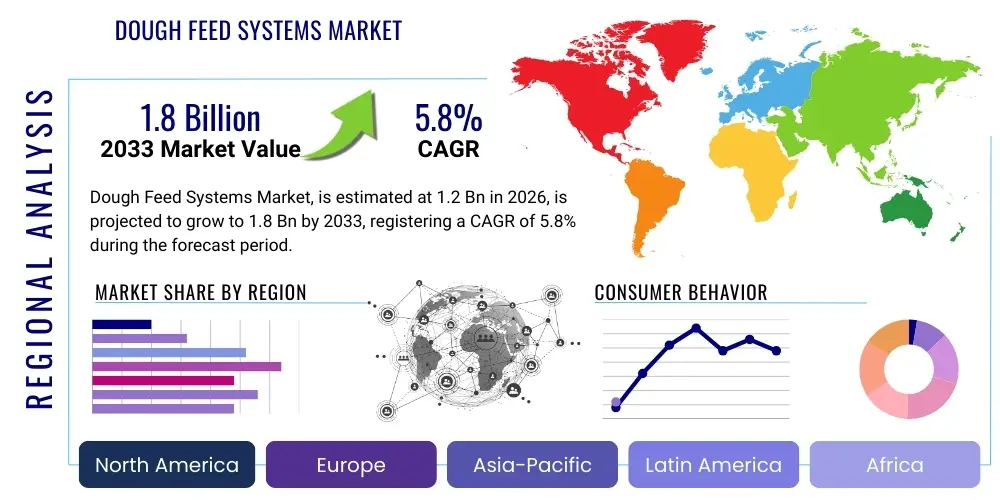

Dough Feed Systems Market Size, By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2026 to 2033 (Financial Impact Analysis)

ID : MRU_ 442927 | Date : Feb, 2026 | Pages : 251 | Region : Global | Publisher : MRU

Dough Feed Systems Market Size

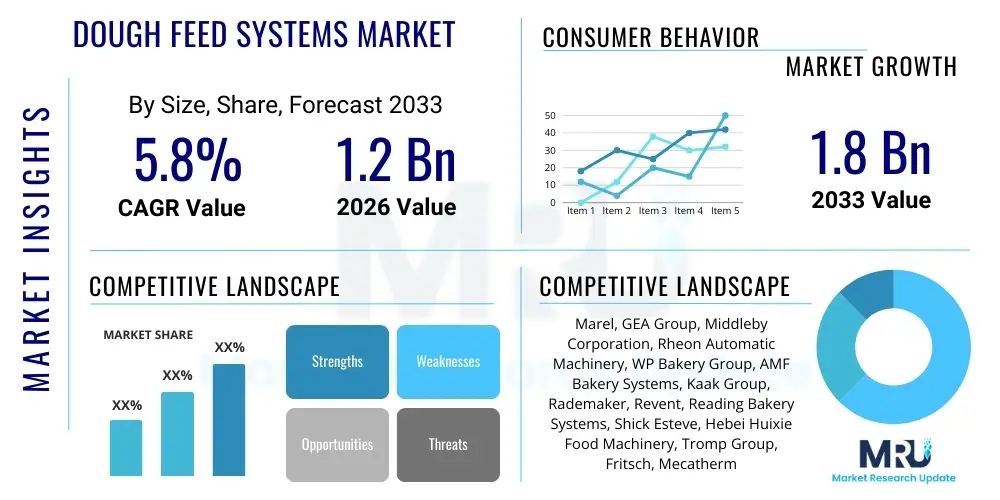

The Dough Feed Systems Market is projected to grow at a Compound Annual Growth Rate (CAGR) of 5.8% between 2026 and 2033. The market is estimated at USD 1.2 Billion in 2026 and is projected to reach USD 1.8 Billion by the end of the forecast period in 2033.

Dough Feed Systems Market introduction

The Dough Feed Systems Market encompasses specialized machinery and integrated process lines designed to efficiently handle, portion, and transfer prepared dough to subsequent processing stages, such as molding, cutting, or baking. These systems are pivotal within the industrial baking sector, enabling high-volume, continuous production while ensuring consistency in product weight, shape, and quality. Key applications span the manufacturing of staples like bread, biscuits, cookies, pizza bases, and various pastries. The operational advantages include significant reductions in labor costs, minimization of product waste, and strict adherence to stringent hygiene and safety standards mandated by global food regulatory bodies. Driving factors for market expansion include the surging global demand for processed bakery goods, the necessity for automation to counteract rising operational expenses, and the continuous technological advancements leading to more precise and flexible dough handling solutions capable of managing different dough viscosities and fermentation levels.

Dough Feed Systems Market Executive Summary

The Dough Feed Systems Market is undergoing rapid transformation, largely driven by fundamental shifts in consumer dietary preferences towards premium, artisanal, yet convenient baked products, necessitating flexible manufacturing lines. Business trends indicate a strong move toward highly modular and integrated systems that can adapt quickly to different product changeovers, focusing heavily on hygienic design (sanitary stainless steel, quick-release components) to minimize downtime for cleaning. Regional trends highlight mature markets like North America and Europe prioritizing replacement and technological upgrades to enhance efficiency and reduce energy consumption, while emerging markets in Asia Pacific (APAC) are experiencing exponential growth driven by large-scale capacity installation to meet rising domestic demand for packaged bakery products. Segment trends show significant growth in fully automated extrusion and sheeting systems, particularly those incorporating sophisticated sensors and control mechanisms for real-time monitoring of dough temperature and consistency, thereby guaranteeing end-product uniformity across mass production environments.

AI Impact Analysis on Dough Feed Systems Market

Users frequently inquire about how Artificial Intelligence (AI) can enhance the precision and efficiency of dough feeding, specifically addressing concerns related to variability in dough rheology and quality control. Common questions revolve around the practical application of machine learning for predictive maintenance of complex mechanical components, optimization of ingredient dosing based on environmental factors (like humidity or temperature), and the feasibility of autonomous process adjustment to maintain uniform weight and texture across vast production runs. There is a strong expectation that AI will move beyond simple automation to enable genuinely adaptive manufacturing environments where the dough feed system can intelligently respond to subtle changes in upstream mixing or fermentation processes. This technological integration is anticipated to drastically reduce waste, improve overall equipment effectiveness (OEE), and establish new benchmarks for food safety and traceability by linking real-time quality metrics directly to operational adjustments.

- AI-driven predictive maintenance forecasts component failure, drastically reducing unplanned downtime.

- Machine learning algorithms optimize feeder speeds and pressure based on real-time dough viscosity readings.

- Enhanced quality control through computer vision systems linked to AI, ensuring accurate portion sizing and defect detection.

- Improved energy efficiency by optimizing motor load and cycle times based on production demand.

- Automated recipe adjustment protocols linked to external factors (e.g., ambient temperature) for consistent output.

- Enhanced traceability by logging all processing parameters via immutable distributed ledger technologies (DLT) or robust databases.

DRO & Impact Forces Of Dough Feed Systems Market

The Dough Feed Systems Market expansion is fundamentally propelled by the increasing global demand for processed and packaged bakery items, which mandates continuous high-speed production lines requiring advanced automation technologies to maintain competitive operational costs. Major drivers include the necessity for labor optimization, stringent food safety regulations compelling manufacturers to adopt closed and hygienic systems, and the relentless pressure to improve manufacturing consistency, minimizing variability in weight and texture of final products. These systems directly address the industry's need for scalable manufacturing solutions capable of handling diverse product portfolios, from delicate laminated pastries to dense bread doughs, thereby increasing the effective throughput of industrial bakeries globally.

However, significant restraints temper the market growth, primarily stemming from the high initial capital investment required for installing complex, fully automated dough feed systems, which can be prohibitive for small and medium-sized bakeries, particularly in developing economies. Furthermore, the specialized nature of these technologies necessitates highly trained maintenance and operational staff, often leading to challenges in finding and retaining appropriate technical expertise. The inherent difficulty in achieving perfect uniformity when handling viscoelastic, live material like fermented dough also presents persistent technical limitations that equipment manufacturers must constantly strive to overcome, impacting system reliability and efficiency.

Opportunities for exponential growth are substantial, particularly through strategic geographical expansion into high-growth regions like APAC and Latin America, where rapid urbanization and Westernization of diets are spurring massive investment in new baking infrastructure. Technological opportunities focus heavily on integrating advanced robotics for precise pick-and-place functionality and leveraging the Internet of Things (IoT) for comprehensive monitoring and remote diagnostics, enabling preventative service models. The shift toward producing highly specialized gluten-free and alternative grain products also creates a specific niche requirement for flexible feeding systems capable of handling non-traditional dough characteristics without cross-contamination. Impact forces governing the market include the fluctuating price of raw materials like wheat and sugar, which influence bakery profit margins and subsequent capital expenditure budgets, alongside evolving consumer health trends demanding cleaner labels and less processed ingredients, pressuring equipment manufacturers to design systems that minimize dough stress and degradation.

Segmentation Analysis

The Dough Feed Systems Market is segmented based on the core technology employed, the degree of automation utilized, and the specific application sector within the bakery industry. Analyzing these segments provides a clear understanding of where investment is concentrated and how technological preference shifts across different geographic and operational contexts. The By Type segment (Automated vs. Semi-Automated) highlights the overarching trend toward full integration for maximized efficiency, driven largely by high-volume producers, while the By Application segment (Bread, Biscuits, Pizza) reveals the varied demands placed on systems regarding dough handling characteristics, from high-shear processes for biscuits to gentle handling for artisanal bread. The By Operating Principle segment (Extrusion, Sheeting, Pumping) details the fundamental mechanical methods used, reflecting the suitability of each mechanism for specific dough types and product outcomes.

Growth within these segments is non-uniform; automated systems are consistently outperforming semi-automated systems due to their superior throughput and consistency. Extrusion-based systems are seeing elevated demand, particularly in the production of cookies and uniform dough portions for buns, owing to their high precision. Geographically, segmentation analysis demonstrates that capacity expansion is most pronounced in emerging economies, whereas technology refinement and replacement cycles dominate investment decisions in North America and Europe, focusing heavily on features related to sanitation and energy efficiency.

- By Type: Automated Dough Feed Systems, Semi-Automated Dough Feed Systems

- By Application: Bread Production, Biscuit and Cookie Production, Pastry and Cake Production, Pizza and Flatbread Production, Others (e.g., Dumplings, Donuts)

- By Operating Principle: Extrusion Systems, Sheeting and Cutting Systems, Pumping and Metering Systems, Dividing and Rounding Systems

Value Chain Analysis For Dough Feed Systems Market

The value chain for the Dough Feed Systems Market begins with upstream activities involving the sourcing and processing of core raw materials, which primarily include high-grade stainless steel, specialized polymers for conveyor components, and precision electronic controls and sensors. Key upstream participants are metal fabricators, component manufacturers (motors, drives, PLCs), and specialized software providers for automation. The strength of this upstream supply chain directly impacts the final equipment cost and the technological sophistication, requiring robust relationships to manage material cost volatility and ensure the supply of durable, food-grade components compliant with international hygiene standards like EHEDG or USDA.

The midstream involves the core activities of research and development, design engineering, manufacturing, assembly, and testing of the integrated dough feed machinery. Manufacturers differentiate themselves through proprietary intellectual property related to gentle dough handling, energy efficiency, and cleaning-in-place (CIP) capabilities. Manufacturing quality is paramount, as system reliability is a critical factor for large industrial bakeries whose operations rely on near-continuous running. Direct distribution channels, where the manufacturer sells directly to the large industrial bakery end-user, often dominate due to the need for extensive customization, installation support, and specialized service contracts, allowing manufacturers to maintain tight control over quality and post-sales support.

Downstream activities include system installation, commissioning, specialized training for bakery personnel, and ongoing maintenance and spare parts supply. Indirect distribution, involving local agents or specialized food processing equipment distributors, is sometimes utilized in regions where the manufacturer does not maintain a physical presence, particularly for standard, less customized semi-automated units. The end-users (industrial bakeries) critically depend on the effectiveness of this downstream support to maximize their system’s uptime and lifespan. High-quality service contracts, rapid spare parts availability, and the ability to offer remote diagnostic support are essential competitive differentiators in the final stage of the value chain, ensuring customer loyalty and repeat business in a highly specialized capital equipment market.

Dough Feed Systems Market Potential Customers

The primary end-users and potential buyers of industrial dough feed systems are large-scale industrial bakery corporations and contract food manufacturers that specialize in high-volume production of bakery and snack products. These organizations require systems capable of processing several tons of dough per hour with minimal human intervention, making them critical investment targets. Secondary customers include mid-sized regional bakeries that are transitioning from manual or semi-manual operations to increased automation to achieve cost efficiencies and expand their geographical market reach. A third category includes frozen dough manufacturers and foodservice suppliers, which require precise portioning systems for products distributed to restaurants and institutional kitchens globally.

The purchasing decisions of these key customers are heavily influenced by factors such as total cost of ownership (TCO), demonstrated reliability and uptime metrics, the system's flexibility to handle diverse product lines, and its adherence to stringent international food safety standards (e.g., GFSI benchmarking). Emerging markets also present a significant customer base as local food processing capacity rapidly scales up. These customers often prioritize robust, easily maintainable equipment, sometimes favoring semi-automated solutions initially before upgrading to fully integrated, sophisticated lines.

| Report Attributes | Report Details |

|---|---|

| Market Size in 2026 | USD 1.2 Billion |

| Market Forecast in 2033 | USD 1.8 Billion |

| Growth Rate | 5.8% CAGR |

| Historical Year | 2019 to 2024 |

| Base Year | 2025 |

| Forecast Year | 2026 - 2033 |

| DRO & Impact Forces |

|

| Segments Covered |

|

| Key Companies Covered | Marel, GEA Group, Middleby Corporation, Rheon Automatic Machinery, WP Bakery Group, AMF Bakery Systems, Kaak Group, Rademaker, Revent, Reading Bakery Systems, Shick Esteve, Hebei Huixie Food Machinery, Tromp Group, Fritsch, Mecatherm |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Enquiry Before Buy | Have specific requirements? Send us your enquiry before purchase to get customized research options. Request For Enquiry Before Buy |

Dough Feed Systems Market Key Technology Landscape

The contemporary technology landscape of the Dough Feed Systems Market is characterized by the adoption of highly hygienic design principles and advanced automation, focusing on optimizing the handling of often sensitive dough materials. Core technologies include servo-driven mechanisms replacing traditional mechanical linkages, which offers superior precision in metering and portioning, allowing for rapid adjustments to variables like dough density and flow rate without sacrificing accuracy. Furthermore, these systems incorporate sophisticated sensor technologies, such as proximity sensors and high-resolution load cells, enabling precise, closed-loop control over dough mass and pressure, which is critical for maintaining consistency in high-speed operations. The move towards Stainless Steel 316 and specialized food-grade polymers is also central, facilitating effective Clean-in-Place (CIP) or Washdown-in-Place (WIP) capabilities, drastically minimizing sanitation time and the risk of microbial contamination, thereby meeting increasingly strict global food safety mandates.

A significant technological driver is the integration of Industrial Internet of Things (IIoT) frameworks and Supervisory Control and Data Acquisition (SCADA) systems. These platforms allow industrial bakeries to monitor the performance of dough feed lines in real-time, collecting extensive operational data on throughput, efficiency, and component status. This data is leveraged for sophisticated analytics, enabling manufacturers to identify bottlenecks, optimize recipes, and implement predictive maintenance schedules, thereby maximizing Overall Equipment Effectiveness (OEE). The trend toward modular design is another key technology, where interchangeable heads (e.g., switching from sheeting to extrusion) allows a single base system to manage a wider variety of product formats, enhancing manufacturing flexibility and reducing the total investment required for diversified product lines.

Furthermore, specialized dough handling techniques, such as stress-free sheeting and gentle volumetric dividing, are continuously refined to preserve the delicate structure of fermented or laminated doughs, which is essential for premium products like artisanal breads and croissants. These mechanical innovations focus on minimizing temperature rise and mechanical degradation during processing. The future trajectory involves greater reliance on AI and machine vision systems for automated quality inspection and self-calibration, allowing the feed system to autonomously adapt to variations in dough rheology caused by natural ingredient variability, moving the industry closer to truly intelligent manufacturing environments that can maintain near-perfect consistency across extended production cycles.

Regional Highlights

Geographical market dynamics reveal distinct growth trajectories and investment priorities across the globe, heavily influencing demand for specific types of dough feed systems.

- North America: Characterized by high automation penetration and a focus on upgrading existing infrastructure to comply with stringent sanitary standards (e.g., FSMA compliance). The market here is mature, driven by the replacement cycle, demand for highly flexible systems to accommodate diverse product portfolios (including gluten-free and plant-based items), and integration of sophisticated IIoT and AI technologies for optimized OEE. Investment is concentrated in energy-efficient and labor-saving technologies.

- Europe: Similar to North America, Europe exhibits a mature market demanding high-specification, technologically advanced machinery. The emphasis is on gentle dough handling systems crucial for artisanal and specialty bread production, complying with strict European Union machinery directives and food safety regulations. Germany, the UK, and Italy are key innovation hubs, driving demand for modular and energy-optimized dough processing lines.

- Asia Pacific (APAC): This is the fastest-growing region, fueled by massive capacity expansion in countries like China, India, and Southeast Asian nations, driven by rising disposable incomes, rapid urbanization, and the shift from unpackaged to packaged food consumption. Demand is strong for scalable, robust, and cost-effective automated systems suitable for high-volume basic bread and biscuit production. Investment is geared toward installing new plants rather than solely upgrading existing ones.

- Latin America (LATAM): Growth is steady, driven by local and international bakery corporations expanding their manufacturing footprint to serve regional demand. Brazil and Mexico are primary markets, showing increasing adoption of semi-automated and introductory automated systems, often sourced through import, aiming to modernize dated facilities and improve quality consistency across large-scale operations.

- Middle East and Africa (MEA): This region shows potential, with specific growth pockets in the UAE, Saudi Arabia, and South Africa, focusing on enhancing domestic food security and local manufacturing capabilities. Market demand is highly diversified, ranging from basic production equipment for staple foods to high-end systems for catering to expatriate and luxury consumer segments.

Top Key Players

The market research report includes a detailed profile of leading stakeholders in the Dough Feed Systems Market.- Marel

- GEA Group

- Middleby Corporation

- Rheon Automatic Machinery Co., Ltd.

- WP Bakery Group

- AMF Bakery Systems

- Kaak Group (DrieM, Benier, etc.)

- Rademaker BV

- Revent International

- Reading Bakery Systems

- Shick Esteve

- Hebei Huixie Food Machinery Co., Ltd.

- Tromp Group (A Bakeline Brand)

- Fritsch GmbH (A MULTIVAC Group Company)

- Mecatherm

- Escher Mixers

- RONDO Industrial Bakery Solutions

- Sottoriva Srl

- Glimek AB

- Linxis Group

Frequently Asked Questions

Analyze common user questions about the Dough Feed Systems market and generate a concise list of summarized FAQs reflecting key topics and concerns.What are the primary factors driving the adoption of fully automated dough feed systems?

The primary driver is the critical need for consistency in high-volume production, coupled with increasing labor costs and the imperative for stringent food safety compliance. Automated systems minimize human contact, ensure precise weight control, and maximize operational throughput (OEE).

How does dough rheology impact the selection and performance of a dough feed system?

Dough rheology, including viscosity and elasticity, is crucial. High-hydration, sticky doughs (e.g., sourdough) require gentle pumping or specialized extrusion to prevent stress, whereas firmer doughs (e.g., biscuits) utilize sheeting systems. Manufacturers select operating principles (extrusion vs. sheeting) based directly on the dough characteristics to minimize structural damage.

What is the typical lifespan and required maintenance schedule for industrial dough feed equipment?

The lifespan often exceeds 15-20 years with proper maintenance. Scheduled maintenance involves daily cleaning and inspection, weekly lubrication, and major annual overhauls focused on replacing wear parts (belts, seals, blades). Predictive maintenance utilizing integrated sensors is becoming standard practice to maximize uptime.

Which geographical region holds the largest potential for new market entry and investment?

The Asia Pacific (APAC) region, particularly emerging economies like India and Southeast Asia, presents the largest potential for new market entry. This growth is underpinned by rapid consumer demand shift toward packaged bakery goods and substantial government investment in modernizing food processing infrastructure.

How is the Dough Feed Systems Market addressing the trend toward gluten-free and alternative flour production?

The market addresses this by developing highly flexible and modular systems with enhanced anti-stick coatings and specialized gentle handling components. These systems are designed for rapid cleaning and zero cross-contamination risk, crucial when handling non-traditional, less robust dough structures typical of gluten-free recipes.

To check our Table of Contents, please mail us at: sales@marketresearchupdate.com

Research Methodology

The Market Research Update offers technology-driven solutions and its full integration in the research process to be skilled at every step. We use diverse assets to produce the best results for our clients. The success of a research project is completely reliant on the research process adopted by the company. Market Research Update assists its clients to recognize opportunities by examining the global market and offering economic insights. We are proud of our extensive coverage that encompasses the understanding of numerous major industry domains.

Market Research Update provide consistency in our research report, also we provide on the part of the analysis of forecast across a gamut of coverage geographies and coverage. The research teams carry out primary and secondary research to implement and design the data collection procedure. The research team then analyzes data about the latest trends and major issues in reference to each industry and country. This helps to determine the anticipated market-related procedures in the future. The company offers technology-driven solutions and its full incorporation in the research method to be skilled at each step.

The Company's Research Process Has the Following Advantages:

- Information Procurement

The step comprises the procurement of market-related information or data via different methodologies & sources.

- Information Investigation

This step comprises the mapping and investigation of all the information procured from the earlier step. It also includes the analysis of data differences observed across numerous data sources.

- Highly Authentic Source

We offer highly authentic information from numerous sources. To fulfills the client’s requirement.

- Market Formulation

This step entails the placement of data points at suitable market spaces in an effort to assume possible conclusions. Analyst viewpoint and subject matter specialist based examining the form of market sizing also plays an essential role in this step.

- Validation & Publishing of Information

Validation is a significant step in the procedure. Validation via an intricately designed procedure assists us to conclude data-points to be used for final calculations.

×

Request Free Sample:

Related Reports

Select License

Why Choose Us

We're cost-effective and Offered Best services:

We are flexible and responsive startup research firm. We adapt as your research requires change, with cost-effectiveness and highly researched report that larger companies can't match.

Information Safety

Market Research Update ensure that we deliver best reports. We care about the confidential and personal information quality, safety, of reports. We use Authorize secure payment process.

We Are Committed to Quality and Deadlines

We offer quality of reports within deadlines. We've worked hard to find the best ways to offer our customers results-oriented and process driven consulting services.

Our Remarkable Track Record

We concentrate on developing lasting and strong client relationship. At present, we hold numerous preferred relationships with industry leading firms that have relied on us constantly for their research requirements.

Best Service Assured

Buy reports from our executives that best suits your need and helps you stay ahead of the competition.

Customized Research Reports

Our research services are custom-made especially to you and your firm in order to discover practical growth recommendations and strategies. We don't stick to a one size fits all strategy. We appreciate that your business has particular research necessities.

Service Assurance

At Market Research Update, we are dedicated to offer the best probable recommendations and service to all our clients. You will be able to speak to experienced analyst who will be aware of your research requirements precisely.

Contact With Our Sales Team

Customer Testimonials

The content of the report is always up to the mark. Good to see speakers from expertise authorities.

Privacy requested , Managing Director

A lot of unique and interesting topics which are described in good manner.

Privacy requested, President

Well researched, expertise analysts, well organized, concrete and current topics delivered in time.

Privacy requested, Development Manager