Dry Port Market Size, By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2026 to 2033 (Financial Impact Analysis)

ID : MRU_ 442827 | Date : Feb, 2026 | Pages : 258 | Region : Global | Publisher : MRU

Dry Port Market Size

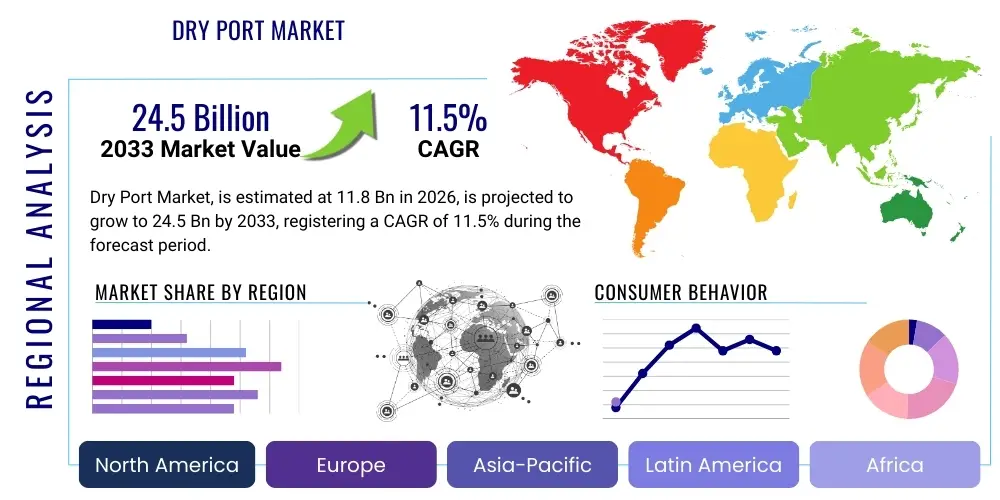

The Dry Port Market is projected to grow at a Compound Annual Growth Rate (CAGR) of 11.5% between 2026 and 2033. The market is estimated at USD 11.8 Billion in 2026 and is projected to reach USD 24.5 Billion by the end of the forecast period in 2033. This substantial expansion is fundamentally driven by the escalating globalization of trade, necessitating more efficient inland logistics solutions and enhanced integration between maritime and terrestrial transportation networks. The increasing volume of container traffic, particularly across emerging economies, mandates the establishment of strategically located inland terminals capable of handling large freight volumes and providing essential value-added services.

The growth trajectory reflects a critical shift in global supply chain management, moving toward multimodal transport systems that prioritize speed, cost-efficiency, and environmental sustainability. Dry ports, often situated near major industrial centers or critical infrastructure hubs, serve as crucial decongestion points for overcrowded seaports, improving throughput capacity and reducing dwell times for maritime vessels. Furthermore, governments and private investors are increasingly recognizing the long-term economic benefits associated with developing comprehensive inland logistics ecosystems, leading to significant investments in rail infrastructure and modern terminal automation.

Dry Port Market introduction

Dry ports, also known as inland container depots (ICDs) or container freight stations (CFSs), are crucial intermodal terminals located inland, connecting seaports via road or rail transport. These facilities function as extensions of gateway ports, offering comprehensive logistics services, including container handling, storage, customs clearance, consolidation, and distribution. The primary objective of a dry port is to improve the flow of international trade by bringing port services closer to industrial and commercial centers, thereby minimizing bottlenecks at congested coastal ports and optimizing the overall supply chain efficiency. This strategic positioning allows for streamlined border clearance procedures and facilitates efficient multimodal transfers, predominantly relying on rail connectivity for high-volume, long-haul movements.

The applications of dry ports are vast, spanning across handling import/export containers, domestic freight distribution, temporary storage, and providing ancillary services such as maintenance and repair of containers, cargo inspection, and specialized warehousing (e.g., cold storage). Key benefits derived from the establishment and utilization of dry ports include reduced transportation costs due to optimized routing, minimized carbon footprint through increased reliance on rail transport, enhanced security of cargo, and, most importantly, improved supply chain resilience and predictability. By decentralizing operations from the seaport, dry ports effectively redistribute logistics workload, contributing significantly to urban decongestion near major coastal areas.

Driving factors propelling the Dry Port Market include the relentless expansion of global containerized trade, significant infrastructural investments aimed at bolstering multimodal connectivity (especially rail links), and the intensifying need among logistics providers for integrated, end-to-end solutions. Additionally, supportive governmental policies encouraging Public-Private Partnerships (PPPs) for infrastructure development, coupled with technological advancements in terminal management systems and automation, are accelerating market adoption. The rising trend of just-in-time inventory management also necessitates reliable, fast, and strategically located logistics hubs, further cementing the dry port's role as a vital component of modern trade infrastructure.

Dry Port Market Executive Summary

The Dry Port Market is experiencing robust growth driven by critical business trends focused on optimizing multimodal logistics and enhancing supply chain resilience. Key business trends include the increasing integration of digital solutions such as Terminal Operating Systems (TOS) and advanced analytics for predictive maintenance and optimized yard management. Furthermore, there is a pronounced shift toward public-private partnership models (PPPs) to finance large-scale infrastructure projects, ensuring risk mitigation and leveraging private sector efficiency in operations. Sustainability is emerging as a dominant trend, with market participants investing in electrified equipment and increasing reliance on high-capacity rail transport to minimize greenhouse gas emissions associated with long-haul trucking, aligning with global decarbonization goals.

Regionally, Asia Pacific (APAC) continues to dominate the market, primarily fueled by the massive trade volumes originating from manufacturing hubs like China, India, and Southeast Asian nations, coupled with significant governmental initiatives focused on developing expansive logistics corridors. North America and Europe are characterized by mature dry port networks, where growth is focused on digitalization, enhancing existing capacity, and improving last-mile delivery integration, leveraging advanced technologies like IoT and AI. Emerging markets in Latin America and the Middle East & Africa (MEA) are witnessing rapid infrastructural development, often linking resource-rich inland areas to coastal export terminals, supported by strategic geopolitical investments aimed at diversified economic growth and strengthening regional trade blocs.

Segment-wise, the market sees high demand in the Rail Transport mode due to its inherent capacity benefits and lower operational costs over long distances, positioning it as the backbone of dry port connectivity. In terms of ownership, the Public-Private Partnership model is gaining substantial traction globally, balancing initial investment burden with operational expertise. Regarding application, container handling and storage remain the core service segments, though value-added services such as consolidation, specialized warehousing, and light manufacturing processes are projected to exhibit the fastest growth, reflecting the dry port's evolution into comprehensive logistics centers rather than mere transit points.

AI Impact Analysis on Dry Port Market

User inquiries regarding the impact of Artificial Intelligence (AI) on the Dry Port Market primarily revolve around operational efficiency gains, predictive capabilities for logistics planning, and the potential displacement of human labor. Common questions focus on how AI can optimize container stacking and retrieval (yard management), whether machine learning models can accurately forecast container flow and resource allocation, and the readiness of existing dry port infrastructure to integrate complex AI systems. Users are keenly interested in the role of AI in automating customs documentation and inspection processes, thereby accelerating throughput and reducing human error. The overarching theme is the expectation that AI will transform dry ports from reactive storage facilities into intelligent, self-optimizing logistics hubs capable of proactive decision-making.

AI's transformative influence is most visible in automating complex operational tasks that traditionally required extensive human input and subjective decision-making. AI-driven algorithms are now being deployed to manage dynamic pricing for storage, predict equipment maintenance needs long before failure occurs, and optimize scheduling for rail and truck arrivals and departures, minimizing idle time and maximizing utilization rates. This predictive optimization extends beyond internal terminal management to external supply chain synchronization, where AI models analyze global shipping schedules and trade data to anticipate peak demands and adjust resource allocation accordingly. Consequently, dry ports leveraging these technologies report significant reductions in operational expenditure and marked improvements in terminal fluidity.

Furthermore, AI facilitates advanced security and monitoring within dry port premises. Computer vision systems powered by deep learning are used for autonomous damage detection on containers, enhanced perimeter surveillance, and tracking unauthorized movements, ensuring compliance and minimizing cargo loss. The integration of AI with IoT sensors provides real-time data streams on equipment performance and environmental conditions, enabling truly responsive control systems. While the initial investment in AI infrastructure is substantial, the long-term benefits derived from increased capacity utilization, enhanced safety, and superior efficiency solidify AI's role as a fundamental driver of modernization and competitiveness in the Dry Port Market.

- AI-driven optimization of yard management and container stacking algorithms for maximum density and accessibility.

- Predictive analytics for equipment maintenance, minimizing unexpected downtime of cranes and handling machinery.

- Automation of customs and documentation processes using Natural Language Processing (NLP) and machine vision, accelerating trade flow.

- Real-time traffic management systems utilizing AI to optimize truck flow within the dry port boundaries and minimize external congestion.

- Enhanced security and surveillance through AI-powered video analytics for anomaly detection and access control.

- Forecasting models for predicting future container volumes and storage requirements, enabling proactive resource planning.

DRO & Impact Forces Of Dry Port Market

The Dry Port Market is significantly propelled by several robust drivers, most notably the relentless growth of international trade and the consequent necessity for enhanced multimodal connectivity. The global emphasis on integrating rail transport into long-haul logistics networks to achieve sustainability targets and reduce carbon emissions strongly favors the development of dry ports, which inherently leverage rail infrastructure. However, the market faces considerable restraints, primarily concerning the substantial initial capital investment required for establishing greenfield dry port facilities, which often involves extensive land acquisition, major infrastructure construction, and deployment of specialized handling equipment. Furthermore, regulatory complexities associated with customs harmonization across different countries can impede the seamless operation of international dry ports, creating bureaucratic friction points.

Opportunities within the market are predominantly concentrated around the adoption of advanced automation and digitalization technologies, including autonomous guided vehicles (AGVs), advanced terminal operating systems (TOS), and blockchain for secure documentation. These technologies promise to significantly improve operational efficiency and reduce reliance on manual labor, leading to lower operating costs in the long term. Moreover, the evolving role of dry ports into specialized logistics parks, offering value-added services such as final assembly, packaging, and cold chain logistics, presents a substantial avenue for revenue diversification and market expansion. The strategic focus on developing integrated logistics corridors, particularly in high-growth regions like Southeast Asia and Eastern Europe, also creates fertile ground for new dry port investments.

The impact forces within this sector are high, dictated by external macro-economic factors such as global trade stability, geopolitical tensions affecting shipping routes, and environmental regulations pushing for cleaner transport modes. Technological advancement acts as a powerful enabling force, transforming traditional manual operations into automated, data-driven processes. Regulatory frameworks, while potentially restrictive, are also increasingly impactful as governments worldwide streamline customs procedures and offer incentives for sustainable infrastructure investment. The long-term viability and growth of dry ports are fundamentally tied to their ability to adapt to rapid technological shifts while successfully navigating the complex matrix of international logistics regulations and large-scale funding requirements necessary for development.

Segmentation Analysis

The Dry Port Market is comprehensively segmented based on three critical factors: the primary Mode of Transport used for connectivity, the Ownership Model governing operations and investment, and the specific Services provided within the facility. Analyzing these segments provides a granular understanding of market dynamics, revealing preferred operational structures and high-growth service areas. The segmentation reflects the diverse geographical and functional requirements placed upon modern dry ports, which vary significantly depending on their strategic location relative to seaports, industrial clusters, and major rail networks.

The Mode of Transport segment is vital as it determines the speed, capacity, and cost structure of the dry port's primary connectivity link, with rail being the dominant choice for efficiency. Ownership structures, ranging from fully public to private, influence operational flexibility and investment decisions. Meanwhile, the Services segment highlights the shift from basic container handling to complex, value-added logistics activities that generate higher margins and better integrate the dry port into the overall supply chain of multinational corporations.

- By Mode of Transport:

- Rail Transport

- Road Transport

- Barge Transport (Inland Waterways)

- By Ownership:

- Public

- Private

- Public-Private Partnership (PPP)

- By Services:

- Container Handling and Storage

- Customs Clearance

- Value-Added Services (e.g., Consolidation, Packaging, Repair, Light Manufacturing)

Value Chain Analysis For Dry Port Market

The Dry Port Market value chain begins with upstream activities focused on the acquisition, development, and maintenance of the core physical and technological infrastructure. Upstream analysis involves sourcing and deployment of capital-intensive assets such as land, rail infrastructure connections (tracks and sidings), specialized handling equipment (e.g., Rubber Tired Gantry cranes (RTGs), Rail Mounted Gantry cranes (RMGs), reach stackers), and advanced IT systems like Terminal Operating Systems (TOS). Key upstream stakeholders include construction companies, rail and road developers, equipment manufacturers (e.g., Kalmar, Konecranes, ZPMC), and financial institutions providing project funding. Ensuring the quality and long-term reliability of these foundational assets is crucial for the dry port's operational longevity and efficiency.

The dry port itself acts as the central node where core activities—including container processing, customs inspection, security checks, stacking, and multimodal transfer—take place. This is the stage where value is primarily generated through operational efficiency and the provision of integrated logistics services. Distribution channels constitute the downstream segment of the value chain, involving the movement of containers and consolidated cargo from the dry port to the final consumption or production centers. This downstream movement is predominantly managed by third-party logistics (3PL) providers, freight forwarders, and domestic trucking or regional rail operators, ensuring timely and cost-effective delivery to the consignee.

Distribution can be categorized into direct and indirect channels. Direct distribution involves movements contracted directly between the dry port operator (or its logistics arm) and large shippers or retailers who control their own transport fleets. Indirect distribution, which represents the majority of the market, involves containers being released to freight forwarders and 3PLs who then manage the final leg of the journey, often leveraging complex consolidation and cross-docking operations at the dry port. The success of the entire value chain hinges on seamless digital integration between the upstream IT providers, the dry port operator, and the downstream logistics providers, ensuring transparent tracking and minimizing handover delays. Efficiency gains at any point in this chain translate directly into reduced costs and faster transit times for global trade.

Dry Port Market Potential Customers

The primary customers and end-users of dry port services are entities deeply embedded in international and domestic supply chains who require efficient, reliable, and integrated logistics solutions beyond basic seaport handling. These customers include global shipping lines (e.g., Maersk, CMA CGM) who utilize dry ports as strategic consolidation and decongestion points to optimize their fleet utilization and improve vessel turnaround times at congested coastal terminals. Furthermore, large multinational manufacturers and retailers (e.g., automotive companies, electronics producers, major retail chains) rely on dry ports to manage their inbound raw materials and outbound finished goods, benefiting from the close proximity of these facilities to manufacturing hubs and consumption markets, thereby reducing inland transport costs.

Freight forwarders and 3PL/4PL providers constitute another significant customer base. They leverage the dry port's facilities for container consolidation, deconsolidation, warehousing, and customs processing, allowing them to offer comprehensive, door-to-door logistics packages to their diverse clientele. These logistics intermediaries rely heavily on the dry port's customs clearance capabilities, viewing it as a pivotal point for regulatory compliance and efficient border processes. By utilizing dry ports, these logistics providers can offer flexible services tailored to the complex needs of modern global trade, including specialized handling for refrigerated or hazardous goods.

Government agencies and state-owned enterprises involved in major infrastructure projects or managing national import/export strategies also function as key stakeholders and indirect customers. Their demand focuses on high-capacity terminals that support national economic policy, particularly those facilitating trade in landlocked regions or boosting regional connectivity. The end-users ultimately benefit from the reduced transit times, lower inventory holding costs, and improved supply chain predictability enabled by strategically deployed and efficiently operated dry port infrastructure. Their collective needs drive innovation in service offerings, pushing dry ports to evolve into sophisticated logistics parks.

| Report Attributes | Report Details |

|---|---|

| Market Size in 2026 | USD 11.8 Billion |

| Market Forecast in 2033 | USD 24.5 Billion |

| Growth Rate | 11.5% CAGR |

| Historical Year | 2019 to 2024 |

| Base Year | 2025 |

| Forecast Year | 2026 - 2033 |

| DRO & Impact Forces |

|

| Segments Covered |

|

| Key Companies Covered | DP World, Hutchison Ports, Qube Holdings, Port of Rotterdam Authority, CSX Corporation, Union Pacific Railroad, Canadian National Railway, Bolloré Logistics, Gefco, CEVA Logistics, Neptune Orient Lines (NOL), Qingdao Port International, Global Logistics Properties (GLP), Kakinada SEZ Limited, Adani Ports and SEZ Limited (APSEZ), CMA CGM Group, DB Schenker, Trelleborg AB, Saudi Logistics Services (SAL), PSA International |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Enquiry Before Buy | Have specific requirements? Send us your enquiry before purchase to get customized research options. Request For Enquiry Before Buy |

Dry Port Market Key Technology Landscape

The technological evolution within the Dry Port Market is centered on three core areas: automation of physical handling, sophisticated digitalization of operations, and enhanced security and sustainability monitoring. Automation is driven by the deployment of advanced equipment such as automated stacking cranes (ASCs) and driverless Automated Guided Vehicles (AGVs) for internal container movement, significantly reducing operational costs and enhancing safety standards. These systems rely heavily on real-time sensor data and high-precision GPS positioning to execute complex tasks, allowing dry ports to operate 24/7 with minimal human intervention. The transition from manual to automated processes demands robust and resilient IT infrastructure capable of handling massive data streams generated by IoT devices and operational technologies.

Digitalization leverages advanced software platforms, primarily Terminal Operating Systems (TOS), which act as the central nervous system of the dry port. Modern TOS integrate modules for resource management, gate automation, yard planning, and real-time tracking, often incorporating elements of Artificial Intelligence (AI) and Machine Learning (ML) to predict traffic flow and optimize resource deployment. Furthermore, the adoption of blockchain technology is gaining momentum for securing and digitizing trade documentation, enabling 'paperless' customs clearance and reducing the risks associated with fraudulent or delayed documents. This digitalization effort aims to create a seamlessly integrated data flow between seaports, dry ports, rail operators, and customs authorities, maximizing supply chain transparency.

Sustainability and compliance technologies are also key. Many dry ports are investing in electrified handling equipment, powered by renewable energy sources, and implementing intelligent energy management systems to reduce their environmental footprint. Advanced sensor networks monitor air quality and noise pollution, ensuring regulatory compliance. Furthermore, security technologies, including high-resolution video analytics and sophisticated container inspection systems (e.g., non-intrusive scanning), are crucial for meeting stringent global security standards. The successful integration of these technologies determines a dry port's competitive advantage, transforming it into an efficient, sustainable, and secure link in the global logistics network.

Regional Highlights

The market dynamics of the Dry Port industry exhibit significant regional variations influenced by trade volume, regulatory environments, and infrastructure investment levels. Asia Pacific (APAC) holds the largest market share and is expected to maintain the highest growth rate throughout the forecast period. This dominance is attributable to the region's concentration of global manufacturing and export activities, particularly in countries like China, India, and Vietnam. Massive government-led initiatives, such as China’s Belt and Road Initiative (BRI) and India's logistics corridor development projects, are driving the establishment of new, high-capacity inland dry ports to link manufacturing hubs to coastal seaports and neighboring countries. The scale of investment in rail connectivity across APAC is unparalleled, solidifying the dry port's role as an essential trade facilitator.

North America and Europe represent mature markets characterized by established dry port networks that focus primarily on optimization and technological upgrades rather than greenfield construction. In North America, dry ports (often called Inland Ports) are crucial for mitigating congestion at major West Coast and East Coast seaports, utilizing extensive intermodal rail networks (operated by companies like BNSF and Union Pacific) to move containers inland efficiently. European dry ports, often leveraging existing inland waterway and rail infrastructure, focus on integrating services across various national borders, emphasizing digitalization and environmental sustainability in line with EU mandates. The focus here is enhancing connectivity between densely populated consumption centers and gateway ports like Rotterdam and Hamburg, utilizing advanced automation to maximize existing land use efficiency.

The Middle East and Africa (MEA), along with Latin America, are emerging high-potential markets. In MEA, strategic investments by Gulf nations (such as the UAE and Saudi Arabia) are transforming these countries into global transit and logistics hubs, developing dry ports to support diversification away from oil economies. These new facilities often incorporate state-of-the-art automation from inception. Latin America, particularly Brazil and Mexico, is seeing increased investment in dry ports to address infrastructure deficits and connect vast agricultural and resource-rich inland regions to major export seaports, driving efficiency in commodity movements. While still facing infrastructural and regulatory hurdles, the long-term trade growth potential in these regions guarantees sustained dry port development.

- Asia Pacific (APAC): Dominates due to manufacturing exports, driven by the Belt and Road Initiative and rapid development of logistics corridors in India and Southeast Asia.

- North America: Focuses on intermodal efficiency, leveraging extensive Class I rail networks to decongest coastal ports and service large consumer markets.

- Europe: Characterized by highly integrated, sustainable multimodal networks utilizing both rail and inland waterways, with a strong focus on cross-border standardization and digitalization.

- Middle East & Africa (MEA): High growth driven by strategic government investments aiming to establish regional logistics hubs and diversify trade routes.

- Latin America: Developing market, crucial for linking inland natural resource extraction and agricultural production centers to global shipping lanes.

Top Key Players

The market research report includes a detailed profile of leading stakeholders in the Dry Port Market.- DP World

- Hutchison Ports

- Qube Holdings

- Port of Rotterdam Authority

- CSX Corporation

- Union Pacific Railroad

- Canadian National Railway

- Bolloré Logistics

- Gefco

- CEVA Logistics

- Neptune Orient Lines (NOL)

- Qingdao Port International

- Global Logistics Properties (GLP)

- Kakinada SEZ Limited

- Adani Ports and SEZ Limited (APSEZ)

- CMA CGM Group

- DB Schenker

- Trelleborg AB

- Saudi Logistics Services (SAL)

- PSA International

Frequently Asked Questions

Analyze common user questions about the Dry Port market and generate a concise list of summarized FAQs reflecting key topics and concerns.What is the primary function of a dry port in the modern supply chain?

The primary function of a dry port is to serve as an inland extension of a seaport, facilitating the efficient transfer of international maritime containers to terrestrial transport modes, chiefly rail. It acts as a critical hub for customs clearance, storage, consolidation, and distribution, ultimately reducing congestion at coastal ports and improving cargo flow predictability.

How do dry ports contribute to environmental sustainability in logistics?

Dry ports significantly enhance environmental sustainability by maximizing the use of high-capacity rail transport for long distances, shifting freight away from energy-intensive long-haul trucking. This modal shift drastically reduces greenhouse gas emissions and lowers the overall carbon footprint per tonne-kilometer of transported cargo.

What is the current growth driver for the Dry Port Market in the Asia Pacific region?

The key growth driver in APAC is the massive expansion of regional manufacturing supply chains, coupled with governmental mega-projects (like logistics corridors) aimed at improving multimodal integration, particularly linking vast inland industrial zones efficiently via rail networks to major coastal export terminals.

What technological advancements are most critical for future dry port efficiency?

Critical technological advancements include AI-driven Terminal Operating Systems (TOS) for optimized yard management, full automation using Automated Guided Vehicles (AGVs) and stacking cranes, and the adoption of blockchain for secure, paperless documentation and real-time supply chain transparency.

What are the main financial challenges associated with developing dry ports?

The main financial challenges involve the high initial capital expenditure required for land acquisition and large-scale infrastructure development, including rail connections and specialized handling equipment. These projects typically require substantial long-term financing, often necessitating Public-Private Partnership (PPP) models to share the investment burden.

To check our Table of Contents, please mail us at: sales@marketresearchupdate.com

Research Methodology

The Market Research Update offers technology-driven solutions and its full integration in the research process to be skilled at every step. We use diverse assets to produce the best results for our clients. The success of a research project is completely reliant on the research process adopted by the company. Market Research Update assists its clients to recognize opportunities by examining the global market and offering economic insights. We are proud of our extensive coverage that encompasses the understanding of numerous major industry domains.

Market Research Update provide consistency in our research report, also we provide on the part of the analysis of forecast across a gamut of coverage geographies and coverage. The research teams carry out primary and secondary research to implement and design the data collection procedure. The research team then analyzes data about the latest trends and major issues in reference to each industry and country. This helps to determine the anticipated market-related procedures in the future. The company offers technology-driven solutions and its full incorporation in the research method to be skilled at each step.

The Company's Research Process Has the Following Advantages:

- Information Procurement

The step comprises the procurement of market-related information or data via different methodologies & sources.

- Information Investigation

This step comprises the mapping and investigation of all the information procured from the earlier step. It also includes the analysis of data differences observed across numerous data sources.

- Highly Authentic Source

We offer highly authentic information from numerous sources. To fulfills the client’s requirement.

- Market Formulation

This step entails the placement of data points at suitable market spaces in an effort to assume possible conclusions. Analyst viewpoint and subject matter specialist based examining the form of market sizing also plays an essential role in this step.

- Validation & Publishing of Information

Validation is a significant step in the procedure. Validation via an intricately designed procedure assists us to conclude data-points to be used for final calculations.

×

Request Free Sample:

Related Reports

Select License

Why Choose Us

We're cost-effective and Offered Best services:

We are flexible and responsive startup research firm. We adapt as your research requires change, with cost-effectiveness and highly researched report that larger companies can't match.

Information Safety

Market Research Update ensure that we deliver best reports. We care about the confidential and personal information quality, safety, of reports. We use Authorize secure payment process.

We Are Committed to Quality and Deadlines

We offer quality of reports within deadlines. We've worked hard to find the best ways to offer our customers results-oriented and process driven consulting services.

Our Remarkable Track Record

We concentrate on developing lasting and strong client relationship. At present, we hold numerous preferred relationships with industry leading firms that have relied on us constantly for their research requirements.

Best Service Assured

Buy reports from our executives that best suits your need and helps you stay ahead of the competition.

Customized Research Reports

Our research services are custom-made especially to you and your firm in order to discover practical growth recommendations and strategies. We don't stick to a one size fits all strategy. We appreciate that your business has particular research necessities.

Service Assurance

At Market Research Update, we are dedicated to offer the best probable recommendations and service to all our clients. You will be able to speak to experienced analyst who will be aware of your research requirements precisely.

Contact With Our Sales Team

Customer Testimonials

The content of the report is always up to the mark. Good to see speakers from expertise authorities.

Privacy requested , Managing Director

A lot of unique and interesting topics which are described in good manner.

Privacy requested, President

Well researched, expertise analysts, well organized, concrete and current topics delivered in time.

Privacy requested, Development Manager