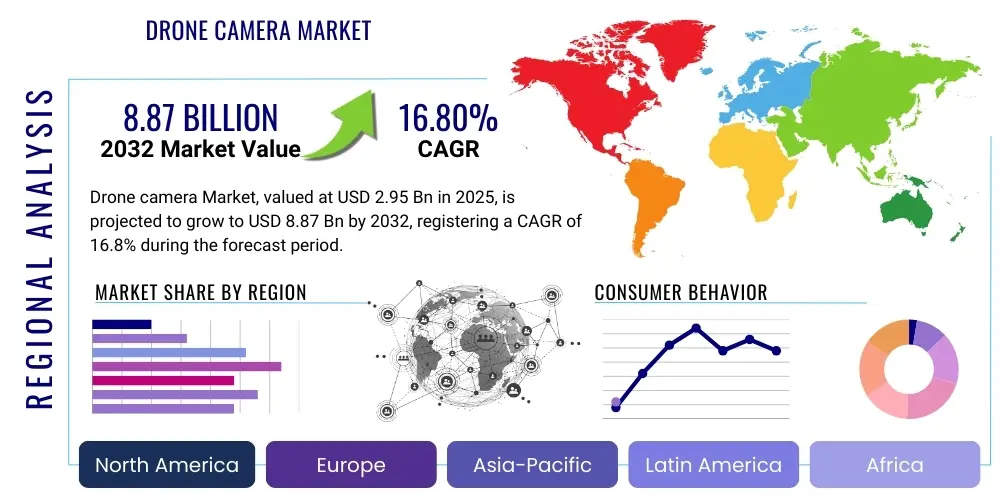

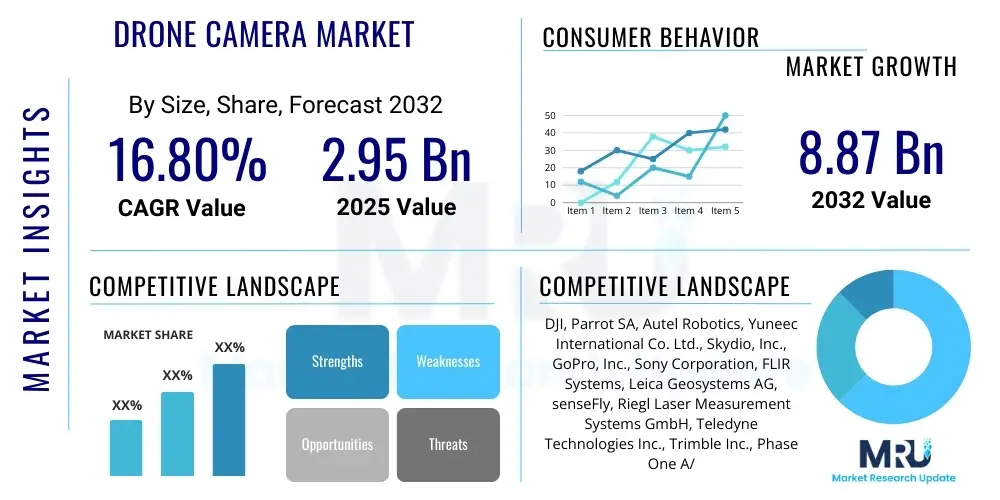

Drone Camera Market Size, By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2026 to 2033 (Financial Impact Analysis)

ID : MRU_ 443368 | Date : Feb, 2026 | Pages : 258 | Region : Global | Publisher : MRU

Drone Camera Market Size

The Drone Camera Market is projected to grow at a Compound Annual Growth Rate (CAGR) of 14.5% between 2026 and 2033. The market is estimated at USD 6.5 Billion in 2026 and is projected to reach USD 16.8 Billion by the end of the forecast period in 2033.

Drone Camera Market introduction

The Drone Camera Market encompasses specialized imaging systems designed for integration into Unmanned Aerial Vehicles (UAVs). These advanced camera payloads are the linchpin of modern drone functionality, transforming airborne platforms into indispensable data acquisition instruments utilized across a myriad of professional and recreational applications, including high-resolution mapping, infrastructure surveillance, precision agriculture, and dynamic cinematic production. The core product definition extends beyond standard digital cameras to include highly specialized sensors such as thermal infrared, multispectral, and LiDAR units, all engineered for weight optimization, robust environmental resilience, and seamless communication with sophisticated flight control systems. The rapid evolution of CMOS sensor technology, coupled with miniaturization of powerful image signal processors (ISPs), allows for the capture of detailed, high-fidelity imagery (often 4K, 6K, or 8K resolution) under challenging aerial conditions, thereby generating actionable intelligence for end-users across global vertical markets. The value proposition of these systems is rooted in their ability to provide superior vantage points, reducing operational risks, lowering associated labor costs, and dramatically accelerating data collection cycles compared to traditional ground-based or manned aviation alternatives.

The major applications dictating market demand are heavily concentrated in commercial sectors. Industrial inspection of critical assets—such as wind turbine blades, high-tension power lines, and vast solar photovoltaic farms—demands cameras equipped with high optical zoom capabilities and integrated thermal imaging to detect minute structural flaws or hot spots indicative of failure. Geospatial intelligence applications, particularly surveying, mapping, and volumetric calculations in construction and mining, require cameras boasting high geometric accuracy, large sensor formats, and global shutter mechanisms to prevent image distortion during rapid movement. Furthermore, the burgeoning field of precision agriculture utilizes multispectral drone cameras to assess crop vigor, identify localized pest outbreaks, and optimize fertilizer application, fostering resource efficiency and improved yield management. These varied applications underscore the requirement for highly customized camera solutions tailored to specific spectral, spatial, and temporal data requirements, moving the market trajectory towards specialized payloads rather than general-purpose imaging devices. The increasing demand for low-latency, real-time video streams for FPV (First Person View) surveillance and dynamic tracking further drives innovation in wireless transmission standards and on-board encoding optimization.

Driving factors propelling sustained market expansion are multifaceted and deeply interconnected with global economic and technological trends. Firstly, the ongoing global push for digital transformation across infrastructure and resource management sectors necessitates high-frequency, reliable monitoring data, a task ideally suited for drone cameras. Secondly, favorable regulatory adjustments, particularly the slow but steady relaxation of rules surrounding Beyond Visual Line of Sight (BVLOS) operations in key economies, unlocks massive operational areas and scalability for drone services, directly translating into increased demand for sophisticated long-range imaging equipment. Thirdly, the dramatic reduction in the cost-to-performance ratio for sensors and stabilization technology makes professional-grade drone cameras accessible to a wider range of Small and Medium Enterprises (SMEs), not just large corporations. Finally, the integration of advanced AI and Machine Learning (ML) capabilities—such as automated object recognition and intelligent flight path generation based on visual input—enhances the autonomy and effectiveness of drone camera systems, positioning them as essential tools for proactive asset maintenance and security surveillance across urban and rural environments globally, ensuring robust and sustained market growth over the forecast period.

Drone Camera Market Executive Summary

The Drone Camera Market is experiencing profound shifts driven by the convergence of miniaturization, artificial intelligence, and regulatory maturation. Current business trends indicate a strong move toward platform specialization, where manufacturers are increasingly focusing on developing purpose-built camera payloads optimized for specific drone models and application requirements, moving away from generic, interchangeable units. This specialization extends to integrated software suites that analyze camera-captured data, creating an ecosystem lock-in effect where the camera hardware, firmware, and proprietary data processing tools are sold as a cohesive solution. Mergers and acquisitions are becoming prevalent, especially involving large defense contractors acquiring niche sensor technology providers to bolster their capacity in thermal and highly secure imaging solutions. Supply chain resilience, particularly concerning the sourcing of high-purity rare earth materials used in optical elements and advanced semiconductor chips for image signal processing, remains a critical strategic priority for top-tier market leaders attempting to mitigate geopolitical and manufacturing risks.

Regional trends reveal distinct growth patterns shaped by regulatory and industrial priorities. The Asia Pacific region, fueled by unprecedented investments in infrastructure development (e.g., high-speed rail, smart grid construction) and the early adoption of agricultural technology in nations like India and China, demonstrates the highest growth momentum, primarily driven by volume and commercial deployment for mapping and surveying. North America continues to lead in technological innovation and high-value defense procurement, maintaining market leadership in terms of revenue, driven by demand for superior quality, high-security payloads mandated by federal agencies and large energy corporations. European growth is modulated by strict compliance requirements, fostering a strong emphasis on cybersecurity, data protection (GDPR implications for surveillance), and ethical design in camera systems, pushing innovation towards edge processing and robust anonymization features.

Analysis of segment trends underscores the rapid obsolescence of low-resolution cameras. 4K resolution is now standard across virtually all commercial applications, with 6K and 8K systems becoming the benchmark for high-end cinematic and detailed inspection tasks demanding maximum pixel density. Sensor specialization is the definitive trend; while RGB cameras remain necessary, the growth rate of specialized sensors—particularly multispectral cameras for environmental and agricultural analysis, and thermal cameras for energy audits and search and rescue—significantly outpaces the growth of standard visual cameras. Furthermore, the market segment dedicated to integrated LiDAR payloads, which combine imaging with precise distance measurement, is forecast to achieve explosive growth, reflecting the industry's need for highly accurate 3D point cloud generation necessary for complex Building Information Modeling (BIM) and digital twinning projects.

AI Impact Analysis on Drone Camera Market

Common user questions regarding AI’s influence in the Drone Camera Market heavily revolve around autonomy and data throughput management. Users frequently inquire: "How does on-board AI improve flight safety and collision avoidance based on camera input?" "Can AI-powered drone cameras classify and tag assets in real-time, reducing manual data review time?" and "What are the ethical and data security implications of using facial recognition AI on drone footage?" This collective query analysis reveals a strong market demand for intelligent automation, moving drone operations from pilot-intensive control to AI-assisted execution. Key concerns center on achieving reliable, low-latency, and context-aware computer vision capabilities that can operate efficiently within the power and computational constraints of a compact aerial platform. The expectations are high regarding AI’s ability to filter massive streams of captured data, transmitting only the most relevant, actionable insights rather than raw footage, thereby overcoming persistent bottlenecks associated with data storage, transmission bandwidth, and human fatigue during prolonged surveillance operations.

The practical application of AI is profoundly transforming the camera itself, effectively turning the sensor into an intelligent endpoint. By embedding neural networks and specialized AI accelerators (NPUs) directly into the camera module—a process termed Edge AI deployment—drone cameras gain the capability to perform immediate, complex visual processing. For instance, in solar farm inspection, the camera's AI identifies and localizes anomalies (e.g., panel micro-cracks or shading issues detected via thermal and visual fusion) with sub-second latency, triggering automated alerts or rerouting the drone for closer inspection without needing continuous interaction with a ground control station. This capability is paramount for scalability, allowing a single operator to manage a fleet of drones, each autonomously performing sophisticated data acquisition tasks. Furthermore, AI significantly enhances image stabilization and quality by predicting drone movement and correcting lens distortion or atmospheric disturbances in real-time, yielding consistently high-quality outputs even under severe operational duress.

Beyond real-time operations, AI is the foundational layer for extracting commercial value from the captured data. Automated photogrammetry processing pipelines leverage deep learning to identify control points, stitch complex imagery, and generate highly accurate 3D models with minimal human intervention, fundamentally changing the economics of surveying and mapping. In security applications, AI models are trained to differentiate between benign movements and genuine threats, significantly reducing false positive rates in vast surveillance areas monitored by drone cameras. This level of autonomy and intelligent filtering not only accelerates post-mission analysis but also ensures that drone camera systems provide tangible ROI by converting high-volume visual data into specific, machine-generated reports and operational recommendations. The future trajectory involves integrating predictive AI that can anticipate equipment failure based on subtle visual cues captured over time, moving maintenance strategies from reactive or scheduled inspections to condition-based, proactive interventions, relying entirely on the precision and analytical power of the onboard camera intelligence.

- Enhanced Real-Time Object Recognition and Tracking (RTORAT) for surveillance and moving target engagement, optimized for variable aerial perspectives.

- Edge AI implementation enabling immediate analysis, intelligent video encoding, and automated data prioritization directly on the drone camera platform.

- Automated defect detection and classification in industrial inspection imagery, improving accuracy and speed while tagging anomalies with precise GPS coordinates.

- Intelligent photogrammetry and 3D modeling, significantly accelerating the creation of detailed geospatial data products by automating control point identification and stitching.

- Improved electronic image stabilization and aerial noise reduction through machine learning algorithms tailored for minimizing sensor vibration and atmospheric distortion.

- Predictive maintenance capabilities based on time-series analysis of visual and thermal data anomaly recognition across large asset portfolios.

- Optimization of data compression and selective transmission protocols based on the semantic content and criticality of the visual information captured.

- Development of AI-driven semantic segmentation for rapid classification of terrain features, crop types, or urban elements in captured imagery.

DRO & Impact Forces Of Drone Camera Market

The market trajectory is significantly bolstered by critical Drivers, primarily encompassing the compelling economic case for drone deployment across various industries. The primary driver is the undeniable efficiency and cost reduction achieved by using drone cameras for tasks traditionally requiring helicopters, scaffoldings, or extensive ground teams. For large infrastructure projects, inspection time can be reduced from weeks to hours, translating directly into massive operational savings. This efficiency is married to the advancement in sensor technology itself; the current generation of cameras is lighter, boasts higher resolution, and features multi-sensor integration (e.g., combined RGB/thermal/LiDAR in one compact unit), consistently expanding the scope of tasks drones can perform effectively. Furthermore, the global military expenditure on modernizing Intelligence, Surveillance, and Reconnaissance (ISR) capabilities serves as a robust, consistent financial driver, pushing the limits of technological innovation in secure, long-range, and highly resilient camera systems, which often trickles down into commercial applications.

The restraining factors pose genuine challenges to widespread market adoption. High acquisition costs associated with specialized, high-accuracy payloads, particularly medium-format cameras and complex LiDAR scanners, remain prohibitive for smaller enterprises or those with limited capital expenditure budgets. However, the most profound restraint is regulatory friction. The absence of harmonized global airspace regulations, coupled with stringent restrictions on Beyond Visual Line of Sight (BVLOS) operations in many jurisdictions, significantly limits the potential for scalable drone camera services, preventing operations over long distances or densely populated areas. Additionally, the growing public anxiety and legislative scrutiny concerning privacy (especially around facial recognition and data collection in urban environments) necessitate complex operational protocols and secure data handling procedures, adding to operational complexity and costs for commercial operators, which manufacturers must address through compliant hardware design.

Significant Opportunities are emerging that promise to unlock new market value. The proliferation of 5G and future 6G networks offers a crucial pathway for seamless, low-latency, real-time data transmission from drone cameras, enabling true remote control and cloud-based processing capabilities previously hampered by bandwidth limitations. A massive opportunity lies in the specialization of camera payloads for nascent markets such as subterranean and enclosed space inspection (using structured light and SLAM-integrated visual sensors) and the healthcare sector (for logistics and emergency site assessment). Furthermore, the trend toward open-source drone platforms and standardized interfaces (like MAVLink) lowers the barriers for third-party component manufacturers, fostering a competitive environment that encourages rapid, continuous innovation in camera technology and peripheral processing units. The integration of advanced AI and machine learning for predictive maintenance constitutes a primary long-term opportunity, embedding the drone camera system into the core of corporate asset management strategies.

Segmentation Analysis

A comprehensive segmentation analysis of the Drone Camera Market is essential for understanding the differentiated demands and consumption patterns across various end-user segments. The categorization by sensor resolution illustrates a market hierarchy where high-end cinematic and mapping applications are driving demand for 6K and 8K sensors, valuing maximum detail and post-production flexibility, contrasting with standard 4K usage dominating general industrial inspection and consumer applications where balancing resolution with file size is key. This resolution-based segmentation directly impacts pricing strategy, with ultra-high-definition cameras commanding premium prices due to the specialized optics and advanced internal processing required to handle large data volumes effectively. Furthermore, understanding the split between cameras utilizing rolling shutter versus global shutter technology is critical; while rolling shutter cameras are cheaper and common in consumer models, global shutter cameras are mandatory for accurate, high-speed mapping tasks to eliminate the "jello effect" and distortion artifacts, thereby defining the segment for professional surveying tools.

Segmentation by sensor type reflects the increasing complexity and specialization required by modern commercial drone tasks. The market is witnessing exponential growth in non-visual sensor segments. Thermal imaging cameras (uncooled microbolometer and cooled detectors) are indispensable in emergency response, construction energy audits, and security surveillance due to their ability to detect heat signatures irrespective of light conditions. Multispectral and hyperspectral cameras are exclusively positioned for precision agriculture and environmental monitoring, providing granular data on plant health and water stress through spectral signature analysis. The integration of LiDAR (Light Detection and Ranging) payloads, often co-located with high-resolution RGB cameras, represents the pinnacle of data acquisition, offering high-density point clouds essential for creating highly accurate Digital Twins of assets and terrain. This deep segmentation highlights that the market is evolving into a specialized tool ecosystem, where users select sensor combinations based not on general quality, but on the specific analytical insight required for their professional duties.

The application segmentation clearly dictates the technical specifications prioritized by manufacturers. The defense and military ISR segment demands ultra-rugged, highly secure, and extremely long-range zoom capabilities, often operating under severe electromagnetic constraints. Conversely, the media and entertainment segment prioritize dynamic range, color science accuracy, and professional video codecs (e.g., ProRes, RAW) for filmmaking flexibility. The industrial inspection sector focuses heavily on reliable data capture under variable weather conditions, favoring advanced ingress protection ratings (IP ratings) and integrated AI for real-time defect identification. This multi-faceted segmentation demonstrates that successful market players must develop targeted product lines, each optimized for the unique power, processing, communication, and environmental requirements of distinct vertical applications, ensuring maximum relevance and competitive advantage within their chosen niches.

- By Resolution:

- Full HD (1080p) - Entry-level and niche surveillance applications.

- 4K and Ultra HD - Commercial standard for inspection and media.

- 6K and Above (High-End Cinematic and Mapping) - Professional surveying and high-budget production.

- By Type/Sensor:

- RGB/Standard Visual Camera - General photography and surveillance.

- Thermal Camera - Security, energy auditing, and search & rescue (SAR).

- Multispectral and Hyperspectral Camera - Precision agriculture and environmental mapping.

- LiDAR Integrated Systems - High-accuracy 3D surveying and digital twin creation.

- By Application:

- Industrial Inspection (Energy, Utilities, Infrastructure) - High zoom and thermal required.

- Mapping and Surveying (Geospatial) - Global shutter and high geometric accuracy necessary.

- Media, Entertainment, and Cinematography - High dynamic range and professional codecs.

- Precision Agriculture - Multispectral analysis for crop health.

- Security, Surveillance, and Law Enforcement - Real-time tracking and low-light performance.

- Defense and Military ISR - Secure, long-range optical capabilities.

- By Mechanism:

- Gimbal-Stabilized Cameras - High-precision, dynamic stability for video and oblique imagery.

- Fixed-Mount Cameras - Cost-effective, used primarily for low-speed photogrammetry and general surveillance.

- By End-Use Industry:

- Construction and Mining - Volumetric calculation and site progress monitoring.

- Energy and Power Generation - Infrastructure defect detection (thermal/visual fusion).

- Agriculture and Forestry - Resource optimization and pest monitoring.

- Government and Public Sector - Homeland security and municipal asset mapping.

- Real Estate and Infrastructure - High-quality visual documentation and aerial tours.

Value Chain Analysis For Drone Camera Market

The upstream segment of the Drone Camera value chain is characterized by intense specialization and a global reliance on a few key semiconductor and optics suppliers. This stage involves the design and procurement of foundational components: high-performance, compact CMOS sensors (from companies like Sony and OmniVision), custom-designed lens assemblies that must withstand vibration and temperature variations, and the specialized microprocessors (Image Signal Processors or ISPs) necessary for high-speed data throughput and on-board computation. Competition at this level focuses on achieving superior image quality metrics—such as dynamic range, low noise performance, and global shutter speed—while simultaneously adhering to the strict weight and power consumption limits inherent in drone technology. Strategic manufacturers often engage in long-term supply contracts to secure access to cutting-edge sensor fabrication capacity, managing the risk associated with single-source component reliance and ensuring intellectual property protection for proprietary gimbal control systems and optical correction algorithms.

The midstream phase focuses on the complex integration, calibration, and software development that transforms components into a functional camera payload. This stage includes mounting the sensor array onto the gimbal mechanism, writing and optimizing firmware for real-time video encoding (e.g., RAW or ProRes output), and rigorous environmental testing to ensure operational reliability under severe weather and altitude conditions. Direct distribution channels are critical for high-value contracts, particularly those involving military sales or large industrial clients, where the manufacturer provides custom integration, specialized training, and dedicated maintenance support. Conversely, the high-volume commercial and prosumer segments rely heavily on indirect distribution through a network of international distributors, certified value-added resellers (VARs), and established global e-commerce platforms. VARs play a crucial role by providing localized technical expertise, integrating the camera with regionally compliant drone platforms, and bundling the hardware with necessary localized data analysis software, bridging the gap between manufacturer capability and end-user application requirements.

Downstream activities define how the captured aerial data is monetized and utilized by the end-users. This involves the operations conducted by Drone Service Providers (DSPs), who acquire the camera systems and execute missions for clients across construction, agriculture, and utilities. The ultimate value extracted is driven less by the camera hardware itself and more by the efficiency and precision of the subsequent data processing—the generation of centimeter-accurate orthophotos, detailed 3D meshes, and AI-driven inspection reports. Consequently, market competitiveness is increasingly shifting downstream, favoring manufacturers who can offer a seamless, vertically integrated solution, encompassing the flight planning software, the camera payload, and the cloud-based analytical platform. This focus on "Data-as-a-Service" means that intellectual property in proprietary data stitching algorithms, cloud storage security, and specialized AI analytics (e.g., thermal signature recognition trained on specific industrial equipment failure modes) dictates long-term market leadership and customer retention, completing the value chain by turning raw pixels into quantifiable business insights.

Drone Camera Market Potential Customers

The potential customer base for sophisticated drone cameras is highly diversified, reflecting the ubiquitous applicability of aerial data across modern commerce and governance. A primary high-value segment comprises the infrastructure and utility sectors, including global power generation companies, telecommunication tower operators, and large-scale transportation authorities (rail, road, port infrastructure). These entities utilize drone cameras for preventative maintenance inspection, demanding payloads capable of thermal imaging and high-resolution optical zoom to identify subtle defects on assets, maximizing uptime and reducing manual inspection risks. This segment is characterized by large, recurring contracts and a preference for highly durable, certified camera systems that can operate reliably in harsh, often remote, environmental conditions, prioritizing Mean Time Between Failures (MTBF) and robust data security features over simple cost.

Another rapidly expanding customer segment is governmental and public safety organizations. This includes police forces, fire and rescue services, border patrol agencies, and federal land management agencies. These customers require cameras optimized for immediate, time-critical operational use, necessitating features like superior low-light sensitivity, geo-referencing accuracy, and robust integration with command and control platforms. Law enforcement, for example, heavily invests in surveillance cameras with long-range optical zoom and rapid deployment capabilities for accident reconstruction and crowd monitoring. Simultaneously, defense and intelligence agencies maintain their position as key consumers, demanding the most advanced, often custom-built, camera technology for sophisticated Intelligence, Surveillance, Target Acquisition, and Reconnaissance (ISTAR) missions, driving technological breakthroughs in areas like hyper-zoom and encrypted data transmission standards.

Finally, the creative and specialized service industries form a crucial customer pillar. This encompasses professional cinematography, demanding cinema-grade cameras (e.g., Phase One, Red Digital Cinema payloads) capable of shooting in high bit-depth RAW formats for maximum color grading flexibility, and specialized geospatial consultants requiring highly calibrated photogrammetry cameras for producing certifiably accurate maps for legal and planning purposes. The common thread among all potential customers is the transition from using drones merely as flying cameras to utilizing them as integrated data collection platforms, meaning that buyers are increasingly purchasing a total solution—the camera, the drone platform, the processing software, and the necessary technical support—to ensure the reliability and analytical quality of the aerial intelligence generated, thereby concentrating purchasing power towards providers offering comprehensive ecosystem support.

| Report Attributes | Report Details |

|---|---|

| Market Size in 2026 | USD 6.5 Billion |

| Market Forecast in 2033 | USD 16.8 Billion |

| Growth Rate | CAGR 14.5% |

| Historical Year | 2019 to 2024 |

| Base Year | 2025 |

| Forecast Year | 2026 - 2033 |

| DRO & Impact Forces |

|

| Segments Covered |

|

| Key Companies Covered | DJI, FLIR Systems, Sony Corporation, Phase One, Leica Geosystems (Hexagon AB), GoPRO, Teledyne FLIR, Autel Robotics, Parrot Drones, Skydio, Yuneec International, Red Digital Cinema, Nikon Corporation, Canon Inc., Hoodman Corporation, Micasense (AgEagle Aerial Systems), Aeryon Labs (L3Harris), AeroVironment, General Atomics Aeronautical Systems, PrecisionHawk, Topcon Corporation, SenseFly (Parrot Group). |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Enquiry Before Buy | Have specific requirements? Send us your enquiry before purchase to get customized research options. Request For Enquiry Before Buy |

Drone Camera Market Key Technology Landscape

The foundation of the modern Drone Camera Market rests on pioneering advancements in image sensor architecture and optical system design, moving beyond incremental improvements toward fundamental transformation. Sensor innovation is centered on developing larger format, higher-density CMOS sensors that are increasingly backlit (BSI) to maximize light capture efficiency, critical for operations in challenging lighting conditions (dawn/dusk). A pivotal technological shift involves the widespread adoption of global shutter technology, even in mid-range cameras, which captures the entire image sensor simultaneously, eliminating the motion artifacts inherent to rolling shutters. This is non-negotiable for high-accuracy photogrammetry, where maintaining geometric integrity across rapidly captured sequential images is paramount for producing reliable 3D models. Moreover, sensor fusion technology is becoming standard, where proprietary algorithms intelligently combine data streams from disparate sensors—such as fusing high-resolution RGB data with thermal infrared readings or integrating visual input with active LiDAR point clouds—to provide a single, comprehensive, highly informative output, far exceeding the analytical capabilities of single-sensor payloads.

Stabilization and mechanical design are another area of intense technological focus. The evolution of brushless motor gimbals has led to systems that are significantly lighter, more energy-efficient, and capable of extremely rapid, precise angular correction to maintain sensor orientation despite violent drone maneuvers or high winds. Advanced 3-axis gimbals now incorporate machine learning algorithms to predictively compensate for known drone vibrational frequencies and aerodynamic turbulence, ensuring cinematic stability even during high-speed flight. Furthermore, technological effort is being directed toward modularity and rapid exchange systems. Manufacturers are developing standardized quick-release mechanisms that allow operators to swap out specialized payloads (e.g., changing from a cinematic camera to a multispectral mapping unit) in seconds, enhancing operational flexibility and reducing downtime, which is a major factor in improving the Return on Investment (ROI) for professional drone service providers operating across multiple industry verticals.

Perhaps the most transformative technological area is data throughput management and embedded intelligence. Modern drone camera systems feature powerful system-on-chips (SoCs) dedicated solely to processing the massive influx of raw data generated by 4K, 6K, and 8K sensors at high frame rates. These powerful ISPs enable complex on-the-fly computational photography features, including superior noise reduction, real-time High Dynamic Range (HDR) processing, and sophisticated lens profile corrections. More critically, the integration of Neural Processing Units (NPUs) facilitates edge computing, allowing the camera to autonomously execute complex machine vision tasks—such as detecting, classifying, and tracking vehicles or environmental changes—before the data leaves the drone. This ability to pre-process and intelligently filter data significantly reduces the required wireless transmission bandwidth and latency, making beyond-visual-line-of-sight (BVLOS) operations more feasible and secure by ensuring that only mission-critical, analyzed intelligence is transmitted back to the ground control station, fundamentally redefining the relationship between data capture and operational decision-making.

Regional Highlights

- North America: The market bastion, characterized by high adoption rates in defense, infrastructure inspection (oil and gas, utilities), and high-end media production. Regulatory environments, while strict (FAA), are mature, fostering innovation in certified and secure systems. Demand is highly focused on robust, AI-integrated payloads and advanced multi-sensor fusion technology.

- Europe: Exhibits robust growth driven by environmental monitoring, construction mapping, and compliance-driven inspection tasks. The region places a premium on data privacy (GDPR compliance), leading to increased demand for drone cameras with strong on-board encryption and processing capabilities to minimize the handling of sensitive raw data outside secure environments.

- Asia Pacific (APAC): The global epicenter of volume growth, fueled by rapid urbanization, substantial investment in large-scale infrastructure projects (e.g., smart cities, dam construction), and intensive commercial adoption in precision agriculture across expansive farmlands. This region benefits from local manufacturing prowess, making high-quality systems accessible and driving market penetration across a broad economic spectrum.

- Latin America (LATAM): Growth is primarily centered around large-scale commodity sectors, including mining (volumetric surveys and safety inspections), large-scale agriculture (soy, corn), and resource management (deforestation tracking). The market favors cost-effective yet rugged camera systems capable of operating autonomously in geographically challenging and remote terrains.

- Middle East and Africa (MEA): Demand is acutely focused on security and energy asset protection, driven by substantial government and private investment in surveillance systems for critical infrastructure (pipelines, refineries, border security). High-performance thermal and long-range visual zoom capabilities are prioritized to ensure effective monitoring across vast, often desert, operational areas.

Top Key Players

The market research report includes a detailed profile of leading stakeholders in the Drone Camera Market.- DJI (Dajiang Innovations)

- FLIR Systems (Teledyne FLIR)

- Sony Corporation

- Phase One A/S

- Leica Geosystems (Hexagon AB)

- GoPro Inc.

- Autel Robotics

- Parrot Drones SAS

- Skydio Inc.

- Yuneec International

- Red Digital Cinema Camera Company

- Nikon Corporation

- Canon Inc.

- Micasense (Part of AgEagle Aerial Systems)

- Aeryon Labs (Now L3Harris Technologies)

- AeroVironment Inc.

- General Atomics Aeronautical Systems

- PrecisionHawk

- Topcon Corporation

- SenseFly (Parrot Group)

Frequently Asked Questions

Analyze common user questions about the Drone Camera market and generate a concise list of summarized FAQs reflecting key topics and concerns.What is the most critical factor driving the commercial adoption of drone cameras?

The most critical factor is the significant improvement in operational safety and efficiency offered by aerial data capture, particularly in hazardous environments like high-voltage line inspection or complex infrastructure surveying, coupled with continuous reductions in hardware costs and the increased analytical capability of AI-driven systems.

How are 4K drone cameras used differently in the construction versus the agriculture sectors?

In construction, 4K cameras are primarily used for generating detailed, accurate 3D models and orthomosaic maps for site progress tracking and compliance auditing. In agriculture, while 4K provides visual context, specialized multispectral cameras are heavily favored for analytical tasks like crop health monitoring and nutrient deficiency identification based on spectral signatures.

What role does Artificial Intelligence (AI) play in modern drone camera systems?

AI facilitates Edge Computing, enabling real-time analysis directly on the camera, leading to automated object tracking, intelligent flight path correction, immediate defect detection in industrial inspection, and optimized data compression without reliance on ground-based post-flight processing.

Which regional market holds the largest share for high-end military and defense drone cameras?

North America currently holds the largest market share for high-end military and defense drone camera systems due to substantial, continuous governmental expenditure on Intelligence, Surveillance, and Reconnaissance (ISR) technologies and advanced payload development, often requiring highly secure and customized optics.

What are the primary restraints affecting the growth of the global drone camera market?

Key restraints include the complexity and variability of global aviation regulations, particularly stringent restrictions on Beyond Visual Line of Sight (BVLOS) flights, and growing public and regulatory concerns regarding data privacy and security of sensitive imagery collected in urban and critical infrastructure environments.

How does the shift towards global shutter technology impact professional mapping services?

Global shutter technology captures all pixels simultaneously, entirely eliminating the motion distortion ("jello effect") artifacts inherent in rolling shutters. This is essential for professional mapping and photogrammetry, ensuring higher geometric accuracy and superior quality when stitching aerial images into precise 3D models and orthophotos.

What is the key technological advantage of using multi-sensor payloads (e.g., RGB and Thermal) in drone cameras?

The key advantage is sensor fusion, which provides comprehensive, multi-dimensional data capture. For inspection, this means simultaneously generating a high-resolution visual record and a thermal map, allowing operators to detect both structural defects and thermal anomalies (hotspots) in a single flight, maximizing mission efficiency.

To check our Table of Contents, please mail us at: sales@marketresearchupdate.com

Research Methodology

The Market Research Update offers technology-driven solutions and its full integration in the research process to be skilled at every step. We use diverse assets to produce the best results for our clients. The success of a research project is completely reliant on the research process adopted by the company. Market Research Update assists its clients to recognize opportunities by examining the global market and offering economic insights. We are proud of our extensive coverage that encompasses the understanding of numerous major industry domains.

Market Research Update provide consistency in our research report, also we provide on the part of the analysis of forecast across a gamut of coverage geographies and coverage. The research teams carry out primary and secondary research to implement and design the data collection procedure. The research team then analyzes data about the latest trends and major issues in reference to each industry and country. This helps to determine the anticipated market-related procedures in the future. The company offers technology-driven solutions and its full incorporation in the research method to be skilled at each step.

The Company's Research Process Has the Following Advantages:

- Information Procurement

The step comprises the procurement of market-related information or data via different methodologies & sources.

- Information Investigation

This step comprises the mapping and investigation of all the information procured from the earlier step. It also includes the analysis of data differences observed across numerous data sources.

- Highly Authentic Source

We offer highly authentic information from numerous sources. To fulfills the client’s requirement.

- Market Formulation

This step entails the placement of data points at suitable market spaces in an effort to assume possible conclusions. Analyst viewpoint and subject matter specialist based examining the form of market sizing also plays an essential role in this step.

- Validation & Publishing of Information

Validation is a significant step in the procedure. Validation via an intricately designed procedure assists us to conclude data-points to be used for final calculations.

×

Request Free Sample:

Related Reports

Select License

Why Choose Us

We're cost-effective and Offered Best services:

We are flexible and responsive startup research firm. We adapt as your research requires change, with cost-effectiveness and highly researched report that larger companies can't match.

Information Safety

Market Research Update ensure that we deliver best reports. We care about the confidential and personal information quality, safety, of reports. We use Authorize secure payment process.

We Are Committed to Quality and Deadlines

We offer quality of reports within deadlines. We've worked hard to find the best ways to offer our customers results-oriented and process driven consulting services.

Our Remarkable Track Record

We concentrate on developing lasting and strong client relationship. At present, we hold numerous preferred relationships with industry leading firms that have relied on us constantly for their research requirements.

Best Service Assured

Buy reports from our executives that best suits your need and helps you stay ahead of the competition.

Customized Research Reports

Our research services are custom-made especially to you and your firm in order to discover practical growth recommendations and strategies. We don't stick to a one size fits all strategy. We appreciate that your business has particular research necessities.

Service Assurance

At Market Research Update, we are dedicated to offer the best probable recommendations and service to all our clients. You will be able to speak to experienced analyst who will be aware of your research requirements precisely.

Contact With Our Sales Team

Customer Testimonials

The content of the report is always up to the mark. Good to see speakers from expertise authorities.

Privacy requested , Managing Director

A lot of unique and interesting topics which are described in good manner.

Privacy requested, President

Well researched, expertise analysts, well organized, concrete and current topics delivered in time.

Privacy requested, Development Manager