and Naval Agencies

Value Chain Analysis For Diving Support Vessel Market

The value chain for the Diving Support Vessel (DSV) Market is characterized by a complex interplay between high-cost manufacturing, specialized technology integration, and highly regulated operational services. The upstream segment is dominated by shipbuilding yards, which handle the hull construction, and specialized equipment manufacturers, particularly those designing and integrating the saturation diving systems, decompression chambers, gas management units, and the dynamic positioning (DP) systems. This upstream phase requires immense capital and adherence to stringent maritime classification society standards (e.g., DNV, ABS). Key upstream activities involve advanced naval architecture design focused on stability and redundancy, procurement of specialized long-lead items such as large thrusters and high-pressure compressors, and the rigorous testing and certification of the complex life support apparatus required for saturation diving, establishing the vessel’s fundamental capability.

The midstream and core operational segment is where DSV owners and operators execute the value proposition. This involves highly specialized activities such as securing long-term contracts (chartering), mobilizing the vessel to the operational field, and deploying expert diving crews, saturation technicians, and ROV pilots. Operational expenditures are substantial, covering specialized crew wages, maintenance of complex equipment, fuel consumption (which is increasingly optimized by hybrid systems), and regulatory compliance costs. The value generated here is contingent on high utilization rates and the reliability of the DP systems, as downtime due to technical failure can incur massive penalties. Effective project management and superior safety records are essential differentiators in this service-delivery stage, directly impacting client retention and day rates.

The downstream flow involves the direct interaction with the end-users—oil majors, subsea contractors, and renewable energy developers. Distribution channels are primarily direct, through negotiated long-term charter agreements or project-specific contracts. Indirect channels are limited but can include brokered charter agreements facilitated by specialized marine services consultancies. The critical final step in the value chain is the delivery of successful subsea outcomes—whether it is the repair of a critical pipeline, the installation of a new jumper, or detailed integrity inspection. The final value captured is based on the quality, safety, and efficiency of the subsea service delivered, making the DSV an enabling asset for multi-billion dollar offshore projects. Customer feedback and adherence to HSE (Health, Safety, and Environment) standards subsequently feed back into the upstream segment, influencing future vessel design specifications and technological upgrades.

Diving Support Vessel Market Potential Customers

The primary customers for Diving Support Vessels are sophisticated entities operating high-value assets in the offshore environment, requiring mission-critical support for asset integrity and operational continuity. Traditionally, the largest segment of end-users consists of Major International Oil Companies (IOCs) such as Shell, ExxonMobil, BP, and TotalEnergies, alongside powerful National Oil Companies (NOCs) like Saudi Aramco, Equinor, Petrobras, and Petronas. These entities require DSVs for the entire lifecycle of their subsea infrastructure, including installation assistance for subsea production systems (SPS), routine inspection of deepwater wellheads, and mandatory preventative and corrective maintenance of extensive pipeline networks that transport hydrocarbons from offshore fields to processing facilities. Their procurement processes are characterized by rigorous vetting, emphasizing safety performance, vessel specification (especially DP3 capability), and demonstrated operational track record, often resulting in multi-year framework agreements.

A rapidly expanding customer base is found within the offshore renewable energy sector, encompassing major utility providers and specialized offshore wind farm developers (e.g., Ørsted, Vattenfall, RWE). These customers utilize DSVs primarily for the construction phase (inter-array and export cable installation support) and, crucially, for the subsequent 25-year operational phase, focusing on the integrity management of foundations, scour protection, and cable repair. Given that most wind farms operate in mid-to-shallow waters, this segment drives demand for highly flexible, smaller, and increasingly environmentally friendly vessels optimized for quicker mobilization and less stringent depth capabilities compared to deepwater oil and gas applications, though demanding similar levels of station-keeping accuracy during critical cable splicing operations.

Furthermore, specialized subsea contractors who undertake work on behalf of the major asset owners also represent a crucial customer segment. These engineering, procurement, construction, and installation (EPCI) companies (e.g., Subsea 7, TechnipFMC) often charter DSVs as part of a turnkey solution offered to the end-client. Additionally, government agencies, particularly navies and coast guards, utilize DSVs or similar vessels for specialized tasks such as underwater ordnance disposal, wreckage salvage, search and recovery missions, and hydrographic survey support in sensitive maritime areas. These diverse potential customers underscore the market's dependence on global capital expenditure in energy infrastructure and maritime security, ensuring a broad, though cyclical, demand base for highly capable diving support assets.

| Report Attributes | Report Details |

|---|---|

| Market Size in 2026 | $5.2 Billion |

| Market Forecast in 2033 | $7.1 Billion |

| Growth Rate | 4.8% CAGR |

| Historical Year | 2019 to 2024 |

| Base Year | 2025 |

| Forecast Year | 2026 - 2033 |

| DRO & Impact Forces |

|

| Segments Covered |

|

| Key Companies Covered | DOF Subsea, Subsea 7, Helix Energy Solutions, TechnipFMC, Allseas Group S.A., Boskalis, Saipem S.p.A., McDermott International, Harvey Gulf International Marine, DeepOcean, Mermaid Maritime Public Company Limited, SBM Offshore, Olympic Subsea, Harkand Group, Bourbon Offshore, Global Offshore, Seaway 7, Swire Pacific Offshore, Van Oord, Cal Dive International. |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Enquiry Before Buy | Have specific requirements? Send us your enquiry before purchase to get customized research options. Request For Enquiry Before Buy |

Diving Support Vessel Market Key Technology Landscape

The technological landscape of the Diving Support Vessel market is rapidly evolving, driven by the dual imperatives of enhancing safety and achieving environmental sustainability. Central to modern DSVs is the adoption of advanced Dynamic Positioning (DP) systems, predominantly classified as DP2 or DP3, utilizing triple redundancy features (three engine rooms, three thruster systems, three control systems) to ensure absolute station keeping integrity, which is non-negotiable when human divers are operating at depth. Furthermore, significant investment is concentrated in advanced saturation diving systems, which now feature more spacious and technologically integrated living chambers, automated gas management systems (e.g., heliox recycling), and hyperbaric rescue chambers (HRCs) with improved capabilities for rapid deployment and evacuation. These technological upgrades aim to minimize human error and extend the safe working envelope for divers engaged in complex, deepwater intervention tasks, directly improving operational effectiveness.

A major current technological shift is the integration of green maritime solutions, moving DSVs toward hybrid and low-emission propulsion systems. Many new builds and major refurbishments feature high-efficiency diesel-electric power plants coupled with large battery energy storage systems (BESS). These hybrid solutions allow DSVs to run in "peak shaving" or "zero-emission loitering" modes, particularly when on station, drastically reducing fuel consumption and nitrogen oxide (NOx) and sulfur oxide (SOx) emissions, aligning with IMO 2030 and 2050 decarbonization targets. Furthermore, enhanced data connectivity, including advanced satellite communication systems and robust cybersecurity measures, are increasingly crucial, enabling real-time data transmission from subsea assets and facilitating remote monitoring and technical support from shore-based operational centers, thereby optimizing fleet management.

Another critical technological domain involves the sophisticated integration of Remotely Operated Vehicles (ROVs) and Autonomous Underwater Vehicles (AUVs) launched and managed from the DSV. Modern DSVs are equipped with dual launch and recovery systems (LARS) capable of handling work-class ROVs that operate simultaneously with divers, providing vital support, observation, and light intervention capabilities. The trend is moving towards heavy-duty ROVs with advanced manipulation capabilities, often incorporating force feedback and augmented reality displays for pilots. Moreover, the deployment of AUVs for preliminary wide-area survey work frees up expensive DSV time, ensuring that the vessel is only utilized when human intervention or heavy work-class ROV operations are strictly necessary. This technological synergy between manned diving, ROVs, and AUVs maximizes the cost-effectiveness and operational flexibility of the deployed asset.

Regional Highlights

- North America: This region, historically driven by the Gulf of Mexico's deepwater E&P activities, maintains a strong demand for high-specification DP3 DSVs, primarily utilized for IMR and complex deepwater tie-backs. The focus remains on maintaining aging infrastructure and supporting the expansion of fields in ultra-deep water. Regulatory oversight, particularly by the Bureau of Ocean Energy Management (BOEM), drives continuous requirements for vessel safety and environmental compliance, ensuring a stable market for high-quality assets. The region acts as a key innovator for specialized vessel modifications and advanced subsea systems, supporting long-duration, high-pressure operations.

- Europe (North Sea): Europe is defined by its maturity in offshore oil and gas and its global leadership in offshore wind development. The North Sea market demands vessels optimized for harsh environmental conditions and increasingly stringent decarbonization mandates. DSVs here are rapidly adopting hybrid-electric propulsion and are heavily utilized in supporting the prolific offshore wind sector for cable maintenance and foundation inspection around the UK, Germany, and the Netherlands. Norway, in particular, drives demand for technologically advanced, often Norwegian-built, high-ice-class DSVs capable of operating near Arctic waters.

- Asia Pacific (APAC): The APAC market is characterized by diverse demands, ranging from conventional oil and gas operations in Southeast Asia (Malaysia, Indonesia, Thailand) to rapidly emerging offshore wind sectors in East Asia (Taiwan, Vietnam, South Korea). Demand tends to be mixed, requiring both DP2 vessels for shallower water IMR and specialized vessels for new installation campaigns. Significant governmental infrastructure spending and the push for energy independence across the archipelago nations contribute to sustained growth, though localized regulatory challenges and a fragmented market structure require strategic operational flexibility.

- Middle East and Africa (MEA): This region is experiencing significant market resurgence, driven by massive capital expenditure from NOCs in the Arabian Gulf and continuous deepwater development off West Africa (Angola, Nigeria). The demand in the Middle East is focused on large-scale infrastructure projects, including new pipeline installations and facility upgrades, requiring sustained saturation diving support. Africa’s deepwater basins necessitate high-spec DSVs for complex subsea construction and maintenance of FPSOs, with contract stability heavily influenced by global oil price stability and geopolitical considerations.

- Latin America: Dominated by Brazil's pre-salt developments managed largely by Petrobras, the Latin American market requires highly specialized, often Brazilian-flagged, DP3 DSVs capable of supporting ultra-deepwater diving and construction work. The market here is highly sensitive to national energy policy and local content requirements, often favoring operators with established regional presence and specific certifications for deepwater safety and environmental protection. Maintenance of existing deepwater production systems remains the primary revenue source, ensuring a steady, though concentrated, demand base.

Top Key Players

The market research report includes a detailed profile of leading stakeholders in the Diving Support Vessel Market.- DOF Subsea

- Subsea 7

- Helix Energy Solutions

- TechnipFMC

- Allseas Group S.A.

- Boskalis

- Saipem S.p.A.

- McDermott International

- Harvey Gulf International Marine

- DeepOcean

- Mermaid Maritime Public Company Limited

- SBM Offshore

- Olympic Subsea

- Harkand Group

- Bourbon Offshore

- Global Offshore

- Seaway 7

- Swire Pacific Offshore

- Van Oord

- Cal Dive International

Frequently Asked Questions

Analyze common user questions about the Diving Support Vessel market and generate a concise list of summarized FAQs reflecting key topics and concerns.What is the primary difference between a DP2 and a DP3 Diving Support Vessel?

The distinction lies in redundancy and safety levels. A DP2 DSV has system redundancy allowing it to operate if a single fault occurs. A DP3 DSV, mandated for high-risk operations near fixed infrastructure, offers highly enhanced redundancy, meaning critical systems are physically segregated and operable even if a fire or flooding event occurs in one compartment, ensuring continuous station-keeping integrity and diver safety.

How does the growth of offshore wind power impact the demand for DSVs?

Offshore wind power significantly diversifies and stabilizes DSV demand, shifting focus from deepwater E&P to mid-water IMR tasks, especially related to subsea cable repair and foundation maintenance. While deepwater saturation capabilities are less critical, there is an increased need for DP2-class, highly fuel-efficient vessels optimized for quick maneuverability within wind farm layouts.

Which geographical region holds the highest potential for DSV market expansion?

The Middle East and Africa (MEA) and the Asia Pacific (APAC) regions are projected to offer the highest near-term growth potential. MEA is driven by large-scale, long-term oil and gas infrastructure expansion, while APAC benefits from a dual push: sustained conventional E&P activity in Southeast Asia coupled with explosive growth in new offshore wind farm developments in Northeast Asia.

What are the main financial restraints affecting DSV operators?

The primary financial restraints include the exceedingly high capital expenditure required for new, high-specification vessels (often exceeding $150 million), high operational costs linked to specialized crew wages and fuel consumption, and market cyclicality, which can lead to rapid fluctuations in day rates and periods of low vessel utilization, challenging long-term profitability.

What role does automation play in subsea inspection supported by DSVs?

Automation, particularly through AI-driven computer vision and high-end ROV deployment, is minimizing the need for divers in routine inspection tasks. This allows DSVs to focus their expensive operational time on complex intervention and repair tasks, maximizing efficiency and significantly reducing the exposure of human divers to hazardous deepwater environments, thereby enhancing overall safety compliance.

To check our Table of Contents, please mail us at: sales@marketresearchupdate.com

Research Methodology

The Market Research Update offers technology-driven solutions and its full integration in the research process to be skilled at every step. We use diverse assets to produce the best results for our clients. The success of a research project is completely reliant on the research process adopted by the company. Market Research Update assists its clients to recognize opportunities by examining the global market and offering economic insights. We are proud of our extensive coverage that encompasses the understanding of numerous major industry domains.

Market Research Update provide consistency in our research report, also we provide on the part of the analysis of forecast across a gamut of coverage geographies and coverage. The research teams carry out primary and secondary research to implement and design the data collection procedure. The research team then analyzes data about the latest trends and major issues in reference to each industry and country. This helps to determine the anticipated market-related procedures in the future. The company offers technology-driven solutions and its full incorporation in the research method to be skilled at each step.

The Company's Research Process Has the Following Advantages:

- Information Procurement

The step comprises the procurement of market-related information or data via different methodologies & sources.

- Information Investigation

This step comprises the mapping and investigation of all the information procured from the earlier step. It also includes the analysis of data differences observed across numerous data sources.

- Highly Authentic Source

We offer highly authentic information from numerous sources. To fulfills the client’s requirement.

- Market Formulation

This step entails the placement of data points at suitable market spaces in an effort to assume possible conclusions. Analyst viewpoint and subject matter specialist based examining the form of market sizing also plays an essential role in this step.

- Validation & Publishing of Information

Validation is a significant step in the procedure. Validation via an intricately designed procedure assists us to conclude data-points to be used for final calculations.

×

Request Free Sample:

Related Reports

Select License

Why Choose Us

We're cost-effective and Offered Best services:

We are flexible and responsive startup research firm. We adapt as your research requires change, with cost-effectiveness and highly researched report that larger companies can't match.

Information Safety

Market Research Update ensure that we deliver best reports. We care about the confidential and personal information quality, safety, of reports. We use Authorize secure payment process.

We Are Committed to Quality and Deadlines

We offer quality of reports within deadlines. We've worked hard to find the best ways to offer our customers results-oriented and process driven consulting services.

Our Remarkable Track Record

We concentrate on developing lasting and strong client relationship. At present, we hold numerous preferred relationships with industry leading firms that have relied on us constantly for their research requirements.

Best Service Assured

Buy reports from our executives that best suits your need and helps you stay ahead of the competition.

Customized Research Reports

Our research services are custom-made especially to you and your firm in order to discover practical growth recommendations and strategies. We don't stick to a one size fits all strategy. We appreciate that your business has particular research necessities.

Service Assurance

At Market Research Update, we are dedicated to offer the best probable recommendations and service to all our clients. You will be able to speak to experienced analyst who will be aware of your research requirements precisely.

Contact With Our Sales Team

Customer Testimonials

The content of the report is always up to the mark. Good to see speakers from expertise authorities.

Privacy requested , Managing Director

A lot of unique and interesting topics which are described in good manner.

Privacy requested, President

Well researched, expertise analysts, well organized, concrete and current topics delivered in time.

Privacy requested, Development Manager