Drilling Starch Market Size, By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2026 to 2033 (Financial Impact Analysis)

ID : MRU_ 440953 | Date : Feb, 2026 | Pages : 257 | Region : Global | Publisher : MRU

Drilling Starch Market Size

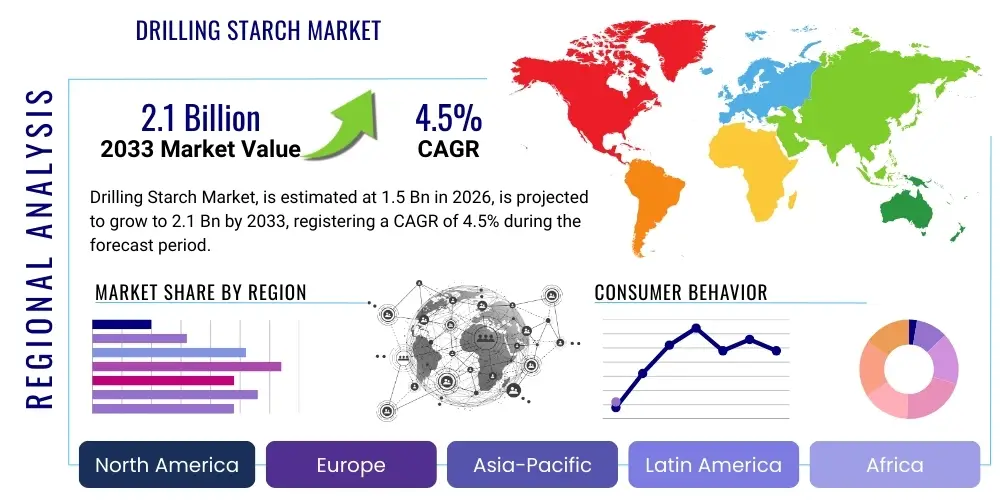

The Drilling Starch Market is projected to grow at a Compound Annual Growth Rate (CAGR) of 4.5% between 2026 and 2033. The market is estimated at $1.5 Billion USD in 2026 and is projected to reach $2.1 Billion USD by the end of the forecast period in 2033.

Drilling Starch Market introduction

Drilling starch, primarily derived from sources such as corn, potato, tapioca, and wheat, is a critical component in formulating drilling fluids, commonly known as drilling muds. It functions predominantly as a fluid loss control agent, preventing the loss of the liquid phase of the drilling mud into porous rock formations, which is essential for maintaining wellbore stability and optimizing drilling efficiency. These biopolymers are favored in the oil and gas extraction industry due to their non-toxic, biodegradable nature and cost-effectiveness compared to synthetic alternatives. The effectiveness of drilling starch is enhanced through chemical modification processes, such as carboxymethylation or hydroxypropylation, which allow the material to withstand the harsh conditions encountered downhole, including elevated temperatures and varying pH levels, thereby extending its functional life and reliability in deep-well applications.

Major applications for drilling starch span across all types of exploration and production (E&P) activities, including conventional onshore drilling, complex offshore projects, and advanced directional drilling techniques. The primary benefits derived from incorporating starch into mud systems include superior rheological control, effective filtration rate reduction, and shale inhibition, which collectively minimize drilling non-productive time (NPT) and protect expensive drilling equipment. In freshwater and saturated saltwater mud systems, modified starches excel at stabilizing the borehole wall and lubricating the drill bit, contributing directly to increased penetration rates and improved overall well economics. Furthermore, the push towards environmentally friendly drilling practices globally has accelerated the adoption of natural, biodegradable additives like drilling starch over traditional synthetic polymers.

The market is currently being driven by several macro-economic and industry-specific factors. Significant growth in global energy demand necessitates continuous E&P investments, particularly in complex reservoirs and unconventional plays that require high-performance drilling fluids. The rebound in crude oil prices post-2020 spurred renewed drilling activity, creating consistent demand for essential drilling fluid additives. Furthermore, stringent environmental regulations imposed by governing bodies worldwide are pushing operators to adopt more sustainable, bio-based chemical solutions, positioning drilling starch as a preferred choice. Technological advancements focused on developing high-performance starches capable of functioning under high-temperature, high-pressure (HTHP) conditions are also expanding the addressable market for these biopolymers.

Drilling Starch Market Executive Summary

The Drilling Starch Market is characterized by steady growth underpinned by the cyclical nature of the oil and gas industry and a structural shift toward sustainable drilling chemicals. Business trends indicate a focus on vertical integration among key suppliers, where raw material producers are increasingly investing in modification facilities to capture higher value in the supply chain. Strategic collaborations between starch manufacturers and major oilfield service companies (OFS) are crucial for product testing, deployment, and customization for specific reservoir challenges. Furthermore, competition is intensifying based on product efficacy, particularly in HTHP applications, prompting manufacturers to invest heavily in R&D to enhance thermal stability and salt tolerance, thereby moving beyond standard commodity starch derivatives.

Regionally, the market dynamics are highly concentrated in areas with robust E&P activities. North America, driven by the prolific shale plays and established offshore drilling in the Gulf of Mexico, remains the largest consumer, demanding specialized starch derivatives for horizontal and extended-reach wells. However, the Middle East and Africa (MEA) are emerging as the fastest-growing regions, fueled by massive long-term upstream investment projects, particularly in Saudi Arabia, UAE, and deepwater exploration off the coast of West Africa. The Asia Pacific region shows strong potential due to growing natural gas exploration in countries like China and Australia, although infrastructure and regulatory diversity pose varying challenges to market entry.

Segment trends highlight the dominance of modified starch derivatives, such as Carboxymethyl Starch (CMS) and Hydroxypropyl Starch (HPS), due to their superior performance characteristics in challenging downhole environments. While native starch remains a cost-effective option for less demanding applications, the increasing complexity of drilling operations necessitates the adoption of enhanced modifications. Application-wise, onshore drilling currently holds the largest market share, but offshore drilling, particularly deepwater and ultra-deepwater exploration, is projected to exhibit a higher growth rate, demanding premium, thermally stable starch products. Key end-user sectors, primarily drilling fluid service providers and independent oilfield operators, are focused on optimizing mud costs without compromising performance, thereby driving demand for efficient, high-yield starch additives.

AI Impact Analysis on Drilling Starch Market

Users frequently inquire about the role of Artificial Intelligence (AI) and Machine Learning (ML) in optimizing drilling fluid formulation and performance prediction, specifically targeting how these technologies affect the utilization of bio-polymers like drilling starch. Key themes revolve around whether AI can precisely model the interaction of starch derivatives with various rock types under dynamic temperature and pressure regimes, thereby minimizing excess usage and maximizing efficiency. Concerns often center on the initial investment required for digitalization and the reliability of AI models when dealing with the complex, non-linear rheology of drilling muds containing natural additives. Expectations are high regarding AI’s ability to move beyond reactive analysis toward predictive maintenance of fluid properties, ensuring optimal fluid loss control using starch derivatives, especially in challenging HTHP or high-salinity environments, ultimately leading to significant cost reductions in additive consumption and operational uptime.

- AI-driven predictive modeling of drilling mud rheology, optimizing starch concentration based on real-time downhole data.

- Machine learning algorithms enhance fluid loss control efficiency by dynamically adjusting starch formulation ratios.

- Predictive maintenance programs reduce the frequency of mud treatment and replacement, optimizing the consumption of drilling starch.

- AI aids in identifying optimal starch modification types required for specific geological formations, improving wellbore stability.

- Generative design techniques accelerate the R&D process for novel high-performance, heat-stable starch derivatives.

- Automated drilling fluid monitoring systems use sensors and AI to detect starch degradation and necessitate timely adjustments.

- Supply chain optimization through AI forecasting, ensuring timely delivery and inventory management of bulk starch chemicals.

DRO & Impact Forces Of Drilling Starch Market

The Drilling Starch Market is subject to a complex interplay of drivers, restraints, and opportunities that collectively shape its growth trajectory. The primary drivers revolve around the continuous need for high-performance drilling fluids in increasing complex exploration landscapes, coupled with growing environmental consciousness promoting the use of sustainable, biodegradable additives. Restraints are predominantly linked to the inherent price volatility of agricultural raw materials (like corn and tapioca) and the fluctuating nature of upstream E&P capital expenditure, which directly impacts the demand for drilling fluid components. Opportunities are emerging mainly from specialized applications, such as deepwater drilling where high-specification, thermally stable starches are essential, and the potential expansion into geothermal drilling, which presents extremely challenging HTHP conditions requiring tailored starch solutions. These forces create a dynamic environment where market participants must balance cost-effectiveness with advanced performance capabilities.

Segmentation Analysis

The Drilling Starch Market is comprehensively segmented based on the product type, its primary application area, and its specific function within the drilling fluid system. This detailed segmentation allows stakeholders to understand specific demand pockets and technological requirements across various drilling contexts globally. The primary segmentation distinguishes between native starches, which are simple and cost-effective, and modified starches, which offer superior performance characteristics essential for modern, challenging drilling environments, reflecting a clear trend toward higher value-added derivatives. Functional analysis focuses on core contributions such as fluid loss control and viscosity, revealing the specialized roles starch fulfills in maintaining borehole integrity and efficient solids suspension. Application segmentation separates demand derived from onshore drilling, which dominates volume, from the highly specialized needs of offshore and deepwater projects.

- By Product Type:

- Native Starch

- Modified Starch

- Carboxymethyl Starch (CMS)

- Hydroxypropyl Starch (HPS)

- Cationic Starch

- Acetylated Starch

- Other Derivatives (e.g., Cross-linked Starch)

- By Application:

- Onshore Drilling

- Offshore Drilling

- Shallow Water

- Deepwater

- Ultra-Deepwater

- By Function:

- Fluid Loss Control Agent (Filtration Control)

- Viscosifier/Rheology Modifier

- Shale Stabilization

- Binding/Lubricating Agent

- By Base Fluid Type:

- Water-Based Mud (WBM)

- Saltwater and Brine Systems

Value Chain Analysis For Drilling Starch Market

The value chain for the drilling starch market begins with the upstream sourcing of agricultural raw materials, primarily corn, potato, tapioca, and wheat. This phase is dominated by large-scale agricultural commodity suppliers and starch processors who extract the native starch. Price volatility and geographical concentration of these crops pose significant upstream risks. Native starch then moves to chemical modifiers and specialized starch manufacturers who perform crucial chemical treatments, such as etherification or esterification, to create performance-enhancing derivatives like CMS and HPS. This manufacturing step adds substantial value, transforming a commodity into a specialized chemical additive capable of surviving extreme downhole conditions. Quality control and adherence to API (American Petroleum Institute) specifications are critical at this stage.

The midstream phase involves the distribution and warehousing of the finished drilling starch products. Distribution channels are bifurcated into direct sales and indirect sales. Direct channels involve large-scale contracts between major starch manufacturers and large integrated oil companies or global oilfield service providers (OFS). Indirect channels rely on a network of specialized drilling fluid chemical distributors and regional chemical resellers, who often provide blending services and technical support tailored to local drilling requirements. Logistics expertise, especially in shipping bulk chemicals to remote drilling sites, is a key determinant of success in this stage. Effective inventory management and minimizing lead times are crucial due to the immediate and project-specific nature of drilling operations.

The downstream segment encompasses the end-users: drilling fluid service providers (e.g., Halliburton, Schlumberger) and independent oil and gas operators who utilize the starch in their mud preparation facilities globally. These end-users assess drilling starch based on cost-efficiency, thermal stability, and environmental compliance. The consumption is driven by active drilling rigs and the complexity of the geological formations being drilled. The ultimate consumer satisfaction hinges on the additive’s performance in preventing fluid invasion and maintaining wellbore stability, thereby directly reducing operational costs. The feedback loop from downstream users back to midstream R&D drives continuous product innovation, particularly the development of high-yield and highly thermally stable products.

Drilling Starch Market Potential Customers

The primary customers for drilling starch are large, integrated oilfield service (OFS) companies responsible for managing and providing comprehensive drilling fluid systems on behalf of operating oil and gas companies. These OFS providers require bulk quantities of high-specification starch derivatives, which they incorporate into proprietary mud formulations tailored to specific drilling projects, geological profiles, and regulatory environments. Their purchasing criteria emphasize product reliability, consistent quality, thermal stability, and the global availability of supply, often necessitating long-term contracts with established chemical manufacturers to ensure supply security and cost predictability. Efficiency in blending and ease of incorporation into water-based mud systems are also critical considerations for these major buyers.

A second major customer group includes independent and national oil companies (NOCs) that manage their drilling operations and fluid systems internally, procuring raw chemical additives directly from specialized suppliers. These buyers, particularly NOCs in regions like the Middle East and Russia, often focus on local sourcing requirements and prefer products that meet national standards while maintaining competitive pricing for large-volume purchases. They tend to be highly price-sensitive for standard native starches but prioritize performance and certification for modified starches used in high-risk, complex wells. The direct relationship allows these customers to have greater control over formulation specifications and procurement cycles.

Furthermore, specialized drilling fluid formulation companies and regional chemical distributors represent a third tier of important customers. These entities cater to smaller, regional independent operators or specific segments of the market, such as geothermal or mining applications. They purchase drilling starch in smaller volumes but require a diverse portfolio of modified and native starches to service various niche applications. Their purchasing decisions are heavily influenced by the technical support offered by the supplier, flexibility in packaging, and the speed of delivery, allowing them to rapidly respond to fluctuating local drilling demands and short-notice projects.

| Report Attributes | Report Details |

|---|---|

| Market Size in 2026 | $1.5 Billion USD |

| Market Forecast in 2033 | $2.1 Billion USD |

| Growth Rate | 4.5% CAGR |

| Historical Year | 2019 to 2024 |

| Base Year | 2025 |

| Forecast Year | 2026 - 2033 |

| DRO & Impact Forces |

|

| Segments Covered |

|

| Key Companies Covered | Cargill, ADM, Tate & Lyle, Ingredion, Roquette Frères, Chemstar Corporation, Wanhua Chemical, Sika AG, Halliburton (Drilling Fluids segment), Schlumberger, BJ Services, DuPont, Archer Daniels Midland Company, Sinochem Corporation, Ashland Global Holdings Inc., BASF SE, CECA (Arkema Group), CP Kelco, AkzoNobel (Nouryon). |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Enquiry Before Buy | Have specific requirements? Send us your enquiry before purchase to get customized research options. Request For Enquiry Before Buy |

Drilling Starch Market Key Technology Landscape

The technological landscape of the drilling starch market is primarily focused on enhancing the performance envelope of natural starches to meet the demands of increasingly complex and severe drilling environments, particularly high-temperature, high-pressure (HTHP) conditions and high-salinity brines. The fundamental technology revolves around chemical modification, predominantly etherification and esterification processes, such as the synthesis of Carboxymethyl Starch (CMS) and Hydroxypropyl Starch (HPS). These processes introduce functional groups that increase the material’s resistance to thermal degradation and bacterial attack, significantly improving fluid loss control efficiency at depths where native starch would rapidly fail. Ongoing research focuses on optimizing reaction parameters to achieve higher degrees of substitution (DS), leading to superior salt tolerance and shear stability, which are crucial for directional drilling applications where mud is subject to intense mechanical stress.

A major technological focus is the development of next-generation starch derivatives capable of operating reliably above 350°F (177°C), leveraging cross-linking technologies and blending with synthetic co-polymers to create hybrid systems. These innovations aim to bridge the performance gap between traditional bio-polymers and costly synthetic alternatives, offering a biodegradable and cost-effective solution for deep wells. Furthermore, advancements in enzymatic modification are gaining traction. This greener technology utilizes highly specific enzymes to achieve targeted structural changes in the starch molecule under milder conditions, reducing energy consumption and minimizing the creation of unwanted byproducts, aligning with the industry's sustainability goals and tightening regulatory mandates regarding chemical processing.

Beyond the chemistry of the starch itself, digital technologies and smart blending systems are forming a key part of the modern technology landscape. Sophisticated sensor technology is being deployed downhole and at the mud mixing plant to provide real-time data on fluid properties, including viscosity and fluid loss rates. This data feeds into proprietary software models used by OFS providers to precisely calculate the required concentration of drilling starch additives, minimizing waste and ensuring optimal performance. Nanotechnology is also an emerging area, with research exploring the integration of starch matrices with nanoparticles to create composite drilling fluid additives that offer synergistic improvements in rheology and filtration control properties, especially in challenging low-permeability reservoirs.

Regional Highlights

The global demand for drilling starch is heavily influenced by regional upstream activity levels, regulatory environments, and the dominant type of drilling activity (onshore vs. offshore) prevalent in key geographical areas. Each region presents unique market drivers and challenges, dictating the preferred type of starch derivative utilized by local operators.

- North America (NA): Represents the largest and most technologically advanced market, driven primarily by extensive shale oil and gas exploration in the Permian Basin and Marcellus Shale. Demand is high for high-performance, thermally stable modified starches essential for horizontal drilling and hydraulic fracturing operations. The established deepwater operations in the Gulf of Mexico also require premium-grade fluid loss control agents, ensuring sustained, high-volume consumption.

- Middle East and Africa (MEA): Projected as the fastest-growing region due to major long-term upstream investment cycles initiated by National Oil Companies (NOCs). Significant conventional drilling activities in Saudi Arabia, UAE, and Kuwait, coupled with deepwater exploration off the coast of West Africa (Nigeria, Angola), drive robust demand. The region often requires highly salt-tolerant modified starches to handle high-salinity reservoirs and varying thermal gradients.

- Asia Pacific (APAC): A rapidly evolving market characterized by increasing exploration in China, India, and Australia (especially LNG projects). The demand profile is mixed, with strong consumption of cost-effective native starches for shallower conventional wells, alongside a growing need for modified starches in deep-gas wells and complex offshore fields. Regulatory variations across countries, particularly concerning environmental discharge, influence product choice.

- Europe: Characterized by mature oilfields and a strong emphasis on environmental compliance. Demand is concentrated around specialized, high-specification modified starches that are biodegradable and meet strict North Sea and EU environmental standards. The focus is shifting towards gas exploration and highly technical operations, sustaining niche demand for premium products.

- Latin America (LATAM): Growth is primarily fueled by offshore activities in Brazil (pre-salt reserves) and Mexico (deepwater Gulf of Mexico). These complex reservoirs necessitate high-quality, thermally and shear-stable drilling starches. Political and economic volatility occasionally restrain growth, but the underlying resource potential drives consistent, if fluctuating, demand for drilling fluid additives.

Top Key Players

The market research report includes a detailed profile of leading stakeholders in the Drilling Starch Market.- Cargill

- ADM (Archer Daniels Midland Company)

- Tate & Lyle

- Ingredion

- Roquette Frères

- Chemstar Corporation

- Wanhua Chemical Group Co., Ltd.

- Sika AG (Through acquired entities)

- Halliburton (Drilling Fluids segment)

- Schlumberger

- BJ Services

- DuPont

- Sinochem Corporation

- Ashland Global Holdings Inc.

- BASF SE

- CECA (Arkema Group)

- CP Kelco

- AkzoNobel (Nouryon)

- Hebei Xingtai Oilfield Chemical Co., Ltd.

- Drilling Specialties Company (Drispac)

Frequently Asked Questions

Analyze common user questions about the Drilling Starch market and generate a concise list of summarized FAQs reflecting key topics and concerns.What is the primary function of drilling starch in drilling fluids?

The primary function of drilling starch, especially modified derivatives, is to act as an effective fluid loss control agent. It helps create a thin, low-permeability filter cake on the borehole wall, minimizing the invasion of drilling mud into porous formations, thereby maintaining stable wellbore pressure and integrity.

How do Modified Starches differ from Native Starches in drilling applications?

Modified starches (e.g., CMS, HPS) undergo chemical processing to enhance their resistance to high temperatures, high salinity, and bacterial degradation. This makes them suitable for complex, deep, and hostile drilling environments where native starches would quickly break down, losing their efficacy for filtration control and viscosity modification.

Which drilling segment utilizes the highest volume of drilling starch?

Onshore drilling operations currently utilize the highest volume of drilling starch globally, driven by the vast number of conventional and unconventional wells, particularly in North America's shale plays, where cost-effective, high-yield water-based mud additives are widely required for fluid loss management.

What are the main environmental benefits of using starch-based drilling additives?

Drilling starches are natural biopolymers that offer significant environmental benefits due to their high biodegradability and low toxicity profile compared to many synthetic polymers. This compliance with stringent environmental regulations, particularly in sensitive areas like offshore deepwater and the North Sea, is a major market driver.

What is the current growth forecast for the Drilling Starch Market?

The Drilling Starch Market is projected to experience steady growth, forecasted to achieve a Compound Annual Growth Rate (CAGR) of 4.5% between 2026 and 2033, driven by increasing global exploration and production activity and the growing necessity for high-performance, environmentally acceptable drilling fluid components.

To check our Table of Contents, please mail us at: sales@marketresearchupdate.com

Research Methodology

The Market Research Update offers technology-driven solutions and its full integration in the research process to be skilled at every step. We use diverse assets to produce the best results for our clients. The success of a research project is completely reliant on the research process adopted by the company. Market Research Update assists its clients to recognize opportunities by examining the global market and offering economic insights. We are proud of our extensive coverage that encompasses the understanding of numerous major industry domains.

Market Research Update provide consistency in our research report, also we provide on the part of the analysis of forecast across a gamut of coverage geographies and coverage. The research teams carry out primary and secondary research to implement and design the data collection procedure. The research team then analyzes data about the latest trends and major issues in reference to each industry and country. This helps to determine the anticipated market-related procedures in the future. The company offers technology-driven solutions and its full incorporation in the research method to be skilled at each step.

The Company's Research Process Has the Following Advantages:

- Information Procurement

The step comprises the procurement of market-related information or data via different methodologies & sources.

- Information Investigation

This step comprises the mapping and investigation of all the information procured from the earlier step. It also includes the analysis of data differences observed across numerous data sources.

- Highly Authentic Source

We offer highly authentic information from numerous sources. To fulfills the client’s requirement.

- Market Formulation

This step entails the placement of data points at suitable market spaces in an effort to assume possible conclusions. Analyst viewpoint and subject matter specialist based examining the form of market sizing also plays an essential role in this step.

- Validation & Publishing of Information

Validation is a significant step in the procedure. Validation via an intricately designed procedure assists us to conclude data-points to be used for final calculations.

×

Request Free Sample:

Related Reports

Select License

Why Choose Us

We're cost-effective and Offered Best services:

We are flexible and responsive startup research firm. We adapt as your research requires change, with cost-effectiveness and highly researched report that larger companies can't match.

Information Safety

Market Research Update ensure that we deliver best reports. We care about the confidential and personal information quality, safety, of reports. We use Authorize secure payment process.

We Are Committed to Quality and Deadlines

We offer quality of reports within deadlines. We've worked hard to find the best ways to offer our customers results-oriented and process driven consulting services.

Our Remarkable Track Record

We concentrate on developing lasting and strong client relationship. At present, we hold numerous preferred relationships with industry leading firms that have relied on us constantly for their research requirements.

Best Service Assured

Buy reports from our executives that best suits your need and helps you stay ahead of the competition.

Customized Research Reports

Our research services are custom-made especially to you and your firm in order to discover practical growth recommendations and strategies. We don't stick to a one size fits all strategy. We appreciate that your business has particular research necessities.

Service Assurance

At Market Research Update, we are dedicated to offer the best probable recommendations and service to all our clients. You will be able to speak to experienced analyst who will be aware of your research requirements precisely.

Contact With Our Sales Team

Customer Testimonials

The content of the report is always up to the mark. Good to see speakers from expertise authorities.

Privacy requested , Managing Director

A lot of unique and interesting topics which are described in good manner.

Privacy requested, President

Well researched, expertise analysts, well organized, concrete and current topics delivered in time.

Privacy requested, Development Manager