Doctor Blade Market Size, By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2026 to 2033 (Financial Impact Analysis)

ID : MRU_ 442944 | Date : Feb, 2026 | Pages : 249 | Region : Global | Publisher : MRU

Doctor Blade Market Size

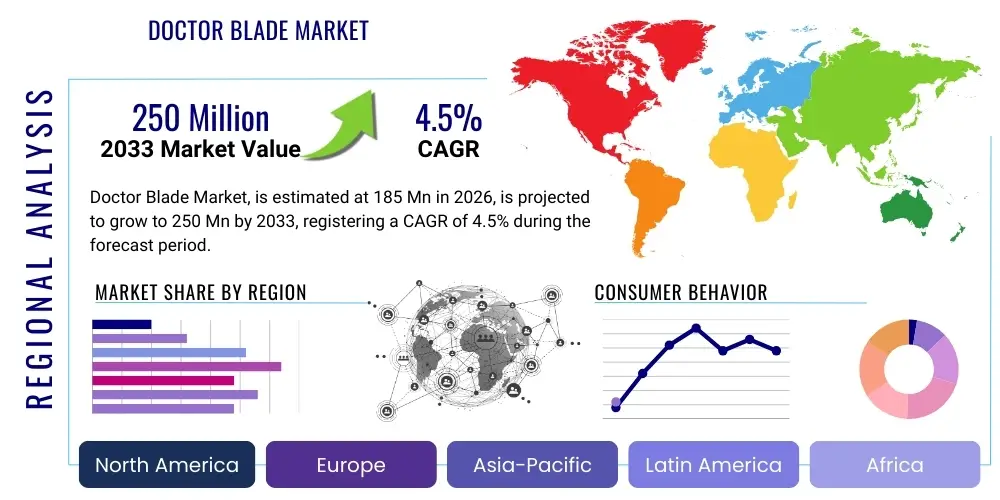

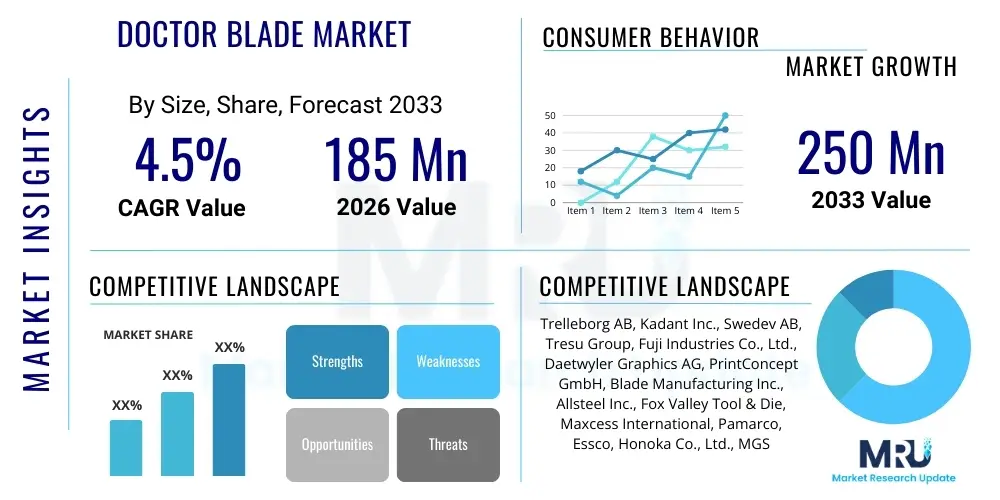

The Doctor Blade Market, a critical component sector within the printing, coating, and flexible electronics industries, is projected to grow at a robust Compound Annual Growth Rate (CAGR) of 4.5% between 2026 and 2033. The market is estimated at $185 Million USD in 2026 and is projected to reach $250 Million USD by the end of the forecast period in 2033. This consistent expansion is underpinned by the sustained demand for high-quality packaging and the accelerating adoption of advanced coating techniques across emerging economies. Market growth is further influenced by ongoing innovations in blade materials, specifically the shift towards ceramic and composite blades that offer enhanced longevity and precision compared to traditional steel counterparts, addressing key operational demands of high-speed printing presses.

The valuation reflects the indispensable role doctor blades play in ensuring precise ink metering and surface quality in complex printing processes, particularly gravure and flexography. As consumer demand for sophisticated packaging aesthetics and increased print run efficiency rises, manufacturers are compelled to invest in higher-performance consumables. This investment cycle drives market value, necessitating detailed analysis of regional manufacturing hubs, especially those centered around textile, food & beverage packaging, and specialized industrial coating applications. The shift towards sustainable printing methods also impacts material choice, subtly favoring blades optimized for water-based or UV-curable inks, thereby contributing to market diversification and valuation uplift.

Furthermore, the market size projection incorporates anticipated growth from adjacent sectors, such as the burgeoning flexible electronics industry, where precision coating is paramount for manufacturing components like OLED displays and flexible solar cells. Doctor blades in these high-precision contexts require exceptionally tight tolerances and advanced surface treatments, commanding premium pricing and expanding the overall market revenue base. While steel blades maintain the largest share due to cost-effectiveness and broad application, the increasing integration of intelligent monitoring systems in printing machinery favors advanced, sensor-compatible blade systems, which will be a key driver for value growth through 2033, mitigating volume fluctuations seen in traditional print sectors.

Doctor Blade Market introduction

The Doctor Blade Market encompasses the manufacturing, distribution, and utilization of precision-engineered components designed primarily for ink metering and excess material removal in various industrial applications, predominantly within the printing and coating sectors. These blades, fabricated from materials such as specialized steel, ceramic, plastic, or composite alloys, are essential in gravure printing, flexographic printing, and certain industrial coating processes, where they scrape residual ink or coating material from the printing cylinder or surface, ensuring only the desired amount remains within the etched cells or designated areas for accurate image transfer. The consistent quality and performance of a doctor blade directly impact the final product quality, including color consistency, image definition, and the elimination of print defects like streaking or hazing. The product description emphasizes precision, material durability, and resistance to chemical erosion and abrasive wear, crucial factors given the high-speed and demanding environments of modern printing presses, making them non-negotiable consumables in high-fidelity production lines.

Major applications of doctor blades span a broad industrial spectrum, with the packaging industry being the most significant consumer, particularly in food packaging, beverage cartons, and flexible packaging films, where gravure and flexography are the primary printing methods employed due to their high throughput and consistency. Beyond packaging, doctor blades are critical in publishing (magazines, catalogs), specialized industrial coating (e.g., medical devices, automotive films), and the nascent but rapidly growing field of flexible electronics manufacturing, including applications for battery electrode coating and photovoltaic panel production. The primary benefit derived from using high-quality doctor blades is the achievement of superior print quality and consistency, coupled with optimized press uptime by reducing the frequency of blade changes and minimizing catastrophic damage to expensive printing cylinders or anilox rollers. Proper blade utilization translates directly into efficiency gains and waste reduction, positioning these components as crucial operational leverage points for manufacturers seeking competitive advantages in quality control.

The market's expansion is fundamentally driven by several intertwined factors, chief among them being the sustained global growth in the packaging sector, particularly in APAC and Latin America, fueled by increasing urbanization and shifting consumer lifestyles that demand packaged goods. Technological advancements in printing press speeds and the continuous push towards higher-resolution graphics necessitate corresponding improvements in doctor blade precision and material science, favoring innovative composite solutions. Furthermore, the rising adoption of specialized functional coatings in industries like aerospace, medical, and electronics, which often rely on precise blade metering for layer thickness control, acts as a significant long-term growth driver. These drivers collectively necessitate continuous research and development into materials that offer lower coefficient of friction, exceptional wear resistance, and minimized cylinder scoring potential, ensuring the market remains dynamic and technologically focused on high-performance consumables.

Doctor Blade Market Executive Summary

The Doctor Blade Market is characterized by steady business trends, marked by a dual focus on cost optimization and performance enhancement, fundamentally shaping competitive dynamics. Manufacturers are increasingly emphasizing proprietary coatings and advanced metallurgy to differentiate their products, shifting the competitive landscape from pure price competition towards value-added performance metrics like lifespan and print consistency. A significant trend involves the integration of Internet of Things (IoT) capabilities within advanced printing machinery, which necessitates doctor blades compatible with predictive maintenance schedules and automated monitoring systems, thereby driving the demand for specialized, high-tolerance components. Furthermore, the global consolidation of major packaging and printing corporations dictates rigorous supplier standards, promoting long-term partnerships with doctor blade manufacturers capable of providing global supply chain reliability and consistent product quality assurance across diverse manufacturing locations. This market structure favors established players with robust R&D capabilities and extensive distribution networks, while smaller firms often specialize in niche applications, such as blades tailored specifically for security printing or highly abrasive coatings.

Regional trends indicate that the Asia Pacific (APAC) region remains the epicenter of market growth, primarily due to the expansive manufacturing base, particularly in packaging, textiles, and consumer electronics production hubs like China, India, and Southeast Asian nations. Rapid industrialization and increasing domestic consumption drive substantial investments in new printing capacity, directly fueling demand for doctor blades. North America and Europe, while representing mature markets, exhibit strong demand for high-end, premium blades, particularly ceramic and advanced composite variants, driven by stringent quality standards in pharmaceutical packaging, high-security printing, and flexible electronics manufacturing. These regions are characterized by technological leadership, focusing on maximizing efficiency and minimizing environmental impact, leading to higher adoption rates of durable, long-life consumables. Latin America and the Middle East & Africa (MEA) present emerging market opportunities, driven by infrastructural development and expanding local packaging industries, transitioning from importing finished goods to localized production, which creates a foundational demand for core consumables like doctor blades.

Segmentation trends highlight the enduring dominance of steel doctor blades in terms of sheer volume due to their versatility and lower initial cost, especially in standard flexographic and general printing applications. However, the fastest-growing segment by value is the ceramic and composite blade material category, favored by gravure printing operations requiring superior wear resistance and extended cylinder life, justifying the higher purchase price through reduced maintenance and increased press uptime. By application, the packaging segment, encompassing both flexible and rigid formats, retains the largest market share, inextricably linked to global consumer goods trends. The application segmentation further reveals a growing penetration of doctor blades into industrial coating processes, which, while smaller in volume, demands highly specialized products due to the viscosity and chemical composition of industrial coatings. This demand underscores a technological segmentation shift toward specialized coatings and edge profiles engineered for specific ink chemistries and operating environments, reflecting a market that is increasingly fragmented by technical requirements rather than just material type.

AI Impact Analysis on Doctor Blade Market

User queries regarding the intersection of Artificial Intelligence (AI) and the Doctor Blade Market primarily revolve around operational efficiency, predictive maintenance, and quality control integration within high-speed printing environments. Common questions address how AI-driven analysis of print quality defects can be linked back to doctor blade wear patterns, if machine learning algorithms can optimize blade replacement schedules, and whether AI-assisted press management systems will dictate specific material specifications for future doctor blades. The underlying themes center on shifting from reactive component replacement to proactive, data-informed maintenance, aiming to maximize press uptime and minimize material waste. Users are particularly interested in the capacity of AI to correlate sensor data (vibration, temperature, pressure) collected from the press with doctor blade performance metrics, thereby predicting failure modes before they manifest as costly print defects, fundamentally altering the traditional consumable procurement cycle and necessitating "smart" or sensor-ready consumables.

The consensus of user concerns suggests that while AI may not directly manufacture the blade, its influence will fundamentally change the selection and utilization process. AI systems analyzing real-time press performance, including factors such as ink consistency, anilox cell volumes, web speed, and environmental humidity, will generate highly specific recommendations regarding blade thickness, material composition, and edge geometry needed for optimal results in any given job. This level of data-driven specification reduces reliance on operator experience and shifts procurement towards performance-based, highly customized solutions, increasing the technical complexity required from blade suppliers. Furthermore, AI-powered vision systems that monitor print uniformity will flag microscopic defects attributable to blade imperfections far earlier than human inspection, accelerating the need for ultra-precise manufacturing tolerances and pushing the market towards zero-defect components, especially for critical applications like currency or pharmaceutical packaging where quality assurance is paramount.

Consequently, the primary expectation is that AI integration will necessitate greater digitalization within the doctor blade manufacturing supply chain, requiring manufacturers to provide detailed digital twins or performance profiles for their products that can be seamlessly integrated into client AI management platforms. This transition mandates advancements in material traceability and consistent quality reporting, establishing digital feedback loops that connect the end-user's operational data directly to the blade's design specifications. Ultimately, AI's impact is not about replacement but about optimization, turning the doctor blade from a simple mechanical consumable into a key variable in a complex, managed ecosystem where operational data dictates the required performance parameters, making high-quality data provision a critical competitive edge for blade suppliers moving forward in the industry.

- AI enables predictive maintenance, optimizing blade replacement timing based on real-time press data and wear modeling.

- Machine learning algorithms correlate micro-vibrations and print defects with doctor blade deterioration, enhancing quality control.

- AI-driven press management systems will standardize and automate the selection of optimal blade materials and profiles for specific jobs.

- Increased demand for "smart" doctor blades featuring traceable digital performance profiles for integration into client operational software.

- AI-powered vision inspection systems accelerate the requirement for zero-defect doctor blade manufacturing tolerances.

DRO & Impact Forces Of Doctor Blade Market

The dynamics of the Doctor Blade Market are dictated by a complex interplay of Drivers, Restraints, and Opportunities (DRO), which collectively form the Impact Forces steering its trajectory. A fundamental driver is the robust, continuous expansion of the global packaging industry, intrinsically linked to population growth, expanding e-commerce, and rising standards of living in developing nations, leading to increased demand for high-volume, high-quality printed materials. This is coupled with technological advancements in high-speed printing presses (gravure and flexography), which necessitate more durable, precision-engineered blades capable of withstanding higher speeds and abrasive ink chemistries, directly boosting demand for premium materials like ceramics and composites. Opportunities arise from the transition to environmentally friendly printing processes, such particularly the adoption of water-based and UV-curable inks, which requires specific blade chemistries and coatings to prevent swelling or premature wear, opening new product development avenues for specialized material formulations that cater specifically to sustainability mandates, differentiating manufacturers based on their ecological compliance and performance.

Conversely, significant restraints hinder growth and operational stability within the sector. Chief among these is the volatile fluctuation in raw material costs, particularly specialized steel alloys and composite components, impacting manufacturing margins and pricing stability for end-users. Furthermore, the inherent nature of doctor blades as high-frequency consumables means that cost sensitivity among procurement managers is exceptionally high, leading to intense price competition, particularly in generic steel blade segments where product differentiation is minimal, pressuring manufacturers to constantly optimize production efficiency. The market also faces the restraint of limited technological awareness in certain smaller printing operations, where resistance to adopting higher-cost, performance-enhanced blades persists due to initial investment barriers, often leading to sub-optimal print quality and higher long-term operational costs due to frequent replacements and cylinder damage. These restraints compel vendors to invest heavily in customer education and lifecycle cost analysis demonstrations to justify the premium price points of advanced products.

The collective impact forces favor specialized innovation and material science expertise, polarizing the market between low-cost, high-volume producers of standard steel blades and high-margin suppliers of proprietary composite and ceramic solutions tailored for extreme performance applications. The long-term opportunities are heavily concentrated in the industrial coating and flexible electronics sectors, which value precision and stability over initial purchase price, providing a hedge against the price pressures prevalent in the traditional packaging segment. The shift towards circular economy principles and sustainable sourcing further acts as an impact force, compelling manufacturers to investigate recyclable or longer-lasting blade materials, potentially through strategic partnerships with advanced materials research institutions. Overall, the market remains highly sensitive to global economic health (affecting advertising and packaging volumes) and ongoing technological evolution in printing machinery, demanding continuous product iteration to maintain relevance and competitive positioning.

Segmentation Analysis

The Doctor Blade Market is comprehensively segmented based on material composition, end-user industry, and specific application type, providing a multifaceted view of demand patterns and technological maturity across various sectors. Analyzing these segments is critical for manufacturers to align their R&D efforts and sales strategies with the highest growth areas and specific customer performance requirements. Material segmentation, which includes steel, ceramic, plastic, and composite blades, remains the most fundamental differentiator, reflecting trade-offs between cost, durability, and resistance to specific ink chemistries and press speeds. The analysis confirms that while steel blades dominate in volume due to widespread adoption and competitive pricing, the value proposition is increasingly shifting towards advanced materials that offer extended life cycles and enhanced cylinder protection in high-specification printing environments, especially those utilizing abrasive pigmentations or highly corrosive solvents.

Application segmentation reveals that packaging, encompassing both flexible and rigid containers for food, beverages, and pharmaceuticals, constitutes the largest and most dynamic market segment, directly correlating with global consumer spending habits and e-commerce expansion. Within packaging, the sub-segments of gravure printing (known for high-quality, long-run jobs) and flexographic printing (versatile and increasingly efficient) define the demand profile for specific blade edge geometries and hardness levels. Moreover, the segment dedicated to industrial coating applications, which includes processes such as applying protective films, battery materials, or specialized textiles, demands extremely high precision and often specialized, chemical-resistant blades, representing a high-value, albeit smaller, market niche. Understanding these application nuances dictates the necessary supply chain readiness and technical support required from doctor blade suppliers, focusing resources where technical complexity yields higher margins.

End-user segmentation differentiates between major market consumers, including large-scale commercial printers, specialized packaging converters, flexible electronics manufacturers, and various industrial coating firms. The behavioral patterns of these end-users differ significantly: large converters prioritize long-term contracts and global consistency, valuing supply chain resilience, whereas flexible electronics firms focus intensely on contamination control and nanoscale precision, accepting premium pricing for guaranteed performance metrics. Geographic segmentation further overlays these technical and end-user profiles, highlighting how material preferences shift regionally—for example, higher adoption of ceramic blades in technologically advanced Western markets compared to the sustained high utilization of general-purpose steel blades in price-sensitive APAC markets. This granular segmentation approach allows for optimized market penetration strategies and tailored product offerings that address precise regional and industrial performance requirements, maximizing revenue potential across diverse economic landscapes.

- By Material:

- Steel Blades (Carbon, Stainless, Alloy)

- Ceramic Blades (Zirconia, Alumina)

- Plastic/Polymer Blades (UHMW, PTFE)

- Composite Blades (Fiber-reinforced, Hybrid materials)

- By Application:

- Gravure Printing

- Flexographic Printing

- Coating Applications (Adhesives, Lacquers, Specialized Films)

- Corrugated Printing

- Digital Printing Enhancements

- By End-User Industry:

- Packaging (Flexible and Rigid)

- Publication and Commercial Printing

- Flexible Electronics and Display Manufacturing

- Textiles and Non-woven Fabric Coating

- Industrial and Automotive Coating

- By Thickness:

- Thin Blades (Below 0.15 mm)

- Standard Blades (0.15 mm to 0.5 mm)

- Thick Blades (Above 0.5 mm)

Value Chain Analysis For Doctor Blade Market

The value chain of the Doctor Blade Market commences with the upstream analysis, which is highly reliant on specialized raw material suppliers, predominantly focusing on high-grade steel alloys (such as tool steel and specialized spring steel), advanced ceramic powders (like Zirconia and Alumina), and proprietary polymer compounds essential for composite blade manufacturing. The procurement phase is highly strategic, requiring suppliers to maintain stringent quality control over metal purity, heat treatment processes, and material consistency, as these factors directly determine the final blade's operational lifespan and resistance to scoring expensive printing rollers. Key activities in the upstream segment involve refining raw materials, alloying specific metals, and manufacturing specialized coatings (e.g., tungsten carbide, chrome plating) that enhance wear characteristics. Fluctuations in global commodity prices for steel and specialized chemicals pose a persistent risk at this stage, necessitating effective hedging strategies and diversified sourcing relationships to maintain cost stability and material availability, ultimately influencing the final price structure of the finished doctor blade product.

The core manufacturing and midstream segment involves the precision engineering of the blades, including processes such as high-precision grinding, laser cutting, edge profiling (lamella or bevel designs), and the application of surface treatments and proprietary coatings. Doctor blade manufacturers differentiate themselves significantly here through patented edge geometries and material layering techniques that are optimized for specific ink types (solvent-based, water-based, UV) and press conditions (speed, pressure). Quality control is paramount, involving rigorous testing for parallelism, flatness, and precise edge sharpness, often utilizing advanced optical metrology equipment to ensure tolerances are met, particularly for high-speed gravure applications where micron-level inaccuracies can result in significant print defects. The complexity of this manufacturing stage mandates high capital expenditure in advanced machinery and highly skilled labor, creating substantial barriers to entry for new competitors who lack the necessary technological precision or experience in highly durable coating applications.

Downstream analysis focuses on the distribution channels and end-user engagement. The distribution channel is multifaceted, primarily utilizing a combination of direct sales (especially for large, multinational printing corporations seeking long-term supply agreements and technical support), specialized industrial distributors and dealers (serving smaller, localized printing operations), and Original Equipment Manufacturer (OEM) relationships (where blades are supplied as initial components or recommended consumables bundled with new printing press installations). Indirect channels, such as dealers and regional agents, play a critical role in inventory management and rapid supply, given the consumable nature of the product and the need for quick replacement to minimize press downtime. Effective downstream management requires robust logistics capabilities and technical field support to assist customers with optimal blade setup and troubleshooting, emphasizing the shift from merely selling a product to providing a comprehensive performance solution, thus maximizing customer lifetime value and solidifying long-term market presence.

Doctor Blade Market Potential Customers

Potential customers for doctor blades are deeply entrenched in industries requiring high-precision fluid application and surface cleaning, primarily functioning as End-Users and professional Buyers who prioritize operational efficiency and product quality consistency. The largest segment of buyers originates from the packaging industry, specifically packaging converters who operate high-speed flexographic and gravure presses to produce flexible films, corrugated boxes, labels, and liquid packaging cartons for the food, beverage, and pharmaceutical sectors. These customers are volume buyers focused on total cost of ownership (TCO), valuing doctor blades that offer extended lifespan and minimal risk of damaging expensive anilox rollers or printing cylinders, necessitating strong contractual relationships with suppliers capable of delivering consistent quality across multi-site global operations, where press uptime is the single most critical factor determining profitability.

Another significant group of potential customers includes large commercial printers and publication houses, although this segment has seen stabilization or minor decline in some regions, they still require doctor blades for high-volume magazine, catalog, and security printing operations. These users demand specialized blades tailored for specific paper types and ink chemistries to achieve precise color registration and high-fidelity imaging. Furthermore, the specialized industrial sector represents a high-growth customer base, encompassing manufacturers in flexible electronics (e.g., OLEDs, touchscreens, specialized sensors), medical device coating, and high-performance textile finishing. Buyers in this segment are highly technical and procurement decisions are often driven by engineering specifications rather than price, seeking extremely tight tolerance blades and proprietary coatings capable of handling novel, highly viscous, or chemically active coating fluids with nanoscale precision, making technical support and R&D collaboration essential elements of the supplier relationship.

The buyer landscape is further segmented by equipment type, targeting operators of various printing press manufacturers, which often dictates specific blade holder systems and required blade dimensions. For example, gravure printing buyers typically gravitate towards composite or ceramic blades for durability against abrasive pigments, while flexographic buyers often use more cost-effective steel or polymer blades for varied applications and shorter run lengths. Distributors and resellers also form a substantial secondary customer base, acting as intermediaries who aggregate demand from smaller, independent print shops that cannot secure direct supply agreements. The strategic focus for doctor blade manufacturers must be tailored, offering volume discounts and global servicing capabilities to major converters while providing technical training and specialized niche products to high-tech industrial buyers, ensuring broad market coverage and adaptability to diverse customer requirements and purchasing behaviors.

| Report Attributes | Report Details |

|---|---|

| Market Size in 2026 | $185 Million USD |

| Market Forecast in 2033 | $250 Million USD |

| Growth Rate | 4.5% CAGR |

| Historical Year | 2019 to 2024 |

| Base Year | 2025 |

| Forecast Year | 2026 - 2033 |

| DRO & Impact Forces |

|

| Segments Covered |

|

| Key Companies Covered | Trelleborg AB, Kadant Inc., Swedev AB, Tresu Group, Fuji Industries Co., Ltd., Daetwyler Graphics AG, PrintConcept GmbH, Blade Manufacturing Inc., Allsteel Inc., Fox Valley Tool & Die, Maxcess International, Pamarco, Essco, Honoka Co., Ltd., MGS International. |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Enquiry Before Buy | Have specific requirements? Send us your enquiry before purchase to get customized research options. Request For Enquiry Before Buy |

Doctor Blade Market Key Technology Landscape

The key technology landscape of the Doctor Blade Market is defined by continuous innovation in material science, precision manufacturing, and surface engineering, aiming to maximize wear resistance, minimize friction, and prevent cylinder scoring in increasingly demanding operational environments. A significant technological focus is placed on proprietary edge profiling, with specialized geometries such as lamella, bevel, and round-edge designs tailored to specific ink types and press speeds. Lamella technology, involving a thin scraping edge backed by a stiffer material, remains crucial for ensuring precise ink metering over extended runs, and continuous R&D is dedicated to optimizing the lamella angle and thickness to achieve the ideal balance between stiffness for efficient wiping and flexibility to minimize damage to expensive printing surfaces. Advances in laser etching and ultra-precision grinding are enabling the repeatable production of these complex edge profiles at microscopic tolerances, directly impacting the final print quality and press efficiency, thereby solidifying precision manufacturing as a core technological competency within the industry.

Material innovation represents the most transformative technological trend, moving beyond traditional carbon and stainless steel towards advanced composite and ceramic solutions. Ceramic doctor blades, predominantly made from materials like Zirconia or Alumina, are celebrated for their exceptional hardness, chemical inertness, and superior resistance to abrasive pigments (common in opaque white inks or metallic formulations), offering operational lifespans several times longer than steel. However, ceramics face challenges in brittleness and higher initial cost. To bridge this gap, composite doctor blades, which blend polymers with reinforcing fibers (like carbon fiber) or metallic layers, are gaining traction. These composites offer a beneficial compromise, providing enhanced flexibility, lower friction, and resistance to swelling often encountered with certain solvents, positioning them as an intermediate technology that balances performance, cost, and safety in flexographic environments, representing a key area of current technological investment among leading manufacturers aiming for material optimization.

Furthermore, surface treatment and coating technologies are pivotal, acting as critical performance enhancers for all base materials, significantly extending the service life and improving wiping efficiency. Technologies such as physical vapor deposition (PVD) and thermal spray coatings, particularly involving Tungsten Carbide or specialized chrome finishes, are applied to steel blades to drastically improve their surface hardness and reduce the coefficient of friction, mitigating the risk of frictional heat buildup and premature wear. The integration of sensors or specialized coatings compatible with IoT-enabled predictive maintenance systems is an emerging technological focus, allowing for real-time monitoring of blade wear, temperature, and vibration. This shift transforms the doctor blade into a 'smart consumable' that feeds data back into the press control system, enabling fully automated, optimized replacement schedules and drastically reducing unforeseen press stoppages. These technological advancements collectively drive higher market value and necessitate substantial technical expertise from all participants in the supply chain.

Regional Highlights

- Asia Pacific (APAC) is the dominant and fastest-growing region, driven by unparalleled expansion in the packaging, textile, and consumer goods manufacturing sectors, particularly across China, India, and Southeast Asia.

- North America represents a mature market characterized by demand for high-performance and specialty blades, driven by stringent quality requirements in flexible electronics and pharmaceutical packaging, prioritizing longevity and advanced materials like ceramics.

- Europe maintains a leading position in gravure technology and sustainable printing, leading to strong demand for environmentally friendly blade materials and systems compatible with water-based and UV inks, with Germany and Italy being key manufacturing hubs.

- Latin America (LATAM) shows high potential growth, fueled by increasing localized production of packaged goods and a growing middle-class consumer base, transitioning from basic printing techniques to higher-quality flexography and gravure processes.

- Middle East & Africa (MEA) is an emerging market, currently showing moderate adoption rates but poised for significant investment driven by large-scale infrastructural projects, urbanization, and a developing regional packaging industry, particularly in the UAE and Saudi Arabia.

The Asia Pacific region, characterized by its massive manufacturing capacity and accelerating urbanization rates, currently holds the largest market share and is projected to register the highest growth rate during the forecast period. Countries like China and India are undergoing rapid industrialization, leading to massive investments in new printing capacity to support burgeoning domestic and export demands for packaged food, beverages, and consumer electronics. This high-volume environment generates immense demand for doctor blades across all material types, though cost-competitiveness remains a crucial factor, favoring regional suppliers who can deliver reliable steel blades at lower price points. However, as quality standards improve, particularly in high-value exports, there is a perceptible shift toward premium ceramic and composite blades in specialized printing operations, indicating a maturing market structure that is starting to prioritize performance and reliability over minimal initial cost, providing a dual opportunity for both local and international suppliers.

North America and Europe constitute the core markets for advanced doctor blade technologies, setting global standards for precision and durability. In North America, the market is characterized by a strong emphasis on automation and minimizing labor costs, driving the demand for longer-lasting consumables to maximize press uptime. The shift towards manufacturing sophisticated products, such as high-definition flexible displays and advanced security features on printed materials, necessitates the adoption of high-precision ceramic and coated steel blades. European markets, particularly Western Europe, exhibit robust demand stemming from the continent's leadership in high-quality gravure printing, especially within the luxury packaging and automotive industries. Furthermore, Europe’s stringent environmental regulations regarding volatile organic compounds (VOCs) compel printers to adopt water-based and UV-curable inks, which in turn drives product innovation in doctor blade coatings and materials designed to resist the unique chemical and abrasive properties of these sustainable ink systems, thereby supporting a high-value, innovation-driven segment.

Emerging economies in Latin America and the Middle East & Africa are characterized by high-potential, nascent markets undergoing rapid expansion. Latin America, driven by Brazil and Mexico, is witnessing significant growth in localized production for consumer goods, reducing reliance on imports and fueling demand for flexographic and gravure consumables. The MEA region's growth is tied closely to oil-independent diversification strategies, with countries investing heavily in infrastructure and local manufacturing, particularly in fast-moving consumer goods (FMCG) packaging. While initial adoption favors standard, cost-effective steel blades, the rapid integration of modern, imported printing technology suggests a forthcoming transition toward higher-performance materials as industrial sophistication increases. Strategic entry into these regions requires localized distribution networks and competitive pricing models, positioning them as essential long-term investment targets for global doctor blade manufacturers seeking diversification beyond saturated mature markets or highly competitive APAC volume segments.

Top Key Players

The market research report includes a detailed profile of leading stakeholders in the Doctor Blade Market.- Trelleborg AB

- Kadant Inc.

- Swedev AB

- Tresu Group

- Fuji Industries Co., Ltd.

- Daetwyler Graphics AG

- PrintConcept GmbH

- Blade Manufacturing Inc.

- Allsteel Inc.

- Fox Valley Tool & Die

- Maxcess International

- Pamarco

- Essco

- Honoka Co., Ltd.

- MGS International

- Flexo Concepts

- Wilkahn GmbH

- Double E Company LLC

- Ohio Carbon Blank Inc.

- Wausau Coated Products Inc.

Frequently Asked Questions

Analyze common user questions about the Doctor Blade market and generate a concise list of summarized FAQs reflecting key topics and concerns.What is the primary function of a doctor blade in the printing industry, and why is material selection critical?

The primary function of a doctor blade is ink metering—it precisely scrapes excess ink or coating from the surface of an engraved cylinder or anilox roll, ensuring only the exact amount remains for transfer, thereby guaranteeing print consistency and image quality. Material selection (e.g., steel, ceramic, composite) is critical because it dictates the blade’s resistance to wear, corrosion from specific ink solvents, and ability to prevent costly damage (scoring) to the printing roller. Using the correct material maximizes press uptime and reduces the total cost of ownership.

How do advancements in sustainable printing inks, such as water-based and UV-curable types, affect doctor blade technology?

Sustainable inks, particularly water-based formulations, often have different chemical compositions and abrasive properties than traditional solvent-based inks. This requires doctor blade manufacturers to develop specialized, corrosion-resistant coatings or polymer-based materials that prevent premature swelling, rusting, or abrasive wear, ensuring the blade maintains its precise edge profile despite the demanding nature of these eco-friendly chemistries. The technological response focuses heavily on composite blades and advanced surface treatments.

What is the key difference in doctor blade requirements for gravure printing versus flexographic printing?

Gravure printing typically demands very high-precision, long-lasting blades, often ceramic or high-grade coated steel, because the process involves high cylinder pressure and the cylinders themselves are extremely expensive. Flexographic printing, used for packaging and labels, usually involves less cylinder pressure but higher frequency of blade replacement, leading to greater use of standardized steel or polymer blades for cost-effectiveness, although high-end flexography increasingly adopts composite blades for superior metering performance.

Which geographic region demonstrates the highest growth potential in the Doctor Blade Market, and what drives this expansion?

The Asia Pacific (APAC) region exhibits the highest growth potential, primarily driven by massive, sustained growth in the packaging sector across countries like China and India, fueled by rising middle-class consumption and rapid urbanization. This expansion necessitates continuous investment in new, high-speed printing machinery and, consequently, a robust and growing demand for all types of doctor blade consumables to support the region's expansive manufacturing base and export activities.

How is predictive maintenance, often enabled by IoT and AI, changing the procurement and use of doctor blades?

AI and IoT integration are shifting the procurement of doctor blades from a reactive, time-based schedule to a proactive, performance-based system. Sensors in modern presses track real-time wear, vibration, and print quality degradation, allowing AI algorithms to predict the optimal moment for blade replacement with high accuracy. This reduces unexpected press downtime, minimizes waste, and favors suppliers who can provide highly consistent, traceable, and sometimes sensor-ready components for seamless integration into digital maintenance platforms.

To check our Table of Contents, please mail us at: sales@marketresearchupdate.com

Research Methodology

The Market Research Update offers technology-driven solutions and its full integration in the research process to be skilled at every step. We use diverse assets to produce the best results for our clients. The success of a research project is completely reliant on the research process adopted by the company. Market Research Update assists its clients to recognize opportunities by examining the global market and offering economic insights. We are proud of our extensive coverage that encompasses the understanding of numerous major industry domains.

Market Research Update provide consistency in our research report, also we provide on the part of the analysis of forecast across a gamut of coverage geographies and coverage. The research teams carry out primary and secondary research to implement and design the data collection procedure. The research team then analyzes data about the latest trends and major issues in reference to each industry and country. This helps to determine the anticipated market-related procedures in the future. The company offers technology-driven solutions and its full incorporation in the research method to be skilled at each step.

The Company's Research Process Has the Following Advantages:

- Information Procurement

The step comprises the procurement of market-related information or data via different methodologies & sources.

- Information Investigation

This step comprises the mapping and investigation of all the information procured from the earlier step. It also includes the analysis of data differences observed across numerous data sources.

- Highly Authentic Source

We offer highly authentic information from numerous sources. To fulfills the client’s requirement.

- Market Formulation

This step entails the placement of data points at suitable market spaces in an effort to assume possible conclusions. Analyst viewpoint and subject matter specialist based examining the form of market sizing also plays an essential role in this step.

- Validation & Publishing of Information

Validation is a significant step in the procedure. Validation via an intricately designed procedure assists us to conclude data-points to be used for final calculations.

×

Request Free Sample:

Related Reports

- Chambered Doctor Blade Systems Market Statistics 2025 Analysis By Application (Flexographic Printing Machine, Corrugated Box Printing Slotting Machine), By Type (Single-blade system, Dual-blade system), and By Region (North America, Latin America, Europe, Asia Pacific, Middle East, and Africa) - Size, Share, Outlook, and Forecast 2025 to 2032

- Doctor Blade Market Statistics 2025 Analysis By Application (Flexo, Gravure, Offset Printing), By Type (Metal Blades, Plastic Blades), and By Region (North America, Latin America, Europe, Asia Pacific, Middle East, and Africa) - Size, Share, Outlook, and Forecast 2025 to 2032

Select License

Why Choose Us

We're cost-effective and Offered Best services:

We are flexible and responsive startup research firm. We adapt as your research requires change, with cost-effectiveness and highly researched report that larger companies can't match.

Information Safety

Market Research Update ensure that we deliver best reports. We care about the confidential and personal information quality, safety, of reports. We use Authorize secure payment process.

We Are Committed to Quality and Deadlines

We offer quality of reports within deadlines. We've worked hard to find the best ways to offer our customers results-oriented and process driven consulting services.

Our Remarkable Track Record

We concentrate on developing lasting and strong client relationship. At present, we hold numerous preferred relationships with industry leading firms that have relied on us constantly for their research requirements.

Best Service Assured

Buy reports from our executives that best suits your need and helps you stay ahead of the competition.

Customized Research Reports

Our research services are custom-made especially to you and your firm in order to discover practical growth recommendations and strategies. We don't stick to a one size fits all strategy. We appreciate that your business has particular research necessities.

Service Assurance

At Market Research Update, we are dedicated to offer the best probable recommendations and service to all our clients. You will be able to speak to experienced analyst who will be aware of your research requirements precisely.

Contact With Our Sales Team

Customer Testimonials

The content of the report is always up to the mark. Good to see speakers from expertise authorities.

Privacy requested , Managing Director

A lot of unique and interesting topics which are described in good manner.

Privacy requested, President

Well researched, expertise analysts, well organized, concrete and current topics delivered in time.

Privacy requested, Development Manager