Dryer, Water Heater and Furnace Venting Market Size, By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2026 to 2033 (Financial Impact Analysis)

ID : MRU_ 440898 | Date : Feb, 2026 | Pages : 242 | Region : Global | Publisher : MRU

Dryer, Water Heater and Furnace Venting Market Size

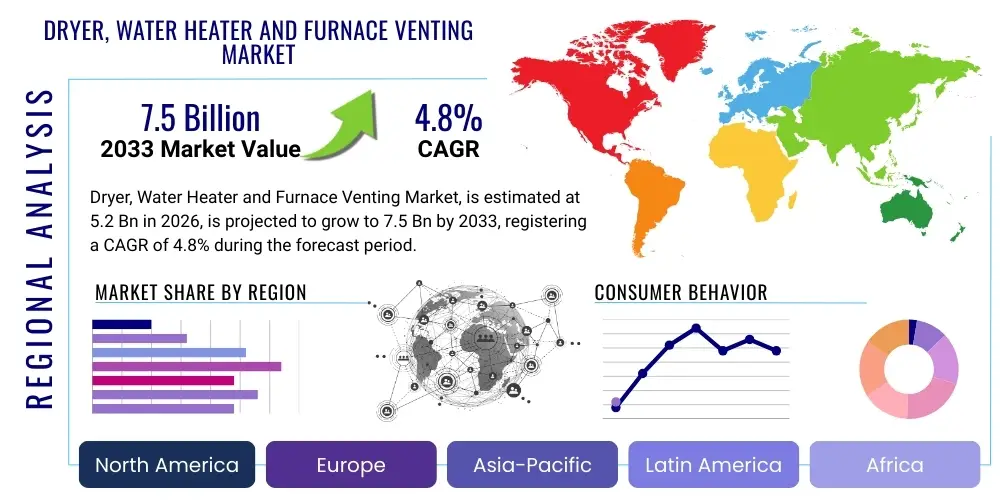

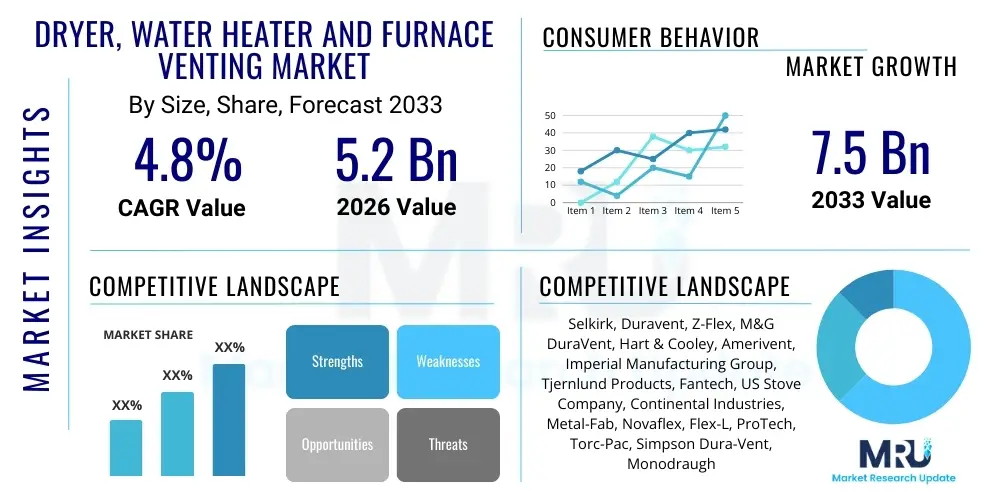

The Dryer, Water Heater and Furnace Venting Market is projected to grow at a Compound Annual Rate (CAGR) of 4.8% between 2026 and 2033. The market is estimated at $5.2 Billion in 2026 and is projected to reach $7.5 Billion by the end of the forecast period in 2033.

Dryer, Water Heater and Furnace Venting Market introduction

The Dryer, Water Heater, and Furnace Venting Market encompasses the manufacturing, distribution, and installation of specialized exhaust systems designed to safely remove combustion byproducts, moisture, and excess heat from residential, commercial, and industrial appliances. These venting systems are critical for maintaining indoor air quality, preventing carbon monoxide poisoning, and ensuring the efficient and safe operation of heating and drying equipment. Products range from rigid and flexible metal pipes (stainless steel, galvanized steel, aluminum) to specialized plastic venting (PVC, CPVC) required for high-efficiency condensing appliances, adhering strictly to international safety standards such as NFPA, ASHRAE, and local building codes, which mandate specific material compatibility and installation procedures based on appliance type and fuel source (natural gas, propane, oil, or electricity).

The core product offerings include single-wall, double-wall, and triple-wall venting systems (Type B, Type L, Type BH, Type A), tailored for specific temperature ratings and corrosive resistance. Dryer venting focuses primarily on managing lint accumulation and moisture expulsion using rigid or semi-rigid aluminum ducts, while water heater and furnace venting deals with high-temperature flue gases and acidic condensate generated by combustion processes. Major applications are predominantly found in the residential construction and renovation sectors, followed by commercial facilities like hotels, laundromats, and industrial processing plants requiring robust, often custom-engineered exhaust solutions to manage continuous operational demands and strict environmental regulations regarding emissions and energy consumption efficiency, thereby driving innovation in material science and modular system design.

Benefits derived from modern venting systems include enhanced appliance energy efficiency, crucial for meeting increasingly stringent governmental energy consumption standards; prolonged equipment lifespan due to reduced internal corrosion and overheating; and paramount safety against fire hazards and asphyxiation from carbon monoxide, which is a key driver for replacement cycles in older homes. The market is driven by several key factors: continuous growth in global construction activities, particularly housing starts in emerging economies; rigorous updates to global building codes demanding higher efficiency and safety features; and a sustained consumer shift toward high-efficiency condensing furnaces and water heaters, which necessitate specialized, corrosion-resistant venting solutions capable of handling lower flue gas temperatures and acidic condensate effectively over long operational periods without compromising structural integrity or system performance.

Dryer, Water Heater and Furnace Venting Market Executive Summary

Current business trends within the Dryer, Water Heater, and Furnace Venting Market highlight a strong focus on system integration, moving away from simple component sales towards comprehensive, standardized venting kits that simplify installation and ensure code compliance. Manufacturers are investing heavily in producing smart venting solutions, often integrating sensors for temperature and pressure monitoring to allow for predictive maintenance and real-time safety alerts, particularly within commercial and industrial settings where downtime is costly. Furthermore, there is a pronounced consolidation among major players seeking economies of scale and control over specialized material supply chains, especially those producing high-grade stainless steel and specialized polymer components required for Category II, III, and IV condensing appliances, thereby increasing the overall barrier to entry for smaller manufacturers and independent distributors lacking advanced technical certification.

Regional trends indicate North America and Europe maintaining dominance, primarily due to established building standards, high rates of residential replacement and retrofit activities driven by energy efficiency incentives, and mandatory adherence to strict gas appliance safety regulations that necessitate periodic inspection and replacement of aging venting infrastructure. Asia Pacific (APAC), however, is emerging as the fastest-growing region, fueled by massive urbanization, burgeoning middle-class housing development, and increasing adoption of modern, centralized heating systems in countries like China and India, replacing traditional, less efficient heating methods. This rapid expansion in APAC is generating significant demand for both traditional metal venting (for standard efficiency units) and specialized polypropylene or PVC venting for newly installed high-efficiency imported systems, creating lucrative opportunities for international manufacturers with local distribution networks capable of handling large-volume construction projects efficiently and meeting diverse regulatory requirements.

Segment trends reveal that the high-efficiency condensing appliance venting segment, utilizing specialized materials like AL29-4C stainless steel and engineered plastics (e.g., Polypropylene or PVC/CPVC), is exhibiting superior growth compared to the traditional galvanized steel and Type B metal venting segments. This growth is directly correlated with global energy transition policies and consumer preference for lower utility bills, making high-efficiency appliances standard in new constructions and crucial in renovation projects. Within the end-user market, the residential segment holds the largest volume share, driven by constant appliance replacement cycles (typically 10-20 years) and regulatory mandates requiring compliance upgrades upon sale or significant renovation of existing properties. However, the commercial and industrial segments, while lower in volume, command higher average selling prices (ASP) due to the necessity of larger diameter, custom-designed, and often pressurized venting systems, demanding higher material specifications and specialized engineering consultancy during the design and installation phases.

AI Impact Analysis on Dryer, Water Heater and Furnace Venting Market

Common user inquiries regarding the intersection of Artificial Intelligence (AI) and the Dryer, Water Heater, and Furnace Venting Market typically revolve around system diagnostics, installation compliance, and supply chain efficiency. Users frequently ask how AI can improve the safety of existing systems, specifically questioning the potential for AI-driven sensors to detect subtle blockages, corrosion, or venting breaches that manual inspections might miss, thereby preventing carbon monoxide leaks or fire hazards. There is significant interest in AI's role in streamlining the complex process of selecting the correct venting components based on local building codes, appliance specifications, and environmental conditions, transforming this process from a highly technical, manual task into an automated, error-proof selection system accessible to contractors and homeowners alike. Furthermore, manufacturers are keenly interested in how machine learning can optimize production scheduling, quality control inspections of welded seams and material thicknesses, and forecast demand fluctuations for specific materials (like specialized polymers or corrosion-resistant alloys) in different geographical regions based on construction permits and climate data.

The key themes emerging from this analysis center on predictive maintenance and compliance automation. Users expect AI to move venting from a passive system component to an active, smart safety mechanism capable of continuous self-monitoring. Concerns often focus on data privacy (especially regarding residential sensor data), the cost associated with retrofitting existing standard systems with smart components, and the necessity for robust cybersecurity measures to protect connected HVAC systems from unauthorized access or operational manipulation. Expectations are high that AI will lead to the development of highly customized, optimized venting paths generated automatically by algorithms that consider heat loss, air friction, material stress, and local regulatory constraints simultaneously, drastically reducing installation time and mitigating common installer errors that lead to system inefficiency or dangerous conditions.

For manufacturers, the primary focus is leveraging AI/ML algorithms to enhance operational resilience and material traceability. By analyzing historical performance data across millions of installed units, AI can inform material science improvements, predicting where failures are most likely to occur under specific climate stresses (e.g., high humidity, freezing temperatures) and enabling the creation of more durable and targeted venting products. AI-powered visual inspection systems using computer vision are already being deployed in high-speed manufacturing lines to detect microscopic flaws in seams and coatings, ensuring product integrity far beyond human capability. This integration of AI elevates product quality, reduces warranty claims, and ensures that complex, safety-critical components meet the rigorous standards necessary for appliances that handle potentially hazardous combustion gases, cementing AI's role as a fundamental tool for safety and quality assurance within the manufacturing pipeline.

- AI-enhanced sensor deployment for continuous monitoring of flue gas temperature, pressure differential, and carbon monoxide levels within the venting system.

- Predictive maintenance algorithms using sensor data to forecast material failure or obstruction risks before operational issues occur, optimizing replacement schedules.

- Automated compliance checking tools for contractors, utilizing machine learning to verify component compatibility and installation adherence against local and national building codes instantaneously.

- Optimization of complex venting path design (route and component selection) through computational geometry and AI modeling, minimizing friction loss and ensuring maximum appliance efficiency.

- AI-driven quality control in manufacturing via computer vision, ensuring precise welding, coating integrity, and dimensional accuracy of all venting components.

- Supply chain optimization using ML to predict demand for specific material grades (e.g., AL29-4C stainless steel, high-temperature polypropylene) based on geopolitical and construction data inputs.

DRO & Impact Forces Of Dryer, Water Heater and Furnace Venting Market

The Dryer, Water Heater, and Furnace Venting Market is fundamentally shaped by a complex interplay of Drivers, Restraints, and Opportunities (DRO), collectively forming the impact forces that dictate market trajectory and investment priorities. A primary driver is the stringent regulatory environment globally, particularly the enforcement of increasingly strict energy efficiency standards (e.g., condensing technology mandates) and enhanced safety codes (e.g., mandatory carbon monoxide detection and non-combustible material use), forcing both replacement and new construction markets to adopt higher quality, more complex venting systems. This regulatory push is further compounded by continuous residential replacement cycles and robust growth in the global construction sector, especially multi-family and commercial properties where large-scale, intricate venting solutions are standard requirements. However, this growth is significantly restrained by the volatility of raw material costs, particularly steel and specialized polymers, which directly impacts manufacturing profitability and necessitates strategic hedging in procurement, coupled with a persistent shortage of skilled HVAC installers capable of correctly handling and certifying complex, high-efficiency venting systems, leading to potential delays and installation errors.

Opportunities in this sector are vast, driven primarily by the ongoing technological shift towards smart home integration and the development of IoT-enabled venting components. The necessity for high-efficiency appliance venting opens substantial market potential for advanced, corrosion-resistant materials and modular, quick-connect systems that reduce labor intensity while ensuring superior sealing capabilities. Furthermore, emerging markets present lucrative opportunities as they modernize their energy infrastructure and housing stock, increasingly adopting centralized heating and high-efficiency water heating technologies that require modern venting solutions. The push for green building certifications and sustainable construction practices also generates demand for venting systems manufactured using recycled content or those designed for superior long-term durability, minimizing overall environmental impact over the building’s lifecycle, appealing strongly to developers focused on achieving high LEED or equivalent sustainability ratings.

The cumulative impact forces emphasize safety and sustainability as non-negotiable market foundations. Safety regulations act as powerful drivers, mandating compliance upgrades and continuous innovation in material testing and system robustness. Economic restraints, such as fluctuating material prices and labor shortages, pressure manufacturers to innovate in design simplicity and supply chain resilience. Ultimately, the market trajectory is highly dependent on manufacturers’ ability to capitalize on technological opportunities—specifically smart integration and advanced materials—to meet regulatory demands while mitigating cost pressures. This balance ensures the market remains highly technical, safety-focused, and primed for disruption through intelligent component design and streamlined installation processes, favoring those companies that invest proactively in R&D aimed at system efficiency and installation ease.

Segmentation Analysis

The Dryer, Water Heater, and Furnace Venting Market is comprehensively segmented based on material composition, the specific application of the appliance being vented, and the end-user environment. Material segmentation is crucial as it dictates compatibility with flue gas temperatures and corrosion resistance, ranging from basic galvanized steel used in traditional applications to highly engineered stainless steel alloys and specialized plastics required for high-efficiency condensing units that produce acidic condensate. Application segmentation—dryer, water heater, and furnace—drives demand for specific dimensions, safety features, and pressure ratings tailored to the unique exhaust characteristics of each appliance type. Finally, end-user segmentation differentiates between the scale, regulatory requirements, and expected operational lifespan demanded by residential, commercial, and industrial installations, with commercial and industrial projects typically requiring larger diameter, custom-engineered, and more durable systems due to continuous use and higher safety oversight requirements.

- Material Type

- Stainless Steel (e.g., AL29-4C, 304, 316)

- Galvanized Steel

- Aluminum (Rigid and Flexible)

- Plastic (PVC, CPVC, Polypropylene/PP)

- Application

- Dryer Venting (Exhausting moisture and lint)

- Water Heater Venting (Atmospheric and Power Vented)

- Furnace Venting (Standard Efficiency and High Efficiency/Condensing)

- Venting Type/Structure

- Single-Wall

- Double-Wall (B-Vent)

- Triple-Wall (A-Vent/L-Vent)

- Flexible/Semi-Rigid

- End-User

- Residential (New Construction and Renovation/Replacement)

- Commercial (Hotels, Multi-Family Units, Offices)

- Industrial (Processing Plants, Large Manufacturing Facilities)

Value Chain Analysis For Dryer, Water Heater and Furnace Venting Market

The value chain for the Dryer, Water Heater, and Furnace Venting Market begins with extensive upstream activities centered on raw material procurement, dominated by the sourcing of specialized metals—primarily various grades of steel (galvanized, stainless steel alloys like AL29-4C for high-efficiency systems) and aluminum—along with high-performance polymers (PVC, CPVC, polypropylene) essential for condensing appliance venting. The quality and stability of these input materials are critical, as venting systems are safety-critical components; volatility in commodity markets directly impacts manufacturing costs and pricing strategies across the entire chain. Upstream suppliers are typically large global metal producers or specialized chemical companies providing high-temperature polymer resins. Control over proprietary alloy formulations or polymer compounds offers a significant competitive advantage, leading manufacturers to form long-term supply contracts to ensure consistent material quality, necessary certifications, and compliance with stringent environmental sourcing mandates.

The midstream stage involves the core manufacturing process, where raw materials are transformed into finished venting components (pipes, fittings, terminations, and accessories) through processes such as rolling, welding, stamping, coating, and advanced plastic injection molding. Key manufacturers focus on achieving high dimensional precision, perfect seal integrity, and ensuring that products meet UL, ETL, and specific appliance manufacturer certifications, often requiring rigorous stress testing and quality control procedures that utilize automated inspection technology. The distribution channel is bifurcated into direct and indirect routes. Direct sales often cater to large HVAC OEMs (Original Equipment Manufacturers) who integrate the venting solutions into their appliance packages or to major commercial/industrial contractors requiring bespoke, large-scale systems. Indirect channels rely heavily on a network of specialized wholesale distributors, HVAC supply houses, plumbing retailers, and major home improvement centers (retail distribution), serving the high-volume residential retrofit and new construction markets efficiently.

Downstream activities center on installation, maintenance, and end-user engagement. Installation is primarily performed by certified HVAC technicians, plumbers, and general contractors, whose technical proficiency and adherence to local building codes are paramount for system safety and performance. The interaction between manufacturers and installers is crucial; manufacturers provide extensive training and technical documentation to ensure proper system setup, especially for complex systems like Category IV venting. Post-sale, the market involves regular inspection and replacement activities, typically driven by appliance failure, regulatory updates, or general material degradation over time. The role of retailers and wholesalers is increasingly focused on technical support and inventory management, ensuring installers have immediate access to the diverse range of compatible components required for the vast array of appliances currently in use, thereby maintaining the critical link between product availability and safe, timely consumer service delivery.

| Report Attributes | Report Details |

|---|---|

| Market Size in 2026 | $5.2 Billion |

| Market Forecast in 2033 | $7.5 Billion |

| Growth Rate | 4.8% CAGR |

| Historical Year | 2019 to 2024 |

| Base Year | 2025 |

| Forecast Year | 2026 - 2033 |

| DRO & Impact Forces |

|

| Segments Covered |

|

| Key Companies Covered | Selkirk, Duravent, Z-Flex, M&G DuraVent, Hart & Cooley, Amerivent, Imperial Manufacturing Group, Tjernlund Products, Fantech, US Stove Company, Continental Industries, Metal-Fab, Novaflex, Flex-L, ProTech, Torc-Pac, Simpson Dura-Vent, Monodraught, Centrotherm, PolyPro |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Enquiry Before Buy | Have specific requirements? Send us your enquiry before purchase to get customized research options. Request For Enquiry Before Buy |

Dryer, Water Heater and Furnace Venting Market Key Technology Landscape

The technology landscape of the Dryer, Water Heater, and Furnace Venting Market is primarily characterized by advancements in material science, focusing on corrosion resistance and thermal performance, and manufacturing techniques aimed at system integration and ease of installation. A significant technological shift has been the widespread adoption of specialized materials for high-efficiency condensing appliances. Standard galvanized steel cannot withstand the acidic condensate (due to lower flue gas temperatures) produced by Category IV appliances; thus, specialized materials like AL29-4C stainless steel (a ferritic alloy offering exceptional corrosion resistance) and high-temperature polypropylene (PP) or engineered PVC/CPVC plastics are becoming the standard. These materials require advanced joining techniques, such as laser welding for metals and specialized solvent cementing or robust gasketed connections for plastic systems, ensuring a tight, non-leak seal capable of handling positive pressure common in power-vented and condensing units.

Beyond material technology, the market is rapidly adopting modular and quick-connect venting systems. Traditional venting often required intricate cutting, sealing, and complex fitting connections on site, increasing labor costs and the risk of improper installation. Modern systems utilize advanced gasketed joints (often silicone or EPDM) combined with twist-lock or clip-based mechanical connections, dramatically reducing installation time and providing a verifiable, secure seal against gas leakage, thereby improving overall system safety and adherence to code. This modular approach extends to termination systems, offering weather-resistant and aesthetically integrated options for wall or roof penetrations, often utilizing advanced UV-resistant coatings and specialized insect/bird screening that maintain optimal airflow without sacrificing building envelope integrity or visual appeal. The incorporation of modular design principles is critical for inventory management and training programs for HVAC contractors across the globe.

Furthermore, digital integration and smart technology are beginning to define the cutting edge of this market. While the venting pipe itself remains relatively passive, the integration of IoT-enabled sensors within the system is a burgeoning technological trend. These smart components can continuously monitor critical metrics such as flue temperature deviations, exhaust gas flow rates, and draft pressure anomalies, transmitting data to appliance control boards or external maintenance systems. This allows for real-time safety diagnostics, ensuring the vent path is clear and functioning correctly, and providing early warnings for potential blockages (e.g., lint buildup in dryers or ice formation in high-efficiency condensate lines). This technological evolution positions the venting system not just as an exhaust conduit, but as a critical, integrated safety and performance monitoring subsystem within the broader HVAC infrastructure, promising reduced maintenance costs and enhanced consumer safety, particularly concerning carbon monoxide prevention.

Regional Highlights

Regional dynamics play a crucial role in shaping demand and technological adoption within the Dryer, Water Heater, and Furnace Venting Market, largely dictated by climate severity, predominant fuel sources, established housing stock age, and regional building codes.

North America (NA), comprising the United States and Canada, represents a mature, high-value market characterized by strict safety standards (e.g., UL 1738, CSA B149.1) and a continuous cycle of replacement driven by energy efficiency upgrades. The prevalence of forced-air furnaces and large water heaters necessitates robust venting solutions. The push towards high-efficiency condensing technology is particularly strong here, creating high demand for specialized AL29-4C and PP venting systems. Retrofit projects in older housing stock, especially those replacing Category I furnaces with Category IV appliances, drive considerable market activity, often requiring complex venting conversions and significant contractor expertise to ensure compliance.

Europe is highly differentiated by country, but overall exhibits a strong emphasis on energy conservation and compact, multi-story housing structures. The market here is dominated by gas boilers (often wall-mounted) and sophisticated cascade systems, requiring specialized co-axial and concentric venting solutions that maximize space efficiency and minimize thermal loss. Germany, the UK, and France are leaders in adopting stringent Ecodesign Directives, mandating high levels of efficiency, which further accelerates the transition to specialized plastic and corrosion-resistant metal venting suitable for low-temperature condensate handling. Innovation often focuses on aesthetic integration into existing European architectural styles and quick installation features.

Asia Pacific (APAC) is the fastest-growing region, driven by rapid urbanization, massive infrastructure development, and a gradual shift towards modern heating systems, moving away from localized heating methods in countries like China and South Korea. While historically utilizing simpler venting solutions, the increasing wealth and adoption of imported high-efficiency appliances in major metropolitan centers are fueling exponential growth for advanced venting components. Regulatory harmonization is less uniform across APAC than in NA or Europe, creating challenges but also opportunities for manufacturers who can adapt products quickly to local specifications. Significant investment in commercial and industrial HVAC infrastructure also bolsters demand for large-scale, custom venting projects.

Latin America (LA) and the Middle East & Africa (MEA) currently represent smaller but developing markets. LA often shows fragmented adoption patterns, with local regulations heavily influencing material choices, often favoring galvanized steel and aluminum due to cost sensitivity. MEA, particularly the Gulf Cooperation Council (GCC) states, sees high demand linked to massive commercial and residential luxury construction booms. While heating is less critical, specialized water heater and high-volume dryer venting (for hotels and laundry services) is critical, requiring systems resistant to extreme heat and corrosive elements often found in coastal environments. Future growth will be tied directly to infrastructure spending and the global adoption rate of international safety standards.

- North America: Focus on high-efficiency condensing appliance venting (AL29-4C, PP) driven by stringent energy codes (AHRI, ASHRAE) and high residential turnover/retrofit rates.

- Europe: High demand for co-axial and concentric venting systems for gas boilers; market highly influenced by Ecodesign directives and space-saving, aesthetically integrated solutions.

- Asia Pacific (APAC): Rapid expansion driven by urbanization, new construction, and increasing adoption of centralized, modern heating/water heating systems in urban centers, leading to high growth in basic and intermediate segment components.

- Latin America and MEA: Market growth tied to commercial construction (MEA) and adoption of international standards; generally characterized by price sensitivity and a focus on essential safety compliance and extreme climate resilience.

Top Key Players

The market research report includes a detailed profile of leading stakeholders in the Dryer, Water Heater and Furnace Venting Market.- Selkirk Corporation

- M&G DuraVent, Inc.

- Z-Flex Inc.

- Hart & Cooley, Inc.

- Imperial Manufacturing Group

- Tjernlund Products, Inc.

- Fantech (Systemair Group)

- Continental Industries, Inc.

- Metal-Fab, Inc.

- Novaflex Group

- Flex-L International

- ProTech Venting

- Torc-Pac Corporation

- Simpson Dura-Vent

- Centrotherm Eco Systems LLC

- PolyPro (DuraVent Brand)

- Reliance Water Heater Co. (Venting Division)

- US Stove Company (Ventis/DynaVent)

- Pinnacle Climate Technologies

- A.J. Manufacturing, Inc.

Frequently Asked Questions

Analyze common user questions about the Dryer, Water Heater and Furnace Venting market and generate a concise list of summarized FAQs reflecting key topics and concerns.What types of materials are required for high-efficiency condensing furnaces?

High-efficiency condensing furnaces produce acidic condensate, necessitating the use of highly corrosion-resistant materials such as specialized stainless steel alloys (e.g., AL29-4C) or engineered plastics like Polypropylene (PP), PVC, or CPVC, designed to withstand positive pressure and low exhaust temperatures.

How often should residential venting systems be inspected or replaced?

Venting systems should be inspected annually by a certified HVAC professional, particularly for integrity, blockages, and corrosion. Replacement frequency depends on material type and age, typically aligned with appliance replacement (10-20 years), or immediately if defects or non-compliance are detected.

What is the difference between Type B-Vent and L-Vent systems?

Type B-Vent (double-wall metal) is used for natural draft gas appliances like standard water heaters, handling non-corrosive flue gases. Type L-Vent (all-fuel metal) is required for moderate-temperature appliances fueled by oil or specific high-temperature wood burning, designed for greater heat resistance.

Are flexible dryer ducts safe, and what are the primary safety concerns?

Semi-rigid aluminum flexible ducts are safer than vinyl or plastic options, but rigid metal ducts are preferred to minimize lint accumulation and fire risk. The primary concern is excessive length, crushing, or low-quality flexible materials leading to blockages and reduced airflow efficiency.

How do smart venting technologies enhance system safety and efficiency?

Smart venting integrates IoT sensors to continuously monitor critical operational parameters like flue gas temperature, pressure, and flow. This real-time data allows for immediate detection of system blockages or breaches, proactively preventing carbon monoxide hazards and optimizing appliance performance by signaling necessary maintenance.

To check our Table of Contents, please mail us at: sales@marketresearchupdate.com

Research Methodology

The Market Research Update offers technology-driven solutions and its full integration in the research process to be skilled at every step. We use diverse assets to produce the best results for our clients. The success of a research project is completely reliant on the research process adopted by the company. Market Research Update assists its clients to recognize opportunities by examining the global market and offering economic insights. We are proud of our extensive coverage that encompasses the understanding of numerous major industry domains.

Market Research Update provide consistency in our research report, also we provide on the part of the analysis of forecast across a gamut of coverage geographies and coverage. The research teams carry out primary and secondary research to implement and design the data collection procedure. The research team then analyzes data about the latest trends and major issues in reference to each industry and country. This helps to determine the anticipated market-related procedures in the future. The company offers technology-driven solutions and its full incorporation in the research method to be skilled at each step.

The Company's Research Process Has the Following Advantages:

- Information Procurement

The step comprises the procurement of market-related information or data via different methodologies & sources.

- Information Investigation

This step comprises the mapping and investigation of all the information procured from the earlier step. It also includes the analysis of data differences observed across numerous data sources.

- Highly Authentic Source

We offer highly authentic information from numerous sources. To fulfills the client’s requirement.

- Market Formulation

This step entails the placement of data points at suitable market spaces in an effort to assume possible conclusions. Analyst viewpoint and subject matter specialist based examining the form of market sizing also plays an essential role in this step.

- Validation & Publishing of Information

Validation is a significant step in the procedure. Validation via an intricately designed procedure assists us to conclude data-points to be used for final calculations.

×

Request Free Sample:

Related Reports

Select License

Why Choose Us

We're cost-effective and Offered Best services:

We are flexible and responsive startup research firm. We adapt as your research requires change, with cost-effectiveness and highly researched report that larger companies can't match.

Information Safety

Market Research Update ensure that we deliver best reports. We care about the confidential and personal information quality, safety, of reports. We use Authorize secure payment process.

We Are Committed to Quality and Deadlines

We offer quality of reports within deadlines. We've worked hard to find the best ways to offer our customers results-oriented and process driven consulting services.

Our Remarkable Track Record

We concentrate on developing lasting and strong client relationship. At present, we hold numerous preferred relationships with industry leading firms that have relied on us constantly for their research requirements.

Best Service Assured

Buy reports from our executives that best suits your need and helps you stay ahead of the competition.

Customized Research Reports

Our research services are custom-made especially to you and your firm in order to discover practical growth recommendations and strategies. We don't stick to a one size fits all strategy. We appreciate that your business has particular research necessities.

Service Assurance

At Market Research Update, we are dedicated to offer the best probable recommendations and service to all our clients. You will be able to speak to experienced analyst who will be aware of your research requirements precisely.

Contact With Our Sales Team

Customer Testimonials

The content of the report is always up to the mark. Good to see speakers from expertise authorities.

Privacy requested , Managing Director

A lot of unique and interesting topics which are described in good manner.

Privacy requested, President

Well researched, expertise analysts, well organized, concrete and current topics delivered in time.

Privacy requested, Development Manager