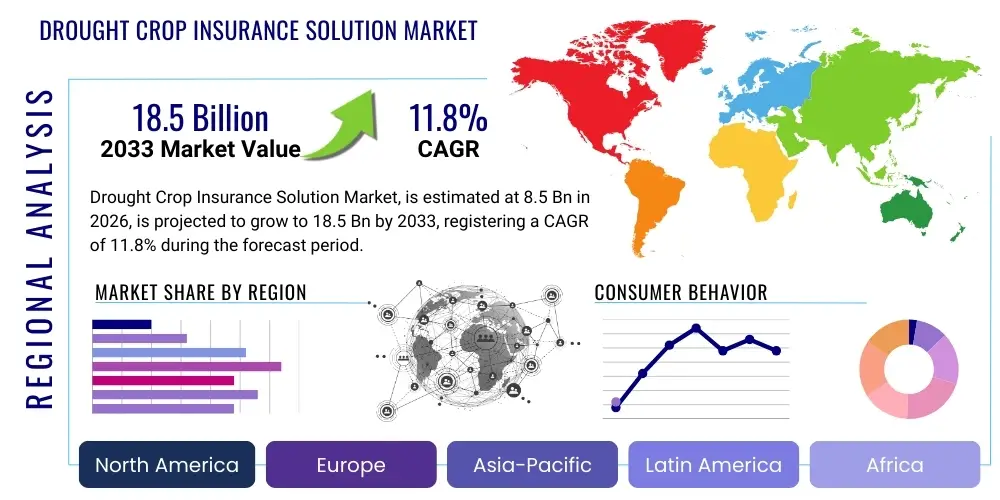

Drought Crop Insurance Solution Market Size, By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2026 to 2033 (Financial Impact Analysis)

ID : MRU_ 441749 | Date : Feb, 2026 | Pages : 246 | Region : Global | Publisher : MRU

Drought Crop Insurance Solution Market Size

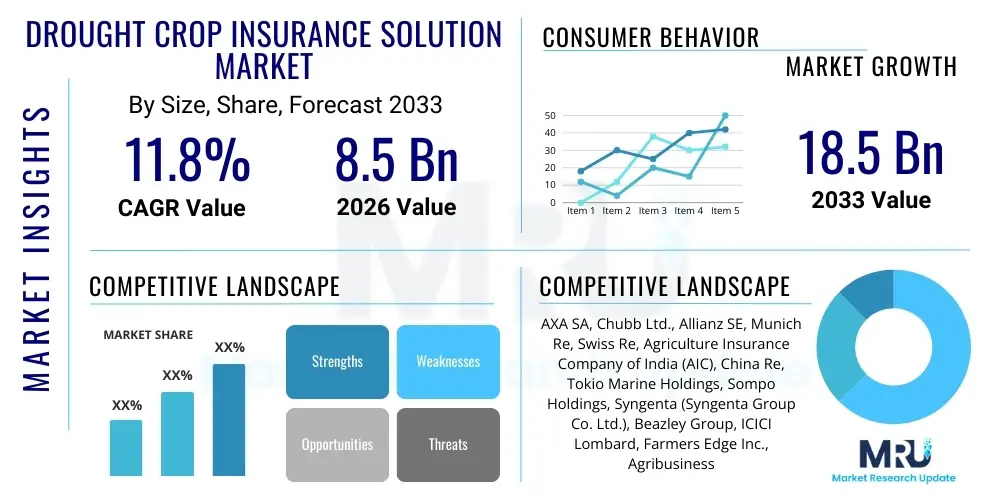

The Drought Crop Insurance Solution Market is projected to grow at a Compound Annual Growth Rate (CAGR) of 11.8% between 2026 and 2033. The market is estimated at USD 8.5 Billion in 2026 and is projected to reach USD 18.5 Billion by the end of the forecast period in 2033.

Drought Crop Insurance Solution Market introduction

The Drought Crop Insurance Solution Market encompasses financial risk mitigation products designed to protect agricultural producers from yield losses or revenue shortfalls resulting from insufficient rainfall, excessive heat, or prolonged dry spells. These solutions are critical instruments for maintaining food security and ensuring the financial stability of farming communities globally, especially as climate variability intensifies. The core product offerings typically include yield-based indemnity policies, revenue insurance, and increasingly popular index-based insurance products that utilize objective data like satellite imagery and weather station readings to trigger payouts based on pre-defined drought metrics, minimizing assessment time and costs.

Major applications of these insurance solutions span a vast array of agricultural activities, focusing primarily on high-value and staple crops such as corn, wheat, soybeans, rice, and various specialty crops. The growing reliance on sophisticated meteorological modeling and geospatial analysis has broadened the scope of coverage, allowing for customized risk profiles specific to local climatic conditions and hydrological cycles. Furthermore, the standardization of these products, often backed by government subsidies and public-private partnerships, has increased accessibility, making them vital tools in regions highly susceptible to recurrent climate shocks, transforming farming from a purely subsistence activity into a more resilient business endeavor.

The primary driving forces behind market expansion include the documented increase in the frequency and severity of extreme weather events attributed to global climate change, heightened awareness among farmers regarding the necessity of proactive risk management, and the crucial support provided by governmental agricultural policies worldwide. These benefits translate directly into stabilized farm incomes, enhanced credit access for capital improvements, and overall improved sustainability of global food production systems. The shift towards parametric insurance models, driven by technological advancements, offers transparency and rapid claims settlement, further accelerating the adoption rate across both developed and developing economies.

Drought Crop Insurance Solution Market Executive Summary

The Drought Crop Insurance Solution Market is currently characterized by robust expansion driven by converging factors: accelerating climate risk, technological innovation, and strong governmental backing. Business trends indicate a definitive shift toward digital delivery platforms and automated claim processes, leveraging artificial intelligence (AI) and satellite remote sensing to enhance accuracy and reduce operational overhead. Insurance providers are increasingly partnering with agricultural technology firms (AgriTech) to offer integrated solutions that bundle weather data services, agronomic advice, and insurance coverage. This integration aims to mitigate 'basis risk' and provide farmers with more holistic risk management tools, securing market competitiveness and increasing farmer loyalty, thereby stabilizing growth across diversified geographical portfolios.

Regionally, North America remains the most mature market, characterized by extensive government subsidy programs and high levels of technological integration, particularly in the use of sophisticated yield prediction models. However, the Asia Pacific (APAC) region is emerging as the fastest-growing market segment. This rapid expansion is fueled by the large number of smallholder farmers highly vulnerable to drought, coupled with aggressive supportive initiatives from nations like India and China aimed at modernizing agricultural insurance schemes and achieving national food security goals. European growth is steady, emphasizing products compliant with the Common Agricultural Policy (CAP) and focusing on ecological sustainability metrics integrated into risk assessment models.

In terms of segmentation trends, index-based insurance (parametric solutions) is gaining substantial traction over traditional indemnity insurance due to its low transaction costs, minimal reliance on field verification, and rapid payout mechanism—a critical feature for farmers facing immediate financial distress post-drought. Furthermore, the distribution channel is evolving, with digital and direct-to-farmer platforms complementing traditional agent and broker networks, improving efficiency and reaching previously underserved rural populations. Crop type segmentation shows staple crops dominating premium volumes, but specialty crops are seeing high growth in premium rates due as climatic volatility severely impacts their high-value yields, necessitating more robust and specialized insurance coverage structures.

AI Impact Analysis on Drought Crop Insurance Solution Market

User queries regarding AI's influence predominantly center on three core areas: the ability of AI to enhance predictive accuracy of drought events, its role in automating and speeding up the claims process, and its capacity to mitigate systemic fraud and basis risk inherent in agricultural insurance. Users are keenly interested in how machine learning algorithms leverage vast datasets—including historical climate patterns, soil moisture readings, satellite imagery, and localized yield data—to create highly granular and accurate drought risk maps. The expectation is that AI-driven models will move beyond generalized regional assessments toward hyper-localized, real-time risk evaluation, thus creating fairer premium structures and more precise loss assessments that truly reflect the farmer's experience.

Furthermore, AI is transformative in optimizing the operational lifecycle of crop insurance. Claims handling, traditionally a protracted and costly affair involving physical field inspections, is being revolutionized by AI-powered image analysis and automated processing engines. These systems can instantaneously analyze high-resolution satellite imagery (NDVI, EVI data) before and after a drought event to quantify vegetative stress and yield loss without human intervention. This capability drastically cuts down the time-to-payout, providing essential liquidity to farmers when they need it most, thereby fulfilling a primary promise of effective insurance: timely relief. Users anticipate that this speed will fundamentally reshape the trust relationship between insurers and policyholders.

Finally, the analytical prowess of AI is pivotal in tackling the challenges of moral hazard and adverse selection. Machine learning algorithms can detect anomalies in historical yield data or policy application information, flagging potential fraudulent claims or identifying farmers who selectively insure only high-risk fields. By providing transparent, data-driven evidence for policy triggers and loss valuations, AI minimizes subjectivity, reduces litigation costs, and stabilizes the financial viability of insurance pools. This enhancement of actuarial fairness is essential for long-term market sustainability and encourages greater participation from private reinsurers and capital market investors looking for scientifically verifiable risk models.

- AI-Enhanced Risk Modeling: Utilization of machine learning for highly accurate, localized drought prediction based on historical, geospatial, and meteorological datasets.

- Automated Claims Processing: Deployment of computer vision and deep learning models to analyze satellite and drone imagery for rapid, remote quantification of crop damage and yield stress.

- Basis Risk Reduction: Use of advanced predictive analytics to align parametric index triggers more closely with actual farm-level losses, improving policy effectiveness.

- Fraud Detection and Prevention: Algorithms identifying anomalous claim patterns, detecting adverse selection, and monitoring policyholder behavior against historical benchmarks to ensure integrity.

- Personalized Premium Calculation: Developing dynamic, individualized premium rates based on farm-specific data, soil health metrics, and adoption of risk-reducing farming practices.

- Optimized Portfolio Management: AI guiding insurers in geographical diversification and reinsurance purchasing decisions by providing real-time aggregation of climate risk exposure.

DRO & Impact Forces Of Drought Crop Insurance Solution Market

The Drought Crop Insurance Solution Market is propelled by systemic global climate change, underpinned by significant policy support, yet simultaneously constrained by economic complexities and technical limitations, creating a dynamic set of impact forces. Key drivers include the undeniable increase in global climatic volatility, which necessitates proactive risk transfer mechanisms for survival in agriculture, and the robust support from national governments globally via heavy premium subsidies and mandatory participation schemes designed to achieve food security and agricultural resilience. Opportunities are burgeoning through the rapid convergence of insurance products with cutting-edge AgriTech, particularly the refinement of parametric insurance leveraging remote sensing, offering efficiency gains that legacy products cannot match.

However, substantial restraints impede faster market penetration. The most significant constraint remains the pervasive basis risk, where the objective index trigger (e.g., rainfall deviation) does not perfectly correlate with the farmer's actual yield loss, leading to dissatisfaction or non-payouts in legitimate loss scenarios, which erodes trust. Furthermore, the high upfront premium costs, even when subsidized, pose a significant barrier to adoption for resource-poor smallholder farmers, particularly in emerging markets lacking deep financial inclusion. Regulatory complexity, often varying widely between regional jurisdictions and sometimes contradicting federal mandates, adds friction to product design and distribution, demanding careful navigation by international insurers.

The market's overall trajectory is determined by the interplay of these impact forces. The dominant driver of climate necessity exerts constant upward pressure, forcing innovation and government intervention. The primary restraint of basis risk acts as a structural inhibitor, demanding technological solutions—specifically, better AI modeling and higher-resolution data—to overcome. The critical opportunities revolve around leveraging technology (IoT, blockchain) to lower distribution costs and enhance transparency, making products affordable and trustworthy. The market size and growth rate are therefore highly sensitive to the successful implementation of public-private partnerships that manage affordability and the continuous refinement of predictive data models that reduce technical basis risk.

Segmentation Analysis

The Drought Crop Insurance Solution Market is segmented primarily across product type, distribution channel, coverage mechanism, and the specific crop types covered, reflecting diverse risk needs and technological adoption rates across global agriculture. Analyzing these segments provides strategic insights into which solutions are gaining prominence and where investment in technology or distribution infrastructure is most vital. The dominance of traditional multi-peril crop insurance is gradually being challenged by index-based solutions, which appeal due to their simplicity and speed, while distribution is moving towards digital channels to achieve greater reach and operational scale, essential for penetrating historically underserved rural areas and maximizing coverage efficiency.

- By Product Type

- Multi-Peril Crop Insurance (MPCI)

- Crop-Hail Insurance

- Revenue Protection (RP) Insurance

- Index-Based Insurance (Parametric)

- Area-Yield Index Insurance

- Weather Index Insurance (Rainfall, Temperature)

- Vegetation Index Insurance (NDVI)

- By Crop Type

- Staple Grains (Wheat, Rice, Corn)

- Oilseeds (Soybeans, Rapeseed)

- Specialty Crops (Fruits, Vegetables, Coffee)

- Feed Crops (Hay, Alfalfa)

- By Distribution Channel

- Insurance Companies/Carriers (Direct Sales)

- Agents and Brokers

- Banks and Financial Institutions

- Online/Digital Platforms

- By Technology Application

- Satellite Remote Sensing

- Weather Stations/Ground Sensors (IoT)

- Data Analytics and AI Modeling

- Geographic Information Systems (GIS)

Value Chain Analysis For Drought Crop Insurance Solution Market

The value chain for Drought Crop Insurance Solutions is complex and highly reliant on data and technology, spanning from upstream data acquisition to downstream risk transfer and distribution. Upstream activities involve providers of highly specialized raw data, including meteorological services, satellite imagery providers (like NASA, ESA, commercial entities), and IoT sensor manufacturers who supply the fundamental real-time environmental data necessary for accurate risk assessment and index triggering. Technology suppliers, specifically AI and software firms specializing in geospatial analytics and predictive modeling, transform this raw data into actionable risk indices and automated claims processing tools. The quality and resolution of this upstream data are paramount, directly dictating the accuracy and viability of the final insurance product, and competition here centers on data granularity and processing speed.

Midstream activities are dominated by the core insurance providers, including primary insurers and reinsurers. Primary insurers design, market, and sell the policies to farmers, managing the immediate policy lifecycle and claims settlement. Reinsurers, often global entities, play a critical role in absorbing the large, catastrophic risks associated with widespread drought, stabilizing the primary insurance market and ensuring liquidity. The distribution channel, which bridges the insurer and the farmer, utilizes both direct and indirect models. Direct channels involve proprietary sales forces or sophisticated online platforms facilitating straight-through processing, offering insurers greater control over the customer experience and data collection, usually targeting large commercial farms.

Indirect distribution relies heavily on independent agents, brokers, microfinance institutions, and agricultural cooperatives, which are essential for reaching dispersed smallholder farmers who require personalized advisory services and local trust. This network acts as a crucial educational and enrollment mechanism, especially in emerging markets where digital literacy is lower. Downstream users are the farmers themselves, government bodies requiring risk reports, and financial institutions relying on insured crops as collateral. The efficiency of the entire chain hinges on the secure and transparent exchange of data, making interoperability and standardization between technology suppliers and insurance platforms a crucial requirement for future growth and minimizing transactional costs.

Drought Crop Insurance Solution Market Potential Customers

Potential customers for Drought Crop Insurance Solutions are fundamentally agricultural producers, though the segment extends far beyond individual farmers to encompass large agribusinesses, financial intermediaries, and governmental stabilization bodies. Smallholder farmers, particularly prevalent in Asia Pacific and Africa, represent a massive but often underserved segment. For this group, drought insurance is often a prerequisite for obtaining microfinance loans, and they typically favor subsidized, index-based parametric products due to lower costs and simplified claim procedures, driven by a need for basic survival risk transfer rather than comprehensive revenue protection.

Commercial farming operations and large agribusinesses, characteristic of North America and Europe, constitute the largest volume consumers in terms of premium value. These entities require highly customized, complex products, such as Revenue Protection (RP) insurance and Multi-Peril Crop Insurance (MPCI), designed to protect high capital investments and manage intricate financial structures. Their purchasing decisions are driven by sophisticated financial risk management strategies, leveraging insurance to ensure predictable cash flows and maintaining favorable debt-to-equity ratios. They prioritize policy flexibility, high coverage limits, and rapid, accurate loss assessment, often demanding direct interaction with specialized insurance brokers and carriers.

In addition to direct producers, key institutional buyers include agricultural cooperatives that purchase coverage on behalf of their aggregated membership, reducing administrative costs through collective bargaining. Furthermore, governments and international development banks act as crucial indirect purchasers or underwriters, utilizing reinsurance solutions to manage systemic regional drought risk that could destabilize national economies or humanitarian aid programs. These institutional bodies frequently demand transparency, actuarial soundness, and verifiable data integrity, often acting as the ultimate buyers of catastrophe bonds or other risk pooling mechanisms facilitated by the robust underlying data models used in drought insurance.

| Report Attributes | Report Details |

|---|---|

| Market Size in 2026 | USD 8.5 Billion |

| Market Forecast in 2033 | USD 18.5 Billion |

| Growth Rate | 11.8% CAGR |

| Historical Year | 2019 to 2024 |

| Base Year | 2025 |

| Forecast Year | 2026 - 2033 |

| DRO & Impact Forces |

|

| Segments Covered |

|

| Key Companies Covered | AXA SA, Chubb Ltd., Allianz SE, Munich Re, Swiss Re, Agriculture Insurance Company of India (AIC), China Re, Tokio Marine Holdings, Sompo Holdings, Syngenta (Syngenta Group Co. Ltd.), Beazley Group, ICICI Lombard, Farmers Edge Inc., Agribusiness Risk Management, Crop Risk Services (CRS), ProAg, QBE Insurance Group, XL Catlin, Starr Companies, Hannover Re |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Enquiry Before Buy | Have specific requirements? Send us your enquiry before purchase to get customized research options. Request For Enquiry Before Buy |

Drought Crop Insurance Solution Market Key Technology Landscape

The technological landscape underwriting the Drought Crop Insurance Solution Market is rapidly advancing, moving away from rudimentary weather station data towards sophisticated, layered digital monitoring systems. Central to this evolution is the reliance on remote sensing and Geographic Information Systems (GIS), which utilize high-resolution satellite imagery (e.g., Sentinel, Landsat data) to continuously monitor large agricultural areas. These systems calculate crucial indices such as the Normalized Difference Vegetation Index (NDVI) and Evapotranspiration (ET), providing objective, verifiable data on vegetative health and water stress. This remote, non-invasive assessment capability is fundamental to parametric insurance models, enabling the automatic trigger of policies based on predefined thresholds, significantly reducing the administrative burden and costs associated with traditional loss adjustment.

Furthermore, the integration of Artificial Intelligence (AI) and Machine Learning (ML) is transforming risk modeling from static historical assessments into dynamic, predictive systems. AI algorithms ingest vast quantities of heterogeneous data—climate models, historical yield data, soil maps, and real-time sensor readings—to predict the probability and severity of future drought events with unprecedented accuracy. This enhanced predictive capability allows insurers to price risk more accurately, leading to fairer and more financially sustainable premium structures. Simultaneously, the application of IoT sensors placed directly in fields allows for hyper-localized data collection on soil moisture and ambient conditions, which, when fused with satellite data, helps mitigate basis risk by ensuring that the index trigger is closely aligned with ground truth conditions.

Finally, emerging technologies such as Blockchain and advanced telematics are beginning to play a supportive yet critical role. Blockchain technology offers a secure, decentralized, and immutable ledger for recording policy details, premium payments, and claims payouts. This dramatically enhances transparency for all stakeholders—farmers, insurers, and regulators—reducing the potential for disputes and fraud, particularly in cross-border reinsurance agreements. Concurrently, high-speed data processing and cloud computing infrastructure are essential for handling the massive scale of geospatial data required for real-time monitoring of millions of acres, ensuring the entire system remains responsive and scalable to the growing global demand for robust drought risk mitigation tools across diversified and climate-vulnerable geographies.

Regional Highlights

- North America: This region, led by the United States and Canada, represents a mature and technologically advanced market segment. Market growth is heavily influenced by large-scale federal programs, such as the US Federal Crop Insurance Program (FCIP), which heavily subsidizes premiums, ensuring high penetration rates for comprehensive products like Revenue Protection. Technology adoption is maximal, with widespread use of satellite imagery, precision agriculture data, and complex actuarial modeling to manage systemic risks associated with major grain crops.

- Europe: The European market is characterized by policy alignment with the Common Agricultural Policy (CAP) and a strong focus on sustainability and ecological resilience. While premium subsidies exist, the market emphasizes integrating climate change adaptation strategies alongside insurance. Products are often tailored to specific regional microclimates and specific high-value crops, with increasing interest in index-based solutions to complement traditional multi-peril coverage, particularly in drought-prone Southern and Eastern European countries.

- Asia Pacific (APAC): APAC is the fastest-growing market globally, driven by a high proportion of smallholder farmers and extreme climatic vulnerability. Countries like India and China have implemented large, mandatory, and highly subsidized national insurance schemes (e.g., PMFBY in India) to protect millions of farmers. The region is a hotbed for innovation in leveraging mobile technology and geospatial data to overcome logistical challenges associated with reaching remote rural populations, often utilizing simple, transparent parametric solutions to manage rapid payouts.

- Latin America: This region presents significant growth potential but remains underdeveloped, marked by highly volatile localized weather patterns and varying levels of government support. Market development is concentrated in countries like Brazil and Argentina, where large commercial farming operations necessitate robust private insurance solutions. The uptake of specialized products is increasing, often driven by international reinsurers bringing sophisticated risk models and distribution expertise into key agricultural economies.

- Middle East and Africa (MEA): MEA is the emerging frontier, characterized by high exposure to extreme aridity and low historical insurance penetration. Market expansion is almost entirely dependent on public-private partnerships, international aid organizations, and development banks introducing micro-insurance products. Parametric drought insurance, focusing on measurable rainfall indices, is the preferred solution due to the lack of historical farm-level data and infrastructural constraints related to traditional loss assessment.

Top Key Players

The market research report includes a detailed profile of leading stakeholders in the Drought Crop Insurance Solution Market.- AXA SA

- Chubb Ltd.

- Allianz SE

- Munich Re

- Swiss Re

- Agriculture Insurance Company of India (AIC)

- China Re

- Tokio Marine Holdings

- Sompo Holdings

- Syngenta (Syngenta Group Co. Ltd.)

- Beazley Group

- ICICI Lombard

- Farmers Edge Inc.

- Agribusiness Risk Management

- Crop Risk Services (CRS)

- ProAg

- QBE Insurance Group

- XL Catlin

- Starr Companies

- Hannover Re

Frequently Asked Questions

Analyze common user questions about the Drought Crop Insurance Solution market and generate a concise list of summarized FAQs reflecting key topics and concerns.What is index-based drought insurance and why is it replacing traditional policies?

Index-based (parametric) insurance pays out based on objective external metrics, like rainfall deficiency measured by satellite, rather than actual farm yield loss. It is preferred because it eliminates costly field inspections, reduces administrative overhead, minimizes basis risk through verified data, and enables faster, more transparent claim payouts.

How is climate change influencing the overall pricing and availability of drought insurance?

Climate change increases the frequency and severity of catastrophic drought events, leading to higher modeled risk. This pressures insurers to raise premiums and necessitates greater involvement from government subsidies and global reinsurers to keep coverage affordable and maintain market stability and liquidity for large-scale risk transfer.

What role does Artificial Intelligence play in determining policy payouts?

AI uses machine learning algorithms to analyze vast datasets (satellite imagery, historical climate records, soil moisture) to accurately predict drought severity, quantify crop stress (via indices like NDVI), and automate the verification process, ensuring that the claim trigger is precise and the payout process is expedited.

What is the primary barrier to adoption of drought insurance in developing markets?

The primary barrier is high premium costs relative to smallholder farmer income, even with subsidies, coupled with basis risk (the index not matching actual loss) and a lack of trust or understanding of complex financial products. Solutions focus on micro-insurance designs and public awareness campaigns supported by technological transparency.

Which geographical region exhibits the highest growth potential for drought insurance solutions?

The Asia Pacific (APAC) region, specifically countries such as India and China, holds the highest growth potential. This growth is driven by massive agricultural populations, acute vulnerability to drought, and robust governmental initiatives aimed at mandatory insurance coverage and modernization of rural financial risk management systems.

To check our Table of Contents, please mail us at: sales@marketresearchupdate.com

Research Methodology

The Market Research Update offers technology-driven solutions and its full integration in the research process to be skilled at every step. We use diverse assets to produce the best results for our clients. The success of a research project is completely reliant on the research process adopted by the company. Market Research Update assists its clients to recognize opportunities by examining the global market and offering economic insights. We are proud of our extensive coverage that encompasses the understanding of numerous major industry domains.

Market Research Update provide consistency in our research report, also we provide on the part of the analysis of forecast across a gamut of coverage geographies and coverage. The research teams carry out primary and secondary research to implement and design the data collection procedure. The research team then analyzes data about the latest trends and major issues in reference to each industry and country. This helps to determine the anticipated market-related procedures in the future. The company offers technology-driven solutions and its full incorporation in the research method to be skilled at each step.

The Company's Research Process Has the Following Advantages:

- Information Procurement

The step comprises the procurement of market-related information or data via different methodologies & sources.

- Information Investigation

This step comprises the mapping and investigation of all the information procured from the earlier step. It also includes the analysis of data differences observed across numerous data sources.

- Highly Authentic Source

We offer highly authentic information from numerous sources. To fulfills the client’s requirement.

- Market Formulation

This step entails the placement of data points at suitable market spaces in an effort to assume possible conclusions. Analyst viewpoint and subject matter specialist based examining the form of market sizing also plays an essential role in this step.

- Validation & Publishing of Information

Validation is a significant step in the procedure. Validation via an intricately designed procedure assists us to conclude data-points to be used for final calculations.

×

Request Free Sample:

Related Reports

Select License

Why Choose Us

We're cost-effective and Offered Best services:

We are flexible and responsive startup research firm. We adapt as your research requires change, with cost-effectiveness and highly researched report that larger companies can't match.

Information Safety

Market Research Update ensure that we deliver best reports. We care about the confidential and personal information quality, safety, of reports. We use Authorize secure payment process.

We Are Committed to Quality and Deadlines

We offer quality of reports within deadlines. We've worked hard to find the best ways to offer our customers results-oriented and process driven consulting services.

Our Remarkable Track Record

We concentrate on developing lasting and strong client relationship. At present, we hold numerous preferred relationships with industry leading firms that have relied on us constantly for their research requirements.

Best Service Assured

Buy reports from our executives that best suits your need and helps you stay ahead of the competition.

Customized Research Reports

Our research services are custom-made especially to you and your firm in order to discover practical growth recommendations and strategies. We don't stick to a one size fits all strategy. We appreciate that your business has particular research necessities.

Service Assurance

At Market Research Update, we are dedicated to offer the best probable recommendations and service to all our clients. You will be able to speak to experienced analyst who will be aware of your research requirements precisely.

Contact With Our Sales Team

Customer Testimonials

The content of the report is always up to the mark. Good to see speakers from expertise authorities.

Privacy requested , Managing Director

A lot of unique and interesting topics which are described in good manner.

Privacy requested, President

Well researched, expertise analysts, well organized, concrete and current topics delivered in time.

Privacy requested, Development Manager